Brookfield Reinsurance PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Reinsurance Bundle

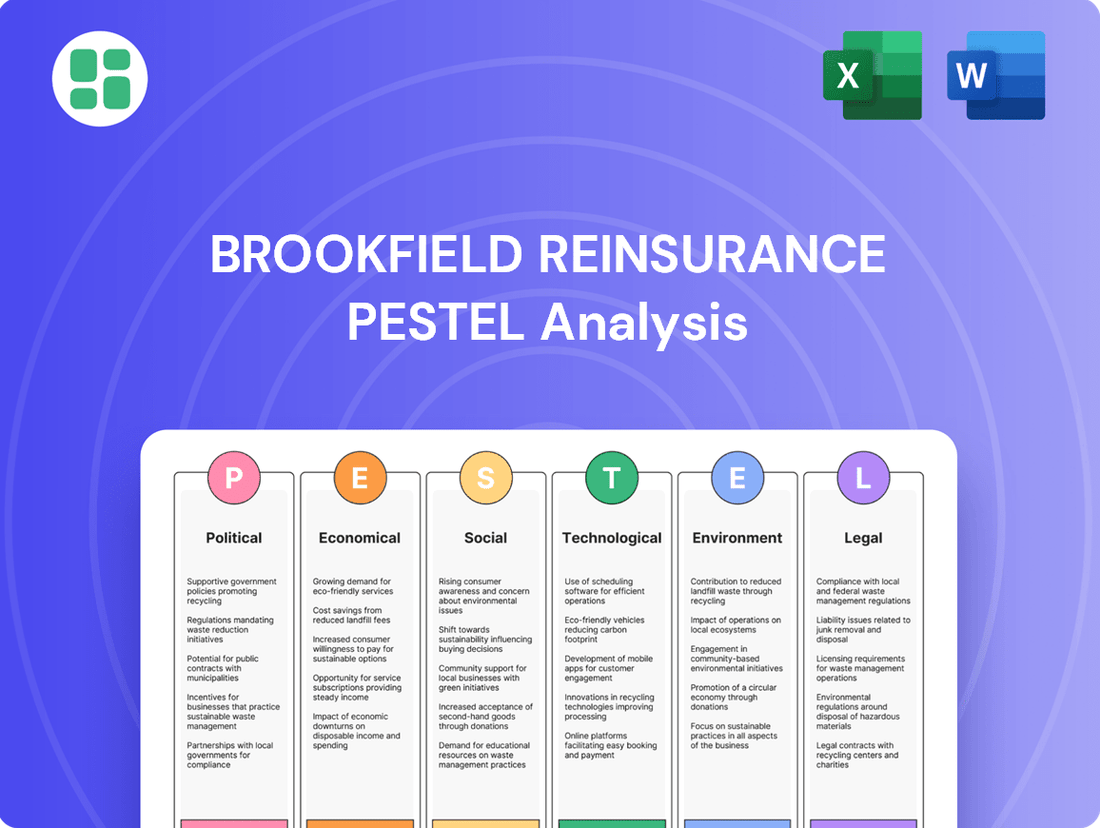

Unlock the strategic advantages shaping Brookfield Reinsurance's future. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental forces impacting the company. Gain a competitive edge by understanding these critical external factors. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Brookfield Reinsurance benefits significantly from regulatory stability in its core markets, such as the United States and Canada. This predictability allows for more confident long-term capital deployment in life and annuity products, as seen in their $5 billion annuity transaction with American Equity Investment Life Holding Company in 2023. Consistent legislative frameworks reduce uncertainty around capital requirements and solvency standards, crucial for managing risk in these long-duration businesses.

Shifts in political priorities, however, could introduce new challenges. For instance, changes in tax policy or new regulations impacting financial services could alter the profitability of existing business lines or necessitate adjustments to capital management strategies. Brookfield Reinsurance actively monitors legislative developments, particularly those related to insurance solvency (like Solvency II in Europe, which impacts global operations) and capital gains tax, to mitigate potential impacts on its strategic planning and operational efficiency.

Brookfield Reinsurance's global operations are significantly impacted by international trade relations and evolving geopolitical landscapes. For instance, the ongoing trade disputes between major economies, such as those involving the United States and China, can create uncertainty in cross-border capital flows, potentially affecting investment opportunities in diverse markets.

Shifts in diplomatic relations and the implementation of new trade policies, like those stemming from Brexit or the reevaluation of existing agreements, directly influence the ease with which Brookfield Reinsurance can access international markets and manage its global investments. These changes can alter regulatory environments and tax structures, impacting the company's profitability and strategic planning.

Geopolitical instability in regions like Eastern Europe or parts of the Middle East presents tangible risks. Such instability can disrupt investment portfolios, increase the cost of doing business due to higher risk premiums, and limit market access. For example, heightened tensions in 2024 have led to increased volatility in global financial markets, requiring careful risk management by companies like Brookfield Reinsurance.

