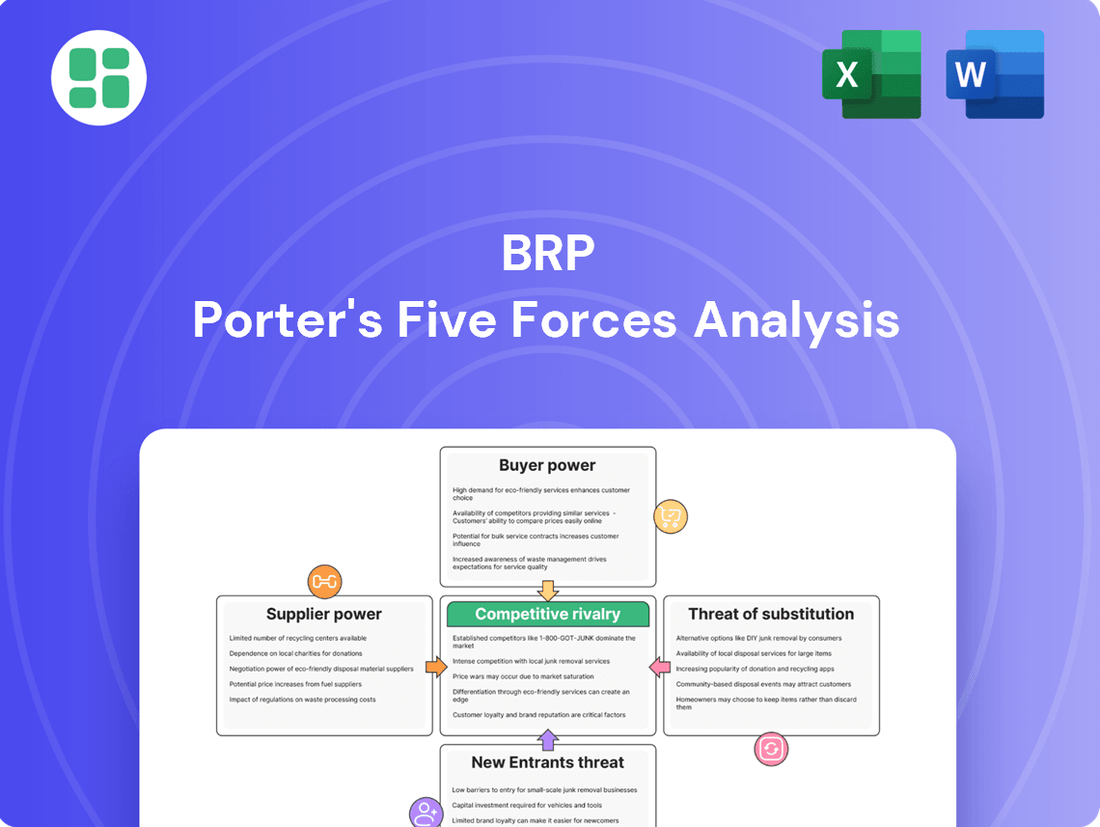

BRP Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BRP Bundle

BRP's competitive landscape is shaped by several key forces, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for navigating BRP's market effectively.

The complete report reveals the real forces shaping BRP’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

BRP's ownership of Rotax engines significantly bolsters its position against suppliers of this critical powertrain component. This vertical integration means BRP is not beholden to external parties for its engines, thereby diminishing the bargaining power of potential engine suppliers.

For other specialized components, such as advanced electronics or unique materials, the supplier landscape is more varied. If a particular part is sourced from only a handful of specialized manufacturers, those suppliers gain considerable leverage due to the limited availability of alternatives for BRP.

The quality and innovation of BRP's recreational vehicles, like its Ski-Doo snowmobiles and Sea-Doo personal watercraft, are significantly shaped by the components and materials sourced from its suppliers. This is especially true for advanced materials, sophisticated electronics, and specialized manufacturing techniques that are integral to the performance and appeal of BRP's offerings.

Suppliers who provide unique or superior inputs, such as high-performance engine parts or advanced composite materials, often wield considerable bargaining power. This is because these specialized components directly contribute to BRP's competitive advantage and the differentiation of its products in a crowded market. For instance, a supplier of a critical engine control unit that enhances fuel efficiency or a unique hull material that improves stability can command better terms.

