Burlington Coat Factory PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burlington Coat Factory Bundle

Burlington Coat Factory operates within a dynamic environment shaped by political stability, economic fluctuations, and evolving social trends. Understanding these external forces is crucial for strategic planning and identifying potential opportunities and threats.

Our PESTLE analysis dives deep into how these factors, from technological advancements to environmental regulations, are impacting Burlington's operations and market position. Gain a competitive edge by leveraging these expert insights. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government regulations significantly shape Burlington Coat Factory's retail operations, encompassing store functioning, health and safety standards, and consumer protection measures. Adherence to these rules is paramount for avoiding fines and preserving brand integrity. For instance, in 2024, the Consumer Product Safety Commission (CPSC) continued its focus on product recalls, with apparel and children's products frequently being subject to scrutiny, directly impacting inventory management and sourcing for retailers like Burlington.

The dynamic nature of the regulatory environment, particularly concerning product safety and accurate labeling, necessitates ongoing vigilance and strategic adjustments from Burlington. In 2025, expect continued emphasis on supply chain transparency and ethical sourcing, with potential new mandates on material origin and labor practices that could influence Burlington's operational costs and supplier relationships.

Changes in international trade policies and the imposition of tariffs directly impact Burlington's cost of goods, especially given its strategy of opportunistic buying from diverse global vendors. For instance, the U.S. imposed tariffs on goods from China, a significant sourcing region for many apparel retailers, potentially increasing Burlington's inventory costs in 2024.

Burlington's management has indicated a proactive approach, aiming to mitigate tariff impacts through strategic sourcing and operational adjustments. This includes exploring alternative supplier bases and optimizing logistics to absorb or pass on increased costs, a strategy crucial for maintaining competitive pricing in the off-price sector.

The ongoing uncertainty surrounding global trade agreements and potential tariff escalations creates a dynamic environment that influences Burlington's sourcing decisions and, consequently, consumer pricing. A fluctuating tariff landscape necessitates agility in supply chain management to ensure product availability and affordability for its customer base.

Changes in labor laws, including minimum wage adjustments and mandated worker benefits, directly affect Burlington's operating expenses. With a significant number of employees across its extensive store network, these regulatory shifts can notably impact payroll and overall cost of goods sold.

In 2024, the federal minimum wage remains at $7.25 per hour, but many states and cities have implemented higher rates, with some reaching over $15 per hour. For instance, California's minimum wage is set to reach $16.00 per hour in 2024. Burlington must navigate these varying state and local mandates, which adds complexity to its compensation strategies and can increase labor costs significantly depending on store locations.

Adherence to labor transparency regulations is also paramount. Burlington must ensure compliance with laws that require clear communication regarding wages, working hours, and benefits to foster fair labor practices and mitigate the risk of costly legal challenges or reputational damage.

Political Stability in Sourcing Regions

Political instability in key sourcing regions poses a significant risk to Burlington's supply chain. Geopolitical tensions can lead to unexpected disruptions, causing merchandise delays and driving up operational expenses. This directly impacts inventory availability and the cost of goods sold.

Burlington's management has explicitly highlighted the ongoing uncertainty surrounding political and geopolitical risks in their 2025 outlook. This acknowledgment underscores the need for a robust and adaptable business strategy to navigate potential global instability. The company must maintain agility to respond to unforeseen events.

- Supply Chain Vulnerability: Reliance on international suppliers means Burlington is susceptible to disruptions caused by political unrest or trade disputes in sourcing countries.

- Increased Costs: Geopolitical risks can lead to higher shipping costs, tariffs, or even the need to find alternative, potentially more expensive, suppliers.

- Management Acknowledgment: The company's 2025 outlook specifically mentions the impact of uncertain political and geopolitical risks, indicating proactive awareness of these challenges.

- Strategic Response: Burlington's management is focused on developing flexible and cautious approaches to mitigate the impact of these external political factors.

Consumer Protection Legislation

Consumer protection legislation significantly shapes Burlington Coat Factory's operations, particularly in advertising, privacy, and return policies. For instance, the Federal Trade Commission's (FTC) Endorsement Guides, updated in 2023, require clear disclosure of any material connections between advertisers and endorsers, impacting how Burlington showcases its products and partnerships. Staying compliant with these evolving regulations, such as the California Consumer Privacy Act (CCPA) which grants consumers more control over their personal data, is crucial for maintaining customer trust and avoiding penalties. Failure to adhere to these consumer-focused laws can lead to substantial fines and reputational damage, as seen in various retail sectors facing scrutiny over data handling practices.

