Burlington Coat Factory Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burlington Coat Factory Bundle

Discover the strategic brilliance behind Burlington Coat Factory's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering invaluable insights for aspiring retailers. Unlock the full blueprint and gain a competitive edge.

Partnerships

Burlington's ability to offer deep discounts hinges on its diverse vendor network, which includes manufacturers, distributors, and brand liquidators. These relationships are vital for securing opportunistic inventory, ensuring a constant flow of desirable merchandise at reduced costs. For instance, in fiscal year 2024, Burlington continued to leverage these partnerships to maintain its competitive pricing strategy.

Burlington relies heavily on logistics and supply chain partners to keep its shelves stocked with constantly changing merchandise. These relationships are vital for moving goods from suppliers to their distribution centers and finally to stores efficiently. In 2024, Burlington continued to leverage partnerships with third-party logistics providers and freight carriers to manage the swift flow of inventory, a critical component of their off-price model.

The company's investment in its own distribution centers, such as the expansion projects seen in recent years, aims to bolster control and streamline operations. This dual approach, combining external expertise with internal infrastructure, is key to ensuring timely and cost-effective inventory movement, especially given the high volume and rapid turnover characteristic of Burlington's business.

Burlington relies heavily on its relationships with real estate developers and landlords to fuel its physical store expansion. These partnerships are crucial for securing prime locations and negotiating favorable lease terms, which directly support Burlington's ambitious growth plans. For instance, the company targeted approximately 100 net new store openings in fiscal year 2025, underscoring the importance of these real estate collaborations.

Technology and IT Solutions Providers

Burlington leverages partnerships with technology and IT solutions providers to streamline its complex retail operations. These collaborations are essential for managing vast inventories, optimizing in-store processes, and boosting the efficiency of its supply chain. For instance, in 2024, retailers like Burlington continued to invest heavily in integrated inventory management systems, with the global retail inventory management market projected to reach over $5 billion by 2027, indicating the critical nature of these IT investments.

These partnerships are crucial for implementing and maintaining the technology that underpins Burlington's customer experience and operational backbone. This includes point-of-sale (POS) systems, advanced data analytics platforms to understand consumer behavior, and robust inventory management software. In 2024, the retail analytics market was valued at approximately $10 billion, highlighting the significant role data plays in competitive retail strategies.

- Point-of-Sale (POS) Systems: Ensuring smooth transaction processing and customer checkout.

- Inventory Management Software: Tracking stock levels across all channels to prevent stockouts and overstocking.

- Data Analytics Platforms: Gaining insights into sales trends, customer preferences, and operational performance.

- Supply Chain Visibility Tools: Enhancing transparency and efficiency from supplier to store.

Community and Charitable Organizations

Burlington actively partners with community and charitable organizations, demonstrating a commitment to corporate social responsibility. These collaborations are central to their business model, allowing them to give back and strengthen their brand presence.

Key partnerships include organizations such as YouthBuild USA, AdoptAClassroom.org, and Delivering Good. Through these alliances, Burlington facilitates customer giving campaigns and donates products, directly impacting local communities and enhancing their public image.

- YouthBuild USA: Supports young people in building skills and careers.

- AdoptAClassroom.org: Provides essential supplies to teachers and students.

- Delivering Good: Channels new product donations to those in need.

Burlington's strategic alliances with vendors are foundational, enabling access to opportunistic inventory at competitive prices. These partnerships, spanning manufacturers, distributors, and liquidators, are critical for maintaining their off-price model. In fiscal year 2024, Burlington's continued reliance on this diverse vendor network underscored its importance for consistent merchandise flow and cost control.

Logistics and supply chain partners are indispensable for Burlington's operational efficiency, ensuring the timely movement of its high-volume, rapidly changing inventory. By collaborating with third-party logistics providers and freight carriers in 2024, Burlington optimized its supply chain, a vital element in delivering value to customers.

Real estate partnerships are paramount for Burlington's expansion strategy, facilitating the acquisition of prime retail locations. The company's target of approximately 100 net new store openings in fiscal year 2025 highlights the crucial role these landlord and developer relationships play in its growth trajectory.

Technology and IT solution providers are key partners for Burlington, supporting everything from inventory management to customer experience. Investments in areas like data analytics, with the market valued around $10 billion in 2024, demonstrate the critical nature of these collaborations for operational backbone and competitive insight.

| Partnership Type | Key Function | 2024/2025 Relevance |

|---|---|---|

| Vendors | Inventory Sourcing | Securing opportunistic, discounted merchandise. |

| Logistics Providers | Supply Chain Management | Efficient movement of goods from suppliers to stores. |

| Real Estate Developers/Landlords | Store Expansion | Securing prime locations for new store openings. |

| IT Solution Providers | Operational Efficiency & Customer Experience | Enhancing inventory management, analytics, and POS systems. |

What is included in the product

Burlington Coat Factory's business model focuses on offering branded apparel and home goods at discount prices to value-conscious shoppers, leveraging a treasure-hunt shopping experience and efficient inventory management.

The Burlington Coat Factory Business Model Canvas acts as a pain point reliever by offering a high-level, editable view of their value proposition, customer segments, and revenue streams, simplifying complex retail operations into a clear, actionable framework.

