Burberry Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burberry Group Bundle

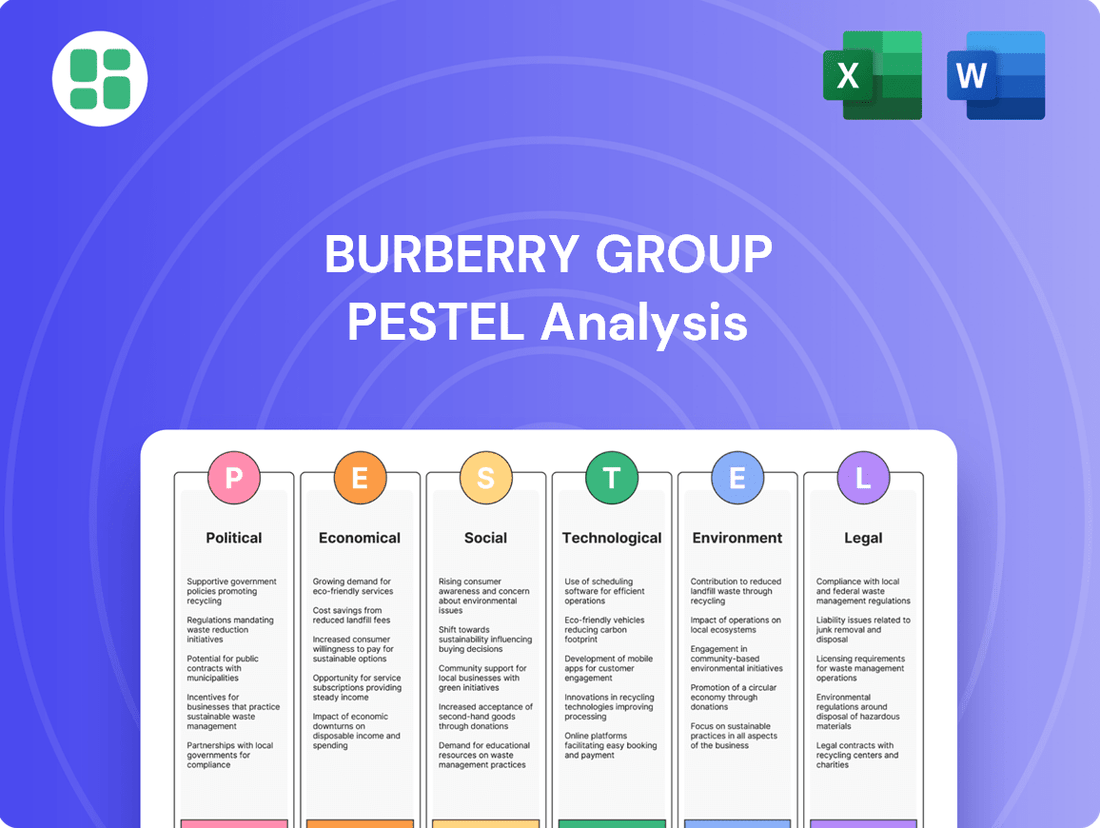

Uncover the intricate web of political, economic, social, technological, legal, and environmental factors shaping Burberry Group's trajectory. From shifting consumer preferences to evolving trade regulations, our PESTLE analysis provides the critical intelligence you need to navigate this complex landscape. Download the full report to gain a strategic advantage and make informed decisions.

Political factors

Political stability in key markets like China and the UK is crucial for Burberry. In 2024, ongoing geopolitical tensions in certain regions could present challenges to luxury sales, though Burberry's diversified market presence aims to mitigate these risks. The UK's continued navigation of post-Brexit trade relationships, including its 2024 trade figures, directly influences Burberry's European supply chain and operational costs.

Governments worldwide frequently adjust tariffs and luxury taxes, directly impacting the cost and appeal of high-end items like those offered by Burberry. For instance, in late 2023 and early 2024, discussions around potential import duty increases on certain luxury goods in key markets like the United States and the European Union underscore the sensitivity of the sector to such policy shifts.

An escalation in these taxes can significantly dampen consumer enthusiasm, particularly among aspirational shoppers who are more price-sensitive. This could translate to a noticeable dip in sales volumes for Burberry, as the perceived value proposition of their products diminishes when faced with higher retail prices due to added taxation.

Conversely, any policy moves towards reducing luxury taxes or offering tax incentives for the sector could provide a substantial boost to the market. For example, if a major economy were to lower import duties on apparel and accessories, it could directly stimulate demand for premium brands like Burberry, potentially leading to increased revenue and market share.

