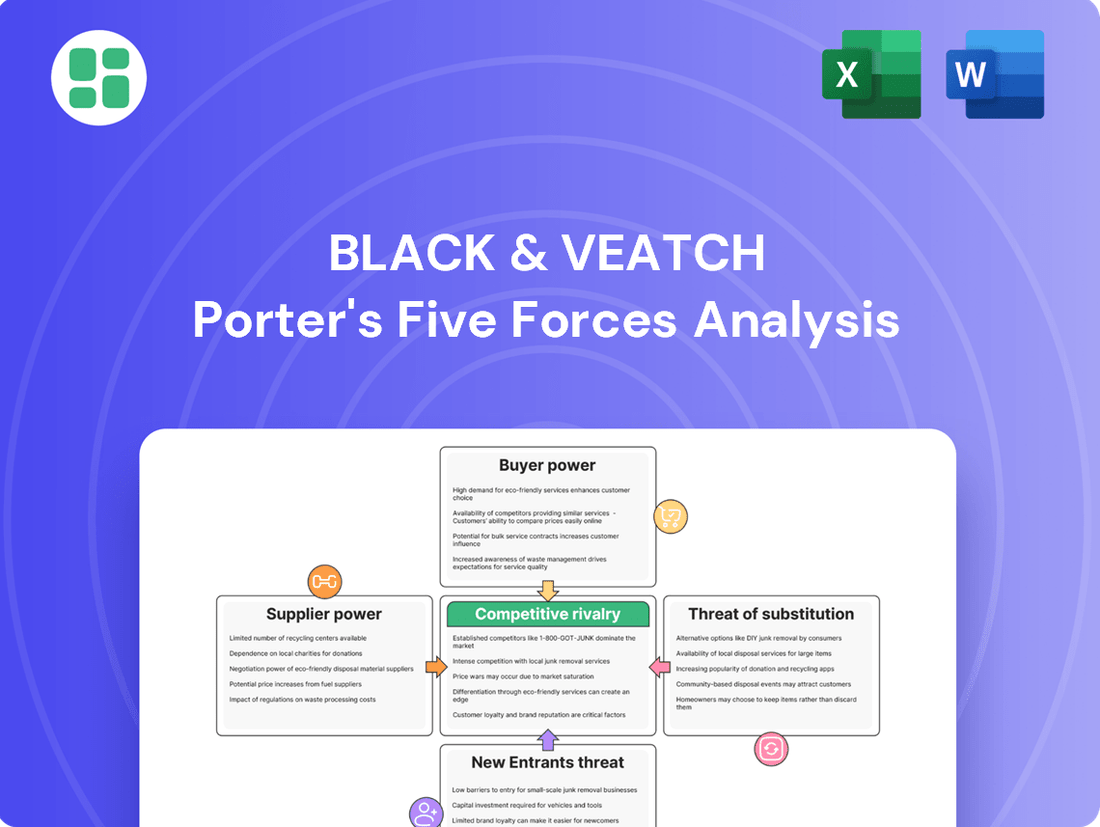

Black & Veatch Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black & Veatch Bundle

Black & Veatch navigates a complex industry landscape, where understanding the intensity of competitive rivalry and the power of buyers is crucial. Their position is significantly shaped by the threat of substitutes and the bargaining power of suppliers, all within the context of potential new entrants.

Ready to move beyond the basics? Get a full strategic breakdown of Black & Veatch’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Black & Veatch’s dependence on highly specialized talent, such as engineers and project managers in areas like renewable energy, significantly influences supplier bargaining power. The limited availability of these professionals, especially in emerging infrastructure sectors, allows them to command higher compensation. For instance, in 2024, the demand for skilled engineers in the clean energy sector outstripped supply, leading to average salary increases of over 7% for experienced professionals in these fields.

For complex infrastructure projects, Black & Veatch frequently needs highly specialized equipment, software, and technology. When there are few providers for these advanced tools or unique technologies, those suppliers gain considerable leverage. This is especially true if the technology is crucial for project success or provides a distinct competitive edge, which can drive up costs for Black & Veatch.

Black & Veatch's reliance on raw materials like steel and concrete for its engineering and construction projects means suppliers of these critical inputs hold significant bargaining power. For instance, global steel prices saw considerable volatility in 2024, impacting project costs. Disruptions in the supply of specialized components, often sourced from a limited number of manufacturers, can further empower these suppliers.

