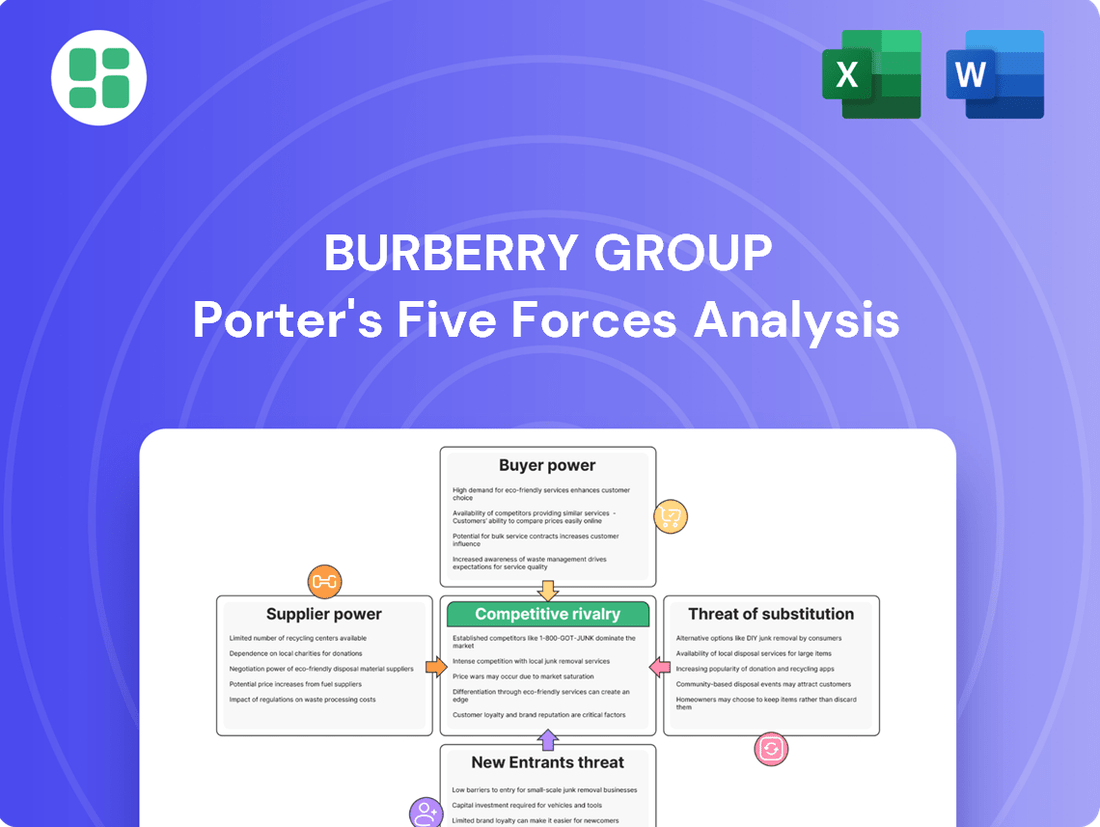

Burberry Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burberry Group Bundle

Burberry navigates a luxury market shaped by intense brand rivalry and discerning buyers, while the threat of new entrants is tempered by high capital requirements and established brand loyalty.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Burberry Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Burberry's reliance on a select group of suppliers for specialized raw materials, such as high-grade cashmere and unique woven fabrics, significantly bolsters supplier bargaining power. These niche providers often possess proprietary knowledge or exclusive access to resources, making it difficult for Burberry to find readily available alternatives. This dependence can lead to price increases or disruptions if suppliers choose to leverage their position, impacting Burberry's cost of goods sold and production schedules.

The production of Burberry's luxury goods, particularly its iconic trench coats and leather goods, relies heavily on skilled artisans and specialized manufacturing techniques. These highly trained craftspeople possess unique expertise that is not easily replicated, giving them significant bargaining power.

Suppliers offering these specialized skills and manufacturing capabilities often have limited capacity. This scarcity, combined with the high demand for quality craftsmanship in the luxury sector, allows them to command higher prices and favorable terms from Burberry, especially for bespoke or signature pieces that define the brand's heritage.