Activities

Opportunistic merchandise buying is the engine driving Burlington's off-price strategy. This involves their buyers swiftly acquiring overstock, end-of-season, or clearance goods from manufacturers and brands at significantly reduced prices. For instance, in fiscal year 2024, Burlington’s inventory turnover rate was approximately 3.7 times, showcasing their efficient movement of acquired goods.

This agile acquisition requires a buying team adept at spotting emerging trends and negotiating hard to secure the best deals. Their ability to react quickly to market shifts ensures a dynamic and appealing product assortment for customers. Burlington’s commitment to this model allows them to offer compelling value, a key differentiator in the retail landscape.

Burlington's key activity revolves around expertly handling its ever-changing inventory. This means swiftly processing new arrivals and getting them to stores where they're most likely to sell, considering local tastes and store capacity. They also strategically manage backstock to boost sales and avoid heavy discounts.

In 2023, Burlington reported a net sales increase to $9.4 billion, underscoring the importance of efficient inventory flow. This sales performance highlights their ability to move a broad range of merchandise, from apparel to home goods, requiring sophisticated allocation strategies to meet diverse customer demands across their approximately 800 stores.

Burlington's store operations are the backbone of its business, with over 1,100 physical locations requiring meticulous daily management. This includes everything from ensuring adequate staffing levels and providing excellent customer service to maintaining visually appealing displays and a clean, inviting atmosphere. In fiscal year 2024, Burlington continued to refine these in-store experiences.

The company emphasizes a 'treasure hunt' shopping environment. This strategy involves constantly refreshing inventory and presenting new arrivals in a way that encourages discovery and impulse purchases. This approach is key to driving foot traffic and repeat visits, as customers anticipate finding unique deals and brands.

Supply Chain Optimization and Logistics

Burlington focuses on continuously enhancing its supply chain efficiency, a critical activity that spans from getting goods from vendors to delivering them to stores. This involves significant investment in infrastructure. For instance, in fiscal year 2024, the company continued to invest in modernizing its distribution network to handle increased volume and improve speed.

A key part of this optimization is the development of larger, more automated distribution centers. These facilities are designed to streamline the receiving, sorting, and shipping processes, reducing labor costs and increasing throughput. By leveraging technology, Burlington aims to minimize handling times and errors throughout the logistics pipeline.

Furthermore, Burlington actively works to optimize freight costs and product sourcing. This includes negotiating favorable shipping rates, consolidating shipments, and strategically sourcing products to achieve the best possible cost of goods sold. These efforts directly contribute to enhanced profitability by reducing operational expenses and improving margins.

- Distribution Center Modernization: Investment in larger, more automated facilities to improve efficiency and speed.

- Freight Cost Optimization: Negotiating better shipping rates and consolidating shipments to reduce transportation expenses.

- Product Sourcing Strategies: Implementing cost-effective sourcing methods to lower the cost of goods sold.

Marketing and Promotion of Value

Burlington's marketing and promotion of value are key to attracting customers. The company focuses on emphasizing its core proposition: brand-name apparel and home goods at prices significantly lower than department stores. This is achieved through a mix of strategies designed to drive traffic and showcase the dynamic nature of their inventory.

Key activities include:

- In-store Promotions: Regularly scheduled sales events, seasonal markdowns, and loyalty program benefits are used to encourage repeat business and impulse purchases.

- Digital Marketing: Burlington utilizes email campaigns, social media engagement, and online advertising to highlight new arrivals, special offers, and its value proposition to a wider audience.

- Local Advertising: Targeted local advertising, including flyers and potentially local media partnerships, helps drive foot traffic to individual store locations by promoting specific deals and the store's overall appeal.

In 2023, Burlington reported net sales of $9.3 billion, reflecting the effectiveness of its value-driven marketing approach in a competitive retail landscape.

Burlington's core activities center on its off-price model, which involves opportunistic buying of merchandise from manufacturers and brands. This agile acquisition strategy is supported by efficient inventory management and a robust supply chain designed for swift product movement to approximately 800 stores. Effective marketing and in-store promotions are crucial for communicating value and driving customer traffic, as evidenced by their 2023 net sales of $9.3 billion.

| Key Activity | Description | Supporting Data (FY2024 unless noted) |

| Opportunistic Merchandise Buying | Acquiring overstock, end-of-season, or clearance goods at reduced prices. | Inventory turnover rate: ~3.7 times. |

| Inventory Management & Allocation | Swiftly processing arrivals, allocating to stores based on demand, and managing backstock. | Net sales: $9.4 billion (2023). |

| Supply Chain & Distribution | Investing in modern, automated distribution centers to streamline logistics. | Continued investment in distribution network modernization. |

| Marketing & Promotions | Highlighting value through in-store events, digital marketing, and local advertising. | Net sales: $9.3 billion (2023). |

