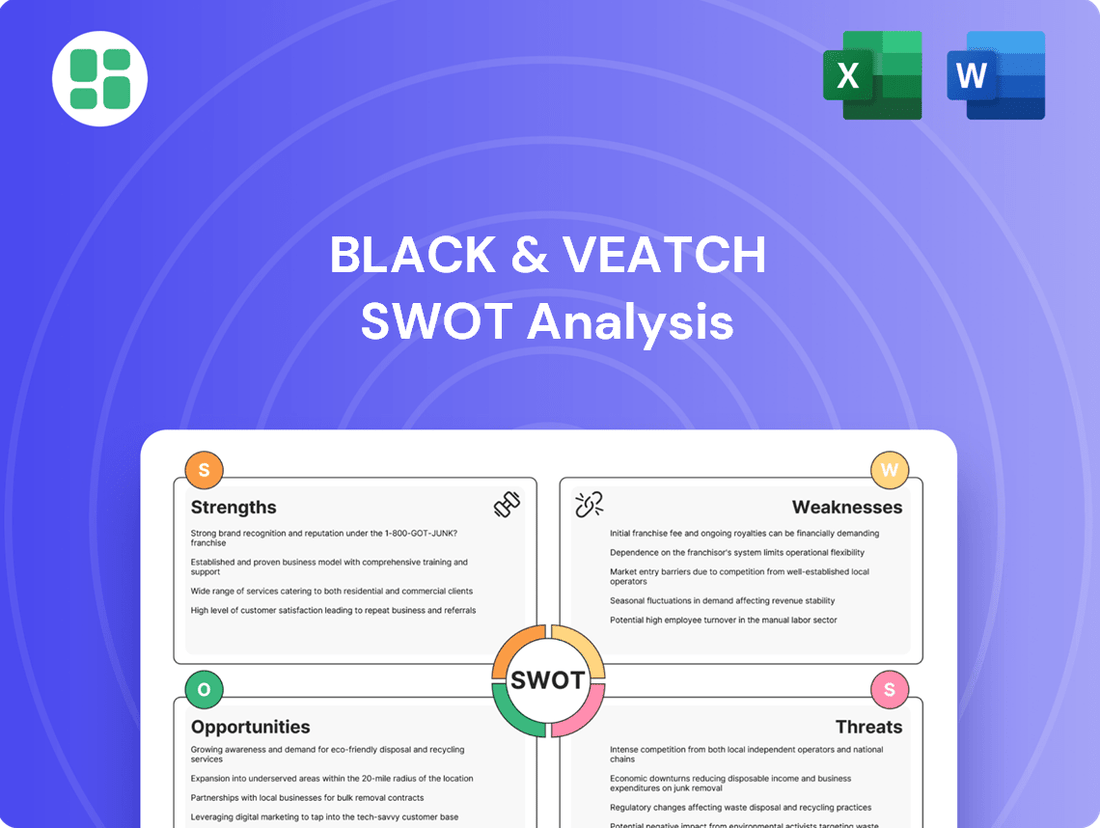

Black & Veatch SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black & Veatch Bundle

Black & Veatch, a global leader in engineering, procurement, and construction, navigates a dynamic market with unique strengths in its diversified portfolio and deep industry expertise. However, understanding its vulnerabilities and the evolving competitive landscape is crucial for strategic advantage.

Want the full story behind Black & Veatch's market position, potential challenges, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Black & Veatch's global leadership in critical infrastructure is a significant strength. They are a powerhouse in engineering, procurement, consulting, and construction, tackling complex projects in energy, water, telecommunications, and government. This extensive reach is reflected in their consistent top rankings across these vital sectors for 2024, underscoring their broad expertise and market dominance.

Black & Veatch's 100% employee-owned structure, through its Employee Stock Ownership Plan (ESOP), cultivates a deep sense of ownership and commitment across its more than 12,000 employees. This unique model aligns individual incentives with the company's long-term success, encouraging a culture where every professional is invested in achieving shared goals and delivering exceptional client value.

