Brunswick PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brunswick Bundle

Navigate the complex external forces shaping Brunswick's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements create both opportunities and challenges for the company. Unlock actionable intelligence to refine your own strategic planning. Download the full analysis now and gain a crucial competitive advantage.

Political factors

Global trade policies and tariffs directly influence Brunswick Corporation's operational costs and supply chain efficiency. For instance, tariffs on key components, such as permanent magnet motors sourced from countries like China and Germany, can lead to increased production expenses. This was evident in the period leading up to and including 2024, where trade tensions and the potential for new tariffs created uncertainty for manufacturers relying on international supply chains.

Government policies significantly shape the recreational landscape, directly impacting Brunswick's core business. For instance, in 2024, the U.S. Army Corps of Engineers continued to manage over 2,500 miles of navigable waterways, providing essential access for boating, a key market for Brunswick. Favorable regulations promoting access to lakes, rivers, and coastal areas, alongside initiatives supporting outdoor recreation, can bolster demand for Brunswick's boat brands and marine services.

Conversely, stricter environmental regulations or changes in boating access policies could present challenges. For example, increased scrutiny on emissions or noise pollution from recreational vessels might necessitate further investment in cleaner technologies, impacting operational costs. The Biden-Harris administration's focus on conservation and sustainable recreation in 2024, as seen in initiatives like the Great American Outdoors Act, signals a potential for supportive policy environments, though specific implementation details will be crucial.

Political stability in regions where Brunswick operates, such as its manufacturing hubs in Mexico and its significant markets in the United States and Canada, is paramount. For instance, the 2024 US presidential election cycle could introduce policy shifts affecting trade agreements or tariffs, potentially impacting Brunswick's operational costs and market access.

Geopolitical tensions, like those in Eastern Europe impacting global energy prices or the ongoing trade disputes between major economies, can disrupt Brunswick's intricate supply chains. This can lead to increased logistics costs and potential delays in product delivery, ultimately affecting sales volumes and consumer confidence in key markets like North America.

Incentives for Green Technologies

Government incentives, such as tax credits and grants for adopting electric and hybrid marine propulsion systems, significantly influence Brunswick's strategic direction. For instance, the Inflation Reduction Act of 2022 in the United States offers substantial tax credits for electric vehicles, which can extend to marine applications, potentially lowering R&D and manufacturing costs for Brunswick's sustainable product lines. This financial support makes greener options more competitive and attractive to a wider customer base.

These political factors can directly impact Brunswick's investment in sustainable technologies, potentially accelerating the development and adoption of eco-friendly marine solutions. Such government backing helps offset the high initial costs associated with new technology development, making it easier for Brunswick to allocate resources towards innovation in areas like electric outboard motors and advanced battery systems.

- Accelerated Adoption: Government subsidies can lower the price point of electric and hybrid marine propulsion systems, making them more accessible to consumers and commercial operators.

- R&D Cost Reduction: Incentives can directly offset research and development expenses, encouraging Brunswick to invest more heavily in innovative green technologies.

- Market Competitiveness: Financial support from governments can help Brunswick's sustainable products compete more effectively on price with traditional internal combustion engine options.

- Regulatory Alignment: Political support for green technologies often signals a broader trend towards stricter environmental regulations, prompting companies like Brunswick to proactively develop compliant solutions.

International Relations and Market Access

Brunswick's international relations significantly shape its market access and global trade opportunities. Strong diplomatic ties with countries like Germany, a key trading partner, can lead to favorable trade agreements and reduced tariffs, boosting export potential. For instance, in 2023, Germany was Brunswick's second-largest export market, with goods valued at over $1.5 billion flowing across the border, highlighting the direct impact of political goodwill on economic activity.

Conversely, strained international relations can erect barriers to market entry and disrupt existing supply chains. Brunswick's ability to secure favorable terms for its key exports, such as advanced machinery and agricultural products, is directly tied to its diplomatic standing. As of early 2024, ongoing trade negotiations with the United States, another major market, underscore the critical role of political dialogue in maintaining and expanding Brunswick's global commercial footprint.

- Trade Agreements: Brunswick's participation in trade blocs like the European Union (EU) provides preferential access to a vast single market, fostering significant cross-border trade.

- Diplomatic Missions: The presence and effectiveness of Brunswick's embassies and trade commissions abroad are crucial for fostering business relationships and navigating foreign regulatory environments.

- Geopolitical Stability: Regional stability, particularly in neighboring countries, directly impacts Brunswick's supply chain security and the willingness of international partners to invest.

