Brunswick SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brunswick Bundle

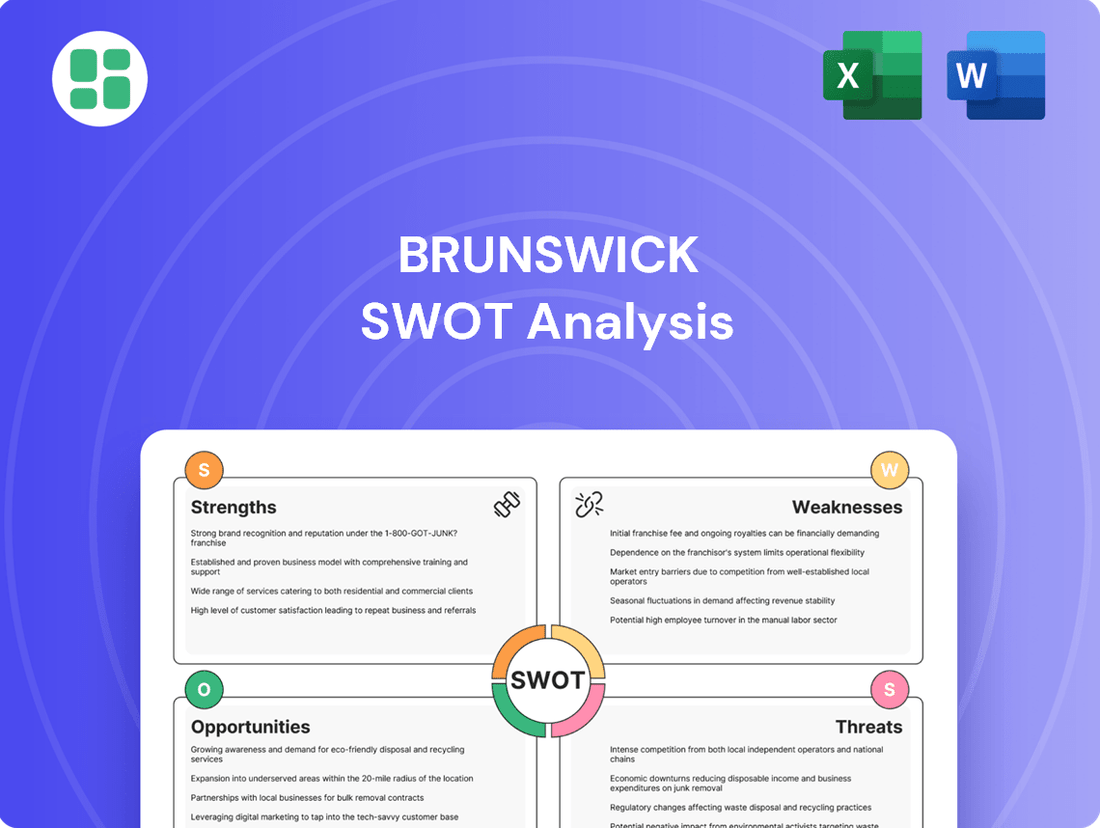

Brunswick's market position is shaped by its strong brand recognition and diverse product portfolio, but also faces challenges from evolving consumer preferences and intense competition. Our comprehensive SWOT analysis delves into these critical factors, offering a clear roadmap for strategic decision-making.

Want the full story behind Brunswick's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Brunswick Corporation stands as a dominant force in marine recreation, showcasing a robust portfolio of over 60 respected brands like Mercury Marine, Boston Whaler, Sea Ray, and Bayliner. This vast collection of well-recognized names fuels significant customer loyalty and provides a substantial edge over competitors.

The company's commanding presence in marine propulsion, especially in the outboard motor segment, reinforces its market leadership. For instance, Mercury Marine consistently captures a substantial share of the global outboard market, a testament to Brunswick's engineering prowess and brand strength.

Brunswick's strength lies in its diversified revenue streams, extending beyond core boat and engine manufacturing. The Parts & Accessories (P&A) segment is a significant contributor, demonstrating resilience even when boat sales face headwinds. For instance, in the first quarter of 2024, Brunswick reported P&A net sales of $320 million, a slight increase from the previous year, highlighting its stability.

