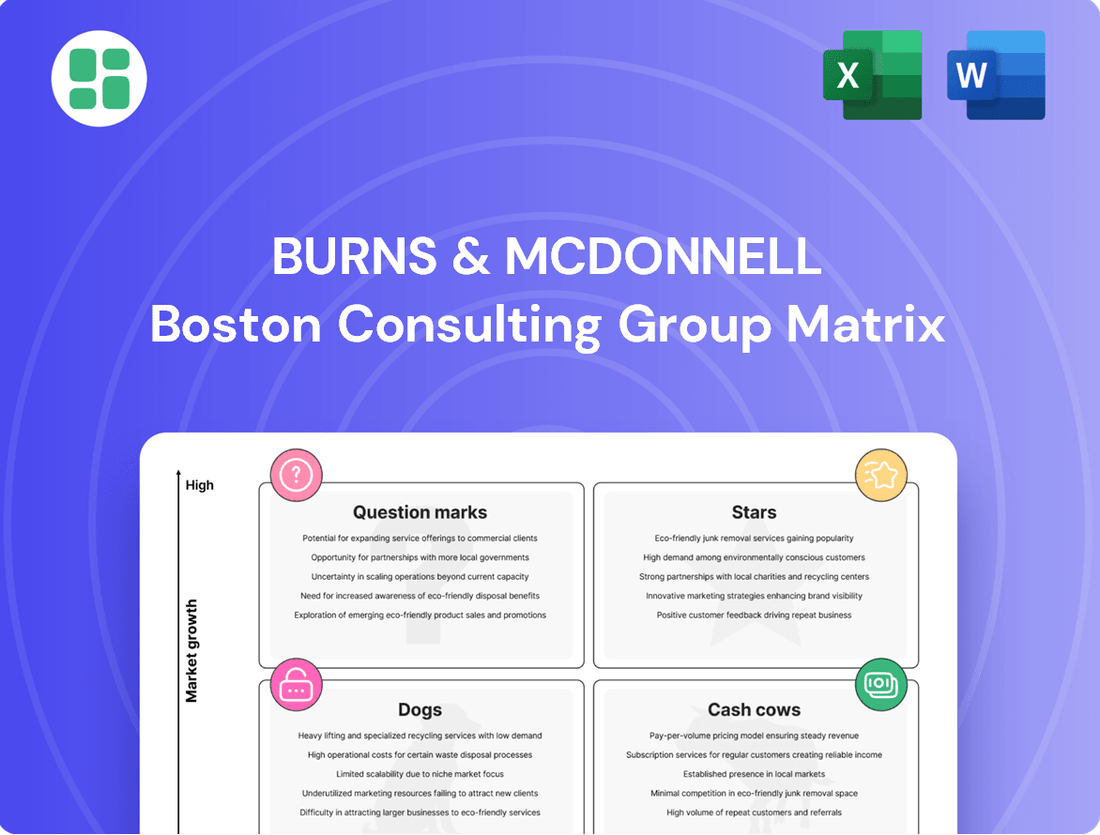

Burns & McDonnell Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burns & McDonnell Bundle

Uncover the strategic positioning of Burns & McDonnell's diverse portfolio with our insightful BCG Matrix preview. See how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, providing a foundational understanding of their market performance.

This glimpse is designed to spark your strategic thinking. Purchase the full BCG Matrix report to unlock detailed quadrant analysis, expert commentary, and actionable recommendations tailored to Burns & McDonnell's unique market landscape. Gain the clarity needed to optimize your investments and drive future growth.

Stars

Burns & McDonnell is a powerhouse in the utility-scale renewable energy EPC market, particularly in solar and battery energy storage systems (BESS). Their significant market share in these high-growth areas, evidenced by their involvement in numerous large-scale solar projects and multi-gigawatt-hour BESS installations, firmly places these services in the Stars category.

The data center market is booming, fueled by the insatiable appetite for digital services and the transformative power of artificial intelligence. Burns & McDonnell stands out as a leader in this dynamic space, consistently earning top rankings for their data center design and engineering expertise.