- International Sanctions: Brunswick's adherence to or exemption from international sanctions imposed on other nations can open or close market opportunities, influencing its export diversification strategies.

Government policies significantly influence Brunswick's market access and operational landscape. Trade tariffs and agreements, such as those impacting components sourced from China and Germany, directly affect production costs, as seen with trade tensions in 2024. Favorable regulations promoting recreational access, like the U.S. Army Corps of Engineers managing navigable waterways in 2024, support Brunswick's core business.

Conversely, stricter environmental regulations could necessitate investments in cleaner technologies, impacting profitability. Political stability in key operating regions, including Mexico, the US, and Canada, is crucial, with events like the 2024 US presidential election posing potential policy shifts.

Government incentives, like those for electric propulsion systems under the Inflation Reduction Act of 2022, can accelerate Brunswick's adoption of sustainable technologies. These factors collectively shape Brunswick's strategic investments and market competitiveness.

What is included in the product

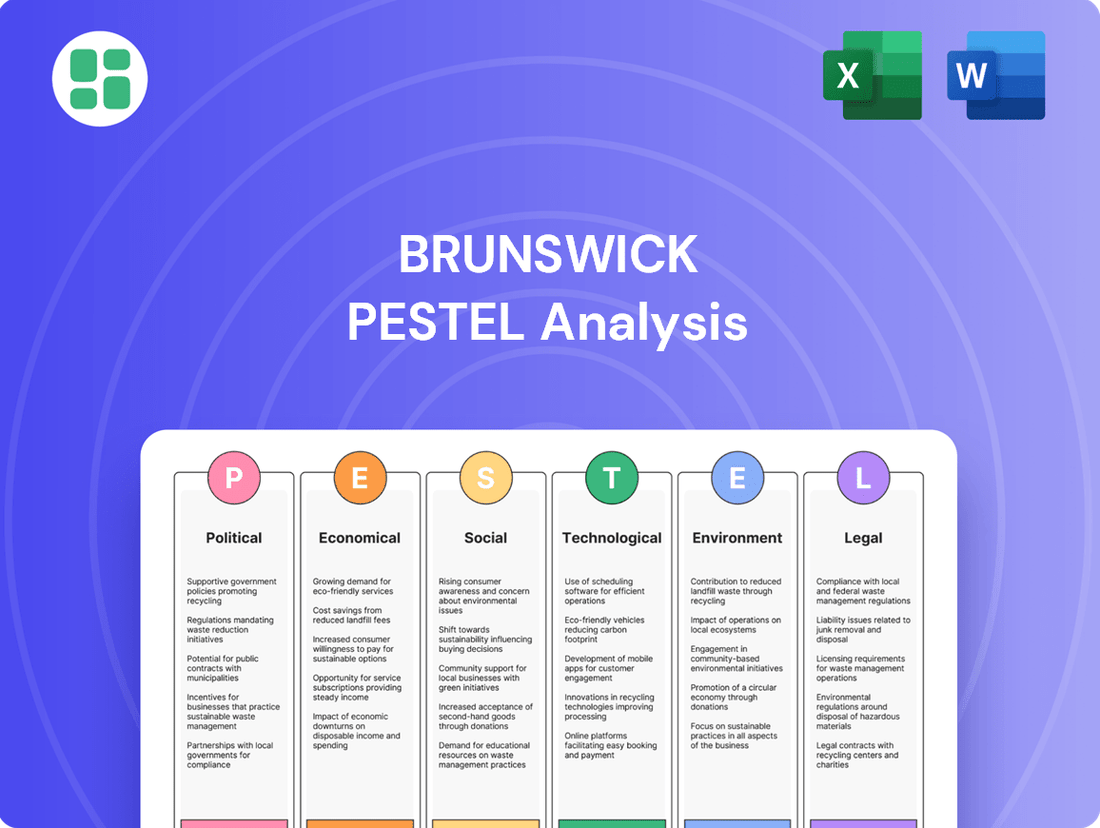

Brunswick's PESTLE analysis offers a comprehensive examination of external macro-environmental factors impacting its operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This analysis is crafted to equip leaders with actionable insights, identifying strategic opportunities and potential threats stemming from real-world market and regulatory dynamics.

Offers a clear, actionable breakdown of external factors, transforming complex market dynamics into manageable insights for strategic decision-making.

Provides a structured framework to identify and mitigate potential threats and capitalize on opportunities, reducing uncertainty in business planning.