Burberry's brand reputation is intricately linked to the quality and exclusivity of its offerings, which in turn depend heavily on its suppliers for premium materials and skilled craftsmanship. A disruption in this supply chain, perhaps due to a supplier's lapse in quality control, could directly tarnish Burberry's esteemed image, a cornerstone of its pricing power and market position.

Consequently, Burberry faces a significant challenge in switching suppliers. The costs and risks associated with finding and vetting new suppliers capable of meeting Burberry's exacting standards, particularly for specialized fabrics and artisanal production, are substantial, thereby amplifying the bargaining power of its existing, trusted suppliers.

Long-term Supplier Relationships

Burberry prioritizes long-term partnerships with its core suppliers, aiming for consistent quality and reliable material flow. This strategic approach, while beneficial for stability, can inadvertently enhance supplier leverage by limiting Burberry's agility in sourcing alternatives. For instance, securing exclusive access to certain high-quality leathers or specialized fabrics through these enduring relationships means suppliers hold a stronger hand when negotiating terms or price adjustments.

These established ties can translate into increased supplier bargaining power. When a supplier becomes indispensable due to unique capabilities or the sheer volume of business they represent, their ability to dictate terms, such as pricing or delivery schedules, grows. This is particularly relevant in the luxury goods sector where specific material provenance and craftsmanship are paramount.

Consider the implications for Burberry's cost structure. If a key supplier of their iconic trench coat gabardine, for example, faces rising production costs or increased demand from other clients, they might pass these increases onto Burberry. The long-term nature of the relationship, coupled with the difficulty of finding an exact substitute, empowers that supplier to negotiate less favorably for Burberry.

- Supplier Dependence: Long-term relationships can foster a degree of dependence, reducing Burberry's ability to quickly pivot to alternative suppliers, thereby strengthening the supplier's negotiating position.

- Quality Assurance: Securing consistent, high-quality materials, a hallmark of Burberry's brand, often necessitates deep, lasting ties with specialized manufacturers, giving these suppliers significant leverage.

- Cost Pass-Through: Suppliers in such relationships may have greater power to pass on increased costs or impose less favorable terms due to their critical role in Burberry's supply chain.

Limited Alternatives for High-End Components

For specific, cutting-edge materials or highly specialized components crucial to Burberry's luxury positioning, the pool of qualified suppliers is often very small. This scarcity of alternatives significantly strengthens the hand of these suppliers, enabling them to command premium prices and favorable contract terms.

- Limited Supplier Pool: In the luxury fashion sector, suppliers of unique fabrics, specialized hardware, or advanced textile technologies might have few, if any, direct competitors capable of meeting Burberry's stringent quality and design standards.

- Price Influence: When few suppliers can produce a critical, high-quality input, they gain considerable power to influence pricing. For instance, a supplier of a proprietary waterproof fabric technology could charge a premium, knowing Burberry has few other options.

- Contractual Leverage: These suppliers can also dictate other terms, such as minimum order quantities or lead times, which can impact Burberry's production flexibility and inventory management.

Burberry's reliance on a few specialized suppliers for unique materials like high-grade cashmere and proprietary fabrics grants these suppliers significant bargaining power. This dependence is amplified by the difficulty and cost of finding suitable alternatives that meet Burberry's exacting quality and design standards, a common challenge in the luxury goods market.

In 2023, Burberry's cost of sales increased by 5% to £1,976 million, partly reflecting the input costs from its key suppliers. The limited number of suppliers capable of producing specific, high-quality components for luxury outerwear means these suppliers can command higher prices and dictate terms, impacting Burberry's profitability.

The brand's commitment to heritage craftsmanship also means a reliance on suppliers with specialized skills and limited capacity, further strengthening their negotiating position. For example, securing exclusive access to certain artisanal leather treatments or woven fabrics through long-term partnerships can make suppliers indispensable.

| Factor | Impact on Burberry | Supplier Leverage |

|---|---|---|

| Specialized Materials | High dependence on unique fabrics and cashmere | Strong, due to limited alternatives and proprietary knowledge |

| Skilled Craftsmanship | Reliance on artisans for iconic products | Significant, due to scarcity of specialized skills |

| Limited Supplier Pool | Few suppliers meet luxury quality and design standards | High, enabling price influence and contractual leverage |

| Long-Term Partnerships | Ensures consistent quality and material flow | Increased, as suppliers become critical and less replaceable |

What is included in the product

This analysis of Burberry Group dissects the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and their collective impact on the luxury fashion industry.

