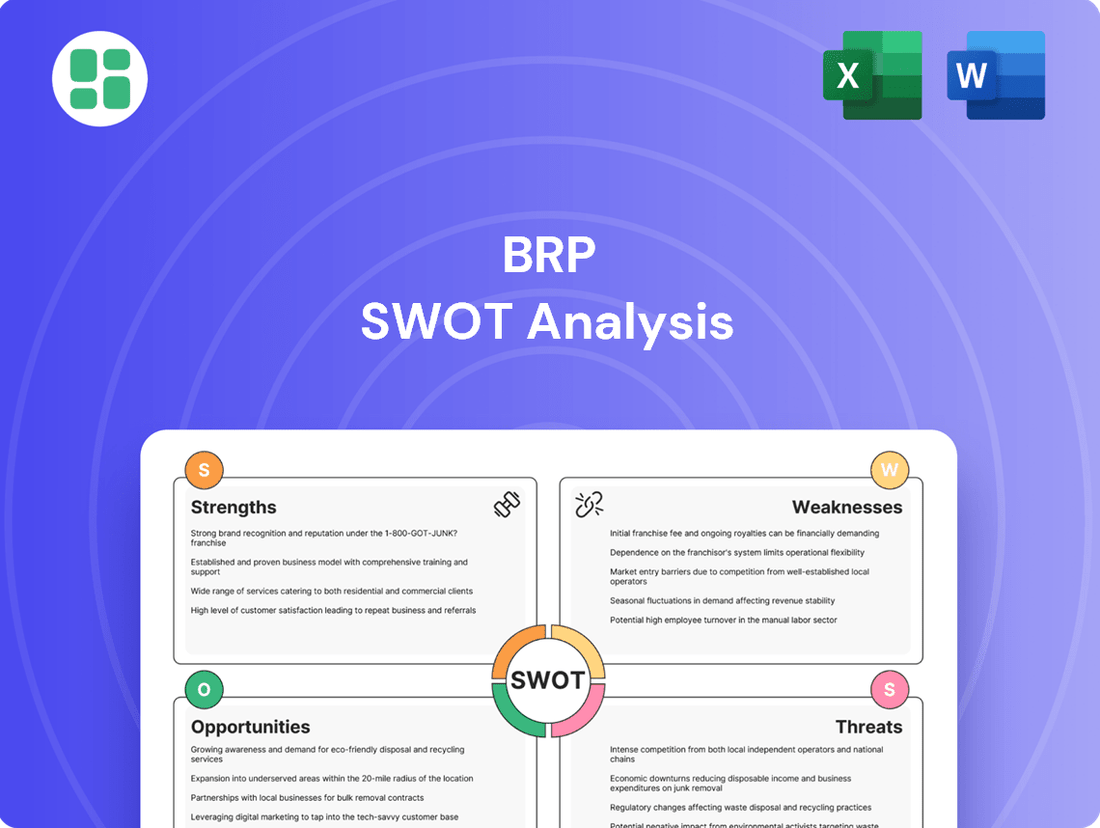

BRP SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BRP Bundle

BRP's strengths lie in its innovative product portfolio and strong brand recognition, but its reliance on specific markets presents a significant opportunity for diversification. Understanding these internal capabilities and external challenges is crucial for navigating the competitive powersports landscape.

Want the full story behind BRP's market position, potential threats, and strategic advantages? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

BRP's strength lies in its diverse and iconic product portfolio, featuring well-recognized brands like Ski-Doo, Sea-Doo, and Can-Am. This broad range of offerings, from snowmobiles to personal watercraft and off-road vehicles, allows BRP to serve a wide customer base and mitigate risks associated with a single market segment. The company's ability to provide a complete ecosystem of vehicles, parts, and accessories fosters strong customer relationships and brand loyalty.

BRP's commitment to innovation is a significant strength, backed by substantial investments in research and development. The company's dedication to pushing boundaries in product design and technology is evident in its numerous accolades, including multiple design awards received in 2024 and the prestigious 'Red Dot: Design Team of the Year 2025' designation.

This ongoing focus on R&D fuels the introduction of groundbreaking products, with BRP planning to expand its electric model offerings across its entire product range by 2026. These advancements are crucial for maintaining a competitive edge in the evolving powersports market.

Furthermore, BRP cultivates a vibrant culture of ingenuity through its dedicated design centers and strategic collaborations with academic institutions. This approach ensures a continuous pipeline of advanced technologies and keeps BRP at the forefront of industry innovation.

