Burlington Coat Factory Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burlington Coat Factory Bundle

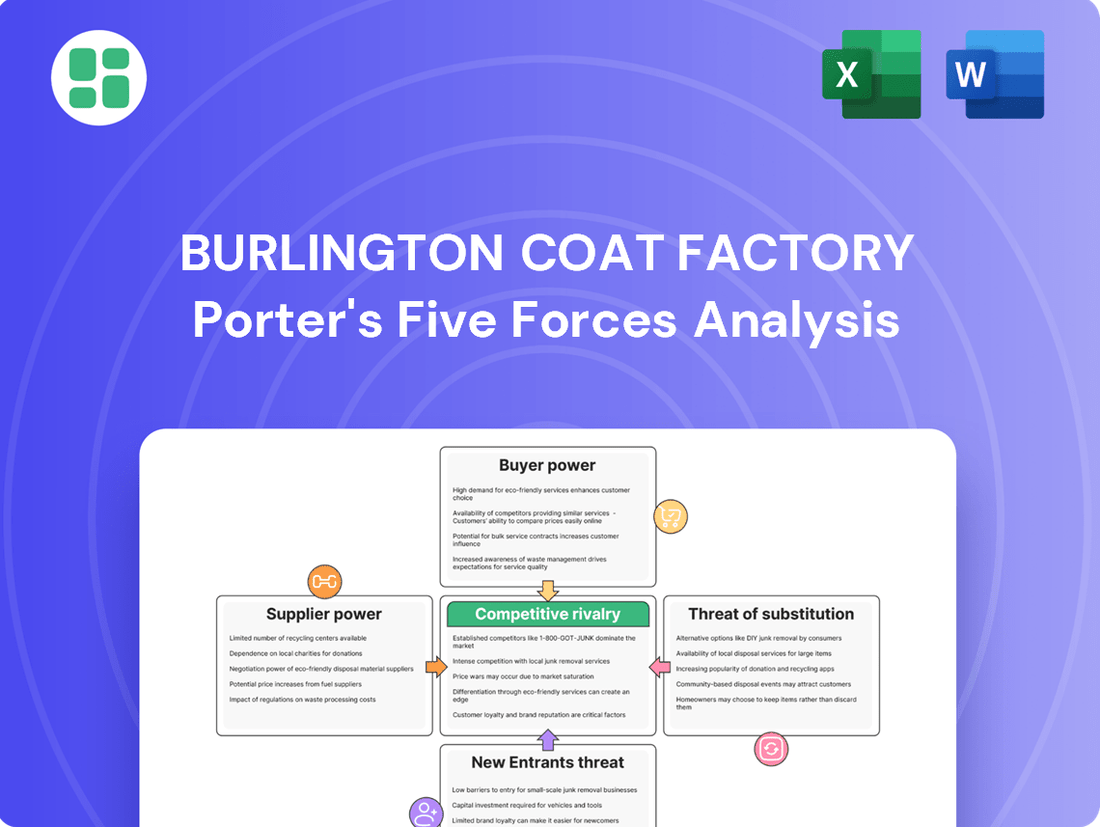

Burlington Coat Factory navigates a retail landscape shaped by moderate buyer power and intense rivalry, with the threat of new entrants being a significant factor. Understanding these dynamics is crucial for any player in the off-price apparel market.

The complete report reveals the real forces shaping Burlington Coat Factory’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Burlington's opportunistic buying strategy significantly diminishes supplier power. By focusing on acquiring excess inventory, closeouts, and irregulars, Burlington creates a competitive landscape among vendors eager to sell. This allows Burlington to dictate terms, as seen in their ability to secure favorable pricing on a substantial portion of their merchandise.

Burlington Coat Factory benefits from a highly fragmented supplier base, featuring a multitude of brand-name and designer manufacturers. This wide network means no single supplier can exert significant leverage over Burlington's purchasing decisions or pricing structures. In 2023, Burlington sourced from thousands of vendors globally, ensuring a diverse and competitively priced inventory.

Burlington's ability to easily switch between suppliers significantly weakens supplier power. With low switching costs, Burlington can readily find alternative vendors offering better pricing or terms, preventing any single supplier from dictating unfavorable conditions. This flexibility is a key advantage in managing their inventory costs.

