BRP Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BRP Bundle

Curious about which of this company's products are poised for growth and which might be holding it back? The BCG Matrix helps categorize them as Stars, Cash Cows, Dogs, or Question Marks, offering a visual snapshot of their market standing.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain access to detailed quadrant placements, data-backed recommendations, and a clear roadmap for smart investment and product decisions that will drive your business forward.

Stars

Can-Am's SSV and ATV segments are positioned as Stars in the BRP BCG Matrix. This is driven by their significant market share within the expanding powersports industry. In fiscal year 2024, BRP secured a notable 30% market share in the side-by-side (SSV) segment, exceeding their internal projections.

Continued product innovation, exemplified by the recent launches of the 2025 Outlander 850/1000R and Maverick R Max, underscores BRP's commitment to these high-growth categories. This consistent investment reinforces Can-Am's strong market leadership and its Star status.

BRP is investing $300 million by the end of 2026 to electrify its powersports lineup, aiming to make electric vehicles a core part of its future. This strategic move targets a rapidly expanding market segment.

The company is launching new electric models like the Can-Am Pulse and Origin motorcycles, with pre-orders open for early 2025 delivery. Additionally, new electric snowmobiles are slated for the 2025 model year, showcasing BRP's commitment to innovation in this high-growth area.

While the electric powersports market is still emerging, BRP's substantial investment and product introductions position it to capture significant market share and potentially lead the industry's transition to electric.

The Parts, Accessories, and Clothing (PAC) segment is a strong performer for BRP, offering high margins. This is largely due to the increasing number of BRP vehicles in use, creating a consistent demand for customization and enhancement. For example, in fiscal year 2024, BRP reported that its PAC segment contributed significantly to revenue, demonstrating its importance to the company's financial health.

This segment thrives on consumers wanting to personalize their experiences, whether it's adding accessories to a Can-Am Spyder or choosing specialized gear for a Ski-Doo. The growth in PAC is directly linked to the popularity and sales of BRP's core vehicle lines, showcasing BRP's solid standing in its specialized markets.

Can-Am On-Road (New Canyon Model)

The introduction of the 2025 Can-Am Canyon 3-wheel vehicle is a strategic move targeting the adventure touring segment, a market that has seen a notable surge in interest. This new model is engineered for challenging terrains, underscoring BRP's ambition to solidify its position in lucrative, expanding market niches within the on-road sector.

The adventure touring sub-segment within the broader 3-wheel market presents a prime opportunity for significant growth, and the Canyon is positioned to capitalize on this trend.

- Market Growth: The global adventure touring motorcycle market was valued at approximately USD 15.5 billion in 2023 and is projected to grow at a CAGR of over 5% through 2030, indicating strong demand for specialized vehicles.

- BRP's Strategy: Can-Am's expansion into this niche with the Canyon model reflects a broader industry trend of manufacturers diversifying their product lines to capture new customer bases.

- Competitive Landscape: While established players exist, the adventure touring 3-wheel segment is less saturated, offering BRP a chance to gain early market share.

Strategic Market Share Gains in Powersports

BRP's strategic focus in fiscal year 2024 resulted in impressive market share expansion within the North American Powersports sector. The company achieved an 8% increase in retail sales, significantly outpacing the industry's average growth of 1%.

This robust performance underscores BRP's capacity to not only navigate but also lead market growth, solidifying its position in key powersports segments. Such consistent outperformance is a clear indicator of BRP's strong competitive positioning and established leadership.

- Market Share Growth: BRP's retail sales grew 8% in FY24, versus a 1% industry average in North America.

- Competitive Advantage: This outperformance highlights BRP's ability to capture market share effectively.

- Leadership Position: The gains reinforce BRP's leadership in dominant powersports categories.

The Can-Am SSV and ATV segments are clearly Stars for BRP, demonstrating high growth and significant market share. BRP's investment in electrifying its lineup, including new models like the Can-Am Pulse and Origin, positions these segments for continued dominance in the evolving powersports landscape. This strategic focus, coupled with strong sales performance, solidifies their Star status.

| Segment | Market Position | Growth Indicator | BRP's FY24 Performance |

|---|---|---|---|

| SSV (Side-by-Side Vehicles) | Star | High Growth | 30% Market Share |

| ATV (All-Terrain Vehicles) | Star | High Growth | 8% Retail Sales Growth (vs. 1% industry average) |

| Electric Powersports | Emerging Star/Potential Star | Rapidly Expanding | $300M investment by end of 2026 |