Economic factors

Interest rates significantly influence consumer financing for large purchases like boats, a key market for Brunswick. As of early 2024, the Federal Reserve maintained a target range for the federal funds rate between 5.25% and 5.50%, reflecting a period of elevated borrowing costs. This directly translates to higher monthly payments for consumers seeking boat loans, potentially reducing affordability and dampening demand for new and pre-owned vessels.

When interest rates rise, the cost of borrowing increases, making boat financing less attractive. For instance, a modest increase in a loan's annual percentage rate (APR) can add hundreds or even thousands of dollars to the total cost of a boat over its lifespan. This heightened expense can push potential buyers to postpone or cancel their purchases, thereby impacting Brunswick's sales volumes and revenue streams, particularly in segments heavily reliant on consumer credit.

Brunswick's profitability is directly affected by inflation, which drives up the cost of essential inputs like raw materials, skilled labor, and logistics. For instance, in 2024, the marine industry, including Brunswick's engine segment, continued to grapple with elevated material costs, particularly for metals and components, leading to increased production expenses.

The company has explicitly noted inflationary pressures on its engine production costs throughout 2024. This means that the price of building their engines has gone up, potentially squeezing their profit margins if they cannot fully pass these costs onto consumers.

Fuel prices are a major driver of operating costs for Brunswick's customers, directly impacting how often they use their boats and their willingness to purchase new ones. For instance, if gasoline prices surge, as seen with the average price of regular unleaded reaching over $3.50 per gallon in early 2024, boaters might cut back on excursions.

This reduction in usage can dampen demand for new boat sales, a key segment for Brunswick. When the cost of simply running a boat increases significantly, the overall appeal of recreational boating can diminish, creating headwinds for the industry.

Disposable Income and Consumer Spending

Global economic growth significantly influences disposable income, which in turn directly impacts consumer spending on discretionary items like recreational boats. For Brunswick, a healthy economy generally translates to higher consumer confidence and more available funds for leisure purchases. For instance, in 2024, global GDP growth is projected to be around 2.7%, providing a generally supportive environment for consumer spending, though regional variations exist.

A downturn in disposable income or a dip in consumer confidence can lead to a noticeable slowdown in sales for companies like Brunswick. When consumers feel financially insecure, they tend to cut back on non-essential expenditures. In the US, consumer spending accounts for a substantial portion of GDP, and any contraction here directly affects industries reliant on discretionary purchases.

Brunswick's performance is closely tied to the economic well-being of its target markets. Factors such as inflation rates, interest rates, and employment figures all play a crucial role in shaping disposable income levels. For example, rising inflation in 2024 has put pressure on household budgets in many developed economies, potentially dampening demand for big-ticket recreational items.

- Disposable income is a key driver for recreational product sales.

- Global economic growth of approximately 2.7% in 2024 supports consumer spending.

- Economic downturns and reduced consumer confidence directly impact Brunswick's sales.

- Inflationary pressures in 2024 may constrain consumer spending power.

Currency Exchange Rates

Fluctuations in currency exchange rates present a significant economic factor for Brunswick. Unfavorable shifts can directly reduce the value of international sales revenue when converted back to Brunswick's reporting currency. For instance, if the Euro weakens against the US Dollar, sales made in Euros will translate to fewer Dollars, impacting top-line growth.

Furthermore, the cost of imported components or raw materials is also susceptible to exchange rate volatility. If Brunswick relies on suppliers in countries with strengthening currencies, the cost of these essential inputs will rise, potentially squeezing profit margins. For example, a 5% depreciation of the Canadian Dollar against the US Dollar in late 2024 could increase the cost of imported machinery for Brunswick.

- Impact on Revenue: A stronger domestic currency reduces the value of foreign sales.

- Impact on Costs: A weaker domestic currency increases the cost of imported goods.

- Competitive Landscape: Exchange rates can affect the price competitiveness of Brunswick's products versus foreign rivals.

- Hedging Strategies: Companies like Brunswick may employ financial instruments to mitigate currency risks.

Consumer confidence, a key economic indicator, directly influences spending on discretionary items like boats. In early 2024, consumer sentiment surveys indicated a cautious optimism, though concerns about inflation persisted. This delicate balance means that while some consumers may feel secure enough to make large purchases, others might hold back due to economic uncertainties.

Unemployment rates are also a critical factor. Lower unemployment generally correlates with higher disposable income and a greater propensity to spend on leisure activities. For instance, the US unemployment rate remained historically low in early 2024, hovering around 3.9%, which generally supports demand for recreational products.