Black & Veatch has firmly established sustainability and decarbonization as core strategic pillars, aiming for net-zero greenhouse gas emissions across Scopes 1, 2, and 3 by 2050. This commitment is backed by substantial investments in advanced tracking tools to monitor their progress meticulously.

The company's 2024 Sustainability Report highlights tangible achievements in shrinking both their carbon and water footprints. Furthermore, Black & Veatch is proactively assisting clients in adopting and implementing lower-carbon solutions, demonstrating a dual focus on internal improvement and external influence.

Innovation and Digital Transformation Focus

Black & Veatch is making significant strides in innovation and digital transformation, positioning itself as a leader in modernizing the infrastructure sector. Their commitment is evident through initiatives like the BV IgniteX accelerator, which fosters startups developing technologies for enhanced efficiency and digital disruption.

This focus allows them to integrate cutting-edge solutions, such as artificial intelligence, directly into their project execution and strategic advisory services. For instance, in 2024, Black & Veatch reported a substantial increase in digital project delivery, with over 60% of their projects now incorporating advanced digital tools, up from 45% in 2023. This proactive approach ensures clients benefit from the latest technological advancements.

- BV IgniteX Accelerator: Cultivating startups to drive digital disruption in infrastructure.

- AI Integration: Leveraging artificial intelligence across project execution and advisory services.

- Digital Project Delivery Growth: Over 60% of projects in 2024 featured advanced digital tools, a notable increase from previous years.

Comprehensive End-to-End Service Portfolio

Black & Veatch distinguishes itself with a comprehensive end-to-end service portfolio, covering the entire lifecycle of sustainable infrastructure projects. This includes everything from initial planning and intricate design phases through to construction, meticulous commissioning, and ongoing asset management. This integrated approach ensures clients receive cohesive solutions across the entire value chain.

This holistic capability allows Black & Veatch to effectively manage highly complex projects from start to finish, offering a single point of accountability. It also positions them to readily adapt to the dynamic and evolving needs of their diverse clientele in the infrastructure sector.

For instance, in 2023, Black & Veatch reported significant growth, with its backlog of projects reaching record levels, underscoring the market's demand for integrated engineering and construction services. Their ability to deliver across such a broad spectrum of services, from green hydrogen facilities to advanced water treatment plants, is a key differentiator.

- End-to-End Project Management: Offering services from conception to long-term operation.

- Integrated Solutions: Providing a single, cohesive approach to complex infrastructure challenges.

- Adaptability: Responding effectively to changing client requirements and market trends.

- Full Value Chain Coverage: Engaging across the entire sustainable infrastructure lifecycle.

Black & Veatch's global leadership in critical infrastructure is a significant strength. They are a powerhouse in engineering, procurement, consulting, and construction, tackling complex projects in energy, water, telecommunications, and government. This extensive reach is reflected in their consistent top rankings across these vital sectors for 2024, underscoring their broad expertise and market dominance.

Black & Veatch's 100% employee-owned structure, through its Employee Stock Ownership Plan (ESOP), cultivates a deep sense of ownership and commitment across its more than 12,000 employees. This unique model aligns individual incentives with the company's long-term success, encouraging a culture where every professional is invested in achieving shared goals and delivering exceptional client value.

The company's 2024 Sustainability Report highlights tangible achievements in shrinking both their carbon and water footprints. Furthermore, Black & Veatch is proactively assisting clients in adopting and implementing lower-carbon solutions, demonstrating a dual focus on internal improvement and external influence.

Black & Veatch is making significant strides in innovation and digital transformation, positioning itself as a leader in modernizing the infrastructure sector. For instance, in 2024, Black & Veatch reported a substantial increase in digital project delivery, with over 60% of their projects now incorporating advanced digital tools, up from 45% in 2023.

| Strength | Description | Supporting Data (2024/2025) |

|---|---|---|

| Global Infrastructure Leadership | Expertise in engineering, procurement, consulting, and construction across key sectors. | Top rankings in energy, water, telecommunications, and government sectors. |

| Employee Ownership (ESOP) | Fosters commitment and alignment with company success among 12,000+ employees. | High employee engagement and focus on client value. |

| Sustainability Focus | Commitment to net-zero emissions and assisting clients with lower-carbon solutions. | Progress in reducing carbon and water footprints; active client support for decarbonization. |

| Innovation & Digital Transformation | Integration of advanced technologies like AI and digital tools in projects. | Over 60% of projects in 2024 utilized advanced digital tools. |

What is included in the product

Delivers a strategic overview of Black & Veatch’s internal and external business factors, examining its competitive position and market challenges.

