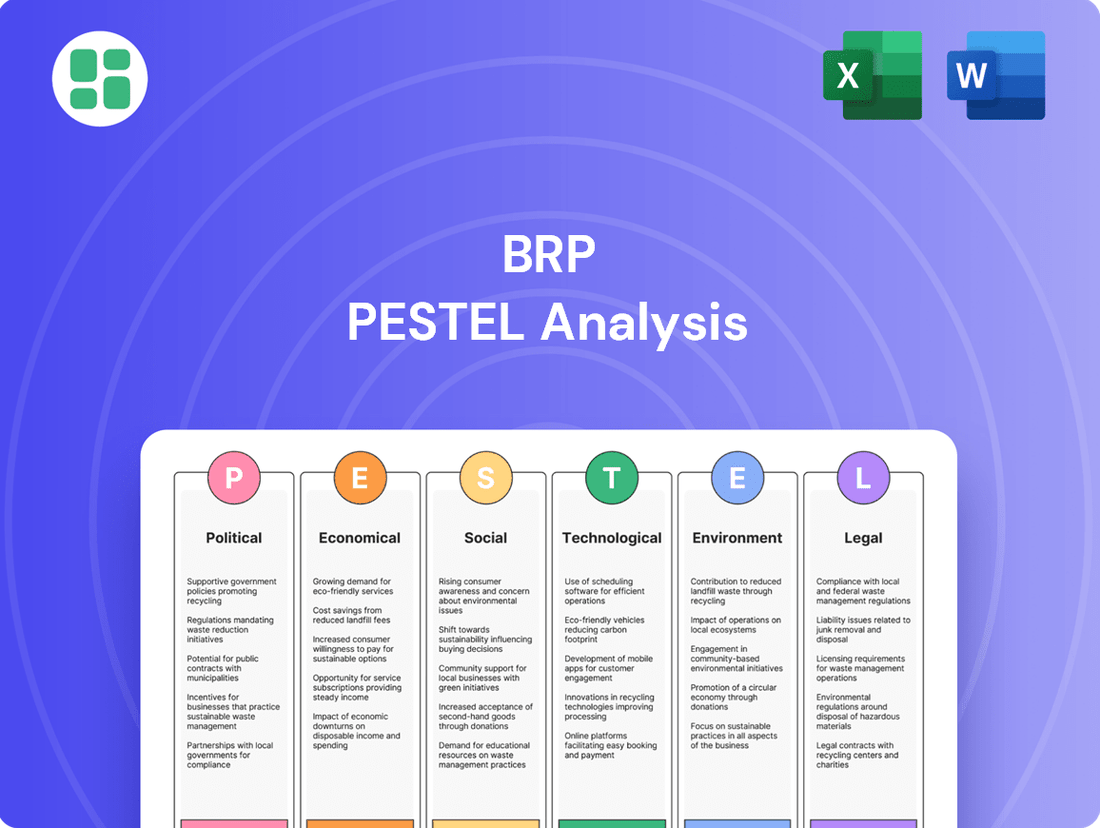

BRP PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BRP Bundle

Unlock the critical external factors influencing BRP's success with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping their industry. Gain a strategic advantage by leveraging these insights for your own business planning and investment decisions. Download the full, expertly crafted analysis now to equip yourself with actionable intelligence.

Political factors

Governments globally are increasingly scrutinizing powersports and marine product usage, implementing stricter rules on noise levels, speed limits, and where these vehicles can operate. For BRP, this means a complex regulatory landscape that can influence product design and market access. For instance, in 2024, several European countries introduced new emissions standards for recreational boats, potentially requiring BRP to invest in cleaner engine technologies for its Sea-Doo and Evinrude lines to maintain sales in those regions.

Trade policies, including international agreements and tariffs, directly impact BRP's global operations. For instance, changes in import duties on components sourced from Asia or export taxes on finished vehicles in key markets like Europe can significantly alter BRP's cost structure and pricing competitiveness. In 2024, ongoing trade discussions and potential adjustments to existing agreements, such as those involving North America and Europe, could create both opportunities and challenges for BRP's extensive supply chain and distribution networks.

Political stability in BRP's key markets, including Canada, the United States, and European countries, is paramount. For instance, BRP's significant presence in Quebec, Canada, means that provincial political stability directly impacts its manufacturing base and R&D investments. Fluctuations in government support for manufacturing or shifts in trade policies can influence BRP's operational costs and market access.

Geopolitical tensions, such as those impacting global supply chains or trade relations, present ongoing risks. For example, trade disputes between major economies could lead to increased tariffs on imported components or finished goods, affecting BRP's pricing strategies and profitability. Monitoring political developments in countries where BRP sources materials or sells its recreational vehicles is therefore essential for risk management.

