Burberry Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burberry Group Bundle

Uncover the strategic positioning of Burberry's product portfolio with our comprehensive BCG Matrix analysis. See which iconic trench coats are your "Stars," which classic scarves are your "Cash Cows," and where potential "Question Marks" might be hiding.

This preview offers a glimpse into Burberry's market share and growth potential, but the full BCG Matrix delivers the detailed quadrant placements, data-backed recommendations, and a clear roadmap to smart investment and product decisions. Purchase the complete report to gain a competitive edge.

Stars

Burberry is significantly boosting its digital commerce, a strategic move to capture more market share in the growing online luxury sector. This investment is a core component of their 'Burberry Forward' initiative, focusing on enhancing customer journeys.

In the first half of fiscal year 2024, Burberry reported a 6% increase in online sales, demonstrating the effectiveness of their digital enhancements. This growth is crucial as the company navigates broader sales challenges, highlighting digital as a key avenue for future revenue.

Burberry's outerwear and scarves are positioned as Stars within the BCG matrix, reflecting a renewed strategic focus under the 'Burberry Forward' initiative. These iconic categories, deeply rooted in the brand's heritage, are being revitalized with new collections, such as the highly anticipated Autumn 2025 line, designed to solidify Burberry's leadership in the luxury market.

This concentrated effort aims to capitalize on the inherent strength and resilience of these product segments, targeting high growth by attracting a wide spectrum of luxury consumers. Burberry's investment in these core areas is a clear signal of their potential to drive future revenue and market share.

Burberry is heavily investing in sustainability, exemplified by its use of 100% organically grown cotton for Heritage Trench Coats and the development of refillable beauty products. This strategic move targets the burgeoning market for ethical luxury, a sector experiencing robust growth. Burberry aims to capture a significant market share by prioritizing innovation and responsible operations within this space.

New Brand Expression & Campaigns

Burberry's 'Burberry Forward' strategy is a significant pivot, aiming to redefine its brand narrative through new expressions and impactful campaigns. The 'It's Always Burberry Weather' campaign, for instance, emphasizes Timeless British Luxury, a core tenet designed to enhance brand desirability and appeal to a wider demographic. This initiative signals a strong ambition for increased market relevance and customer engagement.

The brand's focus on reigniting desirability is crucial for its position in the luxury market. By investing in distinctive storytelling and campaigns, Burberry aims to capture a larger share of customer perception and drive growth. Early indicators suggest a positive shift in brand sentiment, which is a vital sign for future performance.

- Brand Strategy: 'Burberry Forward' focuses on resetting brand storytelling and launching distinctive campaigns to reignite desirability.

- Campaign Focus: 'It's Always Burberry Weather' highlights Timeless British Luxury to attract a broader customer base.

- Growth Ambition: The strategy aims for increased brand relevance and market share in customer perception and engagement.

- Early Results: Initial campaign efforts have shown improvements in brand sentiment.

Strategic Rebalancing of Product Assortment

Burberry is strategically rebalancing its product assortment, shifting focus from niche seasonal fashion to "fewer, bigger ideas" that emphasize recognizable brand codes. This move targets the segment of the luxury market that prioritizes timeless pieces and core categories, a high-growth opportunity. By streamlining its offerings, Burberry aims to correct past inconsistencies and capture a larger market share.

This strategic pivot is designed to resonate with consumers seeking enduring luxury. For instance, Burberry's focus on its iconic trench coats and check patterns aims to solidify its position in core categories. In 2024, the luxury goods market continued its robust growth, with analysts projecting continued expansion driven by demand for heritage brands and classic styles.

- Focus on Core Categories: Burberry is doubling down on its most recognizable and historically successful product lines.

- "Fewer, Bigger Ideas": The brand is prioritizing impactful collections over a broad, fragmented seasonal offering.

- Targeting Timeless Appeal: This strategy aims to attract consumers who value longevity and classic design in luxury goods.

- Market Share Capture: By correcting past inconsistencies, Burberry seeks to solidify its standing and gain a larger share of the high-growth luxury segment.

Burberry's outerwear and scarves are positioned as Stars in the BCG matrix, indicating strong market share in a high-growth category. These iconic products are central to the brand's revitalization efforts under the 'Burberry Forward' strategy. The company is investing heavily in these core segments to drive future revenue and solidify its leadership in the luxury market.

These categories are being refreshed with new collections, such as the Autumn 2025 line, to appeal to a broad luxury consumer base. The aim is to capitalize on their inherent strength and potential for significant growth. In fiscal year 2024, Burberry saw a 6% increase in online sales, underscoring the success of their digital enhancements and strategic focus on key product areas.