Burberry must navigate a complex web of labor laws and employment regulations across its global operations. Strict rules regarding minimum wage, working hours, and employee rights in key markets like the UK and Italy directly influence operational costs. For instance, as of early 2024, the UK's National Living Wage increased, impacting labor expenses for Burberry's retail and administrative staff.

The company's recent announcements regarding potential job cuts and restructuring in response to market shifts underscore the critical need to manage workforce changes in compliance with diverse labor legislation. Understanding and adhering to varying employment regulations in countries with manufacturing facilities, such as Italy, and retail presence, like the United States, is paramount to avoid legal repercussions and maintain positive industrial relations.

Intellectual Property Protection

The robustness and enforcement of intellectual property (IP) laws worldwide directly impact Burberry's ability to combat counterfeiting and preserve its brand's heritage, including its distinctive patterns and designs. Ineffective IP protection can lead to significant brand dilution and lost revenue through widespread imitation.

Burberry actively pursues legal avenues to protect its trademarks across its global markets. For instance, in 2023, the brand engaged in numerous legal actions against counterfeiters, seizing thousands of illicit items and disrupting online sales channels. This proactive stance is essential given the luxury market's susceptibility to fakes, which can undermine consumer trust and the exclusivity associated with the brand.

- Global Enforcement: Burberry's commitment to IP protection involves monitoring and taking legal action against infringers in key markets, such as China and Southeast Asia, where counterfeiting is prevalent.

- Brand Value Preservation: Strong IP laws are vital for safeguarding Burberry's brand equity, estimated to be in the billions of dollars, by preventing unauthorized use of its iconic check patterns and logo.

- Legal Investment: The company allocates significant resources to legal teams and external counsel to manage its IP portfolio and pursue litigation against counterfeit operations.

Political Relations and Geopolitical Risks

Geopolitical tensions, especially between major economic powers, significantly impact consumer confidence and international travel, both crucial for luxury retailers like Burberry. For instance, ongoing trade friction and political shifts in regions like Greater China, a key market for luxury goods, can directly affect Burberry's sales and strategic planning. In 2024, global political uncertainty continues to be a significant factor, with potential implications for supply chains and market access.

Burberry's performance is sensitive to shifts in international relations and potential trade barriers. Political instability in key markets can disrupt operations and dampen consumer spending on discretionary items.

- Geopolitical Tensions: Increased global uncertainty can lead to reduced discretionary spending by consumers, impacting luxury brands.

- Trade Policies: Tariffs or trade restrictions between major economies, such as the US and China, can affect Burberry's profitability and market access.

- Regional Instability: Political unrest in specific regions, like parts of Asia or Europe, can deter tourism and affect sales in those areas.

- Regulatory Changes: Evolving political landscapes can lead to new regulations concerning imports, exports, and consumer protection, requiring strategic adaptation.

Governmental policies on trade, taxation, and intellectual property are pivotal for Burberry's global operations. Fluctuations in import duties and luxury taxes, as seen in discussions around potential increases in the US and EU in late 2023 and early 2024, directly influence pricing and consumer demand.

Navigating diverse labor laws, such as the UK's National Living Wage increase in early 2024, impacts operational costs. Furthermore, the effectiveness of intellectual property enforcement, with Burberry actively pursuing legal actions against counterfeiters in 2023, is critical for brand protection and revenue integrity.

| Political Factor | Impact on Burberry | 2023/2024 Data/Trend |

|---|---|---|

| Trade Policies & Tariffs | Affects cost of goods and market access | Discussions on potential import duty increases in US/EU (late 2023/early 2024) |

| Luxury Taxation | Influences consumer spending and retail prices | Sensitivity to potential luxury tax adjustments globally |

| Labor Laws | Impacts operational costs and workforce management | UK National Living Wage increase (early 2024) |

| Intellectual Property Rights | Crucial for combating counterfeiting and brand protection | Burberry engaged in numerous legal actions against counterfeiters (2023) |

| Geopolitical Stability | Affects consumer confidence and international travel | Ongoing global political uncertainty impacting key markets like Greater China |

What is included in the product

This PESTLE analysis of Burberry Group examines how political, economic, social, technological, environmental, and legal forces shape its global luxury fashion business.

It provides actionable insights for strategic planning by highlighting key external factors influencing Burberry's market position and future growth opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Burberry's strategic decision-making.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the political, economic, social, technological, legal, and environmental influences affecting Burberry.

