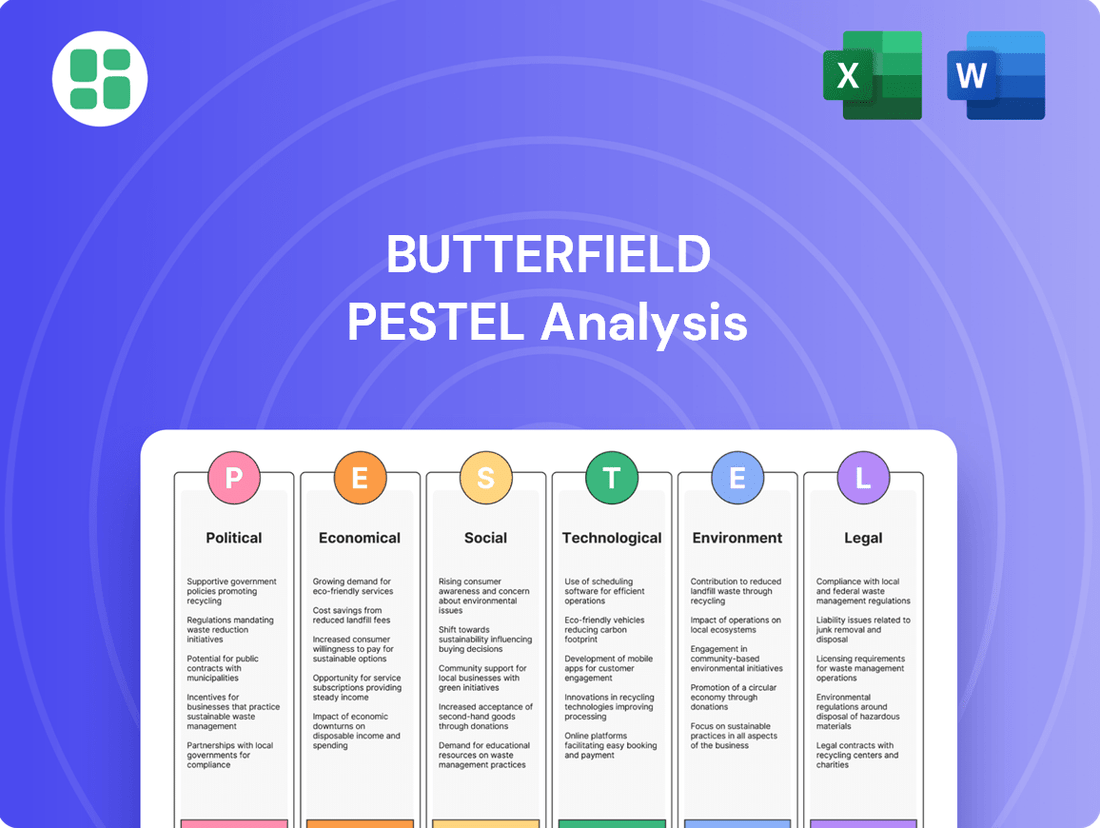

Butterfield PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Butterfield Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Butterfield's trajectory. This comprehensive PESTLE analysis provides the strategic foresight you need to anticipate challenges and capitalize on emerging opportunities. Download the full version now and gain a decisive advantage in your market analysis.

Political factors

Butterfield's operations in key international financial centers like Bermuda, the Cayman Islands, Guernsey, and Jersey depend heavily on political stability and a consistent regulatory framework. These environments are vital for its banking and wealth management services to thrive.

The Bermuda Monetary Authority (BMA) demonstrates its commitment to financial oversight through its Q4 2024 regulatory updates. Its 2025 business plan prioritizes operational resilience and consumer protection, signaling a stable, albeit evolving, regulatory landscape.

The Bermuda government, in conjunction with the Bermuda Monetary Authority (BMA), is actively fostering fintech growth. This includes establishing regulatory frameworks for digital asset businesses, a move that could significantly shape Butterfield's operational environment and competitive dynamics.

The BMA's commitment to this sector is evident in its February 2024 update to the Digital Asset Business Custody Code of Practice. This initiative aims to set industry-leading standards for the secure safekeeping and custody of digital assets, directly impacting how financial institutions like Butterfield manage these emerging asset classes.

