Brunswick Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brunswick Bundle

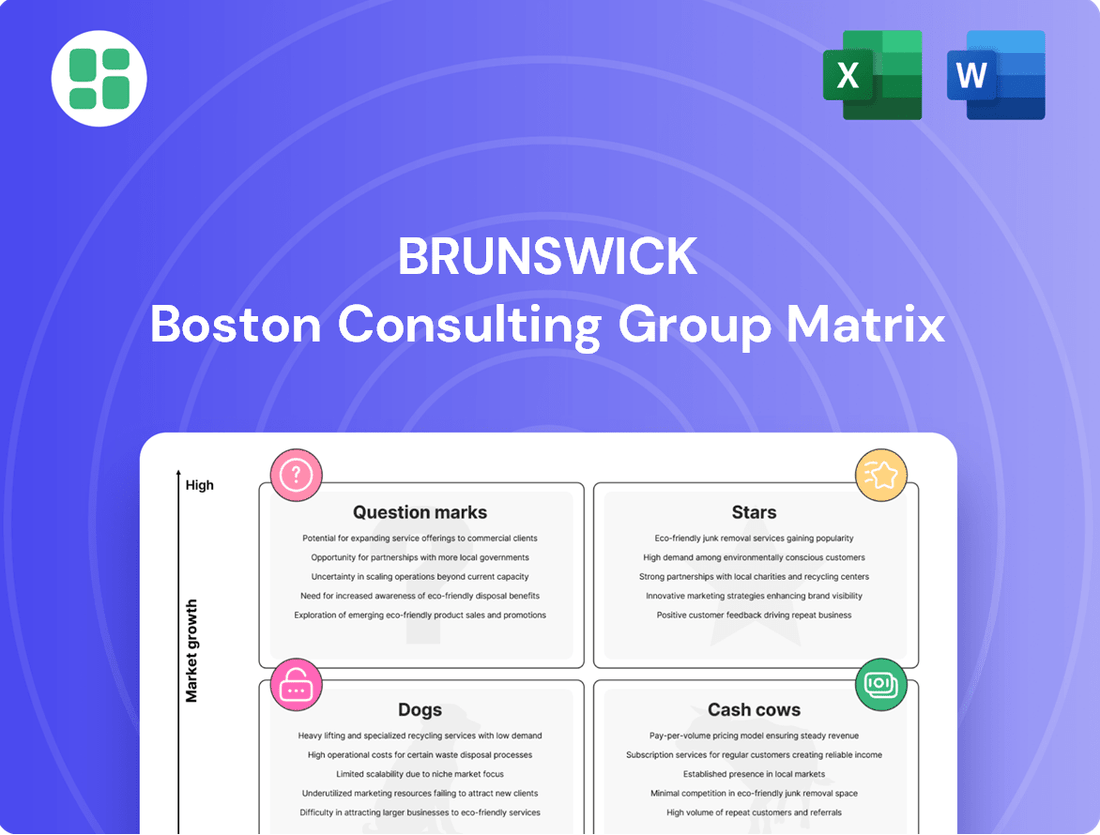

Unlock the strategic potential of your product portfolio with a glimpse into the BCG Matrix. See how your offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and understand the fundamental drivers of market growth and share. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Freedom Boat Club stands out as a Star in Brunswick's BCG Matrix, showcasing robust growth and a dominant position in the burgeoning shared-access boating market. Acquired in 2019, the club has seen its membership base and operational locations more than double, with ambitious global expansion targets including new markets like Dubai and New Zealand by late 2024 and into 2025.

This subscription-driven model offers a stable, recurring revenue stream, insulating it from the volatility often seen in traditional boat sales, and is a critical component of Brunswick's strategy to bolster its recurring revenue businesses.

Mercury Marine's Avator electric outboard series, including models like the 75e and 110e, are positioned as emerging stars within Brunswick's portfolio. These products are capitalizing on the rapidly expanding electric propulsion market, a key area where Brunswick is channeling substantial investment. Their presence at significant industry events like CES 2024 underscores their importance to Brunswick's ACES strategy, which focuses on Autonomy, Connectivity, Electrification, and Shared-Access.