What is included in the product

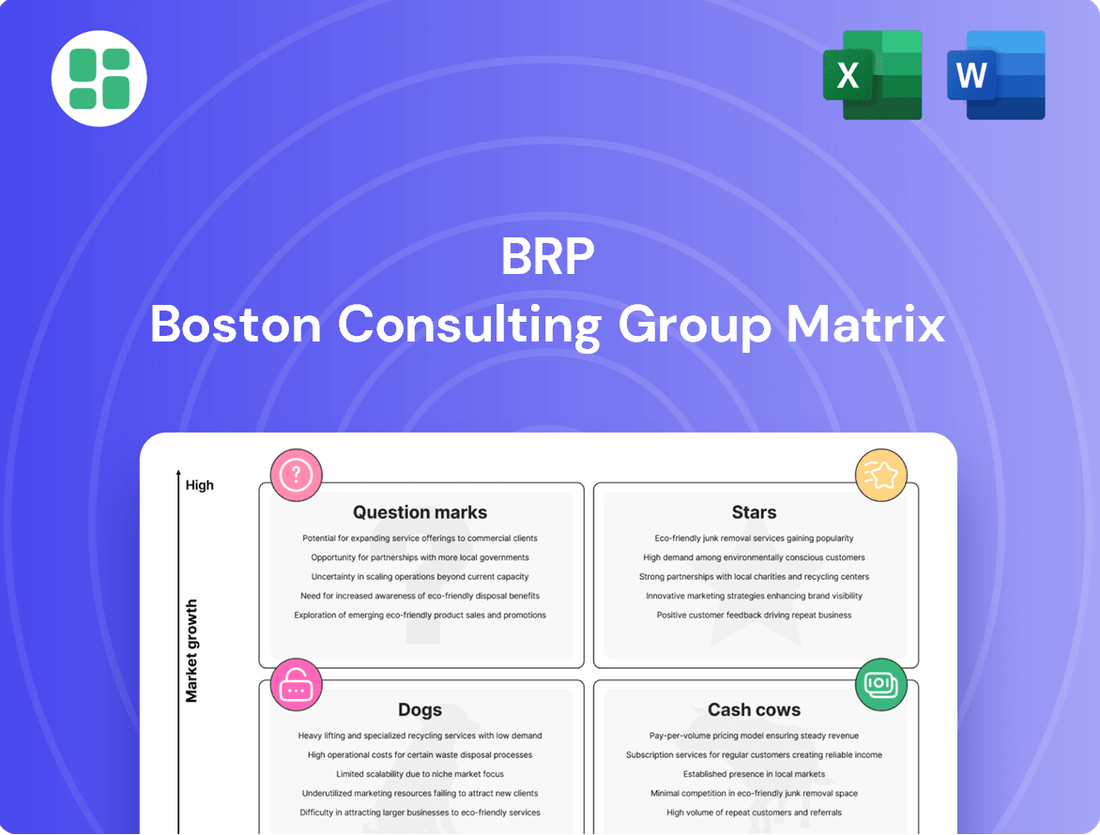

The BRP BCG Matrix offers a strategic framework for analyzing a company's product portfolio based on market growth and relative market share.

It guides decisions on investing in Stars and Question Marks, milking Cash Cows, and divesting Dogs.

Quickly visualize your portfolio's health and identify areas needing strategic attention.

Cash Cows

Ski-Doo snowmobiles stand as a prime example of a Cash Cow within BRP's portfolio. As of 2023, Ski-Doo commanded a substantial 35% share of the snowmobile market, underscoring its established dominance.

This brand consistently generates robust cash flow, a hallmark of a mature business. While recent sales have seen some impact from less favorable winter conditions, Ski-Doo's position as an industry leader remains secure, with BRP's investment strategy prioritizing the maintenance of this leadership and operational efficiency.

Sea-Doo personal watercraft represent a significant Cash Cow for BRP, holding a dominant position in a mature market. Despite a slight dip in retail sales reported in late 2023 and early 2024 due to softer consumer spending, Sea-Doo remains a foundational brand for BRP, consistently generating substantial revenue and robust profit margins.

The enduring strength of the Sea-Doo brand is underpinned by a loyal customer base and an extensive, well-established distribution network. This allows BRP to efficiently reach consumers and maintain its market leadership, even amidst minor economic headwinds.

Lynx Snowmobiles, alongside Ski-Doo, solidifies BRP's commanding presence in the snowmobile sector, especially within European markets. This brand operates as a Cash Cow, meaning it enjoys a strong market share in a mature industry, generating consistent and reliable cash flow for BRP.