Butterfield, as a multinational financial institution, must navigate a complex web of international tax agreements. The introduction of a Corporate Income Tax (CIT) in Bermuda, effective January 1, 2025, for multinational enterprise groups (MNEs), directly impacts Butterfield's operational landscape. This new tax regime, aligning with global initiatives like the OECD's Pillar Two framework, necessitates careful compliance strategies to manage potential impacts on profitability and operational efficiency.

Geopolitical Risks and Economic Sanctions

Geopolitical shifts and the implementation of economic sanctions directly affect Butterfield's global reach and its diverse clientele. Institutions like Butterfield must navigate these complexities to safeguard their operations and client relationships.

The Bermuda Monetary Authority (BMA) plays a crucial role by continuously updating its financial sanctions lists. Financial institutions are obligated to comply with these directives, a process that helps mitigate the risks associated with illicit financial activities and ensures regulatory adherence.

- Global Sanctions Landscape: In 2024, the G7 nations continued to coordinate sanctions against Russia, impacting numerous financial transactions and requiring robust compliance frameworks for institutions operating internationally.

- Regulatory Updates: The BMA's proactive updates to its sanctions lists in early 2025 underscore the dynamic nature of financial regulations and the need for constant vigilance.

- Risk Mitigation: Adherence to these evolving sanctions is paramount for Butterfield to prevent engagement with sanctioned entities and avoid significant penalties.

Government Support for Financial Services Sector

Bermuda's government actively supports its financial services sector, creating a favorable political environment for Butterfield. Recent amendments to banking laws are designed to attract new institutions and foster fintech innovation, a move that could broaden Butterfield's operational landscape.

The extension of restricted banking licenses to a wider array of clients, not solely digital asset businesses, signals a proactive government approach to modernizing financial services. This policy shift could unlock new revenue streams and client segments for Butterfield by facilitating broader market participation.

- Government Focus: Bermuda prioritizes financial services growth, evidenced by legislative updates.

- Fintech Encouragement: Policies aim to boost the fintech industry, potentially creating new partnerships or competitive pressures.

- License Expansion: Restricted banking licenses now cover more client types, opening up new opportunities.

Political stability in Butterfield's key operating jurisdictions, such as Bermuda, Guernsey, and Jersey, is fundamental to its business continuity and investor confidence. Governments in these locations are actively shaping financial sector regulations, with Bermuda's recent introduction of a Corporate Income Tax (CIT) effective January 1, 2025, for multinational enterprises, directly impacting Butterfield's tax strategy and compliance efforts.

The proactive stance of regulatory bodies, like the Bermuda Monetary Authority (BMA), in updating sanctions lists and fostering fintech growth through initiatives like the Digital Asset Business Custody Code of Practice (updated February 2024) demonstrates a commitment to a secure yet evolving financial landscape. These actions directly influence Butterfield's risk management and operational frameworks.

Governmental support for the financial services sector, including amendments to banking laws to attract new institutions and the expansion of restricted banking licenses, creates a favorable environment for Butterfield's growth and diversification. This policy direction, observed throughout 2024 and continuing into 2025, signals opportunities for new revenue streams and client engagement.

Geopolitical events and the implementation of economic sanctions, such as the G7's coordinated actions against Russia in 2024, necessitate robust compliance and risk mitigation strategies for Butterfield. Adherence to evolving international directives is critical to prevent regulatory breaches and maintain operational integrity.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Butterfield, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Butterfield PESTLE Analysis offers a structured framework that simplifies the complex task of understanding external business influences, thereby alleviating the pain of information overload and strategic uncertainty.

Economic factors

Global and regional interest rate trends are a critical factor for Butterfield, directly impacting its net interest margin (NIM). Higher rates generally benefit banks by increasing the spread between what they earn on loans and pay on deposits.

Butterfield's Q1 and Q2 2025 financial results reflect this, with an expanding NIM and a notable increase in net interest income. This performance suggests either a supportive interest rate environment or skillful management of the bank's balance sheet to capitalize on prevailing conditions.

Butterfield's diverse client base, encompassing individuals, high-net-worth clients, and institutions, is intrinsically linked to the economic vitality of its operating jurisdictions. Regions such as Bermuda, the Cayman Islands, and the Channel Islands are crucial for wealth creation, directly influencing demand for Butterfield's banking and wealth management services.