Although the electric outboard market is still in its nascent stages, Mercury Marine's established brand reputation and Brunswick's dedication to pioneering advancements provide a strong foundation. This strategic positioning suggests considerable potential for high future growth and the possibility of achieving market leadership in this dynamic and evolving sector.

New, high-end models like the Boston Whaler 365 Conquest and Sea Ray Sundancer 370 Outboard represent Brunswick's premium offerings. These boats often generate significant buzz and strong sales at industry events, signaling robust demand in the luxury and performance segments of the boating market.

For instance, the Sea Ray Sundancer 370 Outboard, launched in late 2023, received considerable attention and positive reviews, contributing to Sea Ray's strong performance. Boston Whaler's Conquest line consistently performs well, with models like the 365 Conquest appealing to buyers seeking offshore capability and premium amenities.

Navico Group's Advanced Electronics (e.g., Simrad NSX ULTRAWIDE)

Navico Group's advanced electronics, exemplified by the Simrad NSX ULTRAWIDE multi-function display, are a prime example of a potential Star within Brunswick's portfolio. These products are characterized by their innovative technology and significant growth potential, especially within the burgeoning connected boating ecosystem.

Brunswick's acquisition of Navico Group underscores its dedication to its ACES (Autonomy, Connectivity, Electrification, and Shared Access) strategy. The NSX ULTRAWIDE, with its advanced features, directly contributes to the connectivity and autonomy pillars, becoming a crucial element for contemporary marine vessels.

- High Growth Potential: The market for advanced marine electronics is expanding rapidly, driven by consumer demand for integrated and smart boating experiences.

- Technological Innovation: Products like the Simrad NSX ULTRAWIDE offer sophisticated navigation, communication, and entertainment features, setting them apart from competitors.

- Strategic Fit: These electronics align perfectly with Brunswick's ACES strategy, particularly in enhancing the connected boating experience and exploring autonomous capabilities.

- Market Traction: As boaters increasingly seek sophisticated technology, these advanced displays are becoming standard equipment, driving sales and market share.

AI-Powered Boating Intelligence Initiatives

Brunswick's investment in AI-powered Boating Intelligence, including autonomous docking and virtual agents, positions it in a high-growth Star category within the BCG matrix. These nascent technologies are poised to transform the boating experience, offering a distinct competitive edge.

The company is revitalizing its BI Design Lab and demonstrating these innovations at events like CES 2025, underscoring its dedication to pioneering this forward-looking sector. This strategic focus aims to capture future market share in an increasingly tech-driven marine industry.

- AI-Powered Boating Intelligence: Brunswick is investing heavily in AI for features like autonomous docking and virtual assistants.

- Star Category Potential: These initiatives are considered a nascent but high-growth Star area, indicating significant future revenue potential.

- Competitive Advantage: The technologies aim to revolutionize the boating experience and provide a strong competitive differentiator.

- Market Commitment: Re-launching the BI Design Lab and showcasing at CES 2025 highlight Brunswick's commitment to leading in this advanced segment.

Freedom Boat Club, Mercury Marine's Avator electric outboards, advanced Navico Group electronics, and AI-powered boating intelligence all represent Stars in Brunswick's portfolio. These segments are characterized by high market growth and strong competitive positions, aligning with Brunswick's strategic focus on electrification, connectivity, and shared access.

The company's commitment to these areas is evident in its significant investments and the continuous innovation showcased across these product lines. For example, Freedom Boat Club's global expansion and Avator's market entry highlight Brunswick's proactive approach to capturing emerging trends.

| Product/Initiative | Market Growth | Brunswick's Position | Strategic Alignment |

|---|---|---|---|

| Freedom Boat Club | High (Shared Access Boating) | Dominant | Shared Access, Recurring Revenue |

| Mercury Avator Electric Outboards | Very High (Electric Propulsion) | Emerging Leader | Electrification, Innovation |

| Navico Group Electronics (e.g., Simrad NSX ULTRAWIDE) | High (Marine Electronics) | Strong | Connectivity, Autonomy |

| AI-Powered Boating Intelligence | Nascent, High Potential | Pioneering | Autonomy, Connectivity, Future Tech |

What is included in the product

Strategic overview of a company's product portfolio, categorizing units by market share and growth rate.

