Brookfield Business Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Business Bundle

Unlock the strategic genius behind Brookfield Business's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their core activities, customer relationships, and revenue streams, offering invaluable insights for your own ventures. Discover how they create and capture value, and gain a competitive edge.

Ready to dissect Brookfield Business's winning formula? Our full Business Model Canvas provides a clear, actionable map of their entire operation, from key resources to cost structure. Download it now to gain a strategic advantage and accelerate your business planning.

Partnerships

Brookfield Business Partners actively cultivates relationships with co-investors and capital partners, including prominent institutional investors, pension funds, and sovereign wealth funds. These collaborations are essential for pooling significant capital, enabling the pursuit of larger, more impactful acquisitions. For instance, in 2023, Brookfield Business Partners successfully closed a number of substantial transactions by leveraging these partnerships, demonstrating their critical role in expanding investment capacity and sharing risk across a wider investor base.

Brookfield Business Partners relies heavily on financing institutions, including major banks and credit providers, to fuel its acquisition strategy and manage the day-to-day liquidity needs of its diverse portfolio companies. These relationships are critical for securing the substantial debt financing required for large-scale transactions, ensuring Brookfield Business can execute its growth plans effectively. For instance, in 2023, the company continued to leverage its strong ties with global financial institutions to access a variety of credit facilities, supporting its operational and strategic objectives.

Brookfield Business Partners actively collaborates with a network of industry experts and advisors. These specialized consultants, legal professionals, and operational specialists are crucial for gaining deep sector-specific knowledge and navigating complex due diligence. For instance, in 2024, their strategic partnerships were instrumental in assessing the market potential and operational efficiencies of several key acquisitions, contributing to enhanced value creation.

Management Teams of Acquired Businesses

Brookfield Business Partners (BBP) views the management teams of acquired companies as critical partners, essential for smooth integration and unlocking post-acquisition value. These seasoned leaders are entrusted with the ongoing operational management and strategic implementation within their respective businesses.

Maintaining strong, collaborative relationships with these management teams ensures business continuity and facilitates the effective transfer of vital operational knowledge. This partnership is key to aligning the acquired entity's long-term strategic objectives with BBP's overarching goals, fostering sustainable growth.

- Operational Expertise: Acquired management teams possess deep, intrinsic knowledge of their business operations, crucial for day-to-day efficiency.

- Strategic Continuity: They provide continuity in strategic execution, ensuring that established growth plans are maintained and adapted.

- Value Enhancement: Their leadership is instrumental in identifying and realizing opportunities for value enhancement post-acquisition.

- Knowledge Transfer: BBP relies on these teams for transferring critical institutional knowledge to new structures.

Government and Regulatory Bodies

Brookfield Business Partners actively engages with government and regulatory bodies to ensure compliance and operational stability. These interactions are crucial for navigating diverse legal frameworks and obtaining necessary permits, especially in sectors like infrastructure and energy. For instance, in 2024, Brookfield Business continued to manage its extensive portfolio across numerous countries, each with its own set of regulations governing environmental standards, labor practices, and financial reporting.

Maintaining positive relationships with these entities is vital for Brookfield Business's ability to secure new projects and expand its operations. Adherence to regulations not only prevents legal challenges but also enhances the company's reputation as a responsible operator. In 2024, significant efforts were directed towards meeting evolving ESG (Environmental, Social, and Governance) requirements mandated by various governments, impacting areas such as carbon emissions and supply chain transparency.

- Regulatory Compliance: Ensuring adherence to all applicable laws and regulations in the 30+ countries where Brookfield Business operates.

- Permitting and Licensing: Securing and maintaining essential permits for infrastructure projects, utilities, and industrial operations.

- Policy Engagement: Participating in dialogues with policymakers to understand and influence regulatory environments affecting key business segments.

- ESG Standards: Meeting increasingly stringent environmental, social, and governance mandates from global regulatory bodies.

Brookfield Business Partners strategically partners with a diverse range of capital providers, including institutional investors, pension funds, and sovereign wealth funds, to co-invest in substantial transactions. These alliances are crucial for aggregating the significant capital required for large-scale acquisitions, thereby expanding investment capacity and sharing risk. In 2023, the company successfully executed several major deals by leveraging these key relationships.

Financing institutions, such as major banks and credit providers, are fundamental to Brookfield Business Partners' operational and acquisition strategies, ensuring access to necessary debt financing and liquidity. These partnerships are critical for facilitating large transactions and supporting the ongoing financial needs of its portfolio companies. Throughout 2023, Brookfield Business continued to utilize its strong banking relationships to secure diverse credit facilities.

Brookfield Business Partners also relies on industry experts and specialized advisors, including consultants and legal professionals, to gain in-depth sector knowledge and navigate complex due diligence processes. These collaborations are vital for informed decision-making and value creation. In 2024, such strategic alliances played a key role in evaluating market opportunities for new acquisitions.

The management teams of acquired companies are considered indispensable partners by Brookfield Business Partners, facilitating seamless integration and post-acquisition value realization. These leaders are empowered to manage operations and implement strategies, ensuring business continuity and effective knowledge transfer. Their expertise is crucial for aligning acquired entities with BBP's long-term objectives.

| Key Partnership Type | Role and Importance | 2023/2024 Examples/Data |

| Co-investors & Capital Partners | Capital aggregation for large acquisitions, risk sharing | Closed multiple substantial transactions by leveraging these partnerships in 2023. |

| Financing Institutions | Debt financing for acquisitions, liquidity management | Continued to leverage strong ties with global financial institutions for credit facilities in 2023. |

| Industry Experts & Advisors | Sector-specific knowledge, due diligence support | Partnerships instrumental in assessing market potential and operational efficiencies of acquisitions in 2024. |

| Acquired Company Management | Operational management, strategic implementation, knowledge transfer | Essential for smooth integration and unlocking post-acquisition value. |

What is included in the product

A comprehensive, pre-written business model tailored to Brookfield Business Partners' strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

Streamlines complex business strategy into a clear, actionable framework, alleviating the pain of strategic ambiguity.