In 2023, Bermuda's GDP experienced a notable expansion, estimated at 2.5%, driven by strong performance in its international business sector, a key area for Butterfield's clientele. Similarly, the Cayman Islands saw robust economic activity, with projected GDP growth of around 3% for the same year, bolstered by its financial services industry, which directly benefits Butterfield's lending and deposit-taking operations.

The Channel Islands, particularly Guernsey and Jersey, also demonstrated resilience in 2023, with their financial services sectors contributing significantly to economic growth, estimated at 1.8% and 2.1% respectively. This sustained economic performance across its core operating regions translates into greater disposable income and investment capital for Butterfield's clients, thereby fueling demand for its comprehensive suite of financial products and advisory services.

Butterfield's operations in multiple international financial centers mean it's directly exposed to currency fluctuations. For instance, a strengthening US Dollar against the Pound Sterling could reduce the reported value of Butterfield's UK-based assets and income when translated into its reporting currency, likely USD. This volatility directly impacts profitability and the balance sheet.

Effective treasury services and foreign exchange management are therefore critical for Butterfield. In 2024, for example, major currency pairs like EUR/USD saw significant swings, presenting both opportunities and risks. Butterfield's ability to manage these movements through hedging strategies and robust treasury operations is key to protecting its financial performance and serving its international clientele effectively.

Deposit Levels and Funding Costs

Butterfield's deposit levels are a cornerstone of its funding strategy, directly influencing liquidity and profitability. The bank reported a solid increase in period-end deposit balances for the full year 2024. This growth was particularly notable in key regions like Bermuda and the Channel Islands, underscoring stable funding dynamics.

The cost associated with these deposits is a crucial factor in managing net interest income. Fluctuations in deposit rates can significantly impact the bank's funding costs. Butterfield's ability to attract and retain deposits at competitive rates is therefore vital for maintaining its financial health and operational efficiency.

- Deposit Growth: Full-year 2024 results showed an increase in period-end deposit balances.

- Geographic Strength: Growth was primarily observed in Bermuda and the Channel Islands.

- Funding Stability: These deposit increases contribute to a stable funding base for the bank.

- Profitability Impact: Changes in deposit levels and their costs directly affect Butterfield's profitability.

Financial Market Stability and Investment Performance

The stability of global financial markets directly impacts Butterfield's asset management fees and the overall financial well-being of its wealth management clients. For instance, in 2024, a volatile market environment could lead to reduced asset values, consequently affecting the fee income generated from managing those assets. Butterfield's strategy to maintain high risk-adjusted returns, a key factor in its 2024 performance, is underpinned by its robust risk management framework and the strength of its client relationships.

Butterfield's investment performance in 2024 and 2025 is crucial for its financial health. The bank aims to deliver consistent high risk-adjusted returns, a goal that directly influences its revenue streams through asset management fees. These returns are achieved through a combination of disciplined risk management and the cultivation of high-quality, long-term client relationships, which are essential for sustained asset growth and fee generation.

Key performance indicators for Butterfield's financial market stability and investment performance include:

- Asset Under Management (AUM) Growth: Tracking the increase or decrease in the total value of assets managed by Butterfield and its clients. For example, a 5% year-over-year growth in AUM for 2024 would indicate positive market performance and client confidence.

- Risk-Adjusted Returns: Measuring investment returns relative to the level of risk taken, such as Sharpe Ratio. A consistently high Sharpe Ratio above 1.5 in 2024 demonstrates effective risk management.

- Client Retention Rates: High retention signifies client satisfaction and trust in Butterfield's investment strategies, contributing to stable fee income. A retention rate exceeding 90% in the wealth management segment for 2024 is a strong indicator.

- Market Volatility Impact: Analyzing how fluctuations in global markets affect the bank's AUM and fee income. For instance, a 10% dip in a major equity index in Q1 2025 could lead to a projected 1% decrease in asset management fees if not offset by strong performance in other asset classes.

Interest rate trends significantly influence Butterfield's net interest margin (NIM), with higher rates generally boosting profitability. Butterfield's Q1 and Q2 2025 results showcased an expanding NIM, indicating a favorable rate environment or adept balance sheet management.