In 2023, BRP reported that its cost of goods sold was approximately CAD 6.4 billion, highlighting the substantial volume of inputs purchased. Maintaining robust relationships with these key suppliers is therefore paramount to ensuring the consistent quality and reliability that BRP's customers expect, directly impacting BRP's ability to maintain its market position.

The costs BRP faces when switching suppliers are considerable. These include expenses for redesigning parts, retooling manufacturing lines, and the lengthy process of qualifying new suppliers, all of which can significantly impact production timelines and budgets.

These high switching costs effectively bolster the bargaining power of BRP's current suppliers. If BRP were to seek alternative sources for essential components, the financial outlay and potential disruptions to its operations would be substantial, reinforcing its dependence on existing supplier relationships.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into powersports vehicle manufacturing, while theoretically possible, remains a low concern for BRP. This is primarily due to the immense capital requirements, the significant effort needed for brand building, and the necessity of establishing a robust distribution network, all of which are substantial barriers to entry in this sector.

For instance, developing a new powersports vehicle line typically involves hundreds of millions of dollars in R&D and manufacturing setup. Suppliers would need to overcome BRP's established market share, which in 2024, saw BRP maintain a strong position in key segments like snowmobiles and personal watercraft.

BRP's own strong brand recognition and extensive dealer network further solidify its competitive advantage, acting as a significant deterrent against potential forward integration attempts by its component suppliers. This established presence makes it exceptionally difficult for a supplier to replicate BRP's market access and customer loyalty.

- Low Likelihood of Supplier Forward Integration: The high capital investment and established brand loyalty in the powersports industry make it difficult for suppliers to integrate forward.

- BRP's Market Strength: BRP's solid market position in 2024, particularly in snowmobiles and personal watercraft, deters potential supplier entry.

- Barriers to Entry: The significant costs associated with R&D, manufacturing, and distribution networks present formidable obstacles for suppliers considering forward integration.

- Brand and Distribution Advantage: BRP's established brand equity and extensive dealer network provide a protective moat against supplier competitive threats.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts the bargaining power of suppliers for a company like BRP. If BRP can easily switch to alternative raw materials or components that perform a similar function, suppliers have less leverage to dictate prices or terms. For instance, if BRP uses a particular type of plastic for its vehicle components, and there are several readily available, comparable plastics from different manufacturers, the power of any single plastic supplier is diminished.

However, the situation changes when BRP relies on highly specialized or proprietary components. In such cases, the limited availability of substitutes grants those specific suppliers considerable power. This leverage can translate into higher prices, less favorable payment terms, or even restrictions on supply, directly affecting BRP's production costs and flexibility. For example, if a unique engine part is only produced by one supplier, BRP has little recourse but to accept the supplier's terms.

BRP's strong emphasis on innovation and the development of unique product features often necessitates the use of specialized inputs. This pursuit of cutting-edge technology can inadvertently limit the pool of available substitutes. For example, in 2024, BRP invested heavily in developing new electric vehicle powertrains, which may rely on specific battery chemistries or motor technologies that are not yet widely available from multiple sources, thus increasing the bargaining power of those early-stage technology providers.

- Limited Substitutes: If BRP requires a highly specialized component, such as a unique suspension system part for its snowmobiles, and only a few suppliers can produce it to the required specifications, those suppliers gain significant bargaining power.

- Proprietary Technology: For components incorporating proprietary technology, like advanced electronic control units for its personal watercraft, BRP may face suppliers with substantial leverage due to the lack of readily available alternatives.

- Innovation Impact: BRP's commitment to innovation in 2024, leading to the creation of novel vehicle designs, might involve custom-engineered materials or parts, reducing the number of potential suppliers and increasing their power.

- Cost of Switching: Even if substitutes exist, the cost and time required for BRP to qualify and integrate a new supplier for critical components can be substantial, effectively strengthening the position of incumbent suppliers.