Niche Subcontractors and Specialty Firms

For intricate projects, Black & Veatch relies on niche subcontractors and specialty firms, such as those providing advanced environmental consulting or unique geotechnical engineering. The scarcity of firms with highly specific, in-demand skills can significantly amplify their leverage.

In 2024, the demand for specialized engineering services, particularly in renewable energy infrastructure and advanced materials, saw a notable increase. This heightened demand for niche expertise means these subcontractors can command higher prices, impacting Black & Veatch's project costs.

- Limited Availability: Firms with unique certifications or proprietary technologies for critical project phases have fewer competitors.

- Cost Escalation: This scarcity allows specialized subcontractors to negotiate more favorable terms, potentially increasing overall project expenses for Black & Veatch.

- Project Dependency: Black & Veatch's reliance on these specialized skills for project completion strengthens the subcontractors' bargaining position.

Financial and Insurance Providers

Financial and insurance providers hold considerable bargaining power when dealing with companies like Black & Veatch, particularly concerning large-scale infrastructure projects. These projects necessitate significant financial arrangements, such as project financing, surety bonds, and specialized insurance policies, often running into hundreds of millions or even billions of dollars. For instance, in 2024, the global infrastructure market was projected to see substantial investment, with a significant portion requiring complex financing structures.

The limited pool of financial institutions and insurance companies capable of underwriting such high-value, complex, and often globally distributed projects means these providers can dictate terms. This scarcity of specialized capacity allows them to exert leverage, influencing the cost of capital and the overall financial feasibility of projects Black & Veatch undertakes. In 2023, the cost of capital for large infrastructure projects saw fluctuations due to rising interest rates and increased demand for project finance, directly impacting project economics.

- Limited Underwriting Capacity: Fewer financial institutions possess the expertise and capital to finance mega-projects, concentrating power.

- Risk Assessment and Pricing: Providers can charge higher premiums or interest rates based on project complexity and perceived risk.

- Bonding Requirements: The necessity of performance and payment bonds places significant reliance on surety providers.

- Insurance Specialization: Unique project risks often require specialized insurance products, further narrowing the provider base.

Suppliers of highly specialized engineering talent, particularly in rapidly growing sectors like renewable energy, hold significant bargaining power due to limited availability. In 2024, demand for these professionals outpaced supply, leading to average salary increases exceeding 7% for experienced engineers in clean energy.

Providers of unique or critical technologies and software for complex infrastructure projects also wield considerable influence, especially when few alternatives exist. This leverage allows them to command higher prices, impacting Black & Veatch's project costs if these tools are essential for success.

The bargaining power of raw material suppliers, such as those for steel and concrete, is amplified by price volatility and potential supply chain disruptions. In 2024, global steel prices experienced significant fluctuations, directly affecting project expenses for Black & Veatch.

Niche subcontractors and specialty firms with unique, in-demand skills, like advanced environmental consulting or geotechnical engineering, benefit from scarcity. The limited number of firms possessing these specific competencies allows them to negotiate more favorable terms, potentially increasing project costs.

| Supplier Type | Key Factor | Impact on Black & Veatch | 2024 Data/Trend |

|---|---|---|---|

| Specialized Engineering Talent | Limited Availability | Higher compensation demands | 7%+ salary increase in clean energy |

| Technology Providers | Few alternatives for critical tools | Increased software/technology costs | N/A (specific data not publicly available) |

| Raw Materials (Steel, Concrete) | Price Volatility & Supply Disruptions | Increased material costs | Significant steel price fluctuations |

| Niche Subcontractors | Scarcity of specific skills | Higher subcontracting fees | Increased demand for renewable energy expertise |

What is included in the product

Analyzes Black & Veatch's competitive environment by examining supplier power, buyer bargaining, threat of new entrants, substitutes, and industry rivalry.

Instantly identify and mitigate competitive threats with a visual representation of each force, allowing for proactive strategy adjustments.

Customers Bargaining Power

Black & Veatch’s core clientele comprises government bodies, municipalities, and major utility companies. These entities often oversee infrastructure projects valued in the billions of dollars, granting them substantial bargaining leverage. For instance, in 2024, municipal infrastructure spending is projected to remain robust, with significant investments in water, energy, and transportation systems, creating a competitive environment for engineering and construction firms.