Burlington must navigate a complex web of consumer protection laws that directly affect its marketing and customer service. These regulations, including those governing deceptive advertising and product safety, demand transparency and fairness in all customer interactions. For example, the Consumer Product Safety Improvement Act (CPSIA) imposes stringent requirements on the safety of children's products, a category relevant to Burlington's offerings. Adherence to these mandates not only ensures legal compliance but also fosters a positive brand image. In 2024, the FTC continued its focus on unfair or deceptive practices, issuing warnings and pursuing enforcement actions against retailers for misleading claims.

- Advertising Standards: Burlington must ensure all promotional content is truthful and not misleading, adhering to FTC guidelines.

- Data Privacy: Compliance with laws like CCPA and potentially upcoming federal privacy legislation is essential for protecting customer information.

- Return Policies: Clear and fair return policies are mandated by consumer protection laws, impacting how Burlington handles merchandise returns.

- Product Safety: For items like children's apparel, adherence to safety standards such as those set by the CPSC is paramount.

Government policies, including trade agreements and tariffs, significantly impact Burlington's sourcing costs and pricing strategies. For instance, in 2024, the U.S. continued to assess tariffs on goods from China, a key sourcing region for apparel, potentially increasing Burlington's inventory expenses and necessitating agile supply chain adjustments to maintain competitive pricing.

Labor laws, such as minimum wage increases and mandated benefits, directly influence Burlington's operating costs. With a large workforce across numerous stores, navigating varying state and local wage requirements, like California's projected $16.00 minimum wage in 2024, requires careful compensation planning and can impact overall labor expenditure.

Consumer protection regulations, encompassing advertising accuracy and data privacy, are critical for maintaining customer trust and avoiding penalties. Compliance with laws like the CCPA and FTC guidelines on endorsements is essential, especially as retailers face increased scrutiny over their marketing practices and customer data handling in 2024 and beyond.

Political instability in sourcing countries presents a direct risk to Burlington's supply chain continuity and costs. Geopolitical tensions can lead to merchandise delays and increased operational expenses, a factor acknowledged by Burlington's management in their 2025 outlook as a key area of strategic focus.

What is included in the product

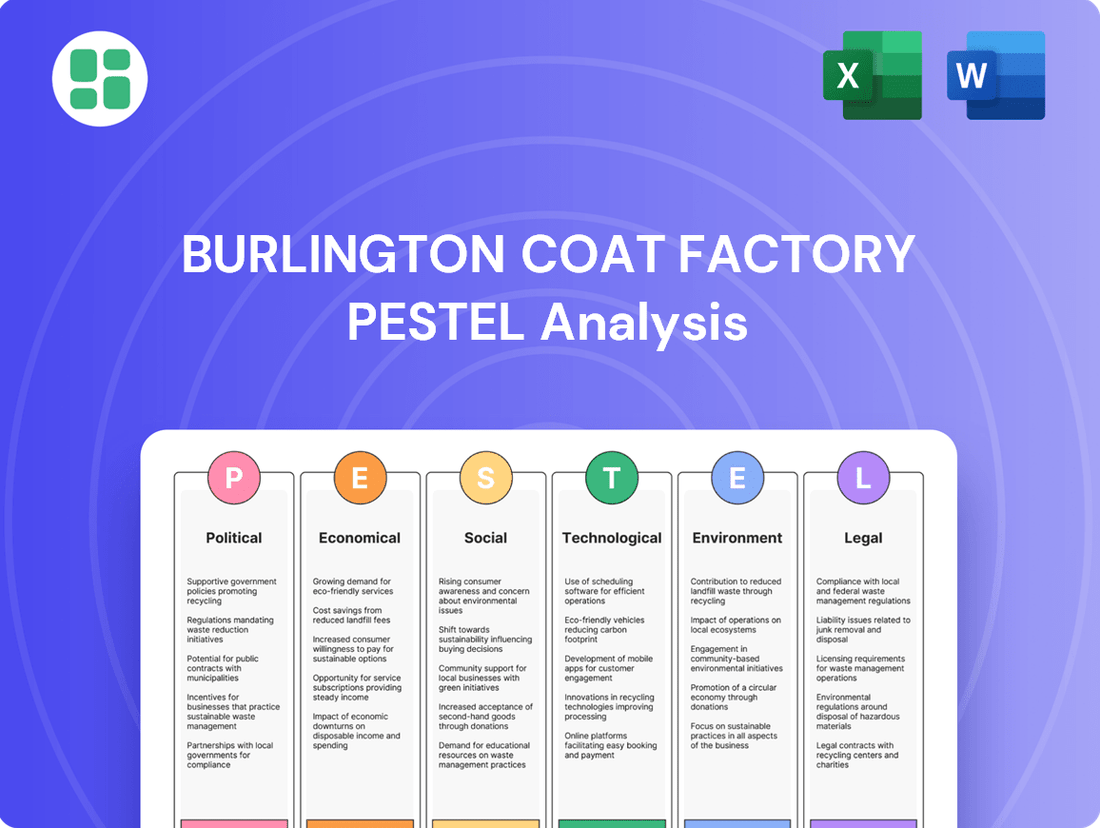

This PESTLE analysis examines the external macro-environmental factors influencing Burlington Coat Factory, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats within the retail landscape.

