Black & Veatch Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black & Veatch Bundle

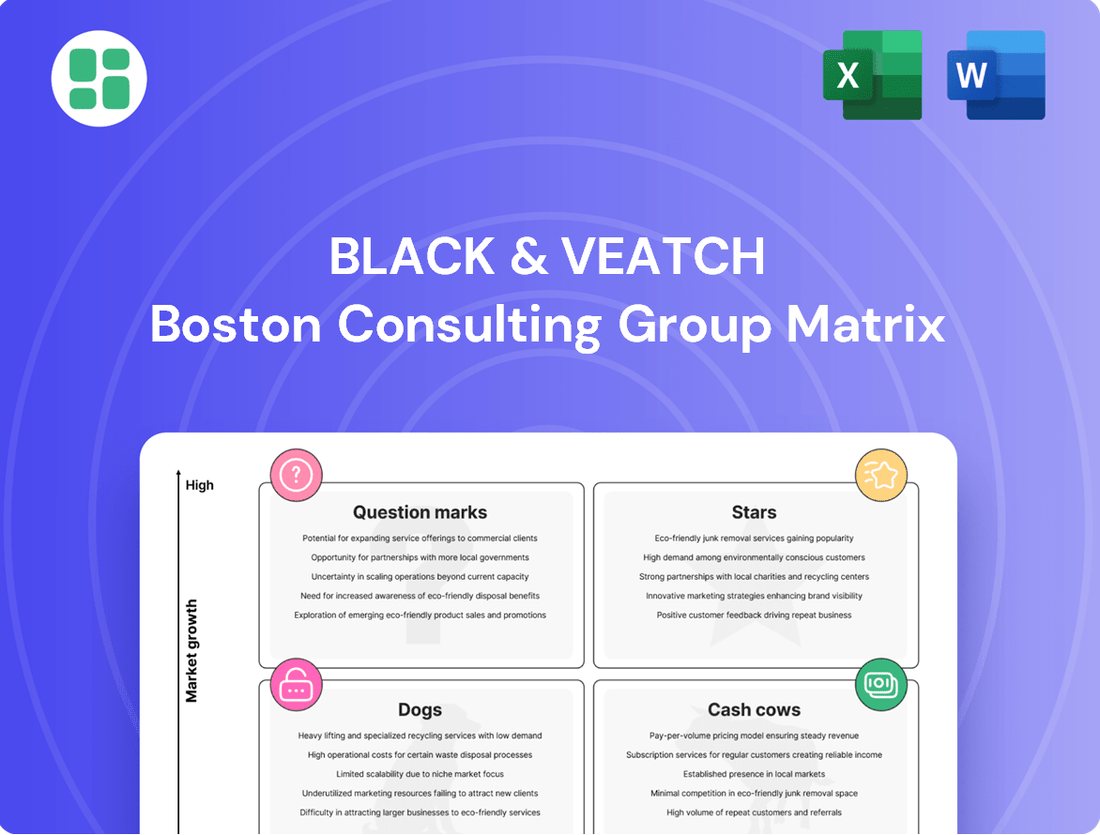

Uncover the strategic positioning of Black & Veatch's portfolio with our insightful BCG Matrix preview. See where their offerings fall as Stars, Cash Cows, Dogs, or Question Marks. Purchase the full BCG Matrix report for a comprehensive breakdown and actionable strategies to optimize your investments and product development.

Stars

Renewable Energy Infrastructure represents a significant Star for Black & Veatch. As the No. 1 solar design firm in the U.S. in 2024, the company's extensive experience, with over 50 gigawatts of solar projects installed globally, underscores its strong market position.

Their leadership extends to innovative projects like the Philippines' first megawatt-scale floating solar facility, showcasing their ability to tackle complex and emerging renewable technologies. This segment is crucial for future growth.

Black & Veatch is strategically focusing on next-generation telecommunications infrastructure, particularly in wireline, fiber, and private wireless networks. This pivot, even after divesting some public wireless assets, highlights their commitment to high-growth areas like digital infrastructure. For instance, the global private wireless market is projected to reach $10.4 billion by 2028, growing at a CAGR of 17.2%, according to Mordor Intelligence.