The sheer scale of these clients’ projects means they can negotiate highly favorable terms, pricing, and quality standards. Their procurement processes are typically lengthy and involve competitive bidding, a mechanism designed to secure the best value. This rigorous approach empowers them to dictate contract conditions and demand exceptional performance from service providers like Black & Veatch, directly impacting profit margins.

While Black & Veatch might secure a strong position within a long-term infrastructure project, the initial selection process for new endeavors grants significant power to customers. They can choose from numerous global engineering and construction firms, evaluating factors like reputation, technical expertise, and cost. This means Black & Veatch must continually demonstrate its value to secure new business.

Black & Veatch's clients are highly experienced in acquiring complex engineering and construction services, often employing specialized procurement teams. These customers typically possess well-defined project specifications and rigorous evaluation processes, enabling them to effectively negotiate terms. This sophistication significantly enhances their bargaining power, influencing pricing, timelines, and performance standards.

Availability of Multiple Qualified Providers

The availability of multiple qualified providers significantly amplifies customer bargaining power in the engineering, procurement, and construction (EPC) sector, particularly within Black & Veatch's core markets like energy, water, and telecom infrastructure. Clients can readily source bids from numerous established global and regional firms.

This competitive environment allows customers to meticulously compare offerings, prioritizing factors such as specialized expertise, proven project execution, cost efficiency, and robust risk mitigation strategies. For instance, in 2024, the global EPC market for infrastructure projects saw a substantial number of bids submitted for major renewable energy installations, reflecting this broad provider base.

- Increased Supplier Competition: Customers can leverage the presence of numerous EPC firms to negotiate more favorable terms and pricing.

- Benchmarking Capabilities: The ease of comparing proposals allows clients to identify the most competitive and suitable partners.

- Focus on Value Proposition: Providers must differentiate themselves not just on price but on the overall value delivered, including technical innovation and project management excellence.

- Reduced Switching Costs: For many projects, the effort and cost to switch between qualified EPC providers are relatively low, further empowering the customer.

Client Focus on Value and Risk Mitigation

Clients in critical infrastructure sectors, including those Black & Veatch serves, increasingly prioritize long-term value, reliability, and sustainability over mere upfront cost. This shift means they are willing to invest in solutions that mitigate risks, such as supply chain disruptions or regulatory changes. For instance, a 2024 report by McKinsey highlighted that for major capital projects, total cost of ownership and risk management can account for up to 60% of a client's decision-making criteria.

This heightened client focus on value and risk mitigation directly translates into increased bargaining power. Customers can demand more comprehensive service packages, cutting-edge technologies, and superior project management from engineering and construction firms like Black & Veatch. They are empowered to negotiate terms that reflect the integrated nature of the solutions they require, moving beyond simple transactional relationships.

Black & Veatch's success in securing and retaining these high-value clients hinges on its consistent ability to deliver on these multifaceted demands. Demonstrating a clear track record in providing reliable, sustainable, and risk-resilient infrastructure solutions is paramount. This capability allows the company to command premium pricing and build stronger, more enduring client relationships, even when faced with significant customer leverage.

Key client expectations influencing bargaining power include:

- Demand for integrated solutions: Clients seek end-to-end project delivery, encompassing design, engineering, procurement, construction, and ongoing operations and maintenance.

- Emphasis on technological innovation: The adoption of advanced technologies, such as digital twins and AI-driven analytics, is crucial for optimizing performance and reducing operational risks.

- Commitment to sustainability and ESG goals: Clients are increasingly evaluating projects based on their environmental, social, and governance (ESG) performance, demanding solutions that align with these objectives.

- Robust risk management frameworks: Clients expect partners to proactively identify, assess, and mitigate project risks, ensuring predictable outcomes and minimizing potential liabilities.

Black & Veatch's customers possess significant bargaining power due to their large project sizes and the competitive landscape of the engineering and construction sector. These clients, often government bodies and utilities, can negotiate favorable terms and pricing because they have numerous global and regional firms to choose from, especially in high-demand areas like renewable energy infrastructure in 2024.

The clients' sophistication in procurement, employing specialized teams and rigorous evaluation processes, further enhances their leverage. They demand integrated solutions, technological innovation, and a strong commitment to sustainability and ESG goals, as highlighted by a 2024 McKinsey report indicating these factors can influence up to 60% of major capital project decisions.

This empowers customers to dictate contract conditions and demand exceptional performance, impacting profit margins for providers like Black & Veatch. The relative ease of switching between qualified providers also reinforces this customer advantage.