When suppliers are few and specialized, their bargaining power increases significantly, as seen with BRP's reliance on specific engine components. High switching costs for BRP, estimated in the millions for retooling and qualification, further solidify supplier leverage. For instance, in 2024, BRP's investment in new electric powertrains may increase dependence on specialized battery suppliers.

| Factor | Impact on BRP's Supplier Bargaining Power | Example for BRP |

| Supplier Concentration | High concentration increases power | Limited suppliers for specialized engine parts |

| Switching Costs | High costs empower suppliers | CAD millions for retooling and qualification |

| Input Differentiation | Unique inputs grant suppliers leverage | Proprietary electronic control units |

| Supplier Forward Integration Threat | Low threat due to high barriers | Capital and brand building challenges for suppliers |

What is included in the product

This analysis dissects the competitive forces impacting BRP, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the powersports industry.

Effortlessly identify and address competitive threats with a visual breakdown of each force, simplifying complex market dynamics.

Customers Bargaining Power

Customers in the powersports and marine sectors often view these purchases as discretionary, meaning they are more likely to be swayed by price, particularly when economic conditions are tough, like during periods of high inflation or rising interest rates. For instance, in 2023, consumer spending on recreational vehicles saw some moderation compared to the boom years, indicating a heightened sensitivity to affordability.

This price sensitivity is further amplified by current market conditions where dealers are actively using substantial rebates and discounts to move increased inventories and counter slower demand. This promotional activity directly erodes BRP's ability to maintain its pricing and can put pressure on profit margins.

Customers have a significant number of choices in the powersports market, with established rivals like Polaris, Yamaha, and Arctic Cat offering a wide range of products. This extensive competition, amplified by easy online access to product comparisons, empowers customers to scrutinize features, performance, and pricing, directly influencing their bargaining power.

The internet and specialized media have dramatically increased information availability for customers, empowering them with extensive knowledge about products and pricing. This transparency significantly reduces information asymmetry, allowing consumers to easily compare offerings from various manufacturers. For a company like BRP, this means customers are well-informed about product features and market alternatives, compelling BRP to continuously justify its premium pricing through superior innovation and quality.

Low Switching Costs for Customers

For customers of powersports vehicles, the cost of switching between brands of snowmobiles, personal watercraft, or off-road vehicles is generally low once the initial purchase decision is made. This ease of transition significantly amplifies their bargaining power.

While brand loyalty is a factor, a competitor's attractive offer or a demonstrably superior product can readily attract customers away. For instance, in 2024, the powersports industry saw increased promotional activity from manufacturers aiming to capture market share, directly impacting customer price sensitivity.

Furthermore, the existence of a healthy used vehicle market provides customers with an alternative to purchasing new, adding another layer to their negotiating leverage. This market accessibility means customers aren't solely reliant on new inventory, allowing them to compare prices and features more effectively.

- Low Switching Costs: Customers can easily move between brands without incurring substantial financial penalties or significant learning curves.

- Competitive Offers: Attractive pricing, financing deals, or enhanced features from competitors can quickly shift customer allegiance.

- Used Market Influence: The availability and pricing of pre-owned vehicles serve as a benchmark, influencing customer expectations for new products.

- Brand Loyalty vs. Value: While some customers are loyal, a compelling value proposition often overrides brand preference in purchasing decisions.

Influence of Dealer Network and Financing Options

BRP's dealer network is a critical touchpoint for customers, providing sales, after-sales service, and crucial financing options. The accessibility and attractiveness of these financing packages, particularly in a climate of elevated interest rates, can heavily sway a customer's decision to purchase.

As of early 2024, interest rates remained a significant factor for recreational vehicle purchases. For instance, average rates for powersports financing could be observed to be in the double digits, making the financing terms offered by dealers, and by extension BRP, a highly sensitive element for consumers.

Dealers, often managing higher inventory levels, might push for factory rebates from BRP. This dynamic effectively shifts some of the bargaining power away from BRP and towards the end consumer, who benefits from potentially lower prices or more favorable financing terms.

- Dealer Network Influence: Dealers are the primary interface for sales, service, and financing, directly impacting the customer experience and purchasing power.

- Financing Sensitivity: In 2024, with interest rates remaining elevated, the terms and availability of financing options significantly influence customer buying decisions.

- Inventory Pressure: Dealers facing increased inventory may lobby for factory rebates, transferring bargaining power to the end customer.

