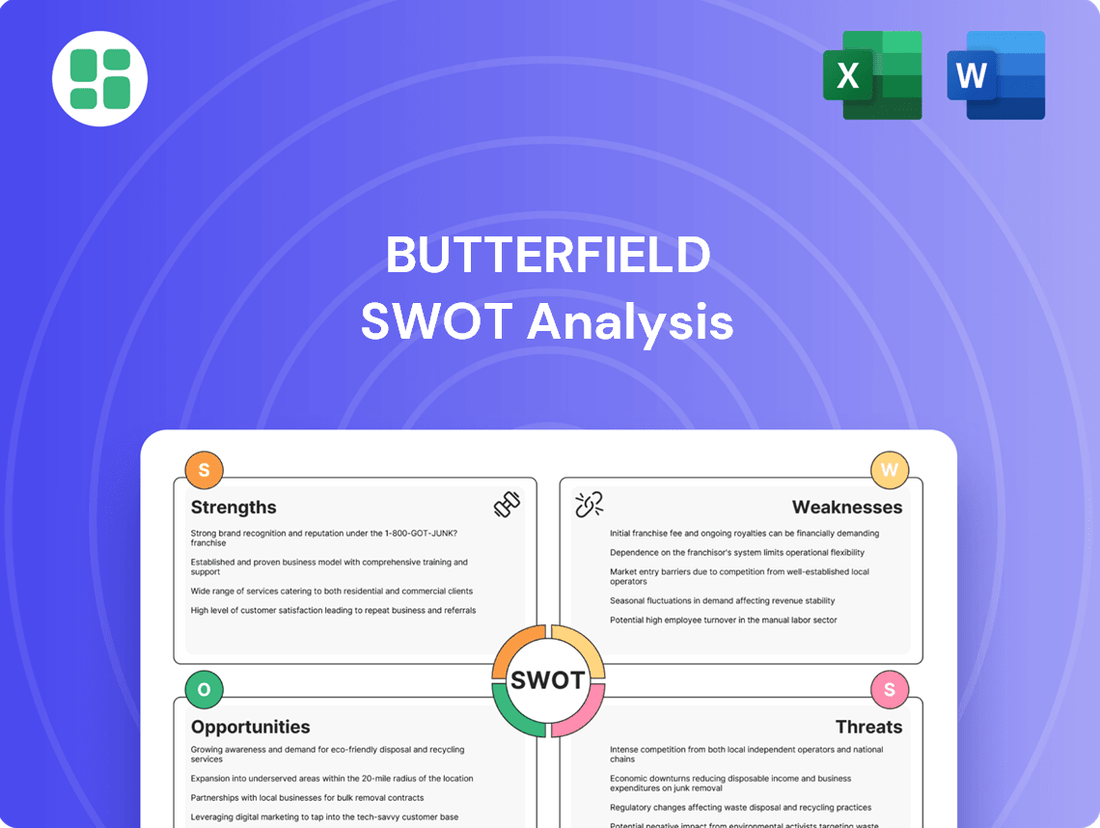

Butterfield SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Butterfield Bundle

Butterfield's current market position reveals a dynamic interplay of strengths and potential vulnerabilities. Understanding these core elements is crucial for any strategic decision-maker.

Want the full story behind Butterfield's competitive edge and areas for development? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Butterfield boasts a robust suite of diversified financial services, encompassing retail and corporate banking, treasury solutions, and comprehensive wealth management. This broad spectrum of offerings allows the bank to serve a wide array of clients, from individuals to large corporations, thereby mitigating risk by not being overly dependent on a single market segment.

The bank's integrated approach to financial services, covering everything from deposits and lending to trust, private banking, asset management, and custody, provides clients with a holistic banking experience. This deepens client relationships and creates multiple touchpoints for revenue generation across the organization.

As of the first quarter of 2024, Butterfield reported total client deposits of $12.1 billion, highlighting the trust and breadth of its customer base, which is a direct result of its comprehensive service model. This diversification is a key strength, contributing to its financial resilience.

Butterfield consistently delivers robust financial performance, evident in its strong returns. For the first quarter of 2024, the bank reported a return on average common equity of 15.1% and a core return on average tangible common equity of 17.4%. These figures highlight the bank's efficiency in generating profits from its shareholder capital.

