Burlington Coat Factory Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burlington Coat Factory Bundle

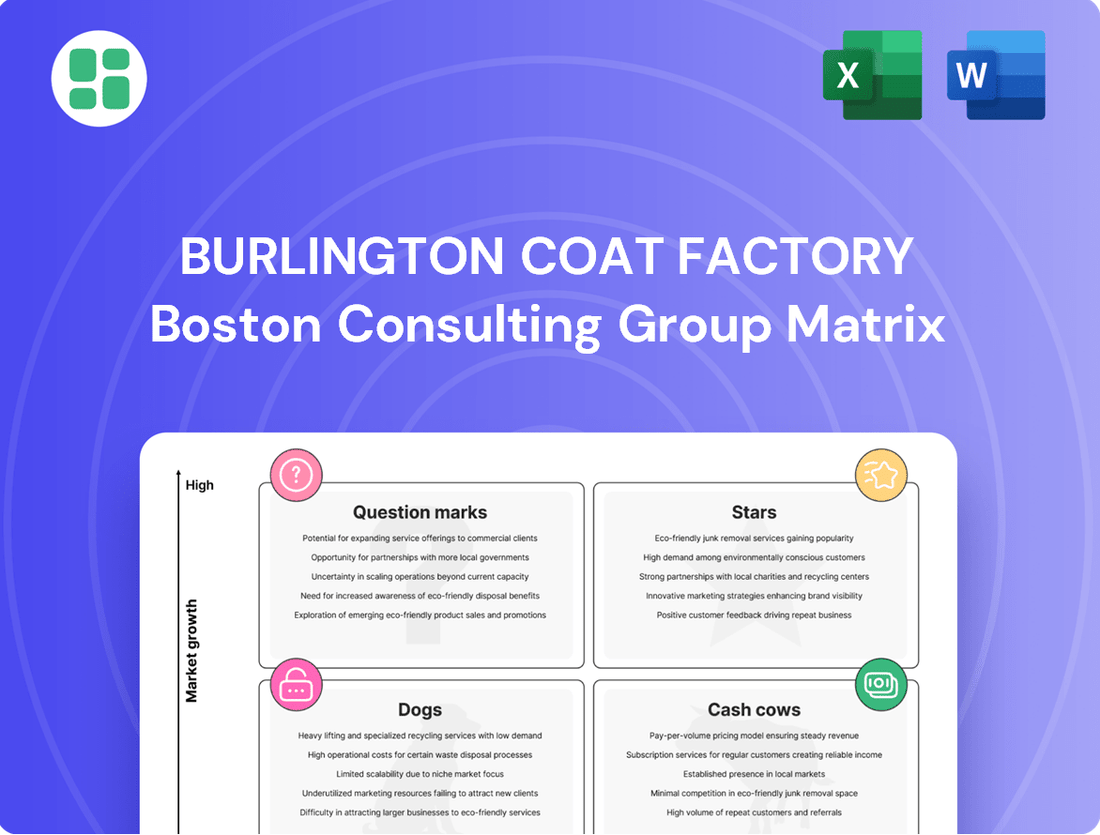

Curious about Burlington Coat Factory's strategic positioning? Our BCG Matrix analysis reveals which of their offerings are potential Stars, Cash Cows, Dogs, or Question Marks. Understanding these dynamics is crucial for any business looking to optimize its portfolio.

Don't miss out on the full picture! Purchase the complete BCG Matrix report for Burlington Coat Factory to gain actionable insights and a clear roadmap for capitalizing on opportunities and mitigating risks. It's your key to informed strategic decisions.

Stars

Burlington's aggressive store expansion, targeting around 100 net new stores annually, positions them as a strong contender in the Stars category of the BCG Matrix. This growth is fueled by opportunistic real estate acquisitions from competitors facing difficulties.

By entering new geographic markets and adopting smaller, more efficient store formats, Burlington is effectively capturing new market share within the burgeoning off-price retail sector. Their long-term vision of reaching 2,000 locations underscores this commitment to high growth and market dominance.