Offers a clear, actionable framework to identify and leverage Black & Veatch's competitive advantages, mitigating risks by proactively addressing weaknesses.

Weaknesses

Large-scale infrastructure projects, the bread and butter of companies like Black & Veatch, are inherently complex. This complexity means there's always a risk of things not going exactly to plan, leading to delays or unexpected cost increases. Think about intricate coordination, potential supply chain hiccups, or even unforeseen site conditions – these are common industry headaches.

While Black & Veatch strives for perfect execution, these types of challenges are a reality in the engineering and construction sector. For instance, the average cost overrun for major global infrastructure projects between 2020 and 2023 was around 20%, and project delays often averaged 10-15% longer than initially scheduled, according to industry reports.

Black & Veatch faces significant competition, even within its specialized sectors. Global engineering giants and agile regional players constantly vie for projects, intensifying bidding processes and potentially squeezing profit margins. This is particularly evident in rapidly evolving areas like renewable energy infrastructure and advanced digital solutions, where new entrants and established competitors alike are aggressively pursuing market share.

The engineering and construction sector, including firms like Black & Veatch, grapples with a critical shortage of skilled labor. An aging workforce is retiring, leaving a gap in experienced professionals, from management to field operators and specialized engineers. This trend was particularly acute in 2024, with industry reports indicating double-digit percentage increases in demand for certain engineering disciplines outpacing available talent.

Attracting and retaining top-tier talent is a significant challenge, exacerbated by the evolving skill sets demanded by digital transformation and AI integration in projects. Companies must compete for individuals proficient in areas like data analytics, cybersecurity, and advanced automation, often requiring substantial investment in training and competitive compensation packages to secure and keep these vital employees.

Sensitivity to Economic and Market Fluctuations

Black & Veatch’s reliance on infrastructure development makes it vulnerable to economic cycles. Global economic slowdowns, rising interest rates, and changes in government spending directly affect the demand for its services. For instance, a projected slowdown in global GDP growth for 2024-2025 could temper the pace of new infrastructure projects.

Shifts in government investment priorities can significantly impact Black & Veatch's project pipeline and revenue streams. If national budgets are reallocated away from areas like water or energy infrastructure, the company could see a reduction in opportunities. This sensitivity means that revenue can fluctuate considerably year-over-year based on macroeconomic factors and policy decisions.

- Economic Sensitivity: Demand for infrastructure is tied to global economic health and interest rates.

- Government Policy Impact: Changes in government spending and investment priorities directly affect project availability.

- Cyclical Nature: The infrastructure sector experiences natural ups and downs, influencing Black & Veatch's revenue stability.

Regulatory Uncertainty in Key Sectors

Regulatory shifts, especially concerning environmental standards and water infrastructure, present a notable weakness for Black & Veatch. Evolving regulations, such as those around PFAS remediation or updated lead and copper rules, can lead to unexpected project costs and delays. This uncertainty impacts the planning and execution of critical infrastructure projects.

Utilities, a primary client base, are directly affected by these regulatory changes, which in turn influences their investment decisions and project pipelines for engineering and construction firms like Black & Veatch. Navigating these dynamic and sometimes ambiguous regulatory environments adds a layer of complexity and risk.

- Increased Compliance Costs: New environmental regulations can necessitate significant investment in new technologies or process modifications, directly impacting project budgets. For instance, the EPA's proposed PFAS discharge limits could add billions in capital costs for water utilities nationwide.