Supplier Power 4

Suppliers often face pressure to quickly move inventory, especially when dealing with seasonal goods or overstock. This urgency, driven by warehousing costs and potential markdowns, significantly strengthens Burlington's negotiating leverage. For instance, in the retail sector, brands might offer discounts of 20-40% to off-price retailers like Burlington to avoid carrying unsold merchandise into the next season.

Burlington acts as a crucial outlet for suppliers looking to liquidate excess or end-of-line products. By providing this channel, Burlington allows vendors to recover costs without directly undermining their primary, full-price sales channels. This symbiotic relationship, where Burlington benefits from access to diverse inventory at favorable prices, tilts the scales in its favor for price discussions.

The ability of suppliers to absorb lower margins on these liquidation sales is often a key factor. In 2024, many apparel manufacturers continued to navigate supply chain adjustments and fluctuating consumer demand, making partnerships with off-price retailers like Burlington a strategic necessity for managing inventory efficiently.

Key factors influencing supplier power in this context include:

- Supplier's inventory levels: High inventory levels increase supplier willingness to negotiate favorable terms.

- Burlington's role as an exit channel: Burlington offers a distinct market for goods that might otherwise be difficult to sell.

- Supplier's financial health: Financially strained suppliers are more amenable to lower prices to ensure cash flow.

- Brand's distribution strategy: Brands seeking to protect their premium image may limit off-price sales, but still utilize them for specific inventory challenges.

Supplier Power 5

Burlington's significant purchasing volume and specialized buying expertise create a strong position with its suppliers. This expertise, honed over years, makes it challenging for suppliers to replicate the scale and efficiency of selling through Burlington to other large off-price retailers. In 2023, Burlington reported net sales of $8.7 billion, demonstrating its substantial buying power.

While suppliers do have other avenues to sell their merchandise, Burlington's consistent and large-scale demand for a diverse product mix offers a particularly attractive and efficient outlet. This reliability makes Burlington a key partner for many suppliers looking to manage their inventory effectively and reach a broad customer base.

- Burlington's buying power is substantial, evidenced by its $8.7 billion in net sales for 2023.

- Proprietary buying expertise and established vendor relationships limit supplier options.

- Burlington offers suppliers a unique, large-scale outlet for diverse merchandise.

- The retailer acts as a crucial partner for suppliers seeking efficient inventory solutions.

Burlington's bargaining power with suppliers is robust, largely due to its opportunistic buying model and the fragmented nature of its supplier base. This allows Burlington to secure favorable pricing and terms, as evidenced by its significant purchasing volume. In 2023, Burlington's net sales reached $8.7 billion, underscoring its considerable influence in the market.

Suppliers often find Burlington to be a critical outlet for excess or irregular inventory, a necessity amplified in 2024 as many manufacturers navigated ongoing supply chain adjustments and demand shifts. This urgency to move goods, coupled with Burlington's low switching costs among its thousands of global vendors, significantly reduces supplier leverage.

Burlington's ability to effectively liquidate merchandise for brands, without damaging their primary sales channels, creates a symbiotic relationship that favors the retailer. This dynamic is crucial for suppliers needing to manage warehousing costs and avoid carrying unsold seasonal goods, often leading to discounts of 20-40% on such inventory.

| Factor | Burlington's Position | Impact on Supplier Bargaining Power |

|---|---|---|

| Buying Strategy | Opportunistic acquisition of excess inventory | Weakens supplier power |

| Supplier Base | Highly fragmented, thousands of global vendors | Weakens supplier power |

| Switching Costs | Low for Burlington | Weakens supplier power |

| Supplier Urgency | High for seasonal/overstock goods | Weakens supplier power |

| Burlington's Scale | $8.7 billion net sales (2023) | Strengthens Burlington's position |

What is included in the product

This analysis dissects Burlington Coat Factory's competitive environment, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the off-price retail sector.

Quickly identify competitive threats and opportunities within the retail landscape, allowing Burlington Coat Factory to proactively adjust strategies and mitigate risks.

Customers Bargaining Power

Burlington's customers wield significant bargaining power, largely because the retail landscape offers a vast sea of alternatives. Shoppers can readily pivot to other off-price retailers, traditional department stores, niche specialty shops, or an ever-expanding universe of online marketplaces. This abundance of choice diminishes any single retailer's hold on customer loyalty, as consumers are rarely locked into a specific brand or store for their needs.

Burlington's customers possess significant bargaining power, largely driven by their pronounced price sensitivity. The core customer base actively seeks value and deep discounts, making them highly responsive to pricing differentials between retailers.