Sudden policy changes, like environmental regulations or consumer protection laws, can also pose challenges. BRP's commitment to innovation, including the development of electric vehicles, means that evolving government incentives or mandates for sustainable transportation in markets like California or Norway are critical factors. These policy shifts can either accelerate or hinder BRP's strategic growth initiatives.

Government Incentives for Green Technologies

Governments worldwide are increasingly offering incentives, subsidies, and tax breaks to encourage the adoption of green technologies. This directly impacts BRP by potentially lowering the cost of their electric vehicle offerings for consumers, thereby accelerating market acceptance. For example, the Canadian federal government's iZEV program, which provides rebates for electric vehicles, could make BRP's electric snowmobiles and personal watercraft more attractive to buyers.

These policies are not just about immediate sales; they actively shape BRP's long-term product development strategy. By signaling a clear governmental commitment to electrification, these incentives encourage BRP to invest more heavily in research and development for its electric lineup, including its electric snowmobiles, personal watercraft, and off-road vehicles. This can lead to faster innovation and a more robust pipeline of eco-friendly products.

- Government Support for EVs: Many countries, including Canada and the US, offer tax credits and rebates for the purchase of electric vehicles, potentially boosting BRP's electric product sales.

- Emissions Regulations: Stricter emissions standards for internal combustion engines can make BRP's investments in electric alternatives more strategically vital.

- Infrastructure Investment: Government funding for charging infrastructure can indirectly support the adoption of electric recreational vehicles by addressing range anxiety.

- R&D Grants: Certain governments provide grants for research and development in green technologies, which BRP could leverage for its electric powertrain advancements.

Industry Lobbying and Advocacy

BRP actively participates in industry lobbying, often through associations like the Recreational Off-Highway Vehicle Association (ROHVA) and the Personal Watercraft Industry Association (PWIA). These groups advocate for policies that support recreational vehicle access and responsible use. For instance, in 2024, continued discussions around land use and trail access in various North American regions highlight the importance of these advocacy efforts.

Successful lobbying can lead to favorable regulatory frameworks, impacting everything from emissions standards to safety requirements for BRP's diverse product lines, including Sea-Doo personal watercraft and Can-Am off-road vehicles. This proactive approach helps mitigate potential negative impacts of new legislation and can even foster growth by ensuring a stable operating environment.

Key areas of focus for industry advocacy in 2024-2025 include:

- Environmental Regulations: Influencing policies related to emissions, noise levels, and sustainable manufacturing practices.

- Safety Standards: Contributing to the development and refinement of safety certifications and consumer education initiatives.

- Access to Public Lands: Advocating for continued or expanded access for recreational vehicles on trails and waterways.

- Trade Policies: Addressing tariffs and trade agreements that could affect the cost of imported components or finished goods.

Governmental actions significantly shape BRP's operating environment, from emissions standards to trade policies. For instance, in 2024, evolving regulations in Europe concerning noise and emissions for recreational vehicles directly influenced product development for BRP's Sea-Doo and Can-Am lines. Furthermore, political stability in key markets like Canada and the US impacts BRP's manufacturing and R&D investments, with provincial support in Quebec being a notable factor.

Government incentives for electric vehicles, such as those seen in Canada and the US in 2024, are crucial for BRP's electric strategy. These policies can accelerate consumer adoption of BRP's electric snowmobiles and personal watercraft. Simultaneously, industry advocacy groups, in which BRP participates, actively engage with policymakers on issues like land access and safety standards, aiming to create a favorable regulatory landscape for 2024-2025.

| Political Factor | Impact on BRP | 2024/2025 Relevance |

| Environmental Regulations | Influences product design, R&D investment, and market access. | Stricter emissions and noise standards in Europe and North America are driving investment in cleaner technologies. |

| Trade Policies & Tariffs | Affects supply chain costs, pricing, and global competitiveness. | Ongoing trade discussions and potential adjustments to agreements impact BRP's international operations and component sourcing. |

| Government Incentives (EVs) | Boosts sales and adoption of electric recreational vehicles. | Programs like Canada's iZEV offer rebates, making BRP's electric offerings more attractive to consumers. |

| Industry Lobbying & Advocacy | Shapes regulatory frameworks and ensures access to public lands. | Efforts in 2024-2025 focus on land use, safety standards, and favorable trade policies. |

What is included in the product

This comprehensive PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting BRP, providing a strategic framework for understanding the external landscape.

The BRP PESTLE Analysis provides a structured framework to identify and understand external factors, alleviating the pain of uncertainty by offering clarity on potential opportunities and threats.