Burberry's commitment to its iconic outerwear and scarves as Stars reflects a strategic decision to leverage proven brand strengths. This focus aligns with the broader luxury market trend favoring heritage brands and timeless styles, which continued its robust growth in 2024.

The brand's strategy of "fewer, bigger ideas" emphasizes these recognizable codes, targeting consumers who value longevity. This approach aims to correct past market inconsistencies and capture a larger share of the high-growth luxury segment.

What is included in the product

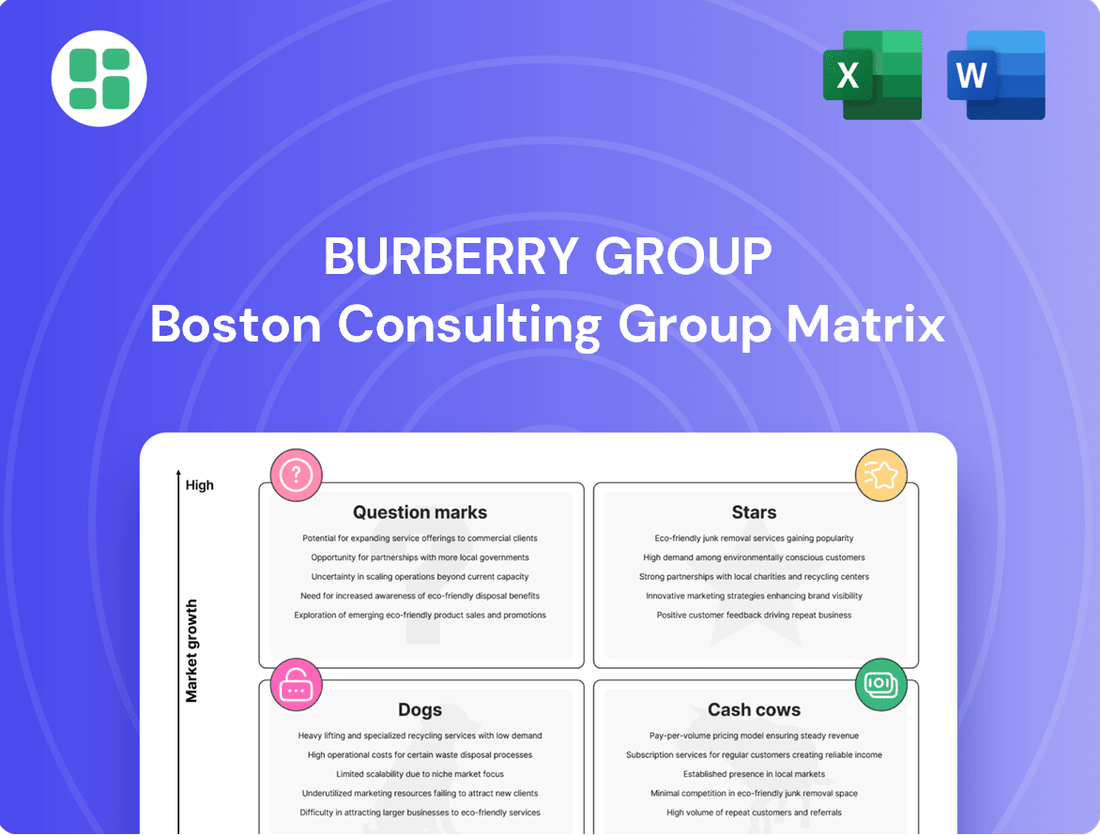

The Burberry Group BCG Matrix analyzes its product portfolio, categorizing items into Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for each business unit.

The Burberry Group BCG Matrix offers a clear, one-page overview, instantly clarifying which business units require investment and which can be leveraged for cash, alleviating the pain of strategic uncertainty.

Cash Cows

The classic heritage trench coat is Burberry’s quintessential Cash Cow. It consistently commands a significant market share in the luxury outerwear sector, a testament to its enduring appeal and brand legacy.

This iconic piece generates robust and stable cash flows, requiring minimal marketing spend due to its unparalleled global brand recognition. For instance, in fiscal year 2024, Burberry reported a 2% increase in retail revenue, with outerwear, including trench coats, being a key driver.

Burberry's iconic check pattern, especially on its scarves, remains a powerful brand symbol and a consistent revenue generator. These products hold a significant market share within their segment, acting as reliable cash cows for the group.