This sensitivity means customers are readily inclined to switch to competitors offering better deals or a superior perceived value proposition. In 2024, the average consumer spent an estimated 15-20% more on essential goods compared to the previous year, amplifying the importance of price for shoppers like Burlington's.

Consequently, Burlington must consistently implement competitive pricing strategies to not only attract but also retain its shopper base. This dynamic forces the company to maintain a lean operational structure to support its discount-oriented business model.

The bargaining power of customers is a significant factor for Burlington Coat Factory, largely due to extremely low switching costs. Customers can easily shift their purchases to a competitor without facing any penalties or significant inconvenience, whether it's a different off-price retailer or even a traditional department store. This ease of transition means Burlington must consistently offer attractive value to retain shoppers.

In 2024, the retail landscape continued to emphasize price sensitivity. With inflation impacting household budgets, consumers were more likely than ever to compare prices across various retailers. Burlington's off-price model inherently caters to this, but the power remains with the buyer; a slightly better deal elsewhere can easily divert sales. For instance, reports indicated that a significant percentage of consumers, upwards of 70% in some surveys, actively sought out discounts and promotions in 2024, underscoring their leverage.

Buyer Power 4

Burlington's customers wield significant bargaining power, amplified by the digital age. With readily available online information, price comparison tools, and social media reviews, shoppers are more informed than ever. This increased transparency means they can easily assess product value and compare offerings across various retailers before committing to a purchase, directly impacting Burlington's pricing strategies.

This heightened customer awareness translates into a greater ability to negotiate or seek out better deals. For instance, the proliferation of discount and off-price retailers in 2024 means consumers have more alternatives, forcing established players like Burlington to remain competitive on price. Data from the National Retail Federation indicated a strong consumer focus on value in 2024, with many shoppers actively seeking discounts and promotions.

The bargaining power of Burlington's customers is evident through several key factors:

- Informed Purchasing Decisions: Customers can easily research product origins, quality, and pricing online, reducing information asymmetry.

- Price Sensitivity: The availability of price comparison apps and a general economic climate in 2024 favoring value-conscious spending empowers customers to demand lower prices.

- Access to Alternatives: The growth of e-commerce and the off-price sector provides consumers with a wider array of shopping options, increasing their leverage.

- Brand Loyalty Erosion: With so much information at their fingertips, customers are less tied to specific brands and more willing to switch for a better deal.

Buyer Power 5

Burlington Coat Factory faces significant buyer power, largely due to the non-differentiated nature of many of its core products, especially apparel and home goods. Customers often see little distinction between similar items across different retailers, making price a primary decision driver.

While Burlington leverages brand names, its inventory often consists of opportunistic buys. This means customers are primarily drawn to the discount, rather than a specific exclusive item, which diminishes brand loyalty to Burlington itself for particular purchases.

- Price Sensitivity: Customers are highly sensitive to price, especially in categories like apparel where numerous alternatives exist.

- Limited Brand Loyalty for Specific Items: While customers may appreciate the availability of branded goods at a discount, this doesn't translate to strong loyalty for specific SKUs that can be found elsewhere.

- Information Availability: Online price comparison tools and readily available product information empower customers to easily find the best deals, further increasing their bargaining power.

Burlington's customers possess considerable bargaining power, primarily due to the abundance of readily available alternatives in the retail market. Shoppers can easily switch to other off-price stores, traditional department stores, or online platforms, diminishing brand loyalty and increasing price sensitivity. In 2024, with continued economic pressures, consumers actively sought value, making price a critical factor in their purchasing decisions.

The low switching costs for customers further amplify their leverage. Consumers face no significant barriers or penalties when moving their purchases to a competitor, meaning Burlington must consistently offer compelling value to retain its customer base. This dynamic necessitates efficient operations to support its discount-focused business model.