What You See Is What You Get

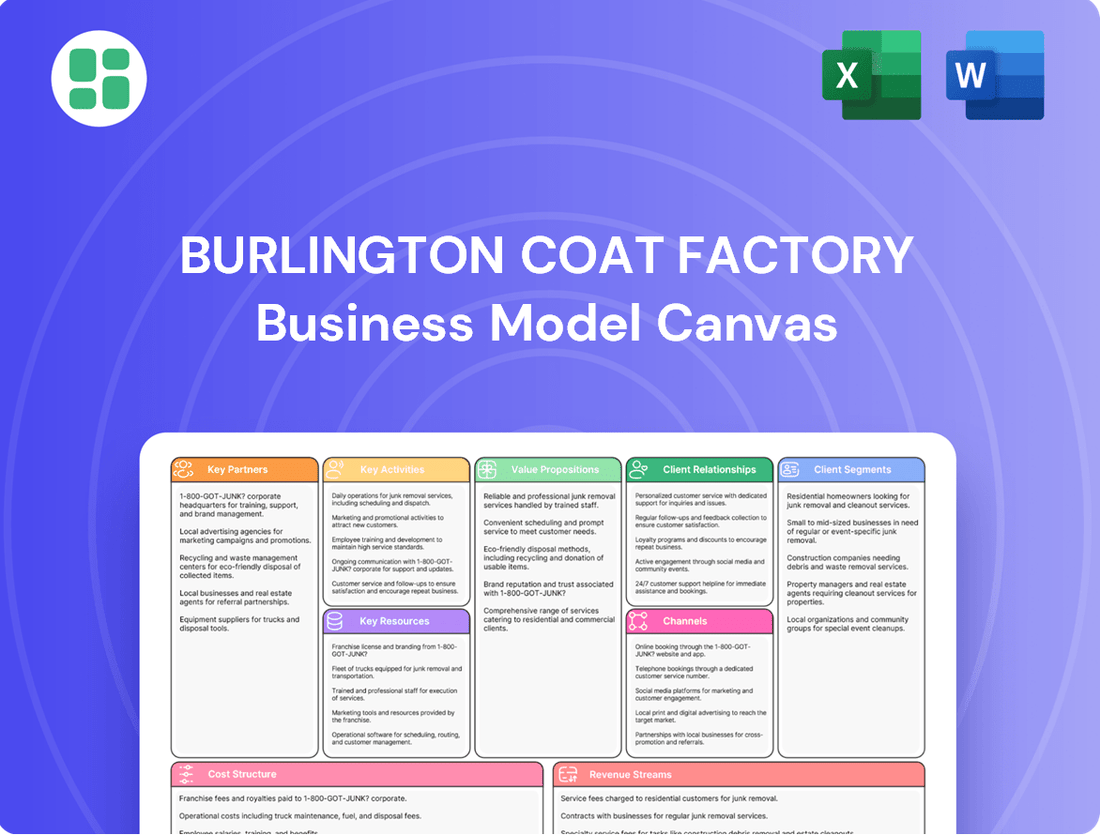

Business Model Canvas

The Burlington Coat Factory Business Model Canvas preview you are viewing is the actual document you will receive upon purchase, offering a transparent look at its comprehensive structure. This means you'll gain immediate access to the complete, professionally formatted canvas, mirroring exactly what you see here. You can be confident that the insights and strategic framework presented will be yours to utilize without any alteration or missing sections.

Resources

Burlington's strong vendor relationships are a cornerstone of its business, acting as a crucial intangible asset. This extensive network allows them to consistently secure high-quality, in-season merchandise from national and designer brands.

These partnerships are fundamental to Burlington's off-price strategy, enabling the acquisition of goods at opportunistic prices. For example, in fiscal year 2024, Burlington reported a significant portion of its merchandise sourced through these established vendor connections, contributing to its competitive pricing structure.

Burlington operates an extensive physical store network, boasting over 1,100 locations spread across 46 states, Washington D.C., and Puerto Rico. This substantial real estate footprint is a core asset, enabling broad customer reach and significant market penetration.

The strategic placement and continuous growth of these stores are vital for ensuring customer convenience and solidifying Burlington's presence in diverse retail landscapes. As of early 2024, Burlington continues to evaluate and optimize its store portfolio, aiming for strategic expansion and enhanced accessibility.

Burlington leverages a sophisticated and increasingly automated supply chain, a critical resource for its off-price retail model. This network is anchored by strategically positioned distribution centers designed to facilitate rapid merchandise flow, a key component of their business. In 2024, Burlington continued to invest in optimizing these logistics to ensure efficient inventory management and cost control.

The company's distribution centers are central to its ability to quickly process and move a high volume of diverse merchandise to its stores. This logistical prowess directly supports Burlington's strategy of offering constantly changing, value-priced inventory, driving frequent customer visits and quick inventory turns. Their operational efficiency in 2024 was paramount to maintaining competitive pricing.

Skilled Buying and Merchandising Teams

Burlington's skilled buying and merchandising teams are a crucial human resource, adept at sourcing desirable products and securing advantageous pricing. Their expertise in inventory management ensures a dynamic and appealing product mix for customers.

These teams are pivotal in Burlington's ability to quickly capitalize on market trends and opportunities, directly impacting the company's competitive edge. For instance, their agility in responding to shifts in consumer demand for specific apparel categories can lead to significant sales uplifts.

- Product Sourcing Expertise: Identifying high-demand, off-price merchandise from a wide range of vendors.

- Negotiation Prowess: Securing favorable terms and pricing, a cornerstone of Burlington's value proposition.

- Inventory Management Agility: Efficiently managing stock levels to maximize sales and minimize markdowns, a key factor in their off-price model.

Brand Recognition and Customer Base

Burlington's established brand name and its loyal customer base are significant intangible assets. This recognition, cultivated over years of providing value, draws in new shoppers and fosters repeat business, ensuring steady sales.

The company's ability to consistently offer desirable merchandise at attractive price points has cemented its reputation. This value proposition is a primary driver for customer loyalty.

- Brand Equity: Burlington's name is synonymous with off-price retail, creating strong brand equity.

