Brunswick Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brunswick Bundle

Brunswick's competitive landscape is shaped by several key forces, including the bargaining power of its suppliers and the intensity of rivalry within the marine industry. Understanding these dynamics is crucial for any stakeholder looking to navigate this market.

Ready to move beyond the basics? Get a full strategic breakdown of Brunswick’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Brunswick's reliance on a concentrated supplier base for specialized components, such as advanced marine electronics from Navico Group and high-performance engine parts, significantly influences supplier bargaining power. When the number of suppliers offering unique technologies is limited, they can command higher prices, directly impacting Brunswick's input costs.

The growing complexity in marine technology, particularly with the integration of electric propulsion systems, further consolidates power among a select few innovative suppliers. This concentration means Brunswick has fewer alternatives, amplifying the suppliers’ ability to negotiate more favorable terms.

The bargaining power of suppliers for Brunswick Corporation is significantly shaped by the cost and availability of key raw materials like fiberglass, aluminum, and various metals essential for boat and engine production. Fluctuations in these inputs directly impact Brunswick's manufacturing costs and profitability.

Global economic conditions, geopolitical events, and persistent supply chain issues, which have been prominent in recent years, can drive up material prices and extend delivery times. This situation grants suppliers greater leverage in negotiating terms and pricing with manufacturers like Brunswick.

For instance, the average price of aluminum, a critical component, saw significant increases in 2023 and early 2024 due to global demand and production constraints, directly affecting boat manufacturers. Similarly, disruptions in global shipping lanes in late 2023 and early 2024 led to higher freight costs and potential delays for components, further amplifying supplier power.

Suppliers who possess unique technology or patents, particularly for crucial components like advanced marine electronics or high-performance engine parts, can significantly influence pricing and availability for Brunswick. For instance, a supplier controlling a key piece of proprietary navigation software could command higher prices.

Brunswick's strategy to counter this includes acquiring companies with such valuable intellectual property. By integrating Navico Group, a leader in marine electronics, Brunswick brought significant technological capabilities in-house, reducing its reliance on external suppliers for critical innovations and thereby lessening their bargaining power.

Labor and Manufacturing Costs for Suppliers

Rising labor and manufacturing costs for suppliers can significantly shift bargaining power towards them, potentially increasing expenses for companies like Brunswick. This dynamic is especially pronounced in areas with robust labor unions or mandated high minimum wages, as suppliers face greater pressure to absorb or pass on these elevated operational expenses.

While supply chain disruptions have eased compared to the peak pandemic period, manufacturers are still contending with higher overall costs. For instance, in 2024, the U.S. manufacturing sector experienced continued wage growth, with average hourly earnings for production and nonsupervisory employees in manufacturing increasing by approximately 4.5% year-over-year through the third quarter.

- Increased Input Costs: Suppliers facing higher wages and material expenses may pass these costs onto Brunswick, reducing Brunswick's profitability.

- Regional Wage Disparities: Suppliers operating in regions with strong labor protections or high cost-of-living indexes will likely have greater bargaining power due to elevated labor expenses.

- Manufacturing Cost Pressures: Despite supply chain improvements, persistent inflation in manufacturing inputs continues to affect supplier pricing strategies in 2024.

Brunswick's Scale and Vertical Integration Efforts

Brunswick's significant global scale as a leading marine manufacturer, with brands like Sea Ray and Boston Whaler, provides a degree of leverage over suppliers. This scale allows for larger order volumes, potentially securing more favorable terms.

Furthermore, Brunswick's strategic investments in vertical integration, notably its ownership and production of Mercury Marine engines, directly reduce its reliance on external engine suppliers for a substantial portion of its boat manufacturing. This internal control over critical components like engines significantly mitigates the bargaining power of independent engine manufacturers.

- Scale Advantage: Brunswick's status as a global leader allows it to negotiate from a position of strength due to high order volumes.

- Vertical Integration: Producing Mercury Marine engines in-house reduces dependency on external engine suppliers.