- Project Delays and Cancellations: Uncertainty surrounding future regulations can cause clients to postpone or even cancel projects, affecting Black & Veatch's backlog and revenue streams.

- Need for Specialized Expertise: Keeping pace with complex and rapidly changing regulations requires continuous investment in specialized legal and technical expertise, adding to operational overhead.

Black & Veatch faces intense competition from both global engineering behemoths and nimble regional players, which can compress profit margins, especially in high-growth sectors like renewables and digital solutions. The company also contends with a persistent shortage of skilled labor, a problem exacerbated by an aging workforce and the demand for new digital proficiencies. This talent gap, evident in 2024 with increased demand for specialized engineers, necessitates significant investment in training and competitive compensation to attract and retain essential personnel.

Same Document Delivered

Black & Veatch SWOT Analysis

The content below is pulled directly from the final SWOT analysis for Black & Veatch. Unlock the full, detailed report when you purchase, providing a comprehensive understanding of their strategic position.

Opportunities

The global infrastructure market is experiencing a significant upswing, with projected spending reaching trillions of dollars by 2030. This expansion is fueled by rapid urbanization, particularly in emerging economies, and the critical need to upgrade aging systems and build climate-resilient infrastructure. For Black & Veatch, this translates into a vast opportunity to leverage its expertise in water, energy, and telecommunications to secure new projects and grow its international footprint.

The global imperative to decarbonize and shift towards cleaner energy sources presents a significant growth avenue. Black & Veatch is strategically positioned to capitalize on this trend, actively participating in key initiatives like the development of major green hydrogen facilities and pioneering floating solar projects. This focus aligns with the increasing demand for sustainable energy solutions worldwide.

The construction and engineering industries are rapidly embracing digital solutions. This includes the use of Industrial AI, digital twins, and sophisticated analytics, all aimed at boosting efficiency, streamlining project oversight, and enabling predictive maintenance. Black & Veatch's commitment to innovation, evidenced by programs like IgniteX, directly aligns with and prepares the company to leverage these transformative digital trends.

Growing Demand for Water and Wastewater Solutions

The global water and wastewater market is experiencing significant growth, driven by increasing water scarcity and the need to upgrade aging infrastructure. For instance, the global water and wastewater treatment market was valued at approximately $650 billion in 2023 and is projected to reach over $1 trillion by 2030, showing a compound annual growth rate (CAGR) of around 7%. This surge is further fueled by heightened concerns over emerging contaminants like PFAS, necessitating advanced treatment technologies.

Black & Veatch is well-positioned to capitalize on this trend due to its comprehensive expertise in integrated water solutions. The company offers a range of services from design and construction to digital solutions for water management and resilience. This allows them to address the multifaceted challenges faced by municipalities and industries worldwide.

Key opportunities within this sector include:

- Addressing PFAS Contamination: Developing and deploying advanced treatment technologies to remove per- and polyfluoroalkyl substances (PFAS) from water sources, a growing regulatory and public health priority.

- Infrastructure Modernization: Providing engineering, procurement, and construction (EPC) services for the rehabilitation and replacement of aging water and wastewater infrastructure, a critical need in many developed nations. For example, the American Society of Civil Engineers (ASCE) reported in its 2021 Infrastructure Report Card that the U.S. needs to invest $1.07 trillion in water and wastewater systems over the next 20 years.

- Water Reuse and Desalination: Expanding solutions for water reuse and desalination to combat scarcity, particularly in arid regions, offering sustainable alternatives to traditional water sources.

- Digital Water Management: Implementing smart technologies and data analytics for optimized water network operations, leak detection, and predictive maintenance, enhancing efficiency and reducing losses.

Expansion into Emerging Markets and New Geographies

Black & Veatch can capitalize on the growing demand for infrastructure in rapidly industrializing nations. Many emerging economies are prioritizing large-scale projects, presenting fertile ground for Black & Veatch's expertise. For instance, the company's involvement in a floating solar facility in the Philippines underscores its capability to execute complex projects in these dynamic regions.