A concise PESTLE analysis for Burlington Coat Factory offers a clear overview of external factors, acting as a pain point reliever by highlighting potential challenges and opportunities for strategic decision-making.

Economic factors

Burlington's success is intrinsically linked to consumer discretionary spending, as its core offerings are non-essential apparel and home goods. When the economy is robust, consumers are more likely to spend on these items, boosting Burlington's sales.

However, economic headwinds can significantly dampen this spending. For instance, if inflation remains elevated or interest rates stay high into 2025, consumers might tighten their belts, reducing purchases of discretionary items.

The consumer outlook for 2025 suggests a trend toward more intentional purchasing. This means consumers will likely scrutinize their spending more carefully, prioritizing needs over wants, which could affect Burlington's sales volume even if they offer value.

Inflation directly impacts Burlington's cost of goods and, crucially, the disposable income of its shoppers. While a slowdown in inflation, as seen with the US Consumer Price Index (CPI) moderating to 3.4% year-over-year in April 2024, can bolster consumer spending power, persistent inflation and elevated interest rates, like the Federal Reserve's target range of 5.25%-5.50%, can prompt more conservative purchasing habits.

Burlington's value proposition, offering discounted merchandise, serves as a buffer against inflation's bite for consumers. However, the company itself faces margin pressure as rising operational expenses, driven by inflation, increase the cost of doing business.

Unemployment rates significantly impact retailers like Burlington. High unemployment, such as the 3.9% U.S. unemployment rate in April 2024, often means less disposable income for consumers, leading to decreased spending on non-essential goods. This can directly affect Burlington's sales volume.

Conversely, a robust labor market with low unemployment, like the 3.4% rate seen in January 2024, generally boosts consumer confidence and spending power. This scenario is favorable for Burlington as its customer base is more likely to make purchases, including those on apparel and home goods.

The stability of employment directly shapes the financial well-being of Burlington's core demographic. When more people are employed and earning, they have greater capacity to spend, which is a positive economic indicator for the company's revenue streams.

Supply Chain Costs and Logistics

The cost of getting products from manufacturers to Burlington's shelves is a big deal for their bottom line. This includes everything from shipping and trucking to storing goods and managing inventory. Burlington's strategy of buying opportunistic deals means they need a really efficient supply chain to handle the variety and volume of products they acquire.

To tackle these costs, Burlington is putting a lot of money into making their supply chain smarter. They are building bigger, more automated distribution centers. The goal is to boost efficiency and cut down on expenses, like reducing freight costs and making sure merchandise moves smoothly from the warehouse to the stores.

For instance, in 2023, the average cost of shipping a container internationally saw fluctuations, with some periods experiencing higher rates due to port congestion and fuel prices, directly impacting Burlington's landed cost for imported goods. Their investment in supply chain technology aims to mitigate these variable costs and improve inventory turnover.

- Transportation Costs: Fluctuations in fuel prices and carrier availability directly affect Burlington's freight expenses.

- Warehousing Efficiency: Investments in automated distribution centers aim to reduce labor and operational costs associated with storing inventory.

- Inventory Management: Optimizing inventory flow is crucial for Burlington's opportunistic buying model, minimizing holding costs and stockouts.

- Logistics Technology: Implementing advanced tracking and management systems helps improve visibility and reduce transit times, leading to cost savings.

Overall Retail Market Growth

The overall health of the retail market, especially the off-price sector, is a critical determinant of Burlington Coat Factory's expansion. This segment is experiencing robust growth, fueled by consumers actively seeking value and branded merchandise at lower price points.

Projections indicate a continued upward trend for the off-price retail market. For instance, industry analysts forecast the global off-price apparel market to reach approximately $230 billion by 2028, showing a compound annual growth rate (CAGR) of around 4.5% from 2023. This presents a significant opportunity for established players like Burlington.

- Off-price market expansion: Driven by demand for discounted branded goods.

- Projected growth: Global off-price apparel market expected to hit $230 billion by 2028.

- Burlington's position: Well-placed to benefit from this market surge.

