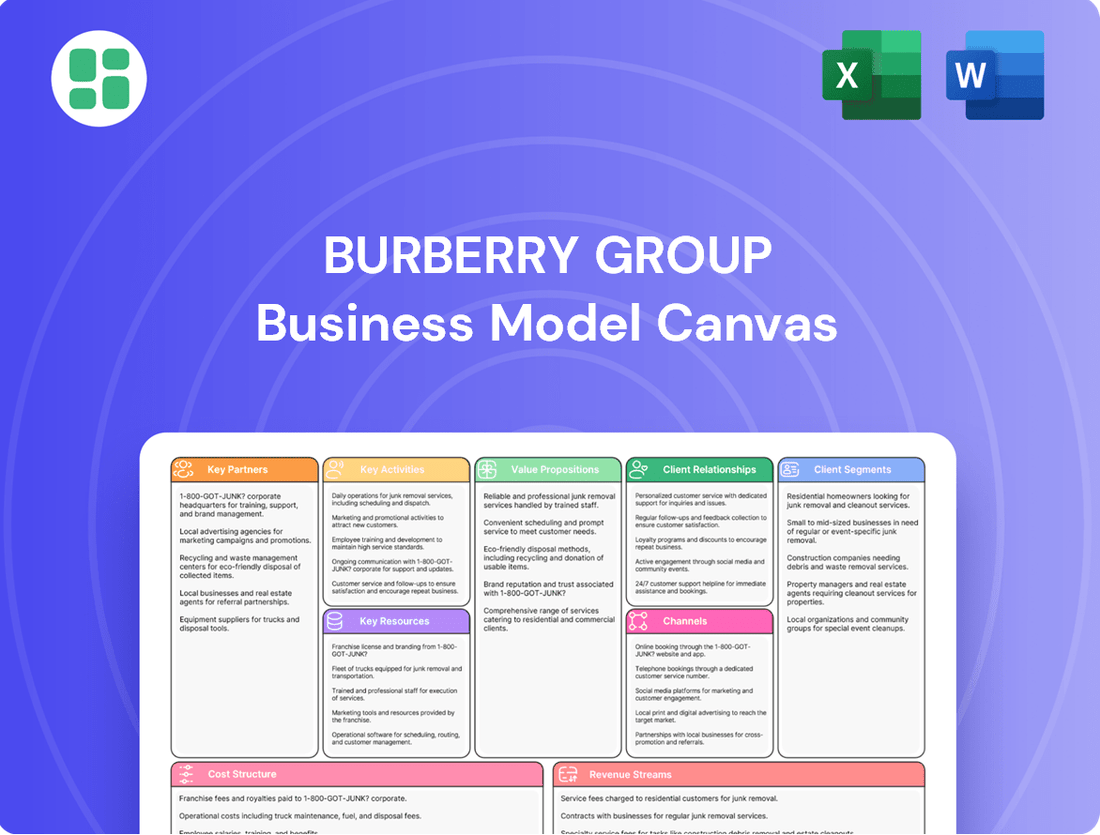

Burberry Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burberry Group Bundle

Uncover the core strategies that fuel Burberry Group's luxury fashion empire with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, key resources, and revenue streams, offering a powerful lens into their success. Ready to dissect the mechanics of a global brand?

Partnerships

Burberry's commitment to quality is underpinned by its luxury manufacturing partners, including wholly owned centers of excellence for leather goods and technical outerwear in Italy, alongside its UK facilities. These partnerships are crucial for maintaining high standards and driving continuous improvement in supply chain working conditions.

The strategic acquisition of Pattern SpA, an Italian outerwear supplier, in 2023 exemplifies Burberry's focus on enhancing its technical outerwear capabilities. This move also serves to deeply embed sustainability throughout its value chain, aligning with evolving consumer expectations and regulatory landscapes.

Burberry actively collaborates with technology and digital innovation partners to elevate its online and in-store customer experiences, with a strong emphasis on seamless omnichannel journeys. A prime example is their partnership with Tencent, which led to the development of a Social Retail Store in Shenzhen. This innovative space integrates digital and physical retail, offering customers interactive experiences that blur the lines between online and offline engagement.

This strategic alliance with Tencent leverages cutting-edge technologies such as artificial intelligence and gamification. These tools are instrumental in personalizing customer interactions, making each visit more engaging and tailored. Furthermore, the partnership aims to significantly improve the integration of online browsing and purchasing with the physical store experience, driving customer loyalty and sales.

Burberry strategically collaborates with licensing partners for specific product categories like eyewear and beauty. This approach allows the company to tap into specialized product development and distribution knowledge from external experts. For instance, in 2023, the beauty segment, managed under license, continued to be a significant contributor to the luxury market's growth, with Burberry's beauty products maintaining a strong presence.

Sustainability and Community Partners

Burberry's commitment to sustainability and community is bolstered by strategic partnerships. They actively collaborate with organizations like ZDHC (Zero Discharge of Hazardous Chemicals) to enhance chemical management within their operations, ensuring a safer environment. In 2023, Burberry continued its support for initiatives such as Girls Inc. of New York City through its Burberry Inspire program, fostering educational and developmental opportunities for young people.

Further extending its impact, Burberry partners with Fashion Avengers to champion the UN Sustainable Development Goals across the fashion industry. This collaboration aims to drive collective action and accountability for a more sustainable future. The company also directs investments toward broader climate change initiatives, demonstrating a commitment that reaches beyond its direct supply chain to address global environmental challenges.

- ZDHC Collaboration: Enhancing chemical management and safety standards.

- Girls Inc. Partnership: Supporting educational and developmental programs for young women.

- Fashion Avengers Alliance: Driving industry-wide action on UN Sustainable Development Goals.

- Climate Change Investments: Funding projects to address environmental challenges beyond the immediate supply chain.

