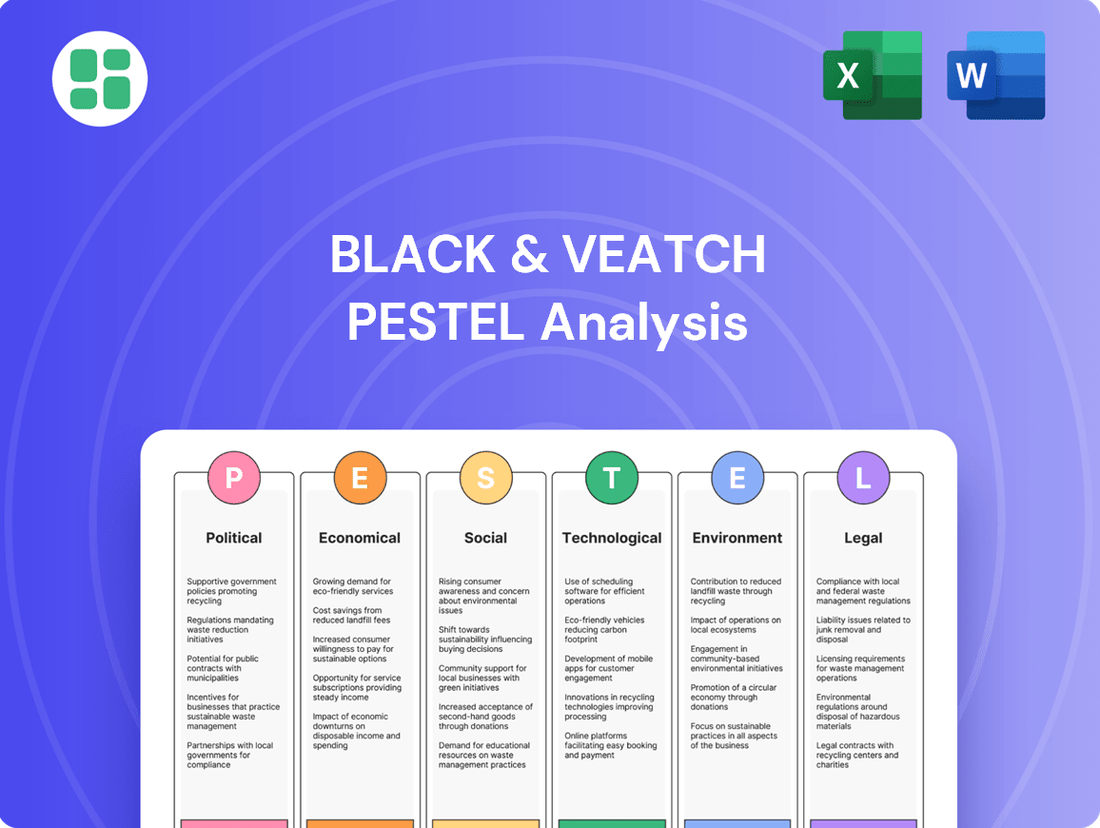

Black & Veatch PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black & Veatch Bundle

Navigate the complex external forces shaping Black & Veatch's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, social attitudes, technological advancements, environmental regulations, and legal frameworks are impacting their operations and strategic direction. Gain a crucial competitive advantage by leveraging these expert insights to inform your own business planning and investment decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government infrastructure spending remains a significant tailwind for engineering and construction firms. The US Infrastructure Investment and Jobs Act, enacted in 2021, allocates substantial funding towards modernizing the nation's infrastructure. This legislation is projected to inject hundreds of billions of dollars into projects spanning energy, water, telecommunications, and transportation sectors through 2025 and beyond.

This sustained public investment translates into a robust demand for the specialized services offered by companies like Black & Veatch. The ongoing commitment to infrastructure development creates a stable and predictable pipeline of work, particularly in areas such as renewable energy integration, water system upgrades, and broadband expansion. Such initiatives directly benefit firms positioned to deliver these critical engineering and construction solutions.

Governments globally are prioritizing the energy transition, with a commitment from the COP28 summit in late 2023 to triple renewable energy capacity by 2030. This push creates significant opportunities for companies like Black & Veatch in developing solar, wind, and hydrogen infrastructure.

These policy drivers are directly impacting Black & Veatch's energy sector operations, fostering increased demand for their engineering, procurement, and construction services in renewable energy projects. The company's expertise aligns with the growing need for sustainable energy solutions.

Political shifts and evolving regulatory landscapes present a dynamic environment for Black & Veatch. New US policies, particularly those impacting infrastructure and defense projects, can create both significant opportunities and potential headwinds. For instance, the Infrastructure Investment and Jobs Act (IIJA) of 2021, with its substantial funding allocations, offers a clear avenue for growth in infrastructure development.