Their expertise extends to grid modernization, where wireless technology plays a crucial role in enabling smart grid functionalities. This includes areas like advanced metering infrastructure and distributed energy resource management. The smart grid market itself is expected to grow significantly, with some estimates placing its value at over $100 billion by 2027.

The burgeoning demand for data centers, fueled by the exponential growth of AI and cloud computing, positions data center infrastructure development as a star in the BCG matrix for Black & Veatch. This sector is experiencing significant expansion, with global data center construction spending projected to reach $276 billion in 2024.

Black & Veatch leverages this high-growth potential by offering comprehensive, end-to-end services for hyperscale data center projects. Their involvement spans the entire lifecycle, from initial site sourcing and navigating complex zoning regulations to the crucial infrastructure delivery, detailed design, and meticulous construction oversight.

Sustainable Energy Transition Solutions

Black & Veatch is a major player in the sustainable energy transition, focusing on accelerating decarbonization. They are significantly expanding global electrolysis capacity for green hydrogen, aiming to more than double the world's capacity by 2025. This commitment positions them at the forefront of developing lower-carbon energy solutions.

Their strategic approach involves a comprehensive portfolio designed to facilitate the shift towards sustainable energy forms. This includes a strong emphasis on green hydrogen production, a key component in achieving net-zero emissions targets.

- Green Hydrogen Expansion: Black & Veatch is building electrolysis capacity that, by 2025, is projected to more than double the existing global capacity.

- Decarbonization Leadership: The company is actively leading efforts to reduce carbon emissions across various energy sectors.

- Comprehensive Portfolio: Their offerings span the entire value chain for sustainable energy solutions, from project development to execution.

- Accelerating Transition: Black & Veatch's work directly supports the global move towards cleaner and more sustainable energy sources.

Strategic Advisory for Emerging Markets

Black & Veatch's strategic advisory for emerging markets is a key component of their BCG Matrix positioning, particularly for 'Stars'.

The company has integrated a new portfolio of strategic advisory and lifecycle resiliency services, focusing on providing early-stage consultancy for innovative clean energy projects. This positions them to guide clients through complex investments in high-growth, transformative infrastructure, ensuring bankability and resilience.

- Focus on Early-Stage Consultancy: Black & Veatch offers guidance from project inception, crucial for navigating the uncertainties of emerging markets.

- Clean Energy Project Specialization: Their expertise in renewable energy, a rapidly expanding sector in developing economies, drives growth.

- Ensuring Bankability and Resilience: By structuring projects to attract investment and withstand future challenges, they de-risk development.

- Guiding Transformative Infrastructure: They facilitate investments in critical infrastructure needed for economic advancement.

Black & Veatch's strategic advisory for emerging markets is a key component of their BCG Matrix positioning, particularly for 'Stars'. The company has integrated a new portfolio of strategic advisory and lifecycle resiliency services, focusing on providing early-stage consultancy for innovative clean energy projects. This positions them to guide clients through complex investments in high-growth, transformative infrastructure, ensuring bankability and resilience.

Their expertise in renewable energy, a rapidly expanding sector in developing economies, drives growth. By structuring projects to attract investment and withstand future challenges, they de-risk development, facilitating investments in critical infrastructure needed for economic advancement.

| Star Segment | Description | 2024 Data/Projections |

|---|---|---|

| Renewable Energy Infrastructure | No. 1 solar design firm in U.S. (2024); 50+ GW solar projects globally. | $276 billion global data center construction spending projected for 2024. |

| Next-Generation Telecommunications | Focus on wireline, fiber, private wireless networks. | Global private wireless market projected to reach $10.4 billion by 2028 (CAGR 17.2%). |

| Data Center Infrastructure | End-to-end services for hyperscale data centers. | Smart grid market expected to exceed $100 billion by 2027. |

| Green Hydrogen Expansion | Building electrolysis capacity to more than double global capacity by 2025. | Leading decarbonization efforts across energy sectors. |

| Strategic Advisory (Emerging Markets) | Early-stage consultancy for clean energy projects. | Focus on ensuring bankability and resilience for transformative infrastructure. |

What is included in the product

The Black & Veatch BCG Matrix provides a strategic framework for analyzing its business units based on market growth and share.