The enduring appeal of the signature check ensures a steady demand, allowing these accessories to contribute substantially to Burberry's cash flow with minimal incremental investment. In 2023, Burberry reported a 2% increase in comparable store sales, with accessories being a key driver of this growth, underscoring their continued strength.

Burberry's licensing revenue, particularly from fragrances, operates as a classic Cash Cow within its BCG Matrix. This segment consistently delivers strong profits and a high market share in the luxury fragrance space.

In 2024, Burberry's licensing agreements, primarily with Interparfums for fragrances, continued to be a significant contributor to its financial performance. While specific licensing revenue figures are often consolidated, the broader luxury fragrance market, which Burberry taps into, experienced continued demand, indicating sustained cash flow generation for the group.

Established Leather Goods (Core Styles)

Burberry's established leather goods, particularly iconic styles like vintage check bags and the Frances bag, represent a classic Cash Cow within their portfolio. These items benefit from enduring brand recognition and customer loyalty, securing a significant market share in their specific segments.

Despite broader market fluctuations in leather goods, these core styles consistently generate substantial and reliable cash flow for Burberry. This stability allows the company to fund investments in other business areas, such as emerging product lines or technological advancements.

- High Market Share: Established leather goods maintain a dominant position in their specific market niches, driven by brand heritage.

- Consistent Revenue: These products contribute stable and predictable cash flow, acting as a financial bedrock for the company.

- Brand Loyalty: Iconic styles leverage existing customer affection, reducing the need for extensive marketing spend to maintain sales.

- Profitability: Their mature status and established production processes typically result in healthy profit margins.

Directly Operated Stores in Mature Markets

Burberry's directly operated stores in mature markets, such as Europe and North America, are its established cash cows. These locations, while experiencing slower growth, provide a stable and significant stream of revenue. For instance, in fiscal year 2024, Burberry reported that its retail revenue from EMBEA (Europe, Middle East, and Africa) and the Americas remained robust, contributing substantially to the group's overall financial performance.

These stores benefit from high brand recognition and a loyal customer base, ensuring consistent sales even in a competitive landscape. The consistent cash flow generated from these mature markets is crucial for funding Burberry's investments in emerging markets and new product development.

- Stable Revenue Generation: Burberry's directly operated stores in mature markets consistently contribute to the company's revenue.

- Brand Strength: High brand recognition in established regions drives steady sales.

- Cash Flow Source: These stores are key generators of reliable cash flow for the group.

- Strategic Importance: The cash generated supports investment in growth areas and innovation.

Burberry's iconic trench coats and check scarves are prime examples of its Cash Cows, consistently generating substantial revenue and profit. These products benefit from high brand recognition and enduring customer loyalty, requiring minimal marketing investment to maintain their market share.

In fiscal year 2024, Burberry reported a 2% increase in retail revenue, with outerwear and accessories being key contributors. This stability allows Burberry to allocate resources to other strategic areas of the business.

The licensing segment, particularly fragrances, also functions as a Cash Cow, leveraging established brand equity for consistent cash flow. While specific segment data isn't always public, the luxury fragrance market's continued demand supports this classification.

Burberry's mature retail presence in established markets like Europe and North America also acts as a stable Cash Cow, providing reliable revenue streams that fund growth initiatives.

| Product Category | BCG Matrix Status | Key Characteristics | FY24 Data/Trend |

|---|---|---|---|

| Trench Coats & Check Scarves | Cash Cow | High Market Share, Strong Brand Loyalty, Stable Revenue | Key drivers of 2% retail revenue increase |

| Fragrance Licensing | Cash Cow | Leverages Brand Equity, Consistent Cash Flow | Benefited from luxury fragrance market demand |

| Mature Market Retail Stores | Cash Cow | Established Presence, Loyal Customer Base, Stable Revenue | Robust revenue from EMBEA and Americas |

What You’re Viewing Is Included

Burberry Group BCG Matrix

The Burberry Group BCG Matrix you are previewing is the identical, fully unlocked document you will receive immediately after purchase. This comprehensive analysis, designed for strategic insight, contains no watermarks or demo content, ensuring you get a polished, ready-to-use report for your business planning.

Rest assured, the Burberry Group BCG Matrix preview you see is the exact final version you’ll download upon completing your purchase. This professionally crafted document, packed with market-backed analysis, is delivered directly to you, eliminating any need for revisions or unexpected content.

What you are currently viewing is the actual Burberry Group BCG Matrix file you’ll obtain once your purchase is confirmed. The full, editable version will be instantly accessible, allowing you to seamlessly integrate it into your strategic discussions or presentations.