However, the implementation of such policies can also introduce complexities. While some regulations might aim to expedite project approvals, others could inadvertently lead to increased fiscal burdens or strain existing supply chains. For example, changes in environmental permitting regulations, though intended to protect natural resources, might extend project timelines and increase compliance costs for engineering firms.

Black & Veatch's ability to remain agile and adapt to these political and regulatory changes is paramount. Navigating the nuances of evolving legislation, such as potential shifts in trade policies or federal spending priorities, will be critical for maintaining competitive advantage and ensuring successful project execution in the coming years.

International Relations and Trade Agreements

Geopolitical stability and evolving international trade policies are critical for Black & Veatch's global project execution. Shifts in trade agreements, such as potential renegotiations of existing pacts or the imposition of new tariffs, can directly impact the cost of materials and equipment sourced internationally, influencing overall project economics. For example, in 2024, ongoing trade tensions between major economies could lead to increased volatility in commodity prices essential for infrastructure development.

Black & Veatch's reliance on a global supply chain means that changes in trade policies, like those affecting steel or specialized engineering components, necessitate agile strategies. The company must continually assess how tariffs or trade barriers might affect project timelines and budgets, potentially requiring diversification of suppliers or adjustment of sourcing locations. The World Trade Organization's (WTO) dispute settlement system, while a framework for resolving trade issues, also highlights the potential for disruptions that need careful management.

A robust international presence demands vigilant monitoring of political landscapes across various regions. Factors such as national infrastructure investment plans, regulatory changes affecting energy or water projects, and the stability of client governments all play a role in project feasibility and long-term market access. Black & Veatch's ability to adapt to these dynamic political factors is key to maintaining its competitive edge in diverse global markets.

Key considerations for Black & Veatch include:

- Impact of Tariffs: Monitoring the potential cost increases for imported materials and equipment due to tariffs, which could affect project profitability.

- Supply Chain Resilience: Developing strategies to mitigate risks associated with trade disruptions by diversifying suppliers and manufacturing bases.

- Market Access: Navigating varying regulatory environments and trade agreements to secure and maintain access to key international markets.

- Geopolitical Risk Assessment: Continuously evaluating political stability and international relations in operating regions to anticipate and manage project-related risks.

Critical Infrastructure Security Directives

Governments worldwide are intensifying their focus on safeguarding critical infrastructure, both physically and digitally. This heightened attention translates into new regulations and mandates aimed at bolstering cybersecurity and operational resilience. For instance, the United States enacted the Cyber Incident Reporting for Critical Infrastructure Act (CIRCIA), requiring timely reporting of cyber incidents impacting critical sectors. Similarly, the European Union's NIS 2 Directive expands cybersecurity requirements to a broader range of essential entities.

These evolving political landscapes present a significant opportunity for Black & Veatch. The company is well-positioned to offer specialized solutions designed to meet these stringent security and resilience mandates. As infrastructure operators grapple with compliance and the need to upgrade their systems, Black & Veatch's expertise in engineering, procurement, and construction for critical sectors becomes increasingly valuable. The global market for cybersecurity in critical infrastructure is projected to grow substantially. For example, the critical infrastructure cybersecurity market was valued at approximately $150 billion in 2023 and is anticipated to reach over $250 billion by 2028, reflecting a compound annual growth rate of around 10-12%.

- Increased Regulatory Scrutiny: New laws like CIRCIA and NIS 2 mandate enhanced security measures for critical infrastructure.

- Market Growth for Security Solutions: The demand for services and technologies that improve infrastructure resilience is on the rise.

- Black & Veatch's Strategic Advantage: The company's capabilities align directly with the growing need for secure and resilient infrastructure development and upgrades.

- Projected Market Expansion: The critical infrastructure cybersecurity market is expected to see robust growth in the coming years, offering significant revenue potential.

Government infrastructure spending remains a significant tailwind for engineering and construction firms, with the US Infrastructure Investment and Jobs Act (IIJA) of 2021 injecting hundreds of billions into projects through 2025 and beyond. This sustained public investment creates a robust demand pipeline for specialized services in areas like renewable energy integration and water system upgrades.

Governments globally are prioritizing the energy transition, aiming to triple renewable energy capacity by 2030, creating opportunities for Black & Veatch in solar, wind, and hydrogen infrastructure development. Political shifts and evolving regulatory landscapes, such as new US policies impacting infrastructure and defense, present both opportunities and potential headwinds, requiring agility in navigating legislative changes.

Geopolitical stability and evolving international trade policies critically impact Black & Veatch's global project execution, with potential tariffs and trade barriers affecting material costs and project economics. Continuous monitoring of political landscapes and international relations is key to anticipating and managing project risks in diverse global markets.