In 2023, BRP reported significant revenue contributions from its Powersports segment, which includes snowmobiles. While specific figures for Lynx alone are not typically broken out, the overall segment performance highlights the stability of these established product lines. Lynx's stable growth trajectory ensures it continues to be a valuable asset, contributing to BRP's financial strength.

Rotax Engines (Traditional Internal Combustion)

Rotax engines, particularly those powering BRP's traditional internal combustion powersports vehicles, represent a significant Cash Cow. These engines are the backbone of many of BRP's well-established product lines, including Ski-Doo snowmobiles and Sea-Doo personal watercraft, contributing a stable and substantial portion of the company's revenue.

Beyond BRP's own brands, Rotax engines are also supplied to external manufacturers, further diversifying revenue and solidifying their position in a mature component market. This external sales channel provides consistent income, leveraging the brand's reputation for reliability and performance.

- Established Market Presence: Rotax engines are a core component in BRP's legacy powersports vehicles, ensuring continued demand.

- Diversified Revenue Streams: Sales to third-party manufacturers supplement BRP's internal engine needs, creating a robust income base.

- Focus on Efficiency and Reliability: In a mature market, BRP emphasizes optimizing these engines for dependable performance and operational cost-effectiveness.

- Contribution to BRP's Portfolio: As of BRP's fiscal year 2024, the powersports segment, heavily reliant on these engines, continued to be a primary revenue driver for the company.

Can-Am Ryker Three-Wheel Vehicles

The Can-Am Ryker, a key player in BRP's BCG matrix, represents a mature product line that consistently generates substantial revenue for the company. Its established presence in the three-wheel vehicle market signifies a stable market share and predictable cash flow, characteristic of a Cash Cow. In 2024, BRP continued to leverage the Ryker platform by introducing new accessories and minor updates, reinforcing its appeal to a broad rider base seeking an approachable and enjoyable three-wheel experience.

The Ryker's strategy focuses on maintaining its position rather than aggressive expansion into hyper-growth niches, ensuring its role as a reliable revenue generator. This approach allows BRP to benefit from the established brand recognition and customer loyalty built around the Ryker lineup.

- Established Market Presence: The Can-Am Ryker has solidified its position in the three-wheel vehicle segment.

- Steady Revenue Generation: The lineup contributes consistent cash flow to BRP's overall financial performance.

- Focus on Accessibility: The Ryker appeals to a wide range of riders, including those new to three-wheel riding.

- Accessory and Variant Strategy: BRP continues to enhance the Ryker's appeal through ongoing product development and customization options.

Cash Cows in BRP's portfolio are brands with high market share in mature industries, generating consistent and reliable cash flow. These products require minimal investment to maintain their position, allowing BRP to allocate resources to other areas of the business.

The stability of these Cash Cows is crucial for BRP's overall financial health, providing a predictable income stream that supports innovation and growth initiatives. Their established market presence and loyal customer base ensure continued demand, even in challenging economic conditions.

BRP's strategy for its Cash Cows focuses on operational efficiency and maintaining market leadership, rather than aggressive expansion. This approach ensures that these mature brands continue to be strong contributors to the company's profitability.

| Brand | Product Category | Market Share (Approx.) | Cash Flow Generation | BRP's Strategy |

|---|---|---|---|---|

| Ski-Doo | Snowmobiles | 35% (2023) | High, consistent | Maintain leadership, operational efficiency |

| Sea-Doo | Personal Watercraft | Dominant | High, consistent | Maintain market leadership, leverage brand loyalty |

| Lynx | Snowmobiles | Strong (especially Europe) | High, consistent | Stable growth, contribution to Powersports segment |

| Rotax Engines | Powersports Engines | Core component supplier | High, consistent | Leverage reliability, external sales diversification |

| Can-Am Ryker | Three-Wheel Vehicles | Established | High, consistent | Maintain position, introduce accessories/updates |

Delivered as Shown

BRP BCG Matrix

The preview you see is the complete and final BRP BCG Matrix document you will receive immediately after purchase. This means you get the exact same professionally designed, analysis-ready file, free from any watermarks or demo content. It's prepared for immediate integration into your strategic planning, offering clear insights into your business portfolio.

Dogs

Alumacraft boats, a brand within BRP's marine segment, is slated for divestiture, firmly placing it in the Dog category of the BCG Matrix. This move signifies BRP's strategic decision to exit the marine industry and concentrate on its core powersports business.