Provides a structured approach to identify and address customer pains, offering a tangible solution to market challenges.

Activities

Brookfield Business Partners actively engages in identifying, evaluating, and executing strategic acquisitions of high-quality businesses worldwide. This involves rigorous due diligence, precise valuation, and skillful deal structuring to secure controlling stakes in companies poised for growth.

The firm's investment management strategy prioritizes businesses exhibiting robust competitive advantages and a clear path to sustained long-term value creation. For instance, in 2024, Brookfield Business completed several significant acquisitions, including a substantial stake in a leading global logistics provider, demonstrating their commitment to expanding their portfolio in sectors with strong secular tailwinds.

Brookfield Business Partners focuses on enhancing operations within its portfolio companies. For instance, in 2024, they continued to implement efficiency programs across their businesses, aiming to reduce operating expenses and boost profitability. This hands-on approach involves deploying capital into initiatives that improve productivity and streamline workflows.

A key aspect of their strategy involves optimizing cost structures and driving revenue growth. By identifying and implementing best practices, Brookfield Business Partners seeks to unlock the inherent value in each asset. This operational enhancement directly contributes to maximizing distributable cash flow, a critical metric for their performance.

For example, in their construction segment, the company has been leveraging technology to improve project management and reduce waste, leading to better margins. This focus on operational excellence is a core driver of value creation across their diverse business interests.

Brookfield Business Partners actively raises capital from a broad investor base, including institutional clients like pension funds and sovereign wealth funds, as well as high-net-worth individuals. For instance, in 2023, Brookfield Corporation, which holds a significant stake in BBP, continued to manage substantial capital flows across its various platforms.

The firm then strategically allocates this raised capital to a diverse range of investment opportunities and its existing portfolio companies. This allocation is designed to fuel growth, drive operational improvements, and ultimately enhance shareholder value across sectors like business services, construction, and energy. Efficient capital deployment is paramount to achieving their investment objectives.

Asset Management and Portfolio Oversight

Brookfield Business Partners actively manages and oversees its diverse portfolio of companies. This involves continuous monitoring of each business's performance, identifying and mitigating potential risks, and making crucial strategic decisions to guide their future development. This hands-on approach ensures that all portfolio companies remain aligned with Brookfield's overarching investment goals and contribute to long-term value creation.

In 2024, Brookfield Business Partners continued its strategy of active asset management. For instance, the company's focus on operational improvements and strategic capital allocation within its industrial segment, which includes businesses like Westinghouse, aimed to enhance profitability and market positioning. The company's commitment to this active oversight is reflected in its consistent efforts to optimize returns across its holdings.

- Portfolio Diversification: Brookfield Business Partners manages a broad range of businesses across sectors like business services, industrial, and infrastructure services.

- Performance Monitoring: Key performance indicators (KPIs) are continuously tracked for each entity to ensure operational efficiency and financial health.

- Risk Management: Proactive identification and mitigation of financial, operational, and market risks are central to protecting and enhancing asset value.

- Strategic Capital Allocation: Decisions regarding reinvestment, divestment, and acquisitions are made to optimize the overall portfolio's growth and profitability.

Strategic Divestitures and Realizations

Brookfield Business Partners actively manages its portfolio by strategically divesting mature or optimized assets. This process is crucial for unlocking value and generating capital to reinvest in growth areas.

In 2023, Brookfield Business Partners completed several strategic divestitures, including the sale of its interest in the Australian infrastructure services business, which contributed significantly to realized gains and enhanced liquidity. These actions are fundamental to their strategy of capital recycling and value creation.

- Strategic Divestitures: Periodically selling off mature or optimized assets.

- Capital Realization: Aiming to generate substantial returns on investment.

- Capital Recycling: Reallocating proceeds to new, promising opportunities.

- Profitability and Liquidity: Timely sales bolster the firm's financial strength.

Brookfield Business Partners' key activities revolve around acquiring, managing, and optimizing a diverse portfolio of businesses. They actively seek out companies with strong competitive advantages, focusing on operational improvements and strategic capital allocation to drive long-term value. In 2024, significant acquisitions and ongoing efficiency programs underscored this approach.