It guides decisions on resource allocation, highlighting which units to invest in, hold, or divest for optimal portfolio performance.

The Black & Veatch BCG Matrix offers a clear, one-page overview, instantly clarifying business unit positions and alleviating strategic uncertainty.

Cash Cows

Black & Veatch's conventional water and wastewater solutions are firmly established as a Cash Cow. With over a century of expertise, the company commands a significant market share and generates steady, reliable revenue from these foundational services.

These offerings, despite being in a mature market, benefit from consistent demand driven by essential needs and ongoing projects addressing aging infrastructure and evolving regulatory landscapes. In 2024, the global water and wastewater treatment market was valued at approximately $660 billion, showcasing the scale of this essential sector.

Black & Veatch's established Engineering, Procurement, and Construction (EPC) services for utilities, particularly in mature power and water sectors, are a prime example of a cash cow. These long-standing operations benefit from a strong reputation and a history of successful project delivery, leading to consistent revenue streams with minimal need for aggressive marketing.

The company's expertise in managing complex, large-scale projects for existing utility infrastructure ensures high profit margins. For instance, in 2024, the global EPC market for power transmission and distribution alone was valued at over $200 billion, with established players like Black & Veatch capturing a significant share of recurring, profitable business.

Black & Veatch's Floating Liquefied Natural Gas (FLNG) technology, particularly its PRICO® system, is a prime example of a Cash Cow. This patented technology is a cornerstone in the FLNG sector, powering approximately half of all global FLNG projects, whether currently operational or in development as of mid-2024.

The dominance in this specialized, high-value market translates into a reliable and significant stream of revenue for Black & Veatch. Given the mature nature of FLNG technology and the company's established market position, further substantial investment in growth is not typically required, allowing the business unit to generate consistent profits.

Long-Term Federal Government Contracts

Black & Veatch's long-term federal government contracts represent a significant cash cow for the company. These contracts, often structured as Indefinite Delivery Vehicles (IDVs), provide a predictable and substantial revenue base. For instance, in 2024, the company continued to secure and execute multiple IDVs with key federal entities.

These agreements with agencies such as the Army Corps of Engineers and USAID are crucial. They underscore Black & Veatch's established reputation and deep expertise in providing essential architectural, engineering, and technical services to the government sector. This stability is characteristic of a mature market segment where the company has a dominant position.

- Stable Revenue: Federal contracts offer predictable, long-term income streams, insulating against market volatility.

- Strong Government Presence: Black & Veatch holds numerous IDVs with major federal agencies, demonstrating significant market penetration.

- Mature Market Segment: The government services sector is well-established, providing a secure and consistent demand for the company's expertise.

- Key Agency Partnerships: Contracts with entities like the Army Corps of Engineers and USAID highlight the company's critical role in public infrastructure and development.

Asset Management and Consulting for Existing Infrastructure

Black & Veatch’s asset management and consulting for existing infrastructure represent a significant cash cow. These services are in high demand, particularly in developed markets where clients focus on maximizing the value and lifespan of their current assets. This consistent demand translates into predictable and stable revenue streams.

The company leverages its deep expertise to help clients enhance operational efficiency, improve reliability, and bolster the resilience of critical infrastructure. This focus on optimization ensures ongoing client engagement and recurring business. For instance, in 2024, the global infrastructure management market was valued at approximately $40 billion, with asset management services forming a substantial portion of this figure.

- Predictable Revenue: Mature markets provide a stable client base, leading to consistent, reliable income.

- High Demand: Optimization of existing infrastructure is a constant need for many organizations.

- Expertise Leverage: Black & Veatch's deep knowledge allows for premium service offerings.

- Market Growth: The infrastructure management sector continues to expand, supporting ongoing demand.