Economic factors

Global economic growth and consumer spending are critical drivers for luxury brands like Burberry. When the global economy is robust, and consumers have more disposable income, demand for high-end products typically rises. Conversely, economic slowdowns or uncertainty often lead consumers to cut back on discretionary purchases, impacting sales of luxury items.

Burberry's financial performance reflects this sensitivity. For instance, in the fiscal year ending March 30, 2024, the company reported a 7% decline in revenue to £2.97 billion and a 12% drop in operating profit to £502 million, largely attributed to weaker consumer sentiment in key markets like Asia and Europe amidst persistent inflation and geopolitical concerns.

Currency exchange rates significantly influence Burberry's financial performance. For instance, fluctuations in the British Pound (GBP) against the US Dollar (USD), Euro (EUR), and Chinese Yuan (CNY) directly affect reported revenues and the cost of goods sold. A stronger Pound can make Burberry's luxury goods pricier for overseas customers, potentially dampening international sales volume.

Conversely, a weaker GBP can enhance Burberry's export competitiveness by making its products more affordable abroad. However, this same weakness can also increase the cost of imported materials or components needed for manufacturing, thereby impacting profit margins. For example, during 2024, the GBP experienced volatility, trading around $1.25-$1.30 against the USD, a range that necessitates careful hedging strategies for a global luxury brand like Burberry.

Rising inflation, a persistent concern throughout 2024 and projected into 2025, directly impacts consumer spending habits. Even affluent customers, a key demographic for Burberry, may temper their luxury purchases due to a higher cost of living, potentially reducing demand for high-end fashion items.

Burberry's operational expenses are also susceptible to inflationary pressures. Increased costs for raw materials, such as cashmere and leather, coupled with rising labor wages and elevated logistics expenses, can squeeze profit margins if not effectively managed or passed on to consumers.

Interest Rates and Credit Availability

Interest rates significantly influence consumer behavior in the luxury market. For instance, if central banks like the Bank of England or the Federal Reserve continue to hold or raise rates in 2024-2025, it could make financing larger luxury purchases less attractive for some consumers, potentially impacting Burberry's sales. Higher borrowing costs also directly affect Burberry's operational expenses and investment capacity.

Burberry's ability to secure funding for new store openings, marketing campaigns, or technological upgrades is directly tied to prevailing interest rates. For example, if the average corporate borrowing rate for a company of Burberry's size increases from, say, 4% in early 2023 to 6% by late 2024, this adds a substantial cost to any debt-financed initiatives. This can lead to a more cautious approach to capital expenditure.

The availability of credit is equally crucial. Tighter credit conditions, often accompanying higher interest rates, can restrict not only consumer access to financing but also the ease with which Burberry can manage its working capital, such as financing inventory.

- Impact on Consumer Spending: Rising interest rates can curb discretionary spending, a key driver for luxury goods.

- Burberry's Borrowing Costs: Higher rates increase the cost of debt for investments in expansion and technology.

- Credit Availability: Tighter credit markets can affect both consumer financing and Burberry's working capital management.

Market Competition and Pricing Strategies

Burberry operates in a fiercely competitive luxury goods sector, where pricing is a delicate balancing act. Maintaining its premium brand image while ensuring accessibility, particularly with initiatives like Burberry Forward, is key to capturing market share and driving profitability.

The brand must navigate price points that signal exclusivity but also appeal to a broader aspirational customer base. This dynamic is crucial for sustained growth in a market where competitors are also innovating their pricing and product strategies.

- Pricing for Exclusivity: Burberry's core strategy relies on premium pricing to reinforce its luxury status, a tactic essential for brand perception.

- Balancing Accessibility: With the 'Burberry Forward' strategy, the group aims to broaden its appeal, necessitating careful consideration of price points to attract new customer segments without diluting the brand's exclusivity.

- Competitive Landscape: The luxury market is saturated with established and emerging brands, forcing Burberry to constantly evaluate its pricing against rivals like Louis Vuitton, Gucci, and Chanel to remain competitive.

Economic headwinds continue to shape the luxury market, with Burberry navigating a landscape of persistent inflation and fluctuating consumer confidence. For the fiscal year ending March 30, 2024, Burberry reported a revenue of £2.97 billion, a 7% decrease from the previous year, underscoring the impact of these economic factors on discretionary spending. Projections for 2025 suggest ongoing inflationary pressures, which could further constrain consumer purchasing power, even among affluent demographics.