Furthermore, the company's investment in Freedom Boat Club is proving to be a strategic advantage. This membership-based model generates recurring revenue and fosters customer loyalty, effectively expanding access to boating. By the end of 2023, Freedom Boat Club had grown to over 400 locations, showcasing its expanding reach and contribution to Brunswick's overall financial health.

This multi-faceted approach to revenue generation, encompassing manufacturing, parts, and a growing service/membership model, significantly reduces Brunswick's reliance on the inherently cyclical nature of new boat sales, thereby enhancing its financial stability and mitigating market-specific risks.

Brunswick’s dedication to innovation and technology is a significant strength, as evidenced by its substantial investments in areas like electric propulsion and integrated smart technologies. This forward-thinking approach is designed to improve the boating experience and tap into growing markets for sustainable and connected marine solutions. For instance, Brunswick has been actively developing and showcasing electric outboard motors, aiming to capture a share of the burgeoning eco-conscious recreational boating segment.

Strong Operational Management and Adaptability

Brunswick's operational management stands out, especially its ability to adapt to tough market conditions. They've skillfully managed inventory and production, aligning supply with demand to protect their profit margins. This strategic approach was evident in their strong cash generation reported in late 2024, a clear sign of their financial and operational discipline.

- Prudent Inventory and Production: Brunswick effectively adjusted supply to meet demand, safeguarding profit margins even amidst challenging market environments.

- Strong Cash Generation: The company reported significant cash generation in late 2024, demonstrating robust financial and operational execution.

- Market Adaptability: This operational flexibility allows Brunswick to successfully navigate market volatility and maintain a stable performance.

Commitment to Sustainability and Employer Recognition

Brunswick's dedication to sustainability is clearly demonstrated in its 2024 Sustainability Report, underscoring its efforts to innovate within the marine sector with eco-friendly practices. This commitment resonates with a growing market segment prioritizing environmental responsibility.

The company's strong employer brand is a significant asset, evidenced by its repeated recognition. For the sixth consecutive year, Brunswick was named one of America's Best Large Employers by Forbes in 2024. This consistent acknowledgment not only aids in attracting top-tier talent but also enhances its appeal to consumers who value corporate social responsibility.

- Sustainability Focus: Brunswick's 2024 Sustainability Report details advancements in eco-friendly marine operations.

- Employer Recognition: Forbes has recognized Brunswick as one of America's Best Large Employers for six consecutive years (2019-2024).

- Talent Attraction: Consistent employer accolades help in drawing skilled professionals to the company.

- Consumer Appeal: A strong sustainability and employer reputation positively influences environmentally conscious consumers.

Brunswick's diversified brand portfolio, featuring over 60 names like Mercury Marine and Boston Whaler, fosters strong customer loyalty and market differentiation. Its leadership in marine propulsion, particularly outboard motors, is a key competitive advantage, supported by consistent market share gains. The company's Parts & Accessories segment offers a stable revenue stream, as seen in its $320 million net sales in Q1 2024, providing a buffer against new boat sales cycles.

The strategic expansion of Freedom Boat Club, reaching over 400 locations by the end of 2023, diversifies revenue through a recurring membership model. Brunswick's commitment to innovation, including electric propulsion and smart technologies, positions it for future growth in sustainable marine solutions. Furthermore, its operational agility, demonstrated by prudent inventory management and strong cash generation in late 2024, highlights its resilience in dynamic market conditions.

Brunswick's dedication to sustainability, detailed in its 2024 Sustainability Report, appeals to an environmentally conscious consumer base. Its strong employer brand, recognized by Forbes as one of America's Best Large Employers for six consecutive years (2019-2024), aids in attracting top talent and enhances its corporate reputation.

| Metric | 2023 (Approx.) | 2024 (Q1) | Significance |

|---|---|---|---|

| Parts & Accessories Net Sales | ~$1.2 Billion | $320 Million | Demonstrates revenue stability |

| Freedom Boat Club Locations | >400 (End of 2023) | N/A | Indicates growing service segment |

| Forbes Best Large Employers Recognition | 6th Consecutive Year | 6th Consecutive Year | Highlights strong employer brand |

What is included in the product

Delivers a strategic overview of Brunswick’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

Brunswick's reliance on the leisure and recreational sector makes it particularly vulnerable to economic downturns. When the economy falters, discretionary spending on items like boats often takes a hit. For instance, Brunswick reported a notable decline in sales and earnings for 2024, with lower wholesale orders and softening consumer demand being key drivers.