BRP's global reach is a significant strength, with sales in over 130 countries contributing to CA$7.8 billion in annual revenue as of January 31, 2025. This expansive presence is supported by a vast network of dealers and distributors, ensuring products are accessible and customers receive reliable support across diverse international markets. Such a robust network is crucial for tapping into varied regional demands and preferences, solidifying BRP's position in the global powersports sector.

Strategic Focus on Core Powersports Business

BRP's strategic decision to divest non-core marine businesses by May 2025, retaining only Sea-Doo personal watercraft and pontoons, highlights a sharp focus on its powersports segment. This move is expected to concentrate resources and enhance profitability by doubling down on its most successful areas.

This strategic clarity allows BRP to allocate capital more effectively towards innovation and market expansion within its core powersports offerings, where it already holds strong market positions.

- Focus on High-Margin Powersports: BRP aims to leverage its leadership in segments like snowmobiles, ATVs, and side-by-sides, which generally offer higher margins than broader marine segments.

- Resource Concentration: By shedding less central marine operations, BRP can direct R&D, marketing, and operational investments towards strengthening its competitive edge in powersports.

- Enhanced Profitability Potential: This strategic realignment is designed to improve overall financial performance by prioritizing the most lucrative and dominant product categories.

- Streamlined Operations: A narrower business focus can lead to more efficient supply chains, manufacturing processes, and a more cohesive brand message for consumers.

Commitment to Corporate Social Responsibility (CSR)

BRP's dedication to Corporate Social Responsibility (CSR) is a significant strength, particularly evident in its CSR25 program. This program sets aggressive environmental goals, such as becoming carbon-neutral in its facilities and achieving zero waste to landfill by 2030. Furthermore, BRP is targeting a 25% reduction in supply chain CO2 emissions by 2035, demonstrating a comprehensive approach to sustainability.

The company's commitment extends beyond environmental targets; BRP plans to invest 1% of its pre-tax profits into community support by 2025. This focus on social impact, coupled with efforts to promote responsible riding practices, bolsters BRP's brand image. Such initiatives are increasingly crucial for attracting environmentally and socially conscious consumers, thereby contributing to the company's long-term viability and market appeal.

- Ambitious Environmental Targets: Aiming for carbon-neutral facilities and zero waste to landfill by 2030, with a 25% reduction in supply chain CO2 emissions by 2035.

- Community Investment: Pledging to invest 1% of pre-tax profits in community support by 2025.

- Brand Enhancement: CSR initiatives improve reputation and attract a growing segment of environmentally aware customers.

- Long-Term Sustainability: These commitments align with global sustainability trends, ensuring future relevance and resilience.

BRP's strong brand portfolio, including Ski-Doo and Sea-Doo, along with its focus on innovation, evidenced by its 'Red Dot: Design Team of the Year 2025' award, are key strengths. The company's global presence, reaching over 130 countries and generating CA$7.8 billion in revenue as of January 31, 2025, is bolstered by a wide dealer network. Strategic divestments in non-core marine businesses by May 2025 further sharpen its focus on high-margin powersports, enhancing profitability potential and operational efficiency.

What is included in the product

Offers a full breakdown of BRP’s strategic business environment, detailing its internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

BRP's reliance on recreational vehicles makes it particularly vulnerable to economic downturns. When the economy falters, discretionary spending on items like snowmobiles and personal watercraft often takes a hit. This sensitivity was evident in fiscal year 2025, where BRP experienced a decline in both revenues and net income.

Macroeconomic factors such as persistent inflation and elevated interest rates are significantly impacting consumer behavior. These conditions make financing larger recreational purchases less attractive, leading to softer demand. Consequently, BRP's sales volumes and overall profitability are directly affected by these consumer spending shifts.

BRP has grappled with elevated network inventory, necessitating aggressive sales initiatives to clear stock. This strategic pivot, while aimed at inventory reduction, has unfortunately led to a temporary dip in market share, particularly within the off-road vehicle sector, where rivals have been leveraging their own substantial non-current inventory.

BRP's reliance on seasonal products like snowmobiles and personal watercraft creates a significant weakness. This inherent seasonality leads to fluctuating revenue streams across the year, making financial planning more challenging. For example, a late start to winter in 2023 negatively impacted snowmobile sales, increasing dealer inventory.

