Brookfield Business SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Business Bundle

Brookfield Business Partners leverages its diverse portfolio and strong financial backing to capitalize on market opportunities, but faces challenges from economic volatility and competitive pressures. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Brookfield Business Partners' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Brookfield Business Partners boasts a remarkably diversified portfolio, encompassing sectors like industrials, business services, and infrastructure services. This broad diversification is a significant strength, providing a buffer against downturns in any single market and contributing to its resilience through various economic conditions. For instance, in Q1 2024, the company reported strong performance in its infrastructure services segment, helping to offset more moderate results in other areas.

The company's core strength lies in its profound operational expertise. Brookfield Business Partners excels at acquiring businesses and then actively improving their operations to boost profitability and generate consistent cash flows. This hands-on approach, focused on tangible operational enhancements rather than solely financial maneuvers, has been a key driver of its value creation strategy. This is evident in the successful turnaround and subsequent divestment of several portfolio companies over the past few years.

Brookfield Business Partners (BBP) excels at generating capital through smart sales of its holdings. In 2024 alone, they managed to recycle over $2 billion, and they continued this trend with another $690 million in the second quarter of 2025. This isn't just about selling; it's about putting that money to work effectively.

The capital generated from these divestitures is strategically redeployed. BBP uses it for new investments, buying back their own units, and paying down debt. This disciplined approach to managing their money ensures they can take advantage of new growth opportunities and strengthen their financial position.

Brookfield Business Partners (BBU) benefits immensely from its position as the primary listed entity for Brookfield Asset Management's Private Equity Group. This connection grants BBU access to an expansive global network and substantial resources, including a vast pool of investment capital and a wealth of operational expertise honed across numerous industries and regions. This synergy is crucial for BBU's ability to source and execute large-scale, intricate deals.

In 2024, this integrated approach is particularly evident. For instance, Brookfield Asset Management's total assets under management reached approximately $925 billion by the end of Q1 2024, showcasing the sheer scale of resources available to BBU. This affiliation allows BBU to tap into this immense capital base and leverage the parent company's deep market insights, providing a distinct edge in a competitive investment landscape.

Focus on Essential Products and Services

Brookfield Business Partners (BBP) strategically targets companies offering essential products and services, a move that underpins its resilience. This focus on non-discretionary goods and services creates a stable revenue stream, even when the broader economy faces headwinds. For instance, during the economic disruptions of 2020-2021, BBP's portfolio companies in sectors like business services and industrial products demonstrated robust performance, largely insulated from the sharp downturns experienced by more cyclical industries.

This approach translates into durable cash flows, a key advantage for any investment. By acquiring businesses with strong competitive moats, such as high barriers to entry or significant cost advantages, BBP secures predictable earnings. This strategy is evident in their investments within sectors like waste management and critical infrastructure maintenance, where demand is consistently high and competitive pressures are manageable.

The emphasis on essential offerings provides a solid foundation for BBP's financial performance. Companies providing critical inputs or services to other businesses or consumers are less susceptible to demand shocks. This was particularly noticeable in 2023, where BBP reported stable earnings from its infrastructure services segment, contrasting with more volatile results in other market areas.

- Focus on Essential Sectors: BBP prioritizes businesses providing non-discretionary products and services, ensuring consistent demand.

- Durable Cash Flows: This strategic focus generates stable and predictable earnings, even during economic downturns.

- Competitive Advantages: Investments are made in companies with strong market positions, often protected by barriers to entry or cost efficiencies.

- Resilience in Uncertainty: The portfolio's exposure to essential services provides a buffer against economic volatility, as seen in recent years.

Robust Balance Sheet and Liquidity

Brookfield Business Partners boasts a robust balance sheet and substantial liquidity, a key strength for navigating market volatility. As of Q1 2025, the company reported approximately $2.3 billion in liquidity at the corporate level. This figure saw an increase to $3.329 billion in cash and cash equivalents by June 2025, providing significant financial flexibility.