This sensitivity to economic cycles means that factors like rising interest rates and declining consumer confidence can directly impact Brunswick's bottom line. These economic uncertainties create headwinds for demand in the recreational boating market, a core segment for the company.

Brunswick's financial performance in 2024 highlighted significant headwinds, with net sales dropping by 18.2% year-over-year. This downturn was particularly pronounced in its engine and boat segments, which are critical to its overall business. The company's adjusted operating profit also saw a substantial contraction, falling by 43%.

These sales declines suggest a weakening demand or increased competitive pressure in Brunswick's core markets. Despite efforts to manage inventory levels, the persistent drop in revenue across key product categories points to underlying challenges in driving top-line growth and maintaining healthy profit margins.

Brunswick's reliance on external suppliers for key components leaves its supply chain susceptible to disruptions, a vulnerability that has historically contributed to elevated operational expenses. For instance, in the first half of 2024, the company navigated ongoing logistics challenges that impacted inventory levels and lead times for certain parts, directly affecting production schedules and increasing freight costs.

Furthermore, Brunswick's production costs are notably higher when benchmarked against some of its international rivals. This cost differential can constrain its ability to compete aggressively on price in certain global markets, potentially squeezing profit margins, especially during periods of heightened input cost inflation as seen in early 2024 where raw material prices saw a general uptick.

Dependence on Traditional Boating Market

Brunswick's reliance on the traditional recreational boating sector presents a notable weakness. While the company has pursued diversification, a substantial revenue stream still originates from this core market. For instance, industry forecasts anticipate only modest, flat retail growth for new boats in 2025, indicating a potentially constrained environment for this segment.

This significant exposure makes Brunswick particularly susceptible to fluctuations in boating participation rates and evolving consumer tastes regarding conventional boat ownership. The company's performance is therefore closely linked to the health and trends within this specific industry niche.

- Revenue Concentration: A large percentage of Brunswick's income is still derived from the traditional recreational boating market.

- Market Growth Projections: Retail sales for boats are projected to see flat growth in 2025, signaling limited expansion opportunities in this key area.

- Consumer Sensitivity: The company's financial results are sensitive to shifts in consumer interest and participation in recreational boating activities.

- Dependence Risk: This dependence creates a vulnerability to economic downturns or changes in lifestyle preferences that might impact boat sales and usage.

Impact of Tariffs and Foreign Currency Fluctuations

Tariff risks represent a notable weakness for Brunswick. Potential shifts in trade policies could disrupt supply chains and dampen consumer demand for its products, directly impacting revenue streams. For instance, in early 2024, ongoing trade tensions between major economies continued to create an uncertain environment for global manufacturers like Brunswick.

Foreign currency fluctuations also present a significant challenge. Unfavorable movements in exchange rates have already demonstrably reduced Brunswick's reported sales figures. In the first quarter of 2024, Brunswick noted that currency headwinds contributed to a decline in its international sales performance, highlighting the vulnerability of its financial results to external currency volatility.

- Tariff Uncertainty: Evolving trade policies create unpredictable operating conditions and potential cost increases.

- Currency Headwinds: Adverse exchange rate movements have a direct negative impact on international sales and profitability.

- Reduced Profitability: Both tariffs and currency fluctuations can erode profit margins, impacting overall financial health.

Brunswick's significant reliance on the recreational boating sector, a market expected to see flat retail growth in 2025, presents a key weakness. This concentration makes the company highly susceptible to economic downturns and shifts in consumer interest in traditional boating. For example, Brunswick's net sales declined 18.2% year-over-year in 2024, with its engine and boat segments bearing the brunt of this drop, indicating a direct correlation between market conditions and company performance.