This preview represents the real Burberry Group BCG Matrix document that will be yours after a single purchase, offering a professionally designed and analysis-ready file for immediate download and use.

Dogs

Burberry's historical focus on niche, seasonal fashion items, prior to their 'Burberry Forward' strategy, represented a segment that likely struggled with both market share and growth. These specific collections, often catering to fleeting trends, would have occupied a small portion of the highly competitive luxury fashion landscape, struggling to gain significant traction.

Such offerings are classic examples of 'Dogs' in the BCG matrix, characterized by low growth and low relative market share. For instance, in the fiscal year ending March 2023, Burberry's retail sales in Asia, a key luxury market, saw a modest 2% increase, highlighting the challenging growth environment for less impactful product lines.

Burberry's generic ready-to-wear segment, distinct from its core outerwear, has historically demonstrated weaker performance compared to the group's overall average. This suggests a relatively low market share coupled with sluggish growth within this particular product category.

These less differentiated clothing lines can represent a drag on capital, tying up resources without yielding substantial returns. In the context of a BCG matrix, this positions them as potential 'Dogs' within Burberry's product portfolio, requiring careful evaluation for potential divestment or repositioning.

Regions like the Americas and Greater China faced notable comparable sales drops in the fiscal year 2025. This points to Burberry's struggling market share in these key luxury territories during that time.

The persistent underperformance in these areas suggests they are acting as Dogs for Burberry's current product offerings and strategic direction. This indicates a need for a serious re-evaluation of Burberry's approach in these specific markets.

Wholesale Channel (Strategic Downsizing)

Burberry's wholesale channel is currently positioned as a 'Dog' in its BCG Matrix. This is largely due to a strategic decision to downsize this segment, which has resulted in a significant revenue decline. For instance, the company projected a substantial contraction of 35% to 37% in wholesale revenue for fiscal year 2025.

This strategic review aims to give Burberry greater control over its product distribution and brand presentation. The shrinking wholesale channel reflects a low market share and negative growth within this specific distribution avenue.

- Wholesale Revenue Decline: Projected to fall by 35-37% in FY25, signaling a contraction in this channel.

- Strategic Restructuring: Burberry is actively managing and minimizing the wholesale segment to improve brand control.

- Market Position: Characterized as a 'Dog' due to its low market share and negative growth trajectory within the overall business.

Older, Less Differentiated Footwear Collections

Burberry's footwear segment, as a whole, has shown weaker performance compared to the company's overall average. This suggests that certain footwear collections within Burberry might be struggling with both market share and future growth prospects.

Specifically, older and less differentiated footwear lines could be classified as Dogs in the BCG Matrix. These collections may not be aligning with the evolving preferences of today's luxury consumers, leading to their underperformance.

- Underperforming Category: Footwear's contribution to Burberry's revenue growth has lagged behind the group's overall performance.

- Low Market Share: Some footwear collections likely possess a small slice of the competitive luxury footwear market.

- Limited Growth Potential: These specific lines may not see significant expansion in demand due to their dated appeal or lack of unique selling propositions.

Burberry's wholesale channel is a clear example of a 'Dog' in its BCG matrix. This is a deliberate strategic choice, leading to a significant reduction in this segment. For fiscal year 2025, Burberry projected a substantial decline of 35% to 37% in wholesale revenue, reflecting its low market share and negative growth in this area.

This strategic pruning aims to enhance Burberry's brand control and presentation. The shrinking wholesale operations, characterized by low market share and declining growth, are therefore classified as Dogs, requiring careful management to minimize resource drain.

The footwear category, particularly older or less innovative lines, also fits the 'Dog' profile. These collections have demonstrated weaker performance relative to the company's overall average, indicating a low market share and limited growth potential in the competitive luxury market.

These segments, while potentially requiring capital, do not offer substantial returns. Burberry's strategic focus is shifting away from these underperforming areas, suggesting a potential for divestment or significant repositioning to improve overall portfolio health.

| BCG Category | Burberry Segment | Key Characteristics | FY25 Projection/Observation |

|---|---|---|---|

| Dogs | Wholesale Channel | Low market share, negative growth | Projected 35-37% revenue decline |

| Dogs | Older/Less Differentiated Footwear | Low market share, limited growth potential | Underperformed compared to overall company average |

Question Marks

Burberry's expansion into broader beauty product lines beyond its established fragrance business, which operates as a Cash Cow, signals a strategic move into a high-growth market. This diversification includes innovative offerings like new refillable items, tapping into consumer demand for sustainability and premium experiences.