This strong financial position empowers Brookfield Business Partners to readily fund growth opportunities and pursue strategic acquisitions. It also ensures the company can effectively manage through economic downturns without impacting its operational capabilities. The firm's conservative capitalization and minimal corporate debt maturities further solidify its financial stability and resilience.

- Strong Liquidity Position: $3.329 billion in cash and cash equivalents by June 2025.

- Funding Flexibility: Enables strategic growth initiatives and acquisitions.

- Resilience: Capacity to weather economic challenges due to conservative capitalization.

- Low Debt Risk: Minimal corporate debt maturities enhance financial stability.

Brookfield Business Partners' operational expertise is a significant strength, enabling them to enhance acquired businesses for improved profitability and cash flow. This hands-on approach has led to successful turnarounds and strategic divestments, demonstrating consistent value creation. Their ability to identify and execute on operational improvements is a core driver of their success.

The company's disciplined capital recycling strategy is another key strength. In 2024, they generated over $2 billion from divestitures, continuing this trend with $690 million in Q2 2025. This capital is strategically redeployed into new investments, unit repurchases, and debt reduction, fortifying their financial position and enabling future growth.

Brookfield Business Partners benefits from its affiliation with Brookfield Asset Management, gaining access to a vast global network and substantial capital resources. This synergy, supported by Brookfield Asset Management's $925 billion in AUM as of Q1 2024, provides a distinct advantage in sourcing and executing large-scale transactions.

The company's focus on essential products and services fosters resilience, ensuring stable revenue streams even during economic downturns. This strategic prioritization of non-discretionary goods and services, evident in their infrastructure services segment's performance in 2023, translates into durable and predictable earnings.

Brookfield Business Partners maintains a robust financial position with significant liquidity, holding $3.329 billion in cash and cash equivalents by June 2025. This strong liquidity and conservative capitalization provide financial flexibility for growth and resilience against economic challenges.