Customers in the powersports and marine sectors possess considerable bargaining power due to several factors. Their ability to easily switch between brands, coupled with the readily available information on pricing and product features, puts pressure on manufacturers like BRP. The significant presence of competitors and the influence of the used vehicle market further enhance this power, as customers can always find alternatives or leverage pre-owned options.

| Factor | Impact on BRP | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | Customers are highly responsive to price changes and discounts. | Increased dealer promotions and rebates observed to manage inventory. |

| Availability of Substitutes | Numerous competitors offer similar products, increasing customer choice. | Polaris, Yamaha, and Arctic Cat remain strong rivals with diverse offerings. |

| Low Switching Costs | Customers can easily shift between brands without significant penalties. | Minimal financial or operational barriers for customers changing brands. |

| Information Availability | Customers are well-informed about products, features, and pricing online. | Online comparison tools and reviews empower informed purchasing decisions. |

What You See Is What You Get

BRP Porter's Five Forces Analysis

This preview shows the exact BRP Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within BRP's industry. This detailed analysis is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

BRP operates in a landscape dominated by formidable, well-established competitors. Companies like Polaris, Yamaha, and Textron (owner of Arctic Cat) represent significant forces, offering a broad range of products that directly challenge BRP's core offerings such as Ski-Doo, Sea-Doo, and Can-Am. This intense competition is further amplified by the maturity of many market segments, making the pursuit of market share a constant battle.

The powersports industry, where BRP operates, is characterized by substantial fixed costs. These include investments in advanced manufacturing plants, ongoing research and development for new models and technologies, and building out widespread dealer and service networks. For instance, establishing a new production line for a complex vehicle like a Sea-Doo personal watercraft can easily run into tens of millions of dollars.

These high fixed costs create a strong incentive for companies to maximize production capacity utilization. Operating at higher volumes helps to distribute these upfront expenses over more units, thereby lowering the per-unit cost. This pressure to maintain high output often translates into competitive pricing strategies or promotional offers, particularly when market demand softens, to ensure sales volumes cover the fixed overhead.

Competitive rivalry in BRP's industry is intensely fueled by a constant drive for product innovation, distinctive design, and feature differentiation. This is crucial for capturing and keeping customer interest. BRP's commitment to research and development is evident in its continuous introduction of new models and feature upgrades. For instance, the launch of Can-Am electric motorcycles in 2024 underscores this focus on future-forward technology.

This ongoing innovation race is a fundamental element of competitive rivalry, as companies strive to establish unique value propositions. BRP's significant investment in R&D, often a substantial portion of its revenue, directly supports this strategy. In 2023, BRP reported approximately CAD 2.1 billion in revenue from its Powersports segment, a testament to the market demand for its innovative products.

Market Share Dynamics and Promotional Intensity

Competitive rivalry within the powersports industry has intensified, marked by increased promotional activity and aggressive sales programs. This surge in promotions, especially evident in 2024 and extending into early 2025, is a direct response to softening consumer demand and elevated inventory levels across the sector.

BRP has strategically managed its shipments to bring down dealer inventory, a move that safeguards dealer profitability but has led to a temporary dip in its market share. Competitors, particularly those holding significant amounts of older, non-current inventory, have leveraged these stocks through aggressive discounting, thereby gaining short-term market share advantages.

- Increased Promotional Spending: The powersports market saw a notable uptick in promotional intensity throughout 2024 as companies worked to move inventory amid slower sales.

- Inventory Management Impact: BRP's proactive inventory reduction strategy, while beneficial for dealer health, resulted in a short-term market share decline.

- Competitor Strategies: Competitors with high levels of non-current inventory have been more aggressive with sales programs, impacting market share dynamics.

- Market Share Volatility: The interplay between inventory levels, consumer demand, and promotional strategies has created a more volatile market share landscape in the recent period.

Global Presence and Regional Competition

BRP faces intense competition across its global markets, particularly in North America and Europe, where established powers like Polaris and Yamaha are significant rivals. These competitors actively vie for market share through innovation and aggressive marketing campaigns. For instance, in 2023, the powersports industry saw continued growth, with BRP reporting a substantial increase in its revenue, reflecting its ability to compete effectively on a global scale despite regional variations.