The overall health of the global economy, including GDP growth rates in key markets, significantly impacts Brunswick's sales. Projections for global GDP growth in 2024, estimated around 2.7%, suggest a moderately supportive environment for consumer spending, though regional economic performance can vary considerably.

| Economic Factor | Status (Early 2024) | Impact on Brunswick |

|---|---|---|

| Consumer Confidence | Cautiously Optimistic with Inflation Concerns | Influences discretionary spending on boats. |

| Unemployment Rate (US) | Low (approx. 3.9%) | Generally supports disposable income and demand. |

| Global GDP Growth (Projected) | Approx. 2.7% | Indicates a moderately supportive environment for spending. |

Preview the Actual Deliverable

Brunswick PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Brunswick PESTLE Analysis provides a comprehensive overview of the external factors impacting the company. It covers Political, Economic, Social, Technological, Legal, and Environmental aspects, offering valuable insights for strategic planning.

Sociological factors

Consumer interest in outdoor recreation and water-based activities has seen a notable surge, directly influencing the demand for recreational boats. This trend is a significant factor for companies like Brunswick.

Brunswick's extensive range of products, encompassing everything from fishing boats to pontoons and high-performance craft, allows it to effectively tap into these evolving leisure preferences. For instance, in 2023, Brunswick reported strong performance in its Freedom Boat Club segment, indicating a growing consumer appetite for accessible boating experiences.

Shared access models are gaining significant traction, reflecting a broader societal shift towards access over ownership. This trend is particularly evident in recreational markets, where consumers seek flexible and cost-effective ways to enjoy experiences. Brunswick, a leader in marine manufacturing, is well-positioned to capitalize on this by offering services like those through its Freedom Boat Club brand, which saw membership grow by 16% in 2023, demonstrating the strong consumer appeal of this model.

Demographic shifts are reshaping the boating landscape, with younger generations showing increasing interest. This is a significant trend for Brunswick as it influences product design and marketing strategies to resonate with a broader audience. The industry is actively working to attract a more diverse range of participants across various age groups and income levels.

Emphasis on Health and Wellness

Societal emphasis on health and wellness continues to grow, directly influencing leisure activities. This shift encourages more people to engage in outdoor recreation, including boating, which is a significant market for Brunswick Corporation. For example, in 2024, the marine industry saw continued robust demand, with Brunswick reporting strong sales in its recreational boat segment, reflecting this consumer preference.

This trend translates into sustained demand for Brunswick's diverse portfolio of marine recreation products, from engines to boats. The company's performance in 2024 and projections for 2025 indicate that this focus on active lifestyles is a key driver for the marine sector.

- Growing Health Consciousness: Consumers are increasingly prioritizing physical and mental well-being, leading to greater participation in outdoor activities.

- Demand for Recreation: This societal trend directly fuels demand for products and experiences that facilitate outdoor pursuits like boating.

- Brunswick's Market Position: Brunswick's product offerings align well with this wellness-driven consumer behavior, supporting its market share and sales.

Consumer Demand for Digital Experiences

Consumers are increasingly expecting digital interactions across all aspects of their lives, and boating is no exception. They desire personalized, seamless, and technologically enhanced experiences, whether it's researching a new boat, managing maintenance, or connecting with other boaters. This shift in consumer behavior means that companies like Brunswick must prioritize digital integration to meet these evolving expectations.

Brunswick's strategic investments in digital platforms and smart boat technologies directly address this trend. For instance, their Next Wave strategy emphasizes connected boat features, offering owners enhanced control, diagnostics, and entertainment options. This focus on digital integration is crucial for capturing a market segment that values convenience and advanced functionality.

- Digital Integration: Consumers, particularly millennials and Gen Z entering the boating market, expect intuitive digital interfaces for purchasing, ownership, and service.

- Smart Boat Technology: The demand for connected features, such as remote monitoring, GPS integration, and personalized user experiences, is growing.

- Personalization: Consumers are looking for tailored recommendations and experiences, from boat selection to on-water activities, driven by data analytics.

- Evolving Expectations: By 2025, it's projected that over 60% of boat buyers will research their purchase heavily online, underscoring the need for robust digital engagement.

Societal values are shifting, with a growing emphasis on experiences over material possessions, directly benefiting the recreational boating industry. This trend fuels demand for leisure activities that offer memorable engagement, a key driver for Brunswick's diverse product lines.

The increasing acceptance of shared economy models, like boat clubs, reflects a broader societal move towards access and flexibility. Brunswick's investment in Freedom Boat Club, which saw a 16% membership increase in 2023, highlights its successful adaptation to this evolving consumer preference.

