Butterfield Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Butterfield Bundle

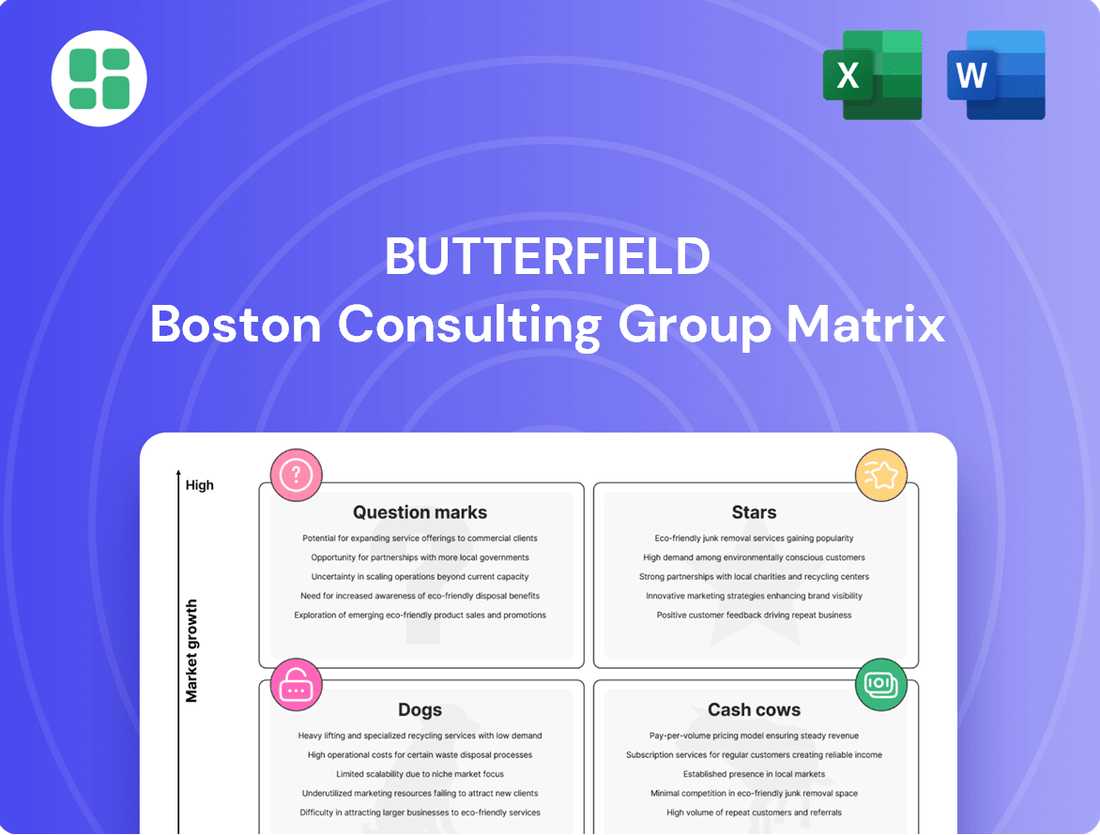

The Butterfield BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks based on market share and growth. This initial glimpse offers a strategic overview, but to truly unlock its potential, you need the full picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Butterfield's strategic expansion of its wealth management services in key international financial centers, like the Cayman Islands, alongside a selective presence in high-growth hubs such as Singapore and Switzerland, clearly designates this segment as a Star within the BCG matrix.

The global financial wealth market experienced robust growth in 2024, with cross-border wealth alone showing a notable increase, creating a fertile ground for Butterfield's ambitious market share expansion efforts.

Fee-based business acquisitions, particularly in the offshore banking sector, represent a strategic move for institutions aiming to bolster non-interest income. Butterfield, for instance, has explicitly stated its commitment to exploring such acquisitions, signaling a desire to enter or deepen its presence in lucrative markets. This approach is designed to enhance revenue streams beyond traditional lending, aiming for higher, more stable margins.

Butterfield's focus on digital client experience enhancement positions it strongly within the Stars quadrant of the BCG Matrix. Significant investments in technology aim to capture and retain market share in a digital-first banking environment. This strategic push is vital for growth across its product lines by boosting accessibility and service quality.

Channel Islands Wealth Management Growth

Butterfield's wealth management operations in the Channel Islands, specifically Guernsey and Jersey, represent a strategic focus area. While currently maintaining a smaller, albeit expanding, market share, the company's sustained investment in these jurisdictions signals a clear intention to capture a more substantial portion of the growing offshore financial market.