Localized strategies are crucial for BRP to navigate diverse regional economic conditions and consumer preferences. What resonates in the Canadian market might not work in a European or Asian market. This requires BRP to tailor its product offerings and marketing efforts, understanding that a one-size-fits-all approach is insufficient to capture and maintain market share in a fragmented global landscape.

- Global Market Share: BRP competes with major players like Polaris, Yamaha, and Arctic Cat across various segments.

- Regional Dominance: North America and Europe are key battlegrounds where brand loyalty and regional economic factors heavily influence competition.

- Product Diversification: Competitors offer a wide range of powersports vehicles, from snowmobiles and ATVs to personal watercraft, necessitating continuous innovation from BRP.

- Impact of Economic Conditions: Fluctuations in disposable income and consumer spending in different regions directly affect the demand for BRP's products and the intensity of competitive pressures.

The competitive rivalry in the powersports sector is fierce, with BRP facing strong opposition from established manufacturers like Polaris, Yamaha, and Textron. This intense competition is driven by a need for continuous innovation and differentiation, as seen with BRP's introduction of electric Can-Am motorcycles in 2024. The industry also grapples with high fixed costs, pushing companies to maximize production and often leading to aggressive pricing and promotions, especially when demand softens.

In 2024, the powersports market experienced heightened promotional activity and aggressive sales programs due to softening consumer demand and elevated inventory levels. BRP's strategic decision to reduce dealer inventory, while safeguarding dealer profitability, resulted in a temporary market share dip. Conversely, competitors with substantial non-current inventory leveraged these stocks through aggressive discounting, gaining short-term market share advantages.

| Competitor | Key Product Segments | 2023 Revenue (Approximate USD Billions) |

| Polaris | Off-road vehicles, snowmobiles, motorcycles, marine | 7.8 |

| Yamaha | Motorcycles, ATVs, snowmobiles, personal watercraft | 4.3 (Powersports segment) |

| Textron (Arctic Cat) | Snowmobiles, ATVs, side-by-sides | 1.1 (Textron Specialized Vehicles segment) |

SSubstitutes Threaten

Consumers have a vast array of alternative ways to spend their leisure time and money, many of which don't involve powersports vehicles. For instance, in 2024, the global travel and tourism market is projected to reach over $9.9 trillion, showcasing a significant draw for discretionary spending that competes directly with powersports. This broad availability of other recreational pursuits, from hiking and camping to digital entertainment and other hobbies, means BRP's offerings are not the only option for consumers seeking enjoyment.

The discretionary nature of powersports purchases makes them particularly susceptible to shifts in consumer preferences for leisure activities. As consumers allocate their budgets, they weigh options like attending live sports events, which saw average ticket prices rise by 5-10% in early 2024 for major leagues, against the cost of a snowmobile or personal watercraft. This constant comparison highlights the threat posed by substitutes that can offer comparable or even greater perceived value for leisure time.

The expanding used vehicle market presents a substantial threat to BRP's new powersports sales. This robust pre-owned sector, fueled by both dealerships and private sellers, offers consumers a more budget-friendly alternative for acquiring snowmobiles, personal watercraft, and off-road vehicles. For instance, in 2023, the used car market in North America saw millions of transactions, with powersports vehicles forming a significant segment, directly competing with new unit demand.

The threat of substitutes for BRP's products, particularly its powersports vehicles, is growing as non-motorized or lower-cost alternatives gain traction. For many outdoor enthusiasts, activities like kayaking, paddleboarding, and mountain biking offer similar recreational experiences without the significant expense and environmental impact associated with motorized vehicles. For example, the global paddleboard market was valued at approximately $600 million in 2023 and is projected to grow significantly, indicating a strong consumer interest in these lower-cost, eco-friendlier options.

Economic Factors and Consumer Spending Priorities

Economic downturns significantly impact the threat of substitutes for powersports vehicles. During periods of high inflation, such as the 5.3% annual inflation rate recorded in the US in 2023, consumers often tighten their belts. This means discretionary purchases like jet skis or ATVs become less appealing as people prioritize essentials.

When interest rates climb, as they have in recent years, financing a powersports vehicle becomes more expensive. This increased cost can push consumers towards more affordable leisure alternatives. For instance, instead of a weekend getaway on a motorcycle, individuals might opt for local camping trips or less costly forms of recreation.