What is included in the product

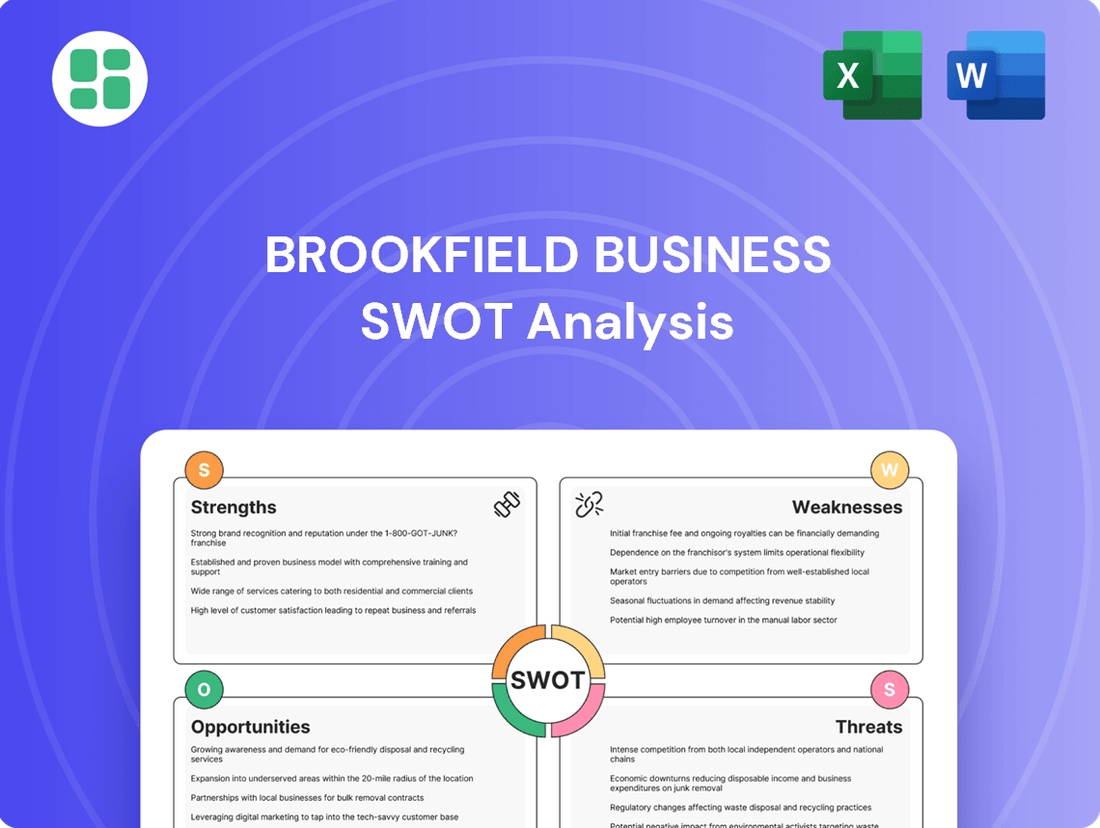

Analyzes Brookfield Business’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, structured framework to identify and address critical business challenges.

Weaknesses

Despite Brookfield Business Partners' efforts to diversify, some parts of its portfolio are still vulnerable to economic slowdowns. For example, its engineered components manufacturing business experienced a noticeable dip in performance during 2024 due to weaker market demand. This sensitivity to economic cycles can introduce volatility into specific business segments.

Brookfield Business Partners (BBU) faced a net loss of $109 million for the fiscal year ending December 31, 2024. This loss was largely attributable to a significant one-time non-cash expense recorded within its healthcare services segment, alongside provisions made by its construction operations.

While these types of expenses are typically not recurring, they can temporarily distort reported net income, potentially influencing investor sentiment in the near term. These events underscore the operational vulnerabilities that can arise in specific business sectors.

A cyber incident impacting Brookfield Business Partners' (BBP) dealer software and technology services significantly hampered its business services segment performance in 2024. This event underscores the substantial operational and financial risks inherent in such breaches, potentially causing direct revenue loss and escalating remediation expenses.

Beyond immediate financial impacts, cyber incidents can severely damage a company's reputation, eroding customer trust and market standing. The evolving and increasingly sophisticated nature of cyber threats presents a continuous, formidable challenge for businesses like BBP that rely heavily on digital infrastructure and services.

Valuation and Leverage Concerns

While some market watchers believe Brookfield Business Partners (BBP) might be trading below its intrinsic value, persistent concerns about its high leverage and overall valuation could act as a drag on its stock. This elevated debt level amplifies financial risk, especially with interest rates on the rise, potentially increasing borrowing expenses and diminishing the appeal of its income-producing assets.

Investors are thus faced with a critical balancing act, needing to weigh BBP's growth prospects against the inherent financial risks associated with its leveraged structure. For instance, as of the first quarter of 2024, Brookfield Business Partners reported total debt of approximately $12.7 billion, a figure that warrants close scrutiny in the current economic climate.

- High Leverage: Brookfield Business Partners carries a significant debt load, which can increase financial risk, particularly in an environment of rising interest rates.

- Valuation Concerns: Despite potential undervaluation claims by some analysts, market sentiment may be tempered by concerns regarding the company's overall valuation metrics.

- Interest Rate Sensitivity: Rising interest rates can directly impact borrowing costs, affecting the profitability and attractiveness of BBP's income-generating portfolio.

- Investor Scrutiny: The balance between BBP's growth potential and its financial leverage requires careful assessment by investors to gauge the risk-reward profile.

Segment-Specific Performance Declines

Brookfield Business's Infrastructure Services segment saw a dip in Adjusted EBITDA during 2024 and the second quarter of 2025. This downturn was largely a consequence of strategic decisions to divest certain operations, including its nuclear technology services and offshore oil services shuttle tanker businesses. While these divestitures free up capital, they naturally reduce revenue and EBITDA in the affected segments in the short term.

The impact of these sales on segment performance is notable. For instance, the sale of its nuclear technology services business contributed to the decline in Infrastructure Services' Adjusted EBITDA. Similarly, the divestiture of its offshore oil services shuttle tanker operations also played a role in this segment-specific performance reduction.

- Infrastructure Services Adjusted EBITDA Decline: Experienced a decrease in 2024 and Q2 2025.

- Strategic Divestitures: Key factors include the sale of nuclear technology services and offshore oil services shuttle tanker operations.

- Short-Term Financial Impact: Divestments generate capital but lead to immediate revenue and EBITDA reductions in specific segments.

- Need for Reinvestment: New investments are required to counteract the impact of these sales and drive future growth.

Brookfield Business Partners' (BBP) portfolio is susceptible to economic downturns, as seen with its engineered components manufacturing segment in 2024. The company reported a net loss of $109 million for the fiscal year ending December 31, 2024, impacted by one-time expenses in healthcare services and provisions in construction. Furthermore, a significant cyber incident in 2024 affected its business services segment, highlighting operational risks. BBP's substantial debt, approximately $12.7 billion as of Q1 2024, amplifies financial risk, especially with rising interest rates, potentially impacting investor sentiment and the appeal of its income-producing assets.

| Weakness | Description | Financial Impact/Data Point |

|---|---|---|

| Economic Sensitivity | Vulnerability to economic slowdowns impacting specific segments. | Engineered components manufacturing experienced a dip in 2024 due to weaker demand. |

| Net Loss and One-Time Expenses | Reported net loss influenced by non-recurring charges. | Net loss of $109 million for FY 2024, attributed to healthcare segment expenses and construction provisions. |

| Cybersecurity Risks | Operational and financial risks from cyber incidents. | Cyber incident in 2024 significantly hampered the business services segment. |

| High Leverage | Significant debt load increasing financial risk. | Total debt of approximately $12.7 billion as of Q1 2024. |

Same Document Delivered

Brookfield Business SWOT Analysis

This is the actual Brookfield Business SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing the same in-depth analysis that will be available to you immediately after checkout.

Opportunities

Brookfield Business Partners is actively pursuing expansion into high-growth sectors, including renewable energy, advanced energy storage, data centers, and semiconductor manufacturing. These markets are propelled by powerful, long-term trends like decarbonization and digitalization, offering substantial growth prospects.

The company's strategic acquisitions reflect this focus. For instance, the recent purchase of an electric heat tracing systems manufacturer and Antylia Scientific underscore Brookfield Business's commitment to aligning its portfolio with these evolving, high-potential industries, positioning it for future upside.

Brookfield Business Partners (BBP) can significantly boost operational efficiency by integrating AI across its diverse portfolio. This technology offers avenues to streamline processes, from supply chain management to customer service, potentially leading to substantial cost savings and improved output. For instance, AI-driven analytics can optimize resource allocation and predict maintenance needs, minimizing downtime in industrial operations.

The company's strategic focus on AI infrastructure positions it to capitalize on the burgeoning AI market. By investing in the foundational elements that enable AI adoption, BBP acts as a key enabler for its own businesses and potentially for others. This 'picks and shovels' approach, as seen in the broader tech sector, allows BBP to benefit from the widespread growth of AI without necessarily developing end-user AI applications itself.

For example, BBP's investments in areas like data analytics platforms and cloud computing services are crucial for AI deployment. As of early 2025, the global AI market is projected to reach hundreds of billions of dollars, with significant growth expected in operational efficiency solutions. BBP's early and strategic positioning in this space is a clear opportunity for enhanced profitability and market leadership.

Brookfield Business Partners (BBP) actively pursues strategic partnerships and acquisitions to bolster its market presence and technological capabilities. A prime example is its substantial $10 billion collaboration with Microsoft, focused on advancing renewable energy solutions for the AI era. This move highlights BBP's commitment to leveraging cutting-edge technology and securing long-term growth avenues.

The acquisition of Antylia Scientific further underscores BBP's growth strategy, demonstrating its intent to broaden its portfolio and enter new, promising sectors. Such strategic moves are crucial for accessing diverse markets, integrating advanced technologies, and expanding its customer reach, thereby reinforcing its competitive standing and paving the way for sustained expansion.

Capitalizing on Emerging Markets and Relocalization Trends

Brookfield Business Partners (BBP) is well-positioned to benefit from the significant growth potential in emerging markets, particularly in regions with substantial infrastructure deficits. For instance, the African Development Bank estimates that Africa needs $130-$170 billion annually for infrastructure development, a gap BBP's expertise can help fill.

Furthermore, the global trend of relocalization, driven by a desire to enhance supply chain resilience, presents a key opportunity. Companies are increasingly looking to nearshore or reshore production, creating demand for industrial and logistics facilities. BBP's extensive global footprint and localized operational expertise allow it to effectively identify and execute projects that support these supply chain shifts, reducing dependency on volatile international trade routes.

- Emerging Market Infrastructure Needs: Africa requires an estimated $130-$170 billion annually for infrastructure, creating significant investment opportunities.

- Relocalization as a Growth Driver: Increased focus on supply chain security is prompting companies to invest in domestic and nearshore manufacturing and logistics capabilities.

- BBP's Strategic Advantage: Its global presence and local operational expertise enable it to capitalize on infrastructure development and relocalization trends.

Value Creation Through Privatization and Operational Improvement

Brookfield Business Partners (BBP) actively pursues value creation by acquiring controlling stakes in companies and implementing operational enhancements. A prime example is their agreement to privatize First National Financial Corporation, a move designed to refine service models and boost earnings potential away from public market scrutiny. This strategy allows BBP to unlock intrinsic value through hands-on management and strategic adjustments.

This approach is particularly effective when businesses can benefit from focused capital allocation and strategic direction, which BBP's private ownership structure facilitates. By taking these businesses private, BBP can implement longer-term strategic initiatives without the short-term pressures often faced by publicly traded entities.

- Operational Improvement Focus: BBP targets businesses where it can drive significant operational efficiencies and strategic growth.

- Privatization Strategy: The First National Financial Corporation privatization exemplifies BBP's tactic to unlock value through private ownership.

- Value Enhancement: The goal is to enhance service models and earnings potential by actively managing and optimizing acquired businesses.

Brookfield Business Partners is strategically expanding into high-growth sectors like renewable energy, advanced energy storage, data centers, and semiconductor manufacturing, driven by global trends in decarbonization and digitalization.

The company's proactive approach to integrating AI across its portfolio offers significant opportunities for enhanced operational efficiency and cost savings, as AI-driven analytics can optimize resource allocation and predict maintenance needs.

BBP's investments in AI infrastructure, such as data analytics platforms and cloud computing services, position it to capitalize on the rapidly expanding AI market, projected to reach hundreds of billions of dollars by early 2025.

Strategic partnerships, like the $10 billion collaboration with Microsoft for renewable energy solutions, and acquisitions, such as Antylia Scientific, are key to BBP's strategy of broadening its portfolio and securing long-term growth avenues.

Threats

Brookfield Business Partners faces significant headwinds from global economic instability, with projections indicating continued volatility. For instance, the IMF's April 2024 World Economic Outlook revised global growth down to 3.2% for 2024, reflecting persistent inflation and high interest rates in major economies. This environment directly impacts investment valuations and the operational performance of its portfolio companies.

Geopolitical tensions, including ongoing conflicts and trade disputes, further exacerbate these risks. These disruptions can impede supply chains, increase operating costs, and create uncertainty in market demand, directly affecting Brookfield Business Partners' ability to realize projected returns on its investments. The firm acknowledges this uncertain outlook over the next 12-18 months as a key threat.

Rising interest rates, such as the Federal Reserve's benchmark rate which has seen multiple increases through 2023 and into 2024, directly translate to higher borrowing costs for Brookfield Business Partners (BBP) and its diverse portfolio companies. This increased cost of capital can put downward pressure on the valuations of income-generating assets within their portfolio, a crucial factor for a company focused on acquiring and managing businesses.

Furthermore, persistent inflationary pressures, which saw the US CPI rise by 3.4% year-over-year in April 2024, present a significant threat. If BBP's portfolio companies cannot effectively pass these increased operating costs onto their customers, their profit margins are likely to be squeezed, impacting overall profitability and the returns on investment.

The asset management landscape is fiercely competitive, with numerous firms actively seeking the same prime investment opportunities. This crowded market often leads to inflated acquisition prices, consequently diminishing the potential returns on new ventures for companies like Brookfield Business Partners (BBP).

In 2023, the global alternative asset management market reached approximately $15 trillion, a figure projected to grow significantly. This highlights the sheer volume of capital and the number of participants chasing deals, directly impacting BBP's ability to secure attractive opportunities at favorable valuations.

To navigate this challenging environment, BBP must consistently showcase its unique strengths and proven operational capabilities. Successfully differentiating its value proposition and demonstrating superior execution are crucial for winning competitive bids and ensuring profitable investments.

Regulatory Changes and Policy Shifts

Regulatory changes, especially in financial, environmental, and trade arenas, pose a significant threat to Brookfield Business Partners (BBP). For instance, shifts in environmental regulations, such as stricter carbon emission standards implemented in 2024, could increase operating costs for BBP's industrial holdings. Similarly, changes in trade policies, like the introduction of new tariffs in key markets during 2025, could directly impact the profitability of BBP's manufacturing and distribution segments.

These policy shifts can necessitate costly adaptations, potentially disrupting established business models and altering competitive dynamics. BBP's proactive approach to compliance and risk management is crucial, but the inherent unpredictability of governmental policy means that unforeseen changes could still create substantial headwinds. For example, unexpected changes in capital gains tax regulations in late 2024 could affect the valuation and divestment strategies of BBP's portfolio companies.

- Increased Compliance Costs: New regulations often require investment in new technologies or processes, impacting operational expenses.

- Trade Barriers: Tariffs and protectionist policies can reduce the competitiveness of BBP's international operations.

- Market Volatility: Sudden policy shifts can create uncertainty, leading to market fluctuations that affect BBP's investment valuations.

- Operational Disruptions: Changes in environmental or labor laws can force significant adjustments to how BBP's businesses operate.

Short-Term Market Volatility and Performance Discrepancies

Brookfield Business Partners (BBP) faces the threat of short-term market volatility, which can impact its unit price regardless of its long-term strategy. For instance, Q1 2025 earnings releases saw varied investor reactions, highlighting this sensitivity.

These short-term fluctuations, often driven by broader market sentiment or segment-specific performance, can create discrepancies between BBP's intrinsic value and its public trading price. This makes it challenging to maintain consistent investor confidence in the immediate term.

- Q1 2025 Earnings Impact: Investor sentiment around earnings reports in early 2025 demonstrated a degree of short-term price sensitivity.

- Segment Performance Fluctuations: Declines in specific business segments, even if temporary, can disproportionately affect overall unit performance.

- Investor Sentiment Volatility: The market's reaction to macroeconomic news or industry trends can lead to unpredictable swings in BBP's unit price.

Brookfield Business Partners (BBP) operates in a highly competitive asset management sector, facing pressure from numerous firms vying for similar investment opportunities. This intense competition can drive up acquisition costs, thereby reducing potential returns on new investments. The global alternative asset management market, valued at approximately $15 trillion in 2023 and projected for significant growth, underscores the crowded nature of this landscape.

SWOT Analysis Data Sources

This Brookfield Business SWOT analysis is built upon a foundation of credible data, including their latest financial filings, comprehensive market research reports, and insights from industry experts. We also incorporate information from official company disclosures and verified news sources to ensure a well-rounded and accurate assessment.