Burlington's home goods segment is a strong contender, likely positioned as a Star in the BCG Matrix. This category is experiencing robust growth, fueled by a sustained consumer interest in home improvement and creating comfortable living spaces, a trend that continued strongly through 2024. Burlington's strategic expansion into home merchandise, moving beyond its core apparel offerings, presents a prime opportunity to capture a larger share of this expanding market.

Burlington's core strength lies in its opportunistic buying strategy. They excel at acquiring brand-name and designer goods at steep discounts, ensuring their inventory remains dynamic and attractive to shoppers. This approach allows them to swiftly leverage market trends and clear overstock from other retailers, a key driver of customer engagement and sales volume.

Value-Driven Consumer Appeal

Burlington's strategy of offering discounted branded merchandise strongly attracts consumers seeking value, particularly those with lower to middle incomes. This focus is especially potent in uncertain economic times when affordability becomes a primary concern for a significant portion of the population.

The company's emphasis on value positions it well in a market where price sensitivity is high. This trend is evidenced by the robust growth observed in the off-price retail sector. For instance, in 2023, the US off-price apparel market saw continued expansion, with companies like Burlington benefiting from increased consumer spending on discounted items.

- Value Proposition: Burlington's core offering of discounted branded goods directly addresses consumer demand for affordability.

- Market Resonance: This value-driven appeal is particularly effective during economic downturns, capturing a broad consumer base.

- Growth Driver: The heightened demand for off-price products fuels Burlington's sales growth and market share expansion.

- Industry Trend: The off-price sector, including apparel, demonstrated resilience and growth in 2023, underscoring Burlington's strategic advantage.

Supply Chain Productivity Improvements

Burlington's strategic investments in supply chain technology and process optimization have yielded tangible results, directly impacting their bottom line. These improvements are crucial for maintaining their competitive edge in the dynamic off-price retail market.

The company's focus on supply chain efficiency is translating into margin expansion. For instance, in the first quarter of 2024, Burlington reported a significant improvement in their operating margin, partly attributed to these initiatives. This operational excellence allows them to manage inventory more effectively, reducing carrying costs and enabling faster turnover, which is key to their value proposition.

By streamlining logistics and improving inventory management, Burlington can offer consistently competitive pricing to its customers. This operational advantage supports their substantial market share within the growing off-price retail sector, a segment that has shown robust growth throughout 2023 and into early 2024.

- Supply Chain Investments: Burlington has been actively investing in advanced supply chain management systems and automation to enhance efficiency.

- Margin Expansion: These investments are directly contributing to margin expansion, with reported operating margin improvements in early 2024.

- Cost Reduction and Inventory Turnover: Enhanced efficiency leads to lower operational costs and faster inventory turnover, bolstering profitability.

- Competitive Pricing and Market Share: The operational gains enable competitive pricing, solidifying Burlington's strong position in the growing off-price retail market.

Burlington's aggressive store expansion, targeting around 100 net new stores annually, positions them as a strong contender in the Stars category of the BCG Matrix. This growth is fueled by opportunistic real estate acquisitions from competitors facing difficulties.

By entering new geographic markets and adopting smaller, more efficient store formats, Burlington is effectively capturing new market share within the burgeoning off-price retail sector. Their long-term vision of reaching 2,000 locations underscores this commitment to high growth and market dominance.

Burlington's home goods segment is a strong contender, likely positioned as a Star in the BCG Matrix. This category is experiencing robust growth, fueled by a sustained consumer interest in home improvement and creating comfortable living spaces, a trend that continued strongly through 2024. Burlington's strategic expansion into home merchandise, moving beyond its core apparel offerings, presents a prime opportunity to capture a larger share of this expanding market.

Burlington's core strength lies in its opportunistic buying strategy. They excel at acquiring brand-name and designer goods at steep discounts, ensuring their inventory remains dynamic and attractive to shoppers. This approach allows them to swiftly leverage market trends and clear overstock from other retailers, a key driver of customer engagement and sales volume.

Burlington's strategy of offering discounted branded merchandise strongly attracts consumers seeking value, particularly those with lower to middle incomes. This focus is especially potent in uncertain economic times when affordability becomes a primary concern for a significant portion of the population.