- Component Control: This integration lessens the impact of potential price increases or supply disruptions from outside engine providers.

Brunswick's bargaining power with suppliers is influenced by its substantial scale and vertical integration, particularly its ownership of Mercury Marine. This allows for larger orders and reduced reliance on external engine providers, thereby diminishing supplier leverage.

However, reliance on specialized, proprietary components from a limited number of tech suppliers, like those for advanced marine electronics, grants those suppliers significant power. This is exacerbated by the increasing complexity of marine technology, which consolidates innovation among fewer entities.

| Factor | Impact on Supplier Bargaining Power | Brunswick's Position |

|---|---|---|

| Supplier Concentration & Technology Differentiation | High | Varies; high for specialized tech, lower for commoditized parts. |

| Cost of Inputs (Materials & Labor) | High | Vulnerable to material price hikes (e.g., aluminum in 2023-2024) and rising labor costs (e.g., ~4.5% wage growth in US manufacturing Q3 2024). |

| Vertical Integration (Mercury Marine) | Lowers | Significant reduction in reliance on external engine suppliers. |

| Customer Switching Costs | Low for commoditized inputs, High for proprietary tech. | Limited ability to switch from unique technology providers. |

What is included in the product

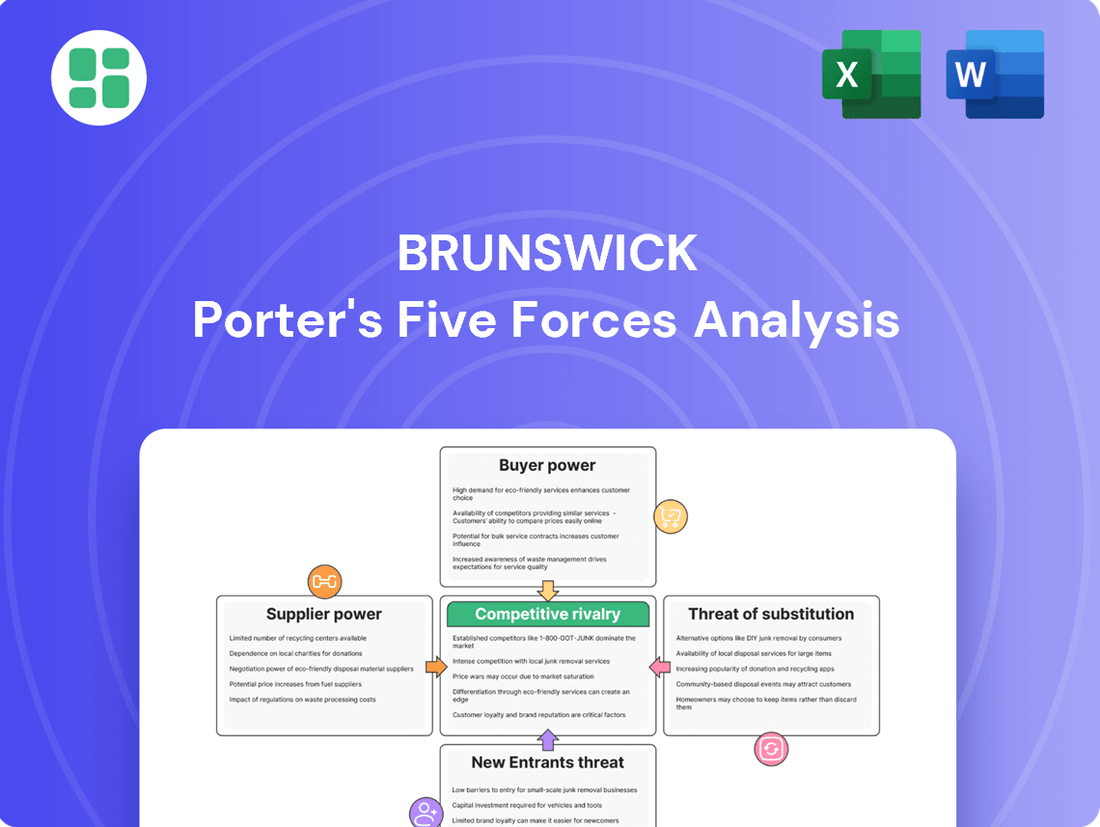

Brunswick's Five Forces analysis dissects the competitive intensity within its industry, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each Porter's Five Forces, allowing for targeted strategy adjustments.