Demographic changes, including the growing interest of younger generations in outdoor pursuits, are reshaping the market. Brunswick's efforts to appeal to a wider age range are crucial, as industry data from 2024 indicates a sustained interest from new boat buyers.

A heightened focus on health and wellness is encouraging more people to engage in outdoor recreation, including boating, which directly boosts demand for marine products. Brunswick's strong sales in recreational boats throughout 2024 underscore this connection between lifestyle choices and market performance.

Technological factors

The marine sector is witnessing a substantial pivot towards electric and hybrid propulsion, fueled by environmental mandates and a growing consumer preference for eco-friendly and less noisy boating experiences. Brunswick's Mercury Marine is actively engaged in pioneering these advanced powertrain solutions.

The market for marine hybrid and fully electric propulsion systems is anticipated to experience robust expansion in the coming years. For instance, the global marine electric propulsion market was valued at approximately $5.9 billion in 2023 and is projected to reach around $15.7 billion by 2030, exhibiting a compound annual growth rate (CAGR) of about 15.1% during this period.

Technological advancements are rapidly transforming the marine industry, creating more connected and intelligent vessels. These innovations include sophisticated smart control systems, AI-driven navigation, and robust remote monitoring capabilities, enhancing user experience and operational efficiency.

Brunswick's Navico Group, a leader in marine electronics, is actively driving this digital integration. In 2023, Navico's product portfolio, including brands like Simrad, Lowrance, and B&G, continued to see strong demand, contributing significantly to Brunswick's overall revenue, which reached $6.5 billion for the full year 2023.

Brunswick Corporation is leveraging innovative manufacturing processes and materials to boost its product offerings. The company's adoption of advanced materials such as lightweight fiberglass, carbon fiber, and aluminum significantly enhances boat performance, durability, and fuel efficiency. For instance, advancements in hull design using composite materials contribute to lighter and stronger vessels, directly impacting fuel economy, a key concern for consumers in 2024.

Automated manufacturing processes are also playing a crucial role. These technologies streamline production, reduce waste, and improve the consistency of finished products. This not only makes Brunswick's boats more appealing but also contributes to more sustainable manufacturing practices, aligning with growing environmental consciousness among buyers. The market's demand for eco-friendlier options is a significant driver for these technological investments.

Autonomous and AI-driven Technologies

Autonomous and AI-driven technologies are rapidly transforming the marine industry, with significant implications for companies like Brunswick. These advancements are poised to enhance safety, efficiency, and user experience in boating. For instance, autonomous docking systems offer a more streamlined and less intimidating experience for boat owners, potentially broadening market appeal. Brunswick's investment in these areas aligns with the broader trend of increasing automation across various sectors.

AI-powered route optimization is another key technological factor. By analyzing real-time data such as weather conditions, water traffic, and fuel efficiency, these systems can suggest the most optimal paths for vessels. This not only saves time and fuel but also contributes to a more enjoyable and predictable boating experience. Brunswick's focus on connected boat technologies, which often incorporate such AI, underscores its commitment to leveraging these innovations.

Predictive maintenance, driven by AI and sensor data, is also a critical emerging technology. This allows for the anticipation and prevention of mechanical failures before they occur, reducing downtime and costly repairs. Brunswick's strategy likely includes integrating these capabilities into its product lines to offer enhanced reliability and lower ownership costs for consumers. The marine industry, in general, is seeing a push towards greater connectivity and intelligent systems, with Brunswick well-positioned to capitalize on these trends.

- Autonomous Docking: Systems are becoming more sophisticated, reducing the learning curve for new boaters.

- AI Route Optimization: Enhances fuel efficiency and travel time for recreational boaters.

- Predictive Maintenance: Utilizes AI to forecast component failures, improving reliability and reducing service costs.

Renewable Energy Integration on Vessels

The marine industry is increasingly adopting renewable energy solutions for vessels, a significant technological shift. This includes integrating solar panels and small wind turbines directly onto boats, enhancing their eco-friendly profile and enabling longer periods of self-sufficiency without shore power. This trend is a key component of the growing emphasis on sustainable practices within the maritime sector.

This movement towards greener marine technology is driven by both consumer demand for sustainable options and regulatory pressures. For instance, the global marine coatings market, which includes antifouling paints that reduce drag and improve fuel efficiency, was valued at approximately USD 8.5 billion in 2023 and is projected to grow, indicating a broader commitment to efficiency and environmental responsibility in marine operations.

- Solar panel efficiency improvements: Advances in photovoltaic technology are making solar panels more compact and powerful, suitable for marine applications.

