Brookfield Reinsurance Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Reinsurance Bundle

Brookfield Reinsurance navigates a landscape shaped by intense competition and significant buyer power, with the threat of substitutes also posing a notable challenge. Understanding these forces is crucial for any stakeholder looking to grasp their strategic positioning.

The complete report reveals the real forces shaping Brookfield Reinsurance’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Brookfield Reinsurance's reliance on Brookfield Asset Management for investment strategy significantly curtails the bargaining power of external investment managers. This internal synergy means traditional service providers have limited leverage, as their services are not central to the core operational model.

While specialized services like actuarial or legal support are sometimes outsourced, these costs are a minor component of the overall expense structure. The availability of numerous providers for these niche functions further dilutes any single supplier's ability to exert significant price or term influence.

Brookfield Reinsurance's position within the larger Brookfield Asset Management structure grants it significant advantages in accessing capital. This means they aren't solely reliant on traditional bank loans or public debt markets, which can be volatile. For instance, Brookfield Asset Management itself managed approximately $850 billion in assets as of the end of 2023, demonstrating a vast pool of resources and established relationships across various financial sectors.

This broad access to capital, encompassing both internal Brookfield funds and a wide array of external financial markets, significantly reduces Brookfield Reinsurance's dependence on any single financial institution. When a company can tap into multiple funding avenues, the bargaining power of individual capital providers, or "suppliers" in this context, is inherently weakened. They are less able to dictate terms when alternatives are readily available.

Data and technology vendors hold moderate bargaining power over Brookfield Reinsurance. Specialized software for data analytics, AI, and risk modeling is vital for today's reinsurance business, and certain vendors provide unique, indispensable solutions.

However, the broader market for enterprise software and data services is quite competitive. This competition allows Brookfield to negotiate favorable pricing and terms. Furthermore, the ability to switch providers if necessary effectively moderates the influence these suppliers can exert.

In 2024, the increasing reliance on advanced analytics in the insurance sector means that vendors of cutting-edge AI and risk modeling tools could see their power strengthen. Yet, Brookfield's scale and diversification across various technology needs provide significant leverage in these negotiations.

Talent pool for specialized roles

The bargaining power of suppliers in the context of the talent pool for specialized roles at Brookfield Reinsurance is influenced by the availability of highly skilled actuaries, underwriters, and investment professionals. These individuals are essential for the company's core operations.

While these specialized skills are critical inputs, the global nature of the talent market and Brookfield's established reputation as an employer of choice help to moderate the bargaining power of individual employees or smaller, specialized recruitment firms. For instance, in 2024, the demand for actuaries remained robust, with many firms competing for top talent, yet Brookfield's brand recognition often allows it to attract candidates without excessive concessions.

- Global Talent Availability: The international availability of specialized insurance and finance professionals helps dilute the power of any single supplier or recruitment agency.

- Employer Branding: Brookfield Reinsurance's strong reputation as a desirable employer can attract talent, reducing reliance on niche, high-cost recruitment channels.

- Industry Demand: While demand for these roles is high, the presence of multiple large financial institutions also means that talent has options, creating a dynamic but not entirely supplier-dominated market.

Regulators as indirect suppliers of operating licenses

Regulators act as crucial, albeit indirect, suppliers by granting the operating licenses and establishing the frameworks essential for reinsurance companies like Brookfield Reinsurance. Their power is exceptionally high because adherence to regulations is non-negotiable; failure to comply can result in significant penalties or the complete inability to operate.

This unique supplier dynamic means that reinsurance firms cannot directly negotiate terms with regulatory bodies in the way they might with traditional suppliers. The cost of compliance, capital requirements, and operational standards are set by these authorities, directly impacting a reinsurer's cost structure and strategic flexibility.

- Regulatory Approval as a Prerequisite: Brookfield Reinsurance, like all entities in the sector, requires licenses from various regulatory bodies to conduct its business, making these regulators indispensable suppliers of operational legitimacy.

- High Barrier to Entry and Operation: The stringent requirements and oversight imposed by regulators create a significant barrier to entry and ongoing operation, underscoring their substantial power.

- Mandatory Compliance and Penalties: Non-compliance with regulatory mandates, such as solvency capital requirements or reporting standards, can lead to severe financial penalties, operational restrictions, or even license revocation, demonstrating the ultimate leverage regulators hold.

- Limited Negotiation Power: Unlike typical suppliers, reinsurers have virtually no ability to negotiate the terms of these essential licenses or the regulatory frameworks themselves, as they are dictated by public policy and financial stability objectives.

Brookfield Reinsurance faces limited bargaining power from traditional external investment managers due to its integration with Brookfield Asset Management. While specialized outsourced services like actuarial or legal support are necessary, they represent a small cost fraction, and the availability of multiple providers dilutes any single supplier's leverage.

The company's access to capital is broad, drawing from Brookfield Asset Management's significant resources, estimated at $850 billion in assets under management by the end of 2023. This reduces reliance on any single financial institution, weakening the bargaining power of individual capital providers.

Data and technology vendors hold moderate power, as specialized analytics and AI solutions are critical. However, market competition allows Brookfield to negotiate favorable terms and switch providers if needed, moderating supplier influence.

In 2024, the demand for specialized talent like actuaries remains high, but Brookfield's strong employer brand and global talent pool access help mitigate the bargaining power of individual professionals or recruitment agencies.

What is included in the product

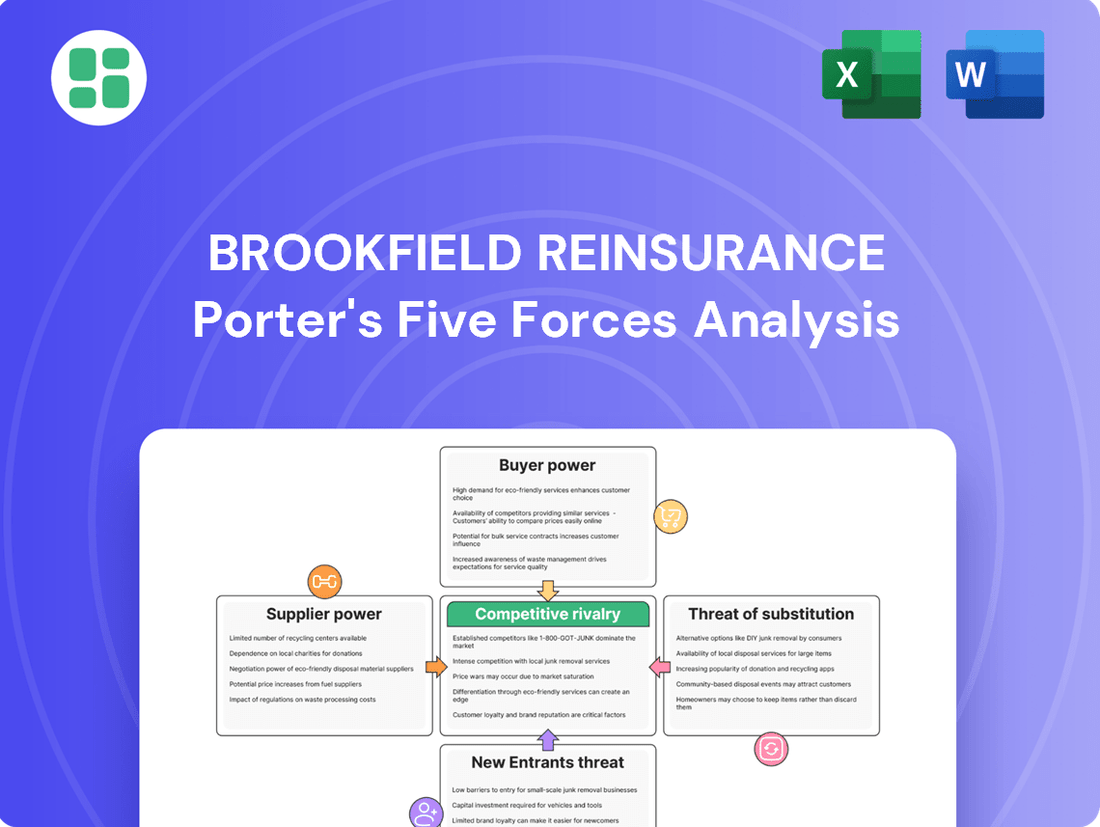

This Porter's Five Forces analysis for Brookfield Reinsurance examines the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the availability of substitutes within the reinsurance market.

Effortlessly identify and mitigate competitive threats with a visual breakdown of Brookfield Reinsurance's Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Brookfield Reinsurance's customers are primarily large, sophisticated insurance companies. These clients possess considerable financial expertise and significant negotiating power due to their scale and market knowledge. For instance, major insurance firms often manage substantial asset portfolios themselves, giving them a deep understanding of reinsurance pricing and terms.

These sophisticated clients typically maintain relationships with multiple reinsurers. This allows them to readily compare pricing, coverage options, and service levels across the industry. Consequently, they can effectively leverage this competitive landscape to secure more favorable terms and customized solutions, directly impacting Brookfield Reinsurance's pricing power.

While customers in the reinsurance market are highly sophisticated, the sheer complexity of managing large, long-term life and annuity blocks means switching reinsurers is not a simple task. The administrative, legal, and operational hurdles involved are substantial, creating a significant barrier to immediate change.

These high switching costs effectively foster a degree of relationship stickiness for Brookfield Reinsurance. Once a complex agreement is established, the customer's immediate ability to exert bargaining power diminishes due to the inherent difficulties and expenses associated with moving their business elsewhere.

The availability of alternative reinsurance providers in the life and annuity sector, including both large, diversified reinsurers and specialized, niche players, grants customers significant leverage. This competitive landscape allows cedents to compare offerings and negotiate more favorable terms, directly impacting Brookfield Reinsurance's pricing power.

Strategic importance of capital solutions

Brookfield Reinsurance's capital solutions are vital for insurers needing to meet solvency requirements, improve capital efficiency, and transfer risk. This strategic necessity means clients prioritize dependable, long-term relationships over solely seeking the lowest price, thereby reducing their bargaining power.

For instance, in 2024, the increasing regulatory scrutiny on insurer solvency, particularly in regions like the EU with Solvency II, drives demand for sophisticated capital management tools. Brookfield's ability to provide these solutions positions them as a partner whose expertise and reliability are highly valued, limiting the customer's leverage for aggressive price concessions.

- Strategic Capital Needs: Insurers require solutions for solvency, capital optimization, and risk transfer.

- Partner Reliability: Clients seek stable, long-term relationships, valuing expertise over price alone.

- Reduced Price Sensitivity: The critical nature of these services lessens the impact of customer price negotiations.

- Market Trends: Growing regulatory pressures in 2024 amplify the demand for Brookfield's specialized offerings.

Customer concentration and scale

Brookfield Reinsurance's customer base, while diverse, can exhibit significant bargaining power due to concentration. Large, strategic deals with major insurance companies, for instance, can represent a substantial portion of the company's revenue. This concentration means that a few key clients hold considerable sway, making customer retention and satisfaction absolutely critical for Brookfield.

The scale of these transactions amplifies customer leverage. For example, if a single large insurance contract accounts for over 10% of Brookfield's annual recurring revenue, that client gains significant bargaining power. This necessitates a proactive approach to managing these relationships, ensuring value delivery and competitive pricing to mitigate churn risk.

- Customer Concentration: A few major insurance clients could represent a disproportionately large share of Brookfield Reinsurance's revenue.

- Increased Bargaining Power: This concentration grants these large clients greater leverage in negotiations.

- Focus on Retention: Brookfield must prioritize customer satisfaction and value to retain these key accounts.

- Risk of Churn: Losing even one major client could significantly impact financial performance.

Brookfield Reinsurance's customers, primarily large insurers, possess substantial bargaining power due to their financial sophistication and the competitive reinsurance market. However, the complexity and cost of switching reinsurers create significant switching costs, which can diminish this power once a contract is in place. Furthermore, the critical need for reliable capital solutions, especially with increasing regulatory pressures in 2024, often makes clients prioritize stability and expertise over price alone, thereby reducing their leverage.

| Factor | Impact on Bargaining Power | Brookfield Reinsurance's Position |

|---|---|---|

| Customer Sophistication | High | Clients understand pricing and terms well. |

| Switching Costs | Lowers power once engaged | High administrative and operational hurdles for clients to change reinsurers. |

| Need for Capital Solutions | Lowers power | Insurers rely on Brookfield for solvency and risk transfer, valuing reliability. |

| Market Competition | High | Availability of alternative reinsurers allows clients to compare and negotiate. |

Preview Before You Purchase

Brookfield Reinsurance Porter's Five Forces Analysis

This preview showcases the complete Brookfield Reinsurance Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning within the industry. You're looking at the actual document; once your purchase is complete, you'll gain instant access to this exact, professionally formatted file, ready for immediate use.

Rivalry Among Competitors

The life and annuity reinsurance market is a mature landscape dominated by established global giants such as Swiss Re, Munich Re, and Hannover Re. These formidable competitors bring substantial capital reserves, deep industry experience, and extensive client networks to the table, creating a highly competitive environment.

These well-established reinsurers offer comprehensive service portfolios and have cultivated enduring relationships with primary insurers, making it challenging for newer entrants to gain significant market share. For instance, in 2023, Swiss Re reported gross written premiums of $50.7 billion, highlighting its substantial market presence and competitive capacity.

Brookfield Reinsurance distinguishes itself by harnessing Brookfield Asset Management's extensive knowledge in alternative investments, aiming for superior returns. This specialized approach lessens direct price competition by offering a unique advantage.

While this strategy provides a competitive edge, rivals might attempt to mirror these capabilities or forge partnerships to gain access to similar expertise. For instance, as of the first quarter of 2024, Brookfield Asset Management managed $803 billion in assets, a significant portion of which is in alternative strategies, showcasing the scale of their differentiated offering.

The reinsurance sector demands substantial capital, with major players like Munich Re and Swiss Re holding tens of billions in capital reserves. For instance, in 2024, Swiss Re reported total equity of approximately $35 billion, underscoring the immense financial commitment required. This capital intensity, coupled with stringent regulatory oversight globally, creates formidable barriers, effectively limiting the number of new entrants and concentrating market power among established, well-funded entities.

Focus on long-term, complex liabilities

Brookfield Reinsurance's strategic focus on long-term life and annuity liabilities creates a concentrated competitive landscape. This specialization demands deep actuarial and risk management expertise, limiting the pool of potential rivals to those with similar capabilities and a strong appetite for complex, long-dated risks.

The rivalry in this niche is therefore more strategic than transactional. Competitors are not just bidding on deals; they are engaging in sophisticated risk assessment and capital allocation, often through reinsurance treaties or block acquisitions. This dynamic is evident in the increasing number of reinsurers actively seeking to acquire or reinsure legacy blocks of business, as seen in the robust M&A activity within the life and annuity reinsurance sector.

- Specialized Expertise: Competition centers on firms with proven actuarial and risk management prowess in handling long-term life and annuity contracts.

- Strategic Rivalry: Competitors engage in complex risk assessment and capital management rather than simple price competition.

- Concentrated Market: The niche nature of these liabilities attracts a limited number of highly specialized reinsurers.

- M&A Activity: The sector sees significant merger and acquisition activity as firms seek to expand their capabilities in managing legacy blocks.

Market growth and consolidation trends

The life and annuity reinsurance market is experiencing robust growth, fueled by insurers' ongoing need for capital relief and efficient risk transfer. This expansion, however, is paralleled by significant consolidation. For instance, in 2023, the U.S. life reinsurance market saw several notable transactions, with companies actively acquiring blocks of business to achieve scale and operational efficiencies.

This dual trend of growth and consolidation intensifies competitive rivalry. Companies are not only competing for new client acquisitions but also for the acquisition of existing business portfolios through mergers and acquisitions. This M&A activity is a key driver of competitive pressure, as firms seek to gain market share and enhance their competitive positioning.

- Market Growth Drivers: Insurers are actively seeking capital relief and risk transfer solutions, boosting demand for reinsurance.

- Consolidation Activity: The market is characterized by ongoing mergers and acquisitions, as companies aim for greater scale and efficiency.

- Competitive Intensity: Rivalry is heightened by competition for both new business and the acquisition of existing insurance portfolios.

- Strategic Acquisitions: In 2023, several significant M&A deals were observed in the U.S. life reinsurance sector, reflecting this consolidation trend.

Competitive rivalry in the life and annuity reinsurance sector is intense, primarily driven by established giants like Swiss Re and Munich Re, who possess substantial capital and deep expertise. Brookfield Reinsurance differentiates itself by leveraging alternative investment strategies, aiming for superior returns and reducing direct price competition, though rivals may seek to replicate this. The market's capital intensity and stringent regulation create high barriers to entry, concentrating power among well-funded incumbents.

| Competitor | 2023 Gross Written Premiums (approx.) | 2024 Total Equity (approx.) | Key Differentiator |

|---|---|---|---|

| Swiss Re | $50.7 billion | $35 billion | Global reach, comprehensive services |

| Munich Re | (Not specified, but a major global player) | (Not specified, but substantial) | Strong financial backing, broad product offering |

| Hannover Re | (Not specified, but a major global player) | (Not specified, but substantial) | Focus on life and health reinsurance |

| Brookfield Reinsurance | (Focus on block reinsurance, not direct GWP comparison) | (Leverages Brookfield Asset Management's $803 billion AUM as of Q1 2024) | Alternative investment expertise, long-term liability focus |

SSubstitutes Threaten

Large insurance companies increasingly opt to retain more risk internally instead of purchasing reinsurance. This self-insurance strategy directly competes with reinsurance providers, particularly when the cost of reinsurance is high or when a company possesses robust internal risk management capabilities. For instance, in 2024, major insurers continued to explore holding larger portions of their risk portfolios, driven by a desire to capture potential investment income from retained premiums.

Capital market solutions like securitization present a significant threat to traditional reinsurance, offering direct risk transfer for insurers. For instance, catastrophe bonds, a form of securitization, allow insurers to offload specific perils directly to investors. While more prevalent in property and casualty, the development of similar bespoke instruments for life and annuity risks could provide an alternative avenue for capital relief, bypassing reinsurers.

Sophisticated insurers are increasingly developing robust internal investment platforms, aiming to replicate the capital optimization and return generation previously sought from reinsurers like Brookfield Reinsurance. This trend directly threatens Brookfield's business model by reducing the demand for its specialized, investment-driven reinsurance solutions, as insurers can achieve similar efficiencies in-house.

For instance, major global insurers in 2024 are allocating significant capital to build out their alternative asset management arms, seeking to capture yield and manage risk more directly. This internal capability bypasses the need for external reinsurers to provide these investment management services, thereby diminishing the threat of substitutes for Brookfield.

Financial engineering and balance sheet optimization

Insurers can use financial engineering to reduce reliance on external reinsurance. This involves sophisticated asset-liability management, dynamic investment portfolio adjustments, and strategic use of derivatives to optimize risk and capital. For instance, by effectively matching assets to liabilities, insurers can absorb more risk internally.

These internal financial strategies act as direct substitutes for traditional reinsurance, especially when the goal is capital optimization. By building robust internal risk management capabilities, companies like Brookfield Reinsurance can reduce their need for third-party capital, thereby impacting the demand for reinsurance services.

Consider the impact of regulatory capital requirements. As of early 2024, Solvency II and similar frameworks continue to push insurers towards more efficient capital deployment. This encourages the adoption of financial engineering techniques over purchasing reinsurance capacity, particularly for well-capitalized entities.

- Internal Capital Management Insurers can optimize their capital structure through techniques like securitization or collateralized reinsurance, reducing the need for traditional reinsurance.

- Asset-Liability Matching Sophisticated ALM strategies allow insurers to hold assets that better align with their liabilities, thereby internalizing more risk.

- Derivative Instruments The use of credit default swaps or other derivatives can hedge specific risks, offering an alternative to reinsurance for certain exposures.

- Investment Portfolio Optimization Adjusting investment strategies to generate higher risk-adjusted returns can bolster an insurer's capital position, making them less dependent on external reinsurance.

Regulatory changes influencing capital requirements

Regulatory shifts, such as updates to Solvency II or IFRS 17, directly impact how insurers must hold capital and manage their risks. These changes can significantly influence the attractiveness of reinsurers like Brookfield.

If capital requirements become less stringent, insurers might find it more economical to retain liabilities themselves rather than ceding them through reinsurance. Conversely, tighter regulations could increase the demand for reinsurance solutions to manage solvency ratios, potentially benefiting Brookfield.

For instance, in 2024, many jurisdictions continued to refine their capital adequacy frameworks. A hypothetical scenario where a major market eases capital requirements for certain life insurance products could reduce the need for traditional reinsurance, making alternative risk transfer solutions more competitive.

- Regulatory Frameworks Impact: Changes in rules like Solvency II and IFRS 17 alter insurers' capital needs.

- Incentive Shift: Easing regulations may lessen insurer motivation to offload liabilities via reinsurance.

- Tightening Impact: Stricter rules could make new, non-reinsurance risk management options more appealing.

- Market Dynamics: In 2024, ongoing regulatory evolution continued to shape the demand for reinsurance services.

Insurers increasingly leverage capital markets for risk transfer, bypassing traditional reinsurers like Brookfield. For example, catastrophe bonds and other securitization instruments allow direct risk placement with investors, offering a substitute for reinsurance capacity. In 2024, this trend continued as insurers sought efficient ways to manage their risk exposures.

Sophisticated internal capabilities are emerging as a direct substitute. Insurers are building out their own investment platforms and financial engineering expertise to manage capital and risk more effectively. This reduces their reliance on reinsurers for both risk mitigation and investment management services.

Financial engineering, including advanced asset-liability management and derivative use, allows insurers to internalize more risk. This strategy, driven by a desire for capital optimization, directly competes with the core services offered by reinsurers, particularly for well-capitalized entities.

| Substitute Type | Description | Impact on Reinsurance Demand | Example Trend (2024) |

|---|---|---|---|

| Capital Markets Solutions | Securitization (e.g., Cat Bonds) | Reduces demand for traditional reinsurance capacity. | Continued growth in alternative risk transfer for P&C perils. |

| Internal Capabilities | In-house investment platforms, risk management | Diminishes need for external reinsurance services. | Major insurers expanding alternative asset management arms. |

| Financial Engineering | ALM, derivatives, hedging | Enables greater risk retention by insurers. | Focus on optimizing capital efficiency through internal strategies. |

Entrants Threaten

Entering the life and annuity reinsurance market demands immense capital. For instance, regulatory bodies often mandate significant surplus requirements, meaning new entrants need billions of dollars just to begin operations. This high capital intensity acts as a formidable barrier.

Beyond capital, the complex web of global insurance regulations presents another substantial hurdle. Navigating solvency rules, capital adequacy frameworks, and varying consumer protection laws across different jurisdictions requires specialized expertise and significant investment in compliance, effectively limiting the number of potential new competitors.

Success in life and annuity reinsurance hinges on specialized actuarial and risk management expertise. Brookfield Reinsurance, for instance, relies on a deep bench of actuaries and sophisticated modeling to manage long-term liabilities effectively. This high barrier to entry, requiring significant investment in talent and technology, naturally limits the number of new players entering this market.

Reinsurance thrives on deep-seated trust and established connections. Newcomers face a significant hurdle in replicating the decades-long relationships that incumbents like Brookfield Reinsurance have cultivated with major insurance companies. Securing substantial, long-term reinsurance treaties requires a proven history of reliability and performance, which is difficult for new entrants to demonstrate quickly.

Economies of scale and scope

Existing large reinsurers leverage significant economies of scale in their operations. This includes their ability to spread fixed costs across a larger volume of business in underwriting, claims management, and investment operations. For instance, in 2023, the global reinsurance market saw gross written premiums exceeding $300 billion, a figure dominated by established players.

New entrants face a formidable barrier in replicating these cost efficiencies. Achieving comparable operational leverage and building a sufficiently diversified risk portfolio requires immense initial capital outlay and time to gain market traction. Without this, new companies would struggle to compete on price and risk appetite.

- Economies of scale in underwriting and claims processing reduce per-unit costs for established reinsurers.

- Diversified risk portfolios held by incumbents offer greater stability and pricing power.

- New entrants require substantial capital to achieve comparable operational efficiency and risk diversification.

- The sheer size of existing players makes it difficult for newcomers to achieve competitive cost structures.

Proprietary investment strategies and asset management integration

Brookfield Reinsurance's integration with Brookfield Asset Management's extensive alternative investment expertise presents a significant barrier for new entrants. This synergy allows Brookfield Reinsurance to leverage a vast network and proprietary deal flow, making it exceptionally challenging for newcomers to replicate its operational model and market access.

The difficulty in replicating Brookfield's integrated platform, which includes access to unique investment opportunities and sophisticated asset management capabilities, acts as a strong deterrent. For instance, Brookfield Asset Management managed approximately $925 billion in assets as of December 31, 2023, showcasing the scale and depth of resources available, which new entrants would struggle to match.

- Proprietary Deal Flow: New entrants cannot easily access the exclusive, off-market investment opportunities that Brookfield Reinsurance benefits from through its parent company.

- Integrated Asset Management: The seamless integration with Brookfield Asset Management's operational infrastructure and investment platforms is a complex and costly capability to build.

- Scale and Expertise: The sheer scale of assets under management by Brookfield Asset Management ($925 billion as of year-end 2023) provides a competitive advantage in sourcing and executing large-scale transactions.

The threat of new entrants in the life and annuity reinsurance market is relatively low. High capital requirements, stringent regulatory landscapes, and the need for specialized actuarial expertise create significant barriers to entry. Established players like Brookfield Reinsurance benefit from deep-seated relationships and economies of scale, making it difficult for newcomers to compete effectively.

Brookfield Reinsurance's integration with Brookfield Asset Management, managing approximately $925 billion in assets as of December 31, 2023, provides a substantial competitive advantage. This synergy grants access to proprietary deal flow and sophisticated asset management capabilities that are exceedingly difficult for new entrants to replicate, further solidifying the low threat of new competition.

| Barrier to Entry | Description | Impact on New Entrants |

| Capital Requirements | Billions needed for regulatory surplus and initial operations. | Extremely high, limiting the pool of potential entrants. |

| Regulatory Complexity | Navigating diverse global insurance laws and solvency rules. | Requires specialized expertise and significant compliance investment. |

| Specialized Expertise | Deep actuarial and risk management talent is crucial. | High cost and time to acquire necessary talent and technology. |

| Established Relationships | Trust and long-term connections with insurers are vital. | Difficult for new entrants to build credibility and secure treaties. |

| Economies of Scale | Larger reinsurers spread costs across higher volumes. | New entrants struggle to achieve competitive cost structures. |

| Integrated Platform | Synergy with Brookfield Asset Management's vast resources. | Replication of proprietary deal flow and asset management is nearly impossible. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Brookfield Reinsurance is built upon a foundation of diverse and credible data sources. These include Brookfield Reinsurance's own annual reports and investor presentations, alongside industry-specific research from reputable firms and market data providers.