The company's emphasis on value positions it well in a market where price sensitivity is high. This trend is evidenced by the robust growth observed in the off-price retail sector. For instance, in 2023, the US off-price apparel market saw continued expansion, with companies like Burlington benefiting from increased consumer spending on discounted items.

Burlington's strategic investments in supply chain technology and process optimization have yielded tangible results, directly impacting their bottom line. These improvements are crucial for maintaining their competitive edge in the dynamic off-price retail market.

The company's focus on supply chain efficiency is translating into margin expansion. For instance, in the first quarter of 2024, Burlington reported a significant improvement in their operating margin, partly attributed to these initiatives. This operational excellence allows them to manage inventory more effectively, reducing carrying costs and enabling faster turnover, which is key to their value proposition.

By streamlining logistics and improving inventory management, Burlington can offer consistently competitive pricing to its customers. This operational advantage supports their substantial market share within the growing off-price retail sector, a segment that has shown robust growth throughout 2023 and into early 2024.

| Category | Growth Rate | Market Share | Burlington's Position |

|---|---|---|---|

| Apparel (Off-Price) | High | High | Star |

| Home Goods | High | Growing | Star |

| Store Expansion | High | Expanding | Star |

What is included in the product

BCG Matrix for Burlington Coat Factory analyzes its product categories as Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for each business unit.

The Burlington Coat Factory BCG Matrix offers a clear, one-page overview of each business unit's position, relieving the pain of unclear strategic direction.

Cash Cows

Burlington's core apparel offerings, encompassing women's, men's, and youth categories, are the bedrock of its business, consistently acting as powerful cash cows. These departments are the company's stable income generators, benefiting from a well-established market presence and a loyal customer following.

These mature segments require less aggressive marketing spend due to their consistent demand and significant market share. For instance, in the fiscal year 2023, Burlington reported net sales of $9.5 billion, with apparel categories forming the vast majority of this revenue, underscoring their cash-generating power.

Burlington's footwear and accessories departments are considered Cash Cows within its BCG Matrix. These segments consistently generate substantial revenue due to their stable and reliable performance in the off-price retail environment. For example, in fiscal year 2024, Burlington reported a 3% increase in comparable store sales, with footwear and accessories being key contributors to this growth, demonstrating their enduring appeal and consistent demand.

Seasonal merchandise, like winter coats and holiday decorations, are Burlington's historical strength and are considered cash cows. These are mature product lines that generate significant profits during their peak seasons. For instance, in the fiscal year ending January 2024, Burlington reported net sales of $9.5 billion, with seasonal items playing a crucial role in driving revenue during key shopping periods.

Established Store Network

Burlington's established store network, boasting over 1,100 locations across 46 states and Puerto Rico, forms the bedrock of its operations. This extensive physical footprint ensures consistent revenue generation and customer accessibility, acting as a significant cash cow within its business model.

These mature brick-and-mortar stores are highly efficient, benefiting from established customer traffic and optimized operational processes. They are the primary channel through which Burlington delivers its signature 'treasure hunt' shopping experience, reliably producing substantial cash flow.

- Over 1,100 Stores: Burlington operates a vast network, providing broad market coverage.

- 46 States & Puerto Rico: Significant geographic penetration ensures diverse customer reach.

- Established Customer Traffic: Mature locations benefit from consistent footfall and brand recognition.

- Operational Efficiencies: Long-standing presence allows for optimized supply chains and cost management, contributing to strong cash generation.

Value Proposition and Brand Recognition

Burlington's brand recognition as a go-to for discounted, quality goods is a significant asset. This strong reputation draws a broad customer base eager for value, ensuring steady sales without the need for extensive marketing to build initial awareness. In 2024, Burlington continued to leverage this established presence, with its off-price model consistently proving to be a reliable cash generator.

The company’s ability to consistently offer desirable merchandise at lower price points fuels customer loyalty and repeat business. This inherent value proposition is a key driver of its cash cow status, allowing for efficient inventory turnover and robust sales volume.