The Channel Islands are recognized as significant offshore financial centers, and Butterfield's continued presence and service offerings are designed to leverage this growth. This strategy aims to transform potential into a dominant market position.

- Butterfield's Channel Islands Wealth Management: Positioned as a 'question mark' or potentially 'star' in a BCG matrix, showing growth potential.

- Market Share: Currently small but growing in Guernsey and Jersey, indicating an opportunity for expansion.

- Strategic Focus: Continued provision of banking and wealth management services underscores a commitment to increasing market penetration.

- 2024 Data Insight: While specific 2024 market share figures for Butterfield in the Channel Islands are not publicly detailed, the overall growth trend in offshore financial services suggests a positive environment for wealth management providers. For instance, Jersey's finance industry reported a GVA of £2.7 billion in 2023, demonstrating the sector's economic significance and ongoing activity, which Butterfield aims to capitalize on.

High-Net-Worth Client Segment Focus

Butterfield's strategic focus on the high-net-worth (HNW) and ultra-high-net-worth (UHNW) client segments, primarily through its private banking and trust services, positions it for significant growth. This approach taps into a market segment that actively seeks sophisticated, cross-border wealth management solutions.

Butterfield's established presence and reputation in key offshore financial centers are critical advantages. These locations are favored by HNW and UHNW individuals for their wealth preservation and international investment opportunities, allowing Butterfield to effectively capture this expanding global client base.

- Targeting HNW/UHNW: Butterfield's private banking and trust services are geared towards individuals with substantial assets, often exceeding $1 million or $5 million in investable wealth.

- Cross-Border Demand: These clients frequently require diversified investment portfolios and estate planning that span multiple jurisdictions, a need Butterfield is well-equipped to meet.

- Offshore Expertise: The bank's strong footing in offshore centers like Bermuda, the Cayman Islands, and Guernsey provides a competitive edge in serving these internationally-minded clients.

- Market Growth: The global HNW population continues to expand, with assets under management in private banking projected to grow robustly in the coming years, offering a substantial opportunity for Butterfield.

Butterfield's wealth management operations, particularly in international financial centers and high-growth hubs, are classified as Stars. This designation reflects their high market share in a rapidly expanding industry, driven by increasing global wealth and demand for sophisticated financial services.

The bank’s strategic investments in digital client experience and its focus on the high-net-worth and ultra-high-net-worth segments further solidify its Star status. These initiatives are crucial for capturing and retaining market share in a competitive landscape.

Butterfield's expansion through fee-based acquisitions, especially in offshore banking, aims to enhance non-interest income and achieve higher, more stable margins. This strategic direction is vital for sustained growth and market leadership.

The global wealth management market continues to show strong growth. For instance, the total assets managed by private banks globally were projected to reach over $30 trillion by the end of 2024, indicating a significant opportunity for institutions like Butterfield that are actively expanding their services in this sector.

| Business Segment | Market Growth | Market Share | BCG Quadrant | Strategic Imperative |

|---|---|---|---|---|

| Wealth Management (International & High-Growth Hubs) | High | High | Star | Invest for growth, maintain leadership |

| Private Banking & Trust Services (HNW/UHNW) | High | High | Star | Defend and grow market share |

| Digital Client Experience Enhancement | High | Growing | Star | Continue investment to capture market |

| Channel Islands Wealth Management | Moderate to High | Growing | Question Mark/Star | Invest to gain share |

What is included in the product

The Butterfield BCG Matrix analyzes product/business unit performance based on market growth and share.

It guides strategic decisions on investment, divestment, or maintenance for each category.

Visualize your portfolio's health with a clear, actionable Butterfield BCG Matrix.

Cash Cows

Butterfield's retail banking in Bermuda is a classic cash cow. As the island's first bank, established in 1858, it commands a dominant market position in a mature sector. This segment consistently generates significant cash flow with minimal need for reinvestment, supporting other areas of the business.

Butterfield's Cayman Islands banking operations represent a classic cash cow within the Butterfield BCG Matrix. The company holds a dominant market share in both retail and corporate banking within this jurisdiction.

This mature market offers a consistent and substantial stream of deposits and income, minimizing the need for extensive marketing investments. As of the first quarter of 2024, Butterfield reported total deposits in the Cayman Islands of approximately $7.6 billion, underscoring its stable funding base.

