Burns & McDonnell PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burns & McDonnell Bundle

Gain a critical understanding of the external forces shaping Burns & McDonnell's trajectory with our comprehensive PESTLE analysis. From evolving environmental regulations to technological advancements, this report provides actionable intelligence to inform your strategic decisions. Download the full version now and unlock the insights you need to stay ahead.

Political factors

Government infrastructure spending, especially through programs like the Bipartisan Infrastructure Law (IIJA), is a major boon for companies like Burns & McDonnell. This law alone is directing a massive $568 billion toward more than 66,000 projects across the country.

This substantial federal investment significantly boosts the construction and infrastructure sectors, creating a favorable environment for engineering and consulting firms. The IIJA's impact is projected to fuel considerable job creation within the construction industry through 2025, directly benefiting businesses involved in these large-scale projects.

The Inflation Reduction Act (IRA) is a significant driver of demand for engineering services in the clean energy sector. This legislation, enacted in 2022, provides substantial tax credits and incentives for renewable energy projects, including solar and wind power. For instance, the IRA extended the Investment Tax Credit (ITC) and Production Tax Credit (PTC), which are crucial for making these projects economically viable.

These policies directly fuel growth in areas like solar and wind development, as well as critical grid modernization efforts. Burns & McDonnell's expertise in energy diversification and storage aligns perfectly with these government-backed initiatives. The IRA's impact is projected to significantly boost renewable energy deployment, creating a sustained need for the specialized engineering skills the company offers.

The combination of public policy and private sector investment is creating a fertile ground for continued expansion in clean energy. By 2024, the U.S. renewable energy sector is expected to see record levels of investment, driven by these supportive policies. This trend indicates a strong and ongoing market for engineering firms like Burns & McDonnell that are positioned to capitalize on the clean energy transition.

The engineering and construction sector, including firms like Burns & McDonnell, is experiencing a tailwind from government policies and significant federal investments. For instance, the Infrastructure Investment and Jobs Act, enacted in late 2021, allocated over $1.2 trillion for infrastructure improvements, directly benefiting companies involved in transportation, manufacturing, and utility projects.

These industrial policies are fueling substantial growth in nonresidential infrastructure development. Burns & McDonnell is well-positioned to capitalize on this, as evidenced by their continued success in securing large-scale projects across these vital sectors, reflecting the broader trend of increased capital expenditure in public works.

To maximize these opportunities, Burns & McDonnell needs to maintain agility. Adapting to the dynamic regulatory environment and leveraging the long-term funding commitments from initiatives like the Inflation Reduction Act, which also includes substantial clean energy and infrastructure funding, will be crucial for sustained growth.

International Trade Relations

Global trade relations and agreements profoundly shape international market dynamics for companies like Burns & McDonnell. For example, the imposition of tariffs on key components such as solar panels and batteries, often enacted to bolster domestic manufacturing, can directly affect project expenses and necessitate adjustments in supply chain planning. In 2024, ongoing trade disputes and the renegotiation of existing trade pacts continue to create an unpredictable environment for cross-border commerce.

Burns & McDonnell must remain vigilant in monitoring evolving trade policies and international agreements. This proactive approach is crucial for effectively identifying and capitalizing on global project opportunities while simultaneously mitigating potential risks and navigating the complexities of international business operations.

- Tariffs on Solar Panels: In early 2024, the US continued to assess tariffs on imported solar cells and modules, impacting project economics for renewable energy developments.

- Battery Supply Chain Focus: Governments worldwide are prioritizing domestic battery production, potentially leading to trade restrictions or incentives that influence the cost and availability of critical materials for energy projects.

- Trade Agreement Revisions: Ongoing reviews and potential renegotiations of major trade agreements, such as those involving the European Union and North American countries, could alter market access and operational costs for international projects.

Political Stability and Project Approvals

Political stability is a cornerstone for Burns & McDonnell's success, especially with large infrastructure projects. Unstable political climates can lead to project cancellations or significant delays, impacting revenue streams. For instance, the 2024 US elections could introduce policy shifts that affect energy and infrastructure spending, a core market for the firm.

Government funding and appropriations are directly tied to political decisions. Delays in budget approvals or changes in federal priorities, such as the fluctuating emphasis on renewable energy versus traditional power sources, can create uncertainty. In 2024, infrastructure bills continue to be a focus, but the allocation of funds and specific project types remain subject to political negotiation, potentially slowing down project pipelines.

A predictable political landscape streamlines permitting and regulatory processes, which are critical for project execution. Burns & McDonnell thrives when there's a consistent approach to environmental reviews and land use approvals. Regions with stable governance and clear regulatory frameworks, like many in the US Midwest and Southeast, often offer a more reliable project environment compared to politically volatile areas.