Customers Bargaining Power

Brunswick's customer base is quite varied, ranging from casual weekend boaters to professionals running commercial fleets. This diversity means different groups have different sensitivities to price. For instance, buyers looking at premium brands like Boston Whaler might not be as concerned about cost.

However, those entering the market for more basic boats are definitely more influenced by economic factors. Things like interest rates and general affordability play a big role, giving these customers more leverage. In 2024, with rising interest rates impacting consumer credit, this price sensitivity in the entry-level segment is particularly noticeable, increasing customer bargaining power.

The availability of numerous recreational activities and alternative ways to enjoy the water significantly boosts customer bargaining power. For Brunswick, this means that if consumers can easily choose other leisure pursuits or access boating without the commitment of ownership, they will likely demand more competitive pricing and compelling value from Brunswick's offerings.

For instance, the growth of boat clubs and rental services provides readily accessible alternatives to outright boat ownership. In 2024, the boat rental market continued to expand, with platforms reporting increased user engagement, putting pressure on traditional boat manufacturers and dealers to demonstrate superior value or more flexible ownership models.

Customers today wield significant power, largely due to the vast amount of information readily available on digital platforms. They can easily compare product features, prices, and read reviews from other users, empowering them to make more informed purchasing decisions and negotiate better terms. This heightened awareness means businesses must be transparent and competitive to attract and retain customers.

Brunswick's strategic focus on digital transformation and leveraging customer insights directly addresses this shift. By understanding what informed consumers are looking for, Brunswick can tailor its offerings and pricing to better meet these demands, thereby mitigating some of the increased bargaining power customers possess. For instance, in 2024, companies that effectively utilized customer data saw an average increase in customer retention rates of 10-15% compared to those who did not.

Dealer Network Influence and Inventory Levels

Brunswick Corporation's reliance on a dealer network significantly impacts customer bargaining power. When dealers hold substantial inventory, they become more motivated to offer discounts and promotions to move products. For instance, in early 2024, reports indicated robust dealer inventory levels for recreational boats, a key segment for Brunswick. This oversupply can translate into more competitive pricing for consumers, as dealers seek to liquidate stock and maintain cash flow, thereby amplifying the customer's ability to negotiate better terms.

The bargaining power of customers is further influenced by the dealer network's dynamics and inventory management. High dealer inventory levels, a situation observed in the marine industry throughout much of 2023 and continuing into early 2024, can create a buyer's market. Dealers, eager to reduce carrying costs and free up capital, may be more willing to negotiate on price or offer additional incentives. This competitive pressure among dealers ultimately benefits the end customer, enhancing their leverage in purchase decisions.

- Dealer Network as Intermediary: Brunswick primarily distributes its products through independent dealers, who serve as the direct point of sale to the end consumer.

- Inventory Levels and Pricing: High dealer inventory, a factor observed in 2023-2024, often leads to increased discounting and promotional activities by dealers to manage stock.

- Customer Leverage: When dealers are motivated to sell due to high inventory, customers gain greater bargaining power, enabling them to negotiate more favorable prices and terms.

- Competitive Environment: The competitive nature of the dealer network, especially when coupled with ample inventory, intensifies price competition, directly benefiting the purchasing power of customers.

Impact of Economic Conditions and Discretionary Spending

The bargaining power of customers in the marine industry is significantly influenced by broader economic conditions. As boats and marine products are typically considered discretionary purchases, demand is highly sensitive to macroeconomic indicators. For instance, rising interest rates in 2024 made financing a boat purchase more expensive, potentially dampening consumer enthusiasm and increasing price sensitivity.