Black & Veatch must continually demonstrate its value proposition, focusing on technical expertise, project execution, cost efficiency, and risk mitigation to secure new business and maintain strong client relationships.

Preview the Actual Deliverable

Black & Veatch Porter's Five Forces Analysis

This preview shows the exact Black & Veatch Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This detailed report is ready for your immediate use.

Rivalry Among Competitors

The critical infrastructure sector is a battleground for global Engineering, Procurement, and Construction (EPC) giants. Companies like AECOM, Jacobs, Fluor, Bechtel, and Kiewit possess comparable expertise, a wealth of experience, and a worldwide presence, directly challenging Black & Veatch for major, high-value projects.

This intense rivalry means these firms frequently compete head-to-head across Black & Veatch's key markets, such as energy, water, and telecommunications. For instance, in 2024, major infrastructure deals often saw bids from multiple of these established global players, driving down margins and requiring significant differentiation to win contracts.

Competition on expertise is intense, with many firms offering broad engineering, procurement, and construction (EPC) services. However, the real battleground is in specialized niches. Think renewable energy integration, smart grid solutions, advanced water treatment, or even secure government facilities. Black & Veatch faces rivals who have honed their skills in these specific areas.

To stand out, Black & Veatch needs to continuously invest in and showcase its unique knowledge and innovative approaches. For instance, in the renewable energy sector, where project complexity is rising, firms with proven track records in integrating diverse energy sources like solar, wind, and battery storage will have a distinct advantage. The global renewable energy market was valued at over $1.5 trillion in 2023 and is projected for significant growth, making specialization a key differentiator.

The infrastructure sector, where Black & Veatch operates, often sees intense competition driven by price. This is particularly true for components that are more standardized, leading to a significant emphasis on cost during the bidding process. This competitive dynamic directly impacts project margins, as companies vie to offer the lowest prices to secure contracts.

In 2024, the global infrastructure market continued to experience this pressure. For example, reports indicated that in many large-scale engineering, procurement, and construction (EPC) projects, winning bids were often decided by margins as slim as 1-3%. This highlights the critical need for firms like Black & Veatch to meticulously manage costs and operational efficiencies to maintain profitability amidst aggressive pricing strategies from competitors.

Black & Veatch must therefore strike a delicate balance. Offering competitive pricing is essential to win projects, but it cannot come at the expense of quality or the long-term sustainability of the solutions provided. A focus on value engineering and innovative approaches that reduce lifecycle costs, rather than just upfront price, becomes crucial for securing profitable engagements and avoiding a detrimental race to the bottom.

Reputation and Track Record

In the critical infrastructure sector, a firm's reputation, safety record, and proven track record of successful project delivery are paramount. Competitors constantly leverage their past successes and client relationships to win new business.

Black & Veatch must consistently deliver projects on time and within budget, ensuring high client satisfaction, to maintain its strong reputation and compete effectively. For example, in 2023, Black & Veatch reported a strong safety performance with a Total Recordable Incident Rate (TRIR) of 0.36, significantly below the industry average.

- Reputation as a Key Differentiator: In the infrastructure space, a history of successful, safe, and on-time project completion is a major competitive advantage.

- Client Relationships: Long-standing relationships built on trust and past performance are crucial for securing repeat business and new contracts.

- Performance Metrics: Black & Veatch's commitment to project delivery, evidenced by its 2023 TRIR of 0.36, directly impacts its ability to win bids against established rivals.

Market Growth and Consolidation

The global infrastructure market is experiencing robust growth, fueled by increasing urbanization, the urgent need to address climate change impacts, and the ongoing necessity to upgrade aging infrastructure. For instance, the International Monetary Fund projected global infrastructure investment needs to be around $3.3 trillion annually through 2030. This expansion creates a highly competitive environment as companies like Black & Veatch compete for these significant projects.

The sector is also witnessing a trend toward consolidation. Major mergers and acquisitions are creating larger, more integrated competitors with expanded service offerings and greater financial muscle. This consolidation means Black & Veatch faces rivals that are not only growing organically but also through strategic acquisitions, demanding continuous adaptation in its market approach.

- The infrastructure market is projected to grow significantly, with estimates suggesting global spending could reach trillions annually by 2030, driven by sustainability and modernization efforts.

- Consolidation within the engineering and construction sectors is leading to the emergence of larger, more diversified players capable of undertaking more complex and extensive projects.