- Political Stability: Regions with consistent governance and predictable policy environments are crucial for the long-term planning and execution of Burns & McDonnell's large-scale infrastructure projects.

- Funding Certainty: Shifts in government appropriations and administrative priorities, influenced by election cycles and legislative agendas, directly impact the availability and continuity of funding for key sectors like energy and transportation.

- Regulatory Environment: Stable political conditions foster smoother and more predictable permitting and approval processes, essential for managing project timelines and costs effectively.

Government policies and infrastructure spending remain a significant driver for Burns & McDonnell. The Bipartisan Infrastructure Law (IIJA), with its $568 billion allocation, continues to fuel projects across the nation through 2025, directly benefiting the firm's core operations.

The Inflation Reduction Act (IRA) further bolsters demand in the clean energy sector, with extended tax credits for solar and wind power. This legislation is projected to significantly increase renewable energy deployment, creating a sustained need for specialized engineering services through 2025.

Political stability is paramount for large-scale projects. The 2024 US elections, for example, could introduce policy shifts impacting energy and infrastructure spending, a critical market for Burns & McDonnell. Predictable regulatory environments streamline permitting, crucial for project execution.

| Policy/Legislation | Estimated Impact/Allocation | Projected Timeline |

|---|---|---|

| Bipartisan Infrastructure Law (IIJA) | $568 billion for over 66,000 projects | Through 2025 |

| Inflation Reduction Act (IRA) | Tax credits for renewable energy (solar, wind) | Ongoing, significant boost through 2025 |

| US Elections (2024) | Potential policy shifts impacting infrastructure spending | 2024 onwards |

What is included in the product

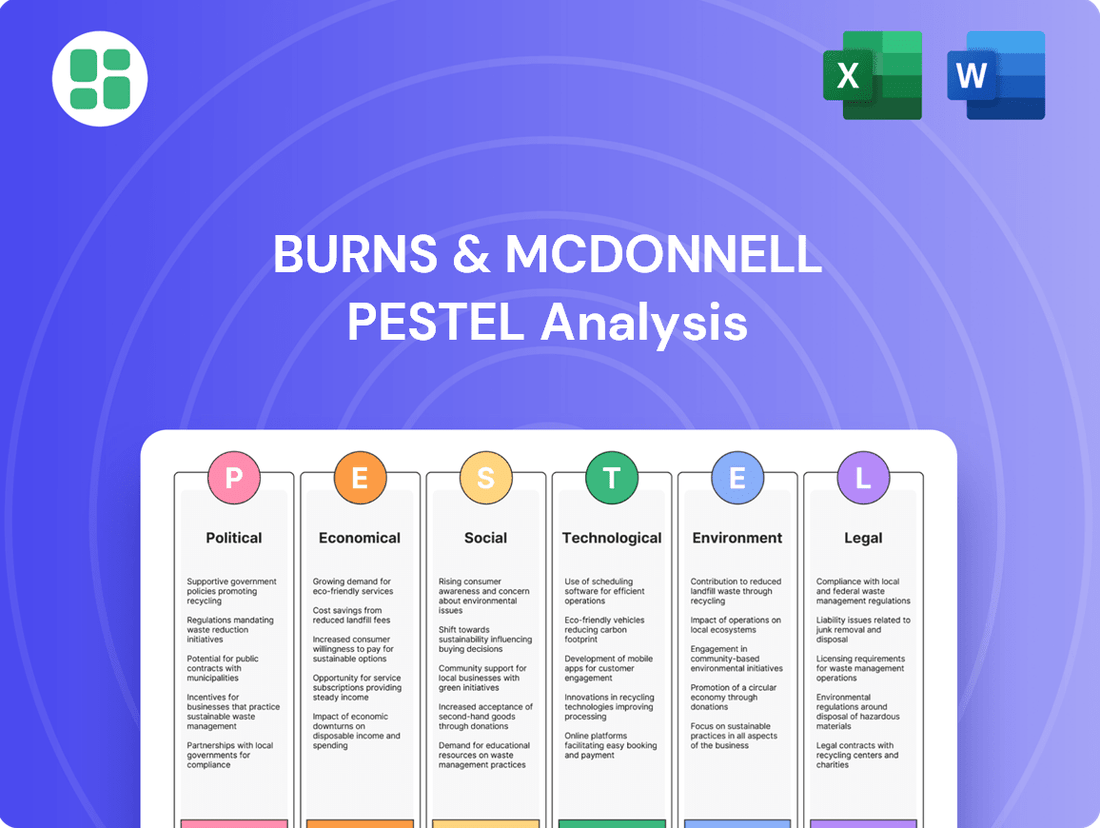

This PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Burns & McDonnell's operations and strategic planning.

It provides actionable insights into external forces, enabling proactive decision-making and the identification of both emerging threats and strategic opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for strategic decision-making.