In a challenging economic climate, characterized by inflation or reduced consumer confidence, households often tighten their budgets. This can translate directly into fewer boat sales and a heightened demand from customers for better value, including lower prices or added incentives. For example, if consumer spending on non-essential goods contracts, customers are more likely to scrutinize prices and negotiate harder.

- Discretionary Nature: Boats are often viewed as luxury or recreational items, making their purchase contingent on available disposable income.

- Economic Sensitivity: Factors like inflation, interest rates, and unemployment directly impact a consumer's ability and willingness to purchase high-ticket items like boats.

- Value Proposition: During economic downturns, customers exert greater bargaining power by demanding lower prices, extended warranties, or bundled services to justify their expenditure.

- Consumer Confidence: In 2024, fluctuations in consumer confidence indices directly correlated with demand for recreational products, influencing customer negotiation leverage.

Customers hold substantial bargaining power, particularly in segments sensitive to price and economic conditions. The availability of alternatives, coupled with easy access to information, allows consumers to compare offerings and negotiate effectively. Brunswick's strategy to leverage customer data and enhance transparency aims to address this dynamic.

The marine industry's reliance on dealers with potentially high inventory levels in 2023-2024 amplified customer leverage. Dealers, facing carrying costs and seeking to liquidate stock, often resort to discounts, benefiting buyers. This environment, influenced by economic factors like rising interest rates in 2024, makes customers more discerning and demanding of value.

| Factor | Impact on Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Price Sensitivity (Entry-Level) | High | Increased due to rising interest rates impacting affordability. |

| Availability of Alternatives (Boat Clubs/Rentals) | High | Continued growth in rental services in 2024 pressured ownership models. |

| Information Accessibility (Online Reviews/Comparisons) | High | Empowers informed decisions and negotiation. |

| Dealer Inventory Levels | High | Robust inventory in early 2024 led to dealer discounting. |

| Economic Conditions (Interest Rates, Inflation) | High | Higher financing costs in 2024 increased price scrutiny. |

Full Version Awaits

Brunswick Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape of the Brunswick Porter's Five Forces Analysis, covering the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive analysis is ready for your immediate use.

Rivalry Among Competitors

The marine recreation industry presents a fascinating duality: it's fragmented across many boat types and price ranges, yet certain segments exhibit significant concentration. This means while you might find a multitude of smaller boat builders, key areas like outboard engines are dominated by a few major players.

Brunswick Corporation itself holds a substantial market share in the outboard engine segment, a testament to this concentration. For instance, in 2023, Mercury Marine, a Brunswick brand, continued its strong performance, underscoring the competitive advantage in these more consolidated markets. However, other boat categories, like custom yachts or specific types of fishing boats, can see much fiercer rivalry from numerous specialized manufacturers, each vying for a niche.

Competitive rivalry within the marine industry is fierce, compelling companies like Brunswick to continuously innovate. This drive for differentiation is evident in their focus on ACES: Autonomy/Assistance, Connectivity, Electrification, and Shared Access. Brunswick's 2024 product pipeline, featuring advancements in electric propulsion and integrated digital solutions, directly addresses this intense competition.

Brunswick Corporation, a global leader in marine propulsion, faces intense competition from both large international players and numerous regional manufacturers. Companies like Yamaha Motor, a significant global competitor, vie for market share across various segments. This global presence necessitates a keen understanding of diverse market needs and regulatory landscapes.

Success in this competitive arena hinges on Brunswick's ability to tailor its product offerings and distribution networks to specific local preferences and compliance requirements. For instance, in 2023, Brunswick reported net sales of $6.9 billion, underscoring the scale of operations and the significant revenue potential that also attracts a multitude of regional competitors, each with localized strengths.

Pricing Strategies and Discounting Pressures

Competitive rivalry at Brunswick often heats up when demand softens. This intensified competition can lead to more frequent discounting and promotional efforts aimed at clearing inventory. For instance, during periods of slower sales in 2024, Brunswick observed an increase in these activities across various product categories.

