Brookfield Reinsurance Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Reinsurance Bundle

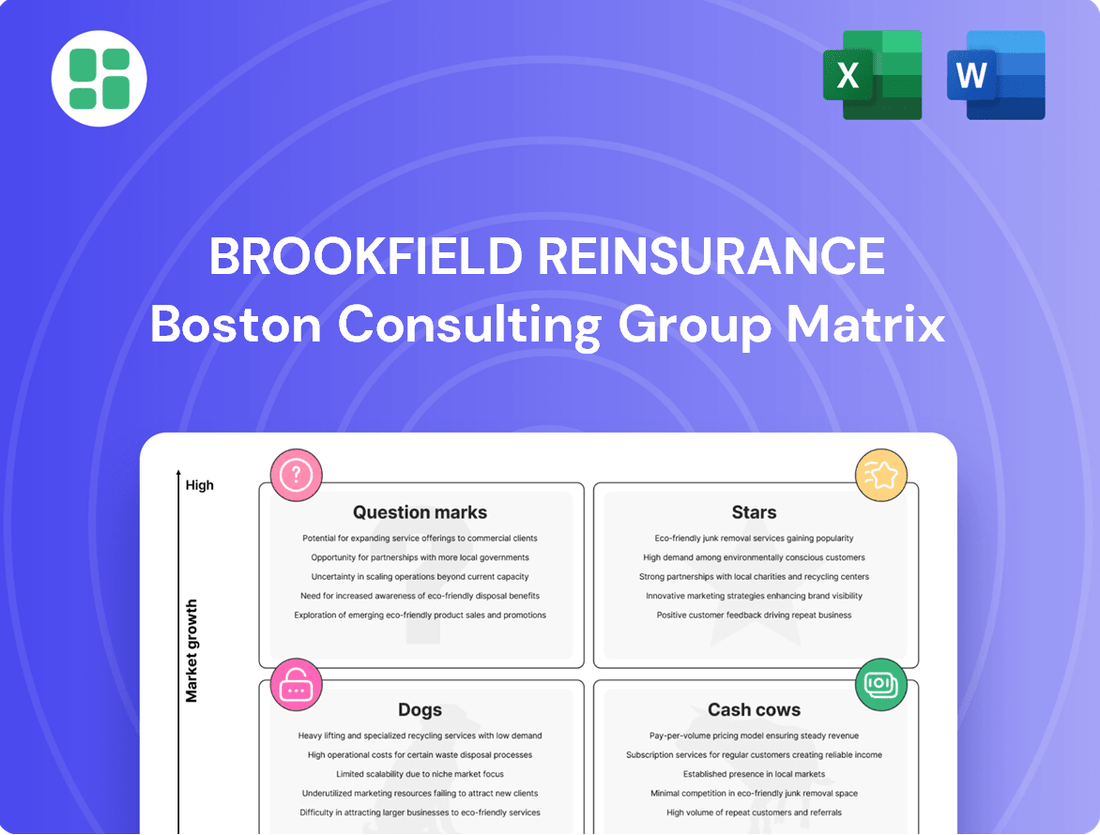

Brookfield Reinsurance's BCG Matrix offers a powerful lens to understand its diverse portfolio, highlighting areas of rapid growth and stable income generation. This strategic framework categorizes its businesses into Stars, Cash Cows, Dogs, and Question Marks, providing a clear snapshot of market position and potential.

Uncover the full strategic implications and actionable insights by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of where Brookfield Reinsurance stands and how to best navigate its market landscape for future success.

Stars

Brookfield Reinsurance is making significant strides in expanding its annuity sales platform. This area is a prime candidate for growth, with a clear strategy for scaling. The company reported over $8 billion in new annuity business in 2023, demonstrating robust initial success.

The momentum continued strongly into 2024, with Brookfield Reinsurance writing $19 billion in retail and institutional annuity sales. This impressive figure solidifies their position as a major player in the North American annuity market.