Economic factors

Interest rate fluctuations significantly impact the cost of capital for Burns & McDonnell's large-scale projects. Higher rates increase borrowing expenses, potentially delaying or scaling back investment decisions. For instance, the Federal Reserve's monetary policy decisions directly influence these rates, affecting project feasibility.

Looking ahead to 2024 and into 2025, projections suggest a potential easing of short-term interest rates. This anticipated decrease could lower financing costs for infrastructure and energy projects, making them more attractive for both public and private sector investment. Such a trend would likely boost demand for Burns & McDonnell's engineering and construction services.

Inflationary pressures and escalating material costs are significant headwinds for the construction sector, directly impacting project budgets and overall profitability. For a firm like Burns & McDonnell, these rising expenses can diminish the intended value of substantial federal investments, demanding agile and strategic project management.

For instance, the Producer Price Index for construction materials saw a notable increase in late 2023 and early 2024, with some categories experiencing double-digit year-over-year growth. This trend necessitates that Burns & McDonnell implement rigorous cost estimation protocols and proactive supply chain management to effectively navigate and mitigate these financial challenges.

The U.S. economy is anticipated to see moderate growth in 2024 and into 2025, fostering consistent demand for essential services like construction and engineering. This economic backdrop is particularly beneficial for firms like Burns & McDonnell, as it signals a healthy environment for their core business operations.

Specifically, projections indicate a GDP growth rate of around 2.3% for 2024, with a slight moderation to approximately 1.9% in 2025, according to recent forecasts. This sustained, albeit moderate, expansion directly fuels demand for infrastructure development and capital projects, areas where Burns & McDonnell excels.

Increased construction activity, especially within the nonresidential and manufacturing sectors, further bolsters this favorable market. For instance, the U.S. Census Bureau reported a significant uptick in nonresidential construction spending through late 2024, highlighting robust investment in these key areas. Burns & McDonnell's strategic positioning to leverage this heightened activity is a critical factor for its ongoing success and market penetration.

Labor Market Dynamics and Wages

The engineering and construction sector is grappling with a persistent shortage of skilled talent, evidenced by a consistently high number of unfilled positions. This scarcity is particularly acute as a significant portion of the experienced workforce approaches retirement age.

This tight labor market is directly translating into upward pressure on wages and benefits. Companies like Burns & McDonnell are facing increased costs to attract and retain qualified engineers and construction professionals due to intense competition for a limited pool of candidates.

- Job Openings: In Q1 2025, the U.S. Bureau of Labor Statistics reported over 750,000 job openings in construction and engineering occupations, a slight increase from the previous year.

- Wage Growth: Average hourly wages for construction managers saw a 4.5% increase in 2024, reaching approximately $49.50, with further growth projected for 2025.

- Retirement Trends: Industry estimates suggest that nearly 40% of the skilled construction workforce could retire within the next decade, exacerbating the talent gap.

- Recruitment Costs: The average cost to fill a skilled trade position has risen by 15% since 2023, highlighting the financial strain of talent acquisition.

Global Supply Chain Stability

Global supply chain disruptions remain a significant concern, impacting project timelines and costs for engineering and construction firms like Burns & McDonnell. Geopolitical events and lingering effects of the pandemic contributed to widespread volatility throughout 2023 and into early 2024, affecting the availability and price of critical materials and equipment. For instance, the Suez Canal blockage in March 2021, though resolved, highlighted the fragility of key transit routes, with ripple effects continuing to be felt in shipping costs and delivery times for certain components.

Burns & McDonnell has shown adaptability in navigating these challenges, but the need for continuous vigilance and proactive strategies is paramount. A diversified sourcing approach, exploring alternative suppliers and geographic regions, is crucial for mitigating risks associated with single-source dependencies. This proactive stance helps ensure the consistent and cost-effective procurement of necessary resources for ongoing and future projects.

The stability of the global supply chain directly influences Burns & McDonnell's ability to adhere to project schedules and manage expenditures effectively.

- Projected global shipping costs saw a notable increase in late 2023 and early 2024 due to renewed shipping disruptions in key maritime routes, impacting material acquisition.

- The International Monetary Fund (IMF) revised its global growth forecast for 2024 downwards in early 2024, citing persistent supply chain pressures and geopolitical uncertainties as contributing factors.

- Companies are increasingly investing in supply chain resilience, with a significant portion of businesses surveyed in late 2023 reporting plans to increase their inventory levels to buffer against potential shortages.

- The cost of key construction materials, such as steel and concrete, experienced price fluctuations throughout 2023, directly linked to energy costs and the availability of raw materials influenced by supply chain dynamics.