Quickly identify underperforming "Dogs" and reallocate resources from "Cash Cows" to promising "Stars."

Cash Cows

Mercury Marine's conventional outboard engines are a quintessential Cash Cow for Brunswick. This segment commands a leading market share within the mature marine engine sector, a testament to its enduring strength and customer loyalty.

Despite facing headwinds in the broader marine industry, including a dip in wholesale orders in Q1 2025, Mercury Marine continues to expand its market share in crucial geographies like the U.S. and Europe. This resilience underscores the segment's stable and profitable nature.

The substantial cash flow generated by these conventional outboards provides Brunswick with the financial flexibility to invest in and nurture its growth-oriented business units, reinforcing the Cash Cow's strategic importance.

Established Boston Whaler models, renowned for their legendary unsinkable construction and premium quality, function as the cash cows within Brunswick's portfolio. These models consistently generate substantial profits in a mature, high-end market segment. For instance, Brunswick reported in their 2024 Q1 earnings that the Boston Whaler brand continues to exhibit robust demand and pricing power, contributing significantly to the company's overall profitability.

Brunswick's Parts & Accessories (P&A) business is a prime example of a Cash Cow within the company's portfolio. This segment consistently generates substantial recurring revenue, largely driven by the ongoing need for maintenance, repairs, and upgrades across Brunswick's diverse marine product lines. Its stable demand, even during broader market slowdowns, underscores its value.

The P&A segment typically boasts strong profit margins, benefiting from established supply chains and the inherent value placed on keeping recreational and professional marine equipment operational. While the overall marine industry experienced some sales volatility in recent periods, Brunswick's P&A operations demonstrated resilience. For instance, in the first quarter of 2024, Brunswick reported that its P&A segment delivered robust performance, with net sales increasing by 7% year-over-year, highlighting its consistent revenue generation capability.

Bayliner (Established Models)

Bayliner, with its established presence and focus on accessible boat models, fits the profile of a Cash Cow within Brunswick's portfolio. The brand consistently captures a significant share of the entry-to-mid-level boating market, ensuring steady sales volumes. This broad appeal and long-standing reputation translate into predictable and reliable cash flow generation for the company.

- Brand Recognition: Bayliner benefits from decades of brand recognition, making it a go-to choice for first-time boat buyers and those seeking value.

- Market Share: In 2024, Bayliner continued to hold a strong position in the recreational boat market, particularly in the sterndrive and outboard segments, contributing significantly to Brunswick's overall sales.

- Profitability: While not always the highest margin per unit compared to luxury brands, Bayliner's high sales volume ensures substantial overall profit contribution, acting as a stable cash generator.

- Cash Flow: The consistent demand for Bayliner's offerings provides a dependable stream of cash flow, which Brunswick can then reinvest in other business segments or innovation.

Sea Ray (Established Cruisers and Sport Boats)

Established lines of Sea Ray cruisers and sport boats, particularly those with a strong legacy and brand recognition, function as cash cows for Brunswick. These models cater to a loyal customer base in a mature segment, generating steady revenue. For instance, Sea Ray's 2024 sales in the cruiser segment continue to show resilience, reflecting the enduring appeal of their established designs. The brand actively introduces new models, but the consistent demand for its proven designs and the brand's established distribution network ensure reliable cash generation.

Sea Ray's cash cow status is supported by several factors:

- Strong Brand Loyalty: Decades of consistent quality and performance have built a dedicated customer base for Sea Ray cruisers and sport boats.

- Mature Market Segment: While growth may be slower, the established cruiser and sport boat market offers predictable demand and stable pricing.

- Consistent Revenue Generation: Sales of these legacy models provide a reliable and substantial income stream for Brunswick Corporation.

- Supporting New Ventures: The profits generated by Sea Ray cash cows help fund research and development for newer, potentially high-growth product lines within Brunswick.