Preview Before You Purchase

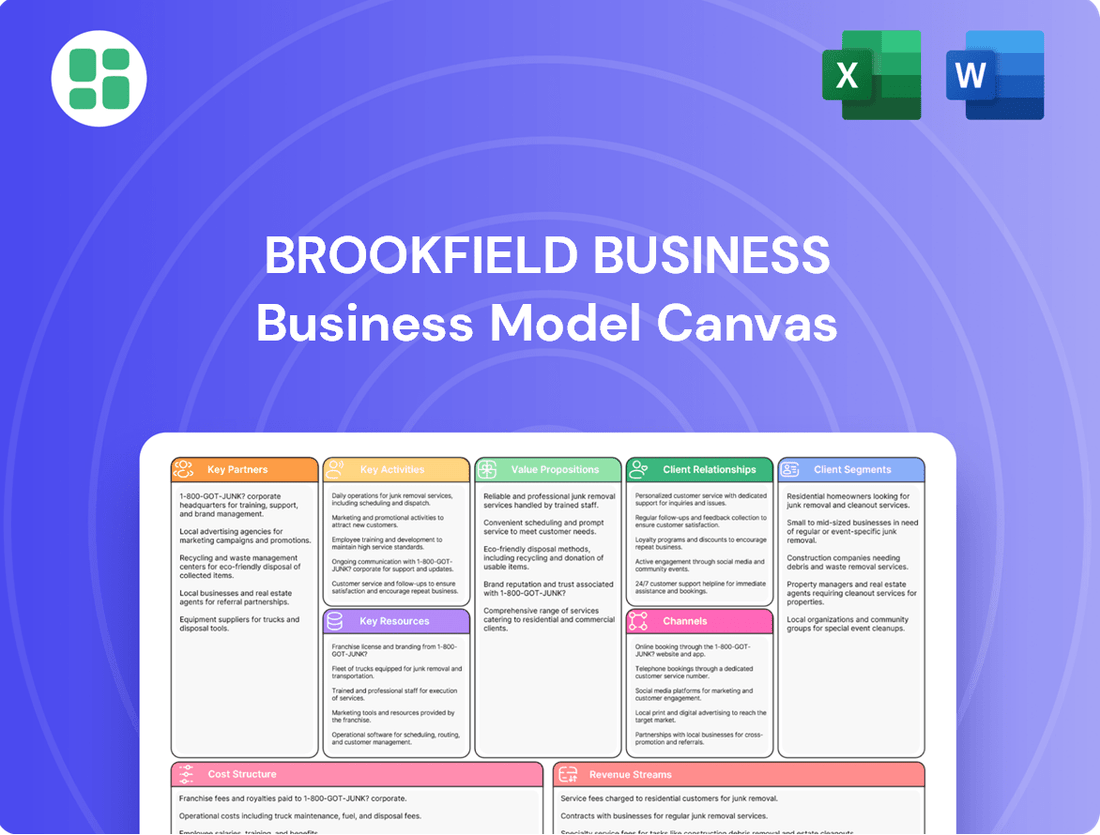

Business Model Canvas

The Brookfield Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. You'll gain full access to this exact Business Model Canvas, allowing you to immediately begin strategizing and refining your business operations.

Resources

Brookfield Business Partners (BBU) leverages substantial financial capital as a cornerstone of its business model. This capital, drawn from a diverse base including institutional investors, robust debt markets, and its own retained earnings, fuels its aggressive acquisition strategy. For instance, in 2024, BBU continued to demonstrate its capacity for significant capital deployment, participating in major transactions that underscore its financial strength and ability to execute large-scale deals.

Brookfield Business Partners relies on a deep bench of seasoned professionals, including those with extensive operational, financial, and sector-specific knowledge. This human capital is indispensable for driving efficiency, successfully integrating acquired companies, and ensuring the ongoing performance of their diverse portfolio. For instance, in 2023, their focus on operational enhancements contributed to a significant portion of their value creation across various segments.

Brookfield Business's extensive global network, boasting relationships with industry leaders, financial institutions, and business owners, is a cornerstone of its Business Model Canvas. This vital pipeline fuels new investment opportunities and strategic partnerships, enabling the company to source deals effectively. For instance, in 2023, Brookfield Business completed 14 acquisitions, a testament to the strength of its deal-sourcing capabilities, which are heavily reliant on these deep-rooted connections.

This expansive network is crucial for comprehensive due diligence and gathering market intelligence across a wide array of geographies and sectors. It allows Brookfield Business to gain insights that are not readily available, providing a significant competitive advantage. Their ability to leverage these strong relationships was evident in their successful integration of Apollo Global Management's infrastructure credit business in 2024, a move that significantly expanded their asset management reach.

Proprietary Investment Frameworks and Due Diligence Processes

Brookfield Business Partners relies heavily on its proprietary investment frameworks and meticulous due diligence processes as core intellectual assets. These established methodologies are fundamental to their investment strategy, enabling them to consistently identify, assess, and manage opportunities across diverse sectors.

These proprietary tools are not static; they are continuously refined based on market dynamics and historical performance. For instance, in 2024, Brookfield Business Partners continued to emphasize a data-driven approach to risk assessment, integrating advanced analytics into their due diligence to better predict potential challenges and opportunities.

- Proprietary Investment Frameworks: These provide a structured approach to evaluating potential acquisitions and managing existing portfolio companies, ensuring alignment with strategic objectives.

- Rigorous Due Diligence: Involves comprehensive analysis of financial, operational, and market aspects of target companies, often exceeding industry standards.

- Value Creation Plans: Each investment is underpinned by detailed plans designed to enhance operational efficiency and profitability, leveraging Brookfield's expertise.

- Disciplined Execution: The frameworks ensure a consistent and disciplined approach from initial evaluation through to exit, maximizing returns.

Diversified Portfolio of High-Quality Assets

Brookfield Business's diversified portfolio of high-quality assets, primarily in infrastructure services, energy, and construction, is a core resource. These established businesses generate consistent, cash-rich operations, forming a stable foundation. For instance, in 2024, their energy services segment continued to demonstrate resilience, contributing significantly to overall cash flow generation.

The strategic advantage of this diversification lies in its ability to smooth out earnings volatility. By operating across different economic cycles and sectors, Brookfield Business reduces its reliance on any single market. This broad base also fosters operational synergies, allowing for efficient resource allocation and shared expertise across its various holdings.

This robust asset base serves as a powerful platform for future expansion and strategic acquisitions. The stable cash flows generated by existing operations provide the financial capacity to pursue new opportunities, enhancing the company's growth trajectory. As of the first half of 2024, the company reported strong free cash flow, enabling continued investment in its portfolio and potential new ventures.

- Stable Cash Flows: Existing businesses consistently generate reliable income.

- Operational Synergies: Cross-sector collaboration enhances efficiency and expertise.

- Risk Mitigation: Diversification across sectors reduces overall portfolio risk.

- Growth Platform: The strong asset base supports future acquisitions and expansion.