Cultural and Artistic Collaborations

Burberry's strategy includes significant cultural and artistic collaborations to elevate its brand image and connect with discerning luxury consumers. These partnerships are carefully curated to align with major collection launches, creating immersive experiences that amplify the brand's narrative. For instance, the brand's alignment with the National Theatre underscores its commitment to sophisticated cultural engagement.

These alliances are crucial for resonating with a luxury audience that values artistic expression and cultural relevance. By associating with esteemed institutions, Burberry reinforces its position as a purveyor of quality and cultural significance. This approach not only enhances brand prestige but also provides a unique storytelling platform for its collections.

- Cultural Resonance: Partnerships with institutions like the National Theatre aim to connect with luxury consumers who appreciate artistic and cultural narratives, enhancing brand prestige.

- Collection Alignment: Collaborations are often timed with major runway events and new collections, creating a cohesive and impactful brand presentation.

- Artistic Showcase: Daniel Lee's Fall 2025 runway show at Tate Britain exemplifies Burberry's dedication to supporting the arts and integrating them into its brand identity.

Burberry's manufacturing excellence is supported by wholly owned centers in Italy and the UK, focusing on leather goods and technical outerwear, crucial for quality and supply chain improvements. The 2023 acquisition of Pattern SpA further bolstered its technical outerwear capabilities and sustainability integration.

Digital innovation is key, with partnerships like the one with Tencent for its Shenzhen Social Retail Store, blending online and offline experiences using AI and gamification to personalize customer journeys.

Licensing partners in eyewear and beauty, like the beauty segment managed under license in 2023, leverage specialized expertise, contributing to market growth and brand presence.

Sustainability efforts involve collaborations with ZDHC for chemical management and organizations like Girls Inc. through the Burberry Inspire program, alongside broader climate change investments.

Cultural partnerships, such as with the National Theatre and the Tate Britain for the Fall 2025 runway show, enhance brand prestige and connect with luxury consumers through artistic expression.

What is included in the product

A comprehensive, pre-written business model tailored to Burberry's strategy, detailing customer segments, channels, and value propositions to reflect real-world operations and plans.

Organized into 9 classic BMC blocks with full narrative and insights, this model is ideal for presentations and funding discussions, designed to help entrepreneurs and analysts make informed decisions.

The Burberry Group Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of its core components, allowing for rapid identification of strategic strengths and potential weaknesses.

This structured approach simplifies complex operations, making it an invaluable tool for quickly understanding Burberry's value proposition and customer relationships, thereby easing the burden of intricate analysis.

Activities

Burberry's central activity revolves around the meticulous design and development of high-end fashion items. This encompasses everything from elegant ready-to-wear apparel to sophisticated leather goods, stylish footwear, and distinctive accessories, all crafted to embody the brand's rich British heritage.

The company strategically blends its iconic heritage with forward-thinking innovation to curate collections that resonate with a diverse global luxury clientele. A key aspect of this strategy involves refining its pricing architecture to ensure product availability across a spectrum of price points, reinforcing category authority and accessibility within the luxury market.

Burberry's manufacturing prowess is anchored in its UK and Italian facilities, where it crafts its luxury goods. This is complemented by a robust global supplier network, ensuring a consistent flow of high-quality materials and finished products. For instance, the iconic Heritage Trench Coats are woven from gabardine in Yorkshire, UK, a testament to the brand's heritage and commitment to in-house craftsmanship.

The company's dedication extends to its Scottish operations, where cashmere scarves are produced in collaboration with long-term partners. This strategic approach to manufacturing and supply chain management not only preserves the brand's artisanal quality but also allows for greater control over production processes. Burberry reported that in fiscal year 2024, its manufacturing sites played a crucial role in delivering its collections, with a focus on maintaining the highest standards of luxury production.

Furthermore, Burberry places a significant emphasis on responsible sourcing and ethical trading practices across its entire supply chain. This commitment ensures that materials are obtained ethically and that suppliers adhere to stringent labor and environmental standards. In 2024, the company continued to invest in initiatives aimed at enhancing transparency and sustainability within its supply network, reflecting a broader industry trend towards conscious luxury.

Burberry's core activities revolve around operating a sophisticated multi-channel retail network. This includes managing its own brick-and-mortar stores, a significant presence in department store concessions, and a robust wholesale business that reaches a global customer base. The company is actively enhancing its digital commerce platform, Burberry.com, to ensure a seamless and engaging online shopping journey for its clientele.

A key focus is optimizing the performance across all these channels. Burberry is strategically working to improve its visibility and sales within key wholesale partnerships, ensuring its products are presented effectively. Simultaneously, the digital arm is being refined to offer an inspiring and user-friendly experience, reflecting the brand's luxury status.

The company is committed to aligning its distribution strategies with evolving customer preferences and purchasing habits. This involves not only expanding its digital reach but also driving efficiency and productivity within its physical store locations. For instance, in the fiscal year ending March 2024, Burberry reported a 2% increase in retail revenue to £2,258 million, demonstrating the effectiveness of its multi-channel approach.

Brand Marketing and Storytelling

Burberry's brand marketing and storytelling are central to its strategy, aiming to reignite desire by showcasing its 'Timeless British Luxury' identity. This involves weaving its rich heritage, iconic brand codes, and distinctive British wit into all campaign efforts.

The brand actively invests in key growth markets, with a significant portion of its marketing spend directed towards Mainland China and the USA. This focus is designed to enhance brand visibility and deepen consumer engagement in these crucial regions.

- Brand Reinforcement: Burberry prioritizes marketing to re-establish its core identity as a symbol of British luxury.

- Heritage and Wit: Campaigns leverage the brand's history and unique British sense of style and humor.

- Geographic Focus: Significant marketing investment is allocated to Mainland China and the USA for increased brand presence.

- Consumer Engagement: The aim is to build stronger connections with consumers through compelling narratives and targeted outreach.