Black & Veatch's established Engineering, Procurement, and Construction (EPC) services for utilities, particularly in mature power and water sectors, are a prime example of a cash cow. These long-standing operations benefit from a strong reputation and a history of successful project delivery, leading to consistent revenue streams with minimal need for aggressive marketing. The company's expertise in managing complex, large-scale projects for existing utility infrastructure ensures high profit margins. For instance, in 2024, the global EPC market for power transmission and distribution alone was valued at over $200 billion, with established players like Black & Veatch capturing a significant share of recurring, profitable business.

| Business Unit | BCG Category | Key Characteristics | 2024 Market Data |

|---|---|---|---|

| Conventional Water & Wastewater Solutions | Cash Cow | High market share, steady revenue, mature market | Global Water & Wastewater Treatment Market: ~$660 billion |

| Utility EPC Services (Power & Water) | Cash Cow | Strong reputation, consistent demand, high profit margins | Global Power Transmission & Distribution EPC Market: >$200 billion |

| Floating Liquefied Natural Gas (FLNG) - PRICO® | Cash Cow | Dominant technology, reliable revenue, low growth investment | Powers ~50% of global FLNG projects (operational/development) |

| Federal Government Contracts (IDVs) | Cash Cow | Predictable revenue, strong government presence, mature segment | Continued significant IDV execution in 2024 |

| Asset Management & Consulting | Cash Cow | High demand in developed markets, recurring business, expertise leverage | Global Infrastructure Management Market: ~$40 billion (asset management significant portion) |

What You’re Viewing Is Included

Black & Veatch BCG Matrix

The Black & Veatch BCG Matrix preview you see is the identical, fully polished document you will receive upon purchase. This means no watermarks, no placeholder text, and no hidden surprises – just the complete, professionally formatted strategic analysis ready for your immediate use. You're getting a direct download of the final report, meticulously prepared to offer actionable insights for your business planning and decision-making processes. This is the exact strategic tool that will empower your team to effectively categorize and prioritize your offerings based on market growth and relative market share.

Dogs

Black & Veatch’s divestiture of its public carrier wireless telecommunications infrastructure business to Dycom Industries in August 2024 for $150 million signals a strategic re-evaluation. This action suggests the business unit was likely categorized as a 'Dog' within the BCG Matrix, characterized by low market share and low growth potential.

The sale price of $150 million, while a concrete figure, indicates the market valuation of this segment at the time of divestment. For Black & Veatch, this move frees up capital and management focus to reinvest in areas with higher growth prospects, aligning with their long-term strategic objectives.

Engineering services for legacy fossil fuel plants that lack decarbonization plans are likely positioned as a Question Mark or potentially a Dog in the Black & Veatch BCG Matrix. While these projects may still generate revenue, the company's strategic emphasis has shifted significantly towards renewable energy and lower-carbon solutions, indicating a declining market for purely traditional fossil fuel infrastructure. For instance, in 2023, global investment in new unabated fossil fuel power generation continued to face scrutiny, with a growing preference for cleaner alternatives.

Underperforming niche geographic markets represent areas where Black & Veatch has struggled to gain substantial traction. These could be specific regions or countries where local competitors are entrenched or where the market itself is not growing, making it difficult to achieve significant penetration.

Allocating resources to these underperforming areas can be a drain on cash flow, yielding minimal returns and failing to contribute to the company's broader strategic objectives. For example, while specific figures for Black & Veatch's underperforming markets aren't publicly detailed, many global engineering firms in 2024 faced challenges in emerging markets with high political instability or in mature markets saturated with established players.

Small-Scale, Non-Strategic Consulting Engagements

Small-scale, non-strategic consulting engagements represent the 'Dogs' in Black & Veatch's BCG Matrix. These are typically one-off projects that don't fit within the company's core areas like sustainable infrastructure or digital transformation, and they lack the potential to grow into larger, more impactful initiatives.