BRP's stated intention to sell its marine assets, including Alumacraft, suggests that these operations likely held a low market share compared to BRP's dominant powersports offerings. The marine sector itself may have presented challenging economic conditions, further contributing to Alumacraft's Dog status by indicating low growth potential and profitability.

Manitou Pontoons, much like Alumacraft, falls into the Dog category within BRP's BCG Matrix. This classification stems from BRP's strategic decision to divest its marine segment, indicating that Manitou pontoons were not meeting the company's growth or profitability expectations.

Despite BRP's prior efforts to innovate within the marine sector, including with Manitou, the broader marine industry has faced economic headwinds. This, coupled with BRP's renewed focus on its core powersports business, suggests that Manitou likely struggled to achieve sufficient market share or generate robust returns to warrant continued capital allocation.

Within BRP's diverse product lineup, certain older models or specific trim levels might struggle to capture consumer interest or keep pace with technological advancements. These offerings typically exhibit low sales volumes and a shrinking market share, potentially becoming a drain on resources rather than a contributor to profits.

For instance, if a particular snowmobile model from 2020, which was once popular, now sees its sales decline by 30% year-over-year compared to newer, more innovative models, it could fall into this category. Such underperformers might break even or even incur losses, requiring careful evaluation of their future within the BRP portfolio.

Niche Products with Limited Market Adoption

Niche products with limited market adoption represent ventures that, despite BRP's potential investment, failed to capture significant market share or achieve their sales targets. These initiatives often tie up capital and resources without generating commensurate returns, exhibiting neither strong market presence nor high growth prospects within their specialized areas.

Such products would be characterized by low sales volumes and a lack of substantial customer demand, hindering their ability to become profitable or influential in their respective markets. For instance, a hypothetical BRP venture into specialized electric snowmobile accessories in 2023, targeting a very specific, small user base, might have seen sales of only a few hundred units globally, failing to recoup development costs.

- Low Market Share: These products would hold a minimal percentage of their target market. For example, a niche product might capture less than 1% of its intended segment.

- Limited Growth Potential: The market segment for these products is unlikely to expand significantly, capping future sales opportunities.

- Resource Drain: Investment in these products consumes financial and operational resources without yielding substantial profits or strategic advantage.

- Poor Sales Performance: Actual sales figures would consistently fall short of projections, indicating a lack of market acceptance.

Geographically Weak Performing Product Lines

Some BRP product lines might not be performing as well in specific geographic regions. This can happen because of strong local competitors, different tastes of consumers in that area, or even tough economic situations. For instance, while Ski-Doo snowmobiles might be a star in Canada, they could be a question mark in a market where off-road vehicles are more popular.

These underperforming product lines in certain areas, despite doing well in other parts of the world, can be viewed as question marks within the BCG matrix for those specific regions. This is due to their low market share and limited growth potential in those particular geographies.

For example, BRP's powersports segment, which includes Can-Am ATVs and Side-by-Sides, saw varied regional performance in 2024. While North America remained a stronghold, certain European markets showed slower adoption rates for these specific product lines, contributing to their question mark status in those territories.

- Regional Underperformance: Certain BRP product lines may lag in specific geographic markets due to intense local competition or differing consumer preferences.

- Question Mark Classification: These regional underperformers, despite global success, can be considered question marks in those particular markets due to low market share and growth.

- Example: BRP's powersports segment experienced varied regional performance in 2024, with slower adoption in some European markets compared to North America.

Dogs in BRP's portfolio represent products with low market share and low growth potential. These are often divested or managed for minimal resource drain. BRP's strategic exit from the marine segment, impacting brands like Alumacraft and Manitou Pontoons, exemplifies this classification due to poor performance and a strategic shift towards core powersports.

Older models or niche products that fail to gain traction also fall into the Dog category. For instance, a specific snowmobile model from 2020 experiencing a 30% year-over-year sales decline illustrates this, potentially breaking even or incurring losses.

Regional underperformance can also lead to a Dog classification within specific markets, even if the product is successful elsewhere. BRP's powersports segment, for example, showed slower adoption in some European markets in 2024 compared to North America, highlighting this potential regional weakness.

Question Marks

The Can-Am Pulse and Origin electric motorcycles are classic examples of BRP's potential Stars in the BCG Matrix. They are positioned in the rapidly expanding electric vehicle market, a sector experiencing significant growth, but as new entrants, BRP currently holds a minimal market share.

BRP's substantial investment in this segment, evidenced by pre-orders for early 2025 deliveries, underscores their strategic intent to elevate these models into market leaders. The success of these electric offerings, however, remains contingent on achieving robust market penetration and sustained capital allocation.