- Hybrid propulsion systems: The development of hybrid systems combining electric motors with traditional engines is gaining traction, reducing emissions and fuel consumption.

- Battery storage advancements: Enhanced battery technology allows for more effective storage of renewable energy, powering onboard systems for extended durations.

Technological advancements are rapidly reshaping the marine industry, with Brunswick at the forefront of adopting these innovations. The company is heavily invested in electric and hybrid propulsion systems, recognizing the market's shift towards sustainability and reduced noise. This is complemented by the integration of smart technologies, including AI-driven navigation and remote monitoring, enhancing both user experience and operational efficiency.

Brunswick's commitment to technological progress is evident in its robust product development and strategic investments. The company is leveraging advanced materials and manufacturing processes to improve product performance and sustainability. Furthermore, the increasing sophistication of autonomous and AI-powered features, such as automated docking and route optimization, is set to broaden the appeal of boating and improve overall safety and efficiency.

The marine sector's embrace of renewable energy solutions, including enhanced solar panel efficiency and advanced battery storage, is a key technological trend. These developments, coupled with innovations in hybrid propulsion, are driving a more environmentally responsible approach to marine operations. Brunswick's proactive engagement with these technologies positions it to capitalize on the growing demand for eco-friendly and technologically advanced marine products.

| Technology Area | Key Developments | Impact on Brunswick | Market Data (2023-2025 Projections) |

|---|---|---|---|

| Propulsion Systems | Electric and hybrid powertrains, advanced battery tech | Strengthening Mercury Marine's product portfolio, meeting eco-demand | Global marine electric propulsion market projected to reach $15.7B by 2030 (15.1% CAGR) |

| Connectivity & AI | Smart control systems, AI navigation, remote monitoring, autonomous docking | Enhancing Navico Group's electronics offerings, improving user experience | Increased adoption of connected boat technologies |

| Materials & Manufacturing | Lightweight composites (fiberglass, carbon fiber), automated processes | Improving boat performance, durability, and fuel efficiency; reducing waste | Focus on lightweight materials for fuel economy gains in 2024 |

| Renewable Energy Integration | Solar panels, wind turbines, improved battery storage | Expanding sustainable options, enabling self-sufficiency for vessels | Growth in marine coatings market (valued at ~$8.5B in 2023) indicates broader efficiency focus |

Legal factors

Brunswick Corporation, a leading marine manufacturer, must navigate a complex web of product safety standards and certifications across its global operations. For instance, its Sea Ray boats and Mercury Marine engines must meet rigorous safety regulations like those set by the U.S. Coast Guard and the European Union’s Recreational Craft Directive. Obtaining these certifications is not merely bureaucratic; it directly impacts consumer trust and mitigates significant legal risks associated with product defects or failures.

Failure to comply can result in substantial penalties and reputational damage. In 2023, regulatory bodies worldwide issued fines and recalls for non-compliant products across various industries, underscoring the financial and operational consequences of neglecting safety standards. Brunswick’s commitment to adhering to standards such as ISO 9001 for quality management and specific certifications for emissions control, like EPA and CARB in the US, is therefore crucial for maintaining market access and operational integrity.

Increasingly strict environmental regulations, like the International Maritime Organization's (IMO) greenhouse gas strategy aiming for net-zero emissions by or around 2050, and the European Union's FuelEU Maritime initiative, are pushing for substantial reductions in marine vessel emissions. Brunswick's engine segment faces a critical need to innovate and adapt its technologies to meet these evolving global and regional standards.

Brunswick's extensive global operations, particularly in the marine sector, are heavily influenced by international maritime laws. These regulations cover everything from trade and shipping practices to the actual operation and safety of vessels. For instance, the International Maritime Organization (IMO) sets global standards for safety, security, and environmental protection at sea, which Brunswick must comply with across its worldwide fleet and operations.

Navigating these complex legal frameworks is crucial for maintaining operational efficiency and avoiding costly penalties. Brunswick's commitment to adhering to these international standards ensures smooth transit and trade, directly impacting its supply chain and market access. In 2024, the global shipping industry continued to grapple with evolving environmental regulations, such as those related to emissions, requiring significant investment in compliance for companies like Brunswick.

Consumer Protection and Warranty Laws

Consumer protection laws, including those governing warranties and product liability, are critical for Brunswick. These regulations dictate how the company must handle customer complaints, product defects, and safety issues, with significant penalties for non-compliance. For instance, in the United States, the Magnuson-Moss Warranty Act sets standards for written consumer product warranties, impacting how Brunswick communicates its product guarantees.