Government fiscal and monetary policies significantly shape the environment for reinsurers like Brookfield Reinsurance. For instance, the U.S. Federal Reserve's monetary policy decisions, including interest rate adjustments, directly impact bond yields, a key component of investment portfolios that reinsurers rely on for returns. As of early 2024, the Fed maintained a hawkish stance, with rates higher than in prior years, which generally benefits reinsurers by increasing investment income on their reserves.

Fiscal policies, such as government spending or tax changes, also play a crucial role. Increased government spending on infrastructure or disaster relief, for example, could lead to more demand for reinsurance coverage. Conversely, austerity measures might dampen economic activity, potentially reducing demand. The stability fostered by predictable fiscal and monetary policies generally supports a healthier market for financial products, including reinsurance, by reducing uncertainty for investors and businesses.

Political Risk in Key Operating Jurisdictions

Brookfield Reinsurance faces political risk in its key operating jurisdictions, particularly concerning potential shifts in regulatory environments that could affect its business model. For instance, changes in capital requirements or investment regulations in markets like the United States or Canada could necessitate significant adjustments to its financial strategies. The company's global footprint means it must constantly monitor political stability and policy continuity in regions where it holds substantial assets or liabilities.

The potential for sudden policy changes, such as alterations to tax laws or insurance sector oversight, poses a direct threat to profitability and operational stability. In 2024, for example, ongoing discussions around financial services reform in several European nations highlight the dynamic nature of the political landscape. Understanding and mitigating these risks is paramount for safeguarding Brookfield Reinsurance's long-term financial health and ensuring the security of its liabilities.

- Regulatory Uncertainty: Evolving financial regulations in major markets like the US and Canada could impact capital allocation and operational flexibility for Brookfield Reinsurance.

- Policy Changes: Sudden shifts in tax policies or insurance sector regulations in operating countries can directly affect the company's profitability and risk management strategies.

- Geopolitical Stability: Political instability in regions where Brookfield Reinsurance has significant investments or liabilities can create operational disruptions and asset value volatility.

Lobbying and Industry Advocacy

Lobbying and industry advocacy play a crucial role in shaping the regulatory landscape for reinsurers like Brookfield Reinsurance. These efforts directly influence capital requirements, taxation policies, and market access, impacting the company's operational framework and profitability. For instance, in 2024, industry groups actively lobbied against proposed changes to solvency regulations in several key European markets, arguing they would disproportionately burden reinsurers and potentially stifle innovation.

Brookfield Reinsurance, through its participation in associations like the Reinsurance Association of America (RAA) and the International Insurance Society (IIS), engages with policymakers to advocate for favorable outcomes. These advocacy efforts focus on issues such as risk-based capital frameworks and international tax treaties. The RAA, for example, reported spending approximately $1.5 million on lobbying efforts in 2023, aiming to influence discussions around federal insurance regulation and disaster risk financing.

The success of these advocacy initiatives can significantly affect Brookfield Reinsurance's competitive positioning. Favorable regulatory treatment, such as advantageous tax provisions or reduced capital burdens, can free up capital for investment and growth. Conversely, stringent regulations, often a result of intense lobbying by consumer groups or competing industries, can increase operational costs and limit strategic flexibility. The ongoing debate surrounding climate risk disclosure mandates, for example, sees significant industry advocacy to ensure proportionality and avoid overly burdensome reporting requirements.

- Industry advocacy groups actively engage policymakers to influence legislation impacting capital requirements and taxation for reinsurers.

- Brookfield Reinsurance participates in industry associations to advocate for its business interests, focusing on regulatory frameworks and tax policies.

- Lobbying efforts can lead to more favorable capital burdens and tax treatments, enhancing a reinsurer's competitive edge.

- The effectiveness of advocacy is crucial in navigating regulatory changes, such as those related to climate risk disclosures.

Brookfield Reinsurance operates within a dynamic political landscape where government stability and policy consistency are paramount. Favorable regulatory environments, like those in the US and Canada, support long-term capital deployment, as demonstrated by their 2023 annuity transaction with American Equity. However, shifts in political priorities, such as changes in tax policy or new financial service regulations, could necessitate strategic adjustments, impacting profitability and capital management.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Brookfield Reinsurance, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to help stakeholders navigate market dynamics and identify opportunities.

A streamlined PESTLE analysis for Brookfield Reinsurance that cuts through complexity, offering actionable insights to navigate external challenges and capitalize on opportunities.

Economic factors

The prevailing interest rate environment significantly shapes Brookfield Reinsurance's investment returns, particularly given its substantial portfolio of life and annuity liabilities. In a low-rate scenario, such as those seen in recent years, investment yields can be compressed, making it more challenging to meet the long-term guaranteed returns promised to policyholders. This dynamic can pressure profitability as the company seeks assets that can generate sufficient income.