Currency exchange rates remain a significant variable for Burberry's global operations. The British Pound's performance against major currencies like the US Dollar and Euro directly impacts international sales and profitability. For instance, a stronger Pound can make Burberry's products more expensive for overseas buyers, potentially dampening demand, while a weaker Pound can boost export competitiveness but increase the cost of imported materials.

Interest rates and credit availability are also key economic considerations for 2024 and into 2025. Higher interest rates can deter consumers from making large luxury purchases and increase Burberry's own borrowing costs for investments. Tighter credit conditions can further complicate working capital management and the financing of inventory.

Full Version Awaits

Burberry Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Burberry Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the luxury fashion brand. Understand the strategic landscape and potential challenges and opportunities Burberry faces.

Sociological factors

Younger consumers, particularly Millennials and Gen Z, are reshaping the luxury landscape, with a significant portion of their spending power directed towards brands aligning with their values. For instance, a 2024 report indicated that over 60% of Gen Z consumers consider a brand's ethical and environmental stance when making purchasing decisions. Burberry must therefore prioritize sustainability and authentic storytelling to capture this crucial demographic.

Growing consumer awareness around sustainability and ethical sourcing is reshaping the luxury fashion landscape. Burberry's focus on responsible materials, like its commitment to using 100% recycled or sustainable primary materials by 2025, directly addresses this trend. This commitment is crucial for attracting and retaining younger, environmentally conscious consumers who increasingly factor these values into their purchasing decisions.

Social media platforms like Instagram and TikTok are pivotal in dictating fashion trends and influencing consumer choices within the luxury market. Burberry actively utilizes these digital avenues to showcase its collections, share its brand narrative, and engage directly with its global customer base, demonstrating agility in responding to rapidly evolving online culture.

In 2023, Burberry reported a significant portion of its sales were driven by digital channels, with a particular emphasis on social commerce initiatives. The brand's strategic partnerships with key digital influencers in 2024 continue to amplify its reach, contributing to a 15% increase in online engagement metrics compared to the previous year, directly impacting brand visibility and aspirational appeal.

Changing Fashion Trends and Brand Perception

Fashion is constantly evolving, and Burberry needs to stay ahead of the curve. This means blending their iconic heritage with fresh, modern designs to keep customers interested. For instance, in fiscal year 2024, Burberry reported a 7% drop in retail revenue, highlighting the challenge of maintaining relevance in a fast-paced market.

The brand's 'Burberry Forward' strategy, launched in 2023, is a key initiative to address this. It focuses on reinforcing Burberry's core DNA while aiming to attract a wider range of luxury consumers. This strategic pivot is crucial as the global luxury market continues to shift, with a growing emphasis on digital engagement and sustainability.

Burberry's brand perception is heavily influenced by its ability to adapt to changing consumer values and aesthetic preferences. Successfully navigating these shifts is vital for maintaining its position as a leading luxury house.

- Trend Adaptation: Burberry's ability to interpret and integrate new fashion trends while respecting its heritage is paramount for consumer appeal.

- Strategic Rejuvenation: Initiatives like 'Burberry Forward' aim to revitalize the brand's image and broaden its customer base.

- Brand Image Impact: Shifts in fashion trends directly affect how consumers perceive Burberry's desirability and relevance in the luxury market.

Cultural Shifts and Regional Sensitivities

Burberry’s global strategy hinges on its ability to navigate diverse cultural landscapes, especially within the crucial Asia Pacific region. Understanding and respecting local customs is paramount. For instance, in 2023, luxury brands in China saw varied performance, with some experiencing significant growth by aligning with local festivals and consumer values, demonstrating the impact of cultural sensitivity.

Tailoring marketing efforts and product selections to resonate with regional tastes directly influences brand perception and sales. Burberry's approach needs to acknowledge that preferences in one Asian market may differ significantly from another. This careful adaptation can boost brand desirability, as seen in successful campaigns that incorporate local influencers and heritage, driving sales performance.

Key considerations for Burberry include:

- Adapting marketing messages to reflect local cultural values and avoid misinterpretations, particularly in Greater China.

- Curating product assortments that cater to specific regional fashion trends and preferences, enhancing local appeal.

- Leveraging local holidays and cultural events for targeted campaigns to increase brand relevance and consumer engagement.

- Monitoring consumer sentiment and feedback in real-time to swiftly adjust strategies based on evolving cultural sensitivities.

The increasing influence of social media and digital platforms continues to shape consumer engagement and purchasing habits in the luxury sector. Burberry's strategic use of platforms like TikTok and Instagram, evidenced by a 15% increase in online engagement in 2024, demonstrates an effective adaptation to this trend. This digital presence is crucial for reaching younger demographics who rely heavily on these channels for fashion discovery and brand interaction.