These pricing pressures directly impact the company's financial performance. Brunswick has reported that selective discounting in specific market segments has indeed affected both its sales volume and profit margins. This strategy, while intended to stimulate immediate sales, can erode profitability if not managed carefully.

- Intensified Rivalry: Softer demand periods in 2024 saw competitors employing more aggressive pricing tactics.

- Discounting Impact: Brunswick's own use of selective discounts in certain segments in 2024 directly influenced sales and margin performance.

- Margin Erosion: The pressure to discount can lead to a reduction in overall profitability if not offset by volume increases or cost efficiencies.

Brand Strength and Dealer Network

Brunswick's competitive rivalry is significantly shaped by its robust brand strength and an expansive, loyal dealer network. This dual advantage allows the company to command customer loyalty and market presence.

With a portfolio boasting over 60 well-recognized brands, including Boston Whaler, Sea Ray, and Mercury Marine, Brunswick enjoys substantial brand equity. This recognition translates into pricing power and a strong competitive stance against rivals.

The company's global servicing dealer network is another critical asset, fostering customer relationships and ensuring consistent product support. As of early 2024, Brunswick operates a vast network, facilitating market penetration and customer retention across diverse geographies.

- Brand Portfolio: Over 60 brands including Boston Whaler, Sea Ray, and Mercury Marine.

- Dealer Network Reach: Extensive global servicing dealer network.

- Competitive Advantage: Brand recognition and dealer loyalty reduce competitive intensity.

Competitive rivalry in the marine industry is intense, driven by a mix of large global players and numerous specialized regional manufacturers. Brunswick, with its significant market share in segments like outboard engines, faces direct competition from companies such as Yamaha Motor. This rivalry necessitates continuous innovation, as seen in Brunswick's 2024 focus on electric propulsion and digital solutions.

Periods of softer demand, observed in 2024, often lead to increased discounting and promotional activities among competitors, putting pressure on pricing and profit margins. Brunswick's own strategic use of selective discounts in certain product categories during these times directly impacts its sales volume and profitability, highlighting the delicate balance between stimulating demand and maintaining margins.

Brunswick's strong brand portfolio, featuring over 60 recognized names, and its extensive global dealer network provide a significant competitive advantage. This allows the company to foster customer loyalty and maintain market presence, thereby mitigating some of the intensity of direct competition. The brand equity and dealer support are crucial assets in navigating the crowded marine market.

| Competitor | Key Product Segments | Market Presence |

|---|---|---|

| Yamaha Motor | Outboard engines, motorcycles, marine electronics | Global |

| Sea Ray (Brunswick brand) | Sterndrive and inboard recreational boats | Global |

| Boston Whaler (Brunswick brand) | Center console and dual console boats | Global |

| Mercury Marine (Brunswick brand) | Outboard engines, sterndrive engines, propellers | Global |

SSubstitutes Threaten

The most significant threat to Brunswick's boat and marine engine business comes from alternative recreational activities that vie for consumers' leisure time and money. These substitutes include a wide range of options like land-based vacations, RV travel, and other watersports such as paddleboarding, kayaking, and jet skiing. Even the simple choice of staying home for entertainment competes for these discretionary dollars.

In 2024, the travel and tourism industry saw continued strong demand, with many consumers prioritizing experiences. For example, the U.S. travel market was projected to reach over $1.5 trillion by the end of 2024, indicating a substantial pool of discretionary spending that could be diverted from boating to other leisure pursuits.

The growing popularity of boat clubs and rental services presents a significant threat of substitutes for traditional boat ownership. These alternatives, like Brunswick's own Freedom Boat Club, allow individuals to enjoy boating without the substantial upfront costs, ongoing maintenance, and storage commitments associated with owning a vessel. For instance, Freedom Boat Club reported a significant expansion in its membership base and fleet size in recent years, indicating a strong consumer shift towards these flexible access models.