Conversely, a rising interest rate environment, like the one experienced through 2023 and into 2024, generally benefits reinsurers like Brookfield. Higher rates mean that new investments and the reinvestment of maturing assets can generate greater income, thereby enhancing profitability. However, this also introduces reinvestment risk; if rates fall again unexpectedly, the company might be locked into lower-yielding assets.

For instance, as of early 2024, the Federal Reserve's benchmark interest rate remained elevated compared to pre-pandemic levels, offering improved yields on fixed-income investments. This has been a positive factor for reinsurers managing long-duration liabilities. However, the potential for rate cuts later in 2024 or 2025 means that managing the duration of assets and liabilities remains a critical strategic consideration for Brookfield Reinsurance.

Inflationary pressures directly impact the real value of Brookfield Reinsurance's long-term liabilities, particularly those with fixed payouts like certain life insurance policies. For instance, if inflation rises significantly, the purchasing power of a fixed death benefit diminishes, creating a potential mismatch with the company's investment assets. This erosion of real value necessitates careful management to ensure policyholder commitments can still be met in future dollars.

Managing investment portfolios in an inflationary environment presents a significant challenge for reinsurers. Brookfield Reinsurance must navigate the complexities of maintaining asset values that can keep pace with rising costs. Strategies such as investing in inflation-linked securities or assets with floating rates become crucial to hedge against this erosion of purchasing power and protect the real value of their capital base.

As of early 2024, global inflation rates, while showing some moderation from 2023 peaks, remain a concern in many developed economies, with forecasts suggesting a gradual return to central bank targets. For example, the US CPI saw a year-over-year increase of 3.4% in April 2024, indicating persistent, albeit slower, inflationary trends that directly affect the long-term financial planning and liability management of companies like Brookfield Reinsurance.

Global economic growth trends significantly influence the demand for Brookfield Reinsurance's products. Robust economic expansion generally fuels growth in the insurance market, as individuals and businesses have more disposable income and are more likely to purchase new policies or increase coverage. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight acceleration from 2023, which bodes well for premium income.

Conversely, recessionary risks can negatively impact the sector. Economic downturns often lead to reduced premium growth as policyholders may cut back on expenses, and there's an increased likelihood of policy surrenders. Furthermore, declining asset values during recessions can affect insurers' investment portfolios, potentially impacting profitability and capital reserves. The ongoing geopolitical tensions and inflation concerns in 2024 continue to pose risks to sustained global economic expansion.

Capital Market Performance and Asset Valuation

Global capital markets significantly influence Brookfield Reinsurance's asset valuations. For instance, the MSCI World Index saw a substantial gain of approximately 23% in 2023, reflecting a generally positive equity market environment. However, fluctuating interest rates and widening credit spreads, as observed in periods of economic uncertainty, can directly impact the fair value of fixed-income portfolios held by the company, potentially affecting its balance sheet and solvency ratios. Brookfield Asset Management's deep expertise in navigating these dynamic markets is crucial for mitigating risks and optimizing asset performance.

The performance of various asset classes directly shapes Brookfield Reinsurance's asset valuations. In 2024, while equity markets continued their upward trend, the fixed-income sector experienced mixed performance due to persistent inflation concerns and central bank policy shifts. Alternative investments, such as real estate and infrastructure, also showed varied resilience. For example, as of Q1 2024, private equity valuations remained robust, while certain real estate segments faced headwinds. This necessitates a sophisticated approach to asset management to maintain strong solvency capital ratios.

- Equity Market Performance: Global equities, as tracked by indices like the S&P 500, demonstrated strong performance in 2023, with a year-end return of over 24%. This trend has continued into early 2024, albeit with increased volatility.

- Fixed Income Volatility: Bond yields experienced significant fluctuations throughout 2023 and early 2024, impacting the valuation of fixed-income portfolios. For example, the US 10-year Treasury yield moved between 3.2% and 5.0% in 2023.

- Alternative Investment Landscape: While real estate markets faced challenges in some regions, infrastructure and private equity investments generally provided stable returns, with global private equity fundraising reaching over $1 trillion in 2023.

- Impact on Solvency: Market downturns or significant asset devaluations can strain a reinsurer's capital adequacy. Brookfield Reinsurance's robust capital management, leveraging Brookfield Asset Management's investment acumen, aims to ensure it maintains strong solvency ratios even amidst market turbulence.

Currency Fluctuations and Foreign Exchange Risk

Brookfield Reinsurance's extensive international footprint exposes it to significant currency fluctuations. As of early 2024, the company holds substantial assets and liabilities denominated in various currencies, meaning shifts in exchange rates directly impact the reported value of its holdings and its overall financial performance. For instance, a strengthening US dollar against the Canadian dollar could decrease the reported value of Canadian assets when converted to USD, affecting profitability on cross-border transactions.

The company actively manages this foreign exchange risk through various hedging strategies. These can include forward contracts, options, and currency swaps to lock in exchange rates for future transactions and protect the value of foreign-denominated assets and liabilities. Effective currency risk management is crucial for maintaining stable earnings and asset values in a volatile global economic environment.