The bank's financial health is further underscored by its strong regulatory capital position. As of March 31, 2024, Butterfield's Common Equity Tier 1 (CET1) ratio stood at a healthy 15.6%, significantly exceeding the regulatory minimums. This robust capital buffer provides a solid foundation for continued operations and strategic growth initiatives.

This financial resilience translates into sustained profitability and a reliable capacity for capital returns to shareholders. The bank's ability to maintain high profitability while adhering to stringent capital requirements demonstrates prudent risk management and a well-executed business strategy.

Butterfield's strategic positioning across key global financial hubs, including Bermuda, the Cayman Islands, Guernsey, Jersey, The Bahamas, Switzerland, Singapore, and the UK, is a significant strength. This international footprint grants them access to a broad spectrum of markets and client bases, allowing them to tap into diverse economic opportunities and regulatory environments.

Strong Client Relationships and Low Credit Risk

Butterfield cultivates deep client relationships by prioritizing exceptional service across its diverse customer base, from individuals and small businesses to large institutions and high-net-worth clients. This relationship-centric model fosters loyalty and understanding.

The bank's credit risk remains notably low, largely due to a loan portfolio heavily weighted towards well-secured residential mortgages. As of the first quarter of 2024, Butterfield reported a non-performing loan ratio of just 0.4%, underscoring its conservative lending approach.

- Relationship Focus: Engages with individuals, SMEs, institutions, and HNW clients.

- Low Credit Risk: Significant portion of loans are secured residential mortgages.

- Asset Quality: Conservative lending practices contribute to stable asset quality.

- 2023 Performance: Achieved a Return on Equity of 12.5%, reflecting the strength of its client-focused model.

Commitment to Shareholder Value and Efficiency

Butterfield demonstrates a strong commitment to enhancing shareholder value, evident in its balanced capital return strategy. This includes consistent dividend payouts and active share repurchase programs, reflecting confidence in its financial health and future prospects. For instance, in the first half of 2024, Butterfield returned $50 million to shareholders through dividends and buybacks, underscoring this dedication.

The bank is also prioritizing operational efficiency. This is achieved through diligent expense management and strategic investments in technology. These investments are geared towards improving the client experience and streamlining internal processes, aiming for sustainable growth and increased profitability.

Key initiatives include:

- Balanced Capital Returns: Regular dividends and share buybacks to reward investors.

- Expense Management: Ongoing efforts to control operating costs.

- Technology Investment: Enhancing client experience and operational efficiency.

- Sustainable Growth Focus: Driving long-term value creation for shareholders.

Butterfield's diversified financial services, spanning retail and corporate banking, treasury, and wealth management, create a resilient business model by serving a wide client base. This integrated approach deepens client relationships and offers multiple revenue streams. The bank's strong financial performance, with a Q1 2024 return on average common equity of 15.1%, highlights its efficiency. Furthermore, a robust Common Equity Tier 1 ratio of 15.6% as of March 31, 2024, demonstrates its solid capital position and prudent risk management.

| Metric | Q1 2024 Value | Significance |

|---|---|---|

| Total Client Deposits | $12.1 billion | Indicates customer trust and broad reach. |

| Return on Average Common Equity | 15.1% | Shows strong profitability from shareholder capital. |

| CET1 Ratio | 15.6% | Exceeds regulatory minimums, ensuring financial stability. |

| Non-Performing Loan Ratio | 0.4% | Reflects conservative lending and high asset quality. |

What is included in the product

Analyzes Butterfield’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT data into actionable insights for immediate strategic adjustments.

Weaknesses

Butterfield's geographic concentration in key offshore centers like Bermuda and the Cayman Islands presents a notable weakness. While these locations offer specialized financial services, a significant portion of its principal banking operations are rooted there. This focus means the bank is more susceptible to economic downturns or regulatory changes within these specific jurisdictions compared to a more broadly diversified global institution.

Butterfield's profitability is closely tied to its net interest margin (NIM), which can be quite sensitive to shifts in interest rates. Recent financial disclosures for 2024 have highlighted these fluctuations, with changes in treasury yields and the cost of deposits directly impacting NIM. While the bank has demonstrated an ability to navigate these changes, a more pronounced or rapid escalation in global interest rates could place additional pressure on its net interest income and overall financial health.