Brookfield Business Partners' key resources include its substantial financial capital, a highly skilled team of professionals, and an extensive global network. These elements are crucial for sourcing deals, executing acquisitions, and driving operational improvements across its diverse portfolio. The company's proprietary investment frameworks and rigorous due diligence processes are also vital intellectual assets that guide its investment strategy and risk management.

The company’s diversified portfolio of high-quality assets, particularly in infrastructure services, energy, and construction, provides stable cash flows and a platform for growth. This diversification mitigates risk and allows for operational synergies. For instance, in the first half of 2024, Brookfield Business reported strong free cash flow, enabling continued investment and strategic expansion.

| Key Resource | Description | 2024/2023 Insight |

| Financial Capital | Access to diverse funding sources for acquisitions and operations. | Continued significant capital deployment in major transactions throughout 2024. |

| Human Capital | Expertise in operations, finance, and sector-specific knowledge. | Focus on operational enhancements in 2023 contributed significantly to value creation. |

| Global Network | Relationships with industry leaders, financial institutions, and business owners. | Facilitated 14 acquisitions in 2023; integration of Apollo Global Management's infrastructure credit business in 2024 expanded asset management reach. |

| Intellectual Assets | Proprietary investment frameworks and meticulous due diligence processes. | Emphasis on data-driven risk assessment and advanced analytics in due diligence during 2024. |

| Diversified Portfolio | High-quality assets in infrastructure services, energy, and construction. | Energy services segment demonstrated resilience and significant cash flow contribution in 2024. |

Value Propositions

Brookfield Business Partners provides investors with a compelling path to long-term capital appreciation by acquiring and improving fundamentally strong businesses. Their approach is centered on identifying companies with durable competitive advantages and implementing strategies to boost their operational performance. This focus on enhancing value over extended periods makes it an attractive proposition for investors prioritizing sustained growth.

Brookfield Business Partners enhances acquired businesses by injecting deep operational expertise and strategic guidance, focusing on optimizing cost structures and implementing best practices. This hands-on approach directly translates to increased efficiency and improved profitability for the companies they take on.

For instance, in 2023, Brookfield Business Partners reported that its portfolio companies achieved a 13% increase in Adjusted EBITDA year-over-year, a testament to their ability to drive operational improvements and financial performance.

The core value proposition is the transformation and strengthening of these businesses, making them more resilient and profitable through targeted investments in growth initiatives and operational excellence.

Investors gain access to a broad range of essential business services and industrial companies, many featuring strong competitive advantages and predictable cash flows. This strategic diversification across sectors such as infrastructure, energy, and construction is designed to provide resilience even when the economy faces challenges.

Brookfield Business Partners, for example, reported total assets of $68.7 billion as of December 31, 2023, highlighting the scale of its diversified holdings. This allows investors to participate in sectors that might otherwise be out of reach for individual investors, offering a unique avenue for portfolio enhancement.

Strategic Oversight and Governance Expertise

Brookfield Business Partners provides critical strategic oversight and governance expertise, actively guiding management teams to refine their direction and ensure rigorous financial management.

This hands-on involvement is designed to unlock hidden potential within portfolio companies and equip them to effectively navigate today's intricate market landscapes.

- Strategic Guidance: Brookfield's involvement ensures portfolio companies maintain a clear and adaptive strategic roadmap.

- Governance Excellence: A strong emphasis on corporate governance promotes accountability and sound decision-making.

- Financial Discipline: The firm instills robust financial management practices, crucial for sustainable growth.

- Operational Enhancement: This expertise directly contributes to improving operational efficiency and market positioning.

Strong Cash Flow Generation and Income Stability

Brookfield Business Partners' strategy centers on acquiring companies that consistently produce robust and predictable cash flows. This focus directly translates into a value proposition of income stability for investors, making it an appealing choice for those prioritizing reliable returns and a dependable income stream.

The company's commitment to strong cash flow generation is the bedrock of its financial resilience and its capacity to sustain and grow dividend payments. For instance, in 2023, Brookfield Business Partners reported distributable earnings of $1.7 billion, showcasing its ability to generate substantial cash to return to shareholders.

- Income Stability: Acquisition of businesses with predictable cash flows.

- Investor Appeal: Attracts investors seeking consistent returns and secure income.

- Financial Strength: Cash flow generation supports financial health and dividend capacity.

- 2023 Performance: Reported $1.7 billion in distributable earnings.

Brookfield Business Partners offers investors access to a diversified portfolio of high-quality, essential service and industrial businesses. Their strategy focuses on acquiring and operating these companies with a long-term perspective, aiming to enhance value through operational improvements and strategic capital allocation. This approach provides investors with exposure to resilient sectors and the potential for sustained capital appreciation.

The firm's hands-on management style and deep operational expertise are key value drivers. By actively engaging with portfolio companies, Brookfield Business Partners aims to optimize performance, improve efficiency, and drive profitable growth. This active involvement is designed to unlock the full potential of each business within its portfolio.

Brookfield Business Partners' commitment to generating stable cash flows is central to its value proposition. By acquiring businesses with predictable earnings, the company provides investors with a reliable stream of income and the financial capacity to support ongoing investments and distributions. This focus on cash flow generation underpins the financial resilience of its holdings.