Economic conditions in Butterfield's key operating regions, including Bermuda, the Cayman Islands, and the Channel Islands, directly impact its client base and service demand. Bermuda's GDP grew by an estimated 2.5% in 2023, and the Cayman Islands saw around 3% growth, both driven by their financial services sectors, which are vital for Butterfield.

Currency fluctuations pose a risk, as seen with potential USD strengthening against GBP impacting reported UK asset values. Effective treasury management, including hedging strategies, is crucial for mitigating these impacts, especially given significant currency pair swings observed in 2024.

Butterfield experienced a solid increase in deposit balances in 2024, particularly in Bermuda and the Channel Islands, bolstering its funding base. Managing the cost of these deposits is essential for maintaining healthy net interest income and overall financial performance.

| Economic Factor | Impact on Butterfield | 2023/2024/2025 Data Points |

|---|---|---|

| Interest Rates | Affects Net Interest Margin (NIM) | NIM expanding in Q1/Q2 2025 |

| Regional GDP Growth | Influences client wealth and service demand | Bermuda GDP +2.5% (2023); Cayman Islands GDP +3% (2023) |

| Currency Fluctuations | Impacts reported asset values and income | EUR/USD volatility in 2024 |

| Deposit Growth & Costs | Core to funding strategy and profitability | Deposit balances increased in 2024, strong in Bermuda/Channel Islands |

Same Document Delivered

Butterfield PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Butterfield PESTLE analysis covers all critical external factors impacting the business. You'll get a detailed breakdown of political, economic, social, technological, legal, and environmental influences.

Sociological factors

Customers now expect seamless, intuitive digital experiences across all services, including banking. This shift pressures institutions like Butterfield to prioritize online and mobile platforms. For instance, a 2024 survey indicated that 75% of consumers prefer digital channels for routine banking transactions, a figure likely to grow.

Butterfield's strategic investments in technology directly address these evolving expectations. Their focus on digital transformation, including enhancing mobile app functionality and exploring new digital lending channels, aims to capture this growing demand for convenience and accessibility. This proactive approach is crucial for retaining and attracting clients in a competitive digital landscape.

Demographic shifts, particularly the aging population in key markets like the UK and Channel Islands, are a significant driver for Butterfield. As individuals accumulate wealth over their lifetimes, the demand for sophisticated wealth management, trust, and estate planning services naturally increases. This trend is amplified by substantial intergenerational wealth transfers, with estimates suggesting trillions of dollars are expected to change hands in the coming decades, creating new opportunities for financial institutions like Butterfield to advise on preservation and growth.

Butterfield's commitment to fostering financial literacy through educational initiatives directly supports its long-term client benefit and corporate social responsibility goals. For instance, in 2024, the bank actively participated in community programs aimed at enhancing financial understanding.

These partnerships have led to the launch of accessible financial education platforms, designed to equip individuals with the knowledge to make informed financial decisions. Such efforts contribute to a more financially capable client base and positively impact the wider public, reflecting a dedication to societal well-being.

Workforce Dynamics and Talent Attraction

Maintaining a skilled workforce and attracting top talent in competitive financial hubs like Bermuda and the Cayman Islands is a crucial sociological consideration for Butterfield. The ability to secure and retain human capital directly impacts service delivery and innovation within the financial sector.

Butterfield actively addresses this through its commitment to an inclusive culture, equitable recruitment practices, and robust professional development programs. These initiatives, which include scholarships and internships, are designed to cultivate a pipeline of skilled professionals ready to support the bank's operations and growth. For instance, in 2024, Butterfield continued its investment in talent development, with programs aimed at enhancing digital literacy and leadership skills across its workforce.

- Talent Attraction: Financial centers face intense competition for skilled professionals, making employer branding and employee value propositions critical.

- Workforce Development: Investment in training, upskilling, and career progression is essential for retaining talent and adapting to evolving industry demands.

- Inclusive Culture: Fostering an environment where diverse perspectives are valued enhances innovation and employee engagement.

- Future Skills: Anticipating and developing skills in areas like fintech, cybersecurity, and data analytics is paramount for long-term success.

Corporate Social Responsibility and Community Engagement

Butterfield actively champions corporate social responsibility, focusing on initiatives that foster community well-being and development. This commitment is evident in their support for programs enhancing mental and physical health, as well as providing educational opportunities. For instance, in 2023, Butterfield reported a significant increase in employee volunteer hours dedicated to community projects, reflecting a deeper engagement.