The availability of a strong used boat market directly competes with new boat sales. When new boats become expensive or during economic uncertainty, buyers often turn to pre-owned options. This trend was evident in 2023, where the used boat market saw continued activity as consumers sought more budget-friendly ways to enjoy boating, impacting demand for new inventory across various segments.

Lower-Cost Watercraft Options

The threat of substitutes for traditional boats is significant, particularly from lower-cost watercraft options. Personal watercraft (PWCs), kayaks, and paddleboards provide accessible ways to enjoy the water, appealing to individuals who might find larger boat ownership prohibitive due to cost or complexity. These alternatives offer a lower barrier to entry for water-based recreation.

These substitutes cater to a different segment of the market, often those seeking simpler, more affordable, or more portable recreational experiences. For instance, the PWC market, a key substitute, saw strong demand in 2023, with many manufacturers reporting robust sales figures, indicating a healthy consumer appetite for these alternatives.

- Personal Watercraft (PWCs): Offer a thrilling, individualistic water experience at a lower price point than most motorized boats.

- Kayaks and Paddleboards: Represent the most accessible and lowest-cost options for enjoying lakes, rivers, and calm coastal waters.

- Rental Services: Boat and PWC rental companies also act as substitutes, allowing consumers to access watercraft without the commitment of ownership.

Technological Advancements in Other Industries

Technological advancements in seemingly unrelated industries can emerge as significant substitutes for traditional offerings. For instance, the burgeoning virtual reality (VR) and augmented reality (AR) sectors are rapidly improving immersive entertainment experiences. By 2024, the global VR market was estimated to reach over $100 billion, showcasing its significant growth and potential to capture consumer attention and discretionary spending.

These advancements could indirectly compete for leisure time that might otherwise be allocated to activities like boating or other physical recreational pursuits. As VR and AR become more sophisticated and accessible, they offer compelling alternatives for entertainment and social interaction, potentially diminishing the perceived need for or appeal of certain physical leisure activities.

Consider the impact on the marine leisure industry. While not a direct substitute, the increasing quality and affordability of home-based or location-based immersive entertainment could divert a portion of consumer budgets and free time. For example, a family might opt for a premium VR gaming session that costs a fraction of a day on a boat, offering a different but engaging experience.

- VR/AR Market Growth: The global VR market was projected to exceed $100 billion by 2024, indicating a substantial shift in entertainment spending.

- Leisure Time Competition: Advancements in immersive technologies offer alternative leisure activities that can indirectly substitute for traditional recreational pursuits like boating.

- Cost-Effectiveness: Immersive entertainment often presents a more budget-friendly option compared to physical leisure activities, making it an attractive substitute for some consumers.

The threat of substitutes for Brunswick's offerings is multifaceted, ranging from direct competitors in water recreation to entirely different leisure activities. Consumers have a wide array of choices for their discretionary spending and leisure time, meaning boating must constantly compete for attention and budget. This is particularly true for lower-cost, more accessible water-based activities.

In 2024, the strong performance of the travel and tourism sector, with the U.S. market alone projected to surpass $1.5 trillion, highlights the significant competition for consumer leisure dollars. Furthermore, the rise of boat clubs and rental services, like Brunswick's own Freedom Boat Club, offers a compelling alternative to ownership, attracting consumers seeking flexibility and reduced commitment. The used boat market also remains a persistent substitute, especially during economic fluctuations, providing a more budget-friendly entry point into boating.

| Substitute Category | Examples | 2023/2024 Relevance/Data Point |

| Alternative Leisure Activities | Land-based vacations, RV travel, home entertainment | U.S. Travel Market projected >$1.5 trillion in 2024 |

| Accessible Water Sports | Personal Watercraft (PWCs), Kayaks, Paddleboards | PWC market saw strong demand and robust sales in 2023 |

| Boating Access Models | Boat clubs, rental services | Freedom Boat Club reported significant membership and fleet expansion |

| Pre-owned Market | Used boats | Continued activity in used boat market in 2023 for budget-conscious buyers |

| Immersive Entertainment | Virtual Reality (VR), Augmented Reality (AR) | Global VR market estimated >$100 billion by 2024 |

Entrants Threaten

The marine manufacturing sector, especially for boats and engines, demands significant upfront capital. Companies need substantial investments in state-of-the-art facilities, advanced machinery, and ongoing research and development to stay competitive. For instance, establishing a new boat manufacturing plant can easily run into tens of millions of dollars, making it a formidable hurdle for newcomers.

