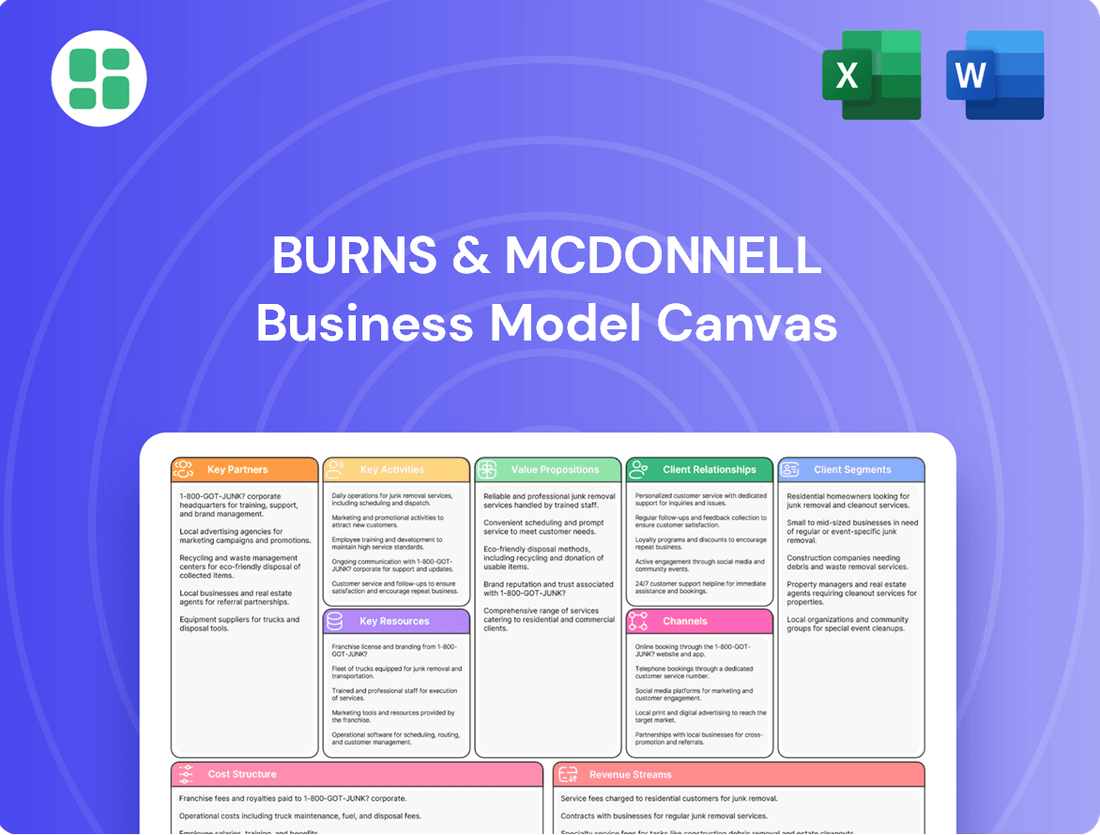

Burns & McDonnell Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burns & McDonnell Bundle

Discover the core of Burns & McDonnell's thriving business with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Perfect for anyone aiming to replicate or adapt proven strategies.

Partnerships

Burns & McDonnell relies heavily on specialized subcontractors for niche expertise and equipment, crucial for complex projects. For instance, in 2024, their solar projects frequently integrated components from leading suppliers like First Solar, utilizing their Series 7 modules, and Array Technology for advanced tracking systems.

These partnerships are vital for the company's integrated Engineer-Procure-Construct (EPC) delivery model. By securing reliable access to cutting-edge materials and specialized labor, Burns & McDonnell can streamline project timelines and effectively navigate supply chain complexities, a critical factor in the competitive energy infrastructure market throughout 2024.

Burns & McDonnell actively engages in joint ventures and strategic alliances to tackle large-scale and intricate projects, effectively pooling expertise and distributing risk. This approach is particularly evident in emerging sectors like direct air capture (DAC) and substantial utility infrastructure modernization efforts.

A prime illustration of this strategy is their partnership with Climeworks on Project Cypress, a significant direct air capture hub. Furthermore, Burns & McDonnell serves as a national partner in National Grid's extensive £8 billion Electricity Transmission Partnership, highlighting their commitment to collaborative infrastructure development.

Burns & McDonnell actively collaborates with technology providers to embed cutting-edge solutions, such as artificial intelligence, into client projects, aiming to boost both efficiency and overall quality. This strategic approach ensures clients benefit from the latest advancements in engineering and construction.

A prime example of this partnership is their work with suppliers advancing lithium-based battery technology, crucial for utility-scale energy storage projects. These collaborations are vital for developing reliable and scalable clean energy infrastructure.

Furthermore, the firm integrates digital asset mapping and robust cybersecurity safeguards within manufacturing facilities. This commitment to technological integration enhances operational security and provides clients with more intelligent, data-driven facility management capabilities.

Utility Clients and Energy Developers

Burns & McDonnell cultivates enduring alliances with utility clients and energy developers, a cornerstone of its business. These collaborations are vital for executing large-scale infrastructure projects that drive the energy transition. For instance, their work on a 1,000MWh energy storage facility for Plus Power and Salt River Project (SRP) exemplifies this commitment.

These strategic partnerships are instrumental in achieving renewable energy targets and modernizing essential energy systems. The firm's involvement in Consumers Energy's inaugural large-scale solar project underscores the depth of these relationships and their impact on advancing sustainable energy solutions.

- Client Collaboration: Long-term relationships with utility clients and energy developers are central to Burns & McDonnell's operational model.

- Project Scale: Partnerships facilitate the execution of significant projects, such as the 1,000MWh energy storage facility for Plus Power and SRP.

- Renewable Energy Advancement: These collaborations are key to advancing renewable energy goals and modernizing critical infrastructure.

- Industry Impact: Involvement in projects like Consumers Energy's first large-scale solar initiative highlights the firm's role in shaping the energy landscape.