Brookfield Reinsurance's strategic acquisitions are a cornerstone of its growth, exemplified by the May 2024 completion of American Equity Investment Life Holding Company (AEL). This move alone pushed their insurance assets under management past $100 billion, a substantial leap in market presence.

The successful integration of AEL's strong fixed annuity business, alongside Argo Group's specialty property and casualty platform, fuels rapid expansion. This strategic consolidation not only broadens their operational scope but also directly contributes to an increase in distributable operating earnings, marking a clear trajectory in a high-growth, high-market-share segment.

Brookfield Reinsurance is significantly expanding its pension risk transfer (PRT) operations, a strategic move to diversify its business. This includes entering new geographical markets, such as its inaugural UK reinsurance transaction in late 2024.

The PRT sector is a high-growth area, with Brookfield Reinsurance reporting over $700 million in PRT premiums during the first quarter of 2024 alone. This substantial inflow of premiums highlights Brookfield's rapid progress and growing influence in this burgeoning market.

Leveraging Alternative Investment Expertise

Brookfield Reinsurance's strategy hinges on its deep expertise in alternative investments, allowing it to optimize its insurance assets for superior returns. This specialized knowledge enables the company to identify and execute higher-yielding strategies, a key differentiator in the market.

This competitive edge translates into attractive risk-adjusted returns, as demonstrated by Brookfield Reinsurance's consistent performance in repositioning assets. For instance, in 2024, the company continued to deploy capital into infrastructure and real estate, sectors where Brookfield Asset Management holds significant global leadership.

- Capital Deployment: Brookfield Reinsurance actively manages its portfolio by shifting assets towards sectors offering higher yields, such as private equity and credit, leveraging Brookfield Asset Management's established track record.

- Risk-Adjusted Returns: The company's ability to source and manage complex alternative investments allows it to achieve attractive returns while maintaining a disciplined approach to risk management.

- Earnings Growth Driver: This strategic focus on alternatives is a primary engine for earnings growth, positioning Brookfield Reinsurance as a frontrunner in capitalizing on these specialized investment opportunities.

Global Expansion into New Markets

Brookfield Reinsurance is strategically broadening its reach beyond North America, marking a significant push into new international territories. This global expansion is a key component of its growth strategy, aiming to tap into diverse markets and diversify revenue streams. The company's proactive approach is designed to transform nascent ventures into future high-performers.

A prime example of this expansion is Brookfield Reinsurance's entry into the UK pension market in March 2025. This move follows its inaugural UK reinsurance transaction, which took place in 2024. Such initiatives underscore a commitment to establishing a robust international presence and capturing emerging opportunities in high-growth regions.

- Global Footprint Expansion: Entry into the UK pension market in March 2025 and first UK reinsurance transaction in 2024.

- Diversification Strategy: Focus on high-growth regions to capture new opportunities and increase international market share.

- Market Penetration: Aiming to transform emerging ventures into future stars through strategic international growth.

Brookfield Reinsurance's annuity sales platform is a clear Star in the BCG matrix, exhibiting high market growth and a strong competitive position. The company's aggressive expansion, marked by $19 billion in annuity sales in 2024, highlights its dominance. Acquisitions like American Equity, completed in May 2024, further solidify its leading market share and revenue growth potential.

| Business Segment | Market Growth | Relative Market Share | BCG Classification |

|---|---|---|---|

| Annuity Sales | High | High | Star |

| Pension Risk Transfer (PRT) | High | Growing | Question Mark/Star (Emerging) |

| Specialty P&C (Argo) | Moderate | Moderate | Cash Cow/Average Dog |

What is included in the product

The Brookfield Reinsurance BCG Matrix analyzes its business units by market growth and share, guiding strategic decisions.

Brookfield Reinsurance's BCG Matrix offers a clear, one-page overview, relieving the pain of complex portfolio analysis for strategic decision-making.