Customer Engagement and Service Enhancement

Burberry actively cultivates strong customer relationships by offering unique in-store and digital experiences. This focus on memorable interactions aims to deepen brand loyalty and encourage repeat business. For instance, in 2024, Burberry continued to invest in digital platforms, enhancing their online customer journey to mirror the luxury feel of their physical stores.

To further personalize the customer experience, Burberry leverages advanced technologies. They are exploring and implementing predictive AI and sophisticated recommendation engines. These tools help anticipate customer needs and suggest relevant products, thereby increasing engagement and sales conversion rates. This strategy is key to maintaining a competitive edge in the luxury market.

Burberry's commitment to sustainability is also a core part of its customer engagement strategy through circular services. These initiatives, such as the 'ReBurberry Services,' offer product repair, reproofing, rental, and resale options. This not only extends the lifespan of their products but also appeals to an increasingly environmentally conscious consumer base, reinforcing their brand values.

- Customer Connection: Building lasting relationships through exceptional in-store and online experiences is paramount.

- Technological Integration: Utilizing predictive AI and recommendation engines to personalize customer interactions and anticipate needs.

- Circular Economy Initiatives: Offering services like repair, reproofing, rental, and resale via 'ReBurberry Services' to promote product longevity and sustainability.

Burberry's key activities encompass the meticulous design and development of luxury fashion, blending heritage with innovation. Manufacturing is strategically managed in the UK and Italy, supported by a global supplier network, with a focus on quality and responsible sourcing. The company operates a sophisticated multi-channel retail network, enhancing its digital commerce platform and optimizing performance across physical stores and wholesale partnerships.

Brand marketing and storytelling are central, emphasizing Timeless British Luxury and investing in key growth markets like Mainland China and the USA. Furthermore, Burberry cultivates strong customer relationships through personalized digital and in-store experiences, leveraging technology and circular economy initiatives to foster loyalty and sustainability.

| Key Activity Area | Description | Fiscal Year 2024 Data/Focus |

|---|---|---|

| Design & Development | Creating high-end fashion items, from apparel to accessories, embodying British heritage. | Focus on blending iconic heritage with forward-thinking innovation. |

| Manufacturing & Supply Chain | Producing luxury goods in UK/Italian facilities and managing a global supplier network. | Emphasis on artisanal quality, responsible sourcing, and ethical trading practices. |

| Retail Operations | Managing brick-and-mortar stores, department store concessions, and wholesale. | Enhancing digital commerce (Burberry.com) and driving efficiency in physical stores. Retail revenue increased by 2% to £2,258 million. |

| Marketing & Brand Building | Showcasing 'Timeless British Luxury' through heritage, brand codes, and British wit. | Significant investment in Mainland China and the USA to enhance visibility and engagement. |

| Customer Relationship Management | Offering unique experiences and personalized interactions to build loyalty. | Leveraging AI for personalized recommendations and promoting circular services like repair and resale. |

Full Document Unlocks After Purchase

Business Model Canvas

The Burberry Group Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. You can be assured that upon completing your order, you will gain full access to this meticulously crafted Business Model Canvas, ready for your strategic analysis and application.

Resources

Burberry's extensive heritage, originating in 1856, is a cornerstone of its business, providing a deep well of brand equity. This history is embodied in its instantly recognizable trench coats, gabardine fabric, and the distinctive check pattern, all of which are critical to its luxury market positioning and appeal.

The brand's legacy of pioneering outerwear technology, particularly in developing durable and waterproof fabrics, offers a unique competitive edge. This history of innovation reinforces its status as a premium and trusted name in fashion.

Burberry's key resources include its vast global retail network, featuring directly operated stores, concessions, and wholesale partnerships in prime luxury locations. This physical presence is a cornerstone of its brand experience.

Complementing its physical stores, Burberry leverages a powerful digital commerce platform, Burberry.com. This online channel is vital for reaching a worldwide customer base and fostering direct engagement.

In 2023, Burberry reported that digital channels accounted for a significant portion of its sales, demonstrating the critical role of its online platform in its overall strategy. The company continues to invest in both its physical and digital retail infrastructure to maintain its competitive edge.

Burberry's skilled workforce, encompassing design teams, product developers, artisans, and retail staff, is a cornerstone of its business. Their expertise in both traditional craftsmanship and contemporary luxury fashion is a vital resource for the brand's unique appeal.

The company's commitment to preserving heritage techniques while pushing fashion boundaries is directly supported by its human capital. In 2024, Burberry continued to invest in employee development programs, aiming to nurture a high-performance culture that drives innovation and maintains the quality expected of a luxury house.

Proprietary Manufacturing Facilities and Supply Chain Infrastructure

Burberry's proprietary manufacturing facilities, notably in Yorkshire, UK, and Florence and Turin, Italy, are cornerstones of its business model, directly supporting its commitment to quality and heritage craftsmanship. These owned sites allow for meticulous oversight of production processes. In 2023, Burberry continued to invest in these capabilities, including the strategic acquisition of an Italian outerwear supplier, enhancing its vertical integration and control over product development and quality.

The company's supply chain infrastructure is another critical resource, focusing on transparency and responsible sourcing. This robust network ensures the integrity of its materials and production, aligning with growing consumer demand for ethical practices. Burberry's efforts in supply chain management are vital for maintaining brand reputation and operational efficiency, especially as global logistics continue to evolve.

- Owned Manufacturing Sites: Yorkshire (UK), Florence (Italy), Turin (Italy).

- Strategic Acquisitions: Italian outerwear supplier acquired to bolster in-house production.

- Supply Chain Focus: Emphasis on transparency, responsible sourcing, and quality control.

Financial Capital and Data Analytics Capabilities

Burberry's financial capital, including its cash reserves and investment capacity, is crucial for funding key strategic initiatives. This financial strength enables significant investments in areas like store refurbishments and the adoption of new technologies, as seen in their ongoing digital transformation efforts.