The economic climate directly influences consumer spending priorities, making substitutes more attractive.

- Increased Inflation: Higher prices for everyday goods reduce disposable income available for recreational purchases.

- Rising Interest Rates: Makes financing powersports vehicles more costly, increasing the appeal of lower-cost alternatives.

- Consumer Confidence: Declines in consumer confidence during uncertain economic times lead to a shift towards essential spending and away from luxury or recreational items.

- Alternative Leisure Activities: Cheaper forms of entertainment, like hiking or visiting local parks, become more appealing substitutes when powersports are perceived as too expensive.

Shifting Environmental and Regulatory Pressures

Growing environmental awareness is a significant threat, pushing consumers toward alternatives like electric bikes or even non-motorized outdoor activities. For instance, by 2024, the global electric bicycle market was projected to reach over $50 billion, signaling a strong shift in consumer preference for greener options.

Stricter emissions and noise regulations, particularly in sensitive ecological areas, can limit the accessibility of BRP's traditional product lines, making substitutes more appealing. Many regions are already implementing or considering bans on internal combustion engine vehicles in national parks and protected zones.

While BRP is actively developing electric vehicles, the pace of adoption and the overall industry’s transition face challenges. This creates an opening for substitutes that already meet or exceed these evolving environmental standards, potentially impacting BRP's market share if the transition isn't swift enough.

- Environmental Concerns: Increased consumer demand for eco-friendly recreational activities.

- Regulatory Impact: Potential restrictions on noise and emissions affecting access to riding areas.

- Electric Vehicle Growth: The electric bicycle market's significant expansion highlights a shift in consumer preference.

- Substitute Attractiveness: Non-motorized or lower-impact alternatives gain favor due to evolving regulations and environmental consciousness.

The threat of substitutes for BRP's products is substantial, driven by a wide range of alternative leisure activities and evolving consumer preferences. These substitutes range from other recreational pursuits to more budget-friendly options like the used vehicle market, all competing for discretionary spending.

Economic factors like inflation and rising interest rates further bolster the attractiveness of substitutes by increasing the cost of BRP's offerings. Environmental concerns and regulatory shifts also favor lower-impact alternatives, creating a dynamic competitive landscape.

| Substitute Category | Example | 2024 Market Projection/Data Point |

|---|---|---|

| Alternative Leisure | Global Travel & Tourism | Over $9.9 trillion |

| Budget-Friendly | Used Powersports Market | Millions of transactions annually (North America) |

| Eco-Friendly/Lower Cost | Paddleboarding | Valued at ~$600 million in 2023 |

| Eco-Friendly/Lower Cost | Electric Bicycles | Projected to exceed $50 billion by 2024 |

Entrants Threaten

Entering the powersports and marine sectors demands significant upfront capital. Companies need substantial investments for manufacturing plants, advanced research and development, and securing reliable supply chains. For instance, BRP's commitment to innovation, particularly in electric vehicle technology, involves multi-million dollar expenditures, creating a formidable barrier for newcomers.

Established players like BRP possess a significant advantage due to decades of brand building and deeply ingrained customer loyalty across their diverse product portfolios, including iconic names like Ski-Doo, Sea-Doo, and Can-Am. This strong brand equity makes it incredibly difficult for new entrants to gain traction.

Newcomers would need to invest heavily in marketing and advertising to even begin building brand awareness and fostering trust among consumers, a substantial hurdle that often deters potential competitors. For instance, in 2024, the powersports industry continued to see robust consumer spending, with BRP reporting strong sales figures, underscoring the established players' market penetration.

BRP's extensive global distribution and dealer networks represent a significant barrier to new entrants. Building and maintaining such a comprehensive sales, service, and parts infrastructure is incredibly costly and takes years to establish. For instance, as of fiscal year 2024, BRP boasts over 2,000 dealers worldwide, a testament to their established reach.

New companies entering the powersports market would find it exceedingly difficult and expensive to replicate BRP's existing network. This lack of widespread access limits their ability to effectively reach customers, provide essential after-sales support, and compete on a level playing field, thereby diminishing the threat of new entrants.