The bargaining power of Burlington's customers is notably high because many of the products, particularly apparel, are not highly differentiated. Customers often perceive similar items across different retailers as interchangeable, making price the dominant factor in their choices. While Burlington offers branded goods at a discount, this often attracts customers based on the price rather than exclusive product loyalty.

| Factor | Impact on Burlington | 2024 Context |

|---|---|---|

| Availability of Alternatives | Reduces customer loyalty, increases price sensitivity. | Continued growth of e-commerce and discount retailers provided more options. |

| Price Sensitivity | Customers actively seek lower prices, driving competitive pricing. | Inflation in 2024 made consumers more value-conscious, with many actively seeking discounts. |

| Low Switching Costs | Customers can easily move to competitors without penalty. | Minimal barriers to switching between retailers for similar goods. |

| Information Availability | Empowers customers to compare prices and products easily. | Price comparison tools and online reviews are widely accessible. |

Preview the Actual Deliverable

Burlington Coat Factory Porter's Five Forces Analysis

This preview showcases the complete Burlington Coat Factory Porter's Five Forces Analysis, offering a thorough examination of industry rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is the exact, professionally formatted analysis you'll receive immediately after purchase, providing actionable insights into Burlington's competitive landscape without any placeholders or surprises.

Rivalry Among Competitors

The off-price retail landscape is a battleground dominated by a few major players, including Burlington, TJX Companies (which includes TJ Maxx, Marshalls, and HomeGoods), and Ross Stores. These giants employ very similar strategies, centering on acquiring branded goods at a discount and then passing those savings onto shoppers. This direct competition for the same customer base naturally fuels aggressive pricing and frequent promotional campaigns.

The retail sector, particularly off-price apparel, often experiences a slower growth trajectory compared to other industries. For instance, the U.S. retail sales growth, while fluctuating, has seen periods of modest expansion, with projections for 2024 indicating continued, albeit measured, growth. This environment means retailers like Burlington are constantly vying for a larger slice of a pie that isn't growing at a breakneck pace.

Market saturation in many regions further squeezes available market share. With numerous competitors, from large department stores to smaller boutiques and online retailers, all targeting similar customer demographics, the fight for consumer attention and spending becomes fierce. This intense competition forces companies to innovate and differentiate constantly to maintain or increase their customer base.

This zero-sum dynamic means that for one retailer to gain market share, another often loses it. Burlington must therefore focus on operational efficiency, compelling value propositions, and effective marketing to draw customers away from rivals. The pressure to outperform is a constant, driving aggressive pricing strategies and promotional activities across the board.

Burlington Coat Factory operates in a highly competitive retail landscape, where intense rivalry is fueled by significant fixed costs. The necessity of maintaining a vast store network, managing substantial inventory levels, and running intricate supply chains creates a high overhead burden. For instance, in 2023, the retail sector's average fixed costs, including rent and utilities for physical stores, represented a considerable portion of operating expenses, pushing companies to prioritize sales volume.

These substantial fixed costs inherently pressure retailers like Burlington to achieve high sales volumes to cover their expenses. This often translates into aggressive pricing strategies and frequent promotional events designed to move merchandise swiftly and maintain cash flow. The drive to offset these fixed costs can easily escalate into price wars, as competitors vie for market share by offering lower prices, impacting profit margins across the board.

Competitive Rivalry 4

Competitive rivalry in the off-price retail sector, where Burlington Coat Factory operates, is intense. Differentiation beyond opportunistic inventory and the "treasure hunt" appeal is difficult, as most chains offer similar discounted brand-name merchandise. This forces competitors to heavily rely on price and convenience to attract customers.

The off-price market, including players like TJ Maxx and Ross Stores, is characterized by frequent promotional activities and aggressive pricing strategies. For instance, in 2023, the U.S. off-price retail segment continued to see robust growth, with companies like TJX Companies reporting comparable store sales increases, highlighting the competitive pressure to consistently offer value.

- Intense Price Competition: Retailers frequently engage in price wars to capture market share.

- Limited Differentiation: Core value proposition of discounted branded goods is similar across most off-price retailers.

- Focus on Convenience: Store location, layout, and ease of shopping become critical competitive factors.

- Inventory Management as a Differentiator: The ability to source unique, desirable merchandise at low prices remains a key, albeit challenging, differentiator.

Competitive Rivalry 5

The ease with which customers can switch between off-price retailers, like Burlington, significantly intensifies competitive rivalry. With low switching costs and often similar product assortments, shoppers can readily compare prices and promotions across different stores. This dynamic means Burlington must constantly strive to offer compelling value to retain its customer base, as consumers are not tied to any single brand.

This high degree of customer mobility forces Burlington to maintain aggressive pricing strategies and continuously refresh its inventory to attract and keep shoppers. The threat of customers easily moving to a competitor offering a slightly better deal or a more desirable product is a constant pressure. For instance, in 2024, the off-price retail sector saw continued growth, with companies like TJX Companies reporting strong sales, highlighting the competitive landscape Burlington operates within.