Butterfield's efficiency ratio has shown some variability, suggesting that despite ongoing initiatives, fully optimizing operational costs against revenue remains a work in progress. For instance, in the first quarter of 2024, the bank reported an efficiency ratio of 59.4%, a slight increase from 58.9% in the previous quarter, highlighting the persistent nature of these challenges.

The expansion of service centers, a strategic move aimed at long-term cost management, necessitates significant upfront capital expenditure and presents integration hurdles. These investments, while promising for future efficiency gains, require careful execution to ensure they contribute positively to the cost-to-income ratio without creating short-term drag.

Sustained attention is crucial to ensure that these operational improvement efforts consistently yield better cost-to-income ratios. The bank must continue to monitor and refine its strategies to translate investments in infrastructure and technology into tangible cost savings and enhanced profitability.

Reliance on Traditional Banking Models

Butterfield's continued reliance on traditional banking and wealth management models, despite ongoing technology investments, presents a significant weakness. This can lead to a slower adaptation to the fast-paced evolution of fintech and digital banking. For instance, while digital banking adoption is soaring, with global digital banking users projected to reach over 3.6 billion by 2024, Butterfield's legacy systems might hinder its ability to compete effectively with digitally native disruptors.

This structural dependence on established methods could create a competitive disadvantage. As of the first quarter of 2024, Butterfield reported a net interest margin of 2.39%, indicating a solid but potentially less agile revenue stream compared to some fintechs with more dynamic fee-based models. The inherent inertia in transforming deeply ingrained banking processes means Butterfield might lag behind competitors who are built from the ground up with digital-first strategies.

- Legacy Systems: Core banking infrastructure may not be as flexible or cost-effective as modern, cloud-native solutions.

- Digital Adoption Gap: Slower integration of cutting-edge digital tools could alienate tech-savvy customers.

- Competitive Pressure: Fintechs offering seamless, app-based experiences pose a direct threat to traditional service models.

- Adaptation Speed: The pace of change in financial services necessitates rapid digital transformation, a challenge for institutions with traditional foundations.

Potential Impact of Restructuring and Job Losses

Butterfield's past restructuring, which included job losses and the relocation of certain roles to service centers like Halifax, presents a potential weakness. While these moves were intended to reduce costs, they may have negatively affected employee morale and the retention of vital institutional knowledge.

Managing such significant organizational changes requires a delicate touch to prevent disruptions in service quality or internal team cohesion. This is particularly crucial for Butterfield, given its reliance on strong client relationships.

For instance, in 2023, the company reported a reduction in its workforce as part of ongoing efficiency initiatives. While specific figures on morale impact are not publicly disclosed, industry trends suggest that significant staff reductions can lead to decreased productivity and increased turnover in the short to medium term.

- Impact on Morale: Past restructuring events may have created an environment of uncertainty, potentially affecting employee engagement and commitment.

- Loss of Institutional Knowledge: Job losses can result in the departure of experienced employees, leading to a depletion of valuable institutional memory and expertise.

- Service Quality Risk: Disruptions caused by restructuring could strain remaining staff, potentially impacting the quality of client service, a key differentiator for Butterfield.

- Cohesion Challenges: Relocating roles and reducing staff can strain internal relationships and hinder the collaborative spirit essential for a relationship-focused business.

Butterfield's operational efficiency, as indicated by its efficiency ratio, remains an area for improvement. The bank's Q1 2024 efficiency ratio stood at 59.4%, a slight uptick from the previous quarter, suggesting ongoing efforts are needed to fully optimize costs against revenue. This persistent challenge highlights the need for continuous refinement of strategies to translate infrastructure and technology investments into tangible cost savings and enhanced profitability.

Preview the Actual Deliverable

Butterfield SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final Butterfield SWOT analysis. Unlock the full report when you purchase.

Opportunities

Butterfield is actively pursuing offshore bank and fee business acquisitions, signaling a clear strategy for growth through inorganic means. This opens doors to expanding its reach into new international financial hubs or deepening its presence in current markets. Such moves are crucial for diversifying revenue sources and broadening its client appeal, ultimately bolstering its market position and scale.

Butterfield has a clear objective to invest in technology, aiming to both elevate the client experience and boost operational efficiency. This strategic focus presents a significant opportunity to fully embrace digital-first wealth management, leveraging artificial intelligence to craft highly personalized financial strategies for clients. By adopting these advanced digital solutions, Butterfield can attract a broader client base, significantly improve the quality of its service delivery, and optimize its internal operations.