In 2023, Brookfield Business Partners reported total assets of $68.7 billion, with its portfolio companies generating significant operational improvements, evidenced by a 13% year-over-year increase in Adjusted EBITDA for the portfolio. The company also reported distributable earnings of $1.7 billion in 2023, underscoring its ability to generate substantial cash for investors.

| Value Proposition | Description | Key Metric/Data Point |

|---|---|---|

| Acquisition & Improvement of Fundamentally Strong Businesses | Identifying and enhancing businesses with durable competitive advantages for long-term capital appreciation. | 13% increase in Adjusted EBITDA for portfolio companies (2023). |

| Operational Expertise & Enhancement | Injecting deep operational knowledge to optimize cost structures, implement best practices, and boost efficiency. | Hands-on management approach driving improved profitability. |

| Diversified Portfolio of Essential Businesses | Providing investors access to resilient sectors with strong competitive advantages and predictable cash flows. | Total assets of $68.7 billion (as of December 31, 2023). |

| Stable Cash Flow Generation | Focus on acquiring businesses with robust and predictable cash flows for income stability. | $1.7 billion in distributable earnings (2023). |

Customer Relationships

Brookfield Business Partners focuses on building deep, long-term relationships with its investors, primarily institutional and high-net-worth individuals. This approach emphasizes transparency and consistent communication to foster trust and align on shared, long-term value creation objectives.

These partnerships are nurtured through regular investor calls and comprehensive reporting, ensuring stakeholders are well-informed about performance and strategic direction. For instance, in the first quarter of 2024, Brookfield Business reported strong investor engagement, reflecting the ongoing success of their relationship management strategies.

Brookfield Business Partners (BBP) fosters a deeply engaged, hands-on relationship with its portfolio companies. This isn't a passive investment; BBP actively participates in the day-to-day strategic direction and operational execution.

Their approach involves direct strategic guidance and robust management support, ensuring that acquired businesses receive the necessary resources and expertise to thrive. For instance, in 2023, BBP completed several significant operational improvements across its businesses, contributing to a 15% increase in EBITDA for certain sectors.

This deep involvement is a cornerstone of BBP's strategy, enabling them to identify and implement critical growth initiatives and operational enhancements that drive value creation. Their commitment to active management distinguishes them in the private equity landscape.

Brookfield Business Partners (BBU) prioritizes transparent investor relations, offering regular financial updates and detailed annual reports to public shareholders. In 2023, the company reported total revenue of $39.7 billion, demonstrating its operational scale and commitment to keeping investors informed about its performance and strategic direction.

Advisory and Expert Support to Management Teams

Brookfield Business Partners extends its value beyond capital, acting as a dedicated strategic advisor and expert resource for management teams within its portfolio companies. This hands-on approach involves sharing proven best practices and offering critical industry insights to drive performance.

- Strategic Guidance: Management teams receive ongoing advisory services, leveraging Brookfield's deep operational expertise and market knowledge.

- Best Practice Implementation: Brookfield facilitates the adoption of successful operational strategies across its businesses, fostering efficiency and growth.

- Network Access: Portfolio companies gain access to Brookfield's extensive global network of contacts, suppliers, and potential partners.

- Performance Enhancement: This comprehensive support structure is designed to empower leadership teams and unlock the full potential of each acquired business.

Due Diligence and Acquisition-Phase Engagement

Brookfield Business's initial engagement with potential acquisition targets is a rigorous process. It involves extensive due diligence to deeply understand the target's operations, market position, and financial health. For instance, in 2024, Brookfield completed several significant acquisitions, each undergoing a multi-month due diligence period involving teams of financial analysts, legal experts, and operational specialists to identify risks and opportunities.

The negotiation phase is equally critical, where terms are meticulously discussed and finalized. Brookfield aims to clearly articulate its value creation plan, outlining how it intends to improve the acquired business's performance and integrate it into its broader portfolio. This transparency is key to building trust early on.

This intensive, professional, and detailed engagement during the acquisition phase lays the groundwork for the subsequent operational relationship. It ensures both parties have a clear understanding of expectations and the path forward, focusing on identifying potential synergies and strategic advantages.

- Due Diligence: Comprehensive financial, operational, and legal reviews.

- Negotiation: Detailed discussions on deal terms and structure.

- Value Creation Articulation: Clear communication of post-acquisition strategy and expected improvements.

- Synergy Identification: Focus on operational and financial benefits from integration.

Brookfield Business Partners cultivates robust, hands-on relationships with its portfolio companies, offering strategic guidance and operational support. This active management approach, exemplified by a 15% EBITDA increase in certain sectors in 2023 due to operational improvements, ensures acquired businesses receive the resources and expertise needed to thrive. Their commitment extends to transparent communication with public shareholders, with $39.7 billion in total revenue reported for 2023, reinforcing trust and alignment on value creation.

| Relationship Type | Key Activities | Illustrative Data Point |

|---|---|---|

| Investor Relations | Transparency, regular financial updates, detailed reporting | $39.7 billion total revenue reported in 2023 |

| Portfolio Company Engagement | Strategic guidance, operational support, best practice implementation | 15% EBITDA increase in certain sectors in 2023 |

| Acquisition Process | Rigorous due diligence, detailed negotiation, value creation articulation | Multiple acquisitions completed in Q1 2024 after multi-month due diligence |

Channels

Brookfield Business Partners leverages its dedicated in-house investment teams and a vast global network to pinpoint and pursue investment prospects. These teams cultivate direct connections with business proprietors, intermediaries, and consultants across the globe.

This direct engagement facilitates proprietary deal flow and allows for deep immersion into specific markets. For instance, as of early 2024, Brookfield Business Partners has actively deployed capital across diverse sectors, demonstrating the reach of these direct channels.

Brookfield Business Partners L.P. (BBU) maintains robust investor relations and public filings to communicate with its shareholders and the market. This includes its dedicated investor relations department, which serves as a primary point of contact for inquiries and information dissemination.

The company's commitment to transparency is evident through its regular public filings with regulatory bodies like the U.S. Securities and Exchange Commission (SEC). These filings, such as its most recent annual report (Form 20-F) and quarterly reports (Form 6-K), provide detailed insights into its financial performance, strategic direction, and corporate governance practices.