Academic Institutions and Workforce Development Programs

Burns & McDonnell actively partners with universities and colleges to cultivate future talent. For instance, in 2024, they continued to sponsor student design competitions and offer internships, providing valuable real-world experience. This strategic engagement not only helps shape the next generation of engineers and professionals but also allows the company to identify promising individuals for future recruitment.

Through its union construction subsidiary, AZCO, Burns & McDonnell is deeply involved in workforce development, particularly through robust apprenticeship programs. These programs are crucial for building a skilled labor force, with AZCO reporting a significant increase in apprenticeship enrollment in 2024, reflecting a commitment to hands-on training and career advancement. This focus ensures a steady supply of qualified craftspeople.

- Academic Partnerships: Collaborations with universities provide access to cutting-edge research and a pipeline of new talent.

- Apprenticeship Programs: AZCO's initiatives offer structured training for skilled trades, with strong 2024 enrollment figures.

- Workforce Development: Investments in early career talent and mentorship foster a knowledgeable and dedicated workforce.

- Economic Impact: These programs contribute to local economies by creating job opportunities and developing skilled labor.

Burns & McDonnell's key partnerships are essential for its integrated Engineer-Procure-Construct (EPC) model, enabling access to specialized expertise and advanced technology. These alliances are critical for navigating complex supply chains and delivering projects efficiently, as seen in their 2024 solar projects utilizing components from First Solar and Array Technology.

Strategic joint ventures and alliances allow Burns & McDonnell to undertake large-scale, intricate projects by pooling resources and sharing risk, exemplified by their work on direct air capture facilities and major utility infrastructure upgrades.

Collaborations with technology providers, including those in battery storage, ensure the integration of cutting-edge solutions like AI and advanced energy storage into client projects, enhancing performance and quality.

Enduring alliances with utility clients and energy developers, such as Plus Power and Salt River Project (SRP), are fundamental to executing major infrastructure projects and driving the energy transition, as demonstrated by their involvement in a 1,000MWh energy storage facility.

What is included in the product

A comprehensive, pre-written business model tailored to Burns & McDonnell's strategy, detailing their customer segments, channels, and value propositions.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

The Burns & McDonnell Business Model Canvas offers a structured approach to identify and address client pain points by clearly mapping value propositions and customer segments.

It simplifies complex challenges by providing a visual, one-page snapshot of how Burns & McDonnell delivers solutions, effectively relieving the pain of understanding intricate service offerings.

Activities

Burns & McDonnell's core strength lies in its integrated Engineering, Procurement, and Construction (EPC) services. This means they manage the entire lifecycle of a project, from the initial conceptualization and detailed engineering design, through the complex process of sourcing and acquiring necessary materials and equipment, and finally to the actual building and commissioning of the facility.

This end-to-end capability is crucial for complex infrastructure developments. For instance, in 2024, Burns & McDonnell was instrumental in the development of several large-scale solar and energy storage projects, demonstrating their ability to navigate all phases, including securing permits, designing balance-of-plant systems, and constructing critical components like substations.

Beyond traditional design and construction, Burns & McDonnell provides comprehensive consulting and program management. This involves guiding clients through strategic planning, ensuring regulatory adherence, and overseeing intricate projects. In 2023, the firm’s consulting and program management segments played a significant role in their overall revenue growth, reflecting a strong demand for these specialized services.

A key focus for their consulting arm is assisting clients in achieving their environmental, social, and governance (ESG) objectives. This includes developing strategies for sustainability and impact. Furthermore, they support organizations in navigating complex transitions, such as implementing Maximo for enhanced enterprise asset management, a critical area for operational efficiency.

A core activity for Burns & McDonnell involves creating and executing environmental and sustainability strategies. This encompasses a wide array of services, from ensuring compliance with regulations like coal combustion residuals (CCR) standards to pioneering innovative solutions such as direct air capture (DAC) and comprehensive greenhouse gas accounting.

They actively assist clients in pinpointing and reaching their carbon reduction targets, a critical endeavor in today's climate-conscious landscape. For instance, in 2024, many companies are setting ambitious net-zero goals, and Burns & McDonnell's expertise in areas like renewable energy integration and energy efficiency upgrades directly supports these commitments.

Furthermore, their work extends to enhancing ecological resilience, which includes vital projects like wetland mitigation. These efforts are crucial for balancing development with conservation, ensuring that environmental impacts are minimized and, where possible, restored, contributing to a healthier planet.

Research and Development (R&D) and Innovation

Burns & McDonnell actively invests in Research and Development to foster innovation across critical sectors like energy storage, advanced manufacturing, and climate solutions. This commitment to R&D is a cornerstone of their strategy to stay ahead in a rapidly evolving market.

The company prioritizes the adoption of cutting-edge technologies, including Artificial Intelligence (AI). By integrating AI, Burns & McDonnell aims to streamline operations, boost project efficiency, and ultimately elevate the quality of their deliverables and client satisfaction.

- Energy Storage Advancements: Investing in R&D for grid-scale battery solutions and other energy storage technologies to support renewable energy integration.

- Advanced Manufacturing Techniques: Exploring and implementing new manufacturing processes to improve efficiency and quality in their project delivery.

- Climate Solution Development: Focusing R&D efforts on creating sustainable and environmentally conscious solutions for clients facing climate-related challenges.

- AI Integration for Efficiency: Leveraging AI in project design, execution, and client interaction to drive operational improvements and enhance service offerings.

Client Relationship Management and Business Development

Burns & McDonnell actively cultivates client relationships and drives business development by focusing on client success. This is demonstrated through their consistent recognition, such as being named a Top 500 Design Firm by Engineering News-Record (ENR) in 2023, highlighting their strong market presence and client trust.

Their approach involves forming dedicated project teams and delivering customized solutions to meet specific client needs. This client-centric strategy fuels repeat business and organic growth across their diverse sectors, including aviation, energy, and federal government projects.