Cash Cows, as defined by the BCG Matrix, are established products or business units with high market share in low-growth industries. They generate more cash than they consume, providing vital funding for other parts of the business. Brunswick's Mercury Marine outboards and its Parts & Accessories segment exemplify this, consistently delivering strong profits and revenue.

The Boston Whaler and Sea Ray brands, with their loyal customer bases and strong presence in mature segments, also function as cash cows. Bayliner, appealing to a broad market with its accessible models, further solidifies this role through high sales volumes and predictable cash flow.

| Brunswick Business Unit | BCG Category | Key Characteristics | 2024 Performance Indicator |

|---|---|---|---|

| Mercury Marine Outboards | Cash Cow | High market share, mature industry, stable demand | Continued market share expansion in key regions (Q1 2025 data shows resilience) |

| Parts & Accessories (P&A) | Cash Cow | Recurring revenue, strong margins, consistent demand | 7% year-over-year net sales increase (Q1 2024) |

| Boston Whaler | Cash Cow | Premium brand, loyal customers, strong pricing power | Robust demand and profitability contribution (Q1 2024 earnings) |

| Sea Ray Cruisers/Sport Boats | Cash Cow | Established legacy, loyal customer base, predictable revenue | Resilient sales in cruiser segment (2024 data) |

| Bayliner | Cash Cow | High sales volume, broad market appeal, consistent cash generation | Strong position in entry-to-mid-level market (2024) |

What You See Is What You Get

Brunswick BCG Matrix

The preview you are currently viewing is the identical, fully functional Brunswick BCG Matrix document you will receive immediately after your purchase. This means you get the complete analysis, without any watermarks or placeholder content, ready for immediate integration into your strategic planning processes. The professional formatting and insightful data presented here are precisely what will be delivered, ensuring a seamless transition from preview to practical application for your business decisions.

Dogs

Within Brunswick's diverse boat manufacturing operations, certain older or niche brands likely fall into the Dogs category of the BCG matrix. These are products with a low market share in mature or declining segments, meaning they aren't attracting many new customers. For instance, if a particular model has seen its sales shrink by 5% year-over-year in a market that itself is only growing at 1%, it fits this profile.

These "Dogs" often struggle to generate substantial profits and may even drain resources, requiring significant investment for minimal return. While Brunswick doesn't typically single out specific underperforming brands publicly, it's a common strategic challenge for large conglomerates. In 2023, the recreational boating industry saw a slight contraction in unit sales compared to the pandemic boom years, making older, less innovative models even more susceptible to this classification.

Certain sterndrive engine offerings from Mercury Marine, particularly those in segments experiencing a decline in popularity or facing intense competition from the growing outboard market, could be categorized as Dogs in the BCG Matrix. The marine industry's pronounced shift towards outboard power has directly impacted demand for specific sterndrive applications.

This trend has resulted in significant sales drops for these particular sterndrive models, signaling both low market growth and a potentially diminishing market share for Mercury Marine in these niche areas. For instance, while overall marine engine sales saw a modest increase in 2024, sterndrive units in certain recreational segments have lagged, with some reports indicating a decline of over 5% year-over-year in specific horsepower categories where outboards have gained significant traction.

Brunswick Corporation might identify certain international markets or legacy distribution channels as Dogs within its BCG Matrix. These are areas where the company holds a low market share, and the market itself is experiencing little to no growth. For example, in 2024, Brunswick's presence in a specific, mature European marine accessories market might show declining sales and a shrinking customer base, indicating a Dog status.

These underperforming segments often demand significant investment simply to maintain a presence, yet yield minimal returns. They may also face intense competition from established local players who have a stronger understanding of the regional market dynamics. Brunswick's strategic focus on investing in high-growth areas, such as electric propulsion systems in North America and Asia, naturally leads to a de-emphasis on these stagnant international regions.

Non-Core or Divested Business Units (Historical Context)

Historically, Brunswick's non-core or divested business units would be categorized in the 'Dogs' quadrant of the BCG Matrix. These are segments that typically exhibit low market growth and low relative market share, indicating they are not strategic growth drivers for the company. Brunswick continually assesses its portfolio, and while no major divestitures were publicly announced for 2024 or early 2025, this evaluation process is ongoing to optimize resource allocation.