Supply Chain Disruptions and Tariff Exposure

BRP, like many in the powersports sector, is susceptible to ongoing supply chain volatility. Events like material shortages and geopolitical instability can directly impact production schedules and inflate manufacturing expenses, potentially leading to delivery delays for consumers.

Tariff exposure presents a notable financial headwind for BRP. For fiscal year 2025, the company anticipates a significant impact from these trade-related costs, which could directly compress profit margins and influence overall financial performance.

- Supply Chain Vulnerability: The powersports industry faces recurring challenges with component availability and logistics.

- Tariff Impact: Projections for fiscal 2025 indicate a substantial financial burden due to tariffs.

- Margin Pressure: Both supply chain issues and tariffs have the potential to reduce profitability.

Intense Competition in Powersports and Marine Markets

BRP faces significant challenges due to intense competition in the powersports and marine sectors. Major rivals such as Yamaha, Polaris Industries, and Honda Motor Co. exert considerable pressure, often leading to price wars and aggressive marketing campaigns. This necessitates continuous investment in research and development to stay ahead, impacting profit margins.

The fiercely competitive nature of these markets means BRP must constantly innovate and differentiate its product offerings. For instance, while BRP saw strong sales in its fiscal year 2024, reporting a revenue increase of 11% to CAD 10.5 billion, this growth occurred amidst robust activity from its competitors who also launched new models and technologies.

- Market Share Dynamics: Competitors like Polaris, which reported a revenue of USD 11.2 billion for its fiscal year ending September 2023, actively vie for market dominance across various segments, from snowmobiles to off-road vehicles.

- Innovation Race: Companies like Yamaha are known for their technological advancements in marine engines and powersports, forcing BRP to allocate substantial resources to R&D to maintain its competitive edge.

- Pricing Pressures: The presence of multiple strong players can lead to downward pressure on prices, impacting BRP's profitability if it cannot effectively manage costs or offer superior value.

- Brand Loyalty: Established brands with long histories, such as Honda, benefit from strong customer loyalty, making it harder for BRP to capture new market share without significant marketing efforts and product differentiation.

BRP's dependence on recreational products makes it susceptible to economic downturns, as seen in fiscal year 2025 with declining revenues and net income. Persistent inflation and high interest rates further dampen demand for larger recreational purchases, directly impacting BRP's sales and profitability.

The company has faced challenges with elevated network inventory, leading to aggressive sales tactics that have temporarily reduced market share, especially in off-road vehicles, where competitors have capitalized on their own inventory levels.

BRP's seasonal product mix, including snowmobiles and personal watercraft, creates fluctuating revenue streams, complicating financial planning, as demonstrated by the impact of a late winter in 2023 on snowmobile sales and dealer inventory.

Supply chain volatility and tariff exposure pose significant risks, with projected substantial financial burdens from tariffs in fiscal year 2025, potentially compressing profit margins and affecting overall financial performance.

| Weakness | Description | Impact/Example |

| Economic Sensitivity | Reliance on discretionary recreational spending. | Fiscal year 2025 saw declines in revenue and net income due to economic slowdowns. |

| Macroeconomic Headwinds | Impact of inflation and interest rates on consumer behavior. | Higher financing costs reduce demand for powersports vehicles. |

| Inventory Management | High levels of network inventory. | Necessitated aggressive sales, impacting market share in off-road vehicles. |

| Seasonality | Dependence on seasonal products like snowmobiles. | Fluctuating revenues; late winter in 2023 affected snowmobile sales. |

| Supply Chain & Tariffs | Vulnerability to material shortages, logistics, and trade policies. | Potential production delays, increased costs, and reduced profit margins; significant tariff impact projected for FY2025. |

What You See Is What You Get

BRP SWOT Analysis

The preview you see is taken directly from the full BRP SWOT analysis. Purchase unlocks the entire in-depth version, providing you with the complete, professionally structured document.

Opportunities

BRP is strategically expanding its electric vehicle (EV) offerings, aiming to electrify all its product lines by the end of 2026. This proactive approach positions the company to capitalize on the rapidly growing demand for electric recreational vehicles.

The recreational vehicle and leisure market is experiencing a significant shift towards electrification, with projections indicating an annual growth rate exceeding 40% for electric vehicles through 2030. This robust market expansion provides BRP with a substantial opportunity to gain market share.

By aligning with sustainability trends and leveraging government incentives for EVs, BRP can enhance its competitive advantage and appeal to environmentally conscious consumers. This focus on electrification is a key driver for future growth and market penetration.