Brunswick must navigate a complex web of regional and international laws. In the European Union, the Consumer Rights Directive 2011/83/EU provides robust consumer protections, including rights related to distance selling and guarantees, which directly influence Brunswick's e-commerce operations and product return policies. Failure to adhere can lead to substantial fines and reputational damage.

- Warranty Compliance: Brunswick must ensure its product warranties meet or exceed legal minimums in all operating regions, such as the implied warranty of merchantability in the US.

- Product Liability: The company faces potential liability for injuries or damages caused by its products, necessitating rigorous quality control and safety testing.

- Consumer Rights: Adherence to regulations like the EU's Consumer Rights Directive impacts Brunswick's sales practices, particularly in online transactions.

- Regulatory Scrutiny: Brunswick's adherence to these laws is subject to review by consumer protection agencies globally, influencing its operational procedures and risk management.

Data Privacy and Cybersecurity Regulations

Brunswick Corporation, with its increasing reliance on digital platforms and customer data, must navigate a complex landscape of data privacy and cybersecurity regulations. Laws like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States mandate strict protocols for handling personal information, with significant penalties for non-compliance. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the financial risk involved.

The maritime sector, where Brunswick operates, is also facing heightened scrutiny regarding cybersecurity. As vessels become more connected and reliant on digital systems for navigation, operations, and passenger services, the threat of cyberattacks grows. A study by the Ponemon Institute in 2023 indicated that the average cost of a data breach in the maritime industry could exceed $4 million, highlighting the critical need for robust defense mechanisms.

- Regulatory Compliance: Brunswick must ensure adherence to evolving data privacy laws globally, such as GDPR and CCPA, to safeguard customer data and avoid substantial fines.

- Cybersecurity Investment: The company needs to invest in advanced cybersecurity measures to protect its digital infrastructure and connected products from increasingly sophisticated threats.

- Reputational Risk: Data breaches can severely damage Brunswick's reputation and customer trust, impacting sales and brand loyalty.

- Operational Continuity: Cybersecurity failures can disrupt operations, leading to significant financial losses and potential safety risks in the maritime environment.

Brunswick must navigate a complex global legal landscape, from product safety certifications like those from the U.S. Coast Guard and EU's Recreational Craft Directive to international maritime laws set by the IMO. Adherence to these standards, including ISO 9001 and emissions regulations such as EPA and CARB, is vital for market access and mitigating risks associated with non-compliance, which can lead to significant fines and reputational damage, as seen with industry-wide recalls in 2023.

Environmental factors

Climate change significantly impacts recreational boating by altering boating seasons, water levels, and the frequency of extreme weather. For instance, warmer winters in some regions may extend the boating season, potentially boosting demand for products like those offered by Brunswick. Conversely, increased severe storms could disrupt operations and damage vessels, necessitating robust product design and customer support.

Brunswick must consider how changing environmental conditions affect water accessibility and infrastructure. Reduced water levels in key boating areas, driven by drought or altered precipitation patterns, can limit access to marinas and popular waterways. The company's strategic planning must incorporate resilience against these environmental shifts, ensuring continued market access and customer engagement.

Adaptation strategies are paramount for Brunswick to navigate the evolving environmental landscape. This includes investing in technologies that promote sustainable boating practices and developing products that can withstand more volatile weather conditions. For example, the marine industry is increasingly focused on fuel efficiency and emissions reduction, aligning with broader environmental concerns and regulatory trends expected to intensify through 2025.

The marine industry faces increasing scrutiny regarding its environmental impact, particularly concerning carbon footprint reduction. Brunswick Corporation acknowledges this trend, as evidenced in its 2024 Sustainability Report, which details ongoing efforts and investments in eco-friendly operations and product development.

Brunswick's commitment is reflected in tangible goals; for instance, the company aims to achieve net-zero greenhouse gas emissions by 2040. In 2023, they reported a 15% reduction in Scope 1 and 2 emissions compared to their 2020 baseline, demonstrating progress towards this ambitious target.

Brunswick faces increasing scrutiny regarding its environmental footprint, particularly concerning pollution control and waste management. Regulations governing water quality, pollution discharge, and waste disposal from marine vessels are tightening globally. For instance, the International Maritime Organization (IMO) has set ambitious targets for reducing greenhouse gas emissions from shipping, impacting manufacturers of marine engines and propulsion systems like Brunswick. This means Brunswick must invest in cleaner technologies and sustainable manufacturing practices to comply with these evolving standards and avoid potential penalties.