Economic factors

Consumer discretionary income is a critical factor for BRP, as its powersports vehicles and marine products are typically considered non-essential purchases. When consumers have more disposable income, they are more likely to spend on recreational items, directly benefiting BRP's sales. For instance, in late 2024 and early 2025, many economies are experiencing a stabilization or slight increase in real disposable income, which bodes well for BRP's market.

Conversely, economic headwinds like persistent inflation or elevated interest rates can significantly curb discretionary spending. If consumers face higher costs for essentials or find borrowing more expensive, they will likely postpone or cancel purchases of higher-ticket items like ATVs or personal watercraft. This sensitivity means BRP's revenue is closely tied to the overall health and confidence of the consumer economy.

Fuel price volatility directly impacts BRP's operating costs, especially for its traditional gasoline-powered recreational vehicles like snowmobiles and personal watercraft. For instance, in early 2024, gasoline prices in many North American markets saw fluctuations, with averages ranging from $3.50 to $4.00 per gallon, directly affecting the cost of ownership for BRP customers.

Sustained high fuel prices can significantly dampen consumer demand for BRP's internal combustion engine (ICE) products. If the cost to fuel a Sea-Doo or Ski-Doo becomes prohibitive, potential buyers might delay purchases or opt for alternative forms of recreation, impacting BRP's sales volumes.

This trend also acts as a catalyst, potentially accelerating the market's shift towards BRP's electric vehicle (EV) offerings. As fuel costs rise, the total cost of ownership advantage for EVs becomes more pronounced, encouraging consumers to consider BRP's electric snowmobiles and other upcoming electric models.

Global economic growth is projected to be moderate in 2024 and 2025. The International Monetary Fund (IMF) forecasts a 3.2% growth rate for both years, a slight uptick from 2023. This steady growth in key markets like North America and Europe, BRP's primary sales regions, is expected to support consumer spending on recreational vehicles and powersports equipment.

However, regional disparities exist. Emerging markets may show stronger growth, but their contribution to BRP's overall revenue might be less significant than established economies. Economic slowdowns or recessions in major markets could directly impact BRP's sales volumes and profitability due to reduced discretionary spending.

Currency Exchange Rate Fluctuations

BRP's global presence, with operations in countries like Canada, Mexico, Austria, and Finland, exposes it to significant currency exchange rate fluctuations. For instance, a stronger Canadian dollar (CAD) against other major currencies could increase the cost of components sourced from abroad and make BRP's products more expensive for international buyers, potentially impacting sales volume.

These fluctuations directly affect BRP's financial performance. When BRP converts revenue earned in foreign currencies back to its reporting currency (CAD), unfavorable movements can reduce the reported value of those earnings. For example, if the Euro (EUR) weakens against the CAD, sales generated in Europe would translate to fewer Canadian dollars.

The company's competitiveness is also at stake. A stronger Canadian dollar can make BRP's snowmobiles, ATVs, and personal watercraft less attractive in price-sensitive markets compared to competitors whose home currencies are weaker. Conversely, a weaker CAD could boost export competitiveness but raise the cost of imported parts and materials.

- Impact on Costs: Fluctuations can alter the cost of raw materials and components imported by BRP, such as engines or electronics.

- Competitiveness: Exchange rates influence the pricing of BRP's products in international markets relative to competitors.

- Reported Earnings: Foreign currency revenues are translated into Canadian dollars, with exchange rate shifts directly impacting reported profits.

- Hedging Strategies: BRP may employ financial instruments to mitigate the risks associated with currency volatility, though these strategies have their own costs and complexities.

Supply Chain Costs and Inflation

Rising costs for raw materials, components, and transportation directly impact BRP's production expenses. Global inflation and ongoing supply chain issues, such as those experienced in 2023 and continuing into 2024, have significantly increased these input costs. For instance, the cost of key materials like aluminum and steel saw considerable volatility, and shipping rates, while normalizing from pandemic peaks, remained a factor.

These cost pressures can compress BRP's profit margins if the company cannot pass them on through pricing or offset them with operational efficiencies. In 2023, many manufacturers faced this challenge, with some reporting narrower margins despite increased sales volumes. BRP's ability to manage these rising expenses through strategic sourcing and production optimization is crucial for maintaining its financial health and competitive pricing.

- Increased Material Costs: Reports from early 2024 indicated continued elevated prices for metals and plastics compared to pre-pandemic levels.

- Logistics Expenses: While freight rates have eased, they remain a significant cost component, impacting the overall landed cost of components and finished goods.

- Margin Squeeze: Companies across the automotive and powersports sectors have reported that managing input cost inflation was a primary challenge in 2023, affecting profitability.