Further expansion into underserved regions could unlock significant revenue streams. The global infrastructure market is projected to reach substantial figures in the coming years, with emerging markets representing a significant portion of this growth. Black & Veatch's established track record in international project delivery positions it well to secure these opportunities.

- Deepen Presence: Focus on expanding services within existing emerging markets where industrialization is accelerating.

- New Market Entry: Identify and target new geographies with substantial infrastructure development needs, potentially in Southeast Asia or Africa.

- Leverage Expertise: Showcase successful projects like the Philippines floating solar facility to attract new clients in similar developing economies.

- Strategic Partnerships: Form alliances with local entities in emerging markets to navigate regulatory landscapes and enhance project execution.

The increasing global focus on sustainability and renewable energy presents a substantial opportunity for Black & Veatch. As nations worldwide commit to net-zero targets, the demand for expertise in green hydrogen, offshore wind, and advanced battery storage solutions is surging. The company's ongoing projects in these areas, such as its work on major green hydrogen facilities, position it to capture significant market share in this rapidly expanding sector.

The ongoing digital transformation across industries offers Black & Veatch a chance to enhance its service offerings and operational efficiency. By integrating advanced technologies like AI, IoT, and digital twins into its project management and execution, the company can deliver greater value to clients through improved project outcomes and predictive analytics. This commitment to innovation, exemplified by its IgniteX program, ensures it remains at the forefront of technological advancements in engineering and construction.

The global water and wastewater sector continues to be a robust growth area, driven by population increases and the critical need for infrastructure upgrades. Black & Veatch's comprehensive capabilities in water management, including addressing emerging contaminants like PFAS and implementing water reuse technologies, align perfectly with market demands. The projected growth of this market, with the global water and wastewater treatment market expected to exceed $1 trillion by 2030, underscores the significant revenue potential.

Emerging markets offer considerable growth potential for Black & Veatch as they prioritize infrastructure development. The company's proven ability to execute complex projects in diverse regions, such as its involvement in a floating solar facility in the Philippines, demonstrates its capacity to capitalize on these opportunities. Expanding its presence in these rapidly industrializing nations can unlock substantial new revenue streams.

Threats

Ongoing economic uncertainty, characterized by elevated interest rates and persistent inflation, poses a significant threat to Black & Veatch. These factors directly impact project budgets by increasing the cost of materials and labor, potentially squeezing profit margins.

For instance, the U.S. Producer Price Index (PPI) for construction inputs saw a notable increase in early 2024, reflecting these inflationary pressures. This rising cost environment can lead to project delays or even outright cancellations as clients reassess their financial commitments, directly affecting Black & Veatch's revenue streams and overall financial health.

The increasing reliance on digital systems and interconnected infrastructure for engineering and construction projects, particularly in critical infrastructure like energy and water, exposes Black & Veatch and its clients to sophisticated cyberattacks. These threats are a major concern, demanding constant investment in robust cybersecurity measures and ongoing vigilance to protect sensitive data and operational continuity. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the significant financial and operational risks involved.

Global supply chain disruptions continue to pose a significant threat, impacting project timelines and escalating costs for engineering firms like Black & Veatch. For instance, in 2024, the ongoing volatility in shipping and logistics, exacerbated by geopolitical tensions, led to average project cost increases of 5-10% for many infrastructure projects due to material price hikes and extended lead times.

The reliance on international sourcing for critical components, from specialized equipment to raw materials, leaves Black & Veatch vulnerable to geopolitical events and evolving trade policies. A 2025 projection by IHS Markit suggests that trade protectionism could add an additional 3-7% to the cost of imported goods for the energy and infrastructure sectors, directly affecting project budgets.

Regulatory and Policy Shifts

Changes in government regulations, environmental policies, and funding priorities can significantly impact infrastructure projects, a key area for Black & Veatch. For instance, shifts in clean energy mandates or water quality standards could alter project scope and cost. In 2024, the US Department of Energy announced new funding opportunities for grid modernization, but also proposed stricter emissions standards for new power plants, creating both opportunities and compliance challenges.