- Impact on Assets: Fluctuations in exchange rates can alter the reported value of Brookfield Reinsurance's international assets, potentially affecting its balance sheet.

- Profitability of Transactions: Cross-border transactions, including premiums collected and claims paid in foreign currencies, are directly influenced by currency movements.

- Hedging Strategies: Brookfield Reinsurance employs financial instruments like forward contracts and options to mitigate currency risk and protect its financial results.

- 2024 Outlook: Continued volatility in major currency pairs, such as EUR/USD and GBP/USD, presents ongoing challenges and opportunities for managing foreign exchange exposure.

The interest rate environment remains a critical driver for Brookfield Reinsurance, influencing investment income on its substantial liabilities. While higher rates in 2023 and early 2024 boosted yields on new investments, the potential for future rate cuts introduces reinvestment risk. For example, the Federal Reserve's benchmark rate, while elevated in early 2024, was anticipated to see reductions later in the year or in 2025, necessitating careful asset-liability management.

Inflation directly impacts the real value of long-term liabilities with fixed payouts. Brookfield Reinsurance must manage its investment portfolio to outpace inflation, ensuring policyholder commitments retain their purchasing power. As of April 2024, the US CPI was 3.4% year-over-year, highlighting the ongoing need for inflation-hedging strategies in asset allocation.

Global economic growth influences demand for insurance products, with a projected 3.2% global growth in 2024 by the IMF suggesting a positive environment for premium income. However, recessionary risks and geopolitical tensions in 2024 continue to pose challenges to sustained economic expansion and can impact asset valuations.

| Economic Factor | Impact on Brookfield Reinsurance | Key Data/Trends (2023-2024) |

|---|---|---|

| Interest Rates | Affects investment income and profitability; higher rates generally benefit reinsurers. | Federal Reserve rate elevated in early 2024; potential for cuts in late 2024/2025. |

| Inflation | Erodes the real value of liabilities; necessitates investment in inflation-hedging assets. | US CPI at 3.4% YoY in April 2024; global inflation moderating but remains a concern. |

| Economic Growth | Drives demand for insurance products; recessions can reduce premium growth and asset values. | Projected global growth of 3.2% for 2024 (IMF); ongoing geopolitical and inflation risks. |

Full Version Awaits

Brookfield Reinsurance PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Brookfield Reinsurance delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to actionable insights for strategic planning and risk assessment.

Sociological factors

Global demographic shifts, marked by aging populations and rising life expectancies, significantly influence Brookfield Reinsurance's life and annuity segments. As people live longer, the duration and payout profiles of existing liabilities extend, necessitating advanced actuarial modeling and tailored investment strategies to meet future obligations. For instance, the number of individuals aged 65 and over is projected to reach 1.6 billion by 2050, a substantial increase from 703 million in 2019, underscoring the growing demand for retirement solutions.

Consumers increasingly favor financial products offering greater flexibility and transparency, particularly in insurance and annuities. This trend is fueled by a desire for personalized solutions that can be managed digitally, a demand evident in the growing adoption of online financial advisory services and direct-to-consumer insurance platforms.

For instance, a 2024 report indicated that over 60% of millennials and Gen Z prefer digital channels for managing their financial products, highlighting a significant shift away from traditional, in-person interactions. This necessitates product innovation and distribution strategies that prioritize ease of access and clear communication.

Brookfield Reinsurance's success hinges on its capacity to align its offerings with these evolving consumer expectations. Adapting to demands for personalized financial planning tools and digitally integrated services is paramount for maintaining market competitiveness and relevance in the coming years.

Public trust is paramount for financial institutions, including reinsurers like Brookfield Reinsurance, as it directly influences their ability to attract and retain clients. Past financial crises and instances of ethical lapses have significantly eroded this trust across the industry, making transparency and reliability critical differentiators. Brookfield Reinsurance's focus on robust governance and client-focused strategies is essential for building and maintaining a positive reputation, especially as the global financial sector navigates evolving public expectations.

Wealth Distribution and Economic Inequality

Trends in wealth distribution significantly shape the market for life and annuity products. As more individuals enter the middle class, the potential client base for these financial solutions expands. For instance, in 2024, the global middle class was projected to reach over 5 billion people, representing a substantial opportunity for insurers like Brookfield Reinsurance.

Conversely, rising economic inequality can create a more polarized demand. A widening gap between the wealthy and the less affluent might lead to a bifurcation where high-net-worth individuals seek sophisticated wealth management and protection products, while lower-income segments struggle with affordability and accessibility of basic financial security.

Brookfield Reinsurance must consider how economic disparities affect the accessibility and perceived value of its offerings across various socio-economic strata. For example, a 2025 report indicated that nearly 40% of households in developed economies found it challenging to save for retirement, highlighting a segment that may require more tailored, affordable solutions.