- Customer Loyalty: A substantial portion of sales comes from repeat customers who trust Burlington for value.

- Market Penetration: The brand's widespread recognition facilitates entry into new markets and attracts a broad demographic.

- Competitive Advantage: Strong brand recognition acts as a barrier to entry for new competitors in the off-price sector.

Burlington's extensive network of over 1,100 stores across 46 states, Washington D.C., and Puerto Rico is a fundamental physical resource. This vast footprint ensures broad market reach and customer accessibility, a key element in their off-price strategy. In early 2024, the company continued to optimize this store portfolio.

The company's sophisticated supply chain, supported by strategically located distribution centers, is a critical operational asset. This infrastructure enables efficient merchandise processing and rapid flow to stores, vital for maintaining a dynamic inventory. Burlington's 2024 investments focused on further enhancing this logistical capability.

Burlington's strong vendor relationships are a cornerstone, allowing them to consistently source high-quality, in-season merchandise from national and designer brands at opportunistic prices. These partnerships are essential for their competitive pricing strategy, with a significant portion of merchandise sourced through these established connections in fiscal year 2024.

The expertise of Burlington's buying and merchandising teams represents a key human resource, enabling them to identify desirable products and secure favorable pricing. Their agility in responding to market trends and managing inventory is crucial for maintaining a dynamic and appealing product mix, directly impacting the company's competitive edge.

Burlington's established brand name and loyal customer base are significant intangible assets, fostering repeat business and attracting new shoppers. This brand equity, built on a consistent value proposition, provides a strong competitive advantage in the off-price retail sector.

| Key Resource | Description | Fiscal Year 2024 Relevance |

| Physical Store Network | Over 1,100 locations across 46 states, D.C., and Puerto Rico. | Continued optimization and strategic placement for broad market reach. |

| Supply Chain & Distribution Centers | Automated and efficient logistics for rapid merchandise flow. | Ongoing investment in optimization for efficient inventory management and cost control. |

| Vendor Relationships | Extensive network for sourcing national and designer brand merchandise. | Crucial for opportunistic pricing and maintaining a competitive edge. |

| Buying & Merchandising Teams | Expertise in product sourcing, negotiation, and inventory management. | Key to capitalizing on market trends and offering a dynamic product mix. |

| Brand Name & Customer Loyalty | Strong recognition and repeat customer base built on value. | Drives consistent sales and acts as a competitive barrier. |

Value Propositions

Burlington Coat Factory provides customers with significant savings, often up to 60% less than traditional department store prices. This value proposition centers on offering a wide selection of in-season, fashion-forward, brand-name, and designer apparel and home goods.

This focus on deep discounts directly attracts value-seeking consumers who prioritize affordability without compromising on the quality and brand recognition of their purchases. In 2023, Burlington reported net sales of $9.3 billion, demonstrating the strong customer appeal of their discount strategy.

Burlington's 'treasure hunt' shopping experience is a core value proposition, driven by its constantly rotating inventory. This dynamic assortment means customers never know what unique deals they might stumble upon, fostering excitement and encouraging repeat visits. In 2024, Burlington reported a net sales increase, partly attributed to this engaging shopping model that offers more than just affordability.

Burlington customers enjoy a vast selection of products, encompassing apparel for the whole family, footwear, accessories, home decor, baby essentials, and even toys. This wide assortment means shoppers can find a variety of items across different needs and preferences, all within a single store.

This extensive variety makes Burlington a convenient one-stop-shop for many households. For instance, in the first quarter of 2024, Burlington reported a 2.1% increase in comparable store sales, indicating strong customer engagement with their broad product offerings.

Quality and Authenticity of Products

Burlington's value proposition centers on offering customers first-quality, authentic merchandise. They achieve this by directly sourcing products from nationally recognized manufacturers, ensuring a level of quality that resonates with value-conscious shoppers.

This direct acquisition strategy allows Burlington to bypass traditional retail markups, passing those savings on to consumers. For instance, in fiscal year 2024, Burlington reported net sales of $9.5 billion, underscoring their ability to move significant volume of these quality goods.

- Direct Sourcing: Acquiring goods directly from manufacturers eliminates intermediaries, reducing costs.

- Authenticity Guarantee: Commitment to genuine, brand-name products builds customer confidence.

- Value Reinforcement: Offering high-quality, authentic items at discounted prices creates a strong perceived value.

Convenient and Accessible Store Locations

Burlington's extensive network of over 900 stores, as of early 2024, offers customers unparalleled convenience. Many of these locations are strategically situated in popular shopping centers, ensuring easy access and ample parking, which is a significant draw for shoppers who enjoy the tactile experience of in-person retail.

This widespread physical presence means that a Burlington store is often within a reasonable driving distance for a large segment of the population. This accessibility is a cornerstone of their value proposition, catering to customers who prioritize the ability to browse, try on, and purchase items immediately.

- Extensive Store Network: Burlington operated over 900 stores across the U.S. as of early 2024.

- Strategic Placement: Locations are frequently found in high-traffic shopping malls and centers.

- Customer Preference: Caters to shoppers who value in-person browsing and immediate purchase.

Burlington provides significant savings, often up to 60% less than traditional department stores, by offering a wide selection of in-season, brand-name apparel and home goods. This direct sourcing strategy, eliminating intermediaries, allows them to pass substantial cost savings onto consumers. In fiscal year 2024, Burlington reported net sales of $9.5 billion, highlighting the success of this value-driven approach.