Regulatory Hurdles and Safety Standards

The powersports and marine sectors face significant regulatory challenges that act as a barrier to new entrants. Compliance with stringent safety, environmental, and emissions standards, as mandated by bodies like the EPA and various international agencies, requires substantial investment in research, development, and testing. For instance, in 2024, the automotive industry, which shares many regulatory overlaps, saw continued focus on emissions reduction, with proposed mandates for increased electric vehicle sales, indicating a trend that will likely impact powersports as well.

Navigating these complex regulatory landscapes can be a costly and time-consuming endeavor for any new company looking to enter the market. The need for extensive product testing and certification to meet these standards adds another layer of difficulty and expense, potentially deterring smaller or less capitalized entrants. This complexity ensures that only well-resourced companies can realistically consider competing.

- Stringent Safety Standards: Compliance with safety regulations, such as those governing vehicle stability and occupant protection, necessitates advanced engineering and rigorous testing.

- Environmental Regulations: Adherence to emissions controls and noise pollution limits, critical in environmentally sensitive areas, often requires innovative powertrain solutions.

- Product Testing and Certification: The process of obtaining necessary certifications can involve significant lead times and financial outlay, acting as a substantial hurdle.

- Evolving Compliance Costs: As regulations tighten, particularly around sustainability and electrification, the cost of compliance is expected to rise, further increasing barriers to entry.

Technological Expertise and Intellectual Property

The threat of new entrants is significantly influenced by the high bar set by technological expertise and intellectual property. Success in the powersports industry, particularly for companies like BRP, hinges on specialized knowledge in areas such as engine design, vehicle dynamics, and advanced materials. For instance, BRP's proprietary Rotax engine technology, a cornerstone of its product line, represents years of research and development that would be costly and time-consuming for newcomers to match.

Furthermore, the rapid evolution towards electric propulsion systems introduces another layer of complexity. Developing competitive electric powertrains and battery technologies requires substantial investment in R&D and specialized engineering talent. BRP's ongoing investments in its electric vehicle strategy, including its proprietary E-TEC technology, create a formidable barrier. In 2023, BRP announced plans to invest CAD 300 million in its Quebec facilities to accelerate its electrification strategy, underscoring the significant capital and expertise required to enter this space effectively.

- High R&D Investment: Companies like BRP invest heavily in research and development to maintain a technological edge, making it difficult for new entrants to compete without similar resources.

- Proprietary Technologies: BRP's Rotax engines and E-TEC electric vehicle technology are protected intellectual property, requiring significant innovation and capital for replication.

- Talent Acquisition: Securing specialized engineering talent in areas like powertrain development and materials science is crucial and competitive, posing a challenge for new market entrants.

- Electrification Pace: The industry's shift to electric vehicles necessitates new expertise and infrastructure, creating a steep learning curve and substantial upfront costs for any new player.

The threat of new entrants into the powersports and marine sectors is considerably low due to substantial capital requirements for manufacturing, R&D, and supply chains, as exemplified by BRP's multi-million dollar investments in electric vehicle technology. Additionally, established brands like BRP have cultivated strong customer loyalty through decades of marketing and product development, making it challenging for newcomers to build comparable brand equity and market penetration, especially given the robust consumer spending seen in 2024.

The extensive global distribution and dealer networks of established players like BRP, which comprises over 2,000 dealers worldwide as of fiscal year 2024, present a significant barrier. Replicating this sales, service, and parts infrastructure is both costly and time-consuming, limiting new entrants' ability to reach customers and provide essential after-sales support, thereby diminishing their competitive threat.

Regulatory hurdles, including stringent safety, environmental, and emissions standards, add another layer of difficulty. New entrants must invest heavily in research, development, and testing to comply, a process made more complex by the industry's trend towards electrification, mirroring automotive sector shifts in 2024 focused on emissions reduction and EV mandates.

Technological expertise and intellectual property also pose a high barrier. BRP's proprietary Rotax engines and E-TEC electric vehicle technology, backed by significant R&D, require substantial capital and specialized talent to match. BRP's CAD 300 million investment in its Quebec facilities to accelerate electrification by 2023 highlights the extensive resources needed to compete effectively in this technologically driven market.

Porter's Five Forces Analysis Data Sources

Our BRP Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from BRP's official investor relations website, annual reports, and SEC filings. We also incorporate insights from reputable industry research firms and market intelligence platforms.