In 2024, Burberry continued to emphasize data analytics to enhance its creative process. By leveraging insights into customer personas, average order value, and purchase frequency, the company aims to optimize product assortments and pricing strategies. For example, understanding that a significant portion of their online sales in 2023 came from repeat customers with high average order values informed their targeted marketing campaigns.

- Financial Reserves: Adequate cash and investment capacity support capital expenditures for store upgrades and technology integration.

- Data-Driven Insights: Analytics inform product development, inventory management, and personalized customer experiences.

- Customer Behavior Analysis: Metrics like average order value and purchase frequency guide merchandising and pricing decisions.

- Strategic Investment: Financial resources are allocated to maintain brand positioning and drive future growth through innovation.

Burberry's intellectual property, including its iconic brand name, logos, and distinctive check pattern, represents a significant intangible asset. This intellectual capital is meticulously protected through trademarks and design patents, safeguarding its premium market positioning and preventing brand dilution.

The company's creative output, encompassing unique designs, fabric innovations, and marketing campaigns, forms another crucial intellectual resource. This continuous stream of creative development is vital for maintaining its relevance and appeal in the dynamic luxury fashion landscape.

Burberry's commitment to sustainability and ethical practices is increasingly becoming a key resource, resonating with a growing segment of conscious consumers. This focus on responsible business operations enhances brand reputation and fosters long-term customer loyalty.

In 2023, Burberry continued to invest in its digital infrastructure, enhancing its e-commerce capabilities and data analytics. This strategic focus on technology and data underpins its ability to understand and engage with its global customer base effectively.

| Key Resource | Description | 2023/2024 Relevance |

| Intellectual Property | Brand Name, Logos, Check Pattern, Designs | Protected trademarks and patents reinforce luxury status. |

| Creative Output | New Designs, Fabric Innovations, Marketing Campaigns | Drives brand relevance and appeal in the fashion industry. |

| Sustainability & Ethics | Responsible Sourcing, Environmental Initiatives | Appeals to conscious consumers, enhancing brand reputation. |

| Digital Infrastructure & Data | E-commerce, Analytics, Customer Insights | Enables effective global customer engagement and personalized experiences. |

Value Propositions

Burberry's enduring appeal lies in its embodiment of timeless British luxury and a deep-rooted heritage. The brand consistently delivers designs that transcend fleeting trends, appealing to consumers who value authenticity and classic sophistication. This commitment to lasting style is a cornerstone of their value proposition.

Central to this is Burberry's history, originating from Thomas Burberry's innovation in creating weatherproof clothing, most famously the gabardine trench coat. This foundational principle of protection and enduring quality still resonates, offering customers a tangible connection to the brand's legacy and a promise of lasting wear.

In 2023, Burberry reported strong performance in its Outerwear category, a testament to the continued desirability of its heritage pieces. This segment, including iconic trench coats, remains a significant driver of brand perception and customer loyalty, reinforcing the value of its timeless British luxury.

Burberry's exceptional quality and craftsmanship are core to its value proposition, promising customers products made with meticulous attention to detail and using responsibly sourced materials. This dedication ensures longevity and supports the brand's premium positioning. For instance, a single Burberry trench coat collar requires 180 stitches, showcasing the intricate work involved.

This commitment to superior construction and durable materials justifies the higher price point for Burberry items, appealing to consumers who value lasting quality over fast fashion. The company further reinforces this by offering services designed to extend the life of their products, demonstrating a long-term investment in customer satisfaction and product value.

Burberry consistently pushes boundaries in design and functionality, blending traditional craftsmanship with modern innovation. This commitment is evident in their exploration of sustainable materials, with a significant portion of their collections now featuring eco-friendly alternatives, reflecting a growing consumer demand for responsible luxury. For instance, in their 2024 fiscal year, Burberry reported a strong emphasis on their trench coats, a testament to their heritage outerwear, while simultaneously investing in research for next-generation materials.

Exclusive and Personalized Customer Experience

Burberry cultivates an exclusive and personalized customer journey, extending from its opulent physical boutiques to its sophisticated digital channels. This commitment to a premium experience is central to their strategy.

Leveraging advanced technology, including AI-driven insights, Burberry delivers tailored product recommendations and immersive brand interactions. This personalized approach is designed to deepen customer engagement and cultivate lasting loyalty.

For instance, in 2023, Burberry reported a 7% increase in digital revenue, underscoring the effectiveness of their enhanced online platforms in delivering a personalized experience. This focus aims to resonate with their discerning, affluent clientele.

- Personalized digital recommendations

- Immersive in-store experiences

- AI-powered customer service

- Building long-term customer loyalty

Commitment to Sustainability and Ethical Practices

Burberry's commitment to sustainability is a significant draw, particularly for consumers who prioritize environmental and ethical considerations. This dedication is evident in their ambitious targets for emission reductions and their focus on sourcing materials responsibly. For instance, in their 2023/2024 fiscal year, Burberry continued to advance its environmental goals, aiming to cut its absolute greenhouse gas emissions by 46% by 2030 against a 2019 baseline, and by 90% by 2040.

The brand is actively working to eliminate plastic from its consumer packaging, a move that resonates with a growing segment of the market. Furthermore, Burberry's ethical trading programs and exploration of circular business models, such as offering repair and resale services, directly appeal to consumers who are increasingly conscious of the social and environmental impact of their purchases.

- Emission Reduction Targets: Aiming for a 46% absolute reduction in greenhouse gas emissions by 2030 (vs. 2019 baseline).

- Material Sourcing: Prioritizing responsibly sourced materials across product lines.

- Plastic Elimination: Working towards removing plastic from consumer packaging.

- Circular Economy Initiatives: Developing repair and resale programs to extend product life.

Burberry offers a unique blend of heritage British luxury with modern innovation, providing customers with timeless, high-quality products that transcend seasonal trends. This commitment to enduring style and craftsmanship appeals to a discerning clientele seeking authenticity and lasting value in their purchases.