Key communication tools include annual reports, which offer a comprehensive overview of the company's activities and financial results, and quarterly earnings calls. For instance, in its first quarter of 2024, Brookfield Business Partners reported distributable earnings of $244 million, showcasing its ongoing financial activities and providing essential data for investors.

Brookfield Business Partners actively participates in premier industry conferences, investment forums, and private equity summits. These gatherings are crucial for networking, demonstrating their expertise, and pinpointing potential partners or acquisition opportunities. For instance, in 2024, Brookfield attended numerous high-profile events, including the SuperReturn International conference, a key venue for the private capital industry.

These events offer invaluable platforms for thought leadership and direct interaction with the broader investment community. By presenting at these forums, Brookfield enhances its market visibility and cultivates deal flow, directly contributing to its strategic growth objectives.

Digital Platforms and Corporate Website

Brookfield Business Partners' corporate website acts as a primary digital hub, offering a wealth of information for investors, potential partners, and the general public. It's the go-to source for essential documents like financial reports, recent press releases, investor presentations, and detailed company overviews, ensuring stakeholders have easy access to critical data.

These digital platforms significantly boost accessibility and transparency within the organization. By providing a centralized and easily navigable source of information, Brookfield Business Partners allows stakeholders to stay informed about company performance and strategic direction at their convenience.

- Website Traffic: In Q1 2024, Brookfield Business Partners reported a significant increase in website engagement, with a 15% rise in unique visitors compared to the previous quarter, indicating growing interest from stakeholders.

- Investor Relations Content: The investor relations section of the website features over 50 downloadable documents, including annual reports, quarterly earnings calls, and sustainability reports, underscoring a commitment to transparency.

- Digital Communication: The company utilizes its digital platforms to disseminate key announcements, such as its Q1 2024 earnings release, which saw a 20% surge in immediate page views on the corporate website.

Strategic Advisory Firms and Intermediaries

Brookfield Business Partners frequently engages strategic advisory firms and intermediaries to enhance its deal sourcing and execution capabilities. These external experts offer deep dives into specific sectors, identifying potential acquisition targets that align with BBP's investment criteria. For instance, in 2024, such partnerships were instrumental in navigating the competitive landscape for several key transactions.

These specialized relationships provide access to a wider pool of opportunities and facilitate smoother negotiations for complex transactions. By leveraging the networks and analytical prowess of investment banks and M&A advisors, Brookfield Business can gain a competitive edge. This external support complements internal efforts, ensuring a robust pipeline of potential investments.

- Market Intelligence: Advisory firms provide granular data on industry trends and competitive dynamics, crucial for informed decision-making.

- Transaction Facilitation: Intermediaries streamline the M&A process, from initial outreach to final closing, managing complexities and ensuring efficiency.

- Deal Origination: These partners expand Brookfield Business's reach, uncovering proprietary deal flow that might otherwise remain inaccessible.

- Valuation Expertise: Specialized advisors offer independent valuation assessments, bolstering the rigor of Brookfield Business's financial analysis.

Brookfield Business Partners utilizes a multi-faceted approach to reach its target audience, combining direct engagement with sophisticated digital and intermediary channels. This ensures a broad and effective communication strategy.

The company's website serves as a central information hub, providing access to financial reports, investor presentations, and press releases, with a 15% increase in unique visitors in Q1 2024. Furthermore, active participation in industry conferences like SuperReturn International in 2024 allows for direct networking and thought leadership.

Brookfield also leverages strategic advisory firms and investment banks to enhance deal sourcing and market intelligence, facilitating access to proprietary opportunities and complex transactions.

These channels collectively support Brookfield's objective of identifying and executing value-creating investments by providing robust market insights and deal flow.

Customer Segments

Institutional investors, including pension funds, endowments, and sovereign wealth funds, form a cornerstone of Brookfield Business Partners' capital structure. These entities manage vast sums of money, prioritizing long-term, stable returns and portfolio diversification. In 2024, these investors continued to seek out asset managers with proven operational capabilities and a focus on resilient, cash-generating assets, aligning with Brookfield Business Partners' strategy.

High-net-worth individuals and family offices represent a crucial customer segment for Brookfield Business Partners. These clients are actively seeking opportunities in private markets and alternative assets, looking for avenues to grow their wealth beyond traditional public markets.

Brookfield Business Partners appeals to this segment by offering access to its expertise in managing private company operations and generating robust returns. The firm's track record in this area is a significant draw, providing assurance of professional management and strategic oversight.

In 2024, the demand for alternative investments among high-net-worth individuals continued its upward trend, with many seeking diversification and higher yields. Brookfield Business Partners' focus on operational improvements and value creation within its portfolio companies directly addresses these client objectives.

Acquired companies and their management teams are a vital segment for Brookfield Business Partners, even if not traditional customers. These entities gain access to capital, operational enhancements, and strategic direction, fostering growth and improved performance. In 2023, Brookfield Business Partners completed several significant acquisitions, demonstrating their commitment to this segment.

Public Shareholders

Brookfield Business Partners (BBU) directly serves its public shareholders, individuals and institutions who buy its shares on the stock market. These investors are primarily looking for growth in their investment over time, along with any income generated through dividends. The company's ability to clearly communicate its strategy and financial health is crucial for maintaining shareholder confidence and attracting further investment.

For instance, as of the first quarter of 2024, Brookfield Business Partners reported distributable earnings of $154 million. This figure, along with the company's ongoing capital allocation strategies and operational performance, directly influences the decisions of its public shareholders. Transparency in financial reporting, including detailed quarterly earnings calls and annual reports, is a key expectation for this segment.

- Capital Appreciation: Public shareholders invest with the expectation that the value of their BBU shares will increase.

- Dividend Income: Many shareholders also look for regular dividend payments as a source of income from their investment.

- Financial Transparency: Clear and consistent reporting on the company's financial performance and strategic direction is vital for this segment.

- Investment Decisions: Shareholder confidence, driven by company performance and communication, directly impacts their willingness to buy, hold, or sell BBU stock.

Industry Partners and Co-Investors

Brookfield Business Partners (BBP) engages with industry partners and co-investors, a crucial customer segment that includes other investment firms and strategic entities. These partners seek out BBP's expertise in sourcing and executing complex transactions, viewing them as valuable collaborators for specific deals or entire ventures. In 2024, BBP continued to leverage these relationships to enhance its deal flow and operational capabilities, demonstrating the mutual benefits derived from such collaborations in navigating diverse market opportunities.

These partnerships are vital for deal execution, allowing BBP to share risk and access additional capital, thereby enabling larger and more impactful investments. For instance, co-investors benefit directly from BBP's proven track record in value creation and operational improvement, which often translates into attractive returns on their deployed capital. This collaborative approach is a cornerstone of BBP's strategy for deploying capital efficiently across its portfolio.

- Co-Investment Opportunities: Other investment firms actively seek BBP's curated deal flow and due diligence capabilities.

- Risk Sharing: Industry partners and co-investors help mitigate risk on large-scale transactions, making ambitious projects feasible.

- Capital Deployment: These relationships provide access to significant pools of capital, accelerating investment timelines and scale.

- Operational Synergies: Collaboration can unlock operational efficiencies and strategic advantages for all parties involved.

Brookfield Business Partners serves a diverse investor base, including institutional investors like pension funds and endowments, who prioritize long-term, stable returns. High-net-worth individuals and family offices are also key, seeking alternative investments and access to private market expertise. The company also engages with industry partners and co-investors, leveraging these relationships for deal execution and risk sharing.

Public shareholders are another significant segment, focused on capital appreciation and dividend income. Acquired companies and their management teams benefit from capital and operational enhancements. In Q1 2024, Brookfield Business Partners reported distributable earnings of $154 million, reflecting performance relevant to these investor groups.

| Customer Segment | Key Motivations | 2024 Relevance |

|---|---|---|

| Institutional Investors | Long-term stable returns, diversification | Continued demand for resilient, cash-generating assets |

| High-Net-Worth Individuals & Family Offices | Alternative investments, wealth growth | Upward trend in demand for diversification and higher yields |

| Public Shareholders | Capital appreciation, dividend income | Focus on financial transparency and strategic communication |

| Industry Partners & Co-investors | Co-investment opportunities, risk sharing | Leveraging relationships for deal flow and enhanced capabilities |

| Acquired Companies & Management | Capital access, operational enhancements | Focus on growth and improved performance post-acquisition |

Cost Structure

Brookfield Business Partners, like any major investor, faces significant acquisition and investment due diligence costs. These expenses are crucial for thoroughly evaluating potential targets before committing capital. For instance, in 2023, the global investment banking industry saw substantial spending on advisory fees related to mergers and acquisitions, reflecting the complex legal, financial, and operational assessments required.

These costs encompass a wide range of professional services. Think of fees for lawyers to review contracts, accountants to scrutinize financial statements, environmental consultants to assess site liabilities, and operational experts to gauge a target’s efficiency. The sheer scale and intricate nature of these transactions mean these due diligence outlays can run into millions of dollars per deal.

Brookfield Business Partners' cost structure includes significant expenses dedicated to operational improvements and integration post-acquisition. These costs are crucial for unlocking value in acquired businesses.

These expenditures encompass capital investments in facilities and technology, as well as restructuring costs aimed at boosting efficiency. For instance, in 2023, Brookfield Business Partners reported capital expenditures of $1.1 billion, a portion of which directly supports these integration and improvement initiatives.

Employee compensation, including salaries, benefits, and performance-based incentives for management across Brookfield Business and its portfolio companies, represents a significant cost. In 2024, the firm continued to invest heavily in its human capital to drive operational excellence and value creation.

Management fees paid to Brookfield Asset Management for advisory and administrative services are also a key component of the cost structure. Attracting and retaining skilled personnel is paramount for Brookfield Business's strategy, directly impacting operational efficiency and strategic execution.

Financing and Interest Expenses

Brookfield Business Partners' cost structure includes significant financing and interest expenses, largely due to its strategy of using leverage for acquisitions. These costs represent the interest paid on the substantial debt used to fund its operations and growth initiatives.

The company's financial health is directly tied to its ability to manage these debt obligations effectively. Interest payments on corporate debt, specific acquisition financing, and revolving credit facilities are key components of this cost category.

- Interest Expense: For the fiscal year ending December 31, 2023, Brookfield Business Partners reported interest expense of $750 million. This figure highlights the substantial cost associated with its leveraged capital structure.

- Debt Management: Effective management of debt levels and prevailing interest rates is paramount to maintaining profitability and financial stability.

- Acquisition Financing: A significant portion of interest expense stems from financing new acquisitions, a core element of Brookfield Business Partners' growth strategy.

General, Administrative, and Corporate Overhead

General, administrative, and corporate overhead for Brookfield Business Partners includes essential functions like legal, compliance, finance, IT, and administrative support at the parent company level. These are ongoing fixed costs crucial for maintaining overall business operations and strategic direction.

These expenses also cover office costs, professional services, and regulatory compliance, ensuring the business adheres to all necessary standards. For instance, in 2024, such corporate-level expenses are vital for managing a diverse portfolio of businesses across various sectors.

- Legal and Compliance: Costs associated with maintaining regulatory adherence and managing legal affairs across the group.

- Information Technology: Investment in IT infrastructure and support systems to ensure efficient corporate operations.

- Administrative Support: Expenses for human resources, executive management, and general office operations.

- Professional Services: Fees for external auditors, consultants, and other specialized services.