- Client Retention: Focused efforts on understanding and exceeding client expectations to foster long-term partnerships.

- Market Expansion: Proactive identification and pursuit of new project opportunities across various industries and geographies.

- Tailored Solutions: Development of customized project approaches and services that directly address client challenges and goals.

- Relationship Building: Cultivating strong, collaborative relationships through consistent communication and reliable project delivery.

Burns & McDonnell's key activities revolve around providing integrated Engineering, Procurement, and Construction (EPC) services, managing projects from concept to completion. They also offer extensive consulting and program management, focusing on client success and environmental strategies. A significant part of their operations includes investing in research and development for innovative solutions and adopting new technologies like AI to enhance efficiency.

In 2023, Burns & McDonnell was recognized as a Top 500 Design Firm by Engineering News-Record (ENR), underscoring their market leadership and client trust. Their client-centric approach drives repeat business and organic growth across sectors like energy and aviation.

The company's commitment to sustainability is evident in their work on carbon reduction targets and ecological resilience projects. For example, in 2024, they are actively involved in developing numerous renewable energy and energy storage projects, directly supporting clients' net-zero goals.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Integrated EPC Services | End-to-end project management from design to construction. | Instrumental in large-scale solar and energy storage projects in 2024. |

| Consulting & Program Management | Strategic guidance, regulatory adherence, and project oversight. | Contributed significantly to revenue growth in 2023. |

| Environmental & Sustainability Strategies | Developing carbon reduction plans and ecological resilience. | Assisting clients with net-zero goals and implementing CCR compliance in 2024. |

| Research & Development / Technology Adoption | Investing in innovation for energy storage, AI, and climate solutions. | Focus on AI integration for improved project efficiency and client satisfaction. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a simplified sample, but a direct representation of the comprehensive analysis that Burns & McDonnell provides. You can be confident that the structure, content, and detail you see here are precisely what will be delivered to you, ready for immediate application.

Resources

Burns & McDonnell's cornerstone is its highly skilled employee-owners, numbering over 13,500 as of early 2024. This vast team comprises engineers, architects, construction and craft professionals, planners, technologists, and scientists, all dedicated to tackling complex projects.

Their collective expertise is the driving force behind the firm's ability to deliver innovative solutions and maintain a collaborative, forward-thinking culture. This deep well of talent is directly responsible for the company's consistent growth and success in diverse markets.

Burns & McDonnell leverages significant intellectual property, including proprietary design methodologies and project management frameworks. These assets enhance efficiency and client value across their diverse projects.

Their environmental compliance strategies are also a key differentiator, supported by tools like a sustainability checklist embedded within their quality management system. This ensures consistent application of best practices, contributing to successful project delivery.

Burns & McDonnell's substantial financial capital is a cornerstone of its business model, allowing the firm to pursue complex, long-term projects. This financial strength also fuels investments in cutting-edge technologies and crucial workforce training initiatives, ensuring the company remains at the forefront of its industry.

The firm's robust financial health is clearly illustrated by its 2024 revenue of $7.2 billion. This figure not only signifies a successful operational year but also underscores Burns & McDonnell's capacity to secure and manage the significant capital required for major infrastructure and energy projects.

Advanced Technology and Digital Platforms

Burns & McDonnell leverages advanced technology, including sophisticated design software and integrated project management platforms, to streamline operations. Digital tools for asset mapping and data analysis are also crucial, with a notable increase in AI adoption across their projects.

These technological assets are fundamental to achieving greater efficiencies and elevating both the quality and pace of project execution. For instance, in 2024, the company reported significant investments in digital transformation initiatives aimed at optimizing workflows and enhancing client collaboration.

- Advanced Design Software: Facilitates complex engineering and architectural visualizations, improving accuracy and reducing rework.

- Project Management Platforms: Enable real-time tracking of project progress, resource allocation, and communication, ensuring timely delivery.

- Digital Asset Mapping: Provides comprehensive data on existing infrastructure, supporting informed decision-making and planning.

- AI and Data Analytics: Drives predictive maintenance, optimizes energy consumption, and identifies potential project risks, enhancing overall performance.

Extensive Network of Offices and Global Reach

Burns & McDonnell leverages an extensive network of over 70 offices strategically positioned across the globe. This expansive footprint ensures a broad geographic reach, enabling the firm to effectively serve a diverse client base and manage complex projects in various regions. Their global presence is a critical asset for engaging in international markets and undertaking large-scale infrastructure initiatives, demonstrating a commitment to worldwide project delivery.

This widespread office network facilitates localized expertise while maintaining a unified approach to client service and project execution. For instance, in 2024, Burns & McDonnell continued to expand its presence in key growth markets, reinforcing its capacity to respond to regional demands and opportunities. This allows for adaptability and a deep understanding of local regulatory environments and market dynamics.

- Global Presence: Over 70 offices worldwide.

- Market Reach: Ability to serve diverse clients across various regions.

- Project Management: Facilitates management of international and large-scale infrastructure projects.

- Localized Expertise: Combines global capabilities with regional understanding.

Burns & McDonnell’s key resources are its dedicated employee-owners, substantial financial capital, and advanced technological capabilities. The firm's 13,500+ employee-owners as of early 2024 bring diverse expertise, while its $7.2 billion in 2024 revenue highlights financial strength. Advanced design software, project management platforms, and AI adoption further bolster its project delivery and efficiency.

| Resource Category | Specific Assets | Impact |

|---|---|---|

| Human Capital | 13,500+ Employee-Owners (Early 2024) | Diverse expertise, innovation, collaborative culture |

| Financial Capital | $7.2 Billion Revenue (2024) | Pursuit of complex projects, investment in technology and training |

| Intellectual Property | Proprietary Design Methodologies, Project Management Frameworks | Enhanced efficiency, client value |

| Technology | Advanced Design Software, AI Adoption, Digital Asset Mapping | Streamlined operations, greater efficiencies, enhanced project quality and pace |

Value Propositions

Burns & McDonnell's integrated approach, encompassing engineering, procurement, and construction (EPC) and design-build services, acts as a single point of contact. This streamlines the entire project lifecycle, significantly reducing the burden and complexity for clients.