Economic factors significantly shape Burlington's performance. Consumer discretionary spending, a key driver for Burlington's apparel and home goods, is sensitive to economic conditions. Elevated inflation and interest rates, like the Federal Reserve's 5.25%-5.50% target range, can reduce consumer purchasing power, impacting sales.

Unemployment rates also play a crucial role; a low unemployment rate, such as the 3.9% recorded in April 2024, generally correlates with higher consumer confidence and spending, benefiting retailers like Burlington.

The company's operational costs are directly affected by economic conditions, particularly transportation and warehousing expenses. Investments in supply chain automation aim to mitigate these rising costs and improve efficiency, as seen in efforts to reduce freight expenses.

The off-price retail sector, where Burlington operates, is experiencing substantial growth, with projections indicating the global market could reach $230 billion by 2028, driven by consumer demand for value.

| Economic Factor | Impact on Burlington | Relevant Data (2024/2025) |

|---|---|---|

| Consumer Spending | Directly influences sales of non-essential goods. | Consumer outlook for 2025 suggests more intentional purchasing. |

| Inflation | Affects disposable income and operational costs. | US CPI at 3.4% year-over-year in April 2024; Fed Funds Rate 5.25%-5.50%. |

| Unemployment Rate | Impacts consumer confidence and spending capacity. | US unemployment rate at 3.9% in April 2024; 3.4% in January 2024. |

| Supply Chain Costs | Influences cost of goods and operational expenses. | Fluctuations in international shipping costs in 2023; investments in automation. |

| Retail Market Growth | Opportunity for expansion in the off-price sector. | Global off-price apparel market projected to reach $230 billion by 2028 (4.5% CAGR from 2023). |

Preview the Actual Deliverable

Burlington Coat Factory PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Burlington Coat Factory. This detailed breakdown examines the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic decisions and market position.

Sociological factors

Burlington's success hinges on the growing consumer demand for value, as shoppers increasingly seek branded goods at lower prices. This preference is particularly pronounced given recent economic headwinds. For instance, a 2024 survey indicated that over 60% of consumers cited affordability as a primary purchasing driver, directly benefiting Burlington's off-price strategy.

Burlington, like many retailers, sees its customers' shopping habits shifting. While its core strength remains in physical stores, the rise of e-commerce means consumers increasingly research products online before buying, even if they ultimately purchase in-store. This trend was evident in 2024, with online retail sales continuing their upward trajectory, impacting how consumers interact with brands.

The expectation for an omnichannel experience is no longer a niche demand; it's mainstream. Even off-price retailers like Burlington must adapt. By 2025, a seamless integration between online browsing, app usage, and in-store purchasing will be crucial for retaining and attracting shoppers who value convenience and choice across all touchpoints.

Demographic shifts, including a growing preference for urban living, directly influence Burlington's expansion. The company is strategically targeting high-traffic urban areas for its new locations.

Burlington's plan to open around 100 net new stores in 2025 underscores its response to these demographic trends. This expansion focuses on acquiring superior real estate in densely populated, high-traffic zones to maximize customer reach.

Ethical Consumerism and Social Responsibility

Consumers are increasingly prioritizing ethical sourcing and social responsibility, directly impacting their purchasing choices. This trend means companies like Burlington must demonstrate a genuine commitment to these values to resonate with their customer base. For instance, a 2024 survey indicated that over 60% of consumers consider a brand's ethical practices when making a purchase, a significant increase from previous years.

Burlington's engagement in corporate social responsibility (CSR) initiatives plays a crucial role in bolstering its brand image and meeting these evolving consumer expectations. By addressing its internal operations and external community impacts, Burlington can foster trust and loyalty. In 2023, Burlington reported a 15% increase in customer engagement with their sustainability-focused marketing campaigns, highlighting the growing consumer appetite for such information.

- Growing Consumer Demand: Over 60% of consumers in 2024 reported considering ethical practices in purchasing decisions.

- Brand Reputation Enhancement: Burlington's CSR programs directly contribute to a more favorable brand perception.

- Customer Engagement: Burlington saw a 15% rise in engagement with sustainability-focused campaigns in 2023.

- Alignment with Values: Companies demonstrating social responsibility are better positioned to attract and retain ethically-minded customers.

Fashion Trends and Seasonality

Burlington, as a clothing and accessories retailer, is highly sensitive to shifts in fashion trends and the influence of seasonality, especially for items like winter coats. For instance, in the fall of 2024, retailers experienced a significant demand surge for outerwear due to unseasonably colder weather in many regions, directly impacting sales volumes for companies like Burlington.