The company's dedication extends to empowering underrepresented entrepreneurs, recognizing their vital role in economic growth. This strategic focus not only bolsters Butterfield's public image but also cultivates stronger, more resilient relationships within the communities where it operates. Their 2024 ESG report highlighted substantial investments in local business incubators, aiming to create a more inclusive economic landscape.

Key aspects of Butterfield's community engagement include:

- Support for mental and physical well-being programs

- Investment in educational and learning opportunities

- Funding and mentorship for underrepresented entrepreneurs

- Increased employee volunteerism in community initiatives

Sociological factors significantly influence Butterfield's operations, particularly customer expectations for seamless digital experiences, with 75% of consumers preferring digital channels for routine banking in 2024. Demographic shifts, like an aging population in key markets, increase demand for wealth management services, a trend amplified by anticipated intergenerational wealth transfers. Butterfield's focus on financial literacy and community well-being, including support for underrepresented entrepreneurs, strengthens its social license to operate and brand reputation.

Technological factors

Butterfield is making significant strides in digital transformation, investing heavily in technology to improve both client experience and internal operations. A prime example is their utilization of cloud services, such as Microsoft Azure, for hosting critical applications, aiming for greater agility and scalability.

This strategic push into digital enhancement is crucial for Butterfield to maintain its competitive edge in the evolving financial landscape and to broaden its suite of services. For instance, in 2024, the company reported a substantial increase in digital channel engagement, with mobile banking transactions growing by 15% year-over-year, underscoring the success of these technological investments.

Butterfield, like all financial institutions, operates in an environment where cybersecurity and data protection are critical. The increasing sophistication of cyber threats means the bank must invest heavily in advanced security measures to safeguard customer information and its own operational integrity. This is not just a technical challenge but a core business imperative.

The bank's commitment to robust data protection is reflected in its corporate governance. These guidelines mandate strict compliance, proactive risk management, and direct oversight from senior management. This structure ensures that cybersecurity is a consistent priority, with regular training programs designed to equip staff to identify and combat financial crime and cyber threats effectively.

The financial technology (fintech) sector presents a significant competitive challenge for Butterfield. The Bermuda Monetary Authority's active encouragement of digital assets and fintech innovation fosters a rapidly evolving market. Butterfield must stay ahead by embracing new technologies, perhaps through strategic alliances or in-house development, to counter emerging players and adapt to changing payment preferences.

Adoption of AI and Machine Learning

The banking sector's embrace of AI and machine learning is accelerating, with institutions leveraging these technologies for everything from refining credit scoring models to boosting workforce productivity. Butterfield's strategic integration of AI can unlock significant advantages in risk management, operational intelligence, and customer engagement.

For instance, in 2024, a significant portion of financial institutions reported using AI for fraud detection, with some studies suggesting a potential reduction in fraud losses by as much as 20%. Butterfield's adoption could translate into more accurate risk assessments and streamlined operations.

- AI in Credit Modeling: Enhancing predictive accuracy and reducing default rates.

- Operational Efficiency: Automating tasks and improving employee output.

- Customer Service: Personalizing interactions and resolving queries faster.

- Risk Management: Strengthening fraud detection and compliance monitoring.

Mobile and Online Banking Advancements

Butterfield's commitment to mobile and online banking advancements directly impacts customer experience and operational efficiency. The reliability of these digital channels is paramount for retaining and attracting clients in today's fast-paced financial landscape. By consistently updating its platforms, Butterfield aims to provide a seamless and secure banking environment for its diverse customer base.

In 2024, the global digital banking market continued its robust growth, with mobile banking adoption rates soaring. For instance, reports indicated that by the end of 2024, over 85% of retail banking transactions in developed markets were expected to be conducted digitally. Butterfield's investment in user-friendly interfaces and secure transaction processing is therefore critical to staying competitive and meeting evolving customer expectations for instant access and control over their finances.

- Digital Engagement: Enhanced mobile and online platforms foster greater customer interaction and loyalty.

- Operational Efficiency: Streamlined digital processes reduce the need for in-person transactions, lowering operational costs for Butterfield.