- Growing Middle Class: In 2024, the global middle class was estimated to surpass 5 billion, presenting a larger addressable market for life and annuity products.

- Economic Inequality Impact: Increased wealth disparity can lead to a demand split, with affluent customers seeking premium products and lower-income groups prioritizing affordability.

- Affordability Challenges: Data from 2025 suggests a significant portion of households face difficulties in saving, emphasizing the need for accessible and cost-effective financial solutions.

- Product Customization: Tailoring products to meet the diverse needs and financial capacities of different socio-economic segments is crucial for market penetration.

Health and Wellness Trends and Their Impact on Risk

Shifting health and wellness trends significantly influence mortality and morbidity rates, directly impacting life and health reinsurance. For instance, increased life expectancy due to medical advancements, like targeted cancer therapies approved in 2024, can lower mortality risk for insured individuals. Conversely, rising rates of chronic diseases, such as obesity and type 2 diabetes, which affected an estimated 40% of US adults in 2023, can increase morbidity risk.

The integration of wellness programs and health data into underwriting is becoming crucial for accurate risk assessment. Companies are leveraging data from wearable devices and health apps, which saw a 15% increase in adoption in 2024, to offer more personalized pricing. This data-driven approach allows reinsurers like Brookfield Reinsurance to better understand and price the long-term health profiles of insured populations.

- Increased Life Expectancy: Advances in medicine, including new treatments for cardiovascular diseases and Alzheimer's, are extending average lifespans, reducing the frequency of mortality claims.

- Chronic Disease Prevalence: The growing incidence of lifestyle-related illnesses, such as diabetes and heart disease, contributes to higher morbidity claims and necessitates adjustments in risk modeling.

- Public Health Initiatives: Widespread health awareness campaigns and preventative care measures can lead to a healthier population, potentially lowering overall mortality and morbidity risks over time.

- Pandemic Preparedness: The ongoing impact of pandemics, like COVID-19, highlights the need for robust pandemic risk assessment and contingency planning in reinsurance strategies.

Societal attitudes towards risk and financial security are evolving, with a growing emphasis on personalized financial planning and digital accessibility. This shift is driven by younger generations, who increasingly prefer online platforms for managing their finances, as evidenced by over 60% of millennials and Gen Z favoring digital channels in 2024. Brookfield Reinsurance must adapt its product offerings and distribution strategies to meet these demands for flexibility, transparency, and digital integration to remain competitive.

Technological factors

The insurance industry is undergoing a significant digital transformation, impacting how companies like Brookfield Reinsurance operate. This shift involves adopting digital platforms for everything from managing policies and processing claims to interacting with clients. For instance, many insurers are investing heavily in AI-powered claims processing, aiming to reduce settlement times and improve accuracy. In 2024, it's estimated that the global InsurTech market will continue its strong growth trajectory, with digital transformation being a key driver.

Brookfield Reinsurance can leverage these technological advancements to boost operational efficiency and enhance client service. The adoption of digital workflows can streamline processes, leading to reduced administrative costs and faster turnaround times for policyholders. For example, implementing automated underwriting systems can significantly cut down on manual review, a process that historically consumed considerable resources. By embracing these digital tools, Brookfield Reinsurance can position itself for greater agility and competitiveness in the evolving insurance landscape.

Brookfield Reinsurance is increasingly leveraging data analytics and artificial intelligence to sharpen its risk management. By analyzing vast datasets, the company can refine its underwriting processes and actuarial models, leading to more precise risk assessments. This technological advancement is crucial for identifying nascent risks and optimizing how capital is deployed across its portfolio.

The integration of AI allows for more dynamic and accurate pricing of insurance and reinsurance products. For instance, advanced analytics can pinpoint subtle correlations in data that human analysts might miss, enabling better prediction of claim frequencies and severities. This data-driven approach is projected to enhance profitability by ensuring premiums accurately reflect the underlying risks.

However, the adoption of AI in risk management is not without its challenges. Ethical considerations, such as algorithmic bias and data privacy, are paramount. Regulators are also scrutinizing AI's application, demanding transparency and explainability in decision-making processes. Brookfield Reinsurance must navigate these evolving regulatory landscapes to ensure responsible AI implementation.

Brookfield Reinsurance faces escalating cybersecurity threats as it manages highly sensitive financial and personal data. The increasing sophistication of cyberattacks, including ransomware and data breaches, poses a significant risk to client information and operational continuity. For instance, the global average cost of a data breach reached $4.35 million in 2023, underscoring the financial implications of security failures.

Protecting client data and maintaining operational integrity requires substantial investment in advanced security measures and ongoing vigilance. Compliance with stringent data privacy regulations, such as GDPR and CCPA, is paramount, with non-compliance potentially leading to hefty fines. In 2024, regulatory bodies are expected to further tighten enforcement, making robust data protection a critical operational necessity for Brookfield Reinsurance.