The company also faces challenges related to supply chain disruptions and higher production costs compared to international competitors. In the first half of 2024, logistics issues impacted inventory and lead times, increasing operational expenses. Furthermore, adverse currency fluctuations and potential tariff impacts in early 2024 added to the financial pressures, as seen by a decline in international sales attributed to currency headwinds.

| Financial Metric | 2024 Performance | Impact |

|---|---|---|

| Net Sales | -18.2% Year-over-Year | Indicates softening demand and market challenges. |

| Adjusted Operating Profit | -43% | Reflects reduced profitability due to lower sales and cost pressures. |

| Currency Impact (Q1 2024) | Negative contribution to international sales | Highlights vulnerability to foreign exchange rate volatility. |

What You See Is What You Get

Brunswick SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final Brunswick SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Freedom Boat Club's growth is a significant opportunity for Brunswick. In 2024 alone, the club facilitated over 600,000 boating trips, demonstrating robust customer engagement. This expansion, now reaching global markets, highlights the appeal of its shared-access, premium experience.

The subscription-based nature of Freedom Boat Club presents a prime avenue for increasing Brunswick's recurring revenue. This model not only provides consistent income but also fosters customer loyalty and predictable cash flow, enhancing overall financial stability.

The marine industry is seeing a significant push towards electrification, fueled by greater environmental consciousness. This trend is creating a strong demand for electric and hybrid propulsion systems, representing a substantial growth avenue for companies like Brunswick.

Brunswick's Mercury Marine division is well-positioned to leverage this opportunity, having already made considerable investments in research and development for electric propulsion. This proactive approach allows them to capitalize on the growing market for cleaner, more energy-efficient marine technologies.

The global marine battery market, for instance, is projected to grow considerably. Reports suggest it could reach over $10 billion by 2027, indicating the scale of the opportunity in sustainable marine technologies. This shift towards clean energy integration offers a substantial market for Brunswick's innovative solutions.

The marine industry's digital shift, driven by AI, IoT, and sophisticated navigation, presents a significant opportunity for Brunswick. Leveraging its Navico Group, a leader in marine electronics, Brunswick is well-positioned to capitalize on these trends. For instance, in 2023, the marine electronics market saw robust growth, with smart boating solutions becoming increasingly sought after by consumers seeking enhanced connectivity and control. Brunswick's continued investment in these digital offerings can create a competitive edge, improving customer experience and potentially opening doors to new revenue streams through predictive maintenance and advanced features.

International Market Penetration and Expansion

Brunswick has a significant opportunity to grow by pushing into international markets where its presence is currently small. Emerging recreational markets, especially in Asia-Pacific, show strong potential for the marine sector. For instance, the Asia-Pacific recreational boating market is projected to see robust growth, with some estimates suggesting a compound annual growth rate (CAGR) of over 5% in the coming years leading up to 2025. This expansion could diversify Brunswick's revenue and lessen its dependence on the more established North American market.

Key aspects of this international market penetration include:

- Targeting High-Growth Regions: Focusing on areas like Southeast Asia and China, where disposable incomes are rising and interest in leisure activities is increasing.

- Adapting Product Offerings: Tailoring boat models and features to meet the specific preferences and regulatory environments of different international markets.

- Strategic Partnerships: Collaborating with local distributors and dealers to build brand awareness and establish efficient sales and service networks.

- Leveraging Brand Strength: Utilizing Brunswick's established reputation for quality and innovation to gain traction in new territories.

Strategic Acquisitions and Partnerships

Brunswick has a proven track record of growth through strategic acquisitions, notably expanding its Freedom Boat Club franchise. This approach allows for rapid market penetration and the realization of operational efficiencies.

Continuing this acquisition strategy, focusing on emerging sectors such as advanced marine electronics, specialized parts and accessories, or innovative technology companies, could significantly bolster Brunswick's market dominance and broaden its product and service portfolio. For instance, acquiring companies with cutting-edge digital integration for boat ownership could be a key move.

These strategic moves are crucial for staying ahead in a dynamic market. Brunswick's 2023 revenue reached $6.0 billion, with its Boat and Parts & Accessories segments showing strong performance, indicating a solid foundation for further strategic investments.

- Acquisition Focus: Targeting high-growth segments like marine electronics and technology firms.

- Synergy Leverage: Utilizing acquired entities to enhance existing operations and offerings.

- Market Consolidation: Strengthening market position through strategic integration of new businesses.