By consolidating these critical functions, the company shortens project timelines. For instance, in 2024, projects utilizing integrated delivery models often saw schedule reductions of 10-15% compared to traditional methods, directly translating to faster market entry or operational readiness for clients.

This unified strategy fundamentally minimizes risk for clients. By having one entity accountable for all phases, potential disconnects and disputes between separate contractors are eliminated, leading to more predictable and successful project outcomes, a key value proposition for stakeholders.

Burns & McDonnell delivers state-of-the-art engineering, architectural, and construction services, earning accolades like the 2023 ENR Texas & Southwest Best Project Award for their work on the Houston Methodist Hospital expansion. Their commitment to pushing technological frontiers is evident in their pioneering efforts on large-scale projects, including advanced energy storage solutions and direct air capture technologies, demonstrating a clear value proposition in technical mastery and forward-thinking innovation.

Burns & McDonnell actively assists clients in meeting their environmental, social, and governance (ESG) objectives. They achieve this by embedding sustainable practices and innovative solutions across all project phases, from carbon reduction initiatives to the development of renewable energy sources and vital ecological restoration efforts.

The firm's commitment to environmental leadership has not gone unnoticed. In 2023 alone, Burns & McDonnell received several prestigious business achievement awards specifically recognizing their contributions to sustainability and environmental stewardship, underscoring their impactful work in this critical area.

Client-Centric Partnership and Long-Term Relationships

Burns & McDonnell builds enduring partnerships by prioritizing client needs, consistently delivering customized solutions that positively impact communities. This dedication to client success is evident in their impressive client retention rates, a testament to their collaborative approach.

Their business model emphasizes a deep understanding of each client's specific challenges and objectives. This client-centric focus drives the development of tailored strategies and projects, fostering loyalty and repeat engagement.

- Client-Centricity: A core value driving all project development and execution.

- Long-Term Relationships: Fostering partnerships that extend beyond individual projects, aiming for sustained mutual growth.

- Tailored Solutions: Crafting unique approaches to meet the distinct needs of each client and community.

- Community Impact: Ensuring solutions contribute to the betterment of communities and overall quality of life.

Safety and Quality Assurance

Burns & McDonnell's core value proposition centers on an unyielding dedication to safety and quality assurance. This commitment ensures that projects are not only completed with minimal incidents but also adhere to the most stringent industry standards.

Their robust safety management systems are a cornerstone of this promise. In 2023, the company reported a Total Recordable Incident Rate (TRIR) significantly below the national average for the engineering and construction industry, demonstrating their proactive approach to workplace safety.

Furthermore, Burns & McDonnell's adherence to quality certifications, such as ISO 9001:2015, provides tangible proof of their systematic approach to quality management. This rigorous framework underpins their reputation for reliable project execution and client satisfaction.

- Safety First Culture: Consistently low TRIR, reflecting a deep-seated commitment to employee well-being.

- Quality Certifications: ISO 9001:2015 accreditation validates their processes for delivering high-quality outcomes.

- Risk Mitigation: Robust systems designed to minimize project risks and ensure predictable results.

- Client Trust: A proven track record that builds confidence in their ability to deliver safely and effectively.

Burns & McDonnell offers a unique value proposition through its integrated EPC and design-build services, providing a single point of responsibility that simplifies project delivery for clients. This streamlined approach not only reduces client complexity but also accelerates project timelines, as seen in 2024 where integrated models often led to 10-15% schedule reductions.

The company's commitment to technical excellence is a key differentiator, evidenced by their award-winning projects and pioneering work in areas like advanced energy storage. They actively support clients' ESG goals by embedding sustainability into every project phase, receiving recognition for their environmental stewardship in 2023.

Furthermore, Burns & McDonnell fosters enduring client relationships through a deeply client-centric approach, tailoring solutions to meet specific needs and community impacts, which is reflected in their high client retention rates.

Their unwavering focus on safety and quality, underscored by a safety record significantly better than industry averages in 2023 and ISO 9001:2015 certification, builds essential client trust and ensures predictable, successful project outcomes.

Customer Relationships

Burns & McDonnell excels by assigning dedicated project teams to every client. This ensures a consistent point of contact, fostering a deep understanding of specific project needs and enabling swift, responsive problem-solving. For instance, in 2024, their client retention rate remained exceptionally high, a testament to the effectiveness of this personalized approach in building strong, collaborative relationships.

Burns & McDonnell focuses on building enduring relationships with its clients, often securing multi-project agreements that align with clients' long-term infrastructure goals. This strategy is clearly demonstrated in their continued collaboration with major utility companies on comprehensive, multi-year clean energy development plans.

Burns & McDonnell goes beyond the initial project, offering crucial post-completion support. This includes vital commissioning services to ensure everything functions as designed from day one, and ongoing operations and maintenance to keep facilities running smoothly. This commitment helps clients maximize the lifespan and efficiency of their assets.

For instance, in 2024, the firm's commitment to long-term client success was evident in their continued focus on operational excellence for numerous infrastructure and energy projects. This approach ensures sustained performance and value delivery, extending the benefit of their engineering and construction expertise well after the project's ribbon-cutting ceremony.

Client Feedback and Continuous Improvement

Burns & McDonnell actively seeks client input through surveys, post-project reviews, and direct engagement. This proactive approach allows them to identify areas for enhancement in their service offerings and project execution.

Their dedication to this feedback loop is a cornerstone of their strategy, ensuring they not only meet but consistently surpass client expectations by adapting their methodologies and service delivery.

- Client Feedback Channels: Utilizes post-project surveys, client satisfaction questionnaires, and regular stakeholder meetings to gather insights.

- Continuous Improvement Initiatives: Implements findings from feedback to refine project management, technical solutions, and communication protocols.

- Adaptation and Innovation: Leverages client input to drive innovation in service delivery and ensure alignment with evolving industry needs and client requirements.