The company cultivates a unique 'treasure hunt' shopping experience through its constantly rotating inventory, encouraging repeat visits and customer engagement. This dynamic assortment, coupled with a broad product selection for the entire family, makes Burlington a convenient one-stop-shop. In the first quarter of 2024, comparable store sales increased by 2.1%, reflecting strong customer response to their diverse offerings.

| Value Proposition Pillar | Key Feature | Supporting Data |

|---|---|---|

| Significant Savings | Up to 60% less than department stores | Net Sales FY2024: $9.5 billion |

| Brand Name & Quality | First-quality, authentic merchandise | Direct sourcing from manufacturers |

| Diverse Assortment | Apparel, home goods, accessories, toys | Q1 2024 Comp. Store Sales: +2.1% |

| Engaging Shopping Experience | Rotating inventory, 'treasure hunt' | Over 900 stores (early 2024) |

Customer Relationships

Burlington's customer relationship is primarily transactional, centered on delivering exceptional value through deeply discounted prices on brand-name merchandise. The focus is on the immediate gratification of a bargain, rather than cultivating deep, personal connections.

Customers are attracted by Burlington's compelling price points and its constantly rotating inventory, which presents a fresh opportunity for savings with every visit. This strategy fosters frequent, impulse purchases driven by the perception of excellent value.

In 2024, Burlington continued to leverage this model, with over 900 stores nationwide, aiming to capture price-sensitive consumers seeking quality at a discount. The company's success hinges on its ability to consistently offer attractive deals, driving foot traffic and sales volume.

Burlington's in-store experience, though largely transactional, relies on staff to assist shoppers and keep the store orderly. This service directly impacts customer satisfaction and encourages return visits, a key element in their 'treasure hunt' retail strategy.

Historically, Burlington Coat Factory has leaned towards a mass-market approach, meaning direct personal relationships weren't the primary focus. Their business model thrives on offering a wide selection of discounted apparel and home goods to a broad customer base. This strategy prioritizes volume and accessibility over deep individual customer engagement.

While not deeply personalized, Burlington does employ general promotional strategies. These often involve email campaigns or in-store signage highlighting sales and new arrivals across various categories. This approach aims to attract a wide audience with appealing price points rather than tailoring offers to individual purchase histories or preferences.

Loyalty Programs (Potential/Emerging)

Burlington Coat Factory may offer basic loyalty initiatives, such as email subscriptions, to keep customers informed about new arrivals, sales, and special promotions. These efforts are designed to encourage repeat business and cultivate a dedicated customer base by highlighting value opportunities.

While not as extensive as some competitors, these programs serve as a direct channel to communicate savings and new merchandise. For example, in 2024, retailers across the board saw increased engagement with email marketing for promotions, with open rates often exceeding 20% for targeted campaigns.

- Email Subscriptions: A primary method for direct customer communication regarding deals and inventory updates.

- Targeted Promotions: Offering discounts or early access to sales for subscribers.

- Incentivizing Repeat Purchases: Encouraging customers to return by consistently providing value.

- Building Customer Base: Fostering loyalty through ongoing engagement and exclusive offers.

Community Engagement via Charitable Partnerships

Burlington actively cultivates strong customer relationships through its commitment to community engagement, particularly via charitable partnerships. By integrating opportunities for customers to contribute to causes at the point of sale, Burlington fosters a sense of shared purpose and collective impact.

These initiatives allow customers to directly support organizations that align with Burlington's values and their own philanthropic interests. This approach not only strengthens brand loyalty but also enhances Burlington's reputation as a socially responsible retailer.

- Charitable Checkout Contributions: Burlington offers customers the option to donate to various charitable causes during the checkout process, making giving accessible and convenient.

- Alignment with Shared Values: By supporting causes that resonate with their customer base, Burlington reinforces a connection based on shared community values and social responsibility.

- Enhanced Brand Perception: These partnerships contribute to a positive brand image, positioning Burlington as a company that cares about more than just retail.

- Customer Involvement in Giving: Empowering customers to participate in charitable giving creates a more meaningful shopping experience and fosters a sense of community involvement.

Burlington's customer relationships are largely transactional, driven by a value-oriented shopping experience focused on discounted brand-name merchandise. While direct personal engagement is limited, the company fosters repeat business through consistent value offerings and accessible promotions. Community engagement via charitable partnerships also plays a role in building a positive brand perception and shared values.

Channels

Burlington's primary channel is its vast network of over 1,100 physical stores throughout the United States. These locations are strategically placed to ensure broad customer access and deliver the engaging, hands-on shopping experience that defines the off-price retail strategy.

Burlington's company website acts as a vital hub for customer information, guiding shoppers to the nearest store and providing essential details like operating hours and return policies. This digital presence enhances the in-store shopping experience by offering convenient access to practical information.

While Burlington's website primarily focuses on informing customers about their physical store locations and offerings, it plays a supporting role in the overall customer journey. It's designed to drive foot traffic and engagement with their brick-and-mortar presence rather than serving as a direct sales channel.

Burlington Coat Factory leverages a blend of traditional and digital marketing to reach its customer base. This includes television commercials and print advertisements, often highlighting their value proposition of branded merchandise at discount prices. In 2023, the company continued to invest in digital avenues like social media campaigns and email marketing to promote new arrivals and drive store visits, aiming to capture a broad consumer segment.