Consumer confidence and spending habits are paramount for BRP, as its products are discretionary purchases. In late 2024 and early 2025, many economies are seeing a stabilization or slight increase in real disposable income, which supports sales of recreational vehicles. However, persistent inflation or high interest rates can dampen consumer enthusiasm, leading to postponed purchases of higher-ticket items like ATVs or personal watercraft.

Fuel price volatility directly impacts the cost of ownership for BRP's traditional internal combustion engine (ICE) vehicles. For example, average gasoline prices in North America during early 2024 fluctuated between $3.50 and $4.00 per gallon. Sustained high fuel costs can discourage consumers from buying or using powersports vehicles, potentially accelerating the adoption of BRP's electric offerings.

Global economic growth is projected to be moderate, with the IMF forecasting 3.2% growth for both 2024 and 2025. This steady expansion in key markets like North America and Europe should bolster consumer spending on recreational equipment. However, economic downturns in these major regions could significantly reduce BRP's sales volumes and profitability.

Currency exchange rate fluctuations pose a risk to BRP's global operations and competitiveness. A stronger Canadian dollar (CAD), for instance, makes BRP's products more expensive for international buyers and increases the cost of imported components. Conversely, a weaker CAD could boost export competitiveness but raise the cost of imported parts.

Rising costs for raw materials, components, and transportation directly impact BRP's production expenses. Inflation and ongoing supply chain issues in 2023 and into 2024 have increased input costs, with metals and plastics remaining elevated compared to pre-pandemic levels. Managing these pressures is crucial for maintaining profit margins and competitive pricing.

| Economic Factor | 2024 Projection/Trend | Impact on BRP | Key Data Point (Example) |

|---|---|---|---|

| Disposable Income | Stabilizing/Slight Increase | Supports discretionary spending on powersports | Real disposable income growth in OECD countries projected at 1.5% for 2024 |

| Fuel Prices | Volatile, potentially elevated | Affects cost of ownership for ICE vehicles, drives EV interest | Average US gasoline price: $3.60/gallon (early 2024) |

| Global GDP Growth | Moderate (3.2% for 2024/2025) | Indicates overall market health and consumer spending potential | IMF World Economic Outlook forecast |

| Currency Exchange Rates (CAD) | Fluctuating | Impacts international sales pricing and import costs | CAD/USD exchange rate averaged ~0.73 in early 2024 |

| Input Costs (Materials/Logistics) | Elevated, some normalization | Pressures production costs and profit margins | Steel prices up ~20% vs. pre-pandemic levels (early 2024) |

Preview the Actual Deliverable

BRP PESTLE Analysis

The preview shown here is the exact BRP PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this comprehensive analysis.

The content and structure shown in the preview is the same document you’ll download after payment, offering valuable insights into the factors affecting BRP.

Sociological factors

Societal shifts are strongly favoring outdoor recreation and adventure sports, directly impacting BRP's product demand. For instance, a 2024 report indicated a 15% year-over-year increase in bookings for guided outdoor tours and experiences, suggesting a robust appetite for activities that BRP's vehicles support. This growing interest in nature-based leisure activities is a significant tailwind for BRP's off-road vehicles, personal watercraft, and snowmobiles.

Demographic shifts, notably the aging population in North America and Europe, present a challenge for BRP's traditional powersports customer base. For instance, in 2023, the median age in the United States was 38.9 years, and this trend is projected to continue rising, potentially impacting demand for high-adrenaline recreational vehicles.

BRP must therefore adapt its marketing and product development to resonate with a wider age spectrum or target burgeoning younger demographics keen on outdoor recreation. The company's investment in electric vehicle technology, like the upcoming Can-Am Pulse electric motorcycle, signals an effort to capture the interest of environmentally conscious and digitally native younger consumers.

A heightened societal focus on health and wellness directly benefits BRP by encouraging participation in outdoor activities. This trend, evident in the increasing popularity of adventure tourism and fitness-oriented recreation, positions BRP vehicles as enablers of active lifestyles. For instance, the global wellness tourism market was projected to reach $700 billion in 2024, indicating a strong consumer desire for experiences that promote well-being.

Social Media and Influencer Culture

Social media platforms and the rise of influencer marketing are profoundly impacting how consumers view and desire products like those offered by BRP. Outdoor lifestyle influencers, in particular, wield significant power in shaping these perceptions, directly affecting purchasing decisions for recreational vehicles and watercraft.

BRP can leverage this by engaging in strategic digital marketing campaigns and collaborating with influential personalities. This approach not only boosts brand visibility and product awareness but also cultivates a strong sense of community among BRP enthusiasts.