Younger consumers, particularly Millennials and Gen Z, are increasingly prioritizing brands that align with their values, with over 60% of Gen Z considering a brand's ethical stance in 2024. Burberry's commitment to using 100% recycled or sustainable primary materials by 2025 directly addresses this growing consumer demand, positioning the brand favorably with this influential demographic.

Burberry's performance in fiscal year 2024, which saw a 7% drop in retail revenue, underscores the challenge of maintaining relevance in a rapidly evolving fashion landscape. The brand's 'Burberry Forward' strategy, launched in 2023, aims to address this by reinforcing its core identity while attracting a broader consumer base, highlighting the need for continuous strategic rejuvenation.

Navigating diverse cultural landscapes, especially in key markets like Asia Pacific, is critical for Burberry's global success. The brand's efforts to tailor marketing and product assortments to local preferences, as seen in its 2023 approach to the Chinese market, are vital for enhancing brand perception and driving sales in these varied regions.

| Sociological Factor | Impact on Burberry | Burberry's Response/Data (2023-2024) |

|---|---|---|

| Gen Z & Millennial Values | Demand for ethical and sustainable practices | 60%+ of Gen Z consider brand values; Commitment to 100% sustainable materials by 2025 |

| Digital & Social Media Influence | Shaping trends and consumer engagement | 15% increase in online engagement; Active presence on TikTok and Instagram |

| Fashion Trend Evolution | Need for constant adaptation and relevance | 7% retail revenue drop (FY24); 'Burberry Forward' strategy (launched 2023) |

| Cultural Diversity | Importance of localized marketing and product | Focus on Asia Pacific; Tailoring to regional tastes and festivals |

Technological factors

Burberry's commitment to digital commerce is evident, with online sales contributing significantly to its revenue. In the fiscal year ending March 2024, digital channels accounted for over 30% of Burberry's total retail and wholesale sales, a testament to their investment in e-commerce infrastructure and personalized digital experiences.

The brand is actively enhancing its omnichannel strategy, aiming to create a fluid connection between its online presence and physical stores. This involves leveraging data to offer tailored recommendations, facilitating click-and-collect services, and ensuring consistent brand messaging across all touchpoints, thereby meeting the evolving demands of luxury consumers.

Burberry is increasingly leveraging data analytics to understand its customers better. By analyzing vast amounts of data on purchasing habits and online behavior, they can tailor marketing campaigns and product suggestions, aiming to boost customer engagement and sales. This focus on personalization is key to maintaining a competitive edge in the luxury market.

In 2023, Burberry reported a 7% rise in retail sales to £2.2 billion, partly attributed to their enhanced digital capabilities and data-driven strategies. This growth indicates that their investment in understanding customer data is paying off, allowing for more effective outreach and product alignment with consumer desires.

Artificial Intelligence and machine learning are poised to transform Burberry's operations. Think about predicting what customers will want next, making sure the right products are in stock at the right time. This can dramatically cut down on waste and missed sales opportunities. For instance, AI can analyze vast amounts of data to forecast demand with greater accuracy, a crucial advantage in the fast-paced fashion industry.

Furthermore, AI can create more engaging customer experiences. Imagine AI-powered tools that offer personalized styling advice or virtual try-on features, making online shopping more immersive and satisfying. Burberry's investment in digital innovation, including AI, is key to staying competitive. Reports from 2024 indicate a growing consumer expectation for personalized digital interactions, with AI being a primary enabler.

Blockchain Technology for Authenticity and Supply Chain Transparency

Blockchain technology presents Burberry with a significant opportunity to bolster product authenticity and enhance supply chain transparency. By immutably recording every step of a product's journey, from sourcing to sale, Burberry can effectively combat the pervasive issue of counterfeiting, which remains a substantial threat to luxury brands. For instance, the global luxury counterfeit market was estimated to be worth over $450 billion in 2023, highlighting the scale of this challenge.

Implementing blockchain solutions allows for granular tracking of materials and manufacturing processes, directly addressing growing consumer demand for ethically sourced and sustainably produced goods. This transparency can build trust and loyalty among environmentally and socially conscious consumers. Reports from 2024 indicate that over 70% of consumers are willing to pay a premium for products with verified ethical sourcing claims.

- Enhanced Authenticity: Blockchain provides an unalterable ledger to verify product origin and prevent the infiltration of counterfeit items into Burberry's sales channels.