- Diversification: Expanding revenue streams and reducing reliance on core segments.

Brunswick can capitalize on the growing global demand for marine technology and digitalization. The company's Navico Group is a leader in marine electronics, and the increasing consumer interest in connected boating experiences, as evidenced by the robust growth in the marine electronics market in 2023, presents a significant opportunity. Continued investment in these digital solutions can enhance customer experience and create new revenue streams.

The company is well-positioned to benefit from the global shift towards electric and hybrid propulsion systems in the marine industry. With significant R&D investments in electric propulsion, Brunswick's Mercury Marine division can capture a share of the expanding market for sustainable marine technologies, which is projected to see substantial growth, with the global marine battery market potentially exceeding $10 billion by 2027.

Expanding its international presence, particularly in emerging markets in the Asia-Pacific region, offers substantial growth potential. This region's recreational boating market is expected to grow at a CAGR exceeding 5% leading up to 2025, providing Brunswick with an opportunity to diversify its revenue base beyond North America.

Brunswick's proven strategy of growth through strategic acquisitions, exemplified by its expansion of Freedom Boat Club, provides a clear path for further market penetration and operational efficiencies. Focusing on acquiring companies in high-growth sectors like advanced marine electronics or innovative technology firms can bolster its market position and product portfolio, especially considering its 2023 revenue of $6.0 billion.

| Opportunity Area | Supporting Data/Trend | Brunswick's Position/Action |

| Digitalization & Connectivity | Marine electronics market robust growth in 2023; smart boating solutions in demand. | Leveraging Navico Group for enhanced customer experience and new revenue streams. |

| Electrification & Sustainability | Global marine battery market projected over $10 billion by 2027. | Mercury Marine's R&D in electric propulsion to capitalize on clean energy demand. |

| International Market Expansion | Asia-Pacific recreational boating market CAGR >5% (pre-2025 estimates). | Targeting high-growth regions and adapting offerings for diversification. |

| Strategic Acquisitions | 2023 Revenue: $6.0 billion; strong performance in Boat & Parts segments. | Acquiring companies in marine electronics and technology to enhance offerings. |

Threats

Ongoing economic uncertainties, such as persistent inflation and elevated interest rates, continue to dampen consumer confidence and curb discretionary spending. This trend directly impacts the demand for Brunswick's higher-priced leisure products, like boats and marine engines, creating significant sales pressure and potentially squeezing profit margins.

For instance, in the first quarter of 2024, consumer sentiment indices remained subdued, reflecting concerns about the cost of living. This economic climate makes consumers more hesitant to invest in large discretionary purchases, a direct threat to Brunswick's core business segments.

The marine recreation industry is inherently competitive, with many companies actively seeking to capture market share. Brunswick, despite its strong standing, faces the challenge of numerous rivals. In a market that is expected to see flat retail growth in 2025, this intense competition could force more aggressive discounting and price reductions, potentially impacting Brunswick's profitability.

The global supply chain continues to be a fragile network, and any significant disruption, like those seen in recent years, can directly impact Brunswick's ability to produce and deliver its products on time. These disruptions often translate into higher shipping costs and longer lead times, directly affecting operational efficiency.

Raw material prices, a key component for Brunswick's manufacturing, have experienced considerable volatility. For instance, lumber prices, a significant input for boat building, saw dramatic swings in 2021 and 2022, impacting production costs. This unpredictability, combined with rising labor costs, puts pressure on Brunswick's profit margins.

Effectively navigating these supply chain vulnerabilities and managing the fluctuating costs of essential materials is paramount for Brunswick to safeguard its financial health and maintain its competitive edge in the market.

Regulatory Changes and Environmental Compliance Costs

Increasing regulatory scrutiny on environmental claims and stricter regulations, especially concerning emissions and sustainable operations in the marine sector, present a significant threat. These changes could drive up compliance expenses and demand substantial capital outlays for novel technologies. For instance, the European Union's proposed Carbon Border Adjustment Mechanism (CBAM), which could impact imported goods based on their carbon footprint, highlights the evolving global regulatory landscape. Brunswick's commitment to sustainability is a positive, but a lag in adapting to these evolving standards could indeed pose a risk.