- This intensified rivalry necessitates Black & Veatch to maintain a strong focus on innovation and strategic partnerships to secure market share and enhance its competitive edge.

The competitive rivalry within the critical infrastructure sector is fierce, with Black & Veatch facing numerous established global Engineering, Procurement, and Construction (EPC) giants. These competitors, including AECOM, Jacobs, Fluor, Bechtel, and Kiewit, possess comparable expertise, extensive experience, and a global footprint, directly vying for major, high-value projects across Black & Veatch's core markets like energy, water, and telecommunications. This intense competition, evident in 2024 with multiple global players bidding on significant infrastructure deals, consistently drives down project margins and necessitates strong differentiation to secure contracts.

Specialization in niche areas such as renewable energy integration, smart grid solutions, and advanced water treatment is becoming a critical differentiator. For example, the renewable energy market, valued at over $1.5 trillion in 2023, rewards firms with proven track records in complex energy source integration. Furthermore, aggressive pricing strategies are prevalent, especially for more standardized project components, with winning bids in 2024 often decided by slim margins of 1-3%, underscoring the need for meticulous cost management and operational efficiency.

A firm's reputation, safety record, and successful project delivery are paramount in winning bids. Black & Veatch's 2023 Total Recordable Incident Rate (TRIR) of 0.36, well below the industry average, highlights the importance of maintaining strong performance metrics. The sector's robust growth, projected at $3.3 trillion annually through 2030, coupled with industry consolidation creating larger competitors, further intensifies this rivalry, compelling Black & Veatch to prioritize innovation and strategic partnerships to maintain its competitive edge.

SSubstitutes Threaten

Large government agencies, utilities, and industrial corporations are increasingly building out their internal engineering, procurement, and construction management expertise. For example, in 2023, several major utility companies announced significant investments in expanding their in-house project management teams to handle a larger portion of their capital expenditure programs, aiming to gain more control and potentially reduce costs on routine infrastructure upgrades.

This trend directly substitutes for the services offered by external firms like Black & Veatch, especially for less complex or standardized projects. When these entities develop robust in-house capabilities, their need for outsourcing specific project phases diminishes, impacting the demand for traditional EPC services and potentially leading to a shift in market dynamics.

The increasing adoption of decentralized energy generation, like rooftop solar and microgrids, presents a significant threat to traditional, large-scale infrastructure. For instance, by the end of 2023, the U.S. saw over 30 GW of solar capacity installed, a record year, indicating a growing preference for localized power solutions.

Similarly, distributed water management systems, such as rainwater harvesting and localized greywater recycling, can reduce reliance on extensive centralized water treatment and distribution networks. This shift could potentially decrease demand for Black & Veatch's traditional large-scale water infrastructure projects.

The rise of advanced predictive technologies and digital twins presents a significant threat of substitution for traditional engineering and consulting services. As these tools become more sophisticated, clients can gain greater autonomy in managing their assets, potentially reducing their reliance on ongoing external support. For instance, the global digital twin market was valued at approximately $6.1 billion in 2023 and is projected to reach $116.4 billion by 2030, indicating rapid adoption and capability expansion.

AI-driven predictive maintenance, in particular, allows for proactive identification and resolution of issues, diminishing the need for reactive or scheduled maintenance contracts that Black & Veatch might otherwise secure. While Black & Veatch actively incorporates these technologies into its offerings, a client's internal capacity to leverage these advanced analytics for self-management can directly substitute for a portion of the recurring service revenue that such firms have historically depended upon.

Modular and Off-Site Construction Methods

The increasing prevalence of modular and off-site construction methods presents a significant threat of substitution for traditional engineering, procurement, and construction (EPC) services. These methods can expedite project timelines and lower overall costs by shifting labor and assembly to controlled factory environments. For instance, the global modular construction market was valued at approximately USD 104.7 billion in 2023 and is projected to reach USD 213.2 billion by 2030, indicating a substantial shift in industry practices.

While Black & Veatch, as a leading EPC firm, can integrate these advanced techniques into its offerings, a widespread industry pivot could diminish the demand for its established on-site execution expertise. This evolution necessitates a strategic adaptation to maintain competitiveness and relevance in a changing project landscape.

- Market Growth: The modular construction market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of over 10% in the coming years.

- Cost Efficiency: Off-site construction can yield cost savings of up to 20% compared to traditional methods due to reduced waste, optimized labor, and shorter build times.