The brand's dedication to sustainability is a key differentiator, attracting environmentally conscious consumers through ambitious emission reduction targets and responsible material sourcing. Initiatives like plastic elimination from packaging and circular economy programs further solidify this appeal, aligning with growing market demand for ethical luxury.

Burberry crafts a premium, personalized customer experience across both physical and digital touchpoints, leveraging technology like AI for tailored recommendations and engagement. This focus on building deep customer relationships fosters loyalty and reinforces the brand's exclusive positioning.

Burberry's value proposition is anchored in its iconic heritage and commitment to quality craftsmanship, exemplified by its enduring trench coats. For instance, in fiscal year 2024, the brand highlighted the continued strength of its outerwear, a category that consistently drives brand perception and customer loyalty.

Customer Relationships

Burberry's approach to customer relationships centers on personalized clienteling, particularly for its high-net-worth clientele, fostering deep loyalty. Store associates build genuine connections, often remembering clients by name and offering bespoke recommendations and early access to coveted new arrivals.

This focus on tailored service significantly enhances the luxury shopping journey, making clients feel valued and understood. In 2024, Burberry continued to invest in digital tools to support this, allowing associates to track client preferences and purchase history, further personalizing interactions and driving repeat business.

Burberry cultivates strong customer relationships by offering a fluid omnichannel experience, seamlessly blending digital interactions with their physical stores. This approach ensures customers feel connected and valued regardless of how they choose to engage with the brand.

Leveraging digital channels, Burberry provides personalized content, virtual try-on features, and interactive in-store experiences. This commitment to digital innovation aims to create a consistent and engaging journey for every customer, enhancing brand loyalty and driving sales.

Burberry cultivates strong customer relationships through immersive brand activations, including exclusive fashion shows and impactful cultural collaborations. These events, like the recent Spring/Summer 2025 collection showcase, aim to forge deeper connections and create memorable brand interactions.

The company also actively invests in community building, notably through programs designed to inspire and empower young talent. This commitment to social responsibility, exemplified by initiatives supporting creative education, resonates with a growing segment of consumers who prioritize ethical brand practices.

These carefully curated experiences and community engagements not only reinforce brand loyalty but also broaden Burberry's appeal, attracting new customers who are drawn to its blend of heritage, innovation, and positive social impact.

Aftercare and Circular Services

Burberry cultivates enduring customer connections through comprehensive aftercare and circular services, exemplified by its ReBurberry Services. This initiative encompasses product repair, reproofing, rental, and resale, directly addressing the growing consumer demand for sustainability and product longevity. For instance, the brand's commitment to extending product life actively contributes to customer loyalty and brand perception.

These circular offerings are strategically integrated into Burberry's global retail footprint, making them accessible to a broad customer base. By providing these services, Burberry not only enhances customer satisfaction but also reinforces its position as a responsible luxury brand, aligning with the values of an increasingly environmentally conscious clientele. This approach fosters a deeper, more meaningful relationship beyond the initial purchase.

- ReBurberry Services: Offers repair, reproofing, rental, and resale options.

- Customer Loyalty: Enhances satisfaction and encourages repeat business through product longevity.

- Global Accessibility: Services are available across numerous Burberry stores worldwide.

- Sustainability Alignment: Meets evolving consumer values by promoting circularity and reducing waste.

Direct Communication and Feedback Mechanisms

Burberry prioritizes direct engagement with its clientele, utilizing sophisticated data analytics to glean insights into evolving customer preferences and valuable feedback. This commitment to understanding customer sentiment allows for a dynamic refinement of both its luxury product lines and the overall service experience.

In 2024, Burberry continued to invest in digital platforms that facilitate this direct communication. For instance, its enhanced loyalty program, which saw a significant uptick in engagement throughout the year, provides a direct channel for personalized offers and feedback collection. This data-driven approach ensures that Burberry remains attuned to customer desires, aiming to surpass expectations in the competitive luxury market.

- Data-driven personalization: Burberry leverages customer data to tailor communication and product recommendations, enhancing engagement.

- Feedback integration: Direct feedback mechanisms are actively used to inform product development and service improvements.

- Digital channel focus: Investments in digital platforms strengthen the direct connection with customers, facilitating two-way communication.

- Loyalty program enhancement: In 2024, the loyalty program saw increased participation, serving as a key tool for gathering customer insights and fostering relationships.

Burberry's customer relationships are built on personalized clienteling, especially for high-net-worth individuals, fostering loyalty through memorable in-store experiences. Digital tools in 2024 supported associates in tracking client preferences, enhancing personalized interactions.

The brand cultivates strong connections via an omnichannel approach, seamlessly blending digital and physical touchpoints. This ensures customers feel valued and consistently engaged, whether online or in-store, reinforcing brand loyalty and driving repeat purchases.

Burberry also focuses on community and sustainability, with initiatives like ReBurberry Services offering repair, rental, and resale. This resonates with consumers valuing ethical practices and product longevity, as seen in the growing demand for circular fashion solutions.

Direct engagement through data analytics allows Burberry to understand evolving customer preferences, informing product development and service enhancements. In 2024, the brand's enhanced loyalty program saw increased participation, serving as a vital channel for insights and relationship building.

Channels

Burberry's directly operated retail stores are the cornerstone of its brand presentation, offering customers an immersive experience with its complete product assortment. As of March 2025, the company maintained a significant global presence with 422 such locations.

These strategically positioned stores are situated in prime luxury retail environments across key markets, including Asia Pacific, Europe, the Middle East, India, and Africa (EMEIA), and the Americas. This extensive network ensures brand visibility and accessibility to its discerning clientele.

Burberry strategically places concessions within high-end department stores globally, such as Selfridges in London and Saks Fifth Avenue in New York. This approach significantly broadens their physical retail presence, tapping into established luxury shopping destinations frequented by their target affluent demographic.

These partnerships offer a symbiotic advantage. Burberry gains access to the existing customer base and high foot traffic of these prestigious retailers, enhancing brand visibility. In 2023, luxury department stores continued to be a significant channel for premium brands, with many reporting robust sales growth, reflecting the enduring appeal of curated luxury environments.