The bank's commitment to digital transformation is particularly relevant in the current financial landscape. For instance, as of early 2024, the global wealth management sector is increasingly prioritizing digital channels, with reports indicating a substantial rise in client adoption of online platforms for investment and advisory services. Butterfield's investment in AI for personalized strategies aligns with this trend, potentially allowing for more sophisticated risk assessment and tailored product recommendations, thereby enhancing client retention and acquisition.

The global wealth management industry is on a strong upward trajectory, with projections indicating continued expansion through 2025 and beyond. This growth is fueled by a significant intergenerational transfer of wealth, estimated to be in the trillions of dollars globally, as well as a rising desire among individuals for tailored financial advice and sophisticated investment strategies. Butterfield, as a comprehensive wealth management provider, is strategically positioned to leverage this expanding market.

Butterfield's established reputation and full-service capabilities allow it to effectively cater to the needs of high-net-worth individuals seeking expert guidance. The firm can further enhance its market penetration by broadening its service portfolio and actively pursuing client acquisition in key international markets experiencing substantial wealth accumulation. This demographic shift represents a considerable opportunity for revenue growth and market share expansion.

Cross-Selling and Deepening Client Relationships

Butterfield can leverage its broad spectrum of banking and wealth management offerings to significantly enhance cross-selling. This strategy allows for the integration of financial solutions, thereby strengthening existing client relationships and increasing customer loyalty.

By providing a more holistic financial experience, Butterfield can boost revenue per client and improve overall customer lifetime value. For example, a client using Butterfield's private banking services might also be a prime candidate for their trust and estate planning solutions, or vice versa.

- Cross-selling potential: Offering integrated financial solutions across banking, wealth management, and fiduciary services.

- Client retention: Deepening relationships can lead to increased client stickiness and reduced attrition.

- Revenue enhancement: Higher revenue per client is achievable through bundled services and expanded product adoption.

- Customer lifetime value: A comprehensive service model aims to maximize the long-term value derived from each customer relationship.

Enhanced Focus on ESG and Sustainability

Butterfield's dedication to sustainability, evidenced by its commitment to binding climate goals, positions it to attract a growing segment of environmentally conscious investors. This focus on corporate social responsibility aligns with increasing regulatory pressures and societal demands for ethical business practices.

By embedding Environmental, Social, and Governance (ESG) principles into its core operations and product development, Butterfield can significantly bolster its brand image. For instance, as of early 2024, a significant portion of global assets under management are now influenced by ESG considerations, highlighting the market demand for sustainable finance.

- Attracting ESG-focused Investors: Growing investor preference for sustainable investments, with global ESG assets projected to reach over $50 trillion by 2025, offers a significant opportunity for Butterfield to capture this market.

- Enhanced Brand Reputation: Demonstrating a strong ESG commitment can differentiate Butterfield in a competitive financial landscape, fostering trust and loyalty among stakeholders.

- Regulatory Alignment: Proactively addressing sustainability aligns Butterfield with evolving global and local regulations concerning climate risk and corporate responsibility, mitigating future compliance burdens.

Butterfield's strategic acquisitions in offshore banking and fee-based businesses present a clear path for expansion into new financial markets and deepening existing ones. This inorganic growth strategy is key to diversifying revenue streams and broadening its client base, thereby strengthening its overall market position and scale.

The bank's investment in technology, particularly AI for personalized wealth management, aligns with the growing trend of digital-first client engagement. This focus is expected to enhance client experience, improve operational efficiency, and attract a wider demographic of investors seeking tailored financial advice.

The global wealth management sector is experiencing robust growth, projected to continue through 2025, driven by significant wealth transfers and increasing demand for sophisticated financial planning. Butterfield is well-positioned to capitalize on this expanding market by leveraging its comprehensive service offerings and reputation.

Butterfield's commitment to ESG principles is a significant opportunity to attract environmentally conscious investors and enhance its brand reputation. With global ESG assets projected to exceed $50 trillion by 2025, aligning with sustainability trends can provide a competitive edge and ensure regulatory compliance.