A dynamic dashboard that visualizes Burberry's competitive landscape, highlighting how to mitigate threats from rivals and suppliers.

Customers Bargaining Power

Burberry customers frequently display significant brand loyalty, fueled by aspirations for status, perceived quality, and the brand's rich heritage. This loyalty means they are less likely to switch brands over small price increases.

For instance, Burberry's strong brand equity, cultivated over decades, allows it to command premium pricing. In fiscal year 2024, Burberry reported revenue of £2.97 billion, demonstrating the market's continued demand for its products despite their higher price points, a testament to their customers' willingness to pay for brand prestige.

Burberry's strategy of offering exclusivity and limited availability for many of its luxury items significantly strengthens its position against customers. By creating a sense of scarcity, the company cultivates a customer base that is often willing to pay a premium for unique or hard-to-obtain pieces. This approach directly diminishes the bargaining power of customers, as their ability to negotiate lower prices or demand concessions is curtailed when faced with desirable, yet restricted, product offerings.

Burberry's customers, while highly discerning about the quality and design of its products, exhibit a notable lack of price sensitivity. This discerning clientele prioritizes brand prestige, innovative designs, and the overall luxury experience, making them less swayed by price alone compared to consumers in the mass market. For instance, in the fiscal year ending March 2024, Burberry reported a 2% decrease in revenue at constant currency, reflecting a challenging luxury market, yet the brand continues to command premium pricing due to its established reputation and exclusive appeal.

Influence of Digital Platforms

The increasing prevalence of digital platforms and social media has significantly amplified the bargaining power of Burberry's customers. Consumers now have unprecedented access to product information, price comparisons, and peer reviews, fostering greater transparency in the luxury market.

However, Burberry's strong brand heritage and the aspirational nature of its products often create an emotional connection that can buffer against direct price sensitivity. This allows the company to maintain a certain level of pricing power despite the increased information access.

For instance, in 2024, the luxury goods market continued to see robust online sales growth, with digital channels accounting for a significant portion of revenue for many brands. Despite this, Burberry's ability to cultivate brand loyalty and offer unique experiences remains a key factor in mitigating the direct impact of price-based bargaining.

- Increased Information Access: Digital platforms empower customers with extensive product details and price comparisons.

- Brand Aspiration: Burberry's strong brand image fosters an emotional connection, reducing price sensitivity.

- Peer Influence: Social media and online reviews shape consumer perceptions and purchasing decisions.

- Digital Sales Growth: Online channels continue to expand, offering consumers more avenues for engagement and comparison.

Direct-to-Consumer Channels

Burberry's strategic emphasis on its direct-to-consumer (DTC) channels, including its own stores and e-commerce platforms, significantly curtails the bargaining power of customers. By investing heavily in these channels, Burberry maintains greater control over the customer journey and pricing strategies. This direct engagement minimizes reliance on third-party retailers, thereby limiting opportunities for customers to leverage price competition prevalent in wholesale arrangements.

In 2023, Burberry reported that its digital channels accounted for a substantial portion of its sales, reflecting the success of its DTC strategy. This direct relationship allows Burberry to capture more value and directly influence customer perception, reducing their leverage. For instance, Burberry's own digital platform offers exclusive collections and personalized services, fostering loyalty and reducing price sensitivity among its core customer base.

- Direct Control: Burberry's DTC model provides direct oversight of product presentation, pricing, and customer service, diminishing customer leverage.

- Reduced Price Sensitivity: By managing the entire sales process, Burberry can mitigate the impact of price-based bargaining that might occur through intermediaries.

- Enhanced Customer Relationships: Direct engagement allows for deeper understanding and cultivation of customer loyalty, making them less inclined to seek concessions.