- Low Switching Costs: Customers face minimal barriers when moving between off-price retailers, making price and product selection the primary drivers.

- Similar Product Offerings: The overlap in merchandise across competitors means differentiation often comes down to execution and value perception.

- Customer Mobility: Shoppers are free to explore multiple retailers, increasing the likelihood of price-sensitive behavior and frequent brand switching.

- Competitive Pressure: This environment necessitates constant innovation in sourcing, merchandising, and pricing to stay ahead of rivals.

Competitive rivalry within the off-price retail sector, where Burlington Coat Factory operates, is exceptionally fierce. This intensity stems from a market populated by a few dominant players like TJX Companies and Ross Stores, all employing similar strategies focused on discounted branded goods. The limited differentiation in core offerings means that price, convenience, and the "treasure hunt" appeal of unique inventory become paramount. This dynamic forces constant promotional activity and aggressive pricing to capture market share.

The pressure to achieve high sales volumes is amplified by significant fixed costs inherent in maintaining a large retail footprint and inventory. For instance, in 2023, retailers across the board faced substantial overheads related to store operations and supply chains. This necessitates aggressive pricing and frequent promotions to drive traffic and offset these costs, often leading to price wars that impact profit margins for all involved.

Customer mobility further exacerbates this rivalry. With low switching costs and often overlapping product assortments, shoppers can easily move between retailers like Burlington, TJ Maxx, and Ross Stores. This necessitates continuous efforts in inventory sourcing, merchandising, and pricing to retain customer loyalty and attract new shoppers. For example, the U.S. off-price retail segment saw continued growth in 2024, underscoring the competitive environment.

| Key Competitors | Market Strategy Focus | Competitive Tactics |

| TJX Companies (TJ Maxx, Marshalls, HomeGoods) | Discounted branded merchandise, "treasure hunt" experience | Aggressive pricing, frequent promotions, diverse store formats |

| Ross Stores | Value-focused apparel and home fashion | Low everyday prices, efficient inventory management, strong private label presence |

| Burlington Coat Factory | Off-price apparel, footwear, accessories, and home goods | Opportunistic buying, value proposition, expanding store base |

SSubstitutes Threaten

Traditional department stores and specialty retailers represent a significant threat of substitution for Burlington. During sales and clearance events, these competitors can offer similar brand-name merchandise at heavily discounted prices, directly challenging Burlington's value proposition.

For instance, during the 2024 holiday season, many department stores reported strong performance in their off-price or clearance sections, attracting consumers looking for deals on apparel and home goods. This competitive pressure can dilute Burlington's appeal, especially if these retailers provide a more curated shopping environment or attractive loyalty programs that enhance the overall customer experience.

Online retailers, from e-commerce behemoths to niche flash-sale sites, present a significant substitute threat to off-price retailers like Burlington. These platforms offer unparalleled convenience, a wider selection, and easy price comparison, directly competing for the discount shopper's dollar. In 2024, the global e-commerce market continued its robust growth, with online sales projected to reach trillions, underscoring the increasing shift in consumer behavior away from traditional brick-and-mortar channels.

The burgeoning resale market presents a significant threat to Burlington Coat Factory. Platforms like Poshmark and ThredUp, alongside local thrift stores, offer consumers access to deeply discounted apparel and home goods. This trend directly challenges Burlington's core value proposition of providing affordable merchandise.

In 2024, the secondhand apparel market is projected to reach $350 billion globally, demonstrating robust consumer adoption. This growth highlights a clear consumer preference for cost-effective alternatives, impacting demand for new, albeit discounted, items found at retailers like Burlington.

Threat of Substitution 4

The rise of apparel rental services presents a growing threat of substitution for traditional retailers like Burlington Coat Factory. Consumers, especially younger demographics, are increasingly open to renting clothing for special events or to experiment with fast fashion trends, bypassing outright purchase. This shift acknowledges a move towards access over ownership, impacting the demand for new apparel.

For instance, the global online clothing rental market was valued at approximately $1.2 billion in 2023 and is projected to grow significantly. This indicates a tangible consumer preference for rental solutions, offering a cost-effective alternative for temporary fashion needs. Such services directly compete with Burlington's core offering by providing a similar utility at a potentially lower price point for specific use cases.

- Apparel rental services offer a cost-effective alternative for consumers, particularly for occasion wear.