- Project Delivery: Modular projects can be completed up to 50% faster than conventional builds, offering a significant advantage in time-sensitive sectors.

Policy Shifts Towards Non-Infrastructure Solutions

Policy shifts favoring demand-side management and conservation present a significant threat of substitutes for traditional infrastructure projects. For example, aggressive water conservation initiatives can reduce the need for new water treatment plants, directly impacting Black & Veatch's potential project pipeline. In 2024, several regions saw increased investment in smart water metering and leak detection technologies, aiming to curb demand by up to 15% in pilot programs.

Similarly, energy efficiency mandates and incentives for renewable energy adoption can diminish the demand for new fossil fuel-based power generation facilities. This trend is accelerating, with a growing number of countries setting ambitious energy efficiency targets. For instance, the European Union's Energy Efficiency Directive aims to reduce final energy consumption by 11.7% by 2030 compared to 2020 projections, potentially substituting demand for new large-scale power infrastructure.

- Policy Prioritization: Governments increasingly favor demand-side management and conservation over new infrastructure.

- Water Sector Impact: Water conservation programs can reduce the urgency for new water treatment plants.

- Energy Sector Impact: Energy efficiency mandates and renewables lessen the need for new power generation.

- Market Trend: Smart metering and efficiency targets are growing substitutes for traditional infrastructure development.

The increasing self-sufficiency of large clients, coupled with the rise of decentralized technologies and advanced digital tools, significantly challenges traditional EPC service models. For instance, in 2024, many major utilities expanded their in-house engineering teams, aiming to manage more capital expenditure projects internally. This trend, along with the growing adoption of rooftop solar and modular construction—a market valued at over $104 billion in 2023—directly substitutes for the services offered by external firms like Black & Veatch, particularly for less complex projects.

Furthermore, policy shifts favoring conservation and energy efficiency, such as ambitious European Union energy efficiency targets for 2030, reduce the demand for new large-scale infrastructure. Smart water metering and leak detection, which saw increased investment in 2024, also diminish the need for traditional water infrastructure projects. The expansion of digital twin technology, projected to reach $116.4 billion by 2030, empowers clients with greater asset management autonomy, substituting for recurring external support services.

| Threat of Substitutes | Key Trends | Impact on Black & Veatch | Supporting Data (2023-2024) |

| In-house Capabilities | Utilities expanding internal EPC expertise | Reduced outsourcing demand for routine projects | Several major utilities increased in-house project management teams in 2023. |

| Decentralized Energy | Growth of rooftop solar and microgrids | Decreased demand for large-scale power infrastructure | Over 30 GW of solar capacity installed in the U.S. in 2023. |

| Digitalization & AI | Advanced predictive maintenance, digital twins | Reduced need for ongoing external support and reactive maintenance | Global digital twin market valued at ~$6.1 billion in 2023. |

| Modular Construction | Off-site and factory-built solutions | Diminished demand for traditional on-site EPC execution | Global modular construction market valued at ~$104.7 billion in 2023. |

| Policy & Conservation | Demand-side management, energy efficiency mandates | Lowered need for new water and power generation facilities | Increased investment in smart water metering in 2024; EU targets 11.7% energy reduction by 2030. |

Entrants Threaten

Entering the critical infrastructure engineering and construction sector, where Black & Veatch operates, demands immense capital. This includes securing large performance bonds, financing complex projects, and maintaining a substantial, highly skilled workforce. For instance, major infrastructure projects can easily run into billions of dollars, presenting a significant barrier.

Newcomers face considerable financial risk, particularly when bidding on multi-billion dollar projects. Established firms like Black & Veatch possess strong balance sheets and established relationships for accessing capital, giving them a distinct advantage. This financial muscle makes it challenging for new entrants to effectively compete on scale and risk absorption.

The infrastructure sector, where Black & Veatch operates, is characterized by extensive regulatory and licensing hurdles. Navigating this complex web of permits, licenses, and adherence to stringent environmental, safety, and construction standards is a significant undertaking.

New entrants face considerable challenges in overcoming these barriers. The process of obtaining necessary approvals can be both time-consuming and expensive, often requiring specialized expertise and substantial upfront investment. For instance, in 2024, the average time to secure major infrastructure project permits in the United States could extend over several years, depending on the project's scope and location.