The maritime industry, in particular, faces growing pressure to reduce its environmental impact. The International Maritime Organization (IMO) has set ambitious greenhouse gas reduction targets, aiming to cut total annual greenhouse gas emissions from international shipping by at least 50% by 2050 compared to 2008 levels. Brunswick, as a key player, will need to navigate these evolving mandates, which may necessitate investments in cleaner engine technologies, alternative fuels, and improved operational efficiencies. Failure to proactively address these requirements could lead to penalties, reputational damage, and a competitive disadvantage.

- Stricter emissions standards: New regulations could require costly upgrades to engine technology and fuel systems.

- Increased compliance costs: Adapting to evolving environmental mandates may lead to higher operational expenses.

- Investment in sustainable technologies: Significant capital may be needed to adopt greener practices and materials.

Geopolitical Risks and Trade Policy Uncertainty

Geopolitical fragmentation and trade policy uncertainties, like potential tariff changes, can significantly disrupt global trade routes and supply chains, impacting the broader economic landscape. For instance, the ongoing trade tensions between major economies, which have seen fluctuating tariff rates in recent years, directly increase the cost of goods and create unpredictability for international businesses. These factors introduce significant risk, potentially affecting Brunswick's international operations, profitability, and access to key markets.

The ongoing shifts in global alliances and the rise of protectionist policies create an environment of heightened uncertainty. For example, in 2024, several countries have signaled intentions to review or renegotiate existing trade agreements, which could lead to new barriers for companies like Brunswick operating across borders. This instability directly impacts strategic planning and can lead to increased operational costs and reduced market access.

- Trade Tensions: Ongoing trade disputes can lead to increased tariffs and non-tariff barriers, impacting the cost of imported components and finished goods for Brunswick.

- Supply Chain Disruptions: Geopolitical instability can interrupt critical supply routes, affecting the timely delivery of raw materials and finished products.

- Market Access Volatility: Changes in trade policies and political relationships can suddenly alter a company's ability to access or operate within key international markets.

- Economic Slowdowns: Heightened geopolitical risk is often correlated with broader economic slowdowns, reducing consumer and business spending globally.

The marine industry faces significant threats from evolving environmental regulations, particularly concerning emissions. Stricter standards could necessitate costly upgrades to engine technology and fuel systems, increasing operational expenses. For example, the International Maritime Organization's (IMO) 2023 strategy aims for net-zero GHG emissions by or around 2050, a target that will require substantial investment in cleaner technologies for companies like Brunswick.

Geopolitical fragmentation and trade policy uncertainties pose a considerable risk, potentially disrupting global supply chains and increasing costs. Fluctuating tariff rates, as seen in recent years, directly impact international business operations. For instance, ongoing trade tensions can lead to increased tariffs and non-tariff barriers, affecting the cost of components and finished goods for Brunswick.

Economic headwinds, including persistent inflation and elevated interest rates, continue to dampen consumer confidence and discretionary spending. This directly impacts demand for Brunswick's higher-priced leisure products, creating sales pressure and potentially squeezing profit margins. In Q1 2024, consumer sentiment remained subdued, reflecting cost-of-living concerns, making consumers hesitant about large discretionary purchases.

| Threat Category | Specific Threat | Impact on Brunswick | Example/Data Point (2024-2025) |

|---|---|---|---|

| Regulatory Environment | Stricter Emissions Standards | Increased compliance costs, need for technological investment | IMO's 2023 strategy targeting net-zero GHG emissions by ~2050 |

| Geopolitical Factors | Trade Policy Uncertainty | Supply chain disruptions, increased costs for components/goods | Fluctuating tariff rates impacting international trade routes |

| Economic Conditions | Subdued Consumer Confidence | Reduced demand for discretionary products, pressure on profit margins | Subdued consumer sentiment indices in Q1 2024 |

| Competition | Intense Market Competition | Potential for aggressive discounting, impacting profitability | Expected flat retail growth in the marine market for 2025 |

| Supply Chain & Costs | Raw Material Price Volatility | Increased production costs, pressure on profit margins | Past significant swings in lumber prices impacting boat building costs |

SWOT Analysis Data Sources

This Brunswick SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and the informed perspectives of industry experts to ensure a thorough and accurate assessment.