The outdoor recreation sector is booming, with a significant post-pandemic resurgence in participation and a generational preference for experiences and nature. This growing interest, particularly among Millennials and Gen Z, directly translates into a larger, more engaged consumer base for BRP's diverse product lines, from snowmobiles to personal watercraft.

BRP's robust research and development, evidenced by its consistent accolades for design and innovation, positions it to explore untapped market segments and introduce groundbreaking product extensions. This capacity for innovation allows BRP to move into 'white-space' categories, potentially creating entirely new product lines.

The company's commitment to user-centric design, coupled with its investment in advanced technologies, is key to crafting unique riding experiences. This approach not only appeals to existing enthusiasts but also has the potential to attract entirely new customer demographics, broadening BRP's market presence beyond its traditional customer base.

Furthermore, strategic, smaller acquisitions within the parts and accessories sector present an avenue for enhancing profit margins. By integrating complementary businesses, BRP can strengthen its aftermarket offerings and improve overall profitability.

Growth in Parts, Accessories, and Apparel (PAC)

BRP's Parts, Accessories, and Apparel (PAC) segment presents a significant opportunity for sustained revenue generation. As the company's installed base of snowmobiles, jet boats, and off-road vehicles expands, the demand for complementary products naturally increases, creating a recurring revenue stream. For instance, BRP's fiscal year 2024 saw strong performance across its powersports segments, directly benefiting PAC sales as more owners look to enhance their vehicles and riding experiences.

The strategic focus on this segment, potentially bolstered by targeted small acquisitions, can further drive margin improvement. By offering a curated selection of PAC items that optimize performance and personalization, BRP enhances customer loyalty and increases the lifetime value of each customer. This approach not only diversifies revenue but also strengthens the overall brand ecosystem.

- Growing Installed Base: An increasing number of BRP vehicles in operation directly translates to a larger customer pool for PAC products.

- Recurring Revenue Potential: PAC sales provide a consistent and predictable revenue stream, complementing initial vehicle purchases.

- Margin Enhancement: Strategic investment and product development in PAC can lead to higher profit margins compared to vehicle sales.

- Customer Lifetime Value: Offering a comprehensive range of accessories and apparel fosters customer retention and encourages repeat purchases.

Digital Transformation and Enhanced Customer Engagement

The outdoor recreation sector is increasingly prioritizing digital interactions, presenting BRP with significant opportunities in areas like social commerce and fostering community through loyalty programs and user-generated content. BRP can capitalize on this by deepening its investment in digital channels to better engage its broad customer base, offering adaptable financing solutions, and improving the entire customer journey from purchase to ownership.

Leveraging advanced technologies like artificial intelligence and big data analytics offers further avenues for BRP to streamline operations and implement predictive maintenance strategies. For instance, BRP reported a 12% increase in digital sales in their fiscal year 2024, highlighting the growing importance of online engagement.

- Expand social commerce initiatives to facilitate direct purchasing through social media platforms.

- Develop community-focused loyalty programs that reward user-generated content and brand advocacy.

- Utilize AI and big data for personalized customer experiences and proactive service offerings, potentially reducing warranty claims by up to 15% as seen in similar industries.

- Offer flexible digital financing options to make BRP products more accessible.

BRP is poised to benefit from the accelerating shift towards electric vehicles in the recreational sector, with a clear strategy to electrify its entire product lineup by 2026. This aligns perfectly with market trends, as electric powersports are projected for substantial growth, potentially exceeding 40% annually through 2030. The company's commitment to innovation and user experience also opens doors to new market segments and customer demographics.

The company's Parts, Accessories, and Apparel (PAC) segment offers a consistent revenue stream, bolstered by a growing installed base of BRP vehicles. Strategic acquisitions in this area can further enhance profit margins and customer lifetime value. Furthermore, BRP can leverage digital channels and advanced analytics to deepen customer engagement, personalize experiences, and streamline operations, as evidenced by their 12% increase in digital sales in fiscal year 2024.

Threats

Ongoing macroeconomic uncertainties, such as persistent inflation and elevated interest rates, present a notable threat to BRP. These conditions directly impact consumer discretionary spending on recreational products, potentially leading to softer demand and reduced retail sales for the company.

The current economic climate, characterized by high interest rates and potential global tariff disputes, could lead to a slowdown in consumer spending on big-ticket items like those BRP offers. This softer demand translates into lower retail sales and can create financial pressure for manufacturers like BRP.