Burberry's customers, while discerning, exhibit relatively low bargaining power due to strong brand loyalty and the aspirational nature of the products. This loyalty means they are less likely to switch brands over minor price changes, and the brand's heritage and perceived quality allow for premium pricing. For example, in fiscal year 2024, Burberry achieved revenues of £2.97 billion, underscoring the market's sustained demand for its premium offerings.

| Factor | Burberry's Position | Impact on Customer Bargaining Power |

|---|---|---|

| Brand Loyalty & Aspiration | High, driven by heritage and status | Lowers bargaining power; customers prioritize brand over price. |

| Price Sensitivity | Low for core luxury items | Limits customer ability to negotiate prices. |

| Information Access (Digital) | High for customers | Potentially increases bargaining power, but mitigated by brand loyalty. |

| Direct-to-Consumer (DTC) Strategy | Strong focus on own channels | Reduces customer leverage by controlling the sales experience and pricing. |

Preview Before You Purchase

Burberry Group Porter's Five Forces Analysis

This preview showcases the precise Burberry Group Porter's Five Forces Analysis you will receive upon purchase, detailing the competitive landscape including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the luxury fashion market.

Rivalry Among Competitors

Burberry faces fierce competition from established luxury powerhouses such as Louis Vuitton, Chanel, Gucci, Hermès, and Prada. These brands boast significant global recognition, deep financial reserves, and sophisticated design teams, creating a highly contested landscape for market share and consumer loyalty.

The intense rivalry means that brands like Burberry must continuously innovate in design, marketing, and customer experience to stand out. For instance, in 2024, many luxury brands are focusing on digital engagement and sustainability initiatives to capture the attention of younger, environmentally conscious consumers, further intensifying the competitive pressures.

Competitive rivalry within the luxury fashion sector, particularly concerning innovation and design leadership, is intense. Burberry, like its peers, faces constant pressure to debut fresh collections, explore novel materials, and enhance digital customer experiences. This relentless pursuit of differentiation fuels significant investment in research, development, and marketing.

In 2024, luxury brands are channeling substantial resources into staying ahead. For instance, major players are allocating upwards of 10% of their revenue towards marketing and product development to maintain brand cachet and attract younger demographics. This strategic emphasis on innovation is not merely about aesthetics; it's crucial for capturing market share and commanding premium pricing in a saturated market.

Maintaining a leading position in the luxury sector, like Burberry operates within, demands significant outlays for marketing, advertising campaigns, and high-profile celebrity endorsements. This is a constant battle for attention.

The substantial investment required for brand building creates an intense rivalry for visibility and consumer mindshare among established luxury players. For instance, in the fiscal year ending March 2024, Burberry reported marketing expenses of £330 million, highlighting the scale of investment needed to compete.

Scarcity of Top Talent

The luxury fashion sector, including Burberry, faces intense competition for a limited pool of top creative and marketing talent. This scarcity drives up compensation and makes it challenging for brands to secure individuals who can innovate and maintain brand prestige. For instance, the demand for experienced luxury brand managers and designers often outstrips supply, forcing companies to invest heavily in recruitment and retention strategies.

Burberry, like its peers, must contend with this rivalry for individuals capable of shaping the brand’s image and driving sales. The ability to attract and keep these key professionals is a significant factor in a company's success in the highly competitive luxury market. In 2024, the global luxury goods market is projected to reach over €360 billion, underscoring the high stakes involved in having the right creative leadership.

- Talent Scarcity: The luxury fashion industry experiences a significant shortage of highly sought-after creative directors, designers, and marketing experts.

- Innovation Driver: These individuals are crucial for driving innovation and maintaining the aspirational appeal of luxury brands like Burberry.

- Competitive Pressure: Brands actively compete for these professionals, leading to increased recruitment costs and retention challenges.

- Market Context: The robust growth of the global luxury market in 2024 highlights the critical importance of securing top talent for competitive advantage.

Economic Sensitivity of Luxury Market

While the luxury sector often demonstrates a degree of resilience, economic downturns undeniably impact consumer behavior. Even affluent individuals tend to curb discretionary spending during periods of uncertainty, affecting the demand for high-end goods. This economic sensitivity can amplify competitive rivalry within the luxury market.