Burberry.com functions as a vital global e-commerce hub, offering a sophisticated and engaging online platform for luxury consumers worldwide. The brand consistently enhances its digital capabilities, product selection, and styling advice to resonate with its target audience.

In 2024, Burberry reported that digital channels continued to be a significant contributor to overall revenue, underscoring the platform's strategic importance. This online presence allows for direct customer engagement and personalized shopping journeys.

Wholesale Partners

Burberry collaborates with a wide array of global wholesale partners, encompassing both niche multi-brand retailers and prominent luxury department stores. This strategy is crucial for expanding the brand's presence and reaching a broader customer base worldwide.

The company has been actively refining its wholesale network, which has led to a decrease in wholesale revenue. However, these partnerships continue to play a vital role in attracting new customers and ensuring significant brand visibility in key markets.

- Global Reach: Burberry's wholesale partners are situated across major international markets, facilitating broad customer access.

- Strategic Importance: Despite revenue shifts, wholesale channels remain key for customer acquisition and brand awareness.

- 2024 Performance Context: While specific 2024 wholesale revenue figures are part of ongoing strategic evaluations, the channel's foundational role in brand exposure persists.

Licensed Boutiques and Distributors

Burberry strategically utilizes licensed boutiques and distributors for specific product lines, notably in beauty and eyewear. This approach allows for specialized management and deeper market reach, leveraging partners with existing expertise and infrastructure. For instance, in 2024, the beauty segment, managed under license, continued to be a significant contributor to brand visibility and revenue, with new fragrance launches driving consumer engagement.

These licensed channels are crucial for expanding Burberry's presence in niche markets where direct control might be less efficient. The partners are responsible for the operational aspects of these boutiques and distribution networks, ensuring brand consistency while benefiting from local market knowledge. This model allows Burberry to focus its resources on core luxury apparel and accessories.

- Specialized Expertise: Partners bring focused knowledge in categories like beauty and eyewear, enhancing product presentation and customer experience.

- Market Penetration: Licensed distributors provide access to wider geographical areas and customer segments, increasing overall brand reach.

- Brand Focus: Burberry can concentrate on its core luxury goods while ensuring specialized categories are managed by experts.

- 2024 Performance: The beauty division, operating under a licensing agreement, reported strong growth in key markets, contributing to Burberry's overall global sales figures.

Burberry's channel strategy is multifaceted, encompassing directly operated stores, department store concessions, e-commerce, wholesale, and licensed operations. This diverse approach ensures broad market reach and caters to various customer preferences. The company's commitment to enhancing its digital presence, as seen in 2024's strong performance of Burberry.com, highlights the growing importance of online sales. Meanwhile, strategic wholesale partnerships, though undergoing refinement, remain vital for customer acquisition and brand visibility. Licensed channels, particularly in beauty, demonstrate Burberry's ability to leverage specialized expertise for category growth.

| Channel | Description | Key Aspect | 2024 Relevance |

|---|---|---|---|

| Directly Operated Retail | Immersive brand experience, full product assortment. | 422 global locations (as of March 2025). | Cornerstone of brand presentation and customer engagement. |

| Department Store Concessions | Presence within high-end retailers. | Access to established luxury environments and affluent demographics. | Broadens physical retail footprint and taps into existing customer bases. |

| E-commerce (Burberry.com) | Global online platform for luxury consumers. | Direct customer engagement, personalized journeys. | Significant contributor to revenue in 2024, underscoring strategic importance. |

| Wholesale | Partnerships with multi-brand retailers and department stores. | Expands presence and reaches broader customer base. | Key for customer acquisition and brand awareness, despite revenue adjustments. |

| Licensed Boutiques/Distributors | Specialized management for beauty and eyewear. | Leverages partner expertise and infrastructure. | Beauty segment reported strong growth in 2024, contributing to overall sales. |

Customer Segments

Burberry's affluent luxury consumers are high-net-worth individuals drawn to premium quality, exclusive designs, and a sophisticated brand experience. These customers are not swayed by price, instead valuing authenticity, superior craftsmanship, and enduring elegance.

This segment demonstrates remarkable resilience in their spending on luxury goods. For instance, in the fiscal year ending March 2024, Burberry reported a 7% increase in revenue, with their core luxury segment driving much of this growth, underscoring the consistent demand from these discerning buyers.

Fashion-Conscious Individuals are Burberry's core demographic, actively seeking the newest luxury trends and appreciating the brand's distinctive heritage and modern designs. They are significantly influenced by high-profile runway shows and collaborations, often driving demand for new collections. In 2024, Burberry's focus on innovative designs and its strong brand identity continues to resonate with this segment, contributing to its premium market positioning.

Heritage Enthusiasts are a core customer group for Burberry, drawn to the brand's deep British roots and iconic status. They specifically seek out timeless pieces like the classic trench coat, recognizing Burberry's historical significance in fashion and its origins in protective outerwear. This segment values authenticity and the enduring legacy that Burberry represents.

Digitally Savvy Consumers

Digitally savvy consumers, particularly younger demographics, represent a key customer segment for Burberry. These individuals, often referred to as digital natives, are highly engaged with luxury brands through online channels and anticipate a cohesive experience across all touchpoints, known as omnichannel. Their purchasing decisions are heavily influenced by digital marketing strategies, a strong social media presence, and engaging online features. This trend is especially pronounced in markets like China, where digital integration is paramount.

Burberry's focus on this segment is evident in its investment in digital innovation. For instance, in the fiscal year ending March 2024, Burberry reported that digital channels contributed significantly to its sales, with online revenue showing robust growth. The brand actively leverages platforms like WeChat in China to create immersive brand experiences, including virtual try-ons and exclusive digital content, directly catering to the preferences of this digitally fluent audience.