Their extensive portfolio includes the successful execution of massive, intricate data center projects for leading global corporations, underscoring their substantial market presence within this rapidly growing industry. For instance, in 2024, the global data center market size was valued at approximately $276.1 billion and is projected to reach $620.5 billion by 2029, growing at a CAGR of 17.5% during the forecast period.

Grid modernization and advanced transmission are experiencing robust growth, driven by the imperative for enhanced reliability, resilience, and the seamless integration of varied energy sources. Burns & McDonnell is actively capitalizing on this trend, evidenced by their substantial project wins and strategic alliances in developing ultra-high-voltage transmission networks. This positions them strongly within a vital and expanding infrastructure sector.

Advanced Manufacturing Facilities

The construction of advanced manufacturing facilities, especially for high-demand sectors like electric vehicle batteries and semiconductors, has experienced significant expansion. Burns & McDonnell’s deep capabilities in industrial design and construction are well-suited to capitalize on this expanding market. Their ability to provide comprehensive, end-to-end solutions for intricate manufacturing projects mirrors the profile of a Star in the BCG matrix.

This sector is a key growth area, driven by reshoring initiatives and the need for domestic production of critical technologies. For instance, the US government's CHIPS and Science Act, enacted in 2022, allocated over $52 billion to boost semiconductor manufacturing and research, signaling a robust demand for the services Burns & McDonnell offers.

- High Growth Market: The demand for advanced manufacturing facilities is projected to continue its upward trajectory, fueled by government incentives and global supply chain realignments.

- Burns & McDonnell's Expertise: The company's established track record in managing complex industrial projects, including intricate process integration and stringent quality control, positions them favorably.

- Turnkey Solutions: Offering a complete package from initial design through construction and commissioning, Burns & McDonnell addresses the full spectrum of client needs in this specialized field.

- Strategic Alignment: Their focus on sectors with substantial investment and long-term growth potential aligns with the characteristics of a Star business unit.

Comprehensive Sustainability and Decarbonization Solutions

Driven by ambitious global ESG targets and significant federal incentives, the market for comprehensive sustainability and decarbonization solutions is experiencing robust growth. Burns & McDonnell is well-positioned to capture this demand with its extensive expertise in environmental performance, carbon reduction, and climate adaptation.

Their integrated approach allows them to tackle complex projects, securing substantial contracts and solidifying their leadership in this high-potential sector. For instance, in 2024, the company announced several major renewable energy and decarbonization projects, underscoring their active role in the energy transition.

- Market Growth: The global ESG investing market reached an estimated $37.7 trillion in 2024, reflecting a strong commitment to sustainable practices.

- Federal Incentives: The Inflation Reduction Act of 2022 continues to drive investment in clean energy and decarbonization, with billions allocated for projects through 2024 and beyond.

- Burns & McDonnell's Position: The firm has secured multiple large-scale renewable energy projects, including wind and solar farms, contributing to a significant portion of their 2024 revenue from sustainable solutions.

- Integrated Solutions: Their ability to offer end-to-end services, from initial assessment to project execution, differentiates them in a market increasingly seeking holistic sustainability strategies.

Burns & McDonnell's involvement in utility-scale solar and battery energy storage systems (BESS) firmly places them in the Stars category due to significant market share in high-growth areas. Their data center design and engineering expertise also positions them as a leader in this booming sector, evidenced by consistent top rankings and extensive project portfolios. Grid modernization and advanced transmission are further growth areas where Burns & McDonnell is actively capitalizing, securing substantial project wins and alliances. The company's deep capabilities in industrial design and construction for advanced manufacturing facilities, especially for EVs and semiconductors, also align with the Star profile, driven by reshoring initiatives and government support like the CHIPS Act.

| Service Area | Market Growth Driver | Burns & McDonnell's Position | 2024 Data Point |

|---|---|---|---|

| Renewable Energy (Solar & BESS) | Global ESG targets, energy transition | Market leader, significant project involvement | Continued expansion in multi-gigawatt-hour BESS projects |

| Data Centers | Digitalization, AI demand | Top-ranked design & engineering firm | Global market valued at ~$276.1 billion in 2024 |

| Grid Modernization & Transmission | Reliability, resilience, renewable integration | Strong project wins and strategic alliances | Development of ultra-high-voltage transmission networks |

| Advanced Manufacturing Facilities | Reshoring, EV & semiconductor demand | Comprehensive end-to-end solutions provider | Leveraging over $52 billion in US semiconductor funding |

| Sustainability & Decarbonization | ESG goals, federal incentives | Extensive expertise, major project contracts | Announced several major renewable energy and decarbonization projects in 2024 |

What is included in the product

Strategic assessment of Burns & McDonnell's portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

Provides actionable insights on investment, divestment, and resource allocation for each business unit.