The economic outlook for 2024 and 2025 indicates moderate GDP growth, which is favorable for Burns & McDonnell's core business. This sustained expansion supports demand for infrastructure and capital projects.

Anticipated interest rate easing in 2024-2025 could reduce financing costs for projects, making them more appealing and potentially increasing demand for the firm's services.

However, persistent inflation and rising material costs present challenges, impacting project budgets and profitability, requiring robust cost management.

The U.S. construction sector is experiencing robust activity, particularly in nonresidential and manufacturing segments, creating significant opportunities for Burns & McDonnell.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Burns & McDonnell |

|---|---|---|---|

| GDP Growth | ~2.3% | ~1.9% | Consistent demand for services |

| Interest Rates | Potential easing | Continued easing | Lower capital costs, increased project viability |

| Inflation | Moderate to high | Moderate | Increased material and labor costs, budget pressure |

| Construction Spending | Strong growth (non-residential) | Continued strength | Increased project pipeline |

What You See Is What You Get

Burns & McDonnell PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Burns & McDonnell PESTLE analysis offers a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

You'll gain valuable insights into market trends, competitive landscapes, and strategic opportunities, all presented in a professional and actionable format.

Sociological factors

The construction and engineering sectors face a significant challenge with an aging workforce, as many experienced professionals approach retirement. This trend, coupled with a slower influx of younger talent, creates a critical need for strategic recruitment. For instance, in 2024, the U.S. Bureau of Labor Statistics projected that employment in architecture and engineering occupations will grow 4 percent from 2022 to 2032, slower than the average for all occupations, highlighting the need to attract new entrants.

Burns & McDonnell must prioritize attracting and retaining a new generation of tech-savvy professionals to bridge this talent gap. Investing in robust training and development programs that equip employees with the latest digital skills is paramount. Furthermore, cultivating an inclusive and forward-thinking workplace culture is essential for appealing to and keeping younger talent who value diversity and innovation.

Societal expectations are increasingly pushing for sustainability, with a growing demand for green building and eco-friendly infrastructure. This trend directly impacts client preferences and project requirements, favoring companies that prioritize environmental responsibility.

In 2024, the global green building market was valued at an estimated $1.07 trillion and is projected to reach $2.47 trillion by 2030, demonstrating a clear upward trajectory. Burns & McDonnell's established expertise in renewable energy, environmental consulting, and sustainable design aligns perfectly with this expanding market, allowing them to capitalize on the heightened demand for environmentally conscious solutions.

Public perception and community engagement are crucial for Burns & McDonnell, especially with projects impacting local areas. Their commitment to social responsibility is evident in initiatives like Earth Day volunteering and projects that provide tangible economic benefits, such as the estimated $10 million in economic impact generated by their recent infrastructure projects in the Kansas City region in 2024.

Maintaining positive community relations directly influences project acceptance and strengthens the firm's overall reputation. For instance, proactive engagement on a new renewable energy facility in Texas in 2025 is expected to foster local support, mitigating potential delays and enhancing long-term operational success.

Diversity, Equity, and Inclusion (DEI)

Burns & McDonnell recognizes the critical importance of Diversity, Equity, and Inclusion (DEI) in its operations and workforce. The company actively pursues initiatives to recruit and retain a diverse talent pool, including women, minorities, and veterans, reflecting a broader industry trend. This commitment is not just about ethical considerations; it's a strategic imperative to combat labor shortages and cultivate a more innovative, representative, and high-performing organization.

The company's employee-owned structure inherently fosters a sense of inclusion and shared purpose. In 2023, Burns & McDonnell reported that 30% of its workforce identified as women, and 25% as minorities, demonstrating tangible progress in workforce diversification. These efforts are crucial for aligning with evolving societal expectations and tapping into a wider range of perspectives to drive business success.

- Workforce Diversity Metrics: In 2023, women comprised 30% of Burns & McDonnell's workforce, with minorities making up 25%.

- Veteran Recruitment: The company actively recruits veterans, recognizing their valuable skills and leadership experience.

- Inclusive Culture: As an employee-owned firm, Burns & McDonnell promotes an inclusive environment where all employees have a stake in the company's success.

- Innovation Driver: DEI initiatives are seen as a key factor in fostering innovation and adaptability within the company.

Changing Client Preferences and ESG Focus

Clients are now deeply invested in Environmental, Social, and Governance (ESG) principles, driving demand for services that support sustainability. This is evident in the surge of interest in water and waste management consulting, as well as a significant push towards renewable energy solutions. For instance, global ESG investments were projected to reach $53 trillion by 2025, a figure that underscores this powerful trend.

Burns & McDonnell's comprehensive suite of services, particularly its environmental and sustainability consulting capabilities, are perfectly positioned to address these shifting client expectations. The company's ability to offer integrated solutions, from environmental impact assessments to renewable energy project development, directly caters to this growing market need.