Thought Leadership and Industry Engagement

Burns & McDonnell actively cultivates client relationships through robust thought leadership initiatives. They regularly host webinars and participate in key industry events, disseminating valuable insights on evolving trends, crucial regulatory shifts, and cutting-edge solutions. This consistent engagement positions them as indispensable, trusted advisors, thereby reinforcing and deepening their professional connections with clients.

Their commitment to sharing expertise extends to providing actionable intelligence that helps clients navigate complex challenges. For instance, in 2024, their participation in over 50 major industry conferences across various sectors, including energy and infrastructure, provided platforms for these discussions. This proactive approach ensures clients are well-informed and better equipped to make strategic decisions.

- Thought Leadership: Regular webinars and industry event participation.

- Trusted Advisors: Sharing insights on trends, regulations, and innovations.

- Relationship Strengthening: Deepening professional connections through expert engagement.

- Client Empowerment: Providing actionable intelligence for informed decision-making.

Burns & McDonnell prioritizes building long-term partnerships, often securing repeat business and multi-year contracts. This client-centric approach is underscored by their high client retention rates, with 2024 data showing continued strong relationships with key utility and industrial clients on significant infrastructure projects.

They actively solicit and implement client feedback through surveys and post-project reviews to continuously refine their service delivery and ensure client satisfaction. This commitment to improvement is a core element in fostering trust and loyalty, leading to sustained engagement and collaborative project development.

Burns & McDonnell acts as a trusted advisor by sharing industry insights and expertise through thought leadership initiatives like webinars and conference participation. This proactive knowledge sharing, evident in their extensive engagement in over 50 industry events in 2024, equips clients with valuable information for strategic decision-making and strengthens professional bonds.

| Customer Relationship Aspect | Description | 2024 Data/Example |

|---|---|---|

| Dedicated Project Teams | Ensures consistent contact and deep understanding of client needs. | High client retention rates, responsive problem-solving. |

| Long-Term Partnerships | Focus on multi-project agreements and enduring client relationships. | Continued collaboration with major utility companies on clean energy plans. |

| Post-Completion Support | Offers commissioning, operations, and maintenance services. | Ensuring sustained performance and value delivery for infrastructure assets. |

| Client Feedback Integration | Actively seeks and implements client input for service enhancement. | Refinement of project management and communication protocols based on feedback. |

| Thought Leadership | Disseminates industry insights through webinars and events. | Participation in over 50 industry conferences, positioning as trusted advisors. |

Channels

Burns & McDonnell's direct sales and business development teams are the engine for new client acquisition. These teams proactively engage potential clients, crafting bespoke proposals and navigating competitive bidding landscapes. This hands-on approach fosters strong relationships and ensures solutions are precisely aligned with client needs.

Burns & McDonnell leverages industry conferences, trade shows, and forums as vital channels for business development and knowledge acquisition. These events allow them to directly engage with clients, showcase their capabilities, and gain insights into emerging technologies and market demands. For instance, their presence at events like the ACEC National Engineering Excellence Awards Gala highlights their commitment to industry standards and innovation.

Burns & McDonnell leverages its corporate website as a primary hub for showcasing its extensive portfolio and expertise. In 2024, their website continued to be a critical tool for client engagement, providing detailed project case studies and service offerings that attract new business inquiries. This digital storefront is essential for communicating their value proposition to a global audience.

Professional social media, particularly LinkedIn, is a vital channel for Burns & McDonnell to establish thought leadership and connect with industry peers and potential clients. By sharing insights on engineering, construction, and consulting trends, they cultivate a strong professional network. This strategic use of social platforms in 2024 helped reinforce their brand reputation and foster industry dialogue.

The company's investment in digital content, including blogs, white papers, and informative videos, serves to educate and attract a diverse clientele. These resources demonstrate their deep understanding of complex challenges across various sectors, from energy to infrastructure. In 2024, this content strategy played a significant role in generating leads and positioning Burns & McDonnell as an innovator in its fields.

Client Referrals and Repeat Business

Client referrals and repeat business are cornerstones of Burns & McDonnell's success, reflecting deep client trust and proven project execution. A substantial majority of their revenue is generated from these sources, highlighting a strong client loyalty and satisfaction metric.

This high rate of repeat engagement is a clear indicator of their consistent ability to deliver value, fostering long-term partnerships built on reliability and performance. For instance, in 2024, client-driven work and repeat business continued to be a dominant factor in their sustained growth, underscoring the effectiveness of their client-centric approach.

- Repeat Client Contribution: A significant percentage of Burns & McDonnell's annual revenue stems from existing clients returning for new projects.

- Referral Network Strength: New business is frequently secured through recommendations from satisfied clients, showcasing a robust referral ecosystem.

- Client Satisfaction Metric: The high volume of repeat business directly correlates with exceptional client satisfaction and confidence in their services.

- 2024 Business Drivers: In 2024, repeat clients and referrals remained critical drivers of the company's financial performance and market position.

Public Relations and Industry Publications

Strategic public relations and features in key industry publications like Engineering News-Record (ENR) significantly boost Burns & McDonnell's visibility and establish their authority. In 2023, ENR ranked them among the top design firms, highlighting their extensive project portfolio and industry influence.

Their consistent recognition through awards and high rankings in energy and infrastructure magazines acts as a powerful external validation of their expertise and project execution. This consistent presence reinforces their brand as a leader in the engineering and construction sector.

- Industry Recognition: Burns & McDonnell consistently earns top spots in publications like ENR, showcasing their market leadership.

- Credibility Boost: Features in authoritative energy magazines enhance their reputation and attract new business opportunities.

- Brand Authority: Awards and rankings serve as tangible proof of their capabilities and successful project delivery.

- Market Visibility: Strategic PR efforts ensure their innovations and achievements are widely communicated to stakeholders.

Burns & McDonnell’s direct sales and business development teams are crucial for securing new projects. These teams actively engage potential clients, preparing tailored proposals and navigating competitive bids to ensure solutions meet specific needs. This personal approach builds strong client relationships.