- Digital Engagement: Younger consumers expect seamless online-to-offline experiences.

- Social Media Influence: Brand perception and purchase intent are shaped by digital marketing and social media presence.

- Omnichannel Expectations: Customers seek consistent brand interaction across all digital and physical touchpoints.

- Regional Focus: Markets like China demonstrate a strong preference for immersive online brand features.

Socially and Environmentally Conscious Buyers

Socially and environmentally conscious buyers are a growing demographic that actively seeks out brands aligning with their values. They prioritize sustainability, ethical production, and brands that demonstrate a commitment to reducing their environmental footprint. For Burberry, this translates to an appreciation for initiatives like responsible sourcing of materials and investments in circular economy principles.

This segment is attracted to Burberry's efforts in using more sustainable materials, such as recycled cashmere and organic cotton, and their focus on extending product life through repair and resale programs. In 2024, the luxury goods market, which Burberry operates within, saw continued growth driven by conscious consumerism, with sustainability becoming a key differentiator.

- Value Proposition: Burberry's commitment to sustainability, ethical sourcing, and circularity resonates deeply with this segment.

- Brand Appeal: Consumers are drawn to Burberry's use of recycled and organic materials, as well as their aftercare services that promote product longevity.

- Market Trend: The increasing demand for sustainable luxury goods in 2024 highlights the importance of this customer segment.

- Impact: Burberry's focus on responsible practices directly addresses the core concerns of these discerning buyers.

Burberry's customer base is multifaceted, encompassing affluent individuals who prioritize quality and exclusivity, alongside fashion-forward consumers seeking the latest trends rooted in the brand's heritage. A significant and growing segment includes digitally savvy younger demographics who expect seamless online experiences and are influenced by social media. Furthermore, a crucial group consists of socially and environmentally conscious buyers who value Burberry's commitment to sustainability and ethical practices.

| Customer Segment | Key Characteristics | 2024 Relevance/Data |

|---|---|---|

| Affluent Luxury Consumers | High-net-worth, value craftsmanship, exclusivity, and brand heritage. | Demonstrated resilience; Burberry's core luxury segment drove growth in FY24. |

| Fashion-Conscious Individuals | Seek new trends, appreciate heritage and modern designs, influenced by runways. | Contribute to premium positioning through demand for new collections. |

| Digitally Savvy Consumers | Younger demographics, expect omnichannel, influenced by digital marketing and social media. | Digital channels contributed significantly to sales in FY24; strong presence in China is key. |

| Heritage Enthusiasts | Drawn to British roots, iconic status, seek timeless pieces. | Value authenticity and enduring legacy, driving demand for classic items. |

| Socially & Environmentally Conscious Buyers | Prioritize sustainability, ethical production, and reduced environmental footprint. | Attracted to recycled materials and circularity initiatives; conscious consumerism is a key market trend. |

Cost Structure

Burberry's manufacturing and production costs are substantial, driven by the premium quality of its luxury goods. This includes the expense of skilled labor, the sourcing of high-grade materials like gabardine, cashmere, and fine leather, and the upkeep of its own manufacturing facilities located in the UK and Italy. For instance, in the fiscal year ending March 2024, Burberry reported a Cost of Sales of £1,941 million, reflecting these significant production expenditures.

Burberry's extensive global retail network, comprising directly operated stores and concessions, represents a significant cost center. These operational expenses include substantial outlays for prime retail rents, essential utilities, and the wages for a dedicated sales and management workforce. In 2024, maintaining this high-touch customer experience, including visual merchandising and store upkeep, remained a core investment, reflecting the brand's commitment to its physical presence.

Burberry dedicates significant resources to marketing, advertising, and brand promotion, a cornerstone of its luxury strategy. In fiscal year 2024, the company reported marketing expenses of £335 million, reflecting a strategic investment in global campaigns, fashion shows, and digital initiatives designed to reinforce its aspirational brand image and drive customer engagement.

Digital Transformation and Technology Investments

Burberry Group significantly invests in its digital infrastructure, channeling substantial resources into upgrading its e-commerce capabilities and creating engaging online customer journeys. This commitment to digital transformation is a core component of its cost structure.

These technology investments are designed to optimize operations and elevate the customer experience. For instance, in the fiscal year ending March 2024, Burberry continued to focus on enhancing its digital channels, which are crucial for reaching a global audience and driving sales growth.

- E-commerce Platform Enhancement: Ongoing development and maintenance of a robust and user-friendly online store.

- Immersive Digital Experiences: Creation of virtual try-ons, personalized content, and interactive online events.

- AI and Data Analytics: Investment in technologies to understand customer behavior, personalize marketing, and improve inventory management.

General and Administrative Costs

General and administrative costs at Burberry cover essential corporate functions like executive compensation, corporate office operations, legal services, and IT infrastructure. These overheads are crucial for maintaining the brand's global operations and strategic direction. For the fiscal year ending March 30, 2024, Burberry reported an operating loss of £93.3 million, indicating a challenging period where managing these costs effectively is paramount.

Burberry has actively pursued cost-saving initiatives and operational restructuring to enhance efficiency. These efforts are designed to streamline processes and reduce expenditure without compromising the brand's premium positioning. For instance, the company has been focusing on optimizing its supply chain and retail network, which directly impacts administrative overheads.

- Executive and administrative salaries: Costs associated with leadership and support staff.

- Corporate office expenses: Rent, utilities, and maintenance for headquarters.

- Legal and professional fees: Expenses for legal counsel, auditing, and consulting services.

- IT infrastructure: Investment in technology systems and support for global operations.