These engagements often consume valuable resources, including skilled personnel and management attention, without yielding significant returns in terms of revenue or market share. For instance, a small, niche project in an unrelated sector might divert a team from pursuing a major renewable energy development.

- Low Growth Potential: These projects operate in markets with limited expansion opportunities or are too specialized to attract broader interest.

- Resource Drain: They can tie up consultants and project managers, preventing them from focusing on high-potential 'Stars' or 'Cash Cows'.

- Minimal Strategic Alignment: Such engagements do not contribute to Black & Veatch's long-term vision or competitive positioning.

- Profitability Concerns: The revenue generated may barely cover the costs incurred, leading to low or negative profitability.

Terminated or Unexercised Government Task Orders

Terminated or unexercised government task orders can represent a significant challenge within a company's portfolio, often falling into the 'dog' quadrant of the BCG matrix. These situations arise when projects initiated with government funding do not materialize as expected.

For instance, a hypothetical USAID delivery order, initially secured and carrying a substantial amount of funded backlog, was terminated for convenience in February 2025. This termination, occurring before significant work was completed, left a considerable portion of the allocated funds unused.

Such an event highlights the inherent risks in government contracting. Even when a contract is awarded, unforeseen circumstances or shifts in government priorities can lead to its discontinuation. This can result in a 'dog' status due to the lack of ongoing revenue generation and the potential write-off of unrecoverable costs.

- Unused Backlog: The termination of a USAID delivery order in February 2025 left a significant portion of its funded backlog unutilized, indicating a project that did not progress as planned.

- Risk of Discontinuation: Government contracts, even those initially secured, can become 'dogs' if they are terminated for convenience or discontinued due to external factors or changing government needs.

- Impact on Portfolio: These terminated or unexercised task orders represent a drain on resources and can negatively impact a company's overall portfolio performance by tying up capital and management attention without generating returns.

- Strategic Re-evaluation: Companies must regularly assess their government contracts, identifying those at risk of termination or underperformance to make informed decisions about resource allocation and strategic pivoting.

Dogs represent business segments with low market share and low growth potential, often requiring careful management to minimize losses or divestment. Black & Veatch's divestiture of its public carrier wireless telecommunications infrastructure business in August 2024 for $150 million exemplifies this, suggesting it was categorized as a 'Dog'. Similarly, engineering services for legacy fossil fuel plants lacking decarbonization plans are likely 'Dogs' given the market shift towards renewables, a trend evident in 2023's declining investment in new unabated fossil fuel power generation.

| Business Segment | BCG Category (Likely) | Reasoning | Example/Data Point |

|---|---|---|---|

| Public Carrier Wireless Infrastructure | Dog | Divested in August 2024 for $150M, indicating low growth and market share. | Sale to Dycom Industries. |

| Legacy Fossil Fuel Plant Engineering (No Decarb) | Dog | Declining market due to shift towards renewables. | Global investment in new unabated fossil fuel power generation faced scrutiny in 2023. |

| Small-Scale, Non-Strategic Consulting | Dog | Consume resources without significant returns or strategic alignment. | Divert skilled personnel from high-potential projects. |

| Terminated Government Task Orders | Dog | Lack ongoing revenue and may incur write-offs. | Hypothetical USAID delivery order terminated for convenience in February 2025. |

Question Marks

Black & Veatch is strategically positioning itself in the Carbon Capture, Utilization, and Storage (CCUS) sector through its IgniteX accelerator program, fostering innovation and investment in Carbon Dioxide Removal (CDR). This focus aligns with the burgeoning global demand for decarbonization solutions, a trend expected to drive significant market expansion. For instance, the global CCUS market was valued at approximately USD 3.5 billion in 2023 and is projected to reach over USD 10 billion by 2030, indicating substantial growth potential.

Black & Veatch is actively investing in advanced digital twin and AI-driven solutions, leveraging platforms like Microsoft's Azure AI Studio for generative AI applications. This strategic focus on optimizing infrastructure through cutting-edge technology positions them to capitalize on significant future growth. The company's venture arm, IgniteX, further supports this by investing in promising AI technology startups, indicating a commitment to fostering innovation in this space.