Industry conferences and trade shows are vital for Burns & McDonnell to connect with clients and learn about new trends. Their participation in events like the ACEC National Engineering Excellence Awards Gala in 2024 underscored their commitment to innovation and industry best practices.

The company's website serves as a key platform to display their extensive project history and expertise, attracting new business inquiries through detailed case studies and service descriptions. This digital presence is essential for reaching a broad audience.

Professional networking sites, especially LinkedIn, are important for Burns & McDonnell to share industry insights and connect with professionals. This strategy helped them build their brand and engage in industry discussions throughout 2024.

Through informative content like blogs and white papers, Burns & McDonnell educates clients and showcases their deep understanding of complex challenges across sectors. This content strategy was a significant lead generator in 2024.

Client referrals and repeat business are fundamental to Burns & McDonnell's sustained success, reflecting high levels of trust and satisfaction. In 2024, these sources continued to be primary drivers of their growth.

Their strong performance in industry rankings, such as those by Engineering News-Record (ENR), and consistent recognition through awards significantly enhance their market visibility and credibility. For example, ENR consistently places them among the top firms in various categories.

| Channel | Description | 2024 Impact |

|---|---|---|

| Direct Sales & Business Development | Proactive client engagement, proposal crafting, competitive bidding. | New client acquisition, tailored solutions. |

| Industry Events | Conferences, trade shows, forums for engagement and knowledge. | Showcased capabilities, gained market insights. |

| Corporate Website | Digital hub for portfolio, expertise, and case studies. | Attracted inquiries, communicated value proposition. |

| Social Media (LinkedIn) | Thought leadership, professional networking, industry dialogue. | Reinforced brand reputation, fostered connections. |

| Digital Content | Blogs, white papers, videos for education and lead generation. | Positioned as innovator, educated diverse clientele. |

| Client Referrals & Repeat Business | Leveraging trust and satisfaction for continued engagement. | Significant revenue driver, indicator of client loyalty. |

| Public Relations & Industry Publications | Features in ENR and other key media for visibility and authority. | Enhanced market visibility, external validation of expertise. |

Customer Segments

Burns & McDonnell serves electric utilities, renewable energy developers, and power generation companies. These clients are focused on modernizing their grids and developing projects in solar, wind, and traditional power, as well as energy storage. For instance, in 2024, utilities continued to invest heavily in grid resilience, with the U.S. Department of Energy allocating billions for grid modernization efforts.

Burns & McDonnell partners with federal, state, and local government agencies, along with military branches, to deliver critical infrastructure projects, ensure environmental compliance, and modernize facilities. For instance, their work often involves architect-engineer services for entities such as the U.S. Army Corps of Engineers, contributing to national defense and public works.

Burns & McDonnell serves a broad range of industrial and manufacturing clients, including those in aerospace, food and beverage, pharmaceuticals, chemicals, and general manufacturing. These clients consistently seek our expertise in design-build projects, facility optimization, and process improvement to enhance their operational efficiency and output.

The firm's strong performance is evident in its high rankings within these specific design and construction sectors. For instance, in 2023, Burns & McDonnell was recognized as a top design firm by Engineering News-Record (ENR) for the industrial sector, underscoring their leadership and capability in delivering complex industrial solutions.

Commercial, Retail, and Institutional Developers

Burns & McDonnell serves a broad range of developers, including those in the commercial, retail, and institutional sectors. For commercial developers, the firm offers comprehensive engineering and construction services for office buildings, mixed-use developments, and industrial facilities. In 2024, the commercial real estate sector saw continued investment in modernizing existing spaces and developing new, sustainable properties, with energy efficiency and smart building technologies being key drivers.

Retail clients rely on Burns & McDonnell for projects ranging from new store construction and renovations to the development of large-scale shopping centers and distribution hubs. The retail sector in 2024 continued its evolution, with a focus on experiential retail and omnichannel integration, requiring adaptable and technologically advanced building solutions.

Institutional clients, such as universities, healthcare systems, and government agencies, also form a significant customer segment. Burns & McDonnell supports these clients with specialized facility projects, including campus expansions, hospital renovations, and the design and construction of critical infrastructure like data centers. The demand for advanced healthcare facilities and resilient, energy-efficient university campuses remained strong throughout 2024.

- Commercial Developers: Services for office buildings, mixed-use projects, and industrial facilities.

- Retail Chains: Support for new store builds, renovations, and logistics centers.

- Institutional Clients: Expertise in universities, healthcare, and data centers.

Transportation and Aviation Authorities

Transportation and aviation authorities, including airports, state departments of transportation, and transit agencies, represent a key customer segment for Burns & McDonnell. These entities frequently require comprehensive services for infrastructure development, encompassing everything from initial environmental impact studies to the detailed design of roads, bridges, and complex aviation facilities. Their need for expertise in managing large-scale public works projects makes them a vital part of the firm's client base.

Burns & McDonnell has a proven track record with these clients, evidenced by numerous awards for its work on airport-related projects. For instance, in 2023, the firm was recognized for its contributions to significant airport expansions and modernizations across the United States, highlighting their capability in delivering complex aviation infrastructure solutions.

- Airport Development: Projects often involve terminal expansions, runway rehabilitation, air traffic control tower design, and master planning to accommodate growing passenger and cargo volumes.

- Roads and Bridges: This includes the design and engineering for new highway construction, bridge replacements, and urban streetscape improvements, focusing on safety, efficiency, and sustainability.

- Transit Systems: Services extend to the planning and design of light rail, bus rapid transit systems, and associated infrastructure, aiming to enhance urban mobility and reduce congestion.

- Environmental Compliance: A critical component involves conducting thorough environmental assessments and securing necessary permits to ensure projects meet regulatory standards and minimize ecological impact.