- Security Focus: Continuous updates ensure robust security measures, protecting customer data and maintaining trust in the digital banking ecosystem.

- Market Trend Alignment: Keeping pace with the global shift towards digital financial services is essential for long-term relevance and growth.

Technological advancements are reshaping Butterfield's operational landscape, driving a significant focus on digital transformation and cybersecurity. The bank's investment in cloud services and AI, for example, aims to boost agility and enhance customer engagement. By the end of 2024, over 85% of retail banking transactions in developed markets were expected to be digital, highlighting the critical need for Butterfield to excel in its digital offerings.

| Technological Area | Butterfield's Focus | Impact/Data Point (2024/2025) |

|---|---|---|

| Digital Transformation | Cloud services (e.g., Microsoft Azure), mobile & online banking enhancement | Mobile banking transactions grew 15% YoY in 2024; >85% of retail banking transactions expected to be digital by end of 2024. |

| Cybersecurity & Data Protection | Advanced security measures, staff training | Increasing sophistication of cyber threats necessitates ongoing investment to safeguard data and operations. |

| Artificial Intelligence (AI) | Credit modeling, operational efficiency, customer service, risk management | AI adoption for fraud detection can reduce losses by up to 20% in some institutions; Butterfield leverages AI for risk assessment and operational intelligence. |

| Fintech Integration | Adapting to digital assets and new payment preferences | Bermuda Monetary Authority encourages fintech innovation, creating a competitive landscape Butterfield must navigate. |

Legal factors

Butterfield operates under rigorous Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations across all its operating jurisdictions, demanding comprehensive compliance to thwart financial crime. These regulations are critical for maintaining the integrity of the financial system and protecting against illicit activities.

The Bermuda Monetary Authority (BMA), a key regulator for Butterfield, consistently updates its regulatory landscape, including directives concerning digital assets. For instance, in 2024, the BMA continued to emphasize robust digital asset custody and transaction monitoring requirements, compelling financial institutions like Butterfield to adapt their compliance programs accordingly.

The full implementation of Bermuda's Personal Information Protection Act (PIPA) on January 1, 2025, alongside comparable data privacy legislation in other operational jurisdictions, presents a significant legal imperative for Butterfield. This mandates stringent protocols for handling and safeguarding client information, directly impacting data management strategies and operational costs.

Adherence to these evolving data privacy laws, including PIPA, is paramount for preserving client confidence and mitigating the risk of substantial fines. Failure to comply could lead to reputational damage and financial penalties, underscoring the critical nature of robust data protection frameworks for Butterfield's continued success and client relationships.

Butterfield operates under stringent banking licensing and prudential requirements mandated by regulators such as the Bermuda Monetary Authority (BMA). These regulations are largely aligned with international standards like the Basel III framework, ensuring robust capital adequacy and liquidity management.

Compliance with Basel III, including its capital and liquidity ratios, is crucial for Butterfield’s stability and operational legitimacy. For instance, as of Q1 2024, Butterfield reported a Common Equity Tier 1 (CET1) capital ratio of 15.9%, comfortably exceeding regulatory minimums.

The bank must also adhere to frameworks such as the Large Exposure Framework, limiting its exposure to single counterparties to mitigate systemic risk. This regulatory environment shapes Butterfield's risk appetite and strategic financial planning.

Consumer Protection Laws and Code of Conduct

New consumer protection measures significantly shape Butterfield's client engagement. For instance, the Bermuda Banking Code of Conduct sets new standards for how the bank interacts with its retail customers, influencing service delivery and communication protocols.

The Bermuda Monetary Authority (BMA) is actively enhancing consumer safeguards. Their 2025 business plan explicitly outlines a focus on developing revised prudential requirements, which will incorporate a stronger emphasis on consumer protection, potentially leading to stricter compliance obligations for Butterfield.

- Bermuda Banking Code of Conduct: Establishes new guidelines for Butterfield's retail client interactions.

- BMA 2025 Business Plan: Commits to updated prudential requirements with increased consumer protection focus.

- Regulatory Scrutiny: Heightened BMA attention on consumer welfare may lead to more rigorous oversight of Butterfield's practices.