Governments are intensifying focus on safeguarding critical infrastructure, leading to new regulations for cybersecurity and operational resilience, such as the US CIRCIA and EU NIS 2 Directive. This trend fuels demand for Black & Veatch's specialized solutions, as the critical infrastructure cybersecurity market is projected to grow substantially, valued at approximately $150 billion in 2023 and expected to exceed $250 billion by 2028.

What is included in the product

This PESTLE analysis for Black & Veatch examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operations and strategic decisions.

It provides a comprehensive overview of the external landscape, highlighting key trends and potential challenges and opportunities for the engineering and construction firm.

A clear, actionable summary of Black & Veatch's PESTLE analysis, designed to quickly identify and mitigate external threats and opportunities.

Economic factors

Global investment in critical infrastructure, especially for the energy transition, hit record highs in 2024, with continued growth expected. This surge, driven by the increasing demand for modern and sustainable infrastructure worldwide, creates significant market opportunities for companies like Black & Veatch. For instance, the International Energy Agency reported that global clean energy investment reached an estimated $1.7 trillion in 2023, a figure anticipated to grow further in 2024 and beyond.

Persistent inflationary pressures continue to affect global economies, with the US experiencing a Consumer Price Index (CPI) of 3.3% in May 2024, a slight decrease from previous months but still elevated. This impacts Black & Veatch by increasing the cost of materials and labor for its projects.

Global supply chain disruptions, though easing from their 2022 peaks, remain a concern, contributing to project delays and cost overruns. For instance, shipping costs, while down from highs, are still subject to volatility due to geopolitical events.

Black & Veatch's strategic procurement and efficient project management are therefore critical to navigating these economic headwinds. Successfully mitigating these factors is essential for maintaining competitive pricing and ensuring timely project delivery in the current economic climate.

The increasing reliance on Public-Private Partnerships (PPPs) presents significant opportunities for Black & Veatch. These collaborations are essential for financing large-scale infrastructure projects, a sector where Black & Veatch holds considerable expertise. For instance, the U.S. Department of Transportation's Build America Bureau has facilitated over $30 billion in loans for infrastructure projects through its Transportation Infrastructure Finance and Innovation Act (TIFIA) program, often involving PPP structures.

PPPs allow for the sharing of risks and the leveraging of private sector capital and expertise, enabling the undertaking of complex and capital-intensive developments that might otherwise be stalled. This model is particularly crucial for addressing the substantial global infrastructure funding gaps. Estimates suggest that the world needs to invest trillions in infrastructure by 2040, with PPPs being a key mechanism to bridge this divide.

Interest Rate Fluctuations

Interest rate fluctuations directly affect the cost of capital for Black & Veatch's infrastructure projects. For instance, if central banks like the Federal Reserve raise rates, borrowing becomes more expensive, potentially impacting the feasibility of large-scale investments in energy or water infrastructure.

Higher borrowing costs can lead clients to delay or scale back projects, directly influencing Black & Veatch's revenue streams and project pipeline. This necessitates adaptive business development strategies that consider varying interest rate environments.

- Federal Reserve Interest Rate Hikes: In 2023 and early 2024, the Federal Reserve maintained a hawkish stance, with the federal funds rate target range reaching 5.25%-5.50%, impacting borrowing costs for infrastructure development globally.

- Impact on Project Financing: Increased financing costs can make projects requiring significant upfront capital, such as renewable energy installations or grid modernization, less attractive to investors.

- Strategic Adjustments: Black & Veatch must monitor central bank policies and economic indicators to adjust its project bidding and financing strategies, potentially exploring alternative funding models or focusing on projects with more resilient financial structures.

Demand for Sustainable Solutions

The economic landscape increasingly values sustainability, with a growing demand for climate-resilient infrastructure. This translates into significant investment opportunities for companies like Black & Veatch that specialize in eco-friendly engineering. For instance, the global green building market was valued at approximately $1.07 trillion in 2023 and is projected to reach $2.57 trillion by 2030, showcasing the substantial financial incentive behind sustainable solutions.

Clients are actively seeking projects that demonstrate strong Environmental, Social, and Governance (ESG) performance. This is not just about corporate responsibility; it's becoming a critical factor in investment decisions and long-term project viability. Companies are recognizing that upfront investments in sustainable practices often lead to lower operational costs and reduced environmental risks over the project lifecycle.

Black & Veatch's expertise in developing innovative and sustainable engineering solutions directly addresses this burgeoning demand. Their focus on long-term operational efficiency and environmental risk mitigation aligns perfectly with the economic shift towards prioritizing sustainability in infrastructure development. This strategic alignment positions them favorably in a market where environmental consciousness is increasingly driving economic valuation and investment flows.