The Burns & McDonnell BCG Matrix provides a clear, visual overview of business unit performance, instantly relieving the pain of strategic uncertainty.

Cash Cows

Burns & McDonnell's traditional power plant services, focusing on maintenance, upgrades, and operational support for existing fossil fuel and nuclear facilities, represent a significant cash cow. Despite a slower new build market, the company leverages its high market share in this mature sector to generate consistent and reliable cash flow. This stability is driven by the ongoing operational needs and stringent regulatory compliance requirements inherent in maintaining these critical infrastructure assets.

Burns & McDonnell's General Civil and Municipal Infrastructure segment operates as a classic Cash Cow within their business portfolio. This division boasts a significant market share in essential civil engineering projects like road construction, bridge building, and traditional water and wastewater treatment plants. These are foundational services with consistent demand from government and municipal entities, ensuring a steady stream of revenue.

The market for these infrastructure projects is mature and stable, characterized by predictable demand and lower requirements for aggressive marketing or promotional spending. This stability translates into reliable cash flow for Burns & McDonnell. For instance, in 2024, the U.S. Department of Transportation allocated substantial funding towards infrastructure improvements, with over $110 billion directed towards roads and bridges through the Bipartisan Infrastructure Law, underscoring the ongoing demand for these services.

Burns & McDonnell's established environmental compliance and remediation services are a clear cash cow. These offerings, including permitting and site cleanup, cater to a broad range of industries with a consistent demand driven by regulatory requirements. This mature market segment leverages the firm's strong reputation and deep expertise, ensuring a stable and predictable revenue stream.

In 2024, the environmental consulting market, a key area for these services, was projected to grow steadily, with many segments experiencing robust demand due to ongoing infrastructure projects and stricter environmental regulations. Burns & McDonnell's long-standing presence and proven track record in this space position them to capitalize on this sustained need for compliance and remediation solutions.

Aviation Facility Design and Maintenance

Aviation Facility Design and Maintenance represents a classic Cash Cow for Burns & McDonnell. The company leverages its deep-seated expertise and long-standing client relationships within this mature sector, which consistently demands airport infrastructure upgrades, expansions, and ongoing operational support. This stability translates into predictable revenue streams and high-margin projects.

In 2024, the aviation sector continued its robust recovery, with passenger traffic often exceeding pre-pandemic levels. For instance, many major U.S. airports reported significant increases in enplanements throughout the year, driving demand for facility improvements and maintenance. Burns & McDonnell's established position allows them to capitalize on this sustained need.

- Established Market Presence: Burns & McDonnell has a strong, long-term foothold in aviation facility design and maintenance.

- Consistent Demand: The sector requires continuous investment in upgrades, expansions, and operational upkeep.

- High-Margin Projects: Mature market expertise and client relationships enable the company to secure profitable contracts.

- Stable Revenue Generation: The predictable nature of airport infrastructure needs ensures a reliable income source.

Food and Beverage Processing Plant Solutions

The food and beverage processing sector, a cornerstone of consistent consumer demand, represents a stable yet active market for facility development. Burns & McDonnell leverages its extensive expertise in this niche to secure a significant portion of the business related to expansions, upgrades, and efficiency enhancements. This mature market, characterized by recurring needs from established clients, provides a predictable and robust revenue stream.

The company's strong track record in designing and constructing these specialized industrial facilities translates into a high market share within this mature segment. This allows Burns & McDonnell to generate reliable cash flow, a hallmark of a cash cow in the BCG matrix. For instance, the global food and beverage processing market was valued at approximately $600 billion in 2023 and is projected to grow steadily, indicating continued opportunities for established players like Burns & McDonnell.

- Strong Market Position: Burns & McDonnell holds a leading position in the food and beverage processing plant solutions market.

