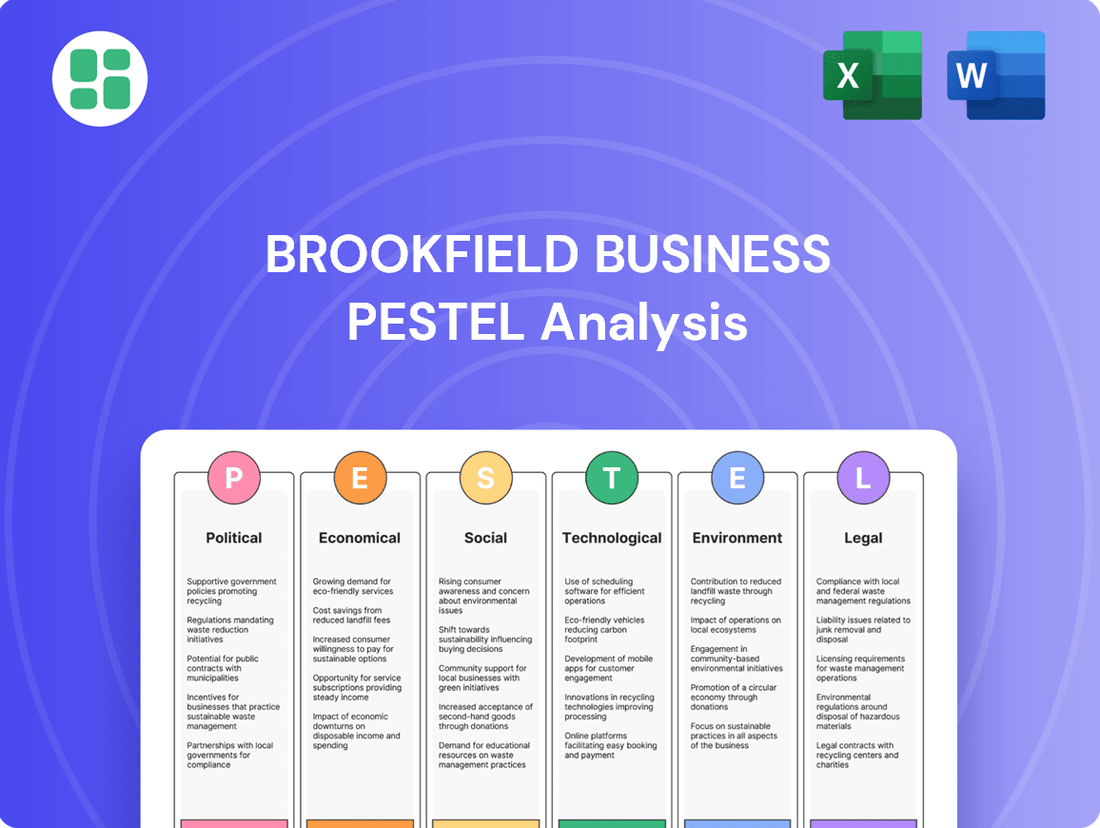

Brookfield Business PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Business Bundle

Uncover the critical external factors influencing Brookfield Business's trajectory. Our PESTLE analysis delves into political stability, economic fluctuations, technological advancements, social demographics, environmental regulations, and legal frameworks. Equip yourself with the foresight needed to anticipate challenges and seize opportunities. Download the complete PESTLE analysis now to gain a strategic advantage.

Political factors

Brookfield Business Partners is well-positioned to capitalize on government infrastructure spending policies, particularly those focused on modernization and expansion. These initiatives often translate into significant project opportunities for companies like Brookfield. For example, in 2023, the US Bipartisan Infrastructure Law allocated over $1.2 trillion to various infrastructure projects, including energy grids, transportation, and broadband, creating a robust pipeline of work.

The company's strategic partnerships directly benefit from these policy shifts. A notable example is Brookfield’s collaboration with Duke Energy in Florida, which involves substantial investments, estimated in the billions, to upgrade the state's electricity grid. This aligns perfectly with governmental goals to enhance grid reliability and resilience against climate-related events, often supported by federal or state incentives.