Insurtech Innovation and Competitive Landscape

Insurtech startups are rapidly reshaping the reinsurance landscape, introducing innovative technologies and agile business models that challenge traditional players. These disruptors are leveraging AI, blockchain, and advanced analytics to streamline processes and offer more tailored solutions. For instance, the global Insurtech market was valued at approximately $11.1 billion in 2023 and is projected to grow significantly, with some estimates reaching over $100 billion by 2030, highlighting the scale of this transformation.

Brookfield Reinsurance must actively engage with this evolving Insurtech ecosystem. Their strategy likely involves a dual approach: either acquiring or partnering with promising Insurtech firms to integrate their cutting-edge capabilities, or developing in-house technological solutions to maintain a competitive edge. This proactive stance is crucial for adapting to new market dynamics and customer expectations driven by technological advancements.

The competitive pressure from Insurtechs necessitates a focus on operational efficiency and product innovation within Brookfield Reinsurance. Key areas of impact include:

- Enhanced Underwriting: Insurtechs are using AI and machine learning for more precise risk assessment, potentially leading to better pricing and reduced losses for reinsurers.

- Improved Claims Processing: Automation and data analytics are speeding up claims handling, reducing administrative costs and improving customer satisfaction.

- New Distribution Channels: Digital platforms and direct-to-consumer models are expanding market reach and creating new avenues for premium growth.

- Data Monetization: Insurtechs are adept at leveraging vast datasets, offering opportunities for reinsurers to develop new data-driven products and services.

Blockchain and Distributed Ledger Technology Potential

Blockchain and Distributed Ledger Technology (DLT) offer significant potential for revolutionizing the reinsurance sector. These technologies can bolster transparency in complex transactions, a critical factor for trust and regulatory compliance.

The efficiency gains in claims processing are a major draw. Imagine faster, more accurate settlements due to automated verification and reduced manual intervention. This streamlining can directly impact operational costs and client satisfaction.

Smart contracts, powered by DLT, are poised to transform reinsurance agreements. By automating the execution of contract terms based on predefined conditions, they can simplify the management of complex reinsurance treaties and reduce the potential for disputes.

The long-term implications for Brookfield Reinsurance include a substantial reduction in administrative overhead and a more agile, data-driven operational model. For instance, the global DLT market is projected to reach USD 145.16 billion by 2029, indicating widespread adoption and innovation across industries, including financial services.

- Enhanced Transparency: DLT provides an immutable and shared record of transactions, increasing visibility for all parties involved in reinsurance contracts.

- Improved Efficiency: Automation of claims processing and contract execution through smart contracts can significantly reduce processing times and manual errors.

- Streamlined Transactions: Complex reinsurance placements and capital management can be simplified, leading to lower administrative costs and faster settlement cycles.

- Future Market Growth: The increasing investment and development in DLT solutions suggest a growing ecosystem ready to support innovative applications within the reinsurance industry.

Technological advancements are fundamentally reshaping the insurance and reinsurance sectors, driving efficiency and innovation. Brookfield Reinsurance is navigating this landscape by embracing digital transformation, leveraging AI for risk assessment, and exploring the potential of technologies like blockchain.

The global Insurtech market continues its robust growth, projected to reach over $100 billion by 2030, underscoring the competitive pressure and opportunities for established players. Brookfield Reinsurance's strategic engagement with Insurtechs, through partnerships or internal development, is crucial for adapting to evolving market dynamics and customer expectations driven by these technological shifts.

The adoption of AI in underwriting and claims processing is enhancing accuracy and speed, with AI in insurance projected for significant growth in the coming years. For instance, AI-driven analytics can pinpoint subtle data correlations for more precise risk prediction, boosting profitability by ensuring premiums accurately reflect underlying risks.

Blockchain and DLT offer enhanced transparency and efficiency in reinsurance transactions, with the global DLT market expected to reach USD 145.16 billion by 2029. Smart contracts, a key application of DLT, can automate reinsurance agreements, reducing administrative overhead and streamlining complex processes.

Legal factors

Brookfield Reinsurance navigates a complex global regulatory landscape, with varying solvency requirements like Solvency II in Europe and NAIC standards in the US significantly impacting capital adequacy. These frameworks, alongside licensing stipulations, directly influence the company's operational structure and financial resilience, making strict compliance a critical factor for stability.

Brookfield Reinsurance must navigate a complex web of data privacy and protection laws, like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These regulations significantly impact how the company collects, stores, processes, and transfers policyholder data. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual turnover or €20 million, whichever is higher. This necessitates robust data governance frameworks to ensure policyholder trust and avoid reputational damage.

Brookfield Reinsurance operates under stringent consumer protection laws, mandating clear disclosures and fair treatment of all policyholders. These regulations, which are continually evolving, aim to prevent misleading advertising and ensure customers understand their contracts, a key aspect of market conduct. For instance, in 2024, regulators across major markets continued to emphasize transparency in insurance product sales, with fines levied for non-compliance impacting firms' reputations and financial performance.