International Financial Regulations and Cross-Jurisdictional Compliance

Butterfield's international operations necessitate navigating a complex landscape of financial regulations across its key jurisdictions, including Bermuda, the Cayman Islands, and the Channel Islands. Staying compliant requires constant adaptation to evolving rules and differing requirements in each location. For instance, as of early 2024, the Cayman Islands continued its focus on economic substance requirements for financial services entities, impacting how companies like Butterfield structure their operations there.

The bank must also contend with global regulatory trends, such as those related to anti-money laundering (AML) and know your customer (KYC) protocols, which are increasingly harmonized but still present jurisdictional nuances. For example, the Financial Action Task Force (FATF) recommendations are a global standard, but their implementation and enforcement can vary significantly. Butterfield's commitment to robust compliance frameworks is crucial for maintaining its reputation and operational integrity in these diverse regulatory environments.

Key legal factors impacting Butterfield include:

- Evolving Anti-Money Laundering (AML) and Know Your Customer (KYC) Standards: Jurisdictions like Bermuda and the Channel Islands are continuously updating their AML/KYC legislation, often in response to international bodies like the FATF, requiring significant investment in compliance technology and training.

- Economic Substance Legislation: The implementation and ongoing review of economic substance rules in offshore financial centers, such as the Cayman Islands, directly influence Butterfield's operational structuring and reporting obligations.

- Data Privacy Regulations: Adherence to data protection laws, including GDPR-like frameworks that may be adopted or adapted by various jurisdictions where Butterfield operates, is paramount for customer trust and avoiding penalties.

- Capital Adequacy and Prudential Supervision: Butterfield is subject to capital requirements and prudential supervision by regulators in each of its operating territories, ensuring financial stability and solvency.

Butterfield's legal framework is shaped by stringent AML and KYC regulations, with regulators like the Bermuda Monetary Authority (BMA) continuously updating directives, particularly concerning digital assets as seen in 2024. Furthermore, the implementation of data privacy laws, such as Bermuda's PIPA from January 1, 2025, imposes strict client information handling protocols, impacting operational strategies and costs significantly.

The bank must comply with international standards like Basel III for capital adequacy, with Butterfield reporting a CET1 ratio of 15.9% in Q1 2024, exceeding minimums. New consumer protection measures, like the Bermuda Banking Code of Conduct, are also influencing client engagement, with the BMA's 2025 plans emphasizing stronger consumer safeguards, potentially leading to increased oversight.

Navigating diverse international regulations, including economic substance requirements in the Cayman Islands and evolving AML/KYC standards globally, demands constant adaptation. Compliance with these varied legal landscapes is crucial for maintaining Butterfield's reputation and operational integrity across its global footprint.

Environmental factors

Butterfield's commitment to sustainability is evident through its adherence to the United Nations Global Compact, signed in 2022, which guides its Environmental, Social, and Governance (ESG) reporting. This framework underpins the bank's annual disclosures on sustainable consumption and production practices.

In 2023, the global sustainable finance market continued its growth trajectory, with sustainable bond issuance reaching an estimated $1.5 trillion. Butterfield's alignment with these initiatives positions it to capitalize on increasing investor demand for environmentally conscious financial products and services.

The financial sector, including institutions like Butterfield, is under growing pressure to address climate change risks. This includes both the physical impacts of climate events, like extreme weather, and transitional risks associated with shifting to a lower-carbon economy.

Regulatory bodies, such as the Bermuda Monetary Authority (BMA), are actively reviewing and adapting their frameworks to incorporate climate-related considerations. This focus underscores the increasing importance of sustainable business practices for financial institutions.

In 2024, global financial institutions are allocating significant capital towards climate-related investments, with estimates suggesting trillions of dollars will be needed to achieve net-zero targets. This trend highlights the financial implications of climate action and the evolving regulatory landscape.

Butterfield is actively developing green products and services to support the global shift towards cleaner energy and sustainable practices. This strategic focus is designed to help clients reduce their environmental impact and capitalize on the growing sustainable finance market.

The demand for sustainable financial products is surging. For instance, global sustainable investment assets reached an estimated $35.3 trillion in early 2024, according to the Global Sustainable Investment Alliance. Butterfield's green offerings are positioned to meet this increasing client demand.

By offering solutions that accelerate the transition to energy-efficient technologies, Butterfield not only aids in combating climate change but also taps into a rapidly expanding market segment. This aligns with broader economic trends favoring environmental, social, and governance (ESG) principles.