- Consistent Demand: The sector experiences ongoing needs for facility expansions and upgrades, ensuring a steady project pipeline.

- Mature Market: While mature, the sector's stability and essential nature provide reliable revenue generation.

- Repeat Business: Deep experience fosters strong client relationships, leading to a high volume of repeat business and predictable cash flow.

Burns & McDonnell's established power plant services, focusing on maintenance and upgrades for existing fossil fuel and nuclear facilities, are a significant cash cow. The company's high market share in this mature sector generates consistent cash flow due to ongoing operational needs and stringent regulatory compliance for critical infrastructure. This stability is further bolstered by consistent demand from government and municipal entities for essential civil engineering projects like road and bridge construction.

In 2024, the U.S. Department of Transportation allocated over $110 billion towards infrastructure improvements, highlighting the sustained demand for these services. Similarly, the aviation sector's robust recovery, with many airports exceeding pre-pandemic passenger traffic in 2024, drives consistent demand for facility upgrades and maintenance, further solidifying aviation as a cash cow.

The food and beverage processing sector also exemplifies a cash cow for Burns & McDonnell. The company's extensive expertise in facility development for expansions and upgrades within this mature market, characterized by recurring client needs, ensures a predictable and robust revenue stream. The global food and beverage processing market, valued at approximately $600 billion in 2023, continues to offer steady opportunities.

| Service Area | Market Maturity | Cash Flow Generation | Key Drivers in 2024 |

| Power Plant Services | Mature | High & Stable | Ongoing maintenance, regulatory compliance, infrastructure needs |

| Civil & Municipal Infrastructure | Mature | High & Stable | Government funding (e.g., Bipartisan Infrastructure Law), essential services demand |

| Aviation Facilities | Mature | High & Stable | Passenger traffic recovery, airport upgrades, operational support |

| Food & Beverage Processing | Mature | High & Stable | Consistent consumer demand, facility expansions, efficiency upgrades |

Delivered as Shown

Burns & McDonnell BCG Matrix

The Burns & McDonnell BCG Matrix preview you're examining is the identical, fully-formatted document you will receive upon purchase. This means no watermarks, no altered content, and no surprises – just a professionally designed, analysis-ready report ready for immediate strategic application.

Dogs

Highly niche consulting services focused on outdated industrial processes would likely fall into the Dogs category of the BCG Matrix. These services cater to a shrinking market, offering little to no growth potential. For instance, consulting on legacy manufacturing equipment that is being phased out globally represents a prime example of such a business segment.

Small, undifferentiated general contracting in commoditized local markets often falls into the Dog category. These businesses typically operate with low barriers to entry, leading to intense price competition and minimal differentiation. For instance, in 2024, the U.S. construction industry, particularly at the local general contracting level, faced persistent challenges with thin profit margins, often hovering around 1-3% for smaller firms, making significant growth or investment difficult without a clear competitive edge.

Implementing or supporting legacy software that is being phased out by the industry represents a Dog in the BCG Matrix. This segment faces declining demand as clients increasingly adopt newer, more efficient technologies.

Businesses in this category often experience low market share and minimal growth potential. For example, in 2024, the market for maintaining custom-built, on-premises systems from the early 2000s has shrunk significantly as cloud-based solutions dominate.

Such ventures are typically cash traps, consuming resources without offering substantial returns. Companies might find themselves investing in specialized skills for outdated systems that offer little competitive advantage, diverting capital from more promising growth areas.

Services Dependent on a Single, Shrinking Client Base

A service line heavily reliant on a single, shrinking client base, especially within a declining industry, would fit the 'Dog' category in the BCG Matrix. This lack of diversification and a contracting market inherently leads to low growth and a diminishing market share. Such a situation is unsustainable long-term without a significant strategic shift.

Consider a hypothetical scenario where a specialized engineering firm, Burns & McDonnell, historically served a major utility company that is now phasing out a specific type of power generation. If this firm's primary revenue stream came from maintaining and upgrading these particular plants, it would be a prime example of a 'Dog'.

- Shrinking Market: The utility's decision to reduce reliance on this power source directly contracts the available market for the engineering firm's services.

- Low Growth Potential: Without new clients or diversified offerings, the service line's growth prospects are severely limited by the decline of its sole client's needs.