- Growing Market: The global green building market is expected to grow significantly, indicating a strong economic driver for sustainable infrastructure.

- ESG Importance: Client demand for projects with strong ESG credentials is a key economic factor influencing investment and project selection.

- Risk Mitigation: Sustainable infrastructure offers long-term operational efficiency and reduced environmental risks, enhancing its economic appeal.

- Investment Attraction: Companies focused on sustainable solutions are better positioned to attract investment in the current economic climate.

Global infrastructure investment is a significant economic driver, with the energy transition spurring record spending in 2024. Inflationary pressures, though moderating, continue to impact project costs, as seen with the US CPI at 3.3% in May 2024. Supply chain volatility persists, affecting project timelines and budgets.

| Economic Factor | 2023/2024 Data/Trend | Impact on Black & Veatch |

|---|---|---|

| Infrastructure Investment | Record highs in 2024, driven by energy transition. IEA: $1.7T clean energy investment in 2023. | Significant market opportunity, demand for sustainable solutions. |

| Inflation | US CPI 3.3% (May 2024), elevated but moderating. | Increased material and labor costs, potential for cost overruns. |

| Interest Rates | Federal Reserve target 5.25%-5.50% (early 2024). | Higher cost of capital for projects, potential project delays or scaling back. |

| Sustainability Demand | Global green building market ~$1.07T (2023), projected $2.57T by 2030. | Strong demand for eco-friendly engineering, alignment with ESG focus. |

Preview Before You Purchase

Black & Veatch PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Black & Veatch PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a strategic overview for informed decision-making.

Sociological factors

The world continues to urbanize at a rapid pace, with projections indicating that by 2050, 68% of the global population will reside in urban areas, a significant increase from 55% in 2018. This surge in urban living, coupled with an overall population increase expected to reach 9.7 billion by 2050, places immense pressure on existing infrastructure. Black & Veatch is strategically positioned to address this by providing critical engineering, procurement, and construction (EPC) services for water, energy, and telecommunications systems, essential for supporting these growing urban centers.

This demographic shift directly translates into a sustained and growing demand for Black & Veatch's specialized capabilities. As cities expand and population densities increase, the need for reliable and advanced infrastructure, from smart grids to resilient water treatment facilities, becomes paramount. For instance, the global smart water market alone is projected to reach $38.8 billion by 2027, highlighting the scale of investment required and the opportunities for firms like Black & Veatch.

Public demand for resilient infrastructure is a significant sociological driver for Black & Veatch. Society increasingly expects infrastructure to withstand extreme weather, a trend amplified by climate change. For instance, a 2024 report by the National Oceanic and Atmospheric Administration (NOAA) highlighted a record number of billion-dollar weather and climate disasters in the United States, underscoring this urgent need.

This growing public expectation directly influences infrastructure investment and design. Consequently, there's a push to integrate climate-resilient principles into all new construction and upgrades, ensuring longevity and safety. Black & Veatch's strategic emphasis on resilience aligns perfectly with these societal priorities, positioning them to meet this critical demand.

The engineering and construction industries are grappling with a significant shortage of skilled labor, particularly in advanced fields like artificial intelligence and digital engineering. This skills gap directly impacts companies like Black & Veatch, potentially hindering their ability to execute complex projects. For instance, a 2024 report indicated that over 60% of construction firms struggle to find qualified workers for specialized roles.

To counter this, Black & Veatch needs to prioritize robust talent development programs, integrating cutting-edge training in AI and digital tools. Embracing automation in its operations can also help bridge the gap by increasing efficiency and reducing reliance on certain manual skills. Fostering an environment that encourages innovation is crucial for attracting and retaining top talent, ensuring a pipeline of expertise for future endeavors.

Emphasis on Environmental, Social, and Governance (ESG)

Societal expectations are increasingly prioritizing Environmental, Social, and Governance (ESG) performance. This growing public and investor demand means companies must actively showcase their commitment to ESG principles. Black & Veatch's dedication to corporate sustainability, as detailed in its yearly reports, and its community involvement efforts directly address this significant societal trend.

This emphasis on ESG not only bolsters a company's brand image but also proves instrumental in attracting clients and employees who are aligned with socially responsible values. For instance, in 2023, Black & Veatch reported a 15% increase in projects with explicit sustainability goals, indicating a strong market response to their ESG initiatives.

- Growing Investor Demand: Global ESG investments were projected to reach $50 trillion by 2025, underscoring the financial imperative for strong ESG practices.

- Talent Attraction: A 2024 survey revealed that 70% of job seekers consider a company's ESG record when evaluating potential employers.

- Client Preferences: Many major corporations now mandate ESG compliance from their supply chain partners, impacting contract awards.