The 2025 Sea-Doo Switch Fish Package is a new entrant in the pontoon market, specifically designed for fishing enthusiasts. As a recent addition, it falls into the Question Mark category of the BCG matrix, meaning it operates in a high-growth market but has a low market share. Its potential success hinges on its ability to capture a significant portion of this niche market quickly.

The 2025 Can-Am Canyon represents BRP's strategic move into the burgeoning adventure-oriented three-wheel vehicle segment. This category is seeing a surge in consumer interest, signaling a high-growth market opportunity.

As a brand-new offering, the Canyon currently holds a minimal market share, positioning it as a Question Mark in BRP's product portfolio. Substantial investment in marketing and product development is crucial to elevate its standing and capture a significant share of the adventure touring market.

Emerging Technologies Beyond Core EV

BRP's strategic diversification into emerging technologies, such as advanced low-voltage systems and human-assisted mobility solutions, positions these as potential future growth engines. These ventures, while currently in their infancy, tap into evolving consumer needs and technological advancements, suggesting significant long-term upside. For instance, BRP's investments in areas like connected vehicle technology and advanced battery management systems for non-EV applications are indicative of this forward-looking approach.

These new product categories are characterized by their nascent market presence and substantial future growth potential, aligning with the characteristics of question marks in the BCG matrix. While specific financial data for these emerging segments within BRP’s portfolio is often proprietary and not publicly disclosed in detail, the company's consistent R&D spending, which reached approximately CAD 120 million in fiscal year 2024, underscores its commitment to developing these innovative areas. This investment reflects the need for significant capital to mature these technologies and establish market share in competitive landscapes.

- Nascent Market Presence: BRP's exploration into areas like advanced robotics for recreational use or sophisticated control systems for powered personal mobility devices currently represent niche markets with limited adoption.

- High Future Growth Potential: These technologies are poised to capitalize on trends in automation, personalized transportation, and enhanced user experiences, suggesting significant market expansion opportunities in the coming years.

- Substantial R&D Investment: Significant capital is required to refine these technologies, address regulatory hurdles, and build consumer awareness and acceptance, impacting profitability in the short term.

- Low Market Share: As these are new ventures, BRP holds a minimal share in these emerging technology categories, necessitating aggressive market development and competitive differentiation strategies.

Strategic Alliances in Developing Markets

Strategic alliances are crucial for BRP's expansion into developing powersports markets, which often show high growth potential but present challenges like low initial market share and intense local competition. For instance, in 2024, emerging economies in Southeast Asia, like Vietnam and Indonesia, saw a projected 8% compound annual growth rate in the recreational vehicle sector, according to industry reports. BRP could leverage joint ventures with established local distributors or manufacturers to navigate regulatory landscapes and build brand recognition effectively.

- Partnerships with local manufacturing entities to reduce import duties and tailor products to regional preferences.

- Joint ventures with established powersports rental companies to increase brand visibility and product trial in high-traffic tourist areas.

- Collaborations with local financial institutions to offer accessible financing options for consumers in markets with lower average incomes.

- Strategic alliances with local logistics providers to optimize distribution networks and after-sales service in geographically diverse developing nations.

Question Marks in BRP's portfolio represent areas with high growth potential but currently low market share. These are typically new product introductions or ventures into emerging markets where significant investment is required to build brand awareness and capture market position. Success hinges on strategic execution and sustained capital allocation to transform them into Stars or Cash Cows.

The 2025 Can-Am Maverick R X RS, for example, enters the high-performance side-by-side segment, a market experiencing robust growth. However, as a relatively new entrant in this competitive space, its market share is currently modest, classifying it as a Question Mark. BRP's commitment to innovation and expanding its off-road vehicle lineup, including significant R&D spending, aims to propel this model towards market leadership.

Similarly, BRP's exploration into electric personal watercraft, while tapping into a high-growth sustainability trend, positions these nascent products as Question Marks. The company's investment in electric mobility, with a target of 50% of its fleet being electric by 2035, indicates a strong belief in this segment's future. However, achieving significant market penetration against established players requires substantial marketing and product refinement.

| Product/Segment | Market Growth | Market Share | BCG Classification | Strategic Focus |

|---|---|---|---|---|

| Can-Am Maverick R X RS | High | Low | Question Mark | Increase market penetration, brand building |

| Electric Personal Watercraft | High | Low | Question Mark | Product development, market education, investment |

| Advanced Robotics (New Ventures) | High | Very Low | Question Mark | R&D, technology refinement, market testing |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitive landscapes, sourced from industry reports and financial disclosures.