Brookfield Business Partners operates within the energy and utilities sectors, which are characterized by a robust and often evolving regulatory landscape. This means that their investments and ongoing operations are under the watchful eye of numerous government agencies. For instance, securing approvals from bodies like the Federal Energy Regulatory Commission (FERC) is a crucial hurdle for significant deals and day-to-day business functions, impacting project timelines and financial viability.

Brookfield Business Partners navigates a complex global environment where trade policies and geopolitical stability are key considerations. While tariffs and trade disputes can impact supply chains and market access, the company's diversified business model, spanning sectors like business services, construction, and energy, offers resilience. This diversification helps mitigate the impact of localized trade disruptions, as seen in the ongoing adjustments to global trade flows throughout 2024.

Privatization trends of public assets

Brookfield Business Partners actively participates in the privatization of public assets, a significant political trend influencing its investment strategy. This involves acquiring controlling stakes in businesses that are transitioning from public to private ownership or management, particularly within infrastructure and utility sectors. For instance, in 2024, the global trend saw continued interest in privatizing state-owned enterprises across various regions, driven by government efforts to improve efficiency and attract private capital. Brookfield's expertise in managing and optimizing these assets makes it a key player in such transactions.

This strategic focus aligns with government policies aimed at reducing public debt and enhancing service delivery through private sector involvement. The ongoing privatization efforts globally present numerous opportunities for Brookfield to deploy capital and leverage its operational capabilities. For example, several European countries have been exploring the sale of stakes in energy grids and transportation networks during 2024 and early 2025, creating a fertile ground for Brookfield's acquisition strategies.

- Global Privatization Momentum: Governments worldwide continued to explore asset sales in 2024, aiming to boost fiscal health and operational efficiency.

- Brookfield's Strategic Advantage: The company's track record in infrastructure and utilities positions it favorably to capitalize on these privatization trends.

- Sector Focus: Infrastructure, utilities, and essential services remain key targets for Brookfield's privatization-related investments.

- Economic Drivers: Fiscal consolidation and the pursuit of private capital for infrastructure development are primary motivators for these political shifts.

Political stability in operating regions

Brookfield Business Partners' long-term investment success, especially in infrastructure and industrial assets, is directly tied to the political stability of its operating regions. Stable political landscapes create favorable conditions for deal-making and offer a predictable environment for business expansion.

Political instability can disrupt operations, increase regulatory uncertainty, and negatively impact asset valuations. For instance, geopolitical tensions in emerging markets where Brookfield may have investments can lead to unexpected policy changes or even nationalization risks, impacting profitability and capital deployment.

- Political Stability Index: Countries with higher political stability, as indicated by indices like the World Bank's Worldwide Governance Indicators, generally offer more secure environments for long-term investments.

- Regulatory Frameworks: Consistent and transparent regulatory frameworks are crucial for industries like utilities and manufacturing, where Brookfield Business Partners is active. Changes in tax laws, environmental regulations, or labor policies can significantly affect operational costs and investment returns.

- Geopolitical Risk: For 2024-2025, geopolitical risks, including trade disputes and regional conflicts, remain a significant factor. Brookfield's diversified portfolio helps mitigate these risks, but localized instability can still impact specific assets or projects.

- Government Support and Incentives: Political willingness to support infrastructure development and industrial growth through incentives or public-private partnerships can be a major driver for investments in sectors like renewable energy or transportation.

Governments globally continue to drive infrastructure development, with significant policy initiatives like the US Bipartisan Infrastructure Law, allocating over $1.2 trillion in 2023, creating substantial opportunities. Brookfield's strategic focus on privatizing public assets, a trend observed across Europe in 2024-2025, aligns with government goals to enhance efficiency and attract private capital.

Political stability is paramount for Brookfield's long-term success, particularly in infrastructure and industrial sectors. Geopolitical risks and regional conflicts in 2024-2025 necessitate careful navigation, though Brookfield's diversified portfolio offers resilience against localized disruptions.

Regulatory frameworks, including tax laws and environmental policies, directly impact Brookfield's operational costs and investment returns. Consistent and transparent regulations are vital, especially in the energy and utilities sectors where government agency approvals, such as from FERC, are critical hurdles.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external forces impacting Brookfield Business, covering Political, Economic, Social, Technological, Environmental, and Legal factors. It offers actionable insights into how these macro-environmental elements create both challenges and strategic advantages for the company.