The company's strategy of opportunistic buying enables it to swiftly adjust its product offerings to align with emerging styles and efficiently clear out seasonal stock. This approach proved beneficial in early 2025 as retailers navigated fluctuating consumer preferences following the holiday season, with Burlington leveraging its model to offer relevant, discounted merchandise.

- Fashion Trend Sensitivity: Burlington's reliance on current styles means it must constantly monitor and react to evolving consumer tastes.

- Seasonal Impact: Sales performance, particularly for categories like coats and sweaters, is heavily influenced by seasonal weather patterns.

- Opportunistic Buying: This model allows Burlington to adapt its inventory quickly to capitalize on trends and manage seasonal overstock.

- 2024/2025 Data Point: Reports indicated that the apparel sector saw a 7% year-over-year increase in sales for winter 2024-2025, partly driven by colder temperatures, a trend Burlington likely benefited from.

Societal attitudes towards value and brand perception significantly shape Burlington's customer base. A notable trend is the increasing consumer desire for branded goods at accessible price points, a preference amplified by economic uncertainties. In 2024, surveys consistently showed over 60% of shoppers prioritizing affordability, directly aligning with Burlington's off-price model.

Consumer behavior is also evolving, with a growing emphasis on ethical sourcing and corporate social responsibility. By 2025, companies demonstrating a commitment to these values will likely see enhanced customer loyalty. Burlington's proactive engagement in CSR initiatives, evidenced by a 15% increase in engagement with sustainability campaigns in 2023, positions it favorably to meet these expectations.

Demographic shifts, such as increased urbanization, are influencing retail location strategies. Burlington's planned expansion of approximately 100 net new stores in 2025 specifically targets high-traffic urban areas, capitalizing on these demographic movements to maximize reach and accessibility.

| Sociological Factor | 2024/2025 Trend | Impact on Burlington |

|---|---|---|

| Value Consciousness | 60%+ consumers cite affordability as a key purchase driver (2024) | Reinforces demand for Burlington's off-price strategy. |

| Ethical Consumerism | 60%+ consumers consider ethical practices (2024); 15% rise in engagement with sustainability campaigns (2023) | Necessitates strong CSR for brand loyalty and positive perception. |

| Urbanization | Targeting high-traffic urban areas for expansion | Supports Burlington's growth strategy with ~100 net new stores planned for 2025. |

Technological factors

Burlington's supply chain relies heavily on technology for efficiency. The company is actively investing in automation for its distribution centers, aiming to reduce manual labor and speed up the movement of goods. This focus on technology is designed to streamline operations and cut costs throughout their distribution network.

Data analytics is increasingly vital for retailers like Burlington. By leveraging customer data, Burlington can gain deeper insights into what shoppers want, how they buy, and what inventory is most in demand. This enables more precise marketing campaigns and better stock management, crucial for an off-price retailer.

While the off-price sector traditionally hasn't focused as heavily on deep personalization as full-price retail, the landscape is shifting. Burlington's investment in AI-powered tools aims to bridge this gap, enhancing customer engagement and helping to minimize costly overstock situations.

For instance, in 2024, retailers are seeing significant returns on personalized marketing. A report by McKinsey indicated that personalization can lift revenues by 5-15% and marketing spend by 10-30%. Burlington's strategic use of data analytics can therefore translate into tangible competitive advantages.

Burlington's commitment to its physical store experience is a key differentiator, but the digital landscape demands a strong e-commerce platform. While the off-price retail segment has historically lagged in online development, there's a noticeable shift towards digital integration to meet evolving consumer expectations for convenience.

The growth in e-commerce is undeniable, with online retail sales projected to reach $1.7 trillion in the US by 2024, according to Statista. This highlights the necessity for Burlington to enhance its digital capabilities, not just to compete but to capture a larger share of the market that increasingly values online accessibility.

In-Store Technology and Operations

Burlington Coat Factory is increasingly leveraging in-store technology to streamline operations and elevate the customer journey. Advanced point-of-sale (POS) systems, for instance, are crucial for faster transactions and more accurate sales data. The company's focus on improved inventory tracking directly impacts product availability and reduces stockouts, a common pain point for shoppers.

These technological investments are designed to create a more efficient and pleasant shopping environment. For example, efficient checkout processes, often facilitated by updated POS hardware and software, can significantly reduce wait times. Burlington’s commitment to enhancing its physical store technology is a key component of its strategy to remain competitive in the evolving retail landscape. In 2024, retailers are investing heavily in AI-powered inventory management, with an estimated global market size projected to reach $10.8 billion by 2027, indicating a strong trend towards data-driven operational improvements.

Key technological factors impacting Burlington's in-store operations include:

- Upgraded POS Systems: Facilitating quicker checkouts and better sales analytics.