- Low Market Share: Even if the firm holds a high percentage of the remaining business, the shrinking overall market means its absolute market share is likely decreasing.

- Unsustainable Model: Continued dependence on this niche, declining segment would inevitably lead to reduced profitability and eventual business failure if not addressed.

Unsuccessful Exploratory Ventures Without Traction

Unsuccessful exploratory ventures without traction represent new service offerings or market explorations that have failed to gain significant client adoption or market interest after initial investment. These ventures, showing no signs of future traction in a low-growth or stagnant sub-segment, could become dogs. They consume resources without delivering adequate returns or market share.

For instance, a consulting firm might invest heavily in developing a new AI-driven analytics platform for a niche industry. If initial client feedback indicates a lack of perceived value or a preference for existing solutions, and the target market shows minimal growth, this venture could be categorized as a dog. In 2024, many companies faced challenges launching new digital services, with some reporting less than 10% adoption rates in their first year for unproven technologies.

- Resource Drain: These ventures consume capital, talent, and management focus that could be better allocated to more promising areas.

- Opportunity Cost: The time and money spent on unsuccessful explorations prevent investment in potentially high-growth opportunities.

- Stagnation Risk: Continued investment in ventures with no traction can lead to overall business stagnation, especially in competitive markets.

Dogs in the BCG Matrix represent business units or service lines with low market share in low-growth industries. These are typically cash traps, consuming resources without generating significant returns or future potential. For example, a company offering consulting on very specific, declining industrial equipment would likely fall into this category.

In 2024, businesses focused on legacy IT infrastructure maintenance, particularly for systems predating widespread cloud adoption, often found themselves in the Dog quadrant. The market for these services has been shrinking, with many organizations actively migrating to newer, more efficient platforms. This shift directly impacts the growth prospects and revenue streams for providers of such legacy support.

These ventures often require ongoing investment to maintain even a minimal market presence, diverting capital from potentially more lucrative opportunities. Without a clear strategy for revitalization or divestment, Dogs can hinder overall company performance and growth.

Consider a hypothetical scenario where Burns & McDonnell has a niche service offering for a particular type of legacy power plant technology that is being decommissioned. The market for this specific service is contracting, and while the firm might hold a significant share of this small market, the overall growth potential is negligible.

| BCG Category | Market Growth | Relative Market Share | Characteristics | Example (Burns & McDonnell context) |

|---|---|---|---|---|

| Dogs | Low | Low | Cash traps, low profitability, little future potential. Often require divestment or harvesting. | Consulting on phasing out industrial equipment; maintenance of outdated power generation systems. |

Question Marks

Direct Air Capture (DAC) and advanced CCUS represent a burgeoning sector, fueled by significant legislative tailwinds. For instance, the Inflation Reduction Act of 2022 in the U.S. offers substantial tax credits, like the enhanced 45Q credit, making these technologies more economically viable. Burns & McDonnell's engagement in this space positions them within a high-growth, albeit still developing, market.

While Burns & McDonnell is actively developing DAC and CCUS projects, the market's nascent stage implies their current market share is modest relative to its vast expansion potential. The global CCUS market, valued at approximately $3.5 billion in 2023, is projected to reach over $15 billion by 2030, indicating substantial room for growth. Successfully capturing a significant portion of this market will necessitate considerable capital investment.

Green hydrogen is a cornerstone for achieving decarbonization goals, positioning it as a high-growth market poised for substantial future investment. The global green hydrogen market was valued at approximately $1.5 billion in 2023 and is projected to reach over $40 billion by 2030, demonstrating its immense potential. Burns & McDonnell is actively involved in green hydrogen generation through electrolysis and associated infrastructure development, reflecting their strategic entry into this burgeoning sector.

While the market's expansion is undeniable, Burns & McDonnell's current market share within this specialized and rapidly evolving green hydrogen production infrastructure segment is likely still in its formative stages. This dynamic places green hydrogen production infrastructure firmly in the Question Mark quadrant of the BCG Matrix, signifying high growth potential but requiring further strategic evaluation and investment to solidify their position.