A clear, actionable breakdown of external factors impacting Brookfield's strategy, enabling proactive decision-making and mitigating potential risks.

Economic factors

Brookfield Business Partners navigated a mixed global economic landscape in Q2 2025, reporting positive financial results that underscore its operational strength. The company's diversified portfolio and strategic focus on compounding value are designed to weather economic downturns, a crucial advantage in an environment where recession risks remain a concern for many sectors.

Brookfield Business Partners actively manages its capital structure, a crucial element in navigating interest rate fluctuations. For instance, in the second quarter of 2025, the company reported a positive impact on its Adjusted EFO (Earnings from Operations) directly attributable to lower interest expenses stemming from reduced corporate borrowings. This highlights how effectively managing debt can cushion the blow of rising rates.

The cost of capital for Brookfield Business is intrinsically linked to prevailing interest rates. Any upward movement in rates directly increases the expense associated with financing new acquisitions, a key growth driver for the company. Furthermore, existing debt obligations become more costly to service, impacting overall profitability and potentially limiting future investment capacity.

Inflationary pressures significantly impact Brookfield's operational costs across its diverse portfolio. For instance, rising energy and raw material prices in 2024 have directly squeezed profit margins for many industrial and manufacturing-focused entities within the conglomerate. This trend can lead to stagnated earnings if companies cannot fully pass on these increased expenses to consumers.

Despite these challenges, Brookfield's strategic emphasis on acquiring and managing high-quality businesses with strong competitive advantages serves as a crucial buffer. These resilient companies are often better positioned to absorb or pass on cost increases, thereby mitigating the full brunt of inflationary pressures on their bottom lines.

Currency exchange rate volatility

Currency exchange rate volatility presents a significant challenge for Brookfield Business Partners, a global enterprise. Fluctuations in exchange rates can impact the U.S. Dollar value of its international assets and earnings. For instance, a strengthening U.S. Dollar against other currencies would reduce the reported value of foreign earnings when converted back. This dynamic affects financial reporting and can influence investment decisions and profitability.

The impact of currency fluctuations is a constant consideration. For example, in early 2024, the U.S. Dollar experienced moderate strength against several major currencies, potentially impacting the translation of overseas profits for companies like Brookfield.

- Impact on Asset Valuation: A stronger USD can devalue foreign assets when reported in USD terms.

- Earnings Translation Risk: Profits earned in foreign currencies can translate to lower USD earnings if the USD strengthens.

- Hedging Strategies: Companies often employ hedging strategies to mitigate currency risks, though these can also incur costs.

- Market Volatility: Geopolitical events and differing economic policies can exacerbate currency volatility, as seen with ongoing global economic adjustments in 2024.

Commodity price trends (energy, construction materials)

Commodity price trends, particularly for energy and construction materials, significantly impact Brookfield Business Partners' operational costs and revenue streams across its diverse portfolio. For instance, rising oil and natural gas prices can boost earnings in its energy services segment, while also increasing input costs for construction projects.

The company's involvement in areas like advanced energy storage means it can capitalize on favorable market trends for materials such as lithium and cobalt. However, volatility in these markets presents both opportunities and risks. For example, the average price of West Texas Intermediate (WTI) crude oil fluctuated considerably in late 2023 and early 2024, impacting energy-related revenues.

- Energy Prices: Fluctuations in oil and gas prices directly affect Brookfield's energy services and infrastructure segments.

- Construction Materials: Trends in lumber, steel, and cement prices influence the profitability of its construction and real estate operations.

- Advanced Materials: The cost and availability of materials like lithium and nickel are critical for its investments in energy storage and renewables.

- Market Volatility: Commodity markets are inherently volatile, requiring strategic hedging and supply chain management to mitigate risks.

Brookfield Business Partners operates within a global economic environment influenced by interest rate policies and inflation, impacting its cost of capital and operational expenses. For instance, in Q2 2025, the company noted a positive impact on Adjusted EFO from reduced interest expenses, showcasing effective debt management amidst fluctuating rates.

Inflationary pressures in 2024 directly affected input costs for many of Brookfield's industrial and manufacturing segments, highlighting the need for resilient business models that can pass on expenses. Currency exchange rate volatility also remains a key factor, with a stronger U.S. Dollar in early 2024 potentially reducing the reported value of foreign earnings.

Commodity price trends, particularly in energy and construction materials, present a dual-edged sword. While rising oil prices can benefit its energy services segment, they also increase costs for construction projects, demonstrating the intricate balance Brookfield must manage across its diverse portfolio.

| Economic Factor | Impact on Brookfield Business Partners | Data/Observation (2024-2025) |

| Interest Rates | Affects cost of capital for acquisitions and servicing existing debt. | Positive impact on Adjusted EFO from lower interest expenses noted in Q2 2025. |

| Inflation | Increases operational costs (energy, raw materials), potentially squeezing profit margins. | Rising energy and raw material prices impacted profit margins in industrial/manufacturing segments in 2024. |

| Currency Exchange Rates | Volatility impacts the USD value of foreign assets and earnings. | Moderate USD strength in early 2024 potentially reduced reported foreign earnings. |

| Commodity Prices | Influences revenue (energy) and costs (construction materials). | WTI crude oil prices fluctuated considerably in late 2023/early 2024, impacting energy segment revenues. |

Same Document Delivered

Brookfield Business PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Brookfield Business PESTLE analysis provides a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the strategic landscape and make informed decisions with this detailed report.

Sociological factors

Population growth in key operating regions, such as Florida, directly drives the demand for essential services and infrastructure, which Brookfield Business Partners invests in. For instance, Florida's population is projected to reach 23.8 million by 2025, a significant increase from 2020. This demographic trend underpins the rationale for increased capital spending in utility and infrastructure sectors.

Brookfield Business Partners relies heavily on a skilled and stable workforce for its diverse industrial and service operations. The availability of qualified labor directly impacts operational efficiency and the capacity for future growth. For instance, in 2024, sectors like renewable energy infrastructure and specialized logistics, key areas for Brookfield, faced ongoing demand for technicians and project managers, with some regions reporting skill shortages.

Public sentiment towards industrial and energy companies is increasingly shaped by environmental concerns and a demand for social responsibility. Brookfield's commitment to sustainability and Environmental, Social, and Governance (ESG) principles is therefore crucial for maintaining its social license to operate and stakeholder confidence. For instance, a 2024 survey indicated that over 70% of consumers consider a company's environmental impact when making purchasing decisions, directly affecting brand perception.

Corporate social responsibility (CSR) expectations

Brookfield Business Partners actively embeds sustainability into its operations, focusing on reducing environmental footprints, prioritizing workforce safety, and maintaining high governance standards. This dedication resonates with the increasing demand from investors and the public for companies to demonstrate strong corporate social responsibility.

The company's commitment is underscored by its participation in initiatives like the Task Force on Climate-related Financial Disclosures (TCFD), which aims to provide consistent and comparable information about climate-related risks and opportunities. As of its latest reporting in 2024, Brookfield Business Partners continued to detail its progress in areas such as greenhouse gas emissions reduction and responsible resource management.

- Environmental Stewardship: Brookfield Business Partners reports on its efforts to minimize its carbon footprint, with specific targets often outlined in its annual sustainability reports, reflecting industry trends towards net-zero commitments.

- Social Impact: The company emphasizes employee well-being and safety, with safety performance metrics regularly disclosed, aligning with a broader societal focus on ethical labor practices.

- Governance Excellence: Strong corporate governance, including transparent reporting and ethical conduct, is a cornerstone of Brookfield's approach, meeting the heightened expectations of stakeholders for accountability.

- Investor Scrutiny: Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions, with a significant portion of global assets under management now screened for ESG performance, impacting capital allocation for companies like Brookfield.

Community engagement and social license to operate

Brookfield Business Partners actively works to be a good corporate neighbor, weaving community interests into its strategic choices. This commitment is crucial for maintaining a social license to operate, which is essential for sustained success. For instance, in 2023, Brookfield invested over $50 million in community development initiatives across its global operations, focusing on education and local infrastructure improvements. This proactive approach fosters trust and goodwill, directly impacting operational continuity and reducing the risk of project delays or community opposition.

Maintaining strong community relationships is more than just good PR; it's a fundamental aspect of risk management and long-term value creation. Brookfield's engagement strategies often involve:

- Local Employment: Prioritizing hiring from local communities, contributing to economic development and fostering positive sentiment. In 2024, approximately 65% of the workforce for Brookfield's renewable energy projects in North America were sourced locally.

- Environmental Stewardship: Implementing practices that minimize environmental impact and contribute to local ecological health, often exceeding regulatory requirements.

- Stakeholder Dialogue: Regularly engaging with local leaders, residents, and community groups to understand concerns and incorporate feedback into business plans.

- Philanthropic Support: Providing financial and in-kind support to local charities and non-profit organizations that address community needs.

Societal expectations regarding corporate responsibility continue to evolve, with a growing emphasis on ethical labor practices and employee well-being. Brookfield Business Partners' focus on workforce safety, evidenced by its consistent reporting on safety metrics, aligns with these rising standards. Furthermore, public perception is increasingly tied to a company's commitment to sustainability and ESG principles, making transparent reporting on environmental impact and social initiatives vital for maintaining stakeholder trust and a positive brand image.

Brookfield's engagement with communities is a strategic imperative, fostering goodwill and mitigating operational risks. By prioritizing local employment, as seen with approximately 65% of its North American renewable energy project workforces sourced locally in 2024, the company contributes to economic development and builds stronger community ties. This approach, coupled with philanthropic support and stakeholder dialogue, solidifies its social license to operate.

| Sociological Factor | Brookfield Business Partners' Response/Impact | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Population Growth | Drives demand for infrastructure and services. | Florida's projected population of 23.8 million by 2025. |

| Workforce Availability & Skills | Impacts operational efficiency and growth. | Ongoing demand for skilled technicians in renewable energy and logistics. |

| Public Sentiment & ESG | Shapes brand perception and investor decisions. | Over 70% of consumers consider environmental impact (2024 survey). |

| Community Relations | Enhances social license to operate and reduces risk. | Over $50 million invested in community initiatives (2023). |

Technological factors

Brookfield is heavily invested in the energy transition, with its affiliates actively developing and deploying advanced renewable energy technologies. This includes significant investments in hydroelectric, wind, and utility-scale solar projects. A particular focus is on battery energy storage systems, which are crucial for grid stability as renewable energy penetration increases.

In 2024, Brookfield Renewable Partners reported a substantial increase in its renewable power generation capacity, driven by new projects coming online and strategic acquisitions. The company’s commitment to battery storage is evident in its growing pipeline of storage projects, aiming to provide reliable clean energy solutions and capitalize on the surging global demand for decarbonization.

Brookfield is heavily investing in digital transformation and automation, particularly within its business services division. For instance, in 2024, the company allocated a substantial portion of its capital expenditures towards technology modernization projects aimed at streamlining operations and improving client experiences.

This strategic push for digitalization is designed to boost operational efficiency and elevate customer satisfaction. By embracing advanced technologies, Brookfield aims to gain a competitive edge in the market, anticipating a significant uplift in productivity and service delivery by 2025.

Cybersecurity threats are a significant concern for Brookfield Business Partners, as evidenced by a recent cyber incident affecting its dealer software and technology services. This event highlights the direct impact such risks can have on operational performance and the integrity of sensitive data.

Maintaining robust data protection is paramount for ensuring business continuity and preserving stakeholder trust. In 2023, the financial services sector experienced a notable increase in cyberattacks, with the average cost of a data breach reaching $4.45 million globally, according to IBM's Cost of a Data Breach Report.

Innovation in infrastructure development and maintenance

Brookfield is significantly investing in the foundational infrastructure necessary for the AI boom, acting as a key enabler. This includes substantial capital allocation towards data centers and semiconductor fabrication plants, essential components for AI's computational demands. For instance, in 2024, Brookfield announced plans to invest billions in expanding its data center portfolio across North America and Europe to meet the escalating need for AI processing power.

The company's strategy emphasizes continuous innovation in how these critical facilities are built and managed. This innovation extends to developing more efficient cooling systems for data centers, utilizing advanced materials in construction for greater durability, and implementing smart technologies for predictive maintenance. This proactive approach ensures operational resilience and cost-effectiveness in a rapidly evolving technological landscape.

- Data Center Expansion: Brookfield's commitment to AI infrastructure development is underscored by its planned USD 10 billion investment in data center capacity globally through 2025.

- Semiconductor Facility Support: The company is actively involved in developing and managing facilities crucial for semiconductor manufacturing, recognizing their pivotal role in AI hardware.

- Technological Integration: Innovation is focused on integrating cutting-edge technologies for energy efficiency and operational uptime in its infrastructure projects.

- Strategic Partnerships: Brookfield is forging partnerships with AI leaders to ensure its infrastructure development aligns with future technological requirements.

Impact of AI and IoT on operational efficiency

Brookfield is actively integrating artificial intelligence (AI) to streamline operations throughout its vast portfolio, with a clear objective of boosting efficiency and elevating customer experiences. This strategic adoption is geared towards optimizing resource allocation and predictive maintenance across its real estate, infrastructure, and renewable energy assets.

The company's forward-thinking approach is exemplified by its collaborations, such as the significant partnership with Microsoft. This alliance is specifically focused on harnessing AI for the advancement of renewable energy solutions, underscoring Brookfield's dedication to leveraging cutting-edge technology for tangible operational improvements and to capitalize on the burgeoning AI market, which is projected to reach trillions of dollars in economic impact by 2030.

Key technological advancements impacting Brookfield's operational efficiency include:

- AI-driven predictive maintenance: Reducing downtime and maintenance costs in infrastructure and renewable energy assets. For example, AI can analyze sensor data from wind turbines to predict potential failures before they occur, saving millions in repair costs and lost energy production.

- IoT for real-time monitoring: Enabling granular oversight of energy consumption, asset performance, and environmental conditions across its properties, leading to smarter energy management and cost savings. The global IoT market is expected to exceed $1.5 trillion by 2025.

- Automation of routine tasks: AI and robotics are being deployed to automate tasks in property management and logistics, freeing up human capital for more strategic initiatives and improving overall productivity.

Brookfield is significantly investing in foundational infrastructure for the AI boom, including data centers and semiconductor fabrication plants. In 2024, the company announced billions in data center expansion across North America and Europe to meet AI processing demands.

The company is integrating AI to streamline operations, boost efficiency, and enhance customer experiences across its real estate, infrastructure, and renewable energy assets. A key partnership with Microsoft focuses on leveraging AI for renewable energy advancements.

Technological advancements like AI-driven predictive maintenance and IoT for real-time monitoring are crucial for Brookfield's operational efficiency. These technologies aim to reduce downtime, optimize asset performance, and improve energy management.

Brookfield's commitment to AI infrastructure development includes a planned USD 10 billion investment in global data center capacity through 2025, alongside support for semiconductor manufacturing facilities.

Legal factors

Brookfield Business Partners, as a global acquirer, faces stringent antitrust and competition laws. In 2024, the European Commission continued its robust enforcement, with significant fines levied against companies for anti-competitive practices, underscoring the need for meticulous compliance in M&A activities.

Navigating these regulations is crucial for Brookfield to obtain approval for its acquisitions and maintain fair competition across its varied business segments. Failure to comply can result in substantial penalties and hinder strategic growth initiatives.

Brookfield Business Partners operates under stringent environmental regulations, a critical legal factor for its energy and industrial businesses. Compliance is paramount, requiring significant investment in sustainable practices and pollution control technologies.

The company actively aligns its reporting with global frameworks such as the Global Reporting Initiative (GRI) and the Task Force on Climate-related Financial Disclosures (TCFD). In 2023, Brookfield reported a 15% reduction in Scope 1 and Scope 2 greenhouse gas emissions intensity compared to its 2019 baseline, demonstrating progress towards its environmental goals.

Brookfield Business Partners' global operations necessitate strict adherence to diverse labor laws and employment regulations across various countries. For instance, in 2024, companies operating in the European Union face increasing scrutiny under directives like the proposed EU Pay Transparency Directive, aiming to ensure equal pay for equal work, which impacts hiring and compensation structures.

The company's commitment to sustainability, as outlined in its guiding principles, translates to robust internal policies that prioritize employee well-being and human rights. This includes fostering a positive work environment, which is crucial given that employee engagement directly correlates with productivity; a 2024 Gallup study indicated highly engaged teams show 23% higher profitability.

Navigating these legal landscapes requires significant investment in compliance. In 2025, the global cost of regulatory compliance for businesses is projected to continue its upward trend, driven by evolving labor standards and data privacy laws, which Brookfield Business Partners must actively manage to mitigate risks and maintain operational integrity.

Contract law and project agreements

Brookfield's strategy hinges on acquiring controlling stakes, making the legal framework of its project agreements critical. These contracts are the bedrock for ensuring long-term cash flow stability and mitigating potential risks associated with its diverse portfolio. For instance, in 2023, Brookfield completed a significant number of transactions, each requiring meticulously drafted agreements to safeguard its investments.

The enforceability and clarity of these contracts directly impact Brookfield's ability to execute complex strategic initiatives and manage its global operations effectively. A robust legal foundation is essential for navigating regulatory landscapes and ensuring predictable returns on its substantial capital deployments. The company's commitment to rigorous due diligence extends to the legal review of every agreement, underscoring its importance to financial performance.

- Contractual Robustness: Brookfield's investment model necessitates strong, legally sound contracts to secure long-term cash flows and manage operational risks across its global holdings.

- Risk Mitigation: The legal structure of project agreements is paramount in protecting Brookfield's substantial capital investments and ensuring the successful implementation of its strategic growth plans.

- Transaction Volume: In 2023, Brookfield was involved in numerous high-value transactions, each requiring complex project agreements that underscore the importance of contract law in its operations.

Data privacy and consumer protection laws

Brookfield’s technology-driven services, including its dealer software, necessitate strict adherence to data privacy and consumer protection laws. Regulations like the EU's General Data Protection Regulation (GDPR) and similar frameworks globally impose significant obligations. Failure to comply can result in substantial fines, impacting financial performance and brand reputation.

For instance, in 2023, the EU continued to enforce GDPR, with reported fines reaching hundreds of millions of euros for various companies. Brookfield's commitment to these standards is therefore paramount for several reasons:

- Mitigating Legal and Financial Risks: Compliance avoids costly penalties and legal battles.

- Building Customer Trust: Demonstrating robust data protection enhances customer confidence and loyalty.

- Safeguarding Sensitive Information: Protecting customer data is essential for operational integrity and preventing breaches.

- Ensuring Market Access: Adherence to international privacy standards facilitates operations in diverse global markets.

Brookfield Business Partners must navigate a complex web of global legal and regulatory frameworks. This includes stringent antitrust laws, as seen in the European Commission's continued robust enforcement in 2024, which can impact M&A approvals and incur substantial penalties for non-compliance.

Environmental regulations are also critical, particularly for its energy and industrial sectors. Brookfield's reported 15% reduction in Scope 1 and 2 GHG emissions intensity by 2023 demonstrates its efforts to align with sustainable practices and global reporting standards like TCFD.

Furthermore, adherence to diverse labor laws, such as the EU's focus on pay transparency in 2024, is essential for managing its global workforce and ensuring fair practices, which a 2024 Gallup study linked to a 23% increase in profitability for engaged teams.

Data privacy laws, including GDPR, are paramount for its technology services, with significant fines levied globally in 2023 for non-compliance, highlighting the need for robust data protection to maintain customer trust and market access.

Environmental factors

Brookfield Business Partners' substantial stake in renewable energy, managed through its affiliates, makes it particularly responsive to evolving climate change policies and the introduction of carbon pricing. These governmental actions directly influence the economic viability and attractiveness of its green energy investments.

The company's commitment to achieving net-zero greenhouse gas emissions by 2050, or even earlier, underscores its strategic alignment with global decarbonization efforts. This commitment positions Brookfield to benefit from policies that incentivize emission reductions and the transition to cleaner energy sources.

For instance, as of early 2024, many jurisdictions are strengthening their carbon pricing mechanisms, with some European nations already implementing or expanding carbon taxes and emissions trading systems. This trend is expected to continue, potentially increasing operational costs for carbon-intensive industries while simultaneously boosting the competitiveness of renewable energy assets within Brookfield's portfolio.

Brookfield's extensive operations in industrial and infrastructure sectors, including construction and energy, inherently demand significant quantities of raw materials, water, and energy. For instance, in 2024, the global demand for critical minerals essential for infrastructure development was projected to rise substantially, impacting supply chains and costs for companies like Brookfield.

Brookfield is actively pursuing strategies to enhance resource efficiency across its diverse portfolio, aiming to reduce waste and optimize consumption. This includes investing in technologies that improve energy and water usage in its facilities and projects, aligning with a broader industry trend towards circular economy principles.

Responsible management of vital resources, particularly water, is a key focus. In 2023, water scarcity affected numerous regions where Brookfield operates, prompting the company to implement advanced water recycling and conservation programs, particularly in its energy and real estate segments, to mitigate risks and ensure operational continuity.

Brookfield Business Partners must adhere to stringent pollution control and waste management regulations, which are critical for its environmental responsibility. The company's 2023 sustainability report highlights significant progress, including a 15% reduction in landfill waste across its global operations compared to 2022, demonstrating a commitment to responsible waste handling and circular economy principles.

Transition to a green economy and renewable energy adoption

Brookfield is heavily invested in the global shift towards a green economy, focusing on renewable energy. This strategy aligns with the growing worldwide need for sustainable power sources, positioning Brookfield as a key player in this evolving market.

The company's portfolio includes significant investments in hydroelectric, wind, solar, and battery storage projects. For instance, as of late 2023, Brookfield Renewable Partners managed over 25,000 megawatts of renewable capacity across more than 250 facilities globally, demonstrating its substantial operational scale.

This focus on clean energy adoption is driven by several factors:

- Growing Investor Demand: There's a significant increase in capital allocation towards ESG (Environmental, Social, and Governance) compliant assets, with renewable energy being a prime beneficiary.

- Government Policies and Incentives: Many governments are implementing policies and offering incentives to accelerate renewable energy deployment, creating a favorable regulatory environment. For example, the US Inflation Reduction Act of 2022 provides substantial tax credits for clean energy projects, impacting investment decisions throughout 2024 and beyond.

- Technological Advancements: Continuous improvements in renewable energy technologies, such as solar panel efficiency and battery storage costs, are making these solutions increasingly competitive with traditional energy sources.

Extreme weather events impacting infrastructure

Brookfield Business Partners, as a significant owner and operator of critical infrastructure, faces substantial risks from increasingly frequent and severe weather events. These disruptions can directly impact the physical integrity and operational continuity of assets like power grids, transportation networks, and communication systems.

Mitigating these impacts requires ongoing investment in infrastructure resilience. For instance, Brookfield's partnerships, such as its collaboration with Duke Energy Florida, focus on grid modernization and hardening efforts. These initiatives are designed to better withstand the physical stresses of extreme weather, ensuring more reliable service delivery and reducing potential financial losses from downtime or damage.

- Increased Investment in Resiliency: Brookfield's capital allocation increasingly prioritizes projects that enhance the durability of its infrastructure against climate-related threats.

- Operational Adaptations: The company is adapting operational strategies to manage the immediate aftermath of extreme weather, including rapid response and repair protocols.

- Financial Exposure: Extreme weather events can lead to significant costs related to repairs, business interruption, and potential regulatory penalties, impacting profitability and asset valuations.

Brookfield's significant investments in renewable energy, managed by affiliates, make it highly sensitive to climate change policies and carbon pricing. These governmental actions directly shape the financial viability of its green energy assets, a critical component of its portfolio as of 2024.

The company's commitment to net-zero emissions by 2050 aligns with global decarbonization trends, positioning it to benefit from incentives for emission reductions. For example, the US Inflation Reduction Act of 2022 offers substantial tax credits for clean energy projects, influencing investment decisions throughout 2024.

Brookfield's operations in sectors like construction and energy require substantial resources, including raw materials and water. In 2024, the demand for critical minerals for infrastructure was projected to surge, impacting supply chains and costs for companies like Brookfield.

The company is actively enhancing resource efficiency, aiming to reduce waste and optimize consumption. This includes investing in technologies that improve energy and water usage, reflecting a broader industry move towards circular economy principles.

Brookfield Business Partners faces risks from increasingly severe weather events, which can disrupt infrastructure operations. To counter this, the company is investing in infrastructure resilience, such as grid modernization efforts with partners like Duke Energy Florida, to better withstand climate-related stresses.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Brookfield Business draws from a diverse range of data sources, including reports from major financial institutions like the World Bank and IMF, as well as government publications and reputable industry analysis firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.