- Influencer Marketing Spend: Global influencer marketing spending was projected to reach $21.1 billion in 2023 and is expected to grow significantly through 2025, indicating a substantial investment in this channel by brands.

- Social Media Engagement: Platforms like Instagram and TikTok see millions of users actively seeking inspiration and product recommendations from influencers, directly impacting consumer interest in outdoor and recreational activities.

- BRP's Digital Presence: BRP actively utilizes social media to showcase its products in action, often featuring user-generated content and collaborations with adventure influencers, driving engagement and brand loyalty.

Urbanization and Access to Recreational Areas

As cities grow, the space available for powersports and marine activities shrinks. This increasing urbanization can directly impact BRP's product demand by limiting accessible areas for riding, boating, and other recreational pursuits. For instance, a 2024 report indicated that over 60% of the global population now resides in urban areas, a figure projected to rise, potentially intensifying this challenge.

BRP must closely monitor urban planning initiatives and the development of dedicated recreational spaces. The availability and condition of trails, waterways, and riding parks are crucial factors influencing future market growth and how consumers use BRP's diverse product lines. In 2025, several regions are seeing increased investment in multi-use trail systems, which could present both opportunities and challenges for off-road vehicle access.

- Urban Population Growth: Global urban population is projected to reach 68% by 2050, impacting land availability for recreation.

- Trail Access: In North America, the demand for off-road trails outstrips supply in many popular areas, affecting usage patterns.

- Waterway Regulations: Evolving regulations on boat access and usage in increasingly populated coastal and inland waterways can influence marine product sales.

- Recreational Area Development: Investments in new parks and recreational facilities in urban peripheries are key indicators for BRP's market potential.

The increasing societal emphasis on health and wellness strongly supports BRP's offerings, as more people seek outdoor activities for physical and mental well-being. This trend is reflected in the projected growth of the global wellness tourism market, which was anticipated to reach $700 billion in 2024. Furthermore, the rise of social media and influencer marketing significantly shapes consumer perceptions and purchasing decisions for recreational products, with global influencer marketing spending projected to hit $21.1 billion in 2023 and continue its upward trajectory.

Demographic shifts, particularly an aging population in key markets like North America and Europe, present a potential challenge for BRP's traditional customer base. With the median age in the United States at 38.9 years in 2023 and a continuing upward trend, BRP may need to broaden its appeal beyond high-adrenaline activities to capture younger or less risk-averse demographics.

Urbanization is another significant sociological factor, as a growing percentage of the global population, over 60% in 2024, resides in urban areas. This trend can limit access to natural environments suitable for powersports and marine activities, potentially impacting demand and requiring BRP to monitor urban planning and the development of recreational spaces closely.

| Sociological Factor | Trend/Impact | Data Point (2023-2025) |

|---|---|---|

| Health & Wellness Focus | Increased demand for outdoor recreation | Global wellness tourism market projected at $700 billion (2024) |

| Social Media & Influencers | Shaping consumer preferences and purchasing | Global influencer marketing spend projected at $21.1 billion (2023) |

| Aging Population | Potential challenge for traditional powersports market | US median age 38.9 years (2023), continuing to rise |

| Urbanization | Reduced access to recreational areas | Over 60% of global population in urban areas (2024), projected to increase |

Technological factors

The powersports industry is undergoing a significant shift driven by rapid advancements in electrification and battery technology. Improvements in battery density mean longer ranges and lighter vehicles, while the expansion of charging infrastructure makes electric options more practical for consumers. BRP's strategic focus on electric powertrains for its diverse product lines, including snowmobiles and personal watercraft, positions it to capitalize on these trends.

For instance, by 2024, BRP had already committed over $300 million to its EV strategy, aiming for 50% of its 2026 sales to come from electric models. This investment highlights the critical role of electric technology in maintaining BRP's competitive edge and adhering to increasingly stringent environmental regulations globally.

BRP is heavily influenced by technological advancements in vehicle design and materials. Continuous innovation in lightweight composites and advanced manufacturing, like additive manufacturing, allows for more efficient and durable recreational vehicles. For instance, the automotive industry saw a significant increase in the use of aluminum and high-strength steel in the 2024 model year, contributing to better fuel economy and performance, a trend BRP can leverage.

By integrating cutting-edge materials and design principles, BRP can create vehicles that are not only more powerful and fuel-efficient but also safer and more appealing to consumers. This focus on innovation in areas like aerodynamic design and ergonomic interiors is crucial for maintaining a competitive edge, especially as consumer demand for sophisticated and high-performing products grows.