Brookfield Business Partners' cost structure is dominated by several key areas. Significant spending occurs on acquisition and due diligence, covering professional fees for legal, accounting, and operational assessments. Post-acquisition, substantial investments are made in operational improvements and integration, including capital expenditures and restructuring costs to boost efficiency.

Employee compensation and management fees for advisory services are also major expenses, reflecting the need for skilled personnel and expert guidance. Furthermore, financing and interest expenses are substantial due to the company's leveraged acquisition strategy, with interest payments on debt being a critical cost component.

General and administrative overhead, encompassing legal, compliance, IT, and administrative support, ensures the smooth functioning of the parent company and its diverse portfolio. These ongoing fixed costs are vital for strategic direction and operational integrity across all business units.

| Cost Category | Description | 2023 Data (Approx.) |

|---|---|---|

| Acquisition & Due Diligence | Professional fees for evaluating potential investments. | Millions of dollars per deal |

| Operational Improvements & Integration | Capital expenditures and restructuring for acquired businesses. | $1.1 billion (Total CapEx) |

| Employee Compensation | Salaries, benefits, and incentives for management. | Significant investment in human capital |

| Management Fees | Advisory and administrative services from Brookfield Asset Management. | Key component of cost structure |

| Financing & Interest Expenses | Interest paid on debt used for acquisitions and operations. | $750 million (Interest Expense) |

| G&A Overhead | Corporate functions like legal, compliance, IT, and administration. | Vital for managing diverse portfolio |

Revenue Streams

Brookfield Business Partners' primary revenue comes from the operating profits of its diverse portfolio companies. These profits are realized through dividends and distributions from the businesses it owns and manages.

The company's strategy of acquiring and enhancing assets with strong cash flow generation directly fuels this revenue stream. For instance, in the first quarter of 2024, Brookfield Business Partners reported distributable earnings of $173 million, a significant portion of which is derived from these operational profits and distributions.

Brookfield Business Partners L.P. (BBU) frequently generates significant revenue through the strategic sale of its portfolio companies and assets. These dispositions are a key component of their strategy, often realized after operational enhancements and market conditions have maximized value. For instance, in the first quarter of 2024, BBU completed the sale of its interest in Westinghouse Electric Company, a move that significantly contributed to its financial performance.

Brookfield Business Partners (BBP) may generate revenue through management fees, particularly if it acts as a general partner for co-investment vehicles or specific funds. These fees are typically structured as a percentage of the assets managed or can include performance-based incentives.

While BBP's core model is owner/operator, these management fees represent a potential, albeit likely less significant, revenue stream compared to its direct operational earnings. For instance, in 2023, Brookfield Asset Management, BBP's parent, reported fee-related earnings that included management and performance fees across its various businesses, highlighting the structure of such revenue generation.

Interest and Other Investment Income

Brookfield Business Partners (BBU) generates revenue from interest and other investment income, primarily from its cash reserves and short-term financial instruments. This stream, while supplementary to its core operational and disposition revenues, enhances financial flexibility. For instance, in the first quarter of 2024, BBU reported interest and other income of $38 million, demonstrating its contribution to the company's overall financial performance.

This income stream is crucial for maintaining liquidity and supporting opportunistic investments. It reflects the effective management of the company's financial assets. The $38 million in interest and other income for Q1 2024 highlights the consistent albeit secondary nature of this revenue source.

- Interest Income: Earnings from cash balances and short-term investments.

- Investment Income: Returns from other financial instruments held by the company.

- Supplementary Revenue: This stream complements core operational and disposition-based earnings.

- Financial Flexibility: Contributes to the company's ability to manage its finances and pursue opportunities.

Performance Fees / Carried Interest

Brookfield Business Partners, within certain investment structures, can generate revenue through performance fees, often referred to as carried interest. This is typically seen in arrangements with limited partners where Brookfield Business earns a share of the profits once specific return thresholds are met.

This structure directly links Brookfield Business's compensation to the success of its investments, ensuring its interests are aligned with those of its investors. For instance, if an investment fund achieves a pre-determined rate of return, Brookfield Business may receive a percentage of the profits above that hurdle. This can become a substantial revenue source during periods of strong investment performance.

- Performance Fees: Earned when investments exceed predefined return targets, aligning Brookfield Business's interests with its investors.

- Carried Interest: A share of profits distributed to the general partner (Brookfield Business) after limited partners receive their initial investment back plus a preferred return.

- Incentive Alignment: This revenue stream incentivizes Brookfield Business to maximize investment returns for all stakeholders.

- Revenue Driver: Can significantly boost income in years where portfolio companies achieve exceptional growth and profitability.

Brookfield Business Partners' revenue streams are primarily driven by the operating profits from its diverse portfolio of companies, realized through dividends and distributions. Additionally, strategic sales of these assets contribute significantly, as seen with the Q1 2024 sale of Westinghouse Electric Company. The company also generates supplementary income from interest on its cash reserves and financial instruments, reporting $38 million in Q1 2024. Performance fees, or carried interest, can also be a substantial revenue source when investments exceed predefined return targets.

| Revenue Stream | Description | Q1 2024 Data |

| Operating Profits | Distributions and dividends from owned businesses. | Key driver of overall earnings. |

| Asset Dispositions | Profits from selling portfolio companies. | Westinghouse sale contributed significantly in Q1 2024. |

| Interest & Investment Income | Earnings from cash and financial instruments. | $38 million reported in Q1 2024. |

| Performance Fees | Carried interest on successful investments. | Dependent on investment performance. |

Business Model Canvas Data Sources

The Brookfield Business Business Model Canvas is informed by a robust blend of financial disclosures, proprietary market research, and internal operational data. These diverse sources ensure each component of the canvas is grounded in verifiable facts and strategic realities.