British Land Company Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

British Land Company Bundle

Unlock the strategic blueprint behind British Land Company's success with our comprehensive Business Model Canvas. Discover how they engage diverse customer segments, forge key partnerships, and generate revenue in the dynamic real estate market.

Dive deeper into British Land Company’s real-world strategy with the complete Business Model Canvas. This downloadable file offers a clear, professionally written snapshot of their value propositions, cost structure, and revenue streams—perfect for strategic analysis.

Want to see exactly how British Land Company operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking, strategic planning, or investor presentations.

Partnerships

British Land frequently partners with institutional investors, including sovereign wealth funds and substantial pension funds, for co-investment in and development of significant real estate ventures. These collaborations are crucial for accessing capital and managing the inherent risks of large-scale projects.

Notable examples include partnerships with GIC for the Broadgate REIT and AustralianSuper for the Canada Water Masterplan, demonstrating British Land's strategy to utilize external capital. These joint ventures are instrumental in accelerating project delivery and unlocking value.

The company leverages these partnerships to crystallize value through strategic asset sales and ongoing joint venture structures. This approach allows British Land to maintain a strong development pipeline while sharing the financial burden and rewards.

British Land heavily relies on collaborations with established construction and development firms to bring its ambitious projects to life. These partnerships are fundamental for the physical realization of their diverse portfolio, which includes large-scale urban regeneration, retail spaces, and logistics hubs.

These expert partners bring specialized knowledge in constructing high-quality, sustainable buildings, ensuring projects are delivered on time and within budget. For example, BAM Construct UK was appointed to deliver the Broadgate Tower extension, a testament to British Land's engagement with leading construction expertise.

British Land's partnerships with local authorities and government bodies are crucial for navigating the complex planning and regulatory landscape. These relationships are vital for obtaining planning permissions, a process that can significantly impact project timelines and viability. For instance, securing consent for major urban regeneration projects often hinges on demonstrating alignment with local development plans and community needs.

These collaborations are not just about compliance; they are about co-creating value. By working closely with councils, British Land can ensure its developments contribute positively to urban regeneration goals, fostering sustainable and vibrant communities. A prime example is the company's success in gaining planning approval for its urban logistics schemes, which are designed to meet the growing demand for efficient last-mile delivery while minimizing disruption to city centers.

In 2024, British Land continued to emphasize these partnerships, recognizing their role in unlocking opportunities for growth and development. The company actively engages with local stakeholders to understand their priorities and integrate them into its project strategies, ensuring that new developments are not only commercially successful but also socially responsible and environmentally sound.

Retailers and Logistics Operators

British Land cultivates robust alliances with major retail chains and urban logistics providers, crucial for maintaining high occupancy and consistent rental revenue. For instance, in 2024, the company continued to focus on securing anchor tenants in its prime retail destinations, understanding that these partnerships are foundational to its income streams.

These collaborations go beyond simple leasing agreements. British Land actively partners with tenants to customize spaces, facilitating both their physical store operations and their expanding e-commerce fulfillment needs. This adaptability is key to retaining valuable occupiers in a dynamic market.

The company’s strategy involves aggressively pursuing and securing space in high-demand urban locations. This competitive approach ensures they attract and retain leading retailers and logistics operators, reinforcing their market position.

- Key Occupier Relationships: Strong ties with major retail chains and logistics operators are essential for occupancy and rental income.

- Tailored Space Solutions: British Land provides customized spaces to meet evolving tenant needs for physical and online operations.

- Competitive Space Acquisition: The company actively competes for prime locations to secure high-demand tenants.

Sustainability and Technology Collaborators

British Land actively collaborates with sustainability consultants and technology firms to drive its environmental agenda. For instance, in 2024, they continued to focus on reducing embodied carbon in construction, a key area where technology providers offer innovative solutions.

Their partnerships extend to academic institutions, fostering research into nature-based solutions and advanced energy efficiency techniques for their properties. This collaborative approach is crucial for meeting their ambitious ESG targets, such as achieving net zero for their operational energy use.

Key collaborations in 2024 included:

- Partnerships with leading smart building technology providers to enhance occupier experience and operational efficiency.

- Collaborations with environmental consultancies to refine embodied carbon calculations and sustainable procurement strategies.

- Engagements with universities on research projects related to circular economy principles and sustainable materials.

British Land's key partnerships are vital for capital access, project execution, and value creation. These include institutional investors like GIC and AustralianSuper, construction firms such as BAM Construct UK, and local authorities, all contributing to large-scale developments and urban regeneration. The company also fosters strong ties with anchor tenants and logistics operators, ensuring consistent rental income through tailored space solutions.

| Partner Type | Example Partner | Contribution | 2024 Focus |

|---|---|---|---|

| Institutional Investors | GIC, AustralianSuper | Capital for co-investment and development | Accelerating project delivery |

| Construction Firms | BAM Construct UK | Expertise in project execution and sustainability | Delivering high-quality, sustainable buildings |

| Local Authorities | Various Councils | Navigating planning and regulatory landscape | Aligning with local development plans |

| Key Occupiers | Major Retail Chains, Logistics Operators | Rental income, occupancy | Securing anchor tenants, customized spaces |

| Sustainability Consultants | Various Firms | ESG strategy, carbon reduction | Reducing embodied carbon, net zero goals |

What is included in the product

This Business Model Canvas outlines British Land's strategy of focusing on urban regeneration and mixed-use development, targeting institutional investors and occupiers with a portfolio of high-quality, sustainable assets.

It details their value proposition of creating thriving urban ecosystems, supported by strong customer relationships and efficient operational processes.

British Land's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their strategy, allowing for quick identification of core components and efficient communication to stakeholders.

This structured approach to visualizing their operations helps alleviate the pain of complex strategy by condensing it into a digestible format for rapid review and adaptation.

Activities

British Land focuses on acquiring prime real estate, particularly in London's key campuses, retail parks, and urban logistics hubs. This strategic acquisition approach is supported by a disciplined capital allocation, which includes selling less crucial assets to fund more profitable ventures.

A prime example of this strategy is British Land's significant investment in retail parks, having acquired £738 million worth of these properties since April 2024. This demonstrates a clear commitment to expanding their portfolio in high-potential sectors.

British Land's key activity of Development Management involves overseeing the entire process of creating