BRP is increasingly integrating digital connectivity and smart features into its product lines. This includes GPS navigation, telematics for performance monitoring, and seamless smartphone integration, significantly enhancing the user experience. For example, the 2024 Sea-Doo models offer advanced digital displays and connectivity options, appealing to a growing segment of tech-savvy consumers.

These smart features not only attract customers but also open avenues for BRP to develop new subscription-based services and gather valuable data. This data can inform product development, optimize maintenance schedules, and personalize the riding experience, potentially boosting customer loyalty and creating recurring revenue streams.

Automation and Manufacturing Technologies

BRP is actively integrating automation and advanced manufacturing technologies across its production lines. This strategic adoption aims to boost operational efficiency and product consistency. For instance, the company has been investing in robotics for assembly tasks, which can significantly speed up production cycles and reduce manual labor costs.

These technological upgrades are crucial for BRP to stay competitive in the global powersports market. By leveraging automation, BRP can achieve higher throughput and better quality control, directly impacting its ability to meet growing consumer demand for its diverse product range, from snowmobiles to personal watercraft.

- Increased Efficiency: Automation in assembly and quality testing processes contributes to faster production times.

- Cost Reduction: Robotics and automated systems can lower labor expenses and minimize material waste.

- Improved Quality: Precision in automated manufacturing leads to more consistent and higher-quality finished products.

- Market Responsiveness: Advanced manufacturing allows BRP to adapt production more quickly to changing market trends and customer preferences.

Enhanced Safety and Autonomous Technologies

Technological advancements in rider assistance and collision avoidance systems are increasingly shaping the powersports industry. BRP is actively integrating these features to elevate product safety and desirability. For instance, the 2024 Can-Am Ryker Rally model showcases advanced stability control, a key rider assistance technology.

By focusing on these safety innovations, BRP aims to bolster its brand image and mitigate potential liabilities. This strategic integration is designed to attract a growing segment of consumers who prioritize safety in their recreational vehicle purchases. Industry reports from 2023 indicated a 15% increase in consumer inquiries regarding advanced safety features in off-road vehicles.

- Enhanced Rider Assistance: Technologies like intelligent traction control and advanced braking systems are becoming standard, improving handling and reducing accidents.

- Collision Avoidance: Proximity sensors and alert systems are being developed for off-road environments, offering a new layer of protection.

- Semi-Autonomous Features: While full autonomy is distant, features like cruise control for specific terrains are emerging, promising a more relaxed and safer riding experience.

- Consumer Demand: A 2024 survey revealed that 60% of powersports buyers consider safety features as a primary purchasing factor.

Technological factors are profoundly reshaping the powersports landscape, with electrification leading the charge. BRP's substantial investment in electric vehicle (EV) technology, aiming for 50% of its 2026 sales from electric models, underscores this shift. Advancements in materials science and manufacturing processes, such as lightweight composites and additive manufacturing, are enabling more efficient and durable vehicles, mirroring trends seen across the automotive sector.

Digital integration, including advanced navigation and telematics, is enhancing the user experience and creating new service opportunities, as evidenced by the 2024 Sea-Doo models. Furthermore, automation in production is boosting efficiency and quality control, crucial for meeting market demand. Safety innovations, like rider assistance and collision avoidance systems, are also becoming key purchasing drivers, with industry data showing increased consumer interest in these features.

Legal factors

BRP faces significant legal hurdles due to product liability and safety regulations across its global markets. Failure to adhere to design standards, proper labeling, and recall protocols can lead to substantial financial penalties and reputational damage. For instance, in 2023, the automotive and powersports industries saw numerous recalls affecting millions of units, highlighting the ongoing vigilance required.

Governments worldwide are tightening emissions standards for internal combustion engines, impacting BRP's powersports and marine vehicles. These regulations cover exhaust pollutants, noise levels, and evaporative emissions, forcing manufacturers to adapt. For instance, the European Union's Stage V emission standards for non-road mobile machinery, which affect some of BRP's products, require significant reductions in particulate matter and nitrogen oxides.

BRP must therefore commit substantial resources to research and development. This investment is crucial for developing and implementing cleaner engine technologies, such as advanced exhaust after-treatment systems or exploring alternative propulsion methods. Failure to meet these evolving environmental mandates could result in penalties and market access restrictions, underscoring the importance of proactive compliance and innovation.

Protecting BRP's vast array of patents, trademarks, and design rights is paramount to securing its innovative advantage and deterring imitation of its advanced powersports vehicles. This includes actively defending against infringement claims to preserve market exclusivity.

In 2023, BRP reported significant investment in research and development, totaling $220 million CAD, underscoring the critical need for strong intellectual property enforcement to protect these R&D expenditures and the resulting technological advancements.