The burgeoning field of Small Modular Reactors (SMRs) and advanced nuclear technologies is attracting substantial global investment, with projections indicating a significant expansion in the clean energy sector. This surge in interest translates into a high-growth opportunity for specialized engineering and consulting services, a market segment where Burns & McDonnell is strategically positioning itself.

While the overall nuclear market is robust, Burns & McDonnell's current market share in the nascent SMR and advanced nuclear consulting segment is understandably low. This is primarily because these innovative technologies are still in their development or early deployment stages, with many projects anticipated to reach commercial operation in the late 2020s and beyond. For instance, the U.S. Department of Energy's Advanced Reactor Demonstration Program (ARDP) has committed over $3.2 billion to two demonstration projects, highlighting the early-stage nature of this market.

To effectively capture future growth in this high-potential area, Burns & McDonnell requires strategic investments in research, development, and specialized expertise. By building capabilities and establishing a strong presence now, the firm can capitalize on the projected market expansion, which is expected to see significant traction as SMRs move from concept to widespread commercial application in the coming decade.

AI Integration in Engineering Design and Smart City Solutions

The integration of AI and machine learning into infrastructure design and smart city solutions represents a significant growth opportunity. This evolving field is seeing increased investment and adoption as cities aim for greater efficiency and sustainability.

Burns & McDonnell is actively exploring and implementing AI technologies to improve project delivery, from initial design to ongoing operations. This strategic focus positions them to capitalize on the growing demand for intelligent infrastructure.

Given the nascent stage of AI adoption in many aspects of engineering design and smart city development, Burns & McDonnell’s market share in this specific niche is likely still developing. This presents a classic Question Mark scenario within the BCG matrix, characterized by high growth potential but currently low market share.

- AI in Infrastructure Design: Enhancing structural analysis, material optimization, and predictive maintenance. For example, AI can analyze vast datasets to identify optimal bridge designs, reducing material costs by up to 15% in pilot projects.

- Smart City Planning: Utilizing AI for traffic flow optimization, energy grid management, and public safety. Cities implementing AI-powered traffic management systems have reported a 20% reduction in commute times.

- Operational Optimization: Employing machine learning for predictive analytics in utility operations, leading to improved resource allocation and reduced downtime. Predictive maintenance in power grids, driven by AI, can prevent outages saving millions in repair costs.

- Market Growth: The global smart cities market is projected to reach $2.5 trillion by 2026, with AI being a key enabler. This rapid expansion underscores the high-growth nature of this sector.

Specialized Resiliency and Climate Adaptation Planning for Underserved Regions

Specialized resiliency and climate adaptation planning for underserved regions represents a significant growth opportunity. As climate impacts like extreme weather events become more frequent and severe, there's a heightened demand for tailored solutions to protect vulnerable infrastructure and communities.

Burns & McDonnell, with its deep expertise in environmental and infrastructure services, is well-positioned to capitalize on this trend. Their capabilities align directly with the need for robust adaptation strategies.

- Market Growth Potential: The global climate adaptation market is projected to reach hundreds of billions of dollars by 2030, with a significant portion driven by infrastructure resilience needs.

- Burns & McDonnell's Position: The company's established track record in engineering, design, and consulting for critical infrastructure provides a strong foundation for offering specialized climate adaptation services.

- Underserved Markets: Targeting localized or historically underserved regions with customized planning can unlock substantial market share, even if initial penetration is modest.

- Investment Focus: Strategic investment in developing bespoke solutions for these specific regional needs could yield high returns as demand for climate resilience planning escalates.

These areas, like advanced nuclear and AI in infrastructure, represent high-growth markets where Burns & McDonnell is developing its presence. However, due to the early stage of these technologies and the company's current market penetration, they fit the Question Mark category in the BCG Matrix. This means they require careful strategic consideration and investment to transform into Stars.

The firm's focus on these emerging sectors highlights a forward-looking strategy aimed at capturing future market share. Success in these Question Mark areas will depend on the company's ability to innovate, secure necessary capital, and build expertise in rapidly evolving technological landscapes.

By strategically investing in these high-potential, low-market-share ventures, Burns & McDonnell aims to cultivate future revenue streams. Their current engagement in these nascent fields positions them to potentially lead in these transformative markets as they mature.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial statements, industry growth projections, and competitive landscape analysis, to provide actionable strategic guidance.