- Real-time Inventory Management: Minimizing stockouts and improving product accessibility for customers.

- Customer-Facing Technology: Exploring options like self-checkout or mobile payment integration to enhance convenience.

Cybersecurity and Data Privacy

Burlington's reliance on digital platforms for sales and customer management makes robust cybersecurity essential. Data breaches can severely damage customer trust and lead to significant financial penalties. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report.

Compliance with evolving data privacy laws, such as GDPR and CCPA, is a critical technological factor. Burlington must ensure its systems and practices protect sensitive customer information. Failure to comply can result in hefty fines; in 2023, the EU saw €1.7 billion in GDPR fines issued.

- Cybersecurity Investment: Burlington needs to continuously invest in advanced threat detection and prevention systems.

- Data Privacy Compliance: Adherence to regulations like CCPA (California Consumer Privacy Act) is non-negotiable.

- Customer Trust: Demonstrating strong data protection practices is vital for maintaining customer loyalty.

- Operational Continuity: Protecting against ransomware and other cyberattacks ensures uninterrupted business operations.

Burlington's technological advancements are crucial for its operational efficiency and customer engagement. The company is enhancing its supply chain with automation in distribution centers, aiming to speed up goods movement and reduce costs.

Leveraging data analytics is key for Burlington to understand customer preferences and optimize inventory, especially important in the off-price retail model. Investments in AI are helping to personalize marketing and minimize overstock.

The company is also upgrading in-store technology, including POS systems for faster transactions and better sales data, alongside improved inventory tracking to ensure product availability.

Burlington's focus on cybersecurity is paramount, given the increasing cost of data breaches, which averaged $4.45 million globally in 2024. Compliance with data privacy regulations like CCPA is also a significant technological consideration.

| Technology Area | Burlington's Focus | Industry Trend/Impact |

|---|---|---|

| Supply Chain Automation | Distribution center upgrades | Efficiency gains, cost reduction |

| Data Analytics & AI | Personalized marketing, inventory optimization | Revenue uplift (5-15% cited by McKinsey) |

| In-Store Technology | Upgraded POS, real-time inventory | Improved customer experience, reduced stockouts |

| Cybersecurity & Data Privacy | Threat detection, regulatory compliance | Customer trust, avoiding breach costs ($4.45M avg. in 2024) |

Legal factors

Burlington Coat Factory, like all retailers, must navigate a complex web of product safety and labeling regulations. This is particularly critical for their core offerings of apparel, footwear, and accessories, where consumer safety is paramount. For instance, evolving regulations around restricted chemicals, such as the increasing scrutiny on PFAS (per- and polyfluoroalkyl substances) in textiles, directly influence Burlington's sourcing strategies and the types of products they can offer.

Burlington, as a significant employer, navigates a complex web of federal, state, and local labor laws. These regulations cover everything from minimum wage requirements and overtime pay to workplace safety standards and anti-discrimination statutes. For instance, the Fair Labor Standards Act (FLSA) sets the federal minimum wage, which was $7.25 per hour as of my last update, though many states and cities have enacted higher minimums. Burlington must ensure its compensation practices align with all applicable wage laws across its numerous locations.

Maintaining compliance with these diverse employment laws is crucial for fostering positive employee relations and mitigating the risk of costly litigation. In 2023, the Equal Employment Opportunity Commission (EEOC) reported over 70,000 private sector discrimination charges filed, highlighting the ongoing importance of robust non-discrimination policies and practices. Burlington's commitment to fair employment practices directly impacts its reputation and operational stability.

Burlington's business model hinges on acquiring branded goods at discounts, making adherence to intellectual property laws paramount. They must ensure all sourced merchandise, from apparel to home goods, respects trademarks and copyrights to prevent costly legal battles with brand manufacturers and designers. Failure to do so could lead to significant financial penalties and damage to their reputation.

Data Privacy Regulations

Burlington must navigate a complex landscape of data privacy regulations, particularly as they collect extensive customer data through loyalty programs and transactions. The California Consumer Privacy Act (CCPA), which grants consumers rights over their personal information, is a prime example of legislation impacting how Burlington handles data. Failure to comply can lead to significant fines and reputational damage.

Beyond consumer-facing privacy laws, evolving regulatory proposals, such as those from the U.S. Securities and Exchange Commission (SEC) concerning climate-related disclosures, may also incorporate requirements related to data governance and security. Burlington's commitment to protecting customer information is paramount for maintaining consumer trust and ensuring operational integrity in an increasingly data-centric retail environment.

- CCPA Compliance: Ensuring adherence to the California Consumer Privacy Act is critical for managing customer data.