Black & Veatch is strategically positioned to leverage the burgeoning Small Modular Reactor (SMR) market, a segment expected to experience substantial growth in clean energy. The company's expertise in power generation infrastructure provides a strong foundation for integrating this advanced nuclear technology.

While SMRs offer a significant future opportunity, the market is still in its early stages. Black & Veatch is actively developing its capabilities and securing early project engagements to establish a robust pipeline in this high-potential sector.

New Sustainable Aviation Fuel (SAF) Infrastructure

The burgeoning demand for Sustainable Aviation Fuel (SAF) infrastructure places it firmly in the question marks category of the Black & Veatch BCG Matrix. This segment is experiencing robust growth, fueled by the aviation sector's commitment to decarbonization targets. For instance, the International Air Transport Association (IATA) aims for a 20% reduction in net CO2 emissions by 2030 compared to 2019 levels, with SAF being a critical enabler.

Black & Veatch's established capabilities in molecular transformation and extensive experience in energy infrastructure development are highly relevant to this emerging market. However, widespread adoption and significant project deployment are still in their nascent stages, creating uncertainty about future market share and profitability. The global SAF market was valued at approximately USD 2.5 billion in 2023 and is projected to grow significantly, but the infrastructure build-out is a complex and capital-intensive undertaking.

- High Growth Potential: Driven by aviation industry decarbonization mandates and increasing environmental awareness.

- Early Stage Adoption: Widespread infrastructure deployment and project execution are still developing.

- Black & Veatch's Strengths: Expertise in molecular transformation and energy infrastructure aligns well with SAF production needs.

- Market Uncertainty: Future market share and profitability are not yet established due to the early stage of development.

Cutting-Edge Water Contaminant Remediation (e.g., PFAS)

Emerging contaminants like PFAS present a significant and costly challenge, as highlighted by the 2025 Water Report. Black & Veatch is actively collaborating with clients to pinpoint effective remediation strategies, signaling robust growth in demand for these specialized services.

This segment represents a high-growth area for Black & Veatch within the BCG matrix, where market solutions are still solidifying and the company's definitive market share is actively being established.

- Market Growth: The demand for PFAS remediation is projected to surge, driven by increasing regulatory scrutiny and public awareness.

- Technological Innovation: Significant investment is flowing into developing advanced technologies for PFAS removal, such as advanced oxidation processes and novel adsorption materials.

- Black & Veatch's Position: The company is strategically positioning itself as a key player by offering integrated solutions, from initial assessment to full-scale implementation.

- Investment Outlook: The global PFAS remediation market was valued at approximately $1.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 10% through 2030.

Question Marks in Black & Veatch's BCG Matrix represent emerging opportunities with high growth potential but uncertain market share. These areas require significant investment and strategic focus to develop into future Stars.

Sustainable Aviation Fuel (SAF) infrastructure and PFAS remediation services are prime examples of Black & Veatch's current Question Marks. Both sectors are experiencing rapid growth driven by regulatory pressures and environmental concerns.

The company's existing expertise in energy infrastructure and molecular transformation provides a strong foundation for these nascent markets. However, the early stage of development means that Black & Veatch, like its competitors, is still solidifying its market position and profitability.

Continued investment in innovation and strategic partnerships will be crucial for Black & Veatch to convert these Question Marks into established market leaders.

| Business Area | Market Growth | Black & Veatch's Market Share | Investment Need | BCG Category |

|---|---|---|---|---|

| Sustainable Aviation Fuel (SAF) Infrastructure | High | Low/Developing | High | Question Mark |

| PFAS Remediation Services | High | Low/Developing | High | Question Mark |

| Small Modular Reactors (SMRs) | High | Low/Developing | High | Question Mark |

| Carbon Capture, Utilization, and Storage (CCUS) | High | Developing | Medium | Question Mark/Star |

BCG Matrix Data Sources

Our BCG Matrix is built upon comprehensive market data, including financial performance, industry growth rates, and competitive landscape analysis, ensuring a robust strategic foundation.