British Land Company PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

British Land Company Bundle

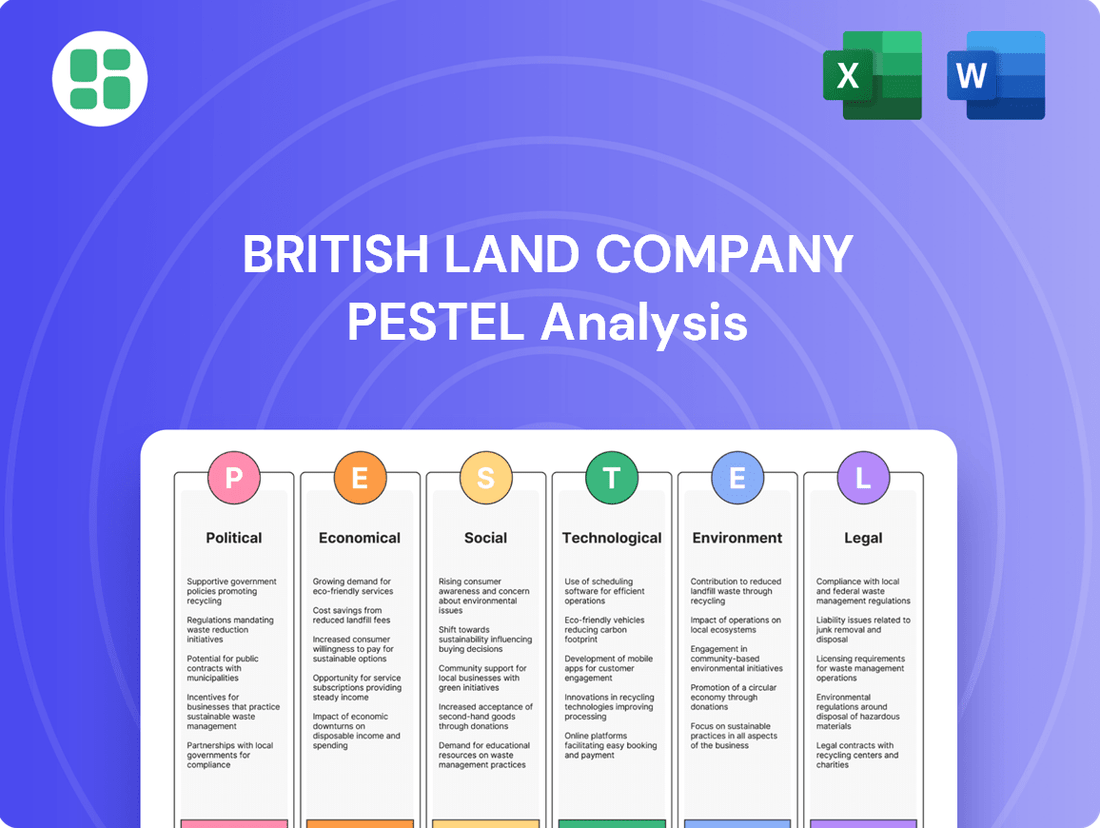

Unlock the strategic advantages British Land Company holds by understanding the political, economic, social, technological, legal, and environmental forces at play. Our PESTLE analysis dives deep into these external factors, revealing critical opportunities and potential threats that could shape the company's trajectory.

Gain a competitive edge with our meticulously researched PESTLE analysis of British Land Company. Equip yourself with actionable intelligence on market dynamics, regulatory shifts, and emerging trends, empowering smarter strategic decisions. Download the full report now to secure your advantage.

Political factors

The UK government's ongoing reforms to the National Planning Policy Framework (NPPF) are a significant political factor for British Land. These changes aim to speed up development and tackle the housing crisis, with proposals for new towns and the potential return of mandatory housing targets. This proactive approach signals a shift towards more interventionist planning.

Further changes are expected with the Planning and Infrastructure Bill, which could simplify planning procedures and grant local authorities stronger compulsory purchase powers. British Land will need to carefully align its development strategies with these evolving regulatory landscapes, especially concerning brownfield sites and the necessary infrastructure investments.

The UK's political climate, particularly the prospect of a general election in 2024 or early 2025, introduces a layer of uncertainty for real estate investors like British Land. Shifts in government priorities could impact property taxation, planning regulations, and environmental policies, necessitating strategic adaptability.

For instance, a change in government might alter capital gains tax rates or introduce new incentives for development, directly influencing British Land's project viability and investment returns. The company's ability to navigate these potential policy changes will be crucial for maintaining its development pipelines and financial stability.

The ongoing trend of devolution across the UK, granting more authority to local councils and mayors, significantly shapes the planning and development environment. This decentralization means British Land must navigate a patchwork of regional priorities and planning policies, rather than a uniform national approach. For instance, the Greater Manchester Combined Authority, led by Mayor Andy Burnham, actively pursues its own development goals, impacting how large-scale projects are approved and integrated within the region.

This shift necessitates a highly localized strategy for British Land's acquisitions and development projects. Understanding the specific economic development agendas and planning frameworks of individual cities and regions, such as those championed by the West Midlands Combined Authority or the Tees Valley Mayor, becomes paramount. Success hinges on aligning projects with these diverse local visions, ensuring buy-in and smooth project execution in each distinct market.

Infrastructure Spending and Policy

The UK government's ongoing commitment to enhancing infrastructure, including transport networks and digital connectivity, presents a significant tailwind for British Land. This focus directly supports the company's urban logistics and campus property segments, which thrive on improved accessibility and efficient movement of goods and people. For instance, the government's £27 billion RIS2 (Road Investment Strategy 2) for 2020-2025 aims to upgrade major road networks, benefiting logistics hubs.

The updated National Planning Policy Framework (NPPF) reinforces this by explicitly backing planning for essential infrastructure like data centers and freight logistics facilities. This policy alignment is crucial for British Land as it seeks to develop sites that cater to the demands of a digitally driven and globally connected economy. The NPPF's emphasis on supporting economic growth through appropriate development is a key enabler.

British Land's strategic positioning and development activities are designed to leverage these infrastructure improvements. By acquiring and developing properties in locations with enhanced connectivity, the company can capitalize on increased accessibility, attracting tenants and driving rental growth. For example, investments in areas near major transport hubs, such as improved rail links or new motorway junctions, directly enhance the value proposition of their assets.

- Government infrastructure investment: The UK government allocated £650 billion for infrastructure investment over the next decade as of 2023, a substantial figure that underpins long-term economic growth and connectivity.

- Digital infrastructure focus: Initiatives like Project Gigabit, aiming to deliver gigabit-capable broadband to at least 85% of the UK by 2025, are vital for British Land's campus and data center developments.

- Transport connectivity: Ongoing upgrades to national rail networks and strategic road improvements directly impact the efficiency of logistics operations and the attractiveness of business locations.

Taxation and Regulatory Changes

Changes in taxation policies, including stamp duty, corporation tax, and business rates, significantly influence the profitability of property investments and development ventures for companies like British Land. For example, the UK's corporation tax rate increased from 19% to 25% in April 2023 for companies with profits over £250,000, impacting net returns on development projects.

Recent shifts in business tax, such as adjustments to business rates, have demonstrably contributed to retail property challenges and some shop closures, directly affecting tenants and, consequently, landlords like British Land. This underscores the tangible financial repercussions of fiscal policy on the real estate sector.

British Land must diligently monitor these evolving fiscal policy shifts to effectively optimize its financial planning and asset management strategies. Staying ahead of these changes allows for proactive adjustments to investment strategies and operational models to mitigate risks and capitalize on opportunities.

- Corporation Tax Hike: UK corporation tax rose to 25% in April 2023, directly affecting developer profits.

- Business Rates Impact: Fluctuations in business rates have been linked to retail sector pressures, influencing tenant viability.

- Stamp Duty Sensitivity: Changes to stamp duty land tax can alter transaction volumes and property valuations.

- Regulatory Scrutiny: Increased regulatory oversight on property development and investment can introduce compliance costs and delays.

The UK's planning system continues to evolve, with ongoing reforms to the National Planning Policy Framework (NPPF) aiming to streamline development and address housing needs. Proposals for new towns and potential reintroduction of housing targets signal a more interventionist approach to land use. The Planning and Infrastructure Bill may further simplify procedures and enhance compulsory purchase powers for local authorities, requiring British Land to adapt its strategies to these regulatory shifts.

The prospect of a general election in late 2024 or early 2025 introduces political uncertainty, which could impact property taxation, planning regulations, and environmental policies. For instance, a change in government might alter capital gains tax or introduce new development incentives, directly affecting project viability and investment returns for companies like British Land.

Devolution across the UK means British Land must navigate a complex landscape of regional planning priorities and development agendas. Success hinges on aligning projects with diverse local visions, as seen with combined authorities like Greater Manchester, requiring a highly localized approach to acquisitions and development.

| Political Factor | Impact on British Land | Supporting Data/Example |

| NPPF Reforms | Streamlined development, potential for new housing targets | Ongoing reforms aim to speed up development and tackle housing crisis. |

| Election Uncertainty | Potential shifts in tax and planning policies | General election expected in 2024/2025, creating policy uncertainty. |

| Devolution | Need for localized planning strategies | Regional priorities vary, requiring adaptation to local authority agendas. |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the British Land Company, offering a comprehensive overview of its external operating environment.

A concise PESTLE analysis for British Land offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for quick referencing during strategic meetings.

Economic factors

The Bank of England's monetary policy directly impacts British Land's cost of debt. Higher interest rates translate to more expensive borrowing for property development and acquisitions.

Looking ahead to 2025, market expectations point towards potential interest rate cuts. For instance, the Bank of England's Monetary Policy Committee has signaled a cautious approach, with some analysts forecasting a potential reduction in the Bank Rate from its current 4.25% (as of May 2024) by mid-2025, which could offer some relief to borrowing costs.

Despite anticipated cuts, borrowing costs are likely to persist at levels higher than the historically low rates seen before 2022. This necessitates robust debt management strategies for British Land, focusing on securing favorable financing terms to support its portfolio and future growth initiatives.

The UK's economic growth trajectory and inflation rates are pivotal for British Land. While 2024 surprised with stronger economic performance than initially forecast, projections for 2025 indicate continued expansion, partly fueled by anticipated interest rate reductions. This stability is vital for boosting consumer spending and business confidence, directly influencing demand in the property market.

A healthy economic climate underpins British Land's ability to achieve rental growth and maintain robust property valuations. For instance, the Bank of England's Monetary Policy Committee has signaled a cautious approach to rate cuts, with expectations of cuts occurring in the latter half of 2024 and potentially continuing into 2025, aiming to bring inflation closer to the 2% target.

The UK commercial property market is poised for a notable rebound in 2025, with projections indicating a capital value uplift and positive rental growth across key sectors like retail, office, and logistics. This positive sentiment is particularly strong for retail parks, which are expected to lead the pack with substantial returns and rental increases.

Specifically, retail parks are anticipated to see rental growth of around 3-5% in 2025, a significant improvement from previous years. This performance is driven by resilient consumer spending and a shift towards omnichannel retail strategies, benefiting well-located and efficiently managed assets.

This favorable outlook for prime commercial property, especially retail parks, directly underpins British Land's strategic direction. The company's focus on active asset management and development within these growth segments is well-positioned to generate sustained, long-term returns for investors.

Investment Market Sentiment and Liquidity

Investor sentiment regarding UK commercial real estate is showing a positive trend, with a noticeable uptick in demand, especially within the retail and office segments. This renewed interest is a crucial factor for companies like British Land.

The anticipated reduction in debt costs is poised to bolster investment returns and, consequently, stimulate a higher volume of real estate transactions. This environment directly benefits property developers and investors by making capital more accessible and profitable.

British Land's strategic maneuvers, including its recent disposals and key acquisitions, such as those in the retail park sector, underscore its agility in adapting to and leveraging evolving investment market conditions. For instance, in the fiscal year ending March 31, 2024, British Land reported a 10.1% increase in its portfolio value to £7.1 billion, reflecting successful strategic asset management.

- Investor Sentiment: A growing appetite for UK commercial property, particularly in retail and office spaces, signals a healthier investment climate.

- Debt Costs: Lower borrowing costs are expected to enhance profitability and encourage more property deals.

- British Land's Strategy: The company's proactive acquisitions, including significant investments in retail parks, demonstrate effective navigation of market shifts.

- Portfolio Performance: British Land's portfolio value grew to £7.1 billion by March 2024, indicating successful strategic execution.

Consumer Spending and Retail Sector Resilience

Consumer activity is showing encouraging resilience, with retail sales experiencing a notable uptick even amidst lingering global economic uncertainties. For instance, UK retail sales volumes saw an increase of 1.0% in April 2024 compared to the previous month, according to the Office for National Statistics. This demonstrates a steady, albeit cautious, return to spending.

The retail sector is undergoing a significant transformation, adapting to evolving consumer habits and the rise of new shopping paradigms. A key trend is the strategic pivot towards retail parks. These locations are proving particularly attractive because they align with current consumer preferences for convenience, accessibility, and open-air environments, offering more flexible and adaptable spaces compared to traditional high streets or enclosed malls.

British Land's strategic emphasis on its retail park portfolio is well-aligned with these market dynamics. This focus positions the company to capitalize on the inherent resilience of this retail sub-sector and the ongoing shifts in consumer behavior. Consequently, British Land is poised to experience increased demand and subsequent rental growth across its retail holdings.

- Retail Sales Growth: UK retail sales volumes increased by 1.0% in April 2024 month-on-month.

- Consumer Preference Shift: Growing consumer demand for convenience and accessibility favors retail parks.

- Retail Park Adaptability: Retail parks offer flexible spaces that can better accommodate evolving retail formats.

- British Land's Positioning: The company's strategic focus on retail parks is expected to drive rental growth and benefit from sector resilience.

The Bank of England's monetary policy continues to shape borrowing costs for British Land. While 2025 might see some interest rate reductions, potentially from the current 4.25% Bank Rate, borrowing will likely remain more expensive than pre-2022 levels. This necessitates continued focus on efficient debt management.

UK economic growth is projected to continue into 2025, supported by anticipated interest rate adjustments. This economic stability is crucial for British Land, as it bolsters consumer spending and business confidence, directly influencing demand for commercial properties and supporting rental growth.

The commercial property market, particularly retail parks, is expected to perform strongly in 2025, with forecasts suggesting rental growth of 3-5% for these assets. This positive outlook for prime commercial property aligns well with British Land's strategic focus on retail parks.

| Economic Factor | 2024 Data/Forecast | 2025 Forecast | Impact on British Land |

|---|---|---|---|

| Bank Rate | 4.25% (May 2024) | Potential cuts, but likely above pre-2022 levels | Influences borrowing costs; strategic debt management is key. |

| UK Economic Growth | Stronger than initially forecast | Continued expansion anticipated | Supports consumer spending and business confidence, driving property demand. |

| Retail Sales Volume | +1.0% (April 2024 vs. March 2024) | Resilient consumer spending expected | Underpins demand for retail assets, particularly retail parks. |

| Retail Park Rental Growth | Positive outlook | 3-5% anticipated | Directly benefits British Land's strategic focus on this sector. |

What You See Is What You Get

British Land Company PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of British Land Company details Political, Economic, Social, Technological, Legal, and Environmental factors impacting the business, providing valuable strategic insights.

Sociological factors

The ongoing shift to hybrid work models is reshaping office demand, with a strong emphasis on top-tier, high-quality buildings designed for collaboration and employee wellness. British Land's campuses are strategically aligned with this trend, as evidenced by mid-week office occupancy levels recovering to pre-pandemic figures.

The company's approach centers on developing dynamic, well-connected locations that appeal to businesses looking for contemporary, adaptable workspaces. This focus on quality and amenity is crucial as companies re-evaluate their real estate needs in light of evolving work preferences.

Consumer preferences are reshaping the retail landscape, with a clear shift towards experiences and convenience. This evolution is particularly evident in the strong performance of retail parks, which offer a blend of shopping, dining, and leisure activities, proving more resilient than traditional high streets or shopping centres. British Land's strategic focus on these accessible, multi-use destinations directly addresses these changing consumer habits, positioning its portfolio for sustained relevance.

Data from 2024 indicates a continued consumer appetite for integrated retail and leisure offerings. For instance, British Land's own retail parks have demonstrated robust footfall and sales growth, outperforming many other retail property types. This trend is supported by consumer surveys from early 2025, highlighting a desire for 'dwell time' and a preference for destinations that cater to a broader range of needs beyond just purchasing goods.

The ongoing shift towards urban living, supported by government plans like the Levelling Up agenda, directly benefits British Land's development pipeline. These initiatives aim to boost housing and infrastructure, creating fertile ground for urban regeneration projects.

British Land's commitment to building sustainable, mixed-use environments aligns perfectly with the demand for revitalized urban centers. This focus on placemaking not only improves local communities but also stimulates economic activity, a key driver for property investment.

By 2023, over 84% of the UK population resided in urban areas, a figure projected to continue rising. This sustained urbanization fuels the need for the kind of integrated living, working, and leisure spaces that British Land specializes in creating, particularly in key cities like London.

Demographic Shifts and Housing Needs

Demographic shifts in the UK, such as an aging population and a rise in single-person households, are intensifying the existing housing shortage. The Office for National Statistics projected a UK population of 67.5 million in mid-2022, with continued growth expected. This evolving demographic landscape directly impacts housing demand, necessitating a greater variety of housing options to meet diverse needs.

Government housing targets underscore the urgency. In 2023, the UK government aimed to build 300,000 new homes annually, a goal that has proven challenging to meet consistently. A significant portion of this target includes a focus on affordable housing, reflecting the growing affordability crisis that many face.

While British Land's core business revolves around commercial real estate, its substantial land holdings present opportunities. For instance, its strategic sites in London and the South East, often zoned for mixed-use development, can play a role in addressing broader community housing needs. This might involve incorporating residential units or supporting local housing associations in their development efforts.

- Population Growth: UK population projected to reach 67.5 million by mid-2022, increasing demand for housing.

- Evolving Households: Rise in single-person households and smaller family units alters housing type requirements.

- Government Targets: Aim to build 300,000 new homes annually, with a strong emphasis on affordable housing.

- British Land's Role: Strategic sites can facilitate mixed-use developments that include residential components, contributing to housing supply.

Community Engagement and Social Value Creation

British Land's commitment to community engagement and social value creation is a cornerstone of its operations. The company actively supports its customers and the communities where it operates, aiming to generate substantial direct social and economic benefits. This approach is not limited to property development but includes targeted initiatives addressing local needs and enhancing resident well-being.

This dedication to social value significantly bolsters British Land's reputation and cultivates stronger, more positive relationships with a wide array of stakeholders, from local residents to government bodies. For instance, in the fiscal year ending March 2024, British Land reported delivering £11.8 million in social value, exceeding its target of £10 million. This contribution is measured across various areas including employment, skills development, and community investment.

- Community Investment: British Land's initiatives often involve direct financial contributions or in-kind support to local charities and community projects.

- Skills and Employment: The company focuses on creating job opportunities and providing training programs for local residents, particularly those facing barriers to employment. In FY24, they facilitated 1,150 jobs for local people across their developments.

- Environmental Stewardship: Beyond social programs, British Land integrates environmental considerations, such as green space development and sustainable building practices, which also contribute to community well-being.

- Stakeholder Relations: By actively engaging with and supporting local communities, British Land builds trust and goodwill, which can translate into smoother planning processes and stronger local partnerships.

Sociological factors significantly influence British Land's strategy, particularly the ongoing shift towards hybrid work models which prioritizes high-quality, collaborative office spaces. The company's focus on creating dynamic, well-connected locations directly addresses evolving employee expectations for amenity-rich environments.

Consumer preferences are increasingly leaning towards experiences and convenience, making retail parks with mixed-use offerings more appealing than traditional retail. British Land's portfolio is strategically positioned to capitalize on this trend, as evidenced by robust footfall and sales growth in its retail park assets during 2024.

Urbanization trends, with over 84% of the UK population living in urban areas by 2023, are a key driver for British Land's mixed-use development pipeline. This sustained urban migration fuels demand for integrated living, working, and leisure spaces, particularly in major cities.

Demographic shifts, including an aging population and more single-person households, are exacerbating the UK's housing shortage, with government targets aiming for 300,000 new homes annually as of 2023. British Land's extensive land holdings offer opportunities to contribute to mixed-use developments that incorporate residential components, addressing these critical housing needs.

Technological factors

The UK real estate sector is rapidly integrating PropTech, with advancements like AI for valuations and virtual viewings becoming more common. British Land can harness these technologies to streamline property management, boost building efficiency, and elevate tenant satisfaction.

For instance, a 2024 report indicated that PropTech investment in the UK reached £1.7 billion, highlighting its growing importance. Embracing these innovations is vital for British Land to maintain its competitive edge and meet its sustainability targets in the evolving property landscape.

The integration of smart building technologies and Internet of Things (IoT) devices is revolutionizing commercial property management. These advancements enable sophisticated energy management, allowing for real-time monitoring and optimization, which can lead to substantial reductions in utility costs. For instance, smart sensors can adjust lighting and HVAC systems based on occupancy, potentially cutting energy consumption by up to 20% in well-implemented systems.

Predictive maintenance, powered by IoT sensors monitoring equipment health, can prevent costly breakdowns and extend asset lifespan. This proactive approach minimizes downtime and ensures smoother operations. British Land's commitment to high-quality, sustainable assets aligns perfectly with these technological shifts, offering a pathway to enhanced operational efficiency and significant cost savings.

Furthermore, these smart systems contribute to creating more desirable and functional spaces for tenants. Features like personalized climate control and seamless connectivity enhance the occupier experience, making properties more attractive in a competitive market. By adopting these technologies, British Land can solidify its position as a provider of premium, future-ready commercial spaces.

Digital platforms are revolutionizing property management, making tasks like rent collection, maintenance requests, and tenant screening much smoother. British Land's adoption of these tools can significantly boost operational efficiency.

Emerging technologies like blockchain offer enhanced security for property transactions and digital contracts. This could streamline the entire process of listing, selling, and completing property deals, reducing friction for all parties involved.

By leveraging these digital advancements, British Land can expect to see a reduction in administrative overhead and a marked improvement in the experience for both its tenants and business partners. For instance, the UK proptech market was valued at approximately £11 billion in 2023, indicating significant investment and adoption in digital solutions within the real estate sector.

Data Analytics and Predictive Modeling

The escalating volume of data is enabling more advanced market intelligence and predictive analytics within the real estate sector. British Land can leverage these data-driven insights to guide strategic property acquisitions, refine asset management practices, and pinpoint developing market trends. This analytical methodology fosters more robust investment decisions and aids in forecasting future property demand and performance.

For instance, in 2024, the real estate industry is seeing a significant uptake in AI-powered tools for site selection and tenant behavior analysis, with reports indicating a 20% increase in the adoption of such technologies by major property firms compared to 2023. British Land's commitment to digital transformation, as highlighted in their 2024 annual report, includes investments in advanced data platforms to enhance these capabilities.

- Enhanced Market Insights: Utilizing big data for granular analysis of demographic shifts, economic indicators, and consumer preferences to identify prime investment locations.

- Optimized Asset Management: Employing predictive analytics to forecast maintenance needs, optimize energy consumption in buildings, and tailor tenant experiences.

- Risk Mitigation: Using data modeling to assess and predict market volatility, interest rate impacts, and potential shifts in property values.

- Strategic Forecasting: Developing sophisticated models to anticipate future rental demand, vacancy rates, and capital appreciation across different property types and geographies.

Construction Technology and Efficiency

Advances in construction technology are significantly reshaping the property development landscape. Building Information Modeling (BIM) and modular construction are prime examples, offering substantial improvements in efficiency, waste reduction, and project timelines. For British Land, a leading property developer, integrating these innovations can directly translate to more sustainable and cost-effective projects.

By adopting modern construction methods, British Land can achieve higher quality buildings and a quicker path to market. For instance, the UK government has set targets for BIM adoption, with mandates for public projects, signaling a broader industry shift. This technological evolution allows for better planning, reduced on-site errors, and potentially lower capital expenditure, enhancing overall project viability.

- BIM Adoption: BIM software can reduce design errors by up to 40%, leading to significant cost savings and faster project completion.

- Modular Construction: This method can cut construction times by 20-50% and reduce waste by up to 90% compared to traditional methods.

- Sustainability Gains: Advanced techniques often incorporate greener materials and processes, aligning with British Land's sustainability goals and potentially reducing operational costs for tenants.

- Market Competitiveness: Early adoption of these technologies can provide a competitive edge by delivering projects faster and more efficiently than rivals.

Technological advancements are fundamentally altering the real estate sector, with British Land poised to benefit from these shifts. The increasing adoption of PropTech, including AI for property valuations and virtual tours, streamlines operations and enhances tenant experience. The UK PropTech market's significant growth, reaching an estimated £11 billion in 2023, underscores the financial viability of these innovations.

Smart building technologies and IoT devices are crucial for optimizing energy consumption and predictive maintenance. These systems can reduce energy usage by up to 20% and minimize downtime, directly impacting operational efficiency and cost savings for British Land. The company's focus on sustainable, high-quality assets aligns perfectly with these technological trends, offering a pathway to improved performance.

Digital platforms are revolutionizing property management, from rent collection to tenant screening, boosting operational efficiency. Furthermore, emerging technologies like blockchain can enhance security and streamline property transactions, reducing friction for all stakeholders. British Land's investment in advanced data platforms, as noted in their 2024 report, positions them to leverage these data-driven insights for strategic decision-making.

Construction technology, such as BIM and modular construction, offers significant improvements in project efficiency, waste reduction, and timelines. BIM adoption, for instance, can reduce design errors by up to 40%, while modular construction can cut project times by 20-50%. These innovations are vital for British Land to deliver more sustainable and cost-effective projects, gaining a competitive edge.

Legal factors

The upcoming Planning and Infrastructure Bill signals a significant legal overhaul designed to speed up development and tackle the housing shortage. This legislation is expected to simplify planning permissions for large infrastructure projects, potentially granting local authorities more robust compulsory purchase powers.

Furthermore, the bill aims to limit the power of councillors to obstruct smaller development proposals. For British Land, this means carefully analyzing these legal shifts to ensure adherence and to identify new avenues for growth and project realization.

Following the Grenfell Tower tragedy, the UK government has implemented significant building safety reforms, notably the Building Safety Act 2022. This legislation imposes stringent duties on developers and building owners to ensure the safety of high-rise residential buildings. British Land, like other major developers, must navigate these new regulations, which mandate detailed safety assessments, the appointment of accountable individuals, and the creation of safety case files.

These enhanced safety requirements translate to increased costs for British Land. For instance, the remediation of existing buildings to meet new fire safety standards can involve substantial expenditure, impacting project budgets and timelines. The company's 2024 financial reporting will likely reflect these ongoing investments in compliance and safety upgrades across its portfolio.

Adherence to these evolving legal frameworks is not merely a matter of compliance but a crucial element of risk management and reputation safeguarding. Failure to meet the rigorous building safety standards could result in significant fines, legal challenges, and damage to British Land's brand, underscoring the importance of proactive engagement with regulatory changes.

The UK government is intensifying environmental regulations, with a particular focus on carbon emission reduction targets and stringent compliance for property management. By 2025, the Future Homes Standard will mandate that new homes are low-carbon and highly energy-efficient, a significant shift impacting the built environment.

British Land's sustainability strategy must actively align with these evolving legal mandates. This includes a strong emphasis on decarbonization across its operations and enhancing the climate resilience of its extensive property portfolio to meet these new legal benchmarks.

Landlord-Tenant Law Evolution

Changes in landlord-tenant laws, especially concerning commercial leases and retail rescue agreements, directly influence British Land's occupier relationships and revenue predictability. For instance, recent legislative shifts could impact the terms of renegotiations or the framework for handling tenant defaults.

British Land's proactive engagement with legal counsel to review tenant restructuring plans underscores the importance of navigating these legal complexities. This approach helps mitigate risks stemming from tenant financial distress or the need for lease modifications.

Staying informed about evolving legal precedents and regulatory changes is vital for British Land's strategic asset management. This diligence ensures compliance and supports the company's ability to adapt its portfolio to the current legal landscape.

- Tenant Insolvency Laws: Stricter regulations regarding tenant insolvency could lead to faster resolution of lease disputes but may also limit renegotiation flexibility for struggling retailers.

- Retail Lease Reforms: Potential reforms aimed at supporting the retail sector, such as caps on rent increases or mandatory break clauses, could alter the financial dynamics of British Land's retail assets.

- Legal Risk Assessment: British Land's investment in legal scrutiny for restructuring plans highlights the increasing need for robust legal due diligence in a dynamic market.

Biodiversity Net Gain (BNG) Requirements

The mandatory Biodiversity Net Gain (BNG) requirement, effective from February 2024 for major developments and later for smaller sites, mandates that all new developments must demonstrably improve habitats. This means British Land's projects must integrate BNG strategies, potentially through on-site habitat creation or financial contributions to national conservation funds.

This new regulation introduces significant environmental and financial considerations into the planning and execution of development projects. For instance, the government estimates BNG could stimulate a market worth £210 million annually by 2027/28, presenting both compliance costs and potential investment opportunities for companies like British Land.

- Mandatory BNG Implementation: Effective February 2024 for large sites, requiring a minimum 10% biodiversity uplift.

- Financial Implications: Potential market value of £210 million annually by 2027/28, impacting project budgets.

- Strategic Adaptation: British Land must develop robust BNG plans, including habitat creation or off-site contributions.

- Regulatory Landscape: Ongoing evolution of BNG rules will necessitate continuous monitoring and adaptation.

The UK's legal landscape is increasingly focused on safety and sustainability, directly impacting property development. The Building Safety Act 2022, for example, imposes stringent requirements on high-rise buildings, necessitating significant investment in compliance for developers like British Land. Furthermore, the mandatory Biodiversity Net Gain (BNG) policy, effective from February 2024, requires a minimum 10% improvement in habitats for new developments, adding complexity and cost to project planning.

These regulatory shifts, alongside potential reforms in tenant insolvency laws and retail lease agreements, demand proactive legal strategy. British Land's ability to navigate these evolving legal frameworks, including adapting to the Future Homes Standard for energy efficiency by 2025, will be critical for mitigating risks and capitalizing on new opportunities in the property market.

| Legal Factor | Impact on British Land | Key Legislation/Regulation | Timing/Data Point |

|---|---|---|---|

| Building Safety | Increased compliance costs, potential project delays | Building Safety Act 2022 | Ongoing investment reflected in 2024 reporting |

| Environmental | Mandatory habitat improvements, energy efficiency standards | Biodiversity Net Gain (BNG), Future Homes Standard | BNG effective Feb 2024; Future Homes Standard by 2025 |

| Commercial Leases | Changes in tenant renegotiation and default handling | Evolving landlord-tenant laws | Impacts revenue predictability |

Environmental factors

The UK government is intensifying its commitment to climate change mitigation, with new policies designed to hit net-zero emissions targets. This regulatory push means companies like British Land must adapt.

British Land is actively decarbonizing its substantial property portfolio, encompassing campuses, retail spaces, and logistics facilities. This strategic alignment with net-zero goals is crucial for long-term business viability and regulatory compliance.

Significant capital is being channeled into energy-efficient retrofits and the adoption of low-carbon technologies across British Land's assets. For instance, in 2024, the company reported a 14% reduction in its Scope 1 and 2 carbon intensity compared to its 2019 baseline, demonstrating tangible progress.

British Land's sustainability strategy prioritizes reusing building components and specifying low-carbon materials, aiming to reduce the carbon intensity of its operations. This focus on retrofitting its portfolio is crucial for enhancing Energy Performance Certificate (EPC) ratings.

In 2024, British Land reported a 12% reduction in Scope 1 and 2 carbon emissions intensity compared to its 2019 baseline, showcasing tangible progress in its environmental commitments. This dedication to sustainable practices is essential for meeting evolving environmental regulations and improving asset value.

The UK's commitment to energy efficiency is intensifying, with the 'Future Homes Standard' set to mandate low-carbon heating and high energy efficiency in all new-build homes from 2025. While British Land primarily operates in commercial real estate, this regulatory shift signals a wider market expectation for energy-conscious design and construction that will influence all new developments, including commercial ones.

Furthermore, the strengthening enforcement of Minimum Energy Efficiency Standards (MEES) for commercial buildings is a direct driver for improved energy performance. This requires ongoing investment in upgrades to ensure British Land's portfolio meets these increasingly stringent energy efficiency requirements, impacting operational costs and asset value.

Biodiversity and Green Infrastructure

The UK's Biodiversity Net Gain (BNG) mandate, effective from February 2024 for major developments, requires a minimum 10% improvement in biodiversity for new projects. British Land must integrate this into their planning, incorporating features like green roofs, living walls, and dedicated habitat areas to meet these ecological uplift requirements. This strategic approach not only ensures compliance but also adds tangible environmental value and aesthetic appeal to their portfolio.

British Land's commitment to green infrastructure is evident in their ongoing projects, aiming to create more sustainable and biodiverse urban environments. For instance, their development at Canada Water is designed with extensive green spaces and ecological corridors, contributing to urban biodiversity. Such initiatives are crucial for mitigating the environmental impact of construction and enhancing the long-term desirability of their real estate assets.

- Regulatory Compliance: Adherence to the Biodiversity Net Gain (BNG) requirement, mandating a 10% ecological uplift for new developments from February 2024.

- Green Infrastructure Integration: Incorporating elements like green roofs, sustainable drainage systems (SuDS), and habitat creation within project designs.

- Property Value Enhancement: Improving the attractiveness and environmental credentials of properties through biodiversity-focused design.

- Environmental Stewardship: Demonstrating a commitment to ecological enhancement and sustainable development practices.

Waste Management and Circular Economy Principles

British Land is increasingly focused on integrating circular economy principles into its operations, aiming to significantly reduce waste and maximize the reuse and recycling of materials throughout its construction and property management activities. This strategic shift is driven by growing environmental awareness and regulatory pressures. For instance, the company has highlighted its efforts in reusing existing building components and materials, a key tenet of the circular economy, which directly contributes to lessening its environmental footprint and conserving valuable resources.

This commitment translates into tangible benefits, not only in terms of environmental stewardship but also potential long-term cost efficiencies. By prioritizing material reuse, British Land can mitigate the expenses associated with virgin material procurement and waste disposal. Their 2024 sustainability report indicates a target to divert 90% of construction and demolition waste from landfill by 2030, demonstrating a clear, data-driven approach to waste management.

- Waste Diversion Target: British Land aims to divert 90% of construction and demolition waste from landfill by 2030.

- Material Reuse: The company actively reuses existing building components and materials in new developments and refurbishments.

- Resource Conservation: Adopting circular economy principles helps conserve natural resources and reduce reliance on new materials.

- Cost Efficiencies: Minimizing waste and maximizing reuse can lead to significant cost savings in construction and property management.

The UK's push towards net-zero emissions is intensifying, with new regulations impacting property development and management. British Land is actively responding by decarbonizing its portfolio, focusing on energy efficiency and low-carbon materials. For example, in 2024, the company reported a 12% reduction in its Scope 1 and 2 carbon emissions intensity compared to a 2019 baseline.

Mandatory Biodiversity Net Gain (BNG) from February 2024 requires a 10% ecological uplift in new developments, pushing companies like British Land to integrate green infrastructure. This includes features such as green roofs and habitat creation, as seen in their Canada Water development, enhancing both environmental value and property appeal.

Circular economy principles are also gaining traction, with British Land aiming to divert 90% of construction and demolition waste from landfill by 2030. This involves reusing building components and materials, a strategy that not only conserves resources but also offers potential cost efficiencies.

| Environmental Factor | British Land's Response/Action | Key Data/Target |

|---|---|---|

| Climate Change & Net-Zero Targets | Decarbonizing property portfolio, energy efficiency retrofits | 12% reduction in Scope 1 & 2 carbon intensity (vs. 2019 baseline) by 2024 |

| Biodiversity Net Gain (BNG) | Integrating green infrastructure, habitat creation | 10% ecological uplift required for new developments (from Feb 2024) |

| Circular Economy & Waste Management | Reusing building components, prioritizing low-carbon materials | 90% of construction & demolition waste diverted from landfill by 2030 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for British Land Company is built on a robust foundation of data from official UK government publications, reputable economic forecasting agencies, and leading property market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the real estate sector.