Carbon Emissions Reduction Targets

Butterfield is actively working to lower its carbon emissions as part of a broader sustainability initiative. This includes a thorough evaluation of its operational environmental impact and the adoption of measures aimed at boosting energy efficiency and minimizing resource use throughout its properties.

The financial sector, like many others, is facing increasing pressure to decarbonize. For instance, in 2024, many financial institutions are setting more ambitious net-zero targets, often aligning with global agreements like the Paris Agreement. Butterfield's commitment to reducing its operational carbon footprint directly addresses these evolving environmental expectations and regulatory landscapes.

Key strategies Butterfield is likely employing to achieve these targets include:

- Investing in energy-efficient technologies for its buildings and data centers.

- Promoting remote work and sustainable business travel policies.

- Exploring renewable energy sources for its facilities.

- Implementing waste reduction and recycling programs across all operations.

Stakeholder Pressure for Environmental Responsibility

Butterfield is experiencing heightened pressure from investors, clients, and the public to prioritize environmental responsibility. This demand directly shapes its operational choices and long-term strategies. For instance, in 2024, sustainable finance saw significant growth, with global sustainable debt issuance projected to reach over $1 trillion, indicating a strong investor appetite for environmentally sound companies.

Demonstrating a genuine commitment to environmental stewardship is becoming crucial for Butterfield's brand image. Companies that effectively showcase their green initiatives are better positioned to attract environmentally conscious clients and investors. By 2025, it's anticipated that over 70% of institutional investors will integrate ESG (Environmental, Social, and Governance) factors into their decision-making processes, underscoring the financial imperative of environmental responsibility.

- Investor Scrutiny: Investors are increasingly scrutinizing companies' environmental impact, demanding transparency and action on climate change and sustainability.

- Client Demand: Clients, particularly in the corporate sector, are seeking financial partners who align with their own sustainability goals, influencing service provider selection.

- Reputational Capital: A strong environmental record enhances Butterfield's reputation, potentially leading to greater market share and customer loyalty.

- Regulatory Landscape: Evolving environmental regulations globally are also pushing financial institutions to adopt more sustainable practices and reporting standards.

Butterfield operates within an evolving environmental landscape, driven by increasing global awareness of climate change and sustainability. The financial sector is under pressure to decarbonize, with many institutions setting ambitious net-zero targets by 2024, aligning with agreements like the Paris Agreement.

Investor scrutiny on environmental impact is intensifying, with a projected 70% of institutional investors integrating ESG factors by 2025. This trend highlights the financial imperative for companies like Butterfield to demonstrate genuine environmental stewardship to attract clients and investors.

Butterfield's proactive development of green products and services aims to meet surging client demand for sustainable financial solutions. Global sustainable investment assets reached an estimated $35.3 trillion in early 2024, underscoring the significant market opportunity for environmentally conscious financial offerings.

The bank is actively working to lower its carbon emissions through energy efficiency measures and exploring renewable energy sources for its facilities. This commitment to reducing its operational footprint addresses evolving environmental expectations and regulatory landscapes.

| Environmental Factor | Impact on Butterfield | Data/Trend (2023-2025) |

|---|---|---|

| Climate Change Risk & Mitigation | Physical and transitional risks require adaptation; opportunities in green finance. | Global sustainable bond issuance reached ~$1.5 trillion in 2023; trillions needed for net-zero by 2024. |

| Sustainable Finance Market Growth | Increased demand for green products and services. | Global sustainable investment assets ~$35.3 trillion (early 2024); investor integration of ESG factors projected to reach 70% by 2025. |

| Regulatory Pressure & ESG Reporting | Compliance with evolving environmental regulations and transparency demands. | Bermuda Monetary Authority reviewing climate-related frameworks; UN Global Compact adherence guides ESG reporting since 2022. |

| Operational Decarbonization | Need to reduce carbon footprint through energy efficiency and renewables. | Financial institutions setting net-zero targets by 2024; focus on energy efficiency and waste reduction. |

PESTLE Analysis Data Sources

Our Butterfield PESTLE analysis is meticulously constructed using data from reputable financial institutions, government publications, and leading market research firms. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in current, verifiable information.