Furthermore, the inherent complexity in designing, engineering, and manufacturing high-quality marine products presents another major barrier. This intricate process requires specialized expertise and a deep understanding of materials science, hydrodynamics, and engine technology, which new entrants often lack.

Brunswick's established brand loyalty and extensive dealer networks present a significant barrier to new entrants. Decades of building trust and a widespread presence mean new companies face immense hurdles in matching this customer recognition and accessibility. For instance, in 2024, the marine industry continued to see strong brand preference for established names, with companies like Brunswick reporting robust sales figures that underscore this loyalty.

The marine industry faces significant regulatory hurdles, including stringent safety, environmental, and manufacturing standards. For instance, the U.S. Environmental Protection Agency (EPA) mandates emissions controls for marine engines, impacting design and production costs. New entrants must invest heavily in compliance and certification processes, such as those required by the U.S. Coast Guard for vessel safety, which can be a substantial barrier to entry.

Access to Supply Chain and Specialized Components

New companies entering the marine industry often struggle to secure consistent access to specialized components, raw materials, and experienced labor. This is a significant hurdle, as established players have already cultivated these vital supply chain relationships.

Incumbents benefit from established networks and purchasing power, which translate into better pricing and more reliable deliveries. For instance, in 2024, major marine manufacturers reported securing key component contracts at prices up to 15% lower than market rates due to long-term supplier agreements.

- Supply Chain Integration: Existing manufacturers often have vertically integrated supply chains, giving them greater control and efficiency in sourcing critical parts.

- Economies of Scale: Large-volume orders by established companies lead to lower per-unit costs for raw materials and components, a benefit new entrants cannot easily replicate.

- Supplier Loyalty: Long-standing relationships foster loyalty among suppliers, who may prioritize existing clients during periods of high demand or limited supply, as seen in the 2023-2024 global semiconductor shortage affecting various industries, including marine electronics.

Intellectual Property and Technological Expertise

Brunswick and its established competitors hold significant intellectual property and deep technological expertise in areas like marine propulsion, navigation systems, and advanced boat design. This creates a substantial barrier for newcomers. For instance, in 2024, the marine industry continued to see significant R&D spending by incumbents, with companies like Brunswick investing heavily in areas such as electric and hybrid marine propulsion systems, aiming to stay ahead of evolving environmental regulations and consumer demands.

New entrants would face the daunting task of either replicating this existing technological prowess through massive investment in research and development or acquiring the necessary patents and expertise. This high upfront cost and the time required to catch up technologically make the threat of new entrants in this specific segment relatively low.

- Intellectual Property as a Barrier: Brunswick's extensive patent portfolio in marine propulsion and navigation systems significantly raises the entry cost for new players.

- R&D Investment Gap: Developing comparable technology would require new entrants to match or exceed the substantial R&D budgets of established firms, which often exceed hundreds of millions annually.

- Acquisition as an Alternative: While acquiring existing technology is an option, it often involves premium valuations, further increasing the financial hurdle for market entry.

- Technological Expertise Advantage: Decades of accumulated knowledge and skilled personnel within incumbent firms create a deep well of expertise that is difficult for new entrants to replicate quickly.

The threat of new entrants in the marine manufacturing sector is generally low due to substantial capital requirements for facilities and advanced machinery. For example, establishing a new boat manufacturing plant can cost tens of millions of dollars. Furthermore, the need for specialized expertise in design, engineering, and materials science creates a significant knowledge barrier for newcomers aiming to compete with established players like Brunswick.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages data from industry-specific market research reports, company financial statements, and expert interviews to provide a comprehensive understanding of competitive intensity.