Resource Depletion and Sustainable Materials

Brunswick, like many in the marine industry, grapples with the increasing scarcity of certain raw materials essential for boat construction. This pressure is a significant driver for the company's ongoing commitment to sustainable sourcing and the integration of eco-friendly and recyclable materials into its manufacturing processes.

The company is actively prioritizing the use of lightweight and sustainable materials to reduce environmental impact and improve fuel efficiency in its vessels. For instance, Brunswick has invested in advanced composite materials that offer durability while minimizing reliance on traditional, less sustainable options.

- Focus on Composites: Brunswick is increasing its use of advanced composite materials, which are lighter and more durable than traditional fiberglass, leading to reduced fuel consumption in boats.

- Recycling Initiatives: The company is exploring and implementing recycling programs for manufacturing waste and end-of-life products, aiming to divert materials from landfills.

- Sustainable Sourcing: Brunswick is working to ensure its supply chain for key materials, such as wood and metals, adheres to sustainable forestry and responsible mining practices.

- Lightweighting Benefits: By using lighter materials, Brunswick contributes to a reduction in the overall carbon footprint of its products throughout their lifecycle.

Conservation Efforts and Boating Access

Growing conservation efforts worldwide, particularly concerning marine ecosystems, present a nuanced challenge for boating access. For instance, the expansion of marine protected areas (MPAs) in regions like the Mediterranean and the Caribbean, driven by concerns over biodiversity loss and climate change impacts, could potentially limit recreational boating zones. Brunswick, as a major player in the marine industry, must actively collaborate with environmental organizations and governmental agencies to navigate these evolving regulations. This engagement is crucial for securing sustainable access for boaters while respecting ecological preservation goals, ensuring the long-term viability of the recreational boating sector.

Brunswick's strategy should involve proactive dialogue and partnership building. By understanding the scientific basis for conservation measures and contributing to sustainable practices, the company can advocate for balanced approaches. For example, in 2023, the International Union for Conservation of Nature (IUCN) reported an increase in MPA designations globally, highlighting the growing trend. Brunswick's commitment to responsible boating, including initiatives like promoting eco-friendly engine technologies and responsible waste management, can bolster its position in these discussions. This proactive stance is vital for maintaining operational flexibility and market access in an increasingly environmentally conscious landscape.

- Marine Protected Areas (MPAs): Increased MPA designations globally, as noted by the IUCN, can lead to restricted boating zones.

- Environmental Partnerships: Collaborating with groups like the Surfrider Foundation or local conservation trusts can foster understanding and sustainable access.

- Regulatory Engagement: Proactive dialogue with bodies such as the EPA or relevant international maritime organizations is key to shaping policy.

- Sustainable Practices: Brunswick's investment in eco-friendly product development and operational efficiencies supports its advocacy for responsible boating.

Environmental factors significantly shape Brunswick's operational landscape, demanding adaptation to climate change and stricter pollution controls. The company's commitment to sustainability, including a net-zero emissions goal by 2040 and a 15% reduction in Scope 1 and 2 emissions by 2023, underscores its response to these pressures. Brunswick is also navigating the challenges of raw material scarcity by prioritizing lightweight, recyclable, and sustainably sourced materials in its product development.

The increasing designation of Marine Protected Areas (MPAs) globally, as highlighted by organizations like the IUCN, presents potential restrictions on recreational boating zones. Brunswick's strategy involves proactive engagement with environmental groups and regulatory bodies to advocate for balanced approaches that support both conservation and continued market access.

| Environmental Factor | Impact on Brunswick | Brunswick's Response/Data |

|---|---|---|

| Climate Change & Weather Volatility | Altered boating seasons, water levels, extreme weather events | Investing in resilient product design; warmer winters potentially extending seasons. |

| Water Accessibility & Infrastructure | Droughts and altered precipitation impacting marina access | Strategic planning for resilience against environmental shifts. |

| Pollution Control & Waste Management | Tightening global regulations on marine vessel emissions and discharge | Investing in cleaner technologies; aiming for net-zero emissions by 2040. Reported 15% reduction in Scope 1 & 2 emissions by 2023 vs. 2020 baseline. |

| Raw Material Scarcity & Sustainability | Pressure on traditional materials | Prioritizing lightweight, sustainable, and recyclable materials; investing in advanced composites. |

| Conservation Efforts & MPAs | Potential limitations on boating zones due to increased MPA designations | Collaborating with environmental organizations; advocating for responsible boating practices. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously constructed using data from reputable sources including government publications, international organizations, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors.