Brookfield Reinsurance Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Reinsurance Bundle

Uncover the strategic brilliance behind Brookfield Reinsurance's marketing efforts. This analysis delves into their product innovation, competitive pricing, strategic distribution, and impactful promotional campaigns.

Go beyond the surface and gain a comprehensive understanding of how Brookfield Reinsurance leverages its 4Ps for market dominance. This detailed report is your key to unlocking actionable insights.

Save valuable time and effort with our ready-made, editable 4Ps Marketing Mix Analysis for Brookfield Reinsurance. Perfect for professionals and students seeking strategic depth and practical application.

Product

Brookfield Reinsurance's capital solutions for insurers, particularly in the life and annuity sectors, are a cornerstone of their offering. These solutions aim to bolster the financial strength and operational efficiency of insurance companies, allowing them to navigate complex regulatory environments and market dynamics. For instance, in 2024, the demand for such solutions surged as insurers sought to de-risk their balance sheets and improve capital allocation.

The product suite is tailored to meet the specific, often intricate, financial requirements of the insurance industry. This includes services that help manage capital, optimize risk, and facilitate strategic growth. As of the first half of 2025, Brookfield Reinsurance has been instrumental in facilitating significant reinsurance transactions, demonstrating their capacity to absorb substantial blocks of business and provide much-needed capital relief to their partners.

Brookfield Reinsurance's core offering is the reinsurance of life and annuity liabilities. This service enables primary insurers to offload a portion of their risk and obligations, thereby improving their capital position and financial maneuverability. For instance, in 2023, Brookfield Reinsurance completed a significant transaction reinsuring $1.3 billion of annuity liabilities for a major US insurer, demonstrating their capacity to handle substantial blocks of business and provide essential balance sheet relief.

Brookfield Reinsurance's distinct advantage lies in its deep integration of Brookfield Asset Management's vast alternative investment knowledge. This synergy allows them to actively enhance returns on reinsured assets, offering clients a compelling value proposition. For instance, as of Q1 2024, Brookfield Asset Management managed over $925 billion in assets, a significant portion of which is allocated to alternative strategies like infrastructure and private equity, directly benefiting Brookfield Reinsurance's product offerings.

This robust investment capability is the bedrock of Brookfield Reinsurance's ability to deliver complex, enduring financial solutions. Their expertise in navigating diverse alternative asset classes, from real estate to credit, empowers them to structure products that meet sophisticated, long-term client needs, a critical factor in the evolving reinsurance landscape.

Pension Risk Transfer (PRT) Solutions

Brookfield Reinsurance's Pension Risk Transfer (PRT) solutions offer a critical service for defined benefit pension plan sponsors. By transferring liabilities to Brookfield Reinsurance, companies can effectively de-risk their pension obligations, significantly reducing financial volatility and improving balance sheet stability. This strategic move allows businesses to focus on core operations rather than managing complex, long-term pension liabilities.

The PRT market is experiencing substantial growth, making it a key focus for Brookfield Reinsurance. This expansion is underscored by their active participation in significant transactions. For instance, in 2023, the PRT market saw record activity, with estimates suggesting over $50 billion in U.S. pension plan liabilities were transferred. Brookfield Reinsurance has been a notable player in this burgeoning sector.

- De-risking Strategy: PRT allows plan sponsors to offload the financial and administrative burden of defined benefit pension plans.

- Market Growth: The PRT market is expanding rapidly, with significant deal volume observed in 2023 and continuing into 2024.

- Financial Stability: Transferring liabilities helps companies reduce financial volatility and improve their risk profile.

- Brookfield's Role: Brookfield Reinsurance is actively engaged in this growing market, facilitating these de-risking transactions.

Wealth Protection and Retirement Services

Brookfield Reinsurance's "Product" offering extends beyond traditional reinsurance, notably with its expanded wealth protection and retirement services. This strategic move, significantly bolstered by the 2024 acquisition of American Equity Investment Life (AEL), positions the company as a major player in the North American annuity market. The integration of AEL's substantial annuity business diversifies Brookfield Reinsurance's revenue streams and broadens its appeal to individuals seeking retirement income solutions.

This expansion allows Brookfield Reinsurance to cater to a wider array of financial needs, from capital management for insurers to individual retirement planning. The company is now a significant provider of fixed indexed annuities (FIAs) and other annuity products, aiming to capture a larger share of the growing retirement market. For instance, AEL reported approximately $60 billion in total assets as of the first quarter of 2024, highlighting the scale of this product diversification.

- Annuity Market Expansion: Following the AEL acquisition, Brookfield Reinsurance is now a leading provider of annuities in North America.

- Diversified Offerings: The company provides a broader range of wealth protection products, including fixed indexed annuities, catering to individual retirement needs.

- Acquisition Impact: The integration of American Equity Investment Life significantly scaled Brookfield Reinsurance's presence in the retirement services sector.

- Asset Growth: AEL's approximately $60 billion in assets as of Q1 2024 underscores the substantial growth in Brookfield Reinsurance's product portfolio.

Brookfield Reinsurance's product strategy centers on providing capital-efficient solutions for insurers and expanding its direct-to-consumer annuity offerings. The acquisition of American Equity Investment Life in 2024 significantly bolstered its presence in the North American annuity market, particularly with fixed indexed annuities. This move allows Brookfield Reinsurance to leverage its investment management expertise to enhance returns on reinsured assets and cater to the growing demand for retirement income solutions.

| Product Area | Key Offering | Target Market | 2024/2025 Data Point | Strategic Importance |

|---|---|---|---|---|

| Reinsurance Solutions | Life & Annuity Liability Reinsurance | Primary Insurers | Facilitated $1.3 billion in annuity liabilities reinsurance in 2023. | Capital relief and de-risking for insurers. |

| Pension Risk Transfer (PRT) | Defined Benefit Pension Liability Transfer | Corporations with Pension Plans | PRT market saw over $50 billion in US liabilities transferred in 2023. | De-risking and balance sheet stability for plan sponsors. |

| Retirement Services | Fixed Indexed Annuities (FIAs) | Individual Retirees | American Equity Investment Life had ~$60 billion in assets as of Q1 2024. | Diversification and direct access to the retirement market. |

What is included in the product

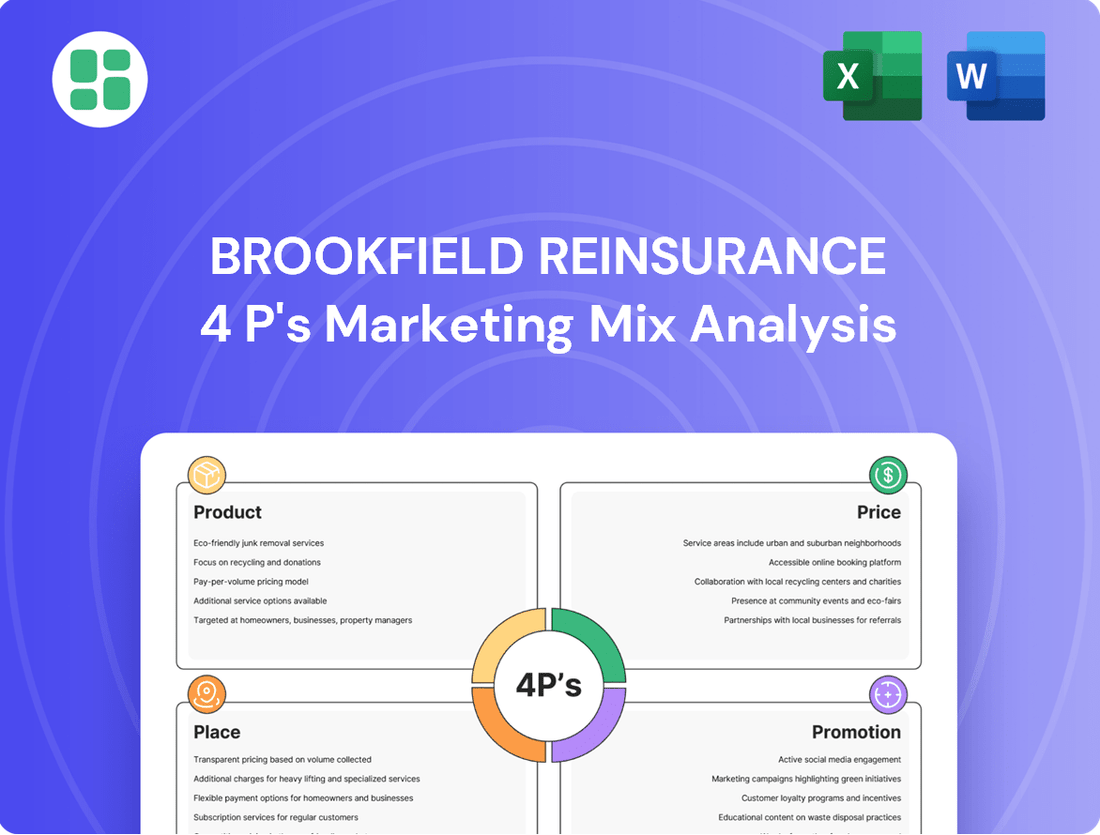

This analysis offers a comprehensive breakdown of Brookfield Reinsurance's marketing mix, detailing their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking to understand Brookfield Reinsurance's market positioning and benchmark their own strategies against a leading player.

Streamlines the complex Brookfield Reinsurance 4Ps analysis into a clear, actionable framework, alleviating the pain of deciphering intricate marketing strategies.

Provides a concise and easily understandable overview of Brookfield Reinsurance's 4Ps, simplifying marketing communication and decision-making for all stakeholders.

Place

Brookfield Reinsurance leverages direct institutional relationships as a cornerstone of its distribution strategy for complex capital solutions. This B2B approach focuses on forging deep connections with insurance companies and other institutional clients, ensuring tailored service delivery.

The company's sales and relationship management teams directly engage with senior executives and key decision-makers within target organizations. This direct model is crucial for understanding and addressing the intricate needs of their sophisticated client base, a strategy that has proven effective in securing significant deals, such as the $1.1 billion annuity transaction with American Equity Investment Life Holding Company in 2023.

Brookfield Reinsurance strategically expands its market reach and distribution channels through key acquisitions. A prime example is the 2023 acquisition of American Equity Investment Life (AEL). This move significantly boosted their insurance assets under management, reaching approximately $63 billion as of the first quarter of 2024, and importantly, integrated AEL's established distribution network.

This integration provides Brookfield Reinsurance with direct access to AEL's extensive network of independent agents, advisors, banks, and broker-dealers. This allows for a more efficient and widespread distribution of their annuity products, enhancing their competitive position in the U.S. market.

Brookfield Reinsurance boasts a significant global presence, with key operations established in Bermuda, the United States, Canada, and the Cayman Islands. This strategic positioning allows them to navigate diverse regulatory landscapes and cater to a broad spectrum of clients.

The company is actively pursuing expansion into new territories, with a notable focus on entering the Japanese market. This move signifies their commitment to broadening their reach and capitalizing on emerging growth opportunities worldwide.

Leveraging Parent Company's Ecosystem

Brookfield Reinsurance thrives by tapping into the vast Brookfield ecosystem. This means leveraging the established networks and deep relationships of Brookfield Asset Management and Brookfield Corporation, which significantly aids in finding new business opportunities and effectively deploying capital. This affiliation acts as an indirect but powerful distribution channel, benefiting from the pre-existing trust and strong market presence built by its parent entities.

This symbiotic relationship provides tangible benefits. For instance, Brookfield Asset Management's global reach, managing over $925 billion in assets as of Q1 2024, offers Brookfield Reinsurance unparalleled access to potential clients and investment avenues. This integration allows for more efficient capital allocation and risk management, drawing upon the collective expertise and market intelligence across the entire Brookfield group.

- Access to Established Client Base: Brookfield Asset Management's extensive client roster provides a natural pool of potential reinsurance clients.

- Enhanced Capital Deployment: The group's diverse investment platforms offer Brookfield Reinsurance a wider array of opportunities to deploy its capital effectively.

- Brand Synergy and Trust: The strong reputation of Brookfield Asset Management and Brookfield Corporation transfers to Brookfield Reinsurance, fostering immediate credibility.

- Operational Efficiencies: Shared resources and expertise within the Brookfield ecosystem can lead to cost savings and improved operational performance.

Tailored Solutions Delivery

Brookfield Reinsurance's 'Place' extends beyond physical locations to encompass the customized delivery of its financial solutions. This involves a bespoke approach, where capital solutions and reinsurance services are precisely engineered to meet the unique risk appetites and strategic objectives of each client. The delivery mechanism is inherently relationship-driven, relying on direct engagement and specialized expertise to structure and manage complex, long-term financial partnerships.

The implementation of these tailored solutions requires dedicated teams who work closely with clients, often involving intricate negotiations and the development of unique contractual frameworks. This personalized approach ensures that the 'place' of service delivery is not a one-size-fits-all model but rather a dynamic and responsive engagement designed for optimal client outcomes.

- Customized Delivery Channels: Solutions are delivered through direct consultation and dedicated client relationship teams, reflecting the bespoke nature of reinsurance and capital solutions.

- Specialized Expertise Deployment: Implementation involves specialized teams with deep knowledge of client-specific risk profiles and financial needs, ensuring precise execution.

- Long-Term Partnership Focus: The 'place' signifies the ongoing, collaborative relationship management required for complex, long-dated financial arrangements.

- Global Reach with Localized Service: While operating globally, Brookfield Reinsurance ensures that service delivery is localized and responsive to the specific regulatory and market nuances of each client's jurisdiction.

Brookfield Reinsurance's 'Place' as a marketing mix element centers on its strategic global presence and its deep integration within the broader Brookfield ecosystem. This dual focus allows for both direct market access and indirect, relationship-driven distribution. The company's operational footprint spans key financial hubs like Bermuda, the United States, Canada, and the Cayman Islands, facilitating navigation of diverse regulatory environments. Furthermore, leveraging the extensive network of Brookfield Asset Management, which managed over $925 billion in assets as of Q1 2024, provides unparalleled access to potential clients and capital deployment opportunities.

| Geographic Presence | Key Markets | Asset Management (Brookfield Group) | Recent Expansion Focus |

|---|---|---|---|

| Global Operations | Bermuda, USA, Canada, Cayman Islands | >$925 billion (Q1 2024) | Japan |

| Distribution Channels | Direct Institutional Relationships, Acquired Networks (e.g., AEL) | Brookfield Ecosystem Leverage | N/A |

Same Document Delivered

Brookfield Reinsurance 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This detailed Brookfield Reinsurance 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain a comprehensive understanding of their market approach.

Promotion

Brookfield Reinsurance's promotional strategy heavily emphasizes relationship-based marketing and sales. This means they focus on building and nurturing strong, lasting connections with their institutional clients, understanding that trust and expertise are paramount in the complex world of reinsurance.

Their approach is highly personalized, utilizing dedicated client-facing teams and direct sales efforts. This direct engagement allows them to deeply understand client needs and demonstrate their capabilities in providing sophisticated financial solutions, fostering loyalty and repeat business.

For instance, in 2024, Brookfield Reinsurance reported a significant portion of its new business originated from existing client relationships, underscoring the effectiveness of this strategy. This focus on ongoing dialogue and support is crucial for securing long-term partnerships in a competitive market.

Brookfield Reinsurance actively cultivates its image as an industry leader by sharing expert perspectives on critical insurance topics like capital management, risk transfer, and alternative investments. This commitment to thought leadership is evident in their published insights, which aim to inform and guide stakeholders within the insurance sector.

The company leverages participation in key industry conferences and forums as a vital promotional avenue. These events provide a platform to demonstrate their deep expertise and highlight innovative solutions, reinforcing their position as a knowledgeable and forward-thinking player in the reinsurance market.

Brookfield Reinsurance's promotion heavily leverages its status as a publicly traded entity, with dual listings on the NYSE and TSX under ticker BNRE (soon to be BNT). This transparency is key to its marketing mix, ensuring potential investors have access to crucial information. For instance, in its Q1 2024 results, the company reported distributable earnings of $292 million, demonstrating its operational performance and financial health.

The company actively engages in robust investor relations, a cornerstone of its promotional strategy. This includes providing regular financial reporting, detailed annual reports, and hosting quarterly earnings calls. These communications are vital for conveying Brookfield Reinsurance's financial strength, strategic objectives, and the inherent value it offers to its stakeholders.

Furthermore, adherence to regulatory filing requirements, such as those with the SEC and SEDAR, is a critical promotional tool. These filings, like the latest 10-Q and 20-F reports, offer a comprehensive view of the company's financial position and operational activities, reinforcing its commitment to transparency and building investor confidence in its long-term prospects.

Strategic Communications and Announcements

Brookfield Reinsurance leverages strategic communications to highlight significant business developments, such as its acquisition of American Equity Investment Life Holding Company (AEL) for approximately $3.8 billion, completed in March 2024. These announcements, often distributed via press releases and business wire services, effectively showcase the company's growth trajectory, enhanced capabilities, and strengthened market positioning to a wide array of stakeholders.

The company's proactive communication strategy aims to inform investors, partners, and the broader financial community about its strategic advancements. For instance, the successful integration of Argo Group, following its acquisition, is positioned as a key factor in expanding Brookfield Reinsurance's global reach and product offerings.

These communications serve a dual purpose: informing the market and actively promoting the company's value proposition. By detailing major acquisitions and strategic alliances, Brookfield Reinsurance reinforces its image as an expanding and capable player in the insurance and reinsurance sector.

- Acquisition Impact: The AEL acquisition, valued at roughly $3.8 billion, significantly bolstered Brookfield Reinsurance's annuity business in 2024.

- Market Signaling: Announcements of partnerships and acquisitions are designed to signal market strength and strategic foresight to investors and competitors.

- Capability Enhancement: Communications often emphasize how new ventures, like the integration of Argo Group, expand the company's operational capabilities and service offerings.

- Stakeholder Engagement: Official press releases and wire services are critical tools for transparently engaging with a diverse base of stakeholders, including shareholders and potential business partners.

Branding and Corporate Identity (e.g., Name Change)

Brookfield Reinsurance is strategically evolving its brand identity with a proposed name change to Brookfield Wealth Solutions. This move underscores the company's expansion beyond traditional reinsurance into a wider array of wealth and retirement management services. The rebranding signals a commitment to a more comprehensive market positioning, aiming to attract a broader client base by highlighting its diversified financial solutions.

This name change is a critical component of their marketing strategy, designed to align public perception with their evolving business model. By emphasizing wealth solutions, Brookfield Reinsurance is setting the stage to capitalize on the growing demand for integrated financial planning and retirement income products. For instance, the global retirement solutions market is projected to reach over $10 trillion by 2027, presenting a significant opportunity for a rebranded entity focused on this space.

- Strategic Alignment: The proposed name change from Brookfield Reinsurance to Brookfield Wealth Solutions directly supports the 'Promotion' aspect of the 4Ps by clearly communicating the company's expanded service offerings.

- Market Perception: This rebranding aims to cultivate a more inclusive and diversified market perception, moving beyond the often-niche perception of pure reinsurance.

- Growth Opportunity: The shift reflects a strategic push into the burgeoning wealth and retirement solutions sector, a market segment experiencing robust growth.

- Competitive Positioning: By adopting a name that better reflects its capabilities, Brookfield aims to enhance its competitive positioning against other financial services firms offering similar integrated solutions.

Brookfield Reinsurance's promotional efforts are deeply rooted in building strong relationships and demonstrating expertise. Their direct sales approach and focus on client-specific solutions foster loyalty, with a significant portion of new business in 2024 originating from existing relationships.

The company actively positions itself as an industry leader through thought leadership content and participation in key industry events, reinforcing its knowledge in areas like capital management and risk transfer.

Transparency through public listings (NYSE, TSX: BNRE/BNT) and robust investor relations, including detailed financial reports and earnings calls, is a core promotional pillar, showcasing financial health and strategic direction. For example, Q1 2024 distributable earnings were $292 million.

Major strategic moves, such as the $3.8 billion acquisition of American Equity Investment Life Holding Company in March 2024, are actively communicated to highlight growth and enhanced capabilities.

| Promotional Activity | Key Focus | 2024/2025 Relevance |

|---|---|---|

| Relationship Marketing | Building trust and long-term client connections | Drives repeat business and new client acquisition |

| Thought Leadership | Sharing expert insights on industry trends | Establishes brand as knowledgeable and forward-thinking |

| Investor Relations | Transparent financial reporting and communication | Builds investor confidence and showcases financial strength |

| Strategic Announcements | Highlighting acquisitions and business developments | Demonstrates growth trajectory and market positioning |

Price

Brookfield Reinsurance employs value-based pricing for its bespoke capital solutions, meaning fees are directly tied to the unique value and benefits delivered to institutional clients. This approach eschews a one-size-fits-all model, instead focusing on the specific risk transfer, capital optimization, and return enhancement achieved through their tailored reinsurance strategies.

For instance, in 2024, a significant portion of their business involved complex, multi-year reinsurance treaties for large insurers seeking to de-risk their balance sheets. The pricing for these arrangements reflected the substantial capital relief and improved solvency ratios provided, with fees reflecting the long-term certainty and financial engineering involved.

Brookfield Reinsurance's pricing strategy hinges on rigorous risk assessment and actuarial modeling. These sophisticated tools meticulously evaluate the liabilities they reinsure, alongside the proposed investment strategies for those assets. This granular approach ensures that premiums accurately capture the inherent risks, anticipated returns, and the long-term financial obligations associated with each contract.

For instance, in 2024, the reinsurer might price a block of annuity business by projecting mortality rates, lapse assumptions, and investment yields over decades. A key factor is the correlation between asset performance and liability payouts. If interest rates are projected to remain volatile, as seen in early 2024 with the Federal Reserve's evolving stance, the pricing models will incorporate wider potential deviations, demanding higher premiums to buffer against adverse market movements.

Brookfield Reinsurance navigates a competitive market for its reinsurance and capital solutions, where pricing is a key differentiator. While each solution is tailored, the company actively monitors and responds to prevailing rates and terms offered by competitors in both the reinsurance and broader capital markets.

The company's pricing strategy aims for a sweet spot, offering terms that are attractive to clients while still meeting Brookfield Reinsurance's internal return objectives. This balancing act is crucial for securing deals in a dynamic environment, with 2024 and early 2025 seeing continued demand for capital solutions driven by regulatory changes and evolving risk management needs.

Long-Term Partnership Considerations

Brookfield Reinsurance's pricing strategies are designed to cultivate long-term relationships, moving beyond single transactions. This approach prioritizes client retention and mutual growth by offering adaptable terms that can be adjusted as client requirements and market dynamics shift. For instance, pricing might include performance-based components or tiered structures that reward sustained engagement.

This long-term perspective is crucial in the reinsurance market, where stability and predictable partnerships are highly valued. By aligning their pricing with client success, Brookfield Reinsurance aims to build trust and ensure a consistent revenue stream. This strategy is supported by the company's robust capital base and its ability to offer tailored solutions that address complex, multi-year risks.

- Focus on Lifetime Value: Pricing models are structured to maximize the value derived from a client relationship over its entire duration, not just the initial contract.

- Flexible Contract Structures: Offering options like adjustable premiums, profit-sharing arrangements, or phased payments accommodates evolving client needs and financial capacities.

- Partnership Incentives: Pricing can include incentives for long-term commitment, such as reduced rates or enhanced coverage for clients who renew or expand their business.