Butterfield's identity as a deposit-led institution, boasting a stable and diversified deposit base across its operating jurisdictions, highlights a robust, low-cost funding advantage. This substantial and consistent inflow of deposits directly fuels significant net interest income, establishing it as a foundational cash cow for the bank's operations.

Established Trust Services

Butterfield's established trust services are a prime example of a Cash Cow within its BCG Matrix. These operations, particularly in core markets like Bermuda, the Cayman Islands, and Guernsey, consistently generate substantial fee income. This stability stems from their long-standing reputation and deep client relationships built around wealth preservation and succession planning.

The trust services business is mature, characterized by high profit margins and predictable revenue streams. In 2024, Butterfield reported robust performance from its trust division, underscoring its role as a reliable income generator. For instance, the bank highlighted steady growth in assets under administration within its trust segment, reflecting ongoing demand for sophisticated wealth management solutions.

- Consistent Fee Income: Butterfield's trust services in Bermuda, Cayman Islands, and Guernsey are a reliable source of recurring fee income, demonstrating maturity and stability.

- High Profit Margins: The business model for wealth preservation and succession planning typically yields strong profit margins due to specialized expertise and established client bases.

- Stable Client Relationships: Long-standing client relationships in these trust services contribute to predictable revenue and lower customer acquisition costs.

- 2024 Performance: The trust division showed continued strength in 2024, with notable increases in assets under administration, validating its Cash Cow status.

Treasury Services

Butterfield's Treasury Services, encompassing cash management and investment portfolio management, are a significant contributor to stable earnings. This division generates diversified fee income and supports efficient balance sheet management, offering steady, low-risk revenue streams within a mature financial landscape.

These services are crucial for maintaining liquidity and optimizing the bank's financial resources. In 2024, Butterfield reported that its treasury and deposit-taking activities formed the backbone of its operations, demonstrating consistent performance.

- Stable Earnings: Treasury Services provide a predictable revenue base through fees associated with cash management and investment advisory.

- Low-Risk Profile: These operations are generally considered low-risk, contributing to the overall stability of the bank's financial performance.

- Balance Sheet Efficiency: Effective treasury management enhances the bank's ability to manage its assets and liabilities efficiently.

- Diversified Income: Fee-based income from these services diversifies revenue away from purely interest-driven activities.

Butterfield's established trust services, particularly in its core markets, represent a significant cash cow. These operations consistently generate substantial fee income due to their mature nature and deep client relationships in wealth preservation and succession planning.

The trust business is characterized by high profit margins and predictable revenue streams, with Butterfield reporting steady growth in assets under administration in 2024, underscoring its reliable income generation capabilities.

This stable, fee-based income stream requires minimal reinvestment, allowing it to fund other business segments and contribute significantly to overall profitability.

Butterfield's Treasury Services also function as a cash cow, providing diversified fee income through cash management and investment portfolio services, which are crucial for balance sheet efficiency and liquidity management.

| Business Segment | BCG Category | Key Characteristics | 2024 Data/Insight |

|---|---|---|---|

| Retail Banking (Bermuda) | Cash Cow | Dominant market share, mature sector, generates strong cash flow. | Established 1858, commands a leading position. |

| Banking (Cayman Islands) | Cash Cow | Dominant market share (retail & corporate), mature market, stable deposits. | Total deposits approx. $7.6 billion (Q1 2024). |

| Trust Services | Cash Cow | Consistent fee income, high profit margins, stable client relationships. | Steady growth in assets under administration. |

| Treasury Services | Cash Cow | Diversified fee income, low-risk profile, balance sheet efficiency. | Forms backbone of operations with consistent performance. |

Full Transparency, Always

Butterfield BCG Matrix

The Butterfield BCG Matrix document you are previewing is the identical, final version you will receive upon purchase. This means the structure, analysis, and formatting are exactly as presented, ready for your immediate strategic application. You can confidently expect a professional, watermark-free, and fully editable report that requires no further work to implement. This comprehensive tool is designed to provide instant clarity on your product portfolio's market position and future potential.

Dogs

Some legacy loan portfolios within Butterfield's operations might be showing signs of weakness. While the bank's overall performance remains robust, a slight uptick in non-accrual loans and a contraction in the total loan book during 2024 point to potential issues in specific, older lending segments. These underperforming areas could be tying up valuable capital without generating adequate returns, especially considering anticipated lower loan yields following rate cuts anticipated after 2024.