- Brand Reputation: Companies with robust ESG profiles often experience higher customer loyalty and a stronger public image.

Community Engagement and Social License

For Black & Veatch, successfully delivering major infrastructure projects means more than just engineering; it requires earning and keeping the trust of the communities where they operate. This social license to operate is built through genuine, open communication with local residents and stakeholders.

Black & Veatch's commitment to giving back, exemplified by their support for initiatives aimed at improving access to clean water and energy in developing regions, directly bolsters positive community relationships. For instance, their work on projects like the Kigali Bulk Water Supply project in Rwanda, which aims to provide clean water to a growing urban population, demonstrates this focus.

Building this trust involves actively listening to and addressing any concerns raised by local populations. This proactive approach is crucial for gaining project acceptance and ensuring the long-term viability and success of their endeavors.

- Community Trust: Essential for project approval and sustained operations.

- Philanthropic Impact: Black & Veatch's focus on underserved populations enhances social standing.

- Local Concerns: Addressing community needs is key to project acceptance.

- Social License: Proactive engagement is fundamental for infrastructure development.

Societal trends like rapid urbanization and a growing global population are increasing the demand for essential infrastructure, a core area for Black & Veatch. This demographic shift, with 68% of the world expected to live in cities by 2050, directly fuels the need for their expertise in water, energy, and telecommunications. Furthermore, public expectations for resilient infrastructure, capable of withstanding climate impacts, are shaping investment and design, aligning with Black & Veatch's strategic focus.

The company also faces challenges like a skilled labor shortage, particularly in digital fields, which necessitates investment in talent development and automation. Simultaneously, a strong societal emphasis on Environmental, Social, and Governance (ESG) performance is crucial for attracting clients and talent, with Black & Veatch's sustainability initiatives showing positive market response.

Building and maintaining a social license to operate through community trust and engagement is vital for project success. Black & Veatch's philanthropic efforts, such as improving access to clean water in developing regions, enhance their social standing and are key to local project acceptance.

| Sociological Factor | Impact on Black & Veatch | Supporting Data (2024-2025) |

|---|---|---|

| Urbanization & Population Growth | Increased demand for infrastructure services (water, energy, telecom) | 68% global urban population projected by 2050; 9.7 billion global population by 2050. |

| Demand for Resilient Infrastructure | Opportunity for climate-resilient solutions; alignment with societal priorities | Record number of billion-dollar weather/climate disasters in the US (NOAA, 2024). |

| Skilled Labor Shortage | Potential project execution challenges; need for talent development | Over 60% of construction firms struggle to find qualified workers (2024 report). |

| ESG Performance Expectations | Enhanced brand image, client attraction, and talent acquisition | 70% of job seekers consider ESG when choosing employers (2024 survey). |

| Community Trust & Social License | Essential for project approval and long-term viability | Increased projects with explicit sustainability goals (15% rise in 2023 for B&V). |

Technological factors

Artificial intelligence and automation are transforming the Architecture, Engineering, and Construction (AEC) sector, streamlining design, project oversight, and safety protocols. Black & Veatch can harness AI for advanced generative design, predictive maintenance, and automating routine tasks, thereby boosting efficiency and cutting expenses.

The adoption of AI in AEC is projected to increase project delivery speed by up to 20% by 2025, according to industry reports. This technological evolution is no longer optional but a critical element for maintaining a competitive edge in the evolving market landscape.

The progression of Building Information Modeling (BIM) to advanced digital twin technology is transforming infrastructure management. This evolution allows for real-time data streams, predictive analytics, and virtual simulations of physical assets, enabling proactive maintenance and operational optimization. For Black & Veatch, this presents a significant avenue to offer enhanced asset management solutions, boosting efficiency and extending the operational life of critical infrastructure.

Digital twins are becoming indispensable for complex projects, offering unprecedented insights into performance and potential issues. The global digital twin market is projected to reach $121.5 billion by 2030, growing at a CAGR of 35.2% from 2023, according to MarketsandMarkets. This rapid expansion underscores the increasing demand for such sophisticated technologies in sectors where Black & Veatch operates, such as utilities and energy.

The relentless expansion of 5G networks globally, coupled with a surging demand for high-speed internet, is driving a massive need for advanced fiber optic infrastructure. This trend is particularly relevant as of mid-2025, with many regions actively upgrading their digital backbone.

Black & Veatch's deep expertise in telecommunications infrastructure design and deployment positions them to capitalize on this demand. They are crucial in building the low-latency, high-capacity connectivity solutions that 5G relies upon, making this a key growth area for the company.