- Brand Recognition: Burlington is widely recognized as a premier destination for discounted, quality merchandise.

- Value-Seeking Customers: The brand attracts a broad demographic actively seeking value, leading to consistent sales.

- Off-Price Model: The company's flexible off-price strategy is a proven, consistent generator of cash flow.

- Reduced Marketing Spend: Established brand awareness minimizes the need for heavy initial marketing investment to attract customers.

Burlington's core apparel, footwear, and accessories segments are strong cash cows, consistently generating substantial revenue. These mature product lines benefit from established market share and customer loyalty, requiring less aggressive marketing spend. For instance, in fiscal year 2024, Burlington reported a 3% increase in comparable store sales, with these categories being key drivers of this growth.

The company's extensive store network, exceeding 1,100 locations, also acts as a significant cash cow. These mature, efficient stores benefit from consistent customer traffic and optimized operations, reliably producing substantial cash flow. Burlington's strong brand recognition as a value retailer further solidifies these segments' cash cow status, ensuring steady sales and efficient inventory turnover.

| Category | BCG Matrix Status | Key Drivers | Fiscal Year 2024 Data Point |

|---|---|---|---|

| Apparel (Women's, Men's, Youth) | Cash Cow | Established market presence, loyal customer base | Formed the majority of $9.5 billion in net sales (FY23) |

| Footwear & Accessories | Cash Cow | Stable performance, enduring appeal | Key contributors to 3% comparable store sales growth |

| Store Network | Cash Cow | Extensive physical footprint, operational efficiencies | Over 1,100 locations across 46 states and Puerto Rico |

Full Transparency, Always

Burlington Coat Factory BCG Matrix

The Burlington Coat Factory BCG Matrix preview you see is the definitive document you'll receive upon purchase, offering an unwatermarked and fully formatted analysis. This comprehensive report, designed for strategic clarity, is identical to the final version you'll download, ensuring immediate usability for your business planning. It’s a professionally crafted tool, ready for immediate application in your competitive analysis or team presentations without any hidden surprises.

Dogs

Merchandise that sits on Burlington's shelves for too long, perhaps because trends were misread or too much was purchased, falls into the 'Dog' category. This slow-moving stock is problematic because it locks up money that could be used elsewhere, costs money to store, and often needs deep discounts to be sold, which hurts profits.

For Burlington, keeping inventory moving quickly is key to their business. Stagnant inventory acts like an anchor, draining valuable resources that could be invested in more popular or profitable items. In 2024, a focus on agile supply chains and data-driven purchasing is crucial to minimize these 'Dogs'.

Underperforming store locations within Burlington Coat Factory, when analyzed through the BCG Matrix, would be classified as Dogs. These are outlets that consistently miss sales targets and demonstrate low profitability, despite the company's overall growth strategy. For instance, in early 2024, while Burlington announced plans to open 30 new stores, some existing locations continued to struggle, potentially due to factors like unfavorable demographics or intense local competition.

Burlington Coat Factory's prior decision to shutter its e-commerce operations strongly suggests its online sales channel was categorized as a 'Dog' in the BCG Matrix. This move was driven by a clear assessment that the online channel suffered from low sales volume and disproportionately high operating expenses when compared to its established brick-and-mortar business.

While many retailers have found significant success online, Burlington's analysis indicated that its e-commerce efforts were not generating adequate returns on investment. This strategic pivot underscores a business reality where some ventures, despite market trends, simply do not prove profitable enough to sustain.

The company's experience with its e-commerce site serves as a prime example of a potential cash trap. In 2023, the broader retail e-commerce sector saw continued growth, with online sales projected to reach over $1.1 trillion in the US alone, highlighting that Burlington's specific challenges were likely internal to its operational model rather than a reflection of the entire online market.

Niche or Less Popular Product Categories

Within Burlington Coat Factory's extensive product offerings, certain niche categories may be classified as Dogs in the BCG Matrix. These are products with low market share and low growth potential, often failing to capture significant customer attention or drive substantial sales volume. For instance, specialized seasonal items that don't resonate broadly or unique accessory lines with limited appeal might fall into this segment.