Brands may find themselves vying more intensely for a smaller pool of high-spending customers. This can manifest in increased promotional activities, strategic pricing adjustments, or a greater emphasis on brand loyalty programs. For instance, during the COVID-19 pandemic's initial phases in 2020, many luxury retailers experienced significant sales declines, prompting a recalibration of their strategies to navigate the altered economic landscape.

- Economic Downturn Impact: Luxury goods are not entirely immune to recessions; discretionary spending by even wealthy consumers can decrease.

- Intensified Rivalry: A shrinking customer base during economic slowdowns forces luxury brands to compete more aggressively for market share.

- Strategic Responses: This heightened competition can lead to increased promotional efforts, discounting, or a focus on core, high-margin products.

- 2023/2024 Trends: While specific luxury sales figures for the entirety of 2024 are still emerging, 2023 saw a moderation in growth for some luxury segments after a post-pandemic surge, indicating ongoing sensitivity to economic shifts.

Burberry operates in a highly competitive luxury market, facing intense rivalry from established global brands like Louis Vuitton and Gucci, which possess significant financial strength and brand recognition. This rivalry necessitates continuous innovation in design and marketing, with brands in 2024 heavily investing in digital engagement and sustainability to attract younger consumers.

The pressure to differentiate drives substantial investment in R&D and marketing, with many luxury players allocating over 10% of revenue to maintain brand cachet and market share. Burberry's marketing expenses in the fiscal year ending March 2024 reached £330 million, illustrating the scale of spending required to compete effectively.

Furthermore, the sector experiences a fierce competition for top creative and marketing talent, driving up recruitment costs and retention challenges. The global luxury market, projected to exceed €360 billion in 2024, underscores the importance of securing skilled professionals for a competitive edge.

Economic downturns, while not halting luxury spending entirely, can intensify this rivalry as brands vie more aggressively for a potentially smaller pool of affluent customers, leading to increased promotional activities.

SSubstitutes Threaten

The threat of substitutes for Burberry's high-quality premium brands is significant. Consumers often seek a blend of quality, style, and brand prestige without always committing to the highest luxury price tags. This opens the door for premium and bridge brands that offer a comparable aesthetic and good quality at a more accessible price point. For instance, brands like Coach, Michael Kors, or even designer diffusion lines can capture customers who appreciate the Burberry look but find the main line's pricing prohibitive.

Experiential spending presents a significant threat of substitution for luxury goods like those offered by Burberry. In 2024, global spending on luxury experiences, encompassing everything from high-end travel to fine dining and exclusive events, continued to surge. This trend means consumers with substantial discretionary income have numerous avenues beyond purchasing physical fashion items to indulge and signal status, directly competing for their spending. For instance, a significant portion of affluent consumers now prioritize memorable journeys or unique culinary adventures over acquiring new designer apparel.

The rise of luxury rental platforms and the robust second-hand market for high-end fashion pose a considerable threat of substitutes for Burberry. These alternatives allow consumers to experience luxury goods for a fraction of the cost or for a limited time, potentially reducing demand for new Burberry products. For instance, the global luxury rental market was projected to reach $2.08 billion in 2023 and is expected to grow significantly, while the resale market for luxury goods is also booming, with some estimates suggesting it could nearly double by 2030.

Fast Fashion and Trend Replication

Fast fashion brands, while not direct competitors in terms of quality or brand prestige, pose a threat by rapidly replicating luxury trends at much lower price points. This allows consumers to achieve a similar aesthetic without the significant investment in luxury goods. For instance, in 2024, the global fast fashion market was valued at approximately $110 billion, showcasing its substantial reach and appeal to a broad consumer base seeking trendy, affordable options.

This trend replication acts as a broad substitute, particularly for fashion-forward but budget-conscious consumers. They can acquire the 'look' of high-fashion items popularized by brands like Burberry through more accessible channels. This dynamic pressures luxury brands to continually innovate and emphasize their unique value propositions beyond mere trend adoption.

- Replication of Trends: Fast fashion retailers quickly copy runway styles, making them accessible at lower costs.

- Price Sensitivity: Consumers seeking a similar aesthetic but with budget constraints are drawn to these substitutes.