Established firms like Black & Veatch possess existing compliance frameworks and a deep understanding of these regulatory requirements. This advantage allows them to operate more efficiently and predictably, creating a substantial barrier for newcomers who must build this capacity from scratch. The cost of non-compliance can also be severe, including hefty fines and project delays, further deterring potential entrants.

Clients in critical infrastructure, especially government and utility sectors, place immense value on a proven track record, extensive experience, and a reputation for safety and reliability. This is a significant barrier for new entrants.

For example, in 2024, major infrastructure projects often require bidders to demonstrate decades of successful project completion and adherence to stringent regulatory standards. New companies simply cannot match this established history, making it difficult to secure contracts against incumbents like Black & Veatch.

The lack of an established reputation and existing client relationships means new entrants struggle to gain the trust necessary to compete for large, complex projects. Winning bids against well-regarded firms with a history of successful delivery is a formidable challenge.

Scarcity of Specialized Expertise and Talent

The critical infrastructure sector, where Black & Veatch operates, requires highly specialized expertise. This includes experienced engineers, project managers, and technical specialists who understand complex systems. New companies entering this field face a significant hurdle in finding and keeping such talent.

Established firms like Black & Veatch have a distinct advantage in attracting and retaining this scarce human capital. They can offer career stability, exposure to large-scale, impactful projects, and competitive compensation packages. This makes it difficult for new entrants to build a competent workforce, acting as a substantial barrier.

- Talent Scarcity: Critical infrastructure projects demand niche skills in engineering, project management, and specialized technical fields.

- Established Firm Advantage: Companies like Black & Veatch leverage their reputation, project portfolio, and compensation to attract top talent.

- Human Capital Barrier: The difficulty in recruiting and retaining specialized personnel presents a significant challenge for new market entrants.

- 2024 Industry Trend: Reports indicate a continued shortage of skilled labor in the engineering and construction sectors throughout 2024, exacerbating this barrier.

Complex Sales Cycles and Client Relationships

The infrastructure sector, where Black & Veatch operates, is characterized by exceptionally long sales cycles, often spanning several years from initial bid to contract award. This complexity, coupled with the necessity of building deep, trust-based client relationships, presents a significant barrier for new entrants. Incumbents, having a proven track record and established rapport, possess a distinct advantage in navigating these intricate procurement processes.

Consider the global infrastructure market, which was projected to reach over $15 trillion by 2024, with major projects requiring extensive due diligence and stakeholder engagement. New companies entering this space must not only demonstrate technical capability but also invest heavily in relationship building and understanding the nuanced requirements of government agencies and large corporations. This investment in time and resources makes it difficult for newcomers to compete effectively against established players with established credibility.

- Long Sales Cycles: Bidding for major infrastructure projects can take 2-5 years, requiring significant upfront investment from participants.

- Client Relationship Dependency: Success hinges on trust and past performance, making it hard for new firms to gain initial traction.

- Procurement Complexity: Navigating diverse and often rigid government and corporate procurement procedures is a substantial hurdle for new entrants.

- Incumbent Advantage: Established firms benefit from existing relationships and a demonstrated history of successful project delivery.

The threat of new entrants in the critical infrastructure engineering and construction sector, where Black & Veatch operates, is generally low. This is primarily due to the substantial capital requirements, including securing performance bonds and financing for large-scale projects, which can easily run into billions of dollars. Newcomers also face significant regulatory and licensing hurdles, demanding extensive expertise and upfront investment to navigate complex permits and standards.

Furthermore, clients in this sector prioritize a proven track record and reputation for reliability, making it difficult for new firms to gain trust and compete against established players. The scarcity of highly specialized talent, coupled with long sales cycles and complex procurement processes, further solidifies this barrier.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Billions of dollars needed for project financing and performance bonds. | High; significant upfront investment required. |

| Regulatory Hurdles | Complex permits, licenses, environmental, and safety standards. | High; time-consuming and expensive to navigate. |

| Reputation & Track Record | Clients demand decades of successful project completion. | High; difficult for new firms to establish credibility. |

| Specialized Talent | Scarcity of experienced engineers and project managers. | High; challenging to attract and retain skilled personnel. |

| Sales Cycles & Relationships | Long bid processes and need for deep client trust. | High; incumbents benefit from established rapport. |

Porter's Five Forces Analysis Data Sources

Our Black & Veatch Porter's Five Forces analysis is built upon a foundation of robust data, including industry-specific market research reports, financial statements from key players, and government regulatory filings to accurately gauge competitive intensity.