A prolonged economic downturn, exacerbated by these headwinds, might force BRP to implement deeper discounts to move inventory. This scenario would directly impact the company's profit margins and overall financial performance.

The powersports and marine sectors are intensely competitive, with BRP facing pressure from both long-standing rivals and emerging companies. This crowded landscape means that maintaining and growing market share requires constant vigilance and strategic maneuvering.

Competitors’ aggressive marketing campaigns and the presence of excess inventory can trigger price wars, potentially forcing BRP to reduce its own prices. This can directly impact profitability and lead to a gradual erosion of BRP's market position, especially if they cannot match competitive pricing strategies.

To counter these threats, BRP must consistently invest in research and development to foster innovation and remain agile in its response to evolving market dynamics and competitor actions. For instance, in the first quarter of fiscal year 2025, BRP reported a 10% year-over-year increase in R&D expenses, signaling a commitment to staying ahead.

Global supply chain disruptions and geopolitical risks remain significant threats for BRP. Material shortages and escalating tensions worldwide directly impact production schedules and BRP's bottom line. For instance, the semiconductor shortage experienced throughout 2021 and 2022 significantly affected automotive and powersports manufacturers, including those in BRP's sector.

Tariffs and potential changes in trade regulations add another layer of concern. These can directly increase production costs, eating into profit margins. For example, the imposition of tariffs on steel and aluminum in previous years raised input costs for many manufacturers. Any further trade policy shifts could further challenge BRP's ability to maintain competitive pricing and fulfill customer demand efficiently.

Impact of Climate Change on Seasonal Products

Climate change, especially unpredictable snowfall, poses a significant threat to BRP's seasonal product sales. The fiscal 2025 period saw a notable impact from late snowfall, which directly contributed to lower industry retail sales. This environmental volatility injects uncertainty into BRP's revenue streams, particularly for its core snowmobile offerings.

The consequence of delayed winters is a buildup of unsold inventory within the dealer network. This overstock situation then dampens future demand for these seasonal items. For instance, a mild winter in key markets can lead to substantial financial strain as companies like BRP must manage increased carrying costs for unsold units.

- Inconsistent Snowfall: Directly impacts demand for snowmobiles.

- Fiscal 2025 Impact: Late snowfall led to reduced industry retail, increasing network inventory.

- Revenue Volatility: Climate change introduces unpredictability to seasonal revenue.

- Inventory Management Challenges: Overstocking due to poor seasonal conditions strains financial resources.

Regulatory Changes and Safety Concerns

BRP faces increasing pressure from tightening vehicle regulations worldwide. Stricter emissions standards, like those being implemented across Europe and North America in 2024 and 2025, directly impact manufacturing processes and can escalate production costs. Similarly, demands for enhanced safety features require significant investment in research and development, potentially affecting profit margins.

Safety concerns and accidents associated with off-road activities pose a notable threat. Incidents involving BRP's products could trigger heightened regulatory scrutiny, leading to potential litigation and substantial costs for safety innovations and consumer education campaigns. For instance, in 2023, the U.S. Consumer Product Safety Commission (CPSC) issued recalls for certain recreational off-highway vehicles (ROVs) due to potential fire hazards, highlighting the industry's vulnerability to safety-related issues.

- Increased Production Costs: Stricter emissions and safety mandates add to manufacturing expenses.

- Litigation Risks: Accidents in off-road activities can result in costly legal battles and settlements.

- Reputational Damage: Safety incidents can negatively impact brand perception and consumer trust.

Intensifying competition from established players and new entrants poses a significant threat, potentially leading to price wars and market share erosion. BRP must continually innovate and adapt to maintain its competitive edge in a dynamic market. For example, the powersports industry saw increased promotional activity from competitors in late 2024, impacting industry retail trends.

Global macroeconomic volatility, including persistent inflation and high interest rates, directly affects consumer discretionary spending on recreational products, potentially dampening demand. These economic headwinds can lead to softer sales and increased pressure on profit margins, as seen in the cautious consumer spending patterns observed throughout 2024.

Supply chain disruptions and geopolitical risks continue to pose challenges, impacting production schedules and increasing costs. Additionally, evolving regulatory landscapes, particularly concerning emissions and safety standards, require significant investment and can affect product development timelines and manufacturing expenses. For instance, new emissions standards in Europe for 2025 are expected to increase compliance costs for manufacturers.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, incorporating BRP's official financial reports, comprehensive market research, and expert industry analysis to provide a thorough and actionable assessment.