Adherence to these legal frameworks is paramount for maintaining customer trust and avoiding penalties. Brookfield Reinsurance must navigate a complex web of rules governing everything from initial sales pitches to claims handling, ensuring ethical practices are embedded in all operations. The company's commitment to transparency directly supports its long-term viability and market standing.

Anti-Money Laundering (AML) and Sanctions Compliance

Brookfield Reinsurance operates under strict legal mandates concerning anti-money laundering (AML) and sanctions compliance. These regulations require rigorous processes for identifying and reporting suspicious financial activities, ensuring thorough due diligence on all clients, and meticulously adhering to global sanctions lists. For instance, in 2024, financial institutions globally, including those in the reinsurance sector, are facing increased scrutiny and penalties for non-compliance, with fines often reaching millions of dollars. A robust compliance framework is therefore critical to managing financial crime risks and maintaining operational integrity.

Key legal obligations include:

- Customer Due Diligence (CDD): Verifying the identity of clients and understanding the nature of their business to assess risk.

- Suspicious Transaction Reporting (STR): Promptly reporting any transactions that appear unusual or potentially linked to illicit activities to relevant authorities.

- Sanctions Screening: Regularly checking clients and transactions against updated international sanctions lists issued by bodies like the UN, OFAC, and HM Treasury.

- Record Keeping: Maintaining detailed records of all transactions and customer information for a specified period to facilitate audits and investigations.

Contract Law and Dispute Resolution Mechanisms

Contract law forms the bedrock of all reinsurance agreements, defining the rights and obligations of both the cedent and the reinsurer. The intricacies of drafting these contracts, particularly concerning claims handling, liability limits, and choice of law, are paramount for Brookfield Reinsurance. In 2024, the global reinsurance market continued to rely heavily on well-defined contractual terms to manage risk transfer effectively.

Dispute resolution mechanisms, such as arbitration and mediation, are critical for maintaining stable and predictable business relationships within the reinsurance sector. The efficiency and fairness of these processes directly impact operational costs and reputation. For instance, the London market, a significant hub for reinsurance, often utilizes arbitration, with proceedings typically aiming for resolution within 12-24 months, depending on complexity.

- Contractual Clarity: Reinsurance contracts must clearly outline terms for claims notification, loss adjustment, and coverage triggers to prevent disputes.

- Arbitration Advantages: Arbitration offers confidentiality and specialized expertise, often preferred over litigation for its speed and finality in complex financial disputes.

- Governing Law: The selection of governing law, such as English law or New York law, significantly impacts contract interpretation and dispute resolution outcomes.

- Regulatory Oversight: While contracts are private agreements, regulatory frameworks in key markets can influence dispute resolution processes and outcomes.

Brookfield Reinsurance must adhere to evolving insurance regulations globally, impacting capital requirements and operational practices. For instance, in 2024, many jurisdictions continued to refine solvency standards, pushing reinsurers to maintain robust capital buffers. Compliance with these frameworks is crucial for maintaining licenses and ensuring financial stability.

Data privacy laws like GDPR and CCPA impose strict rules on handling policyholder information, with significant penalties for breaches. In 2024, enforcement actions continued globally, underscoring the need for strong data governance. Brookfield Reinsurance's commitment to data protection is vital for trust and avoiding substantial fines, which can reach millions.

Consumer protection laws mandate transparency in sales and claims handling, with regulators actively monitoring market conduct. In 2024, there was a continued emphasis on clear product disclosures, and firms faced scrutiny and potential penalties for non-compliance. Upholding these standards is essential for brand reputation and customer loyalty.

Anti-money laundering (AML) and sanctions compliance are critical, requiring diligent customer due diligence and transaction monitoring. In 2024, financial institutions, including reinsurers, faced increased regulatory oversight and significant fines for AML failures. Brookfield Reinsurance's robust compliance framework is key to mitigating financial crime risks.

Environmental factors

Brookfield Reinsurance faces escalating risks from climate change, with a notable increase in the frequency and intensity of natural disasters impacting its property and casualty portfolios. This trend necessitates a recalibration of risk assessment models and could lead to higher capital requirements to buffer against climate-induced volatility. The broader economic stability, which indirectly influences life and annuity lines, is also a concern.

For instance, 2023 saw insured losses from natural catastrophes globally estimated to be around $110 billion, according to Swiss Re, a significant figure that underscores the growing financial exposure. This environmental shift demands continuous adaptation in underwriting practices and investment strategies to maintain long-term portfolio resilience.

Environmental, Social, and Governance (ESG) factors are increasingly shaping investment strategies, particularly for alternative asset managers like Brookfield Reinsurance, a subsidiary of Brookfield Asset Management. ESG criteria now significantly influence asset selection and portfolio construction, pushing for investments that demonstrate strong sustainability practices.

Brookfield Reinsurance, mirroring its parent company's approach, is integrating ESG into its decision-making processes. This includes evaluating the environmental impact of assets and the social responsibility of companies, aiming to align with growing stakeholder demands for responsible investing.