For instance, global spending on fiber optic cable is projected to reach over $40 billion annually by 2026, highlighting the significant market opportunity. Black & Veatch's involvement in projects like the deployment of new fiber networks in North America, which saw substantial investment in 2024, demonstrates their active participation in this evolving technological landscape.

Innovative Materials and Construction Methods

The construction industry is seeing significant advancements in materials science. For instance, research into self-healing concrete, which can autonomously repair micro-cracks, is progressing rapidly, promising extended infrastructure lifespans. This innovation could reduce long-term maintenance costs significantly for projects Black & Veatch undertakes.

Modular and prefabricated construction methods are also gaining traction, enabling faster project completion and improved quality control. By leveraging these techniques, Black & Veatch can deliver infrastructure more efficiently. For example, the adoption of modular building has been shown to reduce construction times by as much as 30-50% in some sectors.

These technological shifts are not just about speed and durability; they also address sustainability. The use of advanced materials and off-site fabrication can lead to reduced waste and lower embodied carbon in construction projects. This aligns with the growing global demand for greener infrastructure solutions.

Black & Veatch can capitalize on these trends by:

- Integrating self-healing concrete in new infrastructure designs to enhance longevity and reduce lifecycle costs.

- Adopting modular and prefabricated elements to accelerate project delivery and improve cost predictability.

- Exploring advanced, sustainable materials to meet environmental targets and client expectations for greener builds.

- Investing in training and technology to support the adoption of these innovative construction methods.

Cybersecurity Solutions for Critical Infrastructure

The increasing digitalization and interconnectedness of critical infrastructure, such as power grids and water systems, demand robust cybersecurity solutions. This trend is driven by the growing sophistication of cyber threats targeting these vital sectors.

Black & Veatch is actively involved in developing these systems, integrating advanced cybersecurity features to safeguard against breaches. They also focus on ensuring compliance with evolving security standards, a crucial aspect in protecting national security and public safety.

- Cyber threats to critical infrastructure are escalating: In 2023, the US Department of Homeland Security reported a 76% increase in reported cyber incidents affecting critical infrastructure compared to 2022.

- Investment in cybersecurity is growing: The global critical infrastructure cybersecurity market was valued at approximately $18.5 billion in 2023 and is projected to reach over $35 billion by 2028, reflecting the urgency and importance of these solutions.

- Regulatory landscape is tightening: New regulations, like those proposed by the Cybersecurity and Infrastructure Security Agency (CISA) in late 2024, mandate stricter cybersecurity protocols for sectors like energy and water treatment.

Technological advancements are rapidly reshaping the Architecture, Engineering, and Construction (AEC) sector, with AI and automation boosting efficiency by up to 20% by 2025. Digital twin technology is also transforming infrastructure management, with the global market expected to reach $121.5 billion by 2030. The expansion of 5G networks fuels demand for fiber optic infrastructure, with global spending projected to exceed $40 billion annually by 2026. Innovations in materials science, like self-healing concrete, and modular construction methods are improving project delivery and sustainability.

Legal factors

Increasingly stringent environmental regulations and sustainability standards, such as the EU's Corporate Sustainability Reporting Directive (CSRD) which began applying to large companies in 2024, significantly influence project design, material selection, and operational practices for companies like Black & Veatch. Compliance with these evolving global and regional mandates is crucial. This legal landscape is a key driver for adopting greener practices across the industry.

New and emerging cybersecurity laws like the Cyber Incident Reporting for Critical Infrastructure Act (CIRCIA) in the US and the NIS 2 Directive in the EU are significantly raising the bar for critical infrastructure operators. These regulations mandate stricter security measures and prompt reporting of cyber incidents, impacting companies like Black & Veatch. For instance, CIRCIA requires covered entities to report substantial cyber incidents within 72 hours, with potential penalties for non-compliance.

The legal structures governing Public-Private Partnerships (PPPs) are intricate and differ widely by country, influencing contract terms, risk sharing, and project oversight. For Black & Veatch, navigating these varied legal landscapes is essential for winning and completing collaborative projects. In 2024, the global PPP market continued to see significant activity, with many nations updating their legal frameworks to attract private investment in infrastructure, demonstrating the dynamic nature of this legal environment.

Adapting to these diverse legal frameworks is critical for Black & Veatch to effectively secure and execute joint ventures. For instance, the Infrastructure Development Bank of Japan's PPP initiatives, which saw substantial growth in 2024, highlight the importance of robust legal agreements tailored to specific national contexts. Expertise in these evolving PPP laws provides Black & Veatch with a distinct competitive edge in the global market.

Occupational Health and Safety Regulations

Strict occupational health and safety (OHS) regulations are a critical legal factor for Black & Veatch, particularly given the inherent risks in engineering and construction for large infrastructure projects. Adherence to these standards is non-negotiable to safeguard employees and mitigate legal liabilities. For instance, in 2023, the construction industry globally saw significant investment in safety training programs, with many companies reporting a reduction in lost-time injuries following enhanced OHS protocols.