Threats

Butterfield operates across various international financial centers, each with its own intricate and constantly changing regulatory environment. This global presence means the bank must navigate a complex web of rules, which can be challenging and costly to manage effectively.

Heightened regulatory demands, especially concerning robust risk management, strong governance, and diligent compliance in critical areas like cybersecurity, anti-money laundering (AML), and data privacy, directly translate into increased operational expenses. For instance, in 2024, financial institutions globally saw significant investments in AML compliance technology and personnel, with some reporting compliance costs in the tens of millions of dollars annually.

Failure to meet these evolving regulatory expectations can result in substantial financial penalties and reputational damage. The potential for fines, coupled with the ongoing investment required to stay ahead of new regulations, presents a significant threat to Butterfield's profitability and operational stability.

Global economic instability and market volatility present a significant threat to Butterfield. Economic downturns, geopolitical risks, and fluctuating market conditions can negatively impact asset valuations, client confidence, and overall financial activity, directly affecting the company's wealth management and banking revenues. For instance, the IMF projected global growth to slow to 2.9% in 2024, down from 3.1% in 2023, highlighting the prevailing uncertainty.

Butterfield contends with formidable competition from established global banks boasting extensive capital and reach, alongside agile fintech firms rapidly innovating in digital services. This intense rivalry pressures Butterfield’s market share and pricing flexibility, particularly as customer expectations for seamless digital experiences continue to rise.

The financial services landscape in 2024 and into 2025 sees fintechs offering specialized, often lower-cost digital alternatives, directly challenging traditional banking models. For instance, the global fintech market is projected to reach over $300 billion by 2025, highlighting the scale of innovation Butterfield must navigate.

Cybersecurity Risks and Data Breaches

Butterfield, like all financial institutions, faces significant cybersecurity risks. A data breach could result in substantial financial penalties and severe damage to its reputation, eroding client confidence. For instance, the global average cost of a data breach reached $4.35 million in 2024, according to IBM's Cost of a Data Breach Report. This highlights the critical need for ongoing investment in advanced security infrastructure and employee training to safeguard sensitive client information and maintain operational integrity.

The increasing sophistication of cyber threats means that even robust defenses can be challenged. Attacks such as ransomware, phishing, and denial-of-service (DoS) are constant concerns. In 2024, financial services firms were among the most targeted industries for cyberattacks. Staying ahead requires continuous adaptation of security protocols and proactive threat intelligence gathering.

- Increased regulatory scrutiny following breaches can lead to hefty fines, impacting profitability.

- Reputational damage from a breach can deter new customers and lead to existing clients moving their assets elsewhere.

- Operational disruption from an attack can halt critical banking services, causing significant inconvenience and financial loss.

- Intellectual property theft, including proprietary trading algorithms or customer data, can be a major competitive threat.

Reputational Risks in Offshore Banking

While offshore banking offers distinct advantages, it inherently carries reputational risks. These risks often stem from public perception associating offshore centers with tax avoidance or even illicit financial activities. Butterfield, like other institutions in this space, must navigate these perceptions carefully.

Negative global sentiment or heightened international scrutiny of offshore financial centers can directly impact Butterfield's client acquisition and retention. This pressure necessitates a robust commitment to adhering to evolving international regulations and maintaining transparent operations to mitigate these threats. For instance, the OECD's Common Reporting Standard (CRS) and the US's Foreign Account Tax Compliance Act (FATCA) have significantly increased transparency requirements for offshore financial institutions, impacting how they operate and are perceived.

- Perception Management: Addressing the stigma of offshore finance is crucial for client trust.

- Regulatory Compliance: Strict adherence to global anti-money laundering (AML) and know-your-customer (KYC) regulations is paramount.

- Transparency Initiatives: Proactive communication about compliance and ethical practices can counter negative narratives.

Butterfield faces significant threats from increasing regulatory scrutiny, which demands substantial investment in compliance and risk management, potentially impacting profitability. Intense competition from both established global banks and agile fintech firms pressures market share and pricing. Furthermore, the constant risk of sophisticated cyberattacks poses a threat to data security, client trust, and operational continuity, with the global average cost of a data breach reaching $4.35 million in 2024. Finally, negative perceptions surrounding offshore banking require careful navigation and a strong commitment to transparency.

SWOT Analysis Data Sources

This Butterfield SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market research, and expert industry commentary to ensure a thorough and accurate assessment.