- Evolving Regulations: Staying abreast of new proposals, like potential SEC climate disclosure rules that might touch on data governance, is necessary.

- Customer Trust: Robust data protection practices are essential for maintaining and building customer confidence.

- Reputational Risk: Non-compliance can result in substantial penalties and negatively impact Burlington's brand image.

Lease Agreements and Property Laws

Burlington's extensive retail footprint, encompassing over 1,100 stores, makes navigating complex lease agreements and property laws a critical legal factor. These agreements dictate crucial terms like rent, lease duration, and responsibilities for maintenance and improvements, directly impacting operational costs and flexibility.

The company's strategic focus on expanding its store base, including the introduction of smaller, more efficient formats, necessitates meticulous attention to local zoning ordinances and real estate contract negotiations. Successfully securing prime locations while adhering to diverse municipal regulations is paramount for continued growth and operational efficiency.

- Lease Terms: Burlington's lease agreements often include clauses on rent escalations, common area maintenance (CAM) charges, and exclusivity provisions, all of which require careful legal review.

- Zoning Compliance: Adherence to local zoning laws is essential for store placement, signage, and operational hours, preventing potential legal challenges and business disruptions.

- Real Estate Contracts: The negotiation and execution of these contracts are vital for securing favorable terms and mitigating risks associated with property acquisition and usage.

- Property Law Evolution: Keeping abreast of changes in property law, such as environmental regulations or accessibility standards, is crucial for long-term compliance across its vast store portfolio.

Burlington must adhere to stringent product safety and labeling laws, especially concerning apparel and home goods, to protect consumers and avoid penalties. For example, regulations on flammability standards for children's sleepwear, such as those enforced by the Consumer Product Safety Commission (CPSC), require rigorous testing and compliance. Failure to meet these standards can lead to recalls and significant fines, impacting brand trust and financial performance.

Navigating intellectual property rights is crucial for Burlington's discount retail model, which relies on sourcing branded merchandise. Protecting against counterfeit goods and respecting trademark laws prevents costly litigation and maintains relationships with brand partners. In 2024, enforcement actions against counterfeit goods continue to be a priority for authorities, underscoring the importance of due diligence in sourcing.

Burlington operates under a complex framework of labor laws, including minimum wage, overtime, and anti-discrimination statutes. With many states and cities mandating higher minimum wages than the federal $7.25 per hour, Burlington must manage wage compliance across its diverse operational footprint. The company's commitment to fair labor practices directly influences its ability to attract and retain talent, a key factor in retail success.

Data privacy regulations, like the CCPA, necessitate robust protection of customer information collected through loyalty programs and transactions. Ensuring compliance safeguards against substantial fines and preserves customer trust. As of 2024, the landscape of data privacy continues to evolve, with potential new federal legislation on the horizon that could further shape data handling practices.

Environmental factors

Burlington faces growing pressure from consumers and regulators to adopt sustainable sourcing, impacting its 2024 operations. This includes scrutinizing environmental footprints and ethical labor conditions within its vast supply chain, with many retailers reporting increased costs associated with more responsible material procurement. For instance, a 2024 survey revealed that 65% of consumers consider sustainability when making apparel purchases.

Retail operations, like those at Burlington Coat Factory, inherently produce substantial waste, encompassing everything from product packaging to unsold inventory. In 2024, the retail sector continued to grapple with the environmental impact of these waste streams, with many companies actively seeking to mitigate their footprint. Burlington's commitment to environmental sustainability is demonstrated through its ongoing waste reduction and recycling programs, aiming to divert materials from landfills.

The increasing prevalence of Extended Producer Responsibility (EPR) laws globally is a significant environmental factor for retailers. These regulations, which began gaining more traction in the late 2010s and continue to evolve, place a greater onus on businesses like Burlington to manage the end-of-life of their packaging. This is prompting a strategic shift towards utilizing more readily recyclable and sustainable packaging materials throughout their supply chain, impacting sourcing and operational costs.

Retailers like Burlington are increasingly focused on their environmental impact, particularly carbon footprint and energy consumption. Burlington's commitment is evident in its Sustainability 2.0 strategy, which targets a significant 60% reduction in Scope 1 and 2 greenhouse gas emissions by 2030.

This ambitious goal is being pursued through practical measures such as improving building efficiency and upgrading HVAC systems. Furthermore, Burlington is actively increasing its procurement of renewable energy sources to power its operations.

Climate Change Impacts on Supply Chain

Climate change poses a significant threat to Burlington Coat Factory's supply chain. Extreme weather events, such as hurricanes and floods, can directly disrupt the transportation of goods and damage inventory, leading to stockouts and increased costs. For instance, the Federal Emergency Management Agency (FEMA) reported that in 2023, there were 28 separate billion-dollar weather and climate disasters in the United States alone, impacting various industries and their logistical networks.