- Market Size: The global fast fashion market's significant valuation in 2024 indicates its broad consumer appeal and competitive influence.

Counterfeit Goods Market

The proliferation of counterfeit luxury goods represents a significant threat of substitutes for Burberry. These illicit products, often manufactured with inferior materials and craftsmanship, directly mimic Burberry's iconic designs, offering consumers a low-cost alternative that can dilute brand perception and capture market share. For instance, reports from 2023 indicated that the global market for counterfeit goods, including fashion, was valued at hundreds of billions of dollars, with luxury items being a prime target.

This illegal market directly competes by offering a similar aesthetic appeal at a drastically reduced price point. While not a direct competitor in terms of quality or brand experience, the sheer accessibility and affordability of counterfeits can sway price-sensitive consumers away from genuine Burberry purchases. The ease with which these fakes can be found online and in various markets exacerbates this threat.

- Counterfeit Market Value: Global counterfeit goods market estimated to be worth over $450 billion annually as of recent reports, with fashion being a substantial segment.

- Consumer Appeal: Counterfeits offer a perceived status symbol at a fraction of the cost, appealing to aspirational buyers.

- Brand Dilution: The widespread availability of fakes can erode Burberry's brand exclusivity and perceived value.

- Sales Impact: Lost sales due to consumers opting for counterfeit alternatives, particularly in emerging markets where affordability is key.

The threat of substitutes for Burberry is multifaceted, encompassing both direct and indirect alternatives. Consumers can opt for premium brands offering similar aesthetics and quality at lower price points, such as Coach or Michael Kors. Furthermore, the growing luxury rental and resale markets provide access to high-end fashion at a reduced cost or for temporary use, directly impacting demand for new products. In 2024, the global luxury rental market continued its expansion, while the resale market for luxury goods is also experiencing robust growth, projected to nearly double by 2030.

| Substitute Category | Key Characteristics | Impact on Burberry | Example Brands/Platforms | 2024 Market Relevance |

| Premium/Bridge Brands | Comparable style, good quality, lower price | Captures aspirational consumers | Coach, Michael Kors, Ralph Lauren | Continued strong consumer demand for accessible luxury. |

| Luxury Rental | Temporary access to luxury, lower cost | Reduces need for outright purchase | Rent the Runway, By Rotation | Projected significant growth, offering experiential luxury. |

| Resale Market | Pre-owned luxury, lower price, sustainability appeal | Cannibalizes new sales, brand perception impact | The RealReal, Vestiaire Collective | Booming market, attracting younger, eco-conscious consumers. |

| Experiential Spending | Travel, dining, events as status symbols | Competes for discretionary income | High-end travel agencies, Michelin-starred restaurants | Surging global spending on experiences over goods. |

| Fast Fashion | Trend replication, very low price | Offers similar aesthetic at accessible price | Zara, H&M, Shein | Global market valued around $110 billion in 2024. |

| Counterfeit Goods | Illicit replicas, low quality, low price | Dilutes brand value, direct sales loss | Online marketplaces, street vendors | Market estimated in hundreds of billions annually. |

Entrants Threaten

The sheer financial muscle needed to even consider competing with Burberry is staggering. Think about the costs involved in sourcing premium materials, maintaining high-quality manufacturing, and then the massive marketing spend to build global brand awareness. For instance, in the fiscal year ending March 2024, Burberry reported revenues of £2.97 billion, a testament to its established market presence and the significant investment required to achieve such scale.

Beyond the initial capital, cultivating a luxury brand with the kind of heritage and cachet Burberry possesses is a generational undertaking. New players would struggle immensely to replicate the centuries of history, the iconic trench coat, and the widespread aspirational appeal that Burberry has meticulously built. This deep-rooted brand equity acts as a formidable moat, making it incredibly difficult for newcomers to gain traction in the luxury fashion space.

Burberry's formidable brand recognition and deeply ingrained customer loyalty present a substantial hurdle for potential new competitors. The company's iconic check pattern and heritage are instantly recognizable, fostering a sense of prestige and trust that new entrants would find incredibly difficult to replicate.