- Growing ESG Investment: Global ESG investments are expected to reach $53 trillion by 2025, highlighting a significant market shift.

- Demand for Sustainable Solutions: Clients are actively seeking expertise in water management, waste reduction, and renewable energy integration.

- Alignment with Burns & McDonnell's Strengths: The company's integrated environmental and sustainability services directly meet these evolving client priorities.

Societal shifts towards sustainability are a major driver, with clients increasingly demanding green building and eco-friendly infrastructure. This trend is reflected in the global green building market, valued at an estimated $1.07 trillion in 2024 and projected to reach $2.47 trillion by 2030, presenting a substantial opportunity for Burns & McDonnell's expertise in renewable energy and sustainable design.

Public perception and community engagement are vital, particularly for projects impacting local areas. Burns & McDonnell's commitment to social responsibility, demonstrated through initiatives like Earth Day volunteering and projects generating significant local economic impact, such as an estimated $10 million in 2024 for Kansas City infrastructure, directly influences project acceptance and reputation.

Diversity, Equity, and Inclusion (DEI) are increasingly recognized as critical for innovation and talent acquisition, especially given the aging workforce in engineering. In 2023, Burns & McDonnell reported 30% women and 25% minority representation, aligning with societal expectations and combating labor shortages by tapping into a wider talent pool.

The growing emphasis on Environmental, Social, and Governance (ESG) principles by clients is reshaping the market, with global ESG investments projected to hit $53 trillion by 2025. Burns & McDonnell's strong capabilities in environmental and sustainability consulting, including renewable energy and water management, directly address this demand for responsible solutions.

Technological factors

Building Information Modeling (BIM) adoption is rapidly increasing across the AEC industry, with projections indicating that 70% of global projects will utilize BIM by 2025, up from approximately 50% in 2022. This technology streamlines design, reduces clashes by an estimated 20-30%, and improves cost estimation accuracy, directly impacting project efficiency and sustainability for firms like Burns & McDonnell.

The integration of digital twins, which are virtual replicas of physical assets, is further revolutionizing project lifecycle management. These twins enable real-time monitoring, predictive maintenance, and enhanced operational optimization, offering significant long-term cost savings and performance improvements, a key advantage for infrastructure projects managed by Burns & McDonnell.

Artificial Intelligence and machine learning are transforming the construction and engineering landscape. For instance, in 2024, AI-powered predictive analytics are helping firms like Burns & McDonnell anticipate potential project delays and cost overruns, with some studies suggesting AI can reduce project costs by up to 10%.

AI is also revolutionizing design processes, enabling faster iteration and optimization, and improving safety. By analyzing vast datasets, AI can identify hazardous patterns in real-time, potentially decreasing workplace accidents. The use of business intelligence and data analytics tools is also on the rise, allowing for more informed decisions regarding resource allocation and project management, leading to an estimated 15% improvement in operational efficiency in early adopters.

The construction industry is seeing a significant uptick in robotics and automation, with companies like Burns & McDonnell exploring these innovations. This technological shift is directly impacting project timelines and safety protocols. For instance, autonomous vehicles and robotic excavators are becoming more common, aiming to speed up groundwork and reduce human exposure to hazardous tasks.

These advancements are crucial in addressing persistent labor shortages. The U.S. Bureau of Labor Statistics projected a need for over 439,000 additional construction workers in 2024 alone. By augmenting human capabilities, robotics can boost productivity, allowing for quicker and more precise execution of complex building phases, thereby mitigating the impact of these shortages.

Burns & McDonnell can capitalize on these trends by integrating advanced robotics and automation into their project delivery. This could involve using drones for site surveying and progress monitoring, or employing robotic systems for repetitive tasks like bricklaying or welding. Such adoption is expected to not only enhance operational efficiency but also improve the overall quality and safety of construction projects.

Advancements in Renewable Energy Technologies

Continuous innovation in renewable energy, including solar, wind, and battery storage, is opening up significant new avenues for engineering and construction firms like Burns & McDonnell. These advancements are not just theoretical; they are translating into tangible project opportunities.

The market is experiencing record-breaking installations. For instance, solar and battery storage projects are consistently setting new benchmarks, with projections indicating substantial continued growth through 2025 and beyond. This surge is driven by both technological improvements and supportive policies.

Emerging technologies are also reshaping the landscape of sustainable construction. Solutions such as solar shingles are becoming more viable, while advancements in hydrogen fuel cells and the development of smarter, more resilient smart grids are influencing how future infrastructure is designed and built.

- Record Growth: Solar installations in the US are projected to reach over 37 GW in 2024, a significant increase from previous years, with battery storage capacity also seeing exponential growth.