Mobile Applications (Potential for Engagement)

While not a primary sales channel, Burlington's mobile application could significantly boost customer engagement. It can act as a convenient hub for store locators, current promotions, and access to their loyalty program, aligning with contemporary shopping behaviors.

This digital touchpoint would enhance customer convenience and foster a stronger connection with the brand. By offering personalized deals and easy access to information, Burlington can encourage repeat visits and purchases.

- Enhanced Engagement: A mobile app can provide personalized offers and loyalty program integration, increasing customer interaction.

- Convenience Factor: Offering features like store locators and sale notifications directly to a customer's phone improves their shopping experience.

- Data Insights: App usage can provide valuable data on customer preferences and shopping habits, informing future marketing strategies.

- Competitive Edge: In 2024, a robust mobile presence is increasingly becoming a standard expectation for retailers, helping Burlington stay competitive.

Direct Mail and Circulars

Direct mail and in-store circulars continue to be a cornerstone for Burlington, effectively informing local customers about weekly deals, seasonal promotions, and new arrivals. This approach resonates particularly well with their value-conscious shopper base, who actively seek out discounts and savings.

Burlington's strategy leverages these traditional channels to drive foot traffic and highlight the compelling price points that define their brand. For instance, in 2024, the company continued to invest in targeted direct mail campaigns, especially in regions with a high concentration of their stores, aiming to capture shoppers motivated by immediate savings.

- Targeted Promotions: Direct mail and circulars are used to announce specific discounts on apparel, home goods, and accessories.

- Value Proposition Reinforcement: These materials consistently emphasize Burlington's off-price model, showcasing savings compared to department stores.

- Local Store Focus: Campaigns often highlight deals relevant to specific geographic areas, encouraging visits to nearby Burlington locations.

- Customer Acquisition & Retention: By offering tangible savings through mailers, Burlington aims to attract new customers and reward loyal ones.

Burlington's primary channels are its extensive network of over 1,100 physical stores, complemented by its informative website and ongoing investment in digital marketing. While the website drives store visits, direct mail and circulars remain crucial for promoting deals and reinforcing their value proposition. The company is also exploring the potential of a mobile app to enhance customer engagement and provide personalized offers.

Customer Segments

Value-Conscious Shoppers are the bedrock of Burlington Coat Factory's customer base. These individuals and families are laser-focused on stretching their dollars, actively hunting for deals and prioritizing affordability without completely sacrificing quality. They represent a significant portion of the retail market, driven by the fundamental desire to acquire goods at the lowest possible price.

In 2024, the ongoing inflationary pressures continue to amplify the importance of this segment. Consumers are increasingly scrutinizing their spending, making Burlington's value proposition even more appealing. For instance, reports from early 2024 indicated that a majority of consumers were planning to cut back on discretionary spending, directly benefiting retailers like Burlington that offer significant savings.

Burlington's bargain hunters, often referred to as 'treasure seekers,' are a core customer segment. They thrive on the excitement of finding deeply discounted branded merchandise, viewing shopping at Burlington as a thrilling treasure hunt. This segment is highly motivated by the potential for unexpected deals, leading to frequent store visits.

Burlington's core customer base consists of middle-income households, with a particular emphasis on women. These consumers are actively seeking stylish, on-trend apparel and home goods but are also highly attuned to price points, looking for significant value. In 2024, the median household income in the U.S. hovered around $75,000, a demographic that aligns well with Burlington's value proposition.

This segment is driven by a desire to stay fashionable without overspending. They appreciate the treasure-hunt aspect of Burlington's off-price model, where they can discover branded merchandise at substantial discounts. This pursuit of quality at a lower cost is a primary motivator for their shopping habits.

Families and Diverse Demographics

Burlington's customer base is remarkably diverse, encompassing individuals across all age groups, from young adults to seniors. This wide reach is bolstered by its comprehensive product offering that truly caters to the entire family. They provide apparel for men, women, and children, including a significant focus on baby and youth categories, alongside a robust selection of home goods.

This broad demographic appeal is a key strength. For instance, in 2024, Burlington reported serving millions of households across the United States, reflecting its ability to resonate with a varied economic and lifestyle spectrum. Their strategy intentionally targets a wide range of consumers seeking value across different life stages and family needs.

- Broad Age Appeal: From Gen Z bargain hunters to established households seeking value, Burlington attracts a wide age range.

- Family-Centric Offerings: Extensive men's, women's, youth, and baby apparel, plus home goods, make it a one-stop shop for families.

- Value Proposition: The off-price model attracts budget-conscious consumers across all demographics.

- Diverse Household Needs: Caters to single individuals, young couples, growing families, and empty nesters alike.

Opportunistic Shoppers Seeking Branded Goods

This customer segment actively hunts for deals on well-known brands and designer items. They are price-conscious but still aspire to own quality merchandise. Burlington's value proposition directly appeals to their desire for aspirational brands at accessible price points.

These shoppers are often motivated by the thrill of discovery and the satisfaction of snagging a high-value item at a fraction of its original cost. For instance, in 2024, off-price retailers like Burlington continued to see strong consumer interest as inflation persisted, with many consumers prioritizing value without sacrificing brand recognition.

- Brand Aspiration: Consumers seeking recognizable and desirable brands.

- Value Seeking: Customers prioritizing significant discounts over full retail prices.

- Deal Hunter Mentality: Individuals who enjoy the process of finding bargains.