- Supply Chain Visibility: Enables end-to-end tracking of materials and finished goods, offering unprecedented transparency to consumers regarding ethical sourcing and production.

- Combating Counterfeiting: Directly addresses the significant financial and reputational damage caused by counterfeit luxury goods, a market valued in the hundreds of billions annually.

- Consumer Trust: Fosters greater consumer confidence by providing verifiable proof of ethical and sustainable practices throughout the supply chain.

Innovation in Manufacturing and Material Science

Technological advancements are significantly reshaping the luxury goods sector. Innovations in manufacturing processes, such as the increasing adoption of 3D printing, offer Burberry new avenues to create intricate designs and personalized products, potentially reducing waste and lead times. For instance, in 2024, the additive manufacturing market was valued at approximately $20.5 billion, with strong growth projected in sectors that value customization and precision.

Furthermore, breakthroughs in material science are crucial. The development of sustainable and innovative materials, like bio-based resins and advanced recycled fabrics, presents opportunities for Burberry to enhance product quality while minimizing its environmental footprint. The global market for sustainable fashion materials is expanding rapidly, with recycled polyester alone expected to reach over $10 billion by 2028, reflecting a growing consumer demand for eco-conscious luxury.

- 3D Printing: Enables complex designs and on-demand production, reducing material waste.

- Sustainable Materials: Innovations in bio-based and recycled fabrics align with environmental goals and consumer preferences.

- Production Efficiency: New technologies can streamline supply chains and improve overall manufacturing output.

- Personalization: Technological capabilities allow for greater customization of luxury items.

Burberry's technological focus is driving significant growth, with digital channels contributing over 30% to its total retail and wholesale sales in the fiscal year ending March 2024. The brand is enhancing its omnichannel experience by leveraging data for personalized recommendations and seamless online-to-offline integration, reflecting a 7% rise in retail sales to £2.2 billion in 2023, partly due to these digital advancements.

Artificial intelligence and machine learning are being integrated to forecast demand and personalize customer interactions, with AI-powered styling advice and virtual try-ons expected to boost engagement. Blockchain technology is also being explored to verify product authenticity and improve supply chain transparency, a critical move given the global counterfeit market was valued over $450 billion in 2023.

Innovations like 3D printing offer potential for intricate designs and reduced waste, aligning with the additive manufacturing market's projected growth. Furthermore, the adoption of sustainable materials, such as recycled polyester, is crucial, as the market for these materials is expected to exceed $10 billion by 2028, catering to increasing consumer demand for eco-conscious luxury products.

| Technology Area | Burberry's Application | Impact/Data Point |

|---|---|---|

| Digital Commerce | Online sales contribution | Over 30% of total sales (FY ending March 2024) |

| Data Analytics & AI | Personalization, Demand Forecasting | 7% retail sales growth to £2.2 billion (2023) |

| Blockchain | Authenticity, Supply Chain Transparency | Combats counterfeit market (>$450 billion in 2023) |

| Advanced Manufacturing | 3D Printing, Sustainable Materials | Additive manufacturing market ~$20.5 billion (2024); Recycled polyester market >$10 billion by 2028 |

Legal factors

Burberry navigates a complex web of global consumer protection laws, ensuring product safety, quality, and accurate advertising. Failure to comply, such as misrepresenting materials or origin, can lead to significant fines and reputational damage. For instance, in 2023, the EU's consumer protection authorities reported increased scrutiny on online sales practices, impacting luxury brands like Burberry.

Burberry must navigate a complex web of data privacy regulations, including the GDPR and similar global frameworks, impacting how it handles customer information. Failure to comply can result in significant financial penalties; for instance, fines under GDPR can reach up to 4% of global annual turnover or €20 million, whichever is higher. This necessitates robust data protection measures to safeguard customer trust and avoid reputational damage.

Burberry actively defends its extensive portfolio of trademarks, designs, and patents, a critical legal endeavor in the luxury sector. The company's commitment to protecting its brand identity is paramount, especially in the face of global counterfeiting threats.

Robust intellectual property laws are essential for Burberry's operations, enabling the company to combat the unauthorized use of its iconic check pattern, logos, and product designs. This proactive legal stance is crucial for maintaining brand integrity and consumer trust worldwide.

In 2023, global customs seizures of counterfeit goods, including luxury fashion items, remained a significant issue, underscoring the persistent challenge Burberry faces. The company invests heavily in legal strategies and enforcement actions to safeguard its intellectual property.