- Investment Surge: Global investment in clean energy technologies is expected to surpass $2 trillion in 2025, signaling strong market confidence and demand for related engineering services.

- Technological Integration: The increasing adoption of solar shingles and the development of hydrogen fuel cell applications are creating new project types and requiring specialized engineering expertise.

- Grid Modernization: Investments in smart grid technologies are crucial for integrating intermittent renewables, presenting opportunities for grid modernization and expansion projects.

Cybersecurity and Data Management

The increasing digitalization of Burns & McDonnell's projects and operations, from smart grid implementations to digital twins for infrastructure, necessitates robust cybersecurity and sophisticated data management. This is crucial for protecting sensitive client and project data, as well as ensuring the operational integrity of connected systems. For instance, the global cybersecurity market was valued at approximately $270 billion in 2023 and is projected to grow, reflecting the escalating importance of these measures across industries.

Adherence to evolving data usage and cybersecurity standards, particularly in smart infrastructure, is paramount. This includes compliance with regulations like GDPR and emerging frameworks for IoT security. Burns & McDonnell must continue to invest in advanced data protection technologies and protocols to maintain client trust and mitigate risks associated with cyber threats. In 2024, the average cost of a data breach reached $4.45 million, underscoring the financial imperative for strong security.

- Enhanced Data Security: Implementing multi-layered security protocols to safeguard proprietary information and client data.

- Compliance Management: Staying abreast of and adhering to evolving global and regional data privacy and cybersecurity regulations.

- Digital Infrastructure Protection: Securing the connected systems and IoT devices deployed in smart city and infrastructure projects.

- Talent Development: Investing in cybersecurity expertise and data management professionals to address the growing threat landscape.

Technological advancements continue to reshape the engineering and construction sector, driving efficiency and innovation. The increasing adoption of Building Information Modeling (BIM) is projected to reach 70% of global projects by 2025, enhancing design accuracy and cost estimation. Digital twins are also gaining traction, offering real-time asset monitoring and predictive maintenance, which can lead to substantial long-term cost savings.

Artificial intelligence and machine learning are transforming project management by enabling predictive analytics for potential delays and cost overruns, with potential cost reductions of up to 10%. Robotics and automation, including autonomous vehicles and robotic excavators, are addressing labor shortages by boosting productivity and improving safety on construction sites, with over 439,000 additional construction workers needed in the US in 2024.

The renewable energy sector is experiencing rapid growth, with solar installations in the US expected to exceed 37 GW in 2024 and global investment in clean energy technologies projected to surpass $2 trillion in 2025. Emerging technologies like solar shingles and hydrogen fuel cells are creating new project opportunities and requiring specialized engineering expertise, while smart grid investments are crucial for integrating renewables.

The increasing digitalization of operations necessitates robust cybersecurity measures, with the global cybersecurity market valued at approximately $270 billion in 2023. Protecting sensitive data and operational integrity is paramount, especially with the average cost of a data breach reaching $4.45 million in 2024, highlighting the financial imperative for strong security protocols and compliance with evolving data privacy regulations.

Legal factors

Increasing regulatory compliance requirements related to sustainable practices are significantly driving the demand for environmental consulting services. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD), which became mandatory for many large companies starting in fiscal year 2024, necessitates extensive reporting on environmental, social, and governance (ESG) factors, including detailed data on emissions and resource management.

Firms like Burns & McDonnell must actively navigate stringent environmental laws, such as those governing pollution control, comprehensive waste management protocols, and increasingly strict carbon emissions targets set by various national and international bodies. The U.S. Environmental Protection Agency (EPA) continues to update regulations, impacting everything from air quality standards to water discharge permits, requiring constant adaptation.

Burns & McDonnell navigates a complex web of labor laws and employment regulations that differ significantly across the U.S. states and international locations where it has a presence. This necessitates careful management of issues like minimum wage requirements, overtime rules, and anti-discrimination statutes to ensure compliance and avoid legal challenges.

The company faces the ongoing challenge of talent shortages in critical engineering and construction fields, requiring strategic compensation and benefits packages that meet or exceed legal minimums for fair wages. Worker safety regulations, such as those enforced by OSHA, are paramount, demanding robust training programs and adherence to strict site safety protocols to prevent accidents and ensure a healthy work environment.

In 2024, the U.S. Bureau of Labor Statistics reported a persistent shortage in skilled trades, impacting sectors where Burns & McDonnell operates. Proactive strategies for talent acquisition and retention are therefore crucial, not only for business growth but also for maintaining compliance with evolving labor market expectations and regulations designed to protect workers.

Governments worldwide are intensifying their focus on sustainability, leading to stricter green building codes and safety regulations. For instance, the U.S. Green Building Council's LEED certification, a widely adopted standard, continues to evolve, pushing for greater energy efficiency and reduced environmental impact in new construction and renovations throughout 2024 and into 2025.