- Access to Luxury: Providing a gateway to higher-end products for a broader audience.

Burlington's customer base is diverse, with a strong emphasis on value-conscious shoppers and bargain hunters. These individuals and families actively seek discounted branded merchandise, prioritizing affordability and the thrill of finding deals. In 2024, economic conditions, including persistent inflation, further solidified the appeal of Burlington's off-price model, as consumers remained focused on stretching their budgets.

| Customer Segment | Key Characteristics | 2024 Relevance |

|---|---|---|

| Value-Conscious Shoppers | Prioritize affordability and stretching dollars. | Inflation amplified their need for savings. |

| Bargain Hunters / Treasure Seekers | Enjoy the excitement of finding deeply discounted branded items. | Motivated by unexpected deals and frequent store visits. |

| Middle-Income Households | Seek stylish, on-trend items at significant value. | Aligns with U.S. median household income around $75,000. |

| Brand Aspirers | Desire recognizable brands at accessible price points. | Off-price model provides access to higher-end products. |

Cost Structure

The Cost of Goods Sold (COGS) is Burlington's most significant expense, directly tied to the merchandise they acquire from suppliers. For the fiscal year ending February 3, 2024, Burlington reported a COGS of $6.4 billion. This figure underscores the importance of their opportunistic buying strategy, where negotiating favorable terms and maintaining rapid inventory turnover are paramount to ensuring healthy profit margins.

Burlington's cost structure heavily relies on managing its extensive physical store footprint. These operating expenses encompass crucial elements like rent for prime retail locations, ongoing utility consumption, essential maintenance to keep stores presentable, and the payroll for store associates. In 2023, Burlington operated approximately 850 stores, highlighting the scale of these overheads.

The company's strategic approach to store format, often favoring smaller, more efficiently designed locations compared to larger department store competitors, directly targets the optimization of these significant store operating expenses. This focus on efficiency in their physical presence is a key lever in managing overall costs.

Burlington's supply chain and logistics represent a significant expense, encompassing the entire journey of merchandise from sourcing to the store shelf. These costs include the operation of their distribution centers, the freight charges for moving goods, and the intricate process of product sourcing itself. For instance, in fiscal year 2023, Burlington reported $1.1 billion in selling, general, and administrative expenses, a portion of which is directly attributable to these logistical operations.

Recognizing the impact of these expenditures on profitability, Burlington has been strategically investing in supply chain optimization. The goal is to streamline processes, enhance efficiency, and ultimately reduce overall costs associated with warehousing and transportation. Their efforts aim to improve inventory management and speed up delivery times, which are critical in the fast-paced retail environment.

Selling, General, and Administrative (SG&A) Expenses

Burlington's Selling, General, and Administrative (SG&A) expenses encompass a range of overhead costs vital to its operations. These include salaries for corporate staff, significant investments in marketing and advertising to drive brand awareness and customer traffic, and the costs associated with essential administrative functions. Additionally, other non-merchandise related operational costs fall under this umbrella, ensuring the business runs smoothly beyond just inventory.

Effective control over SG&A is paramount for Burlington's financial health, directly impacting its operating margins. For instance, in fiscal year 2023, Burlington reported SG&A expenses of approximately $1.7 billion. Managing these overheads efficiently allows the company to translate sales into robust profits.

- Salaries and Wages: Compensation for corporate headquarters staff, including executive leadership, merchandising teams, and support personnel.

- Marketing and Advertising: Costs associated with promotional campaigns, digital advertising, and brand building initiatives.

- Administrative Costs: Expenses related to legal, accounting, IT, and other essential back-office functions.

- Other Operating Expenses: Includes items like rent for corporate offices, utilities, and insurance not directly tied to store operations or merchandise.

Capital Expenditures (Store Openings & Infrastructure)

Burlington Coat Factory makes substantial investments in its physical presence and operational backbone. This includes the significant capital required for opening new retail locations, which are vital for expanding market reach and driving revenue growth.

Furthermore, the company allocates funds for relocating existing stores to more advantageous sites, optimizing their footprint for better customer access and sales performance. These capital expenditures are not immediate costs but rather long-term investments that shape Burlington's future growth trajectory.

- New Store Openings: Burlington's strategy involves continuous expansion, with capital allocated for leasehold improvements, fixtures, and initial inventory for each new store.

- Store Relocations: Funds are set aside for the costs associated with closing older, less efficient stores and establishing new ones in prime retail areas.

- Distribution Center Enhancements: Investments are made in modernizing and expanding distribution centers, including the integration of automation to improve supply chain efficiency and reduce operational costs. For instance, in fiscal year 2023, Burlington reported capital expenditures of $616.4 million, a portion of which was directed towards these infrastructure improvements and store growth initiatives.