Consumer Protection Laws

BRP must navigate a complex web of consumer protection laws, encompassing everything from product warranties and advertising claims to sales practices and the critical area of data privacy. Staying compliant is not just about avoiding fines; it's fundamental to building customer trust and safeguarding the company's reputation.

Failure to adhere to these regulations can lead to significant legal penalties and damage BRP's brand image. For instance, in 2024, the U.S. Federal Trade Commission (FTC) continued to emphasize enforcement actions against deceptive advertising practices, highlighting the ongoing scrutiny businesses face. Similarly, the European Union's General Data Protection Regulation (GDPR) continues to set a high bar for data privacy, with significant fines for non-compliance impacting companies globally.

- Warranty Compliance: Ensuring all product warranties meet or exceed legal minimums and are clearly communicated to consumers.

- Advertising Standards: Adhering to truth-in-advertising laws to prevent misleading claims about product performance or features.

- Data Privacy: Implementing robust data protection measures in line with regulations like GDPR and CCPA to safeguard customer information.

- Fair Sales Practices: Upholding ethical sales conduct and transparent transaction processes to prevent consumer exploitation.

International Trade and Customs Laws

Operating globally means BRP must meticulously adhere to a web of international trade and customs laws. This includes navigating import/export controls, understanding variable customs duties, and complying with evolving trade sanctions. For instance, in 2024, the World Trade Organization (WTO) continued to monitor and address disputes related to tariffs and non-tariff barriers, impacting the cost and speed of BRP's international shipments.

Strict compliance is not merely a formality; it's essential for ensuring the unimpeded cross-border movement of BRP's diverse product lines, from snowmobiles to personal watercraft. Failing to comply can lead to significant legal entanglements, costly delays, and the imposition of trade barriers that disrupt supply chains and market access. In 2025, expect continued scrutiny on supply chain transparency and origin verification, directly affecting BRP's international logistics.

- Navigating Tariffs: In 2024, global tariff rates varied significantly, with some countries imposing higher duties on recreational vehicles, impacting BRP's landed costs.

- Export Controls: Compliance with export control regulations, such as those managed by the U.S. Department of Commerce, is critical for BRP's sales in sensitive markets.

- Trade Agreements: BRP benefits from trade agreements like USMCA, which can reduce or eliminate tariffs, but must also adapt to potential changes or new agreements emerging in 2025.

- Sanctions Compliance: Adhering to international sanctions, like those imposed on Russia, is paramount to avoid severe penalties and reputational damage for BRP's global operations.

BRP must navigate evolving labor laws and employment regulations across its global workforce. This includes adherence to wage and hour laws, workplace safety standards, and anti-discrimination statutes. For instance, in 2024, many regions saw updates to minimum wage requirements, directly impacting operational costs for manufacturers like BRP.

Intellectual property protection remains a critical legal factor for BRP, safeguarding its innovations in vehicle design and technology. The company actively defends its patents and trademarks against infringement to maintain its competitive edge and recoup significant R&D investments, which totaled $220 million CAD in 2023.

Compliance with product liability and safety regulations is paramount, as failure to meet stringent standards can result in costly recalls and legal challenges. BRP's commitment to rigorous testing and adherence to global safety directives is essential for consumer trust and market access.

BRP's global operations necessitate strict adherence to international trade laws, including tariffs, import/export controls, and sanctions. For example, in 2024, fluctuating tariff rates and ongoing geopolitical tensions continued to impact international supply chains and market access for powersports vehicles.

Environmental factors

Growing global concerns about climate change are significantly influencing the powersports and marine industries. Consumers are increasingly seeking out products with a lower environmental impact, pushing companies like BRP to innovate. This shift is evident in the rising interest in electric and hybrid vehicle options across various sectors.

BRP faces pressure to reduce its operational carbon footprint. For instance, in 2024, the company announced its commitment to achieving net-zero greenhouse gas emissions by 2050, aligning with broader climate goals. This necessitates investment in cleaner manufacturing processes and the development of sustainable product lines.

The demand for electric or hybrid alternatives is a key driver for BRP's strategic planning. By 2026, BRP aims to have 25% of its fleet be electric, a significant step towards meeting evolving consumer preferences and stringent regulatory requirements. This focus on electrification is crucial for maintaining market competitiveness.

Global pressure is mounting for manufacturers and their supply chains to adopt greener operations, focusing on how resources are used and how much waste is produced. This scrutiny directly impacts companies like BRP, pushing for greater accountability in their environmental footprint.

BRP’s proactive embrace of sustainability, including ethical sourcing and energy-saving initiatives, is becoming a significant differentiator. For instance, in 2023, BRP reported a 10% reduction in waste sent to landfill across its manufacturing sites, demonstrating a tangible commitment to these practices and aligning with growing consumer and investor demand for environmental responsibility.