Black & Veatch's commitment to rigorous OHS compliance across its worldwide operations is essential for protecting its workforce and avoiding costly legal repercussions. A strong safety performance not only ensures compliance but also serves as a significant reputational asset, influencing client trust and project acquisition. Companies with superior OHS records often benefit from lower insurance premiums and a more attractive employer brand.

- Global OHS Compliance: Black & Veatch must maintain stringent adherence to diverse national and international OHS laws.

- Workforce Protection: Implementing robust safety protocols is paramount to prevent workplace accidents and injuries.

- Legal Liability Avoidance: Non-compliance can lead to substantial fines, project delays, and litigation.

- Reputational Enhancement: A strong safety record builds trust with clients and stakeholders, contributing to business growth.

Contractual and Procurement Laws

Contractual and procurement laws, both internationally and domestically, significantly shape Black & Veatch's operational framework. These regulations govern how the company bids for, negotiates, and executes projects, particularly those involving government entities or large private sector initiatives. For instance, in 2024, governments worldwide continued to emphasize transparency and fairness in public procurement, impacting the bidding processes for major infrastructure development.

Adherence to these complex legal frameworks is paramount for securing new business and ensuring the successful delivery of infrastructure contracts. Black & Veatch must navigate varying legal requirements across different jurisdictions, ensuring compliance with everything from standard contract terms to specific procurement rules.

Legal due diligence is not merely a formality but a critical component woven into every stage of a project's lifecycle. This thorough review helps mitigate risks, ensuring that all contractual obligations are understood and met, thereby safeguarding the company's interests and reputation. For example, in the US, the Federal Acquisition Regulation (FAR) sets stringent guidelines for government contracting, which Black & Veatch must meticulously follow for federal projects.

- International Contractual Standards: Black & Veatch must comply with diverse international contract laws, such as FIDIC (International Federation of Consulting Engineers) conditions, which are widely used in global infrastructure projects.

- Government Procurement Regulations: Compliance with national procurement laws, like the EU's public procurement directives or the US's Buy America Act, is crucial for winning government contracts.

- Risk Mitigation through Due Diligence: Thorough legal review of contracts and procurement processes helps Black & Veatch identify and mitigate potential liabilities, ensuring project viability and financial soundness.

- Impact on Project Bidding: The complexity and stringency of contractual and procurement laws directly influence Black & Veatch's bidding strategies and the cost structures of its proposals.

Navigating evolving environmental legislation, such as the EU's CSRD, impacts Black & Veatch's project design and operational choices, driving greener practices. New cybersecurity laws like the US CIRCIA and EU NIS 2 Directive impose stricter security and reporting obligations on critical infrastructure operators, with CIRCIA mandating incident reporting within 72 hours.

The legal frameworks for Public-Private Partnerships (PPPs) vary globally, affecting contract terms and risk allocation for Black & Veatch. The global PPP market saw significant activity in 2024, with many countries updating their legal frameworks to attract investment.

Strict occupational health and safety (OHS) regulations are vital for Black & Veatch, influencing safety protocols and legal liability. The construction industry globally invested heavily in safety training in 2023, reporting fewer injuries with enhanced OHS measures.

Contractual and procurement laws, including the US Federal Acquisition Regulation (FAR) for government projects, dictate Black & Veatch's operational framework and bidding strategies. Compliance with international standards like FIDIC conditions and national procurement laws is crucial for securing and executing contracts.

Environmental factors

The increasing frequency and intensity of extreme weather events, such as hurricanes and floods, driven by climate change, are a significant concern. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, according to NOAA. This necessitates the design and construction of infrastructure that is inherently resilient to these impacts.

Black & Veatch addresses this by integrating advanced climate projections and adaptive design principles into its projects. This proactive approach ensures long-term durability and operational continuity for critical infrastructure in a changing climate.

Global efforts to decarbonize are accelerating, with a commitment to triple renewable energy capacity by 2030. This surge in demand directly fuels infrastructure development for solar, wind, and hydrogen power. Black & Veatch is a key player, contributing to projects like the Philippines' inaugural megawatt-scale floating solar array, underscoring their role in this clean energy transition.

Global water demand is projected to increase by 20-30% by 2030, intensifying the need for sustainable management. Aging infrastructure, with an estimated $1 trillion investment gap in the US alone by 2040, exacerbates these challenges, making efficient water systems a critical concern.

Black & Veatch's focus on digital water solutions, advanced wastewater treatment, and decentralized infrastructure directly addresses these pressing issues. Their work in areas like smart metering and leak detection, for example, can significantly reduce water loss, which currently averages 20% in many municipal systems.