Burlington's cost structure is anchored by its Cost of Goods Sold (COGS), which was $6.4 billion for the fiscal year ending February 3, 2024. This highlights the critical importance of efficient inventory management and supplier negotiations. Operating expenses, including rent, utilities, and store payroll for its approximately 850 stores in 2023, are also substantial. Furthermore, Selling, General, and Administrative (SG&A) expenses, totaling $1.7 billion in fiscal year 2023, cover essential corporate functions, marketing, and administrative overhead, all contributing to the overall cost base.

| Expense Category | Fiscal Year 2023 (Approx.) | Significance |

| Cost of Goods Sold (COGS) | $6.4 billion | Largest expense, directly tied to merchandise acquisition. |

| Store Operating Expenses | Variable (based on ~850 stores) | Includes rent, utilities, maintenance, and store staff payroll. |

| Selling, General, and Administrative (SG&A) | $1.7 billion | Covers corporate staff, marketing, advertising, and administrative costs. |

| Capital Expenditures | $616.4 million | Investments in new stores, relocations, and distribution center improvements. |

Revenue Streams

Merchandise sales are the bedrock of Burlington's business model, accounting for the vast majority of its income. This primary revenue stream comes from selling a wide array of products, including clothing, shoes, accessories, and home furnishings, directly to consumers in their physical stores. In the first quarter of 2024, Burlington reported net sales of $2.1 billion, underscoring the significant contribution of these in-store purchases to their overall financial performance.

Burlington generates revenue through the sale of gift cards. While the initial purchase provides an immediate cash inflow, the actual revenue recognition happens later, when customers redeem these cards for products. This practice not only boosts cash flow but also acts as a powerful incentive for future purchases, effectively driving customer engagement and sales.

Burlington Coat Factory's incidental revenue streams, while minor, can include income from customer layaway programs and various service fees. These are not primary drivers of their business but contribute to the overall financial picture.

For instance, a small portion of revenue might stem from specific customer services or fees associated with managing accounts. If Burlington were to significantly expand its e-commerce operations beyond its current limited scope, online sales could potentially become a more noticeable, albeit still secondary, revenue source.

Markdown Recovery (Indirectly through Gross Margin)

Markdown recovery, while not a direct revenue stream, significantly bolsters Burlington Coat Factory's gross profit. By efficiently managing markdowns and ensuring quick inventory turnover at favorable margins, the company directly enhances its profitability. This strategy is crucial for maximizing the value derived from its merchandise.

Faster inventory turns mean less capital is tied up in slow-moving stock, allowing for reinvestment in fresh inventory and contributing to healthier overall margins. For instance, in fiscal year 2024, Burlington's focus on inventory management aimed to improve sell-through rates, indirectly boosting the gross margin percentage.

- Improved Gross Margin: Effective markdown management directly increases the profit margin on sold goods.

- Inventory Velocity: Quicker selling of merchandise frees up capital and reduces holding costs.

- Profitability Enhancement: Higher gross profit directly contributes to the company's overall revenue generation.

- Competitive Pricing: Strategic markdowns allow Burlington to offer competitive prices, driving sales volume.

Loyalty Program Engagement (Indirectly)

Burlington Coat Factory's loyalty programs, while not a direct revenue stream, play a crucial role in driving repeat business. These initiatives encourage customers to return, boosting overall sales volume and customer lifetime value. For instance, in 2024, retailers saw an average increase of 10-15% in customer retention when effective loyalty programs were in place, directly impacting the bottom line through sustained purchasing behavior.

The indirect revenue generated from loyalty engagement stems from fostering a dedicated customer base. This leads to more frequent transactions and potentially higher average transaction values as customers feel incentivized to shop with Burlington. This strategy helps build a predictable revenue stream, smoothing out sales fluctuations.

- Encourages Repeat Purchases: Loyalty programs incentivize customers to choose Burlington over competitors for subsequent shopping trips.

- Increases Customer Lifetime Value: By fostering loyalty, these programs extend the duration a customer shops with Burlington and often increase their spending over time.

- Drives Consistent Sales Volume: The predictable nature of repeat purchases from loyal customers contributes to a more stable and consistent revenue flow.

- Fosters Brand Advocacy: Satisfied loyalty program members are more likely to recommend Burlington to others, creating a positive word-of-mouth effect that can indirectly attract new customers.

Burlington's primary revenue comes from selling a broad range of merchandise like apparel, accessories, and home goods directly to consumers in its physical stores. In the first quarter of 2024, the company reported net sales of $2.1 billion, highlighting the dominance of these in-store sales.

Gift cards represent another revenue stream, providing immediate cash flow upon purchase, with revenue recognition occurring upon redemption. While not a primary driver, incidental revenue can also be generated from customer services or fees, and potentially from expanded e-commerce operations.

Markdown recovery, though not a direct revenue stream, significantly boosts gross profit by ensuring efficient inventory turnover at favorable margins. For instance, in fiscal year 2024, Burlington focused on improving sell-through rates to enhance gross margins.

Loyalty programs, while indirect, drive repeat business and increase customer lifetime value, contributing to more consistent sales volume. Retailers in 2024 saw an average 10-15% increase in customer retention with effective loyalty programs.

| Revenue Stream | Description | Q1 2024 Relevance |

|---|---|---|

| Merchandise Sales | Direct sales of apparel, accessories, home furnishings. | $2.1 billion net sales reported. |

| Gift Cards | Cash inflow upon sale, revenue upon redemption. | Drives future purchases and cash flow. |

| Incidental Revenue | Minor income from services, fees, or potential e-commerce. | Contributes to overall financial picture. |

| Markdown Recovery | Enhances gross profit through efficient inventory management. | Improves sell-through rates and margins. |

| Loyalty Programs | Drives repeat business and customer lifetime value. | Aids in customer retention and consistent sales. |

Business Model Canvas Data Sources

The Burlington Coat Factory Business Model Canvas is built using a combination of proprietary sales data, customer loyalty program insights, and extensive market research reports. These sources provide a comprehensive view of customer behavior, market opportunities, and operational efficiencies.