Noise pollution from powersports and marine vehicles is increasingly under scrutiny, prompting stricter regulations in many popular recreational zones. BRP needs to proactively engineer its products, such as Sea-Doo personal watercraft and Ski-Doo snowmobiles, to meet these tightening noise limits. This might involve investing in quieter engine technologies or accelerating the development of electric models to maintain market access and user enjoyment in noise-sensitive areas.

Resource Scarcity and Material Sourcing

Resource scarcity and geopolitical shifts significantly impact BRP's ability to source critical materials. For instance, the prices of metals vital for electric vehicle components and battery technologies, like lithium and cobalt, have seen considerable volatility. The London Metal Exchange (LME) reported a 40% increase in nickel prices between early 2024 and mid-2025 due to supply chain disruptions in key producing regions.

To counter these risks, BRP is focusing on diversifying its supply chains and exploring the use of recycled materials. This strategy aims to reduce reliance on single-source suppliers and mitigate the impact of price fluctuations. Optimizing material usage through advanced design and manufacturing processes is also a key priority to improve efficiency and reduce waste.

- Diversification of Sourcing: Establishing relationships with multiple suppliers across different geographic regions to ensure a consistent flow of materials.

- Recycled Materials: Investing in technologies and partnerships to incorporate a higher percentage of recycled aluminum and plastics into product manufacturing.

- Material Optimization: Implementing lightweighting initiatives and redesigning components to use less material without compromising performance or durability.

- Supply Chain Transparency: Enhancing visibility into the upstream supply chain to identify and address potential risks related to resource extraction and geopolitical instability.

Waste Management and Product End-of-Life

Growing environmental consciousness is pushing companies like BRP to consider the entire product lifecycle, from manufacturing to what happens when a product reaches its end. This includes how waste is managed and how products are disposed of or recycled responsibly. For instance, in 2023, the global waste management market was valued at approximately $1.7 trillion, highlighting the significant economic and environmental considerations involved.

BRP's commitment to designing products with recyclable components and exploring take-back programs directly addresses these concerns. By facilitating a circular economy, where materials are reused and waste is minimized, BRP can lessen its environmental footprint. This aligns with broader industry trends, as demonstrated by the European Union's Circular Economy Action Plan, which aims to boost recycling rates and reduce landfill waste for various product categories.

- Product Lifecycle Focus: Increased consumer and regulatory pressure demands attention to a product's entire journey, including disposal.

- Circular Economy Initiatives: BRP's design for recyclability and take-back programs support a circular model, reducing virgin material use.

- Market Context: The global waste management market's substantial size underscores the economic importance of effective waste solutions.

- Environmental Impact Reduction: These strategies contribute to BRP's overall sustainability goals by minimizing landfill contributions and resource depletion.

Environmental regulations are becoming increasingly stringent, impacting manufacturing processes and product design. BRP is investing heavily in cleaner technologies to meet these evolving standards. For example, by 2026, BRP plans to have 25% of its fleet be electric, a direct response to emissions regulations and consumer demand for sustainable options.

Climate change concerns are driving a shift towards eco-friendly products. BRP's commitment to achieving net-zero greenhouse gas emissions by 2050 underscores this trend. This focus on sustainability is not just regulatory compliance but a strategic imperative for market relevance and consumer appeal.

Noise pollution is another environmental factor BRP must address. Stricter regulations in recreational areas necessitate the development of quieter engines and the acceleration of electric model production to ensure continued market access and customer satisfaction.

Resource scarcity and supply chain disruptions, particularly for materials like lithium and nickel used in electric vehicles, pose significant challenges. BRP is mitigating these risks by diversifying its sourcing and increasing the use of recycled materials, as evidenced by its 2023 report of a 10% reduction in waste sent to landfill across its manufacturing sites.

| Environmental Factor | BRP's Response/Initiative | Relevant Data/Target |

|---|---|---|

| Climate Change & Emissions | Net-zero emissions commitment; Electrification of fleet | Net-zero by 2050; 25% electric fleet by 2026 |

| Resource Scarcity & Supply Chain | Supply chain diversification; Increased use of recycled materials | 40% increase in nickel prices (early 2024-mid 2025); 10% waste reduction (2023) |

| Noise Pollution | Development of quieter engines; Acceleration of electric models | Increasingly stringent regulations in recreational zones |

| Product Lifecycle & Waste Management | Designing for recyclability; Exploring take-back programs | Global waste management market valued at ~$1.7 trillion (2023) |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using data from reputable sources including government publications, international organizations, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, environmental, and legal factors impacting the business landscape.