Burberry's cost structure is heavily influenced by its premium positioning, with significant expenditures in manufacturing, retail operations, and marketing. The brand's commitment to high-quality materials and craftsmanship drives production costs, while its global retail presence incurs substantial expenses for prime locations and customer experience. Strategic investments in digital transformation and brand promotion are also key cost drivers.

| Cost Category | FY2024 Figures (£ million) | Key Components |

|---|---|---|

| Cost of Sales | 1,941 | Skilled labor, premium materials (gabardine, cashmere, leather), manufacturing facility upkeep |

| Marketing & Advertising | 335 | Global campaigns, fashion shows, digital initiatives, brand reinforcement |

| Retail & Operating Expenses | Not explicitly detailed, but includes prime rents, utilities, sales staff wages, visual merchandising | Global store network maintenance, customer experience investment |

| General & Administrative | Implicit within operating expenses, contributing to overall overheads | Executive compensation, corporate office operations, legal, IT infrastructure |

Revenue Streams

Burberry's main income comes from selling its luxury products directly to customers. This happens in their own stores, both full-price and outlet locations, as well as through concessions within other retailers and their online shop, Burberry.com. In the fiscal year ending March 30, 2024, Burberry reported retail revenue of £2,041 million, highlighting the significant contribution of these direct sales channels.

Burberry generates revenue by selling its luxury goods to a network of wholesale partners worldwide. These partners include high-end department stores and curated multi-brand specialty retailers.

While Burberry has been strategically focusing on direct-to-consumer channels, wholesale sales still contribute to its overall revenue. For instance, in the fiscal year ending March 31, 2024, wholesale revenue represented a portion of the company's total sales, although the company has been managing this channel more selectively.

Burberry generates licensing royalties from strategic partnerships where third-party companies utilize the Burberry brand name and designs across specific product categories. These agreements, particularly prominent in beauty and eyewear, allow Burberry to expand its market reach without direct operational involvement in those sectors.

The revenue from these licensing deals is structured as royalties, typically a percentage of the net sales achieved by the licensees. This model leverages the partners' established expertise in product development, manufacturing, and distribution within their respective markets, while Burberry benefits from a consistent revenue stream tied to sales performance.

While specific royalty rates vary by agreement, the beauty segment, for instance, has historically been a significant contributor to Burberry's licensing income. For 2024, the company continued to focus on optimizing these partnerships to ensure brand consistency and maximize financial returns from its intellectual property.

Sales of Core Product Categories (Outerwear, Leather Goods, Accessories)

Burberry's revenue streams are primarily built upon the sales of its core product categories, which historically include outerwear and leather goods. While outerwear and scarves have long been recognized as strong performers, the company is actively working to diversify and rebalance its offerings.

Sales across accessories, womenswear, menswear, and childrenswear also contribute substantially to the overall revenue. This diversified approach helps mitigate risks associated with over-reliance on a single product segment.

For the fiscal year ended March 30, 2024, Burberry reported total revenue of £2.97 billion, demonstrating the significant volume of sales generated across its various product lines. The company's strategic focus remains on amplifying these core categories to drive continued sales growth.

- Outerwear and Scarves: Historically strong performers, forming a significant revenue base.

- Accessories: A key contributor to overall sales, showcasing brand appeal beyond apparel.

- Womenswear, Menswear, and Childrenswear: These categories collectively drive substantial revenue, indicating a broad customer appeal.

- Strategic Amplification: Burberry's focus on enhancing these core categories is central to its sales strategy.

Circular Services and Aftercare

Burberry's ReBurberry Services, encompassing repair, reproofing, rental, and resale, represent a growing facet of their customer engagement strategy. While not a primary revenue driver, these circular services foster strong customer loyalty by extending product life and aligning with increasing consumer demand for sustainable luxury. This focus on circularity is projected to become more significant as the market for pre-owned and rental luxury goods expands, with the global luxury resale market expected to reach $86 billion by 2030, up from $30 billion in 2022.

These initiatives contribute to customer retention and can generate incremental revenue streams through service fees and the resale of authenticated pre-owned items. For instance, the rental segment offers access to high-value items without the commitment of purchase, appealing to a broader customer base. Burberry's commitment to sustainability, as evidenced by these services, is crucial in the modern luxury landscape, where environmental, social, and governance (ESG) factors increasingly influence purchasing decisions.

- Circular Services: Repair, reproofing, rental, and resale (ReBurberry Services) enhance customer loyalty and offer potential for incremental revenue.

- Sustainability Alignment: These services directly support Burberry's sustainability objectives by extending product lifecycles and promoting responsible consumption.

- Market Growth: The expanding global market for luxury resale and rental services indicates a significant future revenue opportunity for brands offering such programs.

- Customer Engagement: ReBurberry Services provide alternative ways for customers to interact with the brand, fostering deeper relationships and brand advocacy.

Burberry's revenue is primarily driven by direct sales through its retail stores, including full-price and outlet locations, as well as its e-commerce platform. In fiscal year 2024, retail revenue reached £2,041 million, underscoring the importance of this channel.

Wholesale partnerships with luxury department stores and multi-brand retailers also contribute to Burberry's income. While managed more selectively, these sales remain a component of the company's overall financial performance.

Licensing agreements generate royalties from third parties using the Burberry brand in categories like beauty and eyewear, providing a steady revenue stream tied to licensee sales performance.

The company's core product categories, including outerwear, accessories, and apparel for men, women, and children, form the backbone of its sales. Total revenue for fiscal year 2024 was £2.97 billion, reflecting strong performance across these lines.

| Revenue Stream | Fiscal Year 2024 (Millions £) | Key Characteristics |

|---|---|---|

| Retail | 2,041 | Direct sales via stores and online; primary revenue driver. |

| Wholesale | (Not specified separately, but a component of total) | Sales to select luxury retailers; strategic channel management. |

| Licensing | (Not specified separately, but a component of total) | Royalties from brand usage in beauty, eyewear, etc. |

| Total Revenue | 2,970 | Combined sales across all categories and channels. |

Business Model Canvas Data Sources

The Burberry Group Business Model Canvas is built upon a foundation of comprehensive financial reports, detailed market research on luxury goods, and internal strategic planning documents. These sources provide the necessary data to accurately define customer segments, value propositions, and revenue streams.