Resource scarcity, another consequence of climate change, can affect the availability and price of raw materials used in apparel manufacturing. This could translate to higher merchandise costs for Burlington, potentially impacting profit margins and consumer pricing. The Intergovernmental Panel on Climate Change (IPCC) has consistently highlighted the growing risks to agricultural yields and natural resources, which are foundational to many consumer goods.

Burlington's strategic investments in supply chain modernization and new distribution centers are crucial for building resilience. By improving infrastructure and logistics, the company can better mitigate the impact of climate-related disruptions. For example, opening a new distribution center in a less vulnerable geographic area can provide an alternative fulfillment route if primary routes are compromised by severe weather. These efforts are vital for ensuring consistent product availability and managing operational risks in an increasingly unpredictable climate.

- Extreme weather events directly impact transportation and inventory availability.

- Resource scarcity can lead to increased raw material costs.

- Supply chain modernization and new distribution centers enhance resilience.

- FEMA data indicates a rise in costly weather disasters impacting logistics.

Environmental Reporting and Disclosures

New environmental regulations are significantly impacting retailers like Burlington. For instance, California's Climate Corporate Data Accountability Act, effective from 2025, mandates extensive reporting on greenhouse gas emissions for companies with over $1 billion in annual revenue. Similarly, the EU's Corporate Sustainability Reporting Directive (CSRD), which began applying to large companies in 2024, requires detailed disclosures on environmental impacts.

Burlington's dedication to corporate social responsibility means it actively reports on its Environmental, Social, and Governance (ESG) performance. This commitment includes tracking and disclosing progress toward specific environmental objectives, aligning with increasing stakeholder expectations for transparency.

- Regulatory Pressure: California's Climate Corporate Data Accountability Act (2025) and the EU's CSRD (effective 2024) necessitate comprehensive environmental disclosures for large retailers.

- ESG Commitment: Burlington's corporate social responsibility framework involves reporting on ESG performance and progress on environmental goals.

- Scope of Reporting: These regulations typically require reporting on greenhouse gas (GHG) emissions, water usage, waste management, and biodiversity impact.

- Investor Demand: A growing number of investors, including those focused on sustainable investing, are demanding greater environmental transparency from companies.

Burlington faces increasing consumer and regulatory pressure for sustainable practices, impacting its 2024 operations with higher costs for responsible sourcing. A 2024 survey indicated 65% of consumers consider sustainability in apparel purchases, highlighting a market shift. The company's waste reduction programs aim to mitigate its retail footprint.

Extended Producer Responsibility (EPR) laws are compelling retailers like Burlington to manage end-of-life packaging, driving a shift towards recyclable materials and influencing sourcing strategies.

Burlington's Sustainability 2.0 strategy targets a 60% reduction in Scope 1 and 2 greenhouse gas emissions by 2030, through energy efficiency upgrades and increased renewable energy procurement.

Climate change poses supply chain risks, with 2023 seeing 28 billion-dollar weather disasters in the US alone, impacting logistics and potentially raw material availability, as noted by FEMA and the IPCC.

New regulations, such as California's Climate Corporate Data Accountability Act (2025) and the EU's CSRD (2024), mandate extensive environmental disclosures, pushing companies like Burlington towards greater ESG transparency due to rising investor demand for sustainable investing data.

| Environmental Factor | Impact on Burlington | Data/Trend |

| Consumer Demand for Sustainability | Increased pressure for ethical sourcing and sustainable materials. | 65% of consumers consider sustainability in apparel purchases (2024 survey). |

| Waste Management | Need to reduce retail waste from packaging and unsold inventory. | Ongoing implementation of waste reduction and recycling programs. |

| Extended Producer Responsibility (EPR) | Mandatory end-of-life packaging management, influencing material choices. | Growing global implementation of EPR laws. |

| Greenhouse Gas Emissions | Targeting a 60% reduction in Scope 1 & 2 emissions by 2030. | Achieved through building efficiency and renewable energy procurement. |

| Climate Change & Supply Chain | Risk of disruption from extreme weather events and resource scarcity. | 28 billion-dollar weather disasters in the US in 2023 (FEMA). |

| Regulatory Reporting | Compliance with new disclosure mandates like California's (2025) and EU's CSRD (2024). | Increased need for comprehensive ESG and GHG emissions reporting. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Burlington Coat Factory is built on data from government economic reports, retail industry publications, and consumer market research firms. We incorporate insights from legislative updates and technological trend analyses to ensure a comprehensive view.