Adopting robust ESG practices is not just about meeting stakeholder expectations; it's also a response to evolving regulatory landscapes. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) has set new standards for transparency in ESG investing, impacting global asset managers.

Brookfield Reinsurance, like other financial institutions, faces escalating regulatory demands concerning climate-related financial risks. Governments globally are implementing stricter disclosure requirements, pushing companies to quantify and report their exposure to climate change impacts. This means Brookfield Reinsurance must adapt its reporting frameworks to align with emerging standards, such as those from the Task Force on Climate-related Financial Disclosures (TCFD).

This regulatory push extends to investment mandates, encouraging or even requiring a shift towards environmentally sustainable assets. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) categorizes financial products based on their sustainability objectives, influencing investment flows. Brookfield Reinsurance needs to demonstrate how its investment strategies contribute to environmental goals to remain compliant and competitive in this evolving landscape.

Resource Scarcity and Operational Sustainability

Resource scarcity poses a growing challenge for the reinsurance sector, impacting the operational sustainability of underlying insurers. For instance, increasing water scarcity in certain regions could elevate the cost of property damage claims related to drought or wildfires, directly affecting the risk pools reinsurers underwrite. Brookfield Reinsurance, while a capital solutions provider, must consider how these environmental shifts influence the long-term viability and operating costs of the insurance companies it supports, potentially altering investment strategies in sectors heavily reliant on natural resources.

The company's own operational sustainability is also a factor. As of 2024, many financial institutions, including those in the reinsurance space, are increasingly focused on reducing their carbon footprint and enhancing energy efficiency. While specific data for Brookfield Reinsurance's direct operational footprint in this context is not publicly detailed, the broader industry trend points towards greater scrutiny of environmental, social, and governance (ESG) factors in investment and operational decisions. This includes managing the environmental impact of its own offices and business travel.

- Water Scarcity Impact: Regions facing severe water stress, such as parts of the American West and Australia, are experiencing increased agricultural losses and wildfire frequency, leading to higher claims for insurers and, by extension, reinsurers.

- Climate Change Adaptation Costs: The need for infrastructure adaptation to climate change, such as flood defenses or drought-resistant agriculture, will likely increase operational costs for many industries, influencing the risk profiles reinsurers assume.

- Renewable Energy Transition: While a move towards renewables can mitigate some resource scarcity issues, the transition itself requires significant capital investment and can introduce new operational risks and insurance needs for energy infrastructure projects.

Stakeholder Demand for Environmental Responsibility

Investors, clients, and employees are increasingly pressuring Brookfield Reinsurance to show a strong commitment to environmental responsibility. This trend is evident in the growing ESG (Environmental, Social, and Governance) investment market, which reached an estimated $37.8 trillion globally in 2024, according to the Global Sustainable Investment Alliance. Companies demonstrating robust sustainability initiatives are seeing a positive impact on their public perception and corporate reputation.

Meeting these stakeholder expectations can significantly enhance brand value and attract capital. For instance, a 2024 survey by Accenture found that 60% of consumers are more likely to buy from brands that are environmentally conscious. Brookfield Reinsurance's focus on sustainable underwriting practices and investments in renewable energy projects, such as its significant investments in wind and solar power, directly addresses this demand.

- Investor Scrutiny: Institutional investors, managing trillions in assets, are increasingly integrating environmental risk into their due diligence, impacting capital allocation decisions.

- Client Preferences: Corporate clients are seeking insurance partners who align with their own sustainability goals, influencing contract awards and renewals.

- Employee Engagement: A company's environmental stance is a key factor in attracting and retaining talent, with a significant portion of the workforce prioritizing employers with strong sustainability commitments.

The increasing frequency and severity of natural disasters, driven by climate change, directly impact Brookfield Reinsurance's property and casualty portfolios, necessitating robust risk modeling and potentially higher capital reserves. For example, global insured losses from natural catastrophes reached approximately $110 billion in 2023, highlighting the growing financial exposure.

Environmental, Social, and Governance (ESG) factors are now pivotal in investment strategies, with the global ESG market valued at an estimated $37.8 trillion in 2024, influencing asset selection and demanding alignment with sustainability practices.

Regulatory pressures, such as the EU's SFDR, are mandating greater transparency on climate-related financial risks, requiring Brookfield Reinsurance to adapt its reporting and investment strategies to support environmental goals and maintain market competitiveness.

Resource scarcity, like water stress in key regions, elevates operational costs and claims for industries, indirectly affecting the risk pools reinsurers underwrite and influencing Brookfield Reinsurance's investment decisions in resource-dependent sectors.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Brookfield Reinsurance is informed by a comprehensive review of data from leading financial institutions like Moody's and S&P, alongside reports from industry bodies and regulatory bodies. We also incorporate insights from economic forecasting firms and analyses of geopolitical trends.