- The global online clothing rental market reached approximately $1.2 billion in 2023, demonstrating growing consumer adoption.

- This trend signifies a behavioral shift towards accessing fashion rather than owning it, posing a substitution threat.

- Burlington must consider how these rental options impact the perceived value of its inventory for certain customer segments.

Threat of Substitution 5

Consumers increasingly opt to extend the lifespan of their current belongings through repair, upcycling, or simply buying less. This trend, amplified by a growing focus on sustainability and conscious consumption, can significantly curb demand for new apparel and home goods, acting as a potent substitute for retailers like Burlington.

For instance, the resale market for clothing, often referred to as the circular economy, is experiencing robust growth. In 2023, the global secondhand apparel market was valued at approximately $177 billion and is projected to reach $350 billion by 2027, indicating a substantial shift in consumer behavior that directly impacts traditional retail models.

- Repair and Upcycling: Consumers are investing in mending services or DIY projects to give new life to existing items, reducing the need for new purchases.

- Reduced Consumption: A conscious effort to buy less, driven by environmental concerns, directly lowers the overall market demand for apparel and home furnishings.

- Resale Market Growth: The booming secondhand market offers a viable and often more affordable alternative to buying new, directly siphoning off potential customers.

The threat of substitutes for Burlington Coat Factory is multifaceted, encompassing traditional retailers, online platforms, and the growing circular economy. These substitutes directly challenge Burlington's value proposition by offering similar goods through different channels or by shifting consumer preferences towards alternative consumption models.

Traditional department stores and specialty retailers can match Burlington's discounted offerings, especially during sales events. For example, during the 2024 holiday season, many department stores saw increased traffic in their clearance sections. Online retailers, meanwhile, continue to expand their reach, with global e-commerce sales projected to exceed trillions in 2024, offering convenience and broad selection.

The resale market, including platforms like ThredUp and local thrift stores, presents a significant challenge. The global secondhand apparel market is expected to reach $350 billion by 2027, indicating a strong consumer embrace of pre-owned items. Apparel rental services, valued at approximately $1.2 billion in 2023, also offer a cost-effective alternative for consumers seeking temporary fashion solutions.

| Substitute Category | Key Characteristics | Impact on Burlington | Relevant 2024/Projected Data |

|---|---|---|---|

| Traditional Retailers (Off-Price/Clearance) | Discounted brand-name merchandise, occasional sales | Direct price competition, potential dilution of value proposition | Strong performance in clearance sections during 2024 holidays |

| Online Retailers (E-commerce, Flash Sales) | Convenience, wider selection, easy price comparison | Captures discount shoppers, shifts preference away from brick-and-mortar | Global e-commerce sales projected to reach trillions in 2024 |

| Resale Market (Secondhand, Thrift) | Deeply discounted apparel/home goods, sustainability focus | Offers highly affordable alternatives, challenges new purchase demand | Global secondhand apparel market projected to reach $350 billion by 2027 |

| Apparel Rental Services | Access over ownership, temporary fashion needs | Provides utility at lower price points for specific uses, impacts ownership demand | Global online clothing rental market valued at $1.2 billion in 2023 |

Entrants Threaten

The threat of new entrants for Burlington Coat Factory is relatively low due to the substantial capital required. Establishing a national off-price retail chain necessitates significant investment in real estate for physical stores, acquiring vast amounts of inventory, and building a sophisticated supply chain network. For instance, opening just one new store can cost hundreds of thousands to over a million dollars in build-out and initial inventory, making it difficult for newcomers to match the scale and reach of established players like Burlington.

The threat of new entrants into the off-price retail sector, like Burlington Coat Factory, remains moderate due to significant barriers. Building the extensive and reliable supplier relationships essential for opportunistic buying is a substantial hurdle. Burlington has spent years cultivating long-standing connections with a vast network of brand-name and designer vendors, a critical factor in consistently acquiring desirable merchandise at deep discounts. Replicating these established networks, built on trust and consistent volume, takes considerable time and investment for any newcomer.

The threat of new entrants for Burlington Coat Factory is moderately low. New companies face significant hurdles in achieving the economies of scale Burlington enjoys in sourcing, distribution, and marketing. For instance, Burlington's vast network allows for substantial purchasing power, driving down costs per unit.

Established players like Burlington benefit from well-developed supply chains and efficient logistics, which are costly and time-consuming for newcomers to replicate. In 2024, the retail sector continued to see consolidation, making it even harder for smaller, less capitalized entrants to gain traction against established giants with optimized operations.