Cash Cows

Brookfield Reinsurance's core life and annuity reinsurance business is a classic cash cow. This mature segment boasts a strong market position and generates consistent, substantial cash flow. These operations are well-established, meaning they don't require significant new investment to maintain their strong performance.

The recent acquisition of American Equity Investment Life Holding Company (AEL) significantly bolstered this cash cow segment. AEL's integration contributed to Brookfield Reinsurance's insurance assets under management surpassing $100 billion by the end of 2023, underscoring the scale and stability of this business line.

Brookfield Reinsurance has successfully shifted its investment portfolio towards strategies that yield higher returns. This strategic repositioning has directly translated into a notable increase in net investment income and distributable operating earnings for the company.

The optimized portfolio is now a robust engine for generating strong, consistent spread earnings from its existing business. This makes it a dependable source of cash flow, requiring minimal ongoing investment for growth.

For instance, in the first quarter of 2024, Brookfield Reinsurance reported a significant uplift in its net investment income, driven by these higher-yielding assets. This performance underscores the effectiveness of their portfolio repositioning strategy.

Brookfield Reinsurance's Established Capital Solutions Services are a prime example of a cash cow within the BCG matrix. This segment consistently generates substantial fee-related earnings for Brookfield Reinsurance by offering critical capital and risk management services to insurance companies.

Leveraging Brookfield's deep expertise, these services provide a reliable, recurring revenue stream with impressive profit margins. For instance, in 2023, Brookfield Reinsurance reported significant contributions from its capital solutions segment, highlighting its role as a stable income generator and a core strength of the business.

Seasoned P&C Reinsurance Operations

Brookfield Reinsurance's seasoned Property and Casualty (P&C) reinsurance operations are a cornerstone of its business, fitting squarely into the Cash Cows quadrant of the BCG Matrix. These businesses, bolstered by a full quarter of earnings from the acquisition of Argo Group in Q1 2024, showcase a stable and mature segment of the company's portfolio. Their consistent performance contributes significantly to overall earnings, reflecting a strong market position within a predictable, albeit lower-growth, market environment.

The P&C reinsurance segment benefits from its established presence and the predictable nature of its revenue streams. This stability provides a reliable source of cash flow for Brookfield Reinsurance, allowing for reinvestment in other business areas or distribution to shareholders. The integration of Argo Group is expected to further solidify this position.

- Stable Earnings Contribution: The P&C reinsurance operations consistently generate substantial earnings, providing a reliable financial foundation.

- Market Leadership: Brookfield Reinsurance holds a significant market share in this mature segment, indicating strong competitive positioning.

- Predictable Revenue: The nature of P&C reinsurance offers a more predictable revenue stream compared to more volatile market segments.

- Acquisition Synergies: The full quarter of earnings from Argo Group in Q1 2024 highlights the immediate positive impact of strategic acquisitions on this segment's performance.

Strategic Alliance with Brookfield Asset Management

Brookfield Reinsurance's strategic alliance with Brookfield Asset Management is a key driver of its Cash Cow status within the BCG framework. This partnership provides a consistent pipeline of high-quality investment opportunities sourced from Brookfield Asset Management's extensive alternative asset platform. This access ensures Brookfield Reinsurance can deploy capital effectively, generating substantial returns.

This symbiotic relationship allows Brookfield Reinsurance to maintain robust profit margins on its insurance assets. By leveraging the expertise and scale of Brookfield Asset Management, the reinsurance arm can optimize asset management, leading to a surplus of cash generation that exceeds its operational needs. For instance, in 2023, Brookfield Reinsurance reported a net income of $1.4 billion, demonstrating its strong cash-generating capabilities.

- Access to diverse alternative assets

- Optimized asset management for high returns

- Consistent generation of surplus cash

- Support for broader business operations and growth

Brookfield Reinsurance's life and annuity business, significantly enhanced by the American Equity acquisition, continues to be a prime cash cow. This mature segment, with over $100 billion in assets under management by the end of 2023, benefits from a strong market position and minimal need for reinvestment, generating consistent cash flow.

The company's Capital Solutions Services also operate as a cash cow, providing steady fee-related earnings and impressive profit margins by managing capital and risk for insurers. In 2023, this segment demonstrated its stability and contribution to overall earnings.

Furthermore, the Property and Casualty reinsurance operations, especially after integrating Argo Group in Q1 2024, represent a stable cash cow. This segment benefits from predictable revenues and a strong market position, contributing reliably to the company's financial strength.

The strategic alliance with Brookfield Asset Management fuels these cash cow segments by providing a consistent pipeline of high-quality investment opportunities, leading to robust profit margins and substantial cash generation, as evidenced by Brookfield Reinsurance's $1.4 billion net income in 2023.

| Segment | BCG Quadrant | Key Driver of Cash Cow Status | 2023/Q1 2024 Highlight |

| Life & Annuity Reinsurance | Cash Cow | Strong market position, minimal reinvestment needs | AUM > $100B (end 2023) |

| Capital Solutions Services | Cash Cow | Steady fee income, high profit margins | Significant contribution to 2023 earnings |

| P&C Reinsurance | Cash Cow | Predictable revenue, established market presence | Full quarter impact from Argo Group (Q1 2024) |

| Strategic Alliance with BAM | Enabler of Cash Cows | Access to diverse alternative assets, optimized asset management | Net income of $1.4B (2023) |

What You See Is What You Get

Brookfield Reinsurance BCG Matrix

The Brookfield Reinsurance BCG Matrix preview you are examining is the identical, fully completed document you will receive immediately after purchase. This means the strategic insights and analysis presented are exactly as they will be delivered, ready for immediate application without any watermarks or placeholder content. You can be confident that the professional formatting and comprehensive data within this preview are precisely what you will download, ensuring a seamless integration into your business planning and decision-making processes.

Dogs

Underperforming legacy portfolios within Brookfield Reinsurance, while not detailed publicly, would represent the 'dogs' in a BCG analysis. These are likely older reinsurance contracts or blocks of business acquired in past deals that no longer fit the company's current focus on high-yield investments or its risk tolerance. For instance, if a portfolio acquired in 2018 yielded only 2.5% in 2023, significantly below the company's target of 5% or more on new acquisitions, it would be a prime candidate for re-evaluation.

Brookfield Reinsurance, like many large, diversified entities, may possess minor assets or business units that don't significantly impact its growth trajectory or market standing. These are often categorized as 'dogs' in a BCG Matrix context, typically generating just enough revenue to cover their costs or very little additional cash flow. For instance, a divested but not yet fully wound-down legacy insurance block might fall into this category.

These 'dog' assets can tie up valuable capital and management attention that could be more effectively allocated to core, high-growth areas of the business. Brookfield Reinsurance's ongoing portfolio review process aims to identify such non-strategic holdings, ensuring that resources are concentrated on ventures with the greatest potential for returns and strategic alignment. As of late 2024, the company has been actively managing its portfolio, with a focus on optimizing capital deployment across its reinsurance and annuity businesses.

Inefficient operational segments within Brookfield Reinsurance's business, those struggling to reach peak efficiency or scale, would be classified as dogs in a BCG Matrix analysis. These areas likely incur higher costs and yield lower profit margins compared to their peers. For instance, if a specific claims processing unit in 2024 reported processing times 20% longer than industry benchmarks and had an operating cost ratio 15% above the average for similar functions, it would exemplify such a dog. These segments drain resources without providing satisfactory returns, impacting the company's overall financial health.

Stagnant Niche Reinsurance Products

Certain niche reinsurance products within Brookfield Reinsurance's portfolio might be categorized as dogs if they've hit market saturation or are experiencing a downturn in demand without any recent innovation. These types of products would typically show both low growth prospects and a small market share, meaning they struggle to attract new clients or contribute significantly to profits. Brookfield Reinsurance would likely adopt a strategy of minimal investment in these stagnant areas, perhaps looking to divest or run them down.

For instance, consider a specific type of specialized liability coverage that was popular a decade ago but has seen its market shrink due to regulatory changes or the emergence of more comprehensive solutions. If such a product within Brookfield Reinsurance's offerings is experiencing declining premium volumes and has a limited client base, it would fit the dog quadrant. In 2024, the global reinsurance market, while robust, is seeing shifts, with growth concentrated in areas like climate risk and specialty lines, leaving older, less adaptable products behind.

- Market Saturation: Products that have reached their peak demand and face intense competition, leading to limited new business opportunities.

- Declining Demand: A reduction in the need for certain specialized coverages due to evolving market conditions, technology, or regulatory landscapes.

- Low Investment Return: These products typically generate minimal profits and do not warrant further capital allocation for development or expansion.

- Strategic Divestment: Brookfield Reinsurance might consider exiting these product lines to reallocate resources to more promising growth areas.

Sub-scale International Ventures

Brookfield Reinsurance's sub-scale international ventures could be categorized as dogs if they represent early attempts in markets where traction and market share remain elusive. These ventures might be characterized by a struggle to achieve profitability or scale, particularly in environments with limited growth prospects. For instance, if a venture in a specific European market, launched in 2023 with an initial investment of $50 million, reported a net loss of $5 million in 2024 and held only 0.5% market share, it would likely fall into this quadrant.

Such ventures demand a critical assessment. The decision hinges on whether a significant reinvestment can catalyze growth or if divesting from these underperforming assets is the more prudent strategy. Brookfield's overall expansion strategy, which saw its total assets under management grow by 12% to $850 billion by the end of 2024, needs to be balanced with the performance of individual international initiatives.

- Underperforming International Markets: Ventures in regions with low market penetration or intense competition, failing to meet projected revenue targets.

- Profitability Challenges: Operations consistently generating losses or operating at very thin margins, indicating a lack of sustainable economic viability.

- Strategic Review Required: A need to evaluate the potential for turnaround through increased investment or the possibility of exiting the market.

- Market Share Stagnation: Failure to capture a meaningful share of the target market, even after sustained effort and capital allocation.

Underperforming legacy portfolios or niche products within Brookfield Reinsurance that exhibit low growth and minimal market share would be classified as 'dogs' in a BCG Matrix. These segments, like older reinsurance contracts acquired in past deals, might yield returns significantly below the company's targets, for example, a 2.5% yield in 2023 versus a target of 5% or more. Such assets can tie up capital and management attention, prompting a strategic review for potential divestment or run-down to reallocate resources to higher-growth areas.

| Category | Description | Example Scenario (Hypothetical) | Potential Strategy |

| Legacy Portfolios | Acquired business blocks with low yield and limited future growth prospects. | A 2018 acquisition yielding only 2.5% in 2023, below Brookfield's target of 5%+. | Divest or run down. |

| Stagnant Products | Niche offerings facing market saturation or declining demand. | A specialized liability coverage seeing reduced premium volumes due to regulatory shifts. | Minimal investment, consider exit. |

| Sub-scale Ventures | International operations struggling to achieve profitability or significant market share. | A 2023 European venture reporting a $5 million loss in 2024 with 0.5% market share. | Assess for turnaround or divestment. |

Question Marks

Brookfield Reinsurance is likely eyeing emerging digital and Insurtech partnerships as potential stars or question marks within its BCG matrix. These ventures, focused on modernizing insurance distribution and claims, offer high growth prospects in a dynamic market. For instance, by 2024, Insurtech funding globally reached approximately $15 billion, indicating significant investor interest in this space.

These digital initiatives, while promising, might currently represent question marks due to their nascent market share and substantial investment needs for scaling. Brookfield's commitment here would be to nurture these platforms, much like investing in early-stage technology companies. The success hinges on swift market adoption and establishing a strong competitive edge, a common challenge for many digital disruptors.

Brookfield Reinsurance's expansion into new geographic markets, like its recent push into the UK pension market, places it firmly in the question mark category of the BCG Matrix. These ventures hold significant growth potential, but Brookfield's current market share is minimal, demanding considerable investment in building out operations and establishing a strong presence.

Developing bespoke risk transfer solutions for nascent sectors presents a significant opportunity, but also a question mark for Brookfield Reinsurance. These highly customized products address a growing need for specialized coverage in areas like cyber risk, parametric insurance for climate events, or even emerging technology liabilities. For instance, the global cyber insurance market was projected to reach $20.6 billion in 2024, indicating substantial demand for tailored solutions.

However, the initial client base for such niche offerings may be limited, requiring substantial investment in marketing and client education. This educational component is crucial to help potential clients understand the value and mechanics of these specialized insurance products. Brookfield Reinsurance must strategically invest in building awareness and demonstrating the efficacy of these bespoke solutions to drive adoption and capture market share in these evolving landscapes.

Expansion of Credit and Private Debt Capabilities for Third Parties

Brookfield Asset Management is actively broadening its credit and private debt operations, aiming to manage assets for external insurance companies. This strategic move taps into a significant growth avenue within the financial sector.

While Brookfield Reinsurance benefits from this expansion, its direct engagement in securing and managing third-party insurance assets, beyond its own requirements, presents a potential challenge. Achieving substantial market share in this area will likely necessitate considerable capital investment.

- Growth Potential: The global private debt market is projected to reach $2.7 trillion by 2028, offering substantial opportunities for asset managers.

- Strategic Alignment: Brookfield's expansion aligns with the increasing trend of insurers seeking external managers for their growing alternative asset allocations.

- Investment Needs: Capturing market share in third-party insurance asset management requires significant investment in technology, talent, and distribution channels.

Innovative Annuity Product Development

Brookfield Reinsurance's investment in developing entirely new annuity products, perhaps targeting specific demographics like younger individuals or those seeking more flexible income options, would likely be a question mark on the BCG Matrix. These innovative offerings, while holding significant growth potential in a crowded market, would initially possess a low market share.

The success of these novel annuities hinges on substantial marketing and distribution investments to achieve widespread adoption. For instance, if a new annuity product launched in 2024 aims to capture even a small percentage of the projected $300 billion U.S. annuity market, it would require significant capital outlay for customer acquisition and education.

- Targeting Underserved Demographics: Development of annuities for niche markets, potentially offering features attractive to millennials or gig economy workers.

- Novel Features Integration: Incorporating elements like enhanced inflation protection or more flexible withdrawal options.

- High Growth Potential, Low Market Share: Aiming to disrupt the market but starting with minimal penetration.

- Significant Investment Required: Substantial marketing, sales, and distribution efforts needed for buyer adoption.

Brookfield Reinsurance's exploration into new product lines, such as parametric insurance for emerging risks or bespoke solutions for niche industries, represents a classic question mark. These ventures offer high growth potential, mirroring the projected 15% compound annual growth rate for the global parametric insurance market through 2027, but currently hold minimal market share.

Significant investment is required to develop these specialized offerings, educate the market, and build distribution channels. The success of these question marks depends on Brookfield's ability to establish a strong competitive advantage and achieve rapid customer adoption in these developing markets.

| Initiative | BCG Category | Rationale | Market Potential | Investment Needs |

| Parametric Insurance | Question Mark | High growth, low market share | Projected 15% CAGR (2024-2027) | Product development, market education |

| Bespoke Risk Transfer | Question Mark | Addressing niche needs, early stage | Growing demand in cyber, climate | Marketing, client engagement |

BCG Matrix Data Sources

Our BCG Matrix draws from comprehensive financial statements, industry growth projections, and competitive landscape analyses to provide strategic clarity.