These divested or underperforming units represent areas where Brunswick has strategically chosen to exit or reduce investment because they no longer align with the company's core competencies or future growth objectives. For instance, in prior years, Brunswick has divested businesses that did not fit its evolving strategy, freeing up capital and management focus for its more promising segments.

- Low Growth Potential: Units in this category typically operate in mature or declining industries, offering limited opportunities for expansion.

- Low Market Share: These businesses often struggle to compete effectively against larger, more established players.

- Strategic Divestment: Brunswick's approach involves actively managing its portfolio, divesting non-core assets to enhance overall profitability and focus.

- Portfolio Optimization: The continuous evaluation aims to ensure resources are directed towards businesses with higher growth and market share potential.

Entry-Level Product Lines Heavily Impacted by Economic Headwinds

Entry-level boat product lines, especially those catering to first-time buyers or those more sensitive to economic shifts, can find themselves in a challenging position. When interest rates climb, as they have in recent periods, and consumers tighten their belts due to reduced discretionary income, these segments often bear the brunt of the slowdown. This makes them prime candidates for the Dogs category in the BCG Matrix.

These product lines may struggle with declining sales volumes and potentially thin profit margins. For instance, during economic downturns, demand for more affordable boat models can evaporate quickly. This situation can lead to a cash trap scenario, where the business unit consumes cash without generating significant returns, hindering overall company growth unless strategic interventions are made.

- Economic Sensitivity: Entry-level boat models are highly susceptible to interest rate hikes and reduced consumer discretionary spending.

- Sales Declines: During market downturns, these segments often experience sharp drops in sales volume.

- Profitability Challenges: Low demand can squeeze profit margins, making these units less attractive financially.

- Cash Trap Potential: Without market improvement or strategic adjustments, these products can become cash drains.

Certain legacy product lines within Brunswick's portfolio, particularly those in mature or declining segments with low market share, would be classified as Dogs. These products offer minimal growth potential and often require significant investment to maintain, yielding little return. For example, if a specific boat model's sales have stagnated or declined by over 3% annually in a market that is also contracting by 1% or more, it fits this profile.

These "Dogs" can represent a drain on resources, impacting overall profitability and strategic flexibility. While Brunswick's public disclosures don't detail specific brands in this category, the industry trend of consolidation and focus on innovation means older, less differentiated offerings are more likely to fall into this quadrant. The recreational boating market in 2024 saw continued shifts, with demand favoring newer technologies and more efficient designs, further pressuring legacy products.

| Category | Market Growth | Market Share | Strategic Implication |

| Dogs | Low | Low | Divest, harvest, or reposition |

| Example Scenario | -1% (Mature/Declining) | < 10% (Relative) | Focus on cost reduction or exit strategy |

| Brunswick Context | Legacy product segments, niche international markets | Underperforming brands, declining sterndrive applications | Resource reallocation to Stars and Cash Cows |

Question Marks

Brunswick's exploration into higher-voltage electric propulsion systems, showcased through concepts at CES 2025 beyond current Avator models, positions them in a burgeoning high-growth market. While definitive market share in this higher-power electric segment is still emerging, the company is investing heavily in research and development to scale these advanced technologies.

This strategic pivot requires substantial R&D expenditure, but the potential for significant returns hinges on successful market adoption. For context, the global electric boat market is projected to reach $10.6 billion by 2027, indicating substantial future opportunity for players like Brunswick in these developing segments.

Brunswick's investment in autonomous boating technologies, like AI-powered virtual agents and autonomous docking, showcases their commitment to innovation. These advancements, part of their Boating Intelligence initiative, represent a high-growth potential area aimed at simplifying the boating experience.

While these technologies are cutting-edge, their current market penetration remains low, demanding significant R&D investment. Brunswick is positioning these innovations as potential future stars, requiring continued development to achieve widespread consumer adoption and market dominance.

Freedom Boat Club's foray into Dubai, slated for Fall 2025, positions this specific venture as a Question Mark within Brunswick's BCG framework. While the broader Freedom Boat Club brand is a strong performer, entering a new, international market like Dubai presents the classic challenge of high potential growth coupled with uncertain initial market penetration.