Compliance with these increasingly stringent building codes and safety standards is not merely a procedural requirement but a critical factor for successful project execution and mitigating potential liabilities for companies like Burns & McDonnell. Failure to adhere can result in significant fines, project delays, and reputational damage.

The integration of advanced technologies, such as wearable devices for real-time worker monitoring and the development of connected worksites, is proving instrumental in enhancing on-site safety and ensuring adherence to these evolving legal frameworks. By mid-2024, industry reports indicate a 15% increase in the adoption of such safety technologies on large-scale construction projects.

Contractual Obligations and Liability

Burns & McDonnell, as a major player in engineering, architecture, and construction, is deeply involved in intricate contractual relationships. These agreements with clients, subcontractors, and various partners form the bedrock of their operations. Effective management of contract law, meticulous handling of project liabilities, and strategic risk allocation are paramount for both successful project execution and the company's overall financial health.

The legal landscape is constantly evolving, particularly with the integration of new technologies and innovative project delivery methods. Understanding the legal ramifications of these advancements, such as those related to digital twins or advanced modular construction, is critical. For instance, in 2024, the construction industry saw increased scrutiny on contractual clauses related to data ownership and cybersecurity in smart building projects, impacting firms like Burns & McDonnell.

- Contractual Complexity: Burns & McDonnell manages a vast portfolio of contracts, each with unique legal stipulations governing scope, timelines, and payment terms.

- Liability Management: Ensuring proper insurance coverage and indemnification clauses within contracts is vital to mitigate risks associated with project failures or accidents.

- Risk Allocation: Fair and clear allocation of risks between parties in contracts is essential to prevent disputes and protect the company's financial interests.

- Emerging Technologies: Legal frameworks surrounding AI-driven design, autonomous construction equipment, and BIM (Building Information Modeling) data rights are becoming increasingly important considerations in contract development.

Data Privacy and ESG Reporting Mandates

Data privacy and ESG reporting are increasingly becoming legal necessities. For instance, companies are now facing new international accounting standards for ESG performance, with reports based on 2024 data due in 2025. This means firms like Burns & McDonnell must ensure their data collection is transparent and their reporting structures are solid, directly impacting how they handle and share information.

These mandates require a significant overhaul in how businesses manage their data. The European Union's Corporate Sustainability Reporting Directive (CSRD), for example, will apply to many large companies, including those operating internationally, for fiscal years beginning on or after January 1, 2024, with the first reports due in 2025. This regulatory shift demands robust internal controls and a clear strategy for data governance to meet compliance requirements.

- Increased Scrutiny: Legal frameworks are tightening around data privacy and ESG disclosures, demanding greater accountability.

- 2025 Reporting Deadline: Companies must prepare to report on 2024 ESG performance using new international standards.

- Data Governance Needs: Robust systems for collecting, managing, and reporting data are now critical legal and operational requirements.

- Compliance Costs: Investing in technology and expertise to meet these evolving legal obligations is essential for engineering firms.

Legal factors significantly shape Burns & McDonnell's operational landscape, particularly concerning environmental compliance and labor laws. Stricter regulations, like the EU's CSRD for 2024 fiscal years, mandate detailed ESG reporting, impacting how companies like Burns & McDonnell manage and present their sustainability data. This necessitates robust data governance and compliance strategies to meet increasing global scrutiny and upcoming 2025 reporting deadlines for 2024 performance.

| Legal Factor Area | 2024/2025 Impact | Key Considerations for Burns & McDonnell |

|---|---|---|

| Environmental Regulations | Increased focus on carbon emissions, waste management, and pollution control. | Adapting to evolving EPA standards, adhering to green building codes (e.g., LEED updates). |

| Labor Laws & Safety | Shortages in skilled trades, emphasis on worker safety and fair wages. | Competitive compensation, robust OSHA compliance, proactive talent acquisition. |

| Contract Law & Liability | Complex agreements, emerging tech implications (AI, BIM). | Meticulous contract management, clear risk allocation, understanding data ownership in smart projects. |

| Data Privacy & ESG Reporting | New international standards for ESG performance, data governance mandates. | Transparent data collection, solid reporting structures, compliance with directives like CSRD. |

Environmental factors

Burns & McDonnell is deeply engaged in climate action, developing advanced Direct Air Capture (DAC) hubs to capture and store carbon. This commitment is crucial as global efforts to limit warming to 1.5°C intensify, driving demand for such technologies. The company's work in this area directly supports the growing need for carbon removal solutions.

Furthermore, the firm designs resilient infrastructure to withstand the escalating impacts of climate change. With an estimated $2.7 trillion needed globally for climate adaptation by 2030, according to the UN Environment Programme, Burns & McDonnell's expertise in building more robust systems is vital for client preparedness.