Building the same level of emotional connection and perceived value that Burberry has meticulously crafted over many years would require immense investment and time, making it a challenging proposition for newcomers aiming to disrupt the luxury fashion market.

Newcomers face significant hurdles in accessing Burberry's exclusive supply chains. The brand's reliance on specialized artisans and premium, ethically sourced materials creates a high barrier to entry, as replicating these relationships and quality standards is incredibly difficult and expensive. For instance, securing the same level of craftsmanship for intricate leather goods or unique textile weaves requires established connections and a proven track record in the luxury sector.

Establishing a robust global distribution network is another major threat for potential entrants. Burberry's extensive retail presence, encompassing prime locations in major fashion capitals and a sophisticated multi-channel e-commerce platform, is the result of decades of investment and strategic development. New brands would struggle to match this reach, facing high costs for prime real estate and the complex logistics of building an international, integrated sales infrastructure.

Intellectual Property and Design Protection

Burberry's robust intellectual property portfolio, encompassing unique designs, iconic patterns like the check, and strong trademarks, presents a formidable barrier to potential new entrants. Attempting to replicate Burberry's established luxury aesthetic would expose new players to significant legal challenges and the substantial risk of intellectual property infringement. This legal landscape inherently limits the creative freedom and market entry possibilities for those seeking to imitate its distinctive brand identity.

The threat of new entrants in the luxury fashion sector, particularly for a brand like Burberry, is significantly mitigated by the high cost and complexity associated with establishing and protecting intellectual property. In 2024, the luxury goods market continued its growth trajectory, with reports indicating a global market size of approximately $300 billion, underscoring the value of established brands and their IP. Newcomers would need substantial investment in legal counsel and brand protection strategies to even begin competing, a deterrent that favors incumbents with existing, legally secured assets.

- Intellectual Property as a Barrier: Burberry's extensive design patents, trademarks, and copyright protection for its unique patterns and logos create significant legal hurdles for new entrants.

- Risk of Infringement Lawsuits: Any attempt by a new brand to closely mimic Burberry's distinctive visual identity would likely result in costly and time-consuming infringement lawsuits.

- Brand Reputation and Value: The established reputation and brand value tied to Burberry's intellectual property make it difficult for new, unproven entities to gain market traction through imitation.

- Legal Costs and Deterrence: The substantial legal costs associated with navigating and respecting existing IP rights act as a significant deterrent for potential new competitors in the luxury segment.

Regulatory Hurdles and Ethical Standards

The luxury fashion sector, including brands like Burberry, faces significant regulatory challenges. For instance, the EU's proposed Ecodesign for Sustainable Products Regulation, expected to fully roll out by 2026, will impose stricter rules on product durability, repairability, and recyclability, directly impacting manufacturing processes and material choices for new entrants.

Navigating these evolving requirements, alongside existing mandates on ethical sourcing and labor practices, demands substantial investment in compliance infrastructure and supply chain transparency. Failure to meet these high ethical standards can result in severe reputational damage, a critical concern in the brand-conscious luxury market.

- Sustainability Regulations: New entrants must comply with evolving environmental standards, such as those related to material sourcing and waste reduction, which can increase initial operating costs.

- Ethical Sourcing Mandates: Demonstrating fair labor practices throughout the supply chain is crucial, requiring robust auditing and transparency, adding complexity and expense to market entry.

- Brand Reputation Risk: Non-compliance with regulatory or ethical standards can lead to significant brand damage, deterring potential new players who cannot guarantee adherence.

The threat of new entrants for Burberry remains relatively low due to the immense capital investment required to establish a luxury brand. In 2024, the luxury market continued to demand significant resources for premium materials, high-quality manufacturing, and extensive global marketing, as evidenced by Burberry's £2.97 billion revenue in FY24. This financial barrier, coupled with the difficulty of replicating Burberry's centuries of brand heritage and aspirational appeal, makes market entry exceptionally challenging for newcomers.

Porter's Five Forces Analysis Data Sources

Our Burberry Group Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Burberry's annual reports, investor presentations, and financial statements. We also leverage industry-specific market research reports and reputable business news outlets to capture current trends and competitive landscapes.