This expansion requires significant capital investment from Brunswick to build brand awareness, establish operational infrastructure, and acquire members in the United Arab Emirates. The success hinges on Brunswick's ability to effectively navigate local market dynamics and consumer preferences to gain traction.

The objective is to transform this Question Mark into a Star by cultivating a strong market position and achieving substantial growth in the Dubai region. Brunswick's strategic allocation of resources will be critical in this transition, aiming to replicate the success seen in its more established markets.

Boateka (Used Boat Marketplace)

Boateka, Brunswick's venture into the used boat marketplace, fits the profile of a Question Mark in the BCG matrix. While the used boat market can experience significant growth, particularly when new boat sales face headwinds, Boateka's position within this often fragmented sector suggests its market share is still in its nascent stages of development.

Brunswick's strategic investment in Boateka, focusing on a shared-access and digital-first approach, signals an ambition to secure a more substantial footprint across the entire boating lifecycle. However, the ultimate profitability and potential for market leadership for Boateka remain uncertain, requiring further observation and performance tracking.

- Market Growth Potential: The used boat market can offer robust growth opportunities, especially during economic cycles that impact new boat purchases.

- Developing Market Share: Boateka's share in the competitive and fragmented used boat market is likely still being established.

- Strategic Investment: Brunswick is actively investing in Boateka to capture more of the customer journey, but its long-term financial success is yet to be confirmed.

- Uncertain Profitability: The digital and shared-access model's ability to generate consistent profits and achieve market dominance is still under evaluation.

Fliteboard (eFoil Surfboards)

Fliteboard eFoil surfboards, highlighted at Brunswick's 2025 Freedom Forum, fit squarely into the Question Mark category of the BCG Matrix. This segment of the marine recreation market is characterized by rapid innovation and substantial growth potential, with the global electric hydrofoil surfboard market projected to reach \$300 million by 2026, growing at a CAGR of over 15%.

Brunswick's involvement via Flite positions them in this emerging niche, yet their market share within this specific, high-growth segment is likely still developing. The company needs to strategically invest in marketing and distribution to capture a larger portion of this expanding market.

- Market Growth: The eFoil market is experiencing significant expansion, driven by technological advancements and increasing consumer interest in watersports.

- Brunswick's Position: While Brunswick has a presence, its market share in this nascent eFoil segment is likely modest, requiring focused effort.

- Investment Needs: Substantial investment in brand building, product development, and distribution networks is crucial to convert Fliteboard's potential into a dominant market position.

- Strategic Focus: Continued innovation and aggressive market penetration strategies are essential for Fliteboard to transition from a Question Mark to a Star in Brunswick's portfolio.

The Freedom Boat Club expansion into Dubai represents a classic Question Mark. While the club model itself is a strong performer, entering a new international market carries inherent uncertainties regarding initial adoption and market share capture. Brunswick's investment here is significant, aiming to cultivate a strong presence in the UAE.

Boateka, Brunswick's digital platform for used boats, also fits the Question Mark profile. The used boat market offers growth, but Boateka's share within this often fragmented sector is still developing. Brunswick's investment aims to capture more of the boating lifecycle, but profitability and market leadership for Boateka remain to be seen.

Fliteboard eFoils are another Question Mark. This niche market is growing rapidly, with global eFoil surfboard market projected to reach $300 million by 2026. Brunswick's presence via Flite means they are in a high-growth area, but their market share is still emerging, requiring strategic investment in marketing and distribution.

| Business Unit | BCG Category | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Freedom Boat Club (Dubai) | Question Mark | High (New Market Entry) | Low (Nascent) | Requires investment to build awareness and gain traction. Potential to become a Star. |

| Boateka | Question Mark | Moderate to High (Used Boat Market) | Low (Developing) | Investment needed to establish market share in a fragmented sector. Profitability uncertain. |

| Fliteboard eFoils | Question Mark | Very High (Emerging Niche) | Low (Developing) | Strategic marketing and distribution investment crucial for growth. Potential to become a Star. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.