Furthermore, building brand recognition and customer loyalty takes considerable investment. New entrants would struggle to compete on price against Burlington, which leverages its scale to offer value to consumers, a core part of its business model that is difficult to undermine.

Threat of New Entrants 4

The threat of new entrants in the off-price retail sector, where Burlington Coat Factory operates, is moderately high but faces significant hurdles. Established players like Burlington have cultivated strong brand recognition and customer loyalty, making it difficult for newcomers to gain immediate traction. Consumers are accustomed to the unique value proposition and the 'treasure hunt' experience offered by these retailers, a perception that takes considerable time and resources to replicate.

Building comparable trust and awareness in a competitive landscape requires substantial investment. For instance, in 2023, the off-price retail segment in the U.S. continued its growth trajectory, with major players reporting steady revenue increases, indicating a market that rewards established brands. A new entrant would need to overcome this inertia.

- Brand Loyalty: Existing off-price retailers benefit from ingrained customer habits and a perceived value that new entrants struggle to match quickly.

- Marketing Investment: Significant capital is required for advertising and promotions to build brand awareness and educate consumers about a new offering.

- Market Saturation: The off-price sector is already populated by well-known brands, making it challenging for a new entity to carve out a distinct market share.

- Economies of Scale: Established retailers often leverage larger purchasing volumes, leading to better cost structures that are hard for new, smaller operations to compete with.

Threat of New Entrants 5

The threat of new entrants for Burlington Coat Factory, particularly within the off-price retail sector, is considerably low due to the immense operational expertise required. Burlington's success hinges on its sophisticated inventory management and rapid merchandise turnover, a complex skill honed over years of practice. This isn't something easily replicated by newcomers.

New players entering this space would face significant hurdles in acquiring the necessary operational capabilities. They would lack the crucial historical data, specialized buying and logistics teams, and the highly optimized systems that Burlington employs to efficiently procure, distribute, and sell a constantly fluctuating inventory. This deep-seated operational complexity serves as a substantial barrier to entry.

- High Barrier to Entry: The off-price retail model demands specialized expertise in inventory management and rapid merchandise turnover, which is difficult for new entrants to replicate.

- Lack of Historical Data: New competitors would be at a disadvantage without the years of data collection and analysis that inform Burlington's buying and selling strategies.

- Operational Complexity: The intricate systems and specialized teams required for efficient sourcing, distribution, and sales of diverse merchandise present a significant challenge.

- Brand Recognition and Scale: Established players like Burlington benefit from existing brand recognition and economies of scale, making it harder for new entrants to compete on price and selection.

The threat of new entrants for Burlington Coat Factory is generally low, primarily due to the significant capital investment required to establish a competitive presence in the off-price retail sector. Building a national footprint necessitates substantial outlays for prime real estate, acquiring diverse inventory, and developing robust supply chains. For example, the cost to open a new retail store can range from hundreds of thousands to over a million dollars for build-out and initial stock, a figure that deters many potential newcomers from entering the market at scale.

Furthermore, cultivating strong, reliable relationships with vendors is a critical barrier. Burlington has spent years building trust and consistent order volume with a wide array of brand-name and designer suppliers, enabling opportunistic buying at deep discounts. Replicating these established networks, which are foundational to the off-price model, demands considerable time and investment from any new competitor. In 2024, the retail landscape continued to favor established players with optimized operations and strong supplier ties, making it even more challenging for new entrants to gain traction against companies like Burlington that benefit from significant economies of scale in sourcing and distribution.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High costs for real estate, inventory, and supply chain development. | Deters new entrants due to substantial upfront investment. |

| Supplier Relationships | Established, long-term vendor connections for opportunistic buying. | Difficult for newcomers to replicate, impacting merchandise acquisition and pricing. |

| Economies of Scale | Leveraging large purchasing volumes for lower unit costs. | New entrants struggle to compete on price and selection due to lack of scale. |

| Brand Recognition & Loyalty | Existing customer base accustomed to value and the 'treasure hunt' experience. | Requires significant marketing investment and time for new brands to build awareness and trust. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Burlington Coat Factory is built upon a foundation of publicly available financial statements, investor relations reports, and industry-specific market research from firms like IBISWorld. We also incorporate data from trade publications and competitor announcements to gauge competitive intensity and buyer power.