They also guide clients in adapting to climate shifts through services like flood plain forecasting and water availability studies. As extreme weather events become more frequent, with the U.S. experiencing a record 28 separate billion-dollar weather and climate disasters in 2023 alone, these services are essential for risk management and operational continuity.

Sustainability and ESG are increasingly critical in construction, shaping everything from project design to material sourcing. Burns & McDonnell actively partners with clients to establish and achieve their sustainability objectives, focusing on measurable environmental performance improvements.

The firm's holistic approach is designed to boost operational efficiency while simultaneously helping clients meet ambitious sustainability targets. For instance, in 2024, the renewable energy sector, a key area for Burns & McDonnell, saw significant growth with over 15 GW of new solar capacity added in the US alone, highlighting the demand for sustainable infrastructure solutions.

Growing worries about running out of resources and producing too much trash are making companies look for specialized help with water and waste. For instance, the U.S. generated over 292 million tons of municipal solid waste in 2022, according to the EPA, highlighting the scale of the challenge.

Expect to see higher fees for waste disposal, which will push businesses to find smart ways to cut costs and follow the rules. This is where companies like Burns & McDonnell step in, offering strategies to lessen the environmental footprint of cleanup projects and promote healthy ecosystems.

Green Building Certifications and Practices

The demand for green-certified buildings, like those meeting LEED (Leadership in Energy and Environmental Design) standards, is experiencing significant growth. Stakeholders are increasingly focused on environmental sustainability, driving this trend. For instance, in 2023, the global green building market was valued at approximately $320 billion and is projected to reach over $700 billion by 2030, showcasing a clear upward trajectory.

This heightened interest encourages the adoption of sustainable materials, energy-efficient designs, and technologies aimed at reducing environmental impact across a building's entire lifecycle. Burns & McDonnell actively integrates these green building principles into its projects, assisting clients in achieving relevant certifications and demonstrating a commitment to eco-friendly development.

Key aspects of this trend include:

- Increased adoption of LEED and similar green building certifications: A growing number of new construction projects are seeking or achieving certifications like LEED Platinum, Gold, Silver, and Certified.

- Focus on lifecycle environmental impact: Emphasis is placed on reducing carbon footprints, water usage, and waste generation from construction through operation and eventual demolition.

- Integration of sustainable technologies: This includes solar power, advanced HVAC systems, smart building management, and water-efficient fixtures.

- Client demand for sustainable solutions: Businesses and organizations are actively seeking partners like Burns & McDonnell to help them meet their own environmental, social, and governance (ESG) goals through sustainable design and construction.

Renewable Energy Transition

The global imperative to shift towards cleaner energy sources is a major environmental driver, fueling significant capital deployment into renewable energy infrastructure. For instance, the International Energy Agency (IEA) reported in early 2024 that global clean energy investment was projected to reach $2 trillion in 2024, a substantial increase driven by renewables and grid modernization.

Burns & McDonnell is actively participating in this energy transition, offering engineering, design, and construction services for a range of renewable projects. Their involvement spans solar farms, wind installations, and battery energy storage systems, critical components for decarbonizing the power sector.

This strategic focus positions Burns & McDonnell to capitalize on the growing demand for sustainable energy solutions. Their projects directly support the reduction of fossil fuel dependency and the overall decarbonization of electricity grids, aligning with global environmental goals.

- Global clean energy investment is expected to hit $2 trillion in 2024, according to the IEA.

- Burns & McDonnell is involved in solar, wind, and battery energy storage projects.

- Their work aids in reducing reliance on fossil fuels.

- The company contributes to the decarbonization of electricity systems.

Environmental factors significantly shape Burns & McDonnell's operations, particularly concerning climate change adaptation and mitigation. The increasing frequency of extreme weather events, evidenced by the 28 billion-dollar weather disasters in the U.S. in 2023, necessitates resilient infrastructure design, a core service for the firm.

The global push for sustainability and ESG compliance is driving demand for services like flood plain forecasting and water availability studies, crucial for clients navigating climate shifts. Furthermore, the substantial global investment in clean energy, projected at $2 trillion for 2024 by the IEA, underscores the market for renewable energy infrastructure, where Burns & McDonnell is actively engaged.

The growing green building market, valued at $320 billion in 2023 and expected to exceed $700 billion by 2030, highlights the demand for sustainable materials and energy-efficient designs, areas where Burns & McDonnell integrates its expertise.

Resource scarcity and waste management are also key environmental concerns, with the U.S. generating over 292 million tons of municipal solid waste in 2022, prompting businesses to seek specialized assistance in reducing their environmental footprint and complying with evolving regulations.

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources, including government publications, international organizations, and leading industry analysis firms. We ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors.