Brookfield Business Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Business Bundle

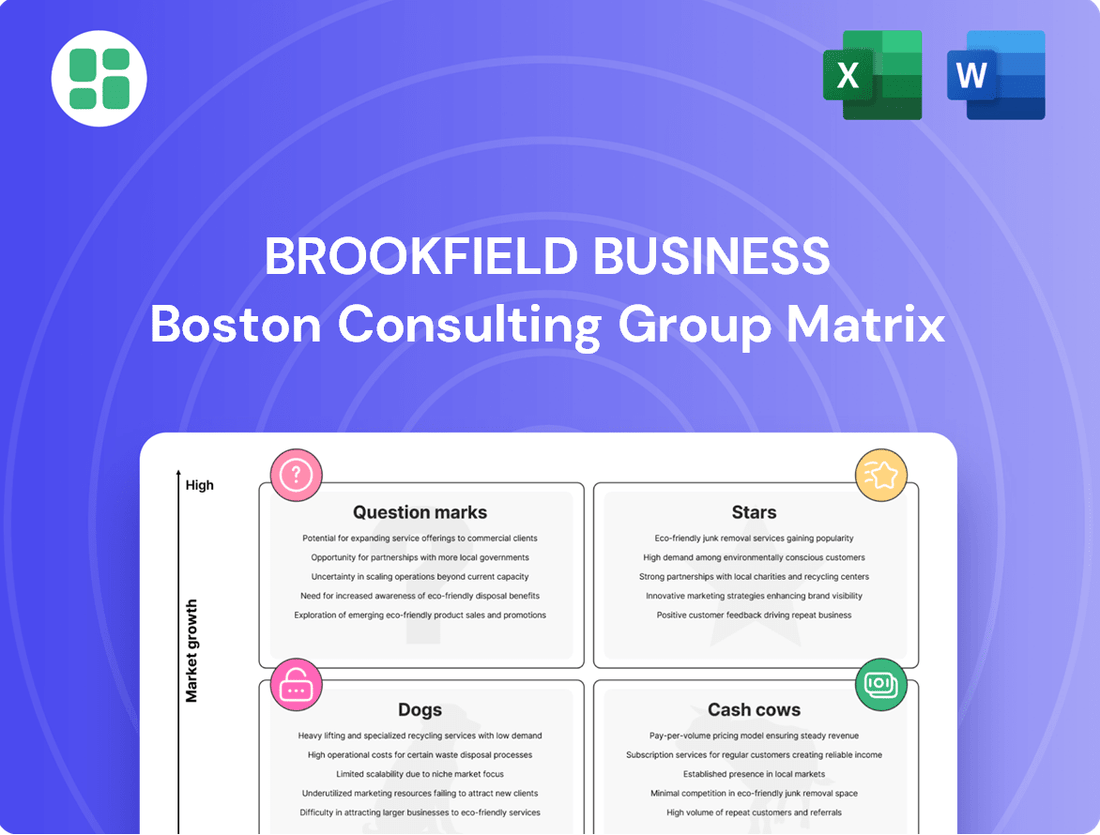

Understand the strategic positioning of Brookfield Business's portfolio with our insightful BCG Matrix preview. See how its products stack up as Stars, Cash Cows, Dogs, or Question Marks, and get a glimpse into potential growth areas and resource allocation.

Don't miss out on the full picture; purchase the complete BCG Matrix report for a comprehensive breakdown, actionable insights, and a clear roadmap to optimize your investment strategy and drive future success.

Stars

Brookfield Business Partners' advanced energy storage segment is a star performer within their portfolio. This sector has seen impressive Adjusted EBITDA growth, boosted by strong demand for premium advanced batteries and successful commercial strategies. For instance, in the first quarter of 2024, this segment reported a significant increase in profitability, partly due to favorable tax impacts, underscoring its strong market position.

Brookfield Business Partners' acquisition of an electric heat tracing systems manufacturer in January 2025 immediately bolstered its Industrials segment. This strategic move positions the company within a growing market, reflecting the characteristics of a Star in the BCG matrix.

The electric heat tracing market is projected for robust growth, with estimates suggesting a compound annual growth rate (CAGR) of over 6% through 2030, driven by increasing demand in industries like oil and gas, chemical processing, and infrastructure development. The acquired company's market-leading position within this expanding sector aligns perfectly with the Star classification.

Antylia Scientific, now part of Brookfield Business Partners, operates within the life sciences sector, a segment often characterized by strong growth and consistent demand for its products. This acquisition positions Antylia as a potential high-market-share player in a field driven by innovation and essential laboratory needs.

The life sciences consumables and testing equipment market is a high-margin, recurring-revenue business. In 2024, the global life sciences market was valued at over $2.5 trillion, with the consumables and equipment segment showing robust year-over-year growth, indicating a favorable environment for companies like Antylia.

Core High-Performing Industrials

Brookfield Business Partners' (BBU) Industrials segment, a key driver of its performance, has demonstrated robust growth in Adjusted EBITDA. This suggests that BBU possesses a strong base of industrial companies, likely leaders in their respective sectors, which are capitalizing on market expansion and delivering solid profitability.

For the first quarter of 2024, BBU reported that its Industrials segment generated approximately $386 million in Adjusted EBITDA. This figure represents a significant portion of the company's overall earnings, underscoring the segment's importance and its capacity for generating substantial cash flow.

- Industrials Adjusted EBITDA (Q1 2024): $386 million.

- Growth Indicator: Strong performance suggests market-leading businesses within the segment.

- Market Position: Companies likely benefit from operating in expanding sectors.

- Profitability: Demonstrates effective management and operational efficiency.

AI Infrastructure Development

Brookfield Business Partners is strategically focusing on AI infrastructure, acting as a key enabler for the AI revolution by providing the essential physical backbone. This approach positions them as a 'picks and shovels' provider in a rapidly expanding sector.

Their involvement includes critical areas like data centers and renewable energy solutions necessary to power AI advancements. For instance, Brookfield's partnership with Microsoft to develop AI-era renewable energy projects underscores their commitment to this foundational aspect of the AI market.

This focus on infrastructure, a segment often characterized by stable, long-term demand, suggests a strong potential for Brookfield to capture significant market share and establish leadership in the burgeoning AI ecosystem.

- AI Infrastructure Focus: Brookfield Business Partners is investing in the physical infrastructure essential for AI, such as data centers and renewable energy.

- Partnerships: Collaborations, like the one with Microsoft for renewable energy supporting AI, highlight their strategic approach.

- Market Position: By providing foundational 'picks and shovels', Brookfield aims for a leading role in the high-growth AI infrastructure market.

Brookfield Business Partners' advanced energy storage segment is a star performer, showing impressive Adjusted EBITDA growth driven by demand for premium batteries and effective commercial strategies. In Q1 2024, this segment saw a notable profit increase, partly due to favorable tax impacts, highlighting its strong market standing.

The acquisition of an electric heat tracing manufacturer in January 2025 immediately enhanced Brookfield's Industrials segment, positioning it in a growing market characteristic of a Star. This sector is projected to grow at over 6% CAGR through 2030, fueled by demand in oil and gas, chemicals, and infrastructure.

Antylia Scientific, now part of Brookfield Business Partners, operates in the life sciences sector, a field known for consistent demand and innovation. This positions Antylia as a potential high-market-share player in a market valued at over $2.5 trillion globally in 2024, with its consumables and equipment segment showing robust growth.

Brookfield's focus on AI infrastructure, including data centers and renewable energy, positions it as a key enabler in the AI revolution. Their partnership with Microsoft for AI-supporting renewable energy projects exemplifies this strategy, aiming for leadership in the burgeoning AI ecosystem.

| Segment | Key Business Area | 2024 Data/Growth Indicator | Market Position/Strategy |

|---|---|---|---|

| Industrials | Advanced Energy Storage | Strong Adjusted EBITDA growth in Q1 2024 | Premium battery demand, effective commercial strategies |

| Industrials | Electric Heat Tracing | Acquired Jan 2025; Market CAGR >6% through 2030 | Market-leading position in a growing sector |

| Industrials | Life Sciences Consumables/Equipment | Global market >$2.5 trillion (2024); robust segment growth | High-margin, recurring revenue; potential high market share |

| Technology/Infrastructure | AI Infrastructure | Focus on data centers & renewable energy for AI | 'Picks and shovels' provider, strategic partnerships (e.g., Microsoft) |

What is included in the product

This BCG Matrix overview offers strategic insights for Brookfield Business's portfolio, identifying units for investment, divestment, or divestment.

The Brookfield Business BCG Matrix provides a clear, one-page overview of each business unit's strategic position, relieving the pain of complex portfolio analysis.

Cash Cows

Within Brookfield Business Partners' Business Services segment, the residential mortgage insurer stands out as a classic cash cow. This operation benefits from a mature and stable market, where it likely commands a significant market share. Its consistent strong performance translates into reliable cash flows, requiring minimal investment in promotion and placement.

In 2024, the residential mortgage insurance industry continued to be a steady contributor to financial services. For instance, major players in the US market, like MGIC Investment Corporation, reported robust earnings, with net income often exceeding $1 billion annually in recent years, underscoring the stability and profitability of this sector. This stability allows for substantial cash generation with limited need for aggressive growth strategies.

Within Brookfield Business Partners' Infrastructure Services segment, their modular building leasing services are a classic Cash Cow. This business thrives in a mature market where demand is steady and predictable, ensuring a reliable stream of income. The need for significant new investment is low, allowing it to generate substantial free cash flow.

In 2024, the modular building leasing sector continued to demonstrate resilience. For Brookfield Business Partners, this segment contributes significantly to their overall earnings, reflecting its established market presence and consistent profitability. The mature nature of this business means it requires less capital expenditure to maintain its competitive edge, directly translating into strong cash generation.

Brookfield Business Partners' lottery services operations are a prime example of a Cash Cow within the BCG framework. These operations are characterized by their strong market position in mature, regulated industries with limited growth potential.

This stable, low-growth environment allows the lottery services to generate consistent and substantial cash flows. For instance, in 2024, the lottery sector, while mature, continued to be a reliable revenue generator for many operators, often seeing steady, albeit modest, year-over-year growth in sales, sometimes in the low single digits, driven by consistent player engagement.

These predictable earnings are invaluable, providing the financial flexibility to invest in higher-growth opportunities or to support other business units within Brookfield Business Partners' diversified portfolio. The stability of these cash flows is a key strength, making them a cornerstone of the company's overall financial health.

Established Industrial Operations (e.g., Clarios)

Established industrial operations like Clarios, a significant holding for Brookfield Business Partners, exemplify strong cash flow generation and resilient margins, even when the wider market faces headwinds.

These businesses, often supplying essential goods and services, typically command leading market shares in their respective mature sectors. This strong market position translates into a consistent and reliable source of capital for the broader partnership. For instance, Clarios, a global leader in advanced energy storage solutions, has consistently shown robust performance. In 2023, Clarios reported strong financial results, contributing significantly to Brookfield Business Partners' overall cash flow. The company's focus on essential products like automotive batteries, which have a consistent demand cycle, underpins its stability.

- Resilient Margins: Clarios has demonstrated an ability to maintain healthy profit margins, even during periods of economic uncertainty, reflecting its strong market position and operational efficiency.

- Strong Cash Flow: The company's business model, centered on essential products, generates substantial and predictable cash flows, which are crucial for funding other ventures within Brookfield Business Partners.

- Leading Market Position: As a dominant player in the automotive battery industry, Clarios benefits from economies of scale and established distribution networks, reinforcing its competitive advantage.

- Essential Products: The demand for automotive batteries remains relatively inelastic, ensuring a consistent revenue stream for Clarios regardless of broader economic fluctuations.

Core Business Services Portfolio

The Business Services segment, a significant component of Brookfield Business Partners' portfolio, demonstrates remarkable resilience and consistent cash flow generation, even amidst challenges in certain sub-segments. This stability is largely attributed to the mature nature of its constituent businesses, many of which hold dominant market positions within their specific service areas.

These established operations consistently contribute to the company's overall profitability, acting as dependable sources of cash. For instance, in 2024, the segment's performance was bolstered by strong showings in areas like business process outsourcing and facility management, which benefited from increased demand for essential operational support.

- Resilient Cash Flows: The Business Services segment consistently generates stable cash, underpinning the company's financial health.

- Mature Businesses: A large portion of the segment comprises well-established companies with proven track records.

- High Market Share: Many service niches within the segment are dominated by Brookfield Business Partners' operations.

- Profitability Contribution: These mature businesses are key drivers of consistent profitability for the overall company.

Cash Cows are businesses with high market share in low-growth industries, generating more cash than they consume. Brookfield Business Partners leverages these stable performers to fund growth initiatives. Their residential mortgage insurer, modular building leasing, lottery services, and industrial operations like Clarios exemplify this strategy.

| Business Unit | Industry | Market Share | Growth Rate | Cash Flow Generation |

| Residential Mortgage Insurer | Financial Services (Mature) | High | Low | Strong & Stable |

| Modular Building Leasing | Construction Services (Mature) | High | Low | Consistent |

| Lottery Services | Gaming (Mature, Regulated) | High | Low | Predictable |

| Clarios (Energy Storage) | Automotive Aftermarket (Mature) | Leading | Low | Substantial |

What You’re Viewing Is Included

Brookfield Business BCG Matrix

The Brookfield Business BCG Matrix preview you're examining is the exact, fully polished document you will receive immediately after your purchase. This means no watermarks, no sample data, and no hidden limitations – just a comprehensive, ready-to-deploy strategic tool designed for immediate application in your business planning.

Dogs

Brookfield Business's shuttle tanker operation, sold in January 2025, was classified as a disposed asset. This move strongly suggests it was a Dog within their portfolio, likely struggling in a low-growth market and draining resources without generating sufficient returns.

The divestiture highlights Brookfield's strategic approach to shedding underperforming assets. In 2024, the offshore oil services sector faced significant headwinds, with many companies reporting reduced capital expenditures from major oil producers, impacting tanker utilization rates and profitability.

Brookfield Business Partners divested its road fuels operation in July 2024. This strategic move indicates the business unit was likely deemed non-core or facing challenges in a market with subdued growth potential. The sale allows Brookfield to redeploy capital towards more promising ventures.

Brookfield Business Partners divested its Canadian aggregates production operation in June 2024. This move suggests the business was potentially operating in a mature, low-growth sector or had a less dominant market position. Such divestitures are common capital recycling strategies, allowing companies to reallocate resources to more promising ventures. For instance, in 2023, the Canadian construction materials market saw a modest growth of approximately 3%, indicating a stable but not high-growth environment.

Engineered Components Manufacturer

The Engineered Components Manufacturer, situated within Brookfield's Industrials segment, is currently navigating a difficult market. Weak demand and reduced sales volumes have put pressure on the company, necessitating stringent cost controls to maintain profitability and cash generation. This challenging environment, marked by a low-growth outlook and potentially a weaker competitive standing, positions it as a likely candidate for the Dog category in the BCG Matrix.

The impact of these market conditions is evident in recent financial performance. For instance, many companies in this sector experienced a decline in revenue during 2023, with some reporting single-digit percentage drops. The need for active cost management is critical, as companies are finding it harder to pass on rising input costs. This often translates into tighter operating margins, making cash flow management a paramount concern for survival and potential turnaround efforts.

- Challenging Market Conditions: The sector has seen a slowdown in industrial production and capital expenditure, directly affecting demand for engineered components.

- Volume Decline: Many manufacturers reported a decrease in order volumes throughout 2023, impacting capacity utilization and profitability.

- Margin Pressure: To remain competitive, companies have had to absorb higher raw material and energy costs, squeezing profit margins. For example, some component makers saw their gross margins shrink by 2-4 percentage points in the last fiscal year.

- Strategic Review: Given the low-growth prospects and competitive pressures, a strategic review is likely needed to determine if divestment or significant restructuring is the best path forward.

Work Access Services

Work Access Services, within Brookfield Business Partners' BCG Matrix, is categorized as a Dog. Its performance has been dampened by challenging market conditions, which have affected the broader Infrastructure Services segment.

This positioning suggests a business operating in a market that is either not growing or is shrinking, where Brookfield Business Partners has a limited presence and struggles to achieve strong profitability.

For instance, in 2024, the Infrastructure Services sector, which includes work access services, faced headwinds from reduced capital expenditure by clients in certain regions due to economic uncertainties and rising interest rates. This led to a slowdown in project pipelines, directly impacting revenue generation for companies like those in work access.

- Market Stagnation: The work access services market is experiencing limited growth, with some segments showing contraction.

- Low Market Share: Brookfield Business Partners holds a relatively small share in this competitive landscape.

- Profitability Challenges: The unit is finding it difficult to generate substantial returns due to market pressures and competitive intensity.

- Strategic Review: Businesses in the Dog quadrant often undergo strategic reviews, which could include divestment or significant restructuring to improve performance or exit the market.

Businesses classified as Dogs in Brookfield Business's portfolio are typically those operating in low-growth or declining markets with a weak competitive position. These units often struggle to generate significant returns and may require substantial investment to improve or are candidates for divestiture.

The shuttle tanker operation, sold in January 2025, and the road fuels operation, divested in July 2024, exemplify this category. Similarly, the Canadian aggregates production, sold in June 2024, likely faced maturity and limited growth.

The Engineered Components Manufacturer and Work Access Services are also positioned as Dogs due to challenging market conditions, volume declines, and profitability pressures. For example, the Infrastructure Services sector, including work access, saw reduced client capital expenditure in 2024.

These divestitures and challenging segment performances highlight Brookfield's strategy of pruning underperforming assets to reallocate capital to more promising areas, a common practice when a business unit consistently underperforms in a stagnant market.

Question Marks

Dealer Software and Technology Services (Post-Upgrade) likely falls into the question mark category of the BCG matrix. The business is in a high-growth market, but the significant investment in technology modernization and customer churn indicate a low or uncertain market share. For instance, the automotive software market was projected to reach $15.7 billion in 2024, highlighting the growth potential, yet the churn suggests competitive pressures or product issues.

Brookfield Business Partners' agreement to privatize First National Financial Corporation, a significant Canadian mortgage lender, signals a strategic investment aimed at modernizing its systems and operations. This initiative targets enhancing efficiency and customer experience, potentially unlocking substantial growth beyond its current stable performance.

The transformation plan for First National Financial Corporation, backed by Brookfield, suggests a move towards a higher-growth trajectory. While the core mortgage lending business is established, the focus on upgrades implies an ambition to capture greater market share or introduce new services, though the immediate impact on returns and market positioning remains to be seen.

Brookfield Business Partners' ventures in new digitalization and AI integration, beyond core infrastructure, would likely be positioned as Question Marks in the BCG Matrix. These are high-growth potential areas, but the company's market share in these nascent applications is probably still minimal. For instance, if Brookfield were investing in early-stage AI-powered personalized healthcare platforms or novel blockchain-based supply chain solutions, these would fit this category.

These initiatives require significant upfront investment to develop and scale, as their full market potential is yet to be proven. Consider the significant capital expenditure required for companies developing advanced AI algorithms for drug discovery or building decentralized finance (DeFi) ecosystems. As of 2024, the global AI market is projected to grow substantially, with many startups seeking substantial funding to capture emerging opportunities, reflecting the high investment needs of these Question Mark ventures.

Potential New Entries into High-Growth Niches (e.g., Payments Sector)

Brookfield Business Partners' potential entry into the payments sector, a dynamic and rapidly expanding area within fintech, positions it as a Question Mark on the BCG matrix. This classification stems from the inherent challenges of establishing a foothold in a market already dominated by established players and innovative startups.

The payments sector is experiencing robust growth, with global digital payment transaction values projected to reach over $16 trillion by 2027, up from an estimated $8.7 trillion in 2023. This presents a significant opportunity, but also requires substantial capital investment to compete effectively.

- High Growth Potential: The payments sector is a recognized high-growth niche, attracting significant venture capital and corporate investment.

- Market Entry Challenges: Entering a competitive landscape requires substantial investment in technology, marketing, and customer acquisition to build market share.

- Strategic Investment Needed: Brookfield would need to allocate significant resources to develop a competitive offering and overcome existing network effects and brand loyalty.

Early-Stage Growth Initiatives in Industrials

Within Brookfield's Industrials segment, nascent growth initiatives focusing on emerging technologies like advanced robotics or sustainable manufacturing processes are positioned as question marks. These ventures, while promising in high-growth niches, are currently smaller in scale and require significant capital infusion and patient development to capture substantial market share and achieve profitability. For instance, a new venture in additive manufacturing for aerospace components, while addressing a rapidly expanding market projected to reach $10 billion by 2028, might still be in its early stages of R&D and customer acquisition.

- Targeting Emerging Industrial Technologies: Focus on areas like AI-driven predictive maintenance or specialized materials science.

- Niche Market Penetration: Aiming for smaller, but rapidly growing, segments within the broader industrial landscape.

- Investment and Time Horizon: Recognizing the need for substantial capital and a longer-term perspective for these initiatives to mature.

- Potential for High Growth: These question marks represent opportunities with the potential to become stars if successful in their development and market entry.

Question Marks represent business units or ventures with low market share in high-growth industries. These are often new products or services that require substantial investment to develop and scale, with uncertain outcomes. Brookfield's exploration into areas like advanced AI applications within its infrastructure services or nascent renewable energy technologies would likely fall into this category, demanding significant capital to gain traction.

The automotive software market, projected to reach $15.7 billion in 2024, exemplifies a high-growth industry where new entrants or specialized service providers might be considered Question Marks if their market share is currently minimal. Similarly, the global AI market is expected to see substantial growth, with many startups seeking significant funding to capture emerging opportunities, reflecting the high investment needs of these ventures.

These initiatives, like potential entries into the dynamic payments sector, require substantial capital investment to compete effectively. The payments sector's projected growth, with global digital payment transaction values anticipated to exceed $16 trillion by 2027, underscores the high-growth potential, but also the significant investment needed to establish a competitive presence.

Brookfield's ventures in emerging industrial technologies, such as advanced robotics or sustainable manufacturing, are also positioned as Question Marks. These require substantial capital infusion and patient development to capture significant market share, despite targeting rapidly expanding niches.

| Business Area | Industry Growth | Market Share (Estimated) | Investment Need | BCG Category |

|---|---|---|---|---|

| Dealer Software & Tech (Post-Upgrade) | High | Low | High | Question Mark |

| New Digitalization & AI Integration | Very High | Minimal | Very High | Question Mark |

| Payments Sector Entry | High | Low | High | Question Mark |

| Emerging Industrial Technologies | High | Low | High | Question Mark |

BCG Matrix Data Sources

This BCG Matrix is built on robust data, incorporating financial statements, market research reports, and industry growth forecasts for comprehensive strategic analysis.