- Low Market Share: These niche products typically hold a small percentage of their respective product market.

- Low Growth Potential: The overall market for these specific items is not expanding significantly.

- Minimal Profit Contribution: Their low sales volume translates to a negligible impact on Burlington's overall profitability.

- Potential for Divestment: Companies often consider divesting or discontinuing such products to reallocate resources to more promising areas.

Inefficient Return Processes

Burlington Coat Factory's inefficient return processes could position them in the 'Dog' quadrant of the BCG Matrix. If the costs associated with handling customer returns, especially for items with high return frequencies or complex processing requirements, significantly outweigh the revenue generated from those returned goods, it negatively impacts profitability. This is particularly concerning for an off-price retailer where profit margins are already slender.

For instance, a high return rate on seasonal apparel, coupled with expensive restocking or refurbishment, can become a substantial drain on resources. In 2023, the retail industry saw return rates averaging around 16.5%, with apparel often being higher. If Burlington's return logistics are not optimized, these costs can easily erode the thin margins characteristic of their business model.

- High Return Processing Costs: Expenses related to shipping, inspecting, and restocking returned items.

- Low Recovery Value: Difficulty in reselling returned merchandise at a price that covers processing costs.

- Impact on Off-Price Margins: Inefficient returns disproportionately affect retailers operating on tighter profit margins.

Dogs within Burlington's operations represent underperforming assets with low market share and minimal growth prospects. These could include specific slow-moving inventory categories, or historically, their e-commerce venture which was discontinued due to low returns. In 2024, Burlington's strategy to focus on store optimization and curated inventory aims to reduce the presence of such 'Dogs'.

The company's approach to managing these 'Dogs' involves either improving their performance, such as through targeted promotions for slow-moving stock, or divesting them entirely, as seen with the e-commerce exit. Minimizing these low-return areas is crucial for freeing up capital for more profitable investments.

Burlington's commitment to efficient inventory management and strategic store portfolio review in 2024 directly addresses the 'Dog' quadrant. By identifying and addressing underperforming products or locations, the company aims to enhance overall operational efficiency and profitability.

The example of Burlington's past e-commerce operations highlights a 'Dog' scenario where high costs and low sales volume led to its closure. This strategic decision, made after assessing the venture's performance, underscores the importance of shedding underperforming business units to focus resources effectively.

Question Marks

Burlington's strategic pivot to smaller, more efficient store formats places them firmly in the Question Mark quadrant of the BCG matrix. This move is designed to boost profitability and accelerate expansion, but the ultimate market share and success of these newer, smaller footprints remain to be seen. In 2024, Burlington continued to refine this strategy, with a significant portion of their new store openings focusing on these more compact designs, reflecting a substantial investment in a high-growth, yet uncertain, future for this specific retail model.

Burlington's efforts to reimagine its store layout, featuring bold signage and organized aisles, fall into the Question Mark category of the BCG Matrix. These initiatives are designed to boost customer engagement and sales, but their ultimate impact on market share and overall ROI remains uncertain as adoption is still unfolding across their vast retail network.

Burlington's strategy of acquiring leases from bankrupt retailers, such as JOANN Fabrics and previously Bed Bath & Beyond, positions these new locations as Question Marks within its portfolio. These moves offer prime real estate at potentially lower costs, fueling expansion. However, the ultimate profitability and market penetration of these converted stores are still unfolding, making their long-term success uncertain.

Targeting Higher-Income 'Trade-Down' Shoppers

Burlington is actively trying to attract shoppers with slightly higher incomes who are choosing to spend less due to economic headwinds. This strategic shift positions this initiative as a Question Mark within the BCG matrix because it's a new demographic target with uncertain potential for market share gains. The company faces the challenge of appealing to this new segment without alienating its established base of value-conscious shoppers.

This strategy is a Question Mark because while the potential market is substantial, its success hinges on Burlington's ability to resonate with these 'trade-down' consumers. For instance, in 2024, a significant portion of consumers reported adjusting their spending habits, with many indicating a greater focus on value and discounts. Burlington's challenge is to demonstrate this value proposition effectively to a more discerning, albeit budget-conscious, audience.