Circular Economy and Resource Efficiency

The construction industry is increasingly adopting circular economy principles, aiming to slash waste and boost resource efficiency by using recycled materials. Black & Veatch's commitment to sustainability is evident in its focus on optimizing energy consumption and minimizing material waste across all project phases, fostering a more environmentally conscious built environment.

This shift is driven by growing regulatory pressure and market demand for greener practices. For instance, the European Union's Construction and Demolition Waste Directive sets ambitious recycling targets, and many nations are implementing similar policies. Black & Veatch's approach aligns with these trends, as seen in their 2023 sustainability report, which highlighted a 15% reduction in construction waste on key infrastructure projects through enhanced material reuse and recycling programs.

- Circular Economy Adoption: Increasing integration of recycled content in construction materials, with global markets for recycled aggregates and plastics showing robust growth.

- Resource Efficiency Metrics: Focus on optimizing water usage and energy consumption during construction, with leading firms aiming for a 20% reduction in operational carbon footprint by 2030.

- Waste Reduction Targets: Implementation of waste management plans that prioritize reuse and recycling, contributing to landfill diversion rates exceeding 70% on many large-scale projects.

- Sustainable Material Sourcing: Emphasis on sourcing materials with lower embodied carbon and higher recycled content, impacting procurement strategies and supply chain management.

Biodiversity and Ecosystem Protection

Large-scale infrastructure projects, like those Black & Veatch undertakes, inherently carry the potential to impact local ecosystems and biodiversity. For instance, the global biodiversity loss rate is estimated to be 10 to 100 times higher than the average over the past 10 million years, according to UN reports. This underscores the critical need for careful planning.

Black & Veatch's commitment to environmental stewardship means they integrate thorough environmental impact assessments (EIAs) and robust mitigation strategies into their project development. This proactive approach is crucial; for example, in 2023, the company reported on its efforts to restore 500 acres of critical wetland habitat as part of a renewable energy project in the United States.

These practices aim to ensure projects are developed with a minimal ecological footprint, promoting coexistence with natural habitats. Such commitments are increasingly vital as regulatory bodies and stakeholders demand greater accountability for environmental protection, with many infrastructure projects now requiring specific biodiversity net gain targets, often exceeding 10% improvement.

- EIA Integration: Black & Veatch consistently incorporates comprehensive EIAs to identify and address potential ecological impacts.

- Mitigation Strategies: The company develops and implements specific plans to offset or minimize negative environmental effects.

- Habitat Restoration: Projects often include components focused on restoring or enhancing local biodiversity, such as the 2023 wetland restoration initiative.

- Regulatory Compliance: Adherence to evolving environmental regulations and biodiversity targets is a core operational principle.

The increasing frequency of extreme weather events, like the 28 billion-dollar disasters in the U.S. in 2023, demands resilient infrastructure. Black & Veatch integrates climate projections and adaptive design to ensure project longevity and operational continuity.

The global push to triple renewable energy capacity by 2030 is driving significant infrastructure investment in solar, wind, and hydrogen. Black & Veatch's involvement in projects like the Philippines' floating solar array highlights their role in this clean energy transition.

With global water demand set to rise 20-30% by 2030 and a projected $1 trillion US infrastructure investment gap by 2040, efficient water management is crucial. Black & Veatch's digital water solutions and advanced treatment methods address water loss, which averages 20% in many municipal systems.

| Environmental Factor | Trend/Impact | Black & Veatch Response |

|---|---|---|

| Climate Change & Extreme Weather | Increased frequency and intensity of events (e.g., 28 US billion-dollar disasters in 2023). | Integrates climate projections and adaptive design for resilient infrastructure. |

| Decarbonization & Renewable Energy | Global commitment to triple renewable capacity by 2030. | Active participation in solar, wind, and hydrogen projects (e.g., Philippines floating solar). |

| Water Scarcity & Aging Infrastructure | Projected 20-30% global water demand increase by 2030; $1T US infrastructure gap by 2040. | Focus on digital water solutions and advanced treatment to reduce water loss (avg. 20%). |

| Circular Economy & Waste Reduction | Growing adoption of recycled materials and waste reduction targets (e.g., EU C&D Waste Directive). | Optimizes energy and material use, achieving up to 15% waste reduction on projects through reuse/recycling. |

| Biodiversity & Ecosystem Impact | Global biodiversity loss rate 10-100x higher than average; demand for biodiversity net gain targets. | Conducts EIAs and implements mitigation strategies, including habitat restoration (e.g., 500 acres wetland in 2023). |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources including government agencies, international organizations like the World Bank and IMF, and leading industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the energy sector.