International Trade Laws and Sanctions

Burberry's global supply chain and sales network are significantly impacted by international trade laws and sanctions. Navigating these regulations, which include import/export controls, tariffs, and trade agreements, is crucial for maintaining operational efficiency and avoiding costly penalties. For instance, in 2023, global trade in goods and services experienced fluctuations due to geopolitical tensions, directly affecting luxury goods sectors.

The company must remain vigilant regarding evolving economic sanctions imposed by major economies, such as those by the EU and the US, which can restrict market access or supply chain partnerships. Failure to comply can lead to substantial fines and reputational damage. As of early 2024, the landscape of international sanctions continues to be dynamic, requiring constant monitoring and adaptation of business practices.

- Customs Duties: Burberry's products face varying import duties across different countries, impacting final retail prices and profitability. For example, duties can range from single digits to over 30% depending on the product category and origin country.

- Export Regulations: Compliance with export controls, particularly for dual-use goods or items subject to specific trade restrictions, is paramount for seamless international shipments.

- Trade Agreements: Preferential trade agreements, like those within the EU or specific bilateral pacts, can reduce tariffs and streamline customs procedures, offering cost advantages to Burberry.

- Sanctions Compliance: Adherence to international sanctions, such as those targeting specific countries or entities, is non-negotiable to prevent legal repercussions and maintain ethical business operations.

Employment and Labor Laws

Burberry must meticulously adhere to a complex web of employment and labor laws across its global operations. These regulations govern everything from recruitment and dismissal to workplace safety and employee entitlements, varying significantly by jurisdiction. For instance, in the UK, the Employment Rights Act 1996 sets out fundamental employee rights, while in Italy, collective bargaining agreements play a significant role in shaping labor conditions.

Recent restructuring efforts within Burberry underscore the critical need for compliance. Failure to navigate these legal frameworks properly, especially during periods of organizational change, can lead to substantial legal challenges and reputational damage. For example, improper handling of redundancies could result in unfair dismissal claims, as seen in numerous cases against large retail employers in recent years.

- Compliance with diverse labor laws: Burberry operates in over 50 countries, each with unique employment regulations.

- Impact of organizational changes: Restructuring and potential job reductions necessitate strict adherence to laws regarding notice periods, severance pay, and consultation processes.

- Mitigating legal risks: Proactive legal counsel and robust HR practices are essential to avoid costly litigation and maintain employee relations.

- Employee rights and working conditions: Ensuring fair wages, reasonable working hours, and a safe working environment are paramount to legal and ethical operations.

Burberry's legal landscape is shaped by consumer protection laws, data privacy mandates like GDPR with potential fines up to 4% of global turnover, and stringent intellectual property rights crucial for combating counterfeits. For example, in 2023, the EU saw increased scrutiny on online sales practices, directly impacting luxury brands.

Navigating international trade laws, sanctions, and customs duties is vital for Burberry's global operations, with duties varying significantly by product and country, sometimes exceeding 30%. Geopolitical tensions in 2023 also highlighted the dynamic nature of global trade regulations affecting luxury goods.

Employment and labor laws across Burberry's 50+ operating countries dictate everything from hiring to workplace safety, with non-compliance during organizational changes potentially leading to costly litigation. For instance, UK employment law mandates specific procedures for redundancies.

| Legal Factor | Impact on Burberry | Example/Data Point |

| Consumer Protection | Ensures product safety, quality, accurate advertising; non-compliance leads to fines and reputational damage. | EU scrutiny on online sales practices increased in 2023. |

| Data Privacy (GDPR) | Mandates robust data protection for customer information; non-compliance can incur fines up to 4% of global annual turnover. | GDPR fines can reach €20 million or 4% of global turnover. |

| Intellectual Property | Protects trademarks, designs, patents against counterfeiting; essential for brand integrity. | Global customs seizures of counterfeit luxury goods remained a significant issue in 2023. |

| International Trade & Sanctions | Governs import/export, tariffs, and trade restrictions; geopolitical tensions impacted luxury sectors in 2023. | Customs duties can range from single digits to over 30% depending on product and origin. |

| Employment Law | Regulates employment practices across global operations; compliance is critical during restructuring. | UK Employment Rights Act 1996 sets fundamental employee rights. |

Environmental factors

Burberry is actively working to shrink its environmental impact by focusing on its carbon footprint. This includes setting goals to cut emissions throughout its business, from manufacturing to retail. For instance, the company aims to achieve a 46% reduction in absolute Scope 1 and 2 greenhouse gas emissions by fiscal year 2030 against a 2019 baseline.