While these expanded beauty categories present a significant growth opportunity, they currently represent a relatively low market share for Burberry. These ventures are in their nascent stages, necessitating substantial investment to build brand recognition and market penetration, positioning them as potential Stars in the future.

Burberry's strategic pivot to attract a broader luxury customer base is a bold move into a high-growth market segment. This expansion aims to tap into a wider demographic previously underserved by the brand, potentially unlocking significant revenue streams.

While the potential is substantial, Burberry's current market share within this expanded target demographic is notably low. This indicates a need for significant investment in marketing and product development to resonate effectively with these new potential customers.

Burberry is significantly investing in advanced digital capabilities and customer value management to craft more personalized customer journeys. This strategic focus aims to elevate the luxury experience through tailored interactions and exclusive digital offerings.

While the luxury sector sees substantial growth in digital engagement, Burberry's current market share in highly differentiated digital services remains relatively low. This suggests that while the potential is high, the effective implementation and widespread adoption of these sophisticated digital features are still in their nascent stages.

New Material Innovation & Supply Chain Transformation

Burberry's investment in new material innovation and supply chain transformation positions it for future growth, aligning with the high-growth potential often seen in 'Stars' within the BCG matrix. This strategic focus aims to enhance sustainability and efficiency, critical factors for long-term market relevance. For instance, in 2024, Burberry continued to explore bio-based alternatives and circular economy principles within its material sourcing, though the direct market share impact of these nascent initiatives is currently limited, reflecting their early-stage development.

- Focus on Next-Gen Materials: Burberry is actively researching and integrating innovative, sustainable materials into its product lines.

- Supply Chain Efficiency and Sustainability: The company is transforming its supply chain to improve environmental performance and operational effectiveness.

- Early Adoption Phase: While strategically vital for future growth, these innovations are still in early adoption, meaning their current market share contribution is minimal.

- Future Growth Potential: These initiatives are designed to capture future market demand for sustainable luxury goods, indicating high future growth prospects.

Strategic Expansion in Emerging Luxury Markets (Selective)

Burberry's strategic expansion in emerging luxury markets, though selective, aligns with its long-term vision for disciplined growth. The company identifies specific underdeveloped luxury markets where its current market share is low, signaling a need for targeted investment and deeper penetration. This approach aims to capitalize on the high growth potential inherent in these regions for luxury goods, even as some established markets face challenges.

For instance, while specific 2024 financial data on individual emerging market penetration is not publicly detailed by Burberry, the broader luxury market in Asia, excluding Japan, saw a robust growth trajectory leading up to 2025. Analysts projected this region to continue outperforming global averages for luxury spending. Burberry's focus in these areas is on building brand awareness and establishing a stronger retail presence, which requires significant upfront investment.

- Targeted Investment: Burberry is channeling resources into emerging markets with unmet luxury demand, aiming to build brand equity and market share.

- Growth Potential: These markets are selected based on their projected high growth rates for luxury goods consumption, offering significant long-term upside.

- Market Penetration Strategy: The focus is on increasing brand visibility and accessibility through strategic retail placements and localized marketing efforts.

- Disciplined Expansion: Despite the potential, Burberry maintains a disciplined approach, ensuring investments are aligned with profitability and long-term brand health.

Burberry's expanded beauty lines, like its sustainable refillable products, are positioned as potential Stars. These ventures are in their early stages with low market share but target high-growth segments.

The company's strategic focus on attracting a broader luxury demographic also falls into the Star category. Despite significant growth potential, Burberry's current market share within this expanded audience is low, requiring substantial investment.

Similarly, Burberry's investment in advanced digital capabilities and personalized customer journeys represents a Star. While the luxury digital sector is growing, Burberry's market share in highly differentiated digital services remains nascent.

Burberry's exploration of next-generation materials and supply chain transformation, such as its 2024 work on bio-based alternatives, also aligns with the Star quadrant. These initiatives, while strategically vital, currently have minimal market share but high future growth prospects.

| Category | Market Growth | Relative Market Share | BCG Matrix Classification |

|---|---|---|---|

| Expanded Beauty Lines (e.g., Refillables) | High | Low | Star |

| Broader Luxury Demographic | High | Low | Star |

| Advanced Digital Services | High | Low | Star |

| Next-Gen Materials & Supply Chain | High | Low | Star |

BCG Matrix Data Sources

Our Burberry Group BCG Matrix is informed by a blend of financial disclosures, industry growth forecasts, and internal product performance data to provide a comprehensive strategic overview.