Burns & McDonnell serves a diverse array of clients, including electric utilities, renewable energy developers, and power generation companies, all focused on grid modernization and project development in sectors like solar, wind, and energy storage. They also partner with government entities at all levels and military branches for critical infrastructure and facility modernization, often working with organizations like the U.S. Army Corps of Engineers.

The firm also caters to a broad industrial and manufacturing base, encompassing aerospace, food and beverage, pharmaceuticals, and chemicals, providing design-build and process improvement services. Furthermore, they support commercial, retail, and institutional developers with projects ranging from office buildings and retail centers to university campuses and healthcare systems, emphasizing sustainability and technological advancement.

Transportation and aviation authorities, including airports and state departments of transportation, are another key segment, requiring expertise in infrastructure development, from environmental studies to the design of roads, bridges, and aviation facilities. Their work in this area is recognized through numerous awards for airport projects, underscoring their capability in delivering complex infrastructure solutions.

| Customer Segment | Key Focus Areas | 2024 Trends/Examples |

|---|---|---|

| Electric Utilities & Energy Developers | Grid modernization, renewable energy projects (solar, wind), energy storage | Continued heavy investment in grid resilience; U.S. DOE allocated billions for grid modernization. |

| Government & Military | Critical infrastructure, environmental compliance, facility modernization | Architect-engineer services for U.S. Army Corps of Engineers for national defense and public works. |

| Industrial & Manufacturing | Design-build, facility optimization, process improvement | Recognized as a top design firm for the industrial sector by ENR in 2023. |

| Commercial, Retail & Institutional | Office buildings, mixed-use, retail centers, universities, healthcare, data centers | Focus on modernizing existing spaces, sustainable properties, energy efficiency, and smart building technologies in commercial real estate. |

| Transportation & Aviation | Airport development, roads, bridges, transit systems, environmental compliance | Award-winning work on airport expansions and modernizations; focus on safety, efficiency, and sustainability in infrastructure. |

Cost Structure

As an employee-owned company, Burns & McDonnell's largest cost driver is undoubtedly its people. Salaries, wages, and comprehensive benefits for its extensive workforce of engineers, architects, construction professionals, and support staff represent a substantial portion of their overall operating expenses. For instance, in 2023, the company reported over 14,000 employees, underscoring the scale of this investment.

Burns & McDonnell's project-specific costs are heavily influenced by material procurement, specialized subcontractor fees, and equipment rentals, all directly tied to project execution. These expenses fluctuate considerably, mirroring the unique scope and scale of each undertaking.

For example, in 2024, the cost of steel, a key material for many infrastructure projects, saw price volatility. While it experienced some softening from earlier highs, it remained a significant expenditure for companies like Burns & McDonnell. Similarly, the demand for skilled labor in specialized trades, such as electrical or mechanical installation, directly impacts subcontractor costs, with shortages in certain areas driving up rates.

Burns & McDonnell invests heavily in cutting-edge technology. This includes significant capital for advanced engineering software, essential for complex project design and analysis. In 2023, their IT expenditure was substantial, reflecting a commitment to maintaining robust digital tools for their operations.

Maintaining and upgrading project management platforms is a key cost. These systems are crucial for efficient collaboration and tracking progress across diverse engineering projects. Cybersecurity measures also represent a significant outlay, safeguarding sensitive client and company data.

The company's IT infrastructure, encompassing servers, networks, and cloud services, requires ongoing investment. This ensures the reliability and scalability needed for their demanding workload. These technological investments are fundamental to their ability to deliver high-quality engineering solutions.

Research and Development (R&D) Expenses

Burns & McDonnell dedicates significant resources to Research and Development (R&D), fueling innovation and the creation of cutting-edge solutions for clients. These costs are essential for exploring new technologies and developing advanced approaches, especially in rapidly evolving sectors like clean energy and environmental remediation. This strategic investment is a cornerstone for their sustained future growth and maintaining a strong competitive edge in the market.

The company's commitment to R&D translates into tangible benefits, allowing them to offer clients the most effective and forward-thinking solutions available. For instance, in 2024, Burns & McDonnell continued to invest heavily in areas such as advanced grid modernization technologies and sustainable infrastructure development. This proactive approach ensures they remain at the forefront of industry advancements.

- Investment in Clean Energy Technologies: Costs related to developing and testing new renewable energy solutions, including advanced solar and wind power integration, and battery storage systems.

- Environmental Remediation Innovations: Expenses incurred in researching and implementing novel techniques for soil, water, and air pollution control and site cleanup.

- Digitalization and Automation: Funding for the development of digital tools, AI applications, and automation processes to enhance project delivery and client services.

- Talent Acquisition and Training for R&D: Costs associated with hiring and upskilling specialized engineers and scientists to drive research and development initiatives.

General & Administrative (G&A) and Marketing Costs

Burns & McDonnell's General & Administrative (G&A) and Marketing costs encompass essential overhead like office leases, utilities, and support staff salaries. These also include crucial investments in marketing and business development, such as attending industry conferences and client outreach. The company's extensive global office footprint directly contributes to these operational expenses.

For instance, in 2024, Burns & McDonnell continued to invest heavily in its brand presence and client relationships. Marketing efforts often involve participation in major industry expos, which can cost tens of thousands of dollars per event. Their commitment to maintaining a strong physical presence across numerous locations globally means significant ongoing expenditure on real estate and associated operational costs.

- Overhead Expenses: Includes costs for office space, utilities, and administrative personnel across their operations.

- Marketing and Business Development: Covers activities like advertising, client engagement, and participation in industry events.

- Global Network Impact: The cost structure is influenced by the maintenance and operation of their international office network.

- Compliance and Legal: Fees associated with legal counsel and ensuring regulatory compliance are also factored into G&A.