Butterfield's smaller international operations, like those in the Bahamas, Switzerland, and Singapore, offering select wealth management services, can fall into the Non-Strategic Small International Operations category if they lack significant scale or a clear growth strategy. These units might consume valuable resources without contributing substantially to the bank's overall market share or competitive positioning. For instance, while Butterfield's overall revenue grew by 8% in 2024, these smaller, non-strategic units may not be driving that growth effectively.

Manual processes in banking, like paper-based loan applications or manual data entry for account updates, are classic examples of "Dogs" in the Butterfield BCG Matrix. These operations, if not yet digitized, are costly and slow. For instance, a bank still relying heavily on manual check processing in 2024 might see its operational costs per transaction significantly higher than competitors who have automated this. This inefficiency directly impacts profitability and offers no real growth avenue.

Highly Niche or Non-Core Product Lines

Highly niche or non-core product lines represent offerings that stray from a bank's primary business activities or its strategic goals for expanding fee-based income. These products often cater to a very specific segment of the market and may struggle to gain substantial traction, leading to limited revenue generation and a negligible market share.

For instance, a bank primarily focused on retail and commercial banking might offer highly specialized wealth management services for a very small, ultra-high-net-worth demographic. While potentially profitable on an individual client basis, the overall contribution to the bank's financial performance could be minimal, especially when compared to its core lending and deposit-taking activities. In 2024, many financial institutions are re-evaluating such segments, seeking to streamline operations and concentrate resources on areas with higher growth potential.

Consider these characteristics:

- Limited Market Appeal: These products target a small, specialized customer base, restricting their overall market reach.

- Low Revenue Contribution: Despite potentially high margins, the volume of business is often insufficient to make a significant impact on total revenue.

- Resource Drain: Maintaining and marketing these niche offerings can consume valuable resources that could be better allocated to core business areas.

- Strategic Misalignment: They may not align with the bank's broader strategic objectives or its efforts to build a diversified and robust fee income stream.

Declining or Stagnant Market Segments

Declining or stagnant market segments represent areas where Butterfield might face challenges in achieving significant growth. These are typically segments within traditional banking that are experiencing a long-term downturn or a lack of expansion. For instance, if certain types of lending or deposit products are seeing reduced demand across Butterfield's operating jurisdictions, and the bank doesn't hold a leading position in those specific niches, it signals limited future potential.

Consider the impact of digital transformation and evolving customer preferences. For example, in 2024, the global financial services industry continued to see a shift away from traditional branch-based banking towards digital channels. If Butterfield has a significant presence in markets where physical branch transactions are declining rapidly and they haven't fully adapted their offerings, these could be considered stagnant segments. Data from the first half of 2024 indicated that while digital banking adoption was soaring, some legacy banking products were seeing single-digit or even negative growth rates in developed markets.

Identifying these areas is crucial for strategic resource allocation. Butterfield would need to assess segments where:

- Secular decline in demand is evident.

- Growth rates are consistently below the industry average or national GDP.

- Butterfield's market share is not dominant, limiting its ability to influence or reverse trends.

- Future expansion opportunities are constrained due to structural market shifts.

Operations or products that exhibit low market share and low growth potential are categorized as Dogs within the Butterfield BCG Matrix. These areas often consume resources without generating significant returns, representing inefficiencies that can drag down overall performance. For instance, manual banking processes in 2024, such as paper-based loan applications, exemplify these low-return, low-growth activities.

Niche product lines that fail to gain traction or stagnant market segments experiencing secular decline also fall into this category. These segments may have limited appeal, contribute minimally to revenue, and drain resources that could be better utilized elsewhere. In 2024, a notable trend was the shift away from physical branches, making legacy banking products in such environments potential Dogs.

Butterfield's strategy for these Dog segments typically involves divestment, liquidation, or a significant overhaul to improve efficiency and profitability. The goal is to free up capital and management attention for more promising ventures.

Question Marks

Emerging digital banking products, like AI-powered financial advisors or blockchain-based payment solutions, are poised for significant growth in the fintech sector. These innovations are entering a high-potential market, but for established players like Butterfield, their current market share in these specific, new offerings would likely be minimal as they work to build adoption and scale.

Butterfield's strategic focus on selective, fee-based acquisitions and expanding its geographic footprint, particularly in high-wealth creation regions like Asia-Pacific (through Singapore), clearly indicates a move towards targeted international market penetration. This approach aims to enter markets where the bank currently holds a low market share but anticipates significant growth potential, aligning with the principles of identifying new, promising territories.