- New Demographic Focus: Targeting higher-income shoppers trading down represents an expansion into a less familiar customer base.

- Unproven Market Share: The actual success of attracting and retaining this segment remains to be seen, making it a high-risk, high-reward endeavor.

- Balancing Act: Burlington must carefully manage its brand image and product assortment to appeal to both new and existing customers.

- Economic Sensitivity: The strategy is directly influenced by ongoing economic conditions that drive consumers to seek better value.

Integration of Technology for Operational Efficiency (beyond supply chain)

Burlington Coat Factory's integration of technology beyond its supply chain is crucial for enhancing overall operational efficiency and customer engagement. For instance, advanced data analytics can be leveraged to understand customer purchasing patterns, leading to more personalized marketing campaigns and tailored product assortments. This data-driven approach can significantly boost sales and customer loyalty.

Mobile app enhancements represent another key area for technological integration. Beyond basic store information, Burlington could implement features such as in-app personalized offers based on browsing history, loyalty program integration for seamless rewards, and even augmented reality features for virtual try-ons. These innovations can create a more engaging and convenient shopping experience.

The company's investment in these broader technological integrations, including AI for customer interactions, holds substantial potential for market share growth. However, the full impact and widespread adoption of these technologies are still in their nascent stages, meaning their complete benefits are yet to be fully realized.

- Personalized Offers: In 2024, retailers leveraging advanced analytics saw an average increase of 10-15% in conversion rates for personalized promotions.

- Mobile App Engagement: Companies with robust mobile apps reported a 20% higher customer retention rate compared to those with basic digital presences.

- AI in Customer Service: Early adopters of AI-powered customer service tools experienced a 25% reduction in response times and a 15% improvement in customer satisfaction scores.

- Data Analytics for Inventory: Effective use of data analytics in 2024 helped retailers reduce stockouts by up to 18% and minimize overstock situations.

Burlington's exploration of new technological integrations, such as AI for customer service and enhanced mobile app features, positions these initiatives as Question Marks. While these advancements promise increased efficiency and customer engagement, their ultimate impact on market share and profitability is still being determined. In 2024, the retail sector saw significant investment in AI-driven personalization, with early adopters reporting an average 10% uplift in sales from targeted campaigns.

These technological ventures are considered Question Marks because their success is not guaranteed, requiring substantial investment and strategic execution to gain market traction. Burlington's ability to effectively leverage these tools will be critical in determining whether they become Stars or falter in the competitive retail landscape. The company is investing in capabilities that could redefine customer interaction, but the return on these investments is still uncertain.

The company's focus on attracting a slightly higher-income demographic that is trading down due to economic pressures places this strategy in the Question Mark category. This represents an attempt to capture a new market segment, but the actual success in gaining market share and retaining these customers is yet to be proven. In 2024, economic conditions led many consumers to prioritize value, creating an opportunity for retailers like Burlington, but also increasing competition for this budget-conscious, yet potentially higher-spending, group.

| Initiative | BCG Category | Rationale | 2024 Relevance |

|---|---|---|---|

| New Store Formats | Question Mark | Expansion into smaller, efficient stores; market share and profitability uncertain. | Continued focus on compact store openings. |

| Store Layout Enhancements | Question Mark | Bold signage and organized aisles to boost engagement; ROI and market share impact pending. | Ongoing rollout across the retail network. |

| Acquiring Bankrupt Retailer Leases | Question Mark | Leveraging prime real estate at lower costs; long-term profitability and penetration uncertain. | Strategic lease acquisitions continue. |

| Targeting Higher-Income 'Trade-Down' Shoppers | Question Mark | New demographic focus with uncertain market share potential; requires careful brand balancing. | Direct response to economic headwinds driving value-seeking behavior. |

| Technological Integrations (AI, Mobile App) | Question Mark | Potential for efficiency and engagement; full benefits and adoption rates still emerging. | Investment in advanced analytics and AI for personalized marketing. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.