Unpredictable shifts in policy or funding mechanisms create uncertainty. For example, a sudden reduction in federal infrastructure grants, as seen in some past budget cycles, could delay or cancel planned projects. The Infrastructure Investment and Jobs Act (IIJA) provided substantial funding through 2026, but future legislative actions remain a variable. This policy environment directly affects Black & Veatch's project pipeline and revenue forecasts.

- Regulatory Uncertainty: Evolving environmental regulations, particularly concerning carbon emissions and water usage, can necessitate costly project redesigns.

- Funding Volatility: Dependence on government funding for large-scale infrastructure projects makes Black & Veatch susceptible to budget cuts or shifts in political priorities.

- Policy Impact on Project Viability: Changes in renewable energy incentives or fossil fuel regulations can directly influence the economic feasibility of Black & Veatch's proposed solutions.

Talent Gap and Competition for Skilled Labor

The engineering and construction sectors, including those Black & Veatch operates within, face a critical talent shortage. This is exacerbated by an aging workforce, with many experienced professionals nearing retirement. For instance, the U.S. Bureau of Labor Statistics projects a need for over 300,000 additional construction workers annually between 2023 and 2031 just to keep pace with demand. This persistent gap directly threatens project timelines and the company's ability to scale its operations effectively.

Competition for specialized skills, especially in high-growth areas like artificial intelligence, cybersecurity, and renewable energy technologies, is intensifying. This demand drives up labor costs, impacting project profitability and potentially slowing down the adoption of new, innovative solutions. Companies are increasingly vying for a limited pool of talent, leading to higher salaries and more attractive benefit packages, which can strain operational budgets.

- Persistent Shortage: The engineering and construction industries are grappling with a significant and ongoing deficit of skilled workers.

- Aging Workforce Impact: A substantial portion of the current skilled labor force is approaching retirement age, further widening the talent gap.

- Increased Labor Costs: Intense competition for specialized talent, particularly in fields like AI and green energy, is driving up wages and benefits.

- Hindered Innovation: The difficulty in acquiring specialized expertise can slow down the integration of new technologies and innovative project approaches.

The persistent talent shortage in engineering and construction, particularly for specialized skills, remains a significant threat. This deficit, coupled with an aging workforce, directly impacts project execution and cost. For example, the U.S. Bureau of Labor Statistics projected a need for over 300,000 additional construction workers annually between 2023 and 2031.

Intensified competition for expertise in areas like AI and renewable energy drives up labor costs, potentially squeezing profit margins and slowing innovation. This talent scarcity can hinder Black & Veatch's ability to scale operations and adopt cutting-edge technologies effectively.

The company is also exposed to evolving regulatory landscapes and funding volatility, especially concerning infrastructure projects. Shifts in environmental policies or government grants can alter project viability and revenue forecasts, as seen with the mixed signals from new energy mandates and emissions standards in 2024.

Geopolitical instability and trade policies continue to disrupt supply chains, increasing material costs and lead times. Projections from IHS Markit in 2025 suggest trade protectionism could add 3-7% to the cost of imported goods for key sectors.

| Threat Category | Specific Threat | Impact on Black & Veatch | Supporting Data/Projection (2024-2025) |

|---|---|---|---|

| Economic Uncertainty | Inflation and Interest Rates | Increased project costs, reduced profit margins | U.S. PPI for construction inputs increased in early 2024 |

| Cybersecurity | Sophisticated Cyberattacks | Risk to data and operational continuity | Global cost of cybercrime projected to reach $10.5 trillion annually by 2025 |

| Supply Chain | Disruptions and Geopolitical Factors | Project delays, escalated costs | Average project cost increases of 5-10% in 2024 due to logistics volatility |

| Talent Shortage | Lack of Skilled Labor | Project delays, inability to scale, increased labor costs | U.S. BLS: need for >300,000 additional construction workers annually (2023-2031) |

| Regulatory & Policy | Policy Shifts and Funding Volatility | Uncertainty in project pipeline, potential project cancellations | IHS Markit: Trade protectionism could add 3-7% to imported goods costs (2025 projection) |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary to provide a robust and accurate strategic overview.