In 2024, Butterfield continued its efforts to bolster its presence in key international hubs. For instance, its wealth management division reported continued growth in assets under management from the Asia-Pacific region, underscoring the success of its targeted expansion strategy in these high-potential markets.

Butterfield's residential property lending in the UK might be classified as a Question Mark within the BCG Matrix if it represents a newer or smaller segment of their business in a highly competitive landscape. This suggests the venture operates in a market with growth potential, but Butterfield's current market penetration is likely modest, necessitating substantial investment to increase its standing.

The UK's residential property market, while generally robust, presents challenges. In 2023, the average house price in the UK stood at approximately £285,000, indicating a significant market size. However, competition from established banks and specialist lenders is intense, meaning Butterfield's share could be minimal, requiring strategic capital allocation to build brand recognition and customer base.

Specialized Financial Services in Developing Offshore Hubs

Butterfield provides specialized financial services in developing offshore hubs like Jersey, aiming to capture a growing market share. These services are strategically positioned in high-growth niches where the bank is actively investing to build a more substantial presence from its current smaller base.

This approach aligns with the concept of building 'Stars' from 'Question Marks' within the BCG framework, focusing on markets with high potential. For instance, in 2024, Butterfield's wealth management services in Jersey are seeing increased demand, driven by evolving regulatory landscapes and a growing appetite for sophisticated financial planning among international clients.

- Focus on Niche Growth: Butterfield targets specialized services in offshore financial centers, identifying high-potential segments.

- Strategic Investment: The bank invests in these developing hubs to cultivate a stronger market position.

- Market Share Expansion: Efforts are concentrated on increasing market share in these strategically chosen locations.

- Leveraging Expertise: Butterfield utilizes its expertise to offer advanced financial solutions tailored to the needs of clients in these offshore centers.

New Client Segments via Technology and Service Centers

Butterfield's investment in technology and the expansion of its Halifax service center are strategic moves designed to tap into previously underserved or entirely new client segments. This focus on enhancing client experience through digital platforms and improved service infrastructure positions the company to capture growth in areas where its current market share might be relatively low, aiming to transform these into future high-performing Stars within the BCG matrix framework.

By leveraging technology, Butterfield can offer more accessible and personalized services, potentially attracting a younger, digitally native demographic or a broader international clientele seeking seamless banking solutions. For example, in 2024, many financial institutions reported significant increases in digital adoption, with mobile banking usage often growing by double-digit percentages year-over-year, indicating a clear market trend Butterfield is likely capitalizing on.

- Targeting Digitally Savvy Clients: Investment in user-friendly apps and online portals caters to clients who prefer self-service and digital interactions.

- Expanding International Reach: Enhanced service centers and technology can support a larger, more geographically diverse client base.

- Converting Low Market Share: These initiatives are designed to build market share in segments where Butterfield has a nascent presence, aiming for future growth.

- Shifting to 'Stars': The strategy aligns with moving potential 'Question Marks' or low-share segments into 'Stars' through focused investment and service improvement.

Question Marks represent business units or products in low-market share positions within high-growth industries. These ventures require significant investment to increase market share and potentially become future Stars. Without careful strategic management, they risk becoming Dogs if market growth slows or competitive pressures intensify.

Butterfield's foray into emerging fintech products, such as AI-driven advisory services, fits this classification. While the fintech sector in 2024 continued its rapid expansion, with global fintech investment reaching hundreds of billions, Butterfield's specific offerings in these nascent areas likely held a small market share. This necessitates substantial capital to build brand awareness and customer adoption.

Similarly, the bank's UK residential property lending, operating in a competitive market with average house prices around £285,000 in 2023, could be considered a Question Mark if its penetration is modest. Significant investment would be required to gain a more substantial foothold against established competitors.

| Business Unit/Product | Market Growth Rate | Relative Market Share | BCG Category | Strategic Implication |

|---|---|---|---|---|

| Emerging Fintech Products (e.g., AI Advisors) | High | Low | Question Mark | Requires significant investment to gain market share. |

| UK Residential Property Lending | Moderate to High (market dependent) | Low | Question Mark | Needs strategic capital allocation to build presence. |

| Wealth Management in Jersey | High | Growing, but starting from a smaller base | Question Mark (potential to become Star) | Focus on investment to capitalize on demand. |

BCG Matrix Data Sources

Our Butterfield BCG Matrix is constructed using comprehensive market data, including financial performance, industry growth rates, and competitive landscape analysis, ensuring robust strategic recommendations.