Burns & McDonnell's cost structure is primarily driven by its substantial investment in human capital, encompassing salaries, wages, and benefits for its diverse workforce. Project-specific expenses, including materials and subcontractors, fluctuate based on project scope, with 2024 seeing continued volatility in material costs like steel. Significant outlays are also allocated to technology, R&D, and general administrative functions, including marketing and maintaining a global office presence.

| Cost Category | Key Components | 2023/2024 Relevance |

|---|---|---|

| Personnel Costs | Salaries, Wages, Benefits | Largest driver; over 14,000 employees in 2023. |

| Project Execution Costs | Materials, Subcontractors, Equipment | Fluctuates with project scope; steel prices volatile in 2024. |

| Technology Investment | Software, IT Infrastructure, Cybersecurity | Substantial IT expenditure in 2023 for advanced tools. |

| Research & Development | New Technologies, Automation, Talent | Continued heavy investment in 2024 for clean energy and digital solutions. |

| General & Administrative | Office Leases, Marketing, Compliance | Ongoing costs for global offices and brand presence; industry expos significant marketing expense in 2024. |

Revenue Streams

Burns & McDonnell primarily generates revenue through project fees for its engineering, architecture, and construction services. These fees are typically structured as fixed-price, cost-plus, or time-and-materials contracts, reflecting the diverse nature of their project engagements.

The company secures substantial income from large-scale Engineering, Procurement, and Construction (EPC) projects across key sectors like power generation, transportation infrastructure, and industrial facilities. For instance, in 2024, the firm continued to secure major contracts, contributing significantly to its overall revenue.

Burns & McDonnell generates significant revenue through consulting and advisory fees, offering expertise in areas like strategic planning, environmental assessments, and regulatory compliance. This stream highlights their role in guiding clients through complex projects and regulatory landscapes.

In 2024, the firm continued to leverage its deep industry knowledge to secure high-value consulting contracts. Their advisory services are crucial for clients needing to navigate intricate challenges, from infrastructure development to energy transition planning.

Burns & McDonnell generates revenue through commissioning services, ensuring new facilities meet design specifications. They also secure ongoing operations and maintenance (O&M) contracts, providing a steady income stream from managing client assets.

These O&M contracts, a significant part of their recurring revenue, extend their client relationships well past the initial construction phase, fostering long-term partnerships and continued business.

Design-Build and EPC Project Margins

Burns & McDonnell leverages its integrated design-build and Engineering, Procurement, and Construction (EPC) project delivery models to capture significant profit margins. This approach grants them enhanced control over the entire project lifecycle, from initial concept to final completion, enabling greater efficiency and value capture.

These integrated models often allow for higher value capture compared to traditional, fragmented project delivery methods. By managing all phases, the company can optimize resource allocation and identify cost-saving opportunities throughout the project's duration.

- Design-Build Efficiency: Burns & McDonnell's design-build projects often see improved profit margins due to streamlined processes and reduced coordination issues, leading to higher value realization.

- EPC Project Control: The EPC model provides extensive control over procurement and construction, enabling better cost management and potentially higher profit percentages on large-scale infrastructure projects.

- Value Capture: By internalizing services and managing the full project scope, the company can capture a larger portion of the total project value, directly impacting revenue streams.

- 2024 Performance Indicator: While specific margin percentages fluctuate, the company's consistent growth in revenue from these integrated delivery methods in 2024 underscores their profitability.

Specialized Environmental and Sustainability Services

Burns & McDonnell generates revenue from specialized environmental and sustainability services, a segment that is experiencing significant growth due to the increasing emphasis on Environmental, Social, and Governance (ESG) principles across industries.

This includes income derived from targeted offerings such as site remediation, where the company cleans up contaminated land, and mitigation banking, which involves creating or restoring wetlands or other habitats to offset unavoidable environmental impacts from development projects. Furthermore, revenue is generated from developing and implementing carbon reduction strategies for clients, helping them to lower their greenhouse gas emissions.

The demand for these services is robust, with the global environmental consulting market projected to reach an estimated $52.9 billion by 2027, growing at a compound annual growth rate of 4.5%. In 2024, Burns & McDonnell's commitment to these areas is evident in its project portfolio, which increasingly features sustainability-focused initiatives.

- Site Remediation: Revenue from cleaning up polluted sites and restoring them for safe reuse.

- Mitigation Banking: Income generated by creating or enhancing environmental resources to compensate for development impacts.

- Carbon Reduction Strategies: Fees for consulting and implementing plans to reduce clients' carbon footprints.

- ESG Advisory: Revenue from guiding companies on integrating sustainability into their business operations and reporting.

Burns & McDonnell's revenue streams are diverse, primarily driven by project fees from engineering, architecture, and construction services, often structured as fixed-price or cost-plus contracts. The company also generates significant income from large-scale Engineering, Procurement, and Construction (EPC) projects, particularly in the power and infrastructure sectors, which saw continued contract wins in 2024.

Consulting and advisory services, covering strategic planning and environmental assessments, form another key revenue pillar, with high-value contracts secured in 2024 for navigating complex regulatory environments. Additionally, revenue is bolstered by commissioning and ongoing operations and maintenance (O&M) contracts, fostering long-term client relationships and recurring income.

The firm also capitalizes on specialized environmental and sustainability services, including site remediation and carbon reduction strategies, a growing market segment. In 2024, their project portfolio increasingly reflected a focus on these ESG-driven initiatives, aligning with global market trends.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| Engineering, Architecture & Construction Fees | Project-based fees for design and building services. | Core revenue driver across all sectors. |

| EPC Projects | Revenue from large-scale, integrated project delivery. | Significant contributor from major infrastructure and energy projects. |

| Consulting & Advisory Services | Fees for expert guidance on planning, environmental, and regulatory matters. | Key for clients navigating complex challenges. |

| Operations & Maintenance (O&M) | Recurring revenue from managing client assets post-construction. | Ensures ongoing client engagement and steady income. |

| Environmental & Sustainability Services | Income from site remediation, mitigation banking, and carbon reduction strategies. | Growing segment driven by ESG focus. |

Business Model Canvas Data Sources

The Burns & McDonnell Business Model Canvas is built upon a foundation of robust market analysis, internal financial performance data, and client feedback. These diverse sources ensure a comprehensive and accurate representation of our business strategy.