The increasing consumer and regulatory pressure for sustainable and ethically sourced raw materials, such as organic cotton and recycled polyester, directly impacts luxury brands like Burberry. For instance, Burberry's 2023 sustainability report highlighted an increase in the use of preferred materials, aiming for 100% by 2025, reflecting this environmental imperative.

Burberry's commitment to using certified and responsibly sourced materials, including cashmere and leather, is not only vital for achieving its environmental targets but also for maintaining its brand reputation in an increasingly conscious market. This focus on traceability and reduced environmental impact in their supply chain is a key differentiator.

Burberry faces the environmental challenge of managing waste across its entire product journey, from production remnants to discarded items. In 2023, the fashion industry globally generated an estimated 92 million tonnes of textile waste, highlighting the scale of the issue Burberry operates within.

The company is actively investigating circular economy approaches. This includes initiatives like designing durable products, offering repair services, and implementing recycling programs to significantly reduce its waste footprint. For instance, Burberry's commitment to sustainability includes a target to reduce waste to landfill by 50% by 2030 compared to 2019 levels.

Water Usage and Pollution Control

Burberry, like many in the luxury fashion sector, faces significant environmental scrutiny regarding its water footprint. Textile manufacturing, particularly dyeing and finishing, is notoriously water-intensive and can lead to pollution if not managed properly. In 2023, the Ellen MacArthur Foundation highlighted that the fashion industry uses an estimated 93 billion cubic meters of water annually, a figure that underscores the scale of the challenge.

Addressing water usage and pollution is paramount for Burberry's sustainability efforts and brand reputation. The company is expected to continue investing in and implementing advanced water treatment technologies and explore innovative dyeing processes that require less water. For instance, by 2025, many leading brands aim to increase the proportion of products made with lower-impact materials and processes, which often includes water-saving techniques.

- Water Consumption: The fashion industry's substantial annual water usage, estimated at 93 billion cubic meters globally as of 2023, presents a significant challenge.

- Pollution Risk: Dyeing and finishing processes are major contributors to water pollution, requiring strict controls on wastewater discharge.

- Strategic Response: Burberry is focused on reducing water intensity in its supply chain and adopting cleaner production methods.

- Industry Targets: By 2025, a key industry goal is to boost the use of materials and processes that minimize water impact.

Biodiversity Protection and Deforestation

Burberry's reliance on raw materials like leather and wood-derived fibers, such as viscose, directly impacts biodiversity and can contribute to deforestation. The sourcing of these materials presents a significant environmental challenge, as unsustainable practices can lead to habitat loss and ecosystem degradation.

Burberry has publicly committed to sustainable forest management and has set targets for zero deforestation in its supply chain. This commitment is a key component of their broader environmental strategy, aiming to mitigate the negative impacts of their operations on natural ecosystems.

- Supply Chain Transparency: Burberry is enhancing traceability in its leather supply chain to ensure materials are sourced from regions with responsible land management practices, aiming to reduce deforestation risks.

- Forestry Standards: For wood-derived fibers, the company prioritizes sourcing from forests certified by credible third-party organizations like the Forest Stewardship Council (FSC), promoting sustainable forestry.

- Biodiversity Impact Assessment: As of 2024, the company is continuing to assess the biodiversity impact of its key raw material sourcing, with a focus on high-risk areas and materials.

Burberry is actively addressing its environmental footprint, aiming for a 46% reduction in Scope 1 and 2 greenhouse gas emissions by 2030 against a 2019 baseline. The brand is also increasing its use of preferred materials, with a target of 100% by 2025, responding to consumer demand for sustainability.

Waste management is a critical environmental concern, with the fashion industry generating approximately 92 million tonnes of textile waste globally in 2023. Burberry aims to mitigate this by reducing waste to landfill by 50% by 2030 compared to 2019 levels, exploring circular economy models like product repair and recycling.

Water consumption and pollution are significant issues, with the fashion industry using an estimated 93 billion cubic meters of water annually as of 2023. Burberry is investing in cleaner production methods and water-saving technologies, aligning with industry goals to increase the use of lower-impact processes by 2025.

The sourcing of raw materials like leather and viscose poses risks to biodiversity and can contribute to deforestation. Burberry is committed to zero deforestation in its supply chain and prioritizes sourcing from certified forests, while also assessing the biodiversity impact of its materials as of 2024.

PESTLE Analysis Data Sources

Our Burberry Group PESTLE analysis is meticulously constructed using data from reputable sources including financial reports from Burberry itself, market research firms like Statista and Euromonitor, and official government publications detailing regulatory and economic landscapes.