- Market Adaptability: Pricing frameworks are designed to be responsive to changes in economic conditions, regulatory environments, and the specific risk profiles of clients.

Leveraging Investment Spreads

Brookfield Reinsurance leverages investment spreads as a core element of its value proposition, influencing its pricing indirectly. Their capacity to achieve superior investment spreads by allocating assets to higher-yielding alternative strategies, expertly managed by Brookfield Asset Management, is a significant differentiator. This strategic deployment allows them to provide competitive reinsurance terms to clients while simultaneously securing attractive returns for the company itself.

This ability to generate enhanced spreads is crucial for their market positioning. For instance, in 2024, Brookfield Reinsurance has continued to emphasize its alternative asset capabilities. Their reported net investment income for Q1 2024 demonstrated the benefits of this strategy, with a notable portion stemming from their diverse portfolio. This financial strength underpins their competitive pricing in the reinsurance market.

The impact on their pricing strategy is evident in their ability to offer more favorable terms compared to competitors who may not have access to similar high-return alternative investment avenues. This creates a virtuous cycle: superior investment performance enables competitive pricing, which in turn attracts more business, further enhancing their asset deployment opportunities and spread generation.

- Superior Investment Spreads: Achieved through deployment into higher-yielding alternative strategies managed by Brookfield Asset Management.

- Competitive Reinsurance Terms: Enabled by the enhanced investment returns, allowing for more attractive pricing for clients.

- Attractive Returns: Maintaining robust profitability for Brookfield Reinsurance itself.

- Market Differentiation: Setting them apart from competitors lacking similar alternative asset access.

Brookfield Reinsurance's pricing is fundamentally value-based, directly linking fees to the unique benefits delivered to institutional clients, such as capital relief and enhanced solvency. This bespoke approach, evident in their 2024 transactions for insurers, reflects the complexity and long-term certainty of their tailored reinsurance strategies.

The company's pricing is underpinned by rigorous actuarial modeling and risk assessment, ensuring premiums accurately reflect liabilities, investment strategies, and long-term obligations. For example, pricing a block of annuity business in 2024 involved projecting mortality and lapse rates over decades, with models adjusting for market volatility, such as interest rate fluctuations seen early in the year.

Brookfield Reinsurance aims to balance client attractiveness with its own return objectives, a crucial strategy in a competitive market. Their pricing is designed for long-term relationships, incorporating flexible structures and incentives for sustained engagement, as seen in their approach to multi-year risk management solutions throughout 2024 and into early 2025.

A key differentiator influencing their pricing is the ability to generate superior investment spreads through Brookfield Asset Management's alternative strategies. This financial strength, demonstrated by their Q1 2024 net investment income, allows them to offer competitive reinsurance terms while securing attractive returns, setting them apart from competitors.

| Pricing Strategy Element | Description | 2024/2025 Relevance | Impact on Client | Impact on Brookfield Reinsurance |

|---|---|---|---|---|

| Value-Based Pricing | Fees tied to delivered value and benefits. | Key for bespoke capital solutions. | Fair pricing for tailored solutions. | Ensures profitability aligned with client success. |

| Risk & Actuarial Rigor | Detailed modeling of liabilities and investments. | Crucial for complex, long-term treaties. | Accurate reflection of risk and obligation. | Mitigates financial exposure. |

| Long-Term Relationship Focus | Flexible terms, performance incentives. | Cultivates client retention and growth. | Adaptable and rewarding partnership. | Secures consistent revenue streams. |

| Investment Spread Leverage | Utilizing alternative asset performance. | Differentiator enabling competitive terms. | More attractive pricing and terms. | Enhanced profitability and market positioning. |

4P's Marketing Mix Analysis Data Sources

Our Brookfield Reinsurance 4P's Marketing Mix Analysis is meticulously crafted using a blend of primary and secondary data sources. We leverage official company disclosures, including investor relations materials and annual reports, alongside proprietary market research and industry-specific databases to capture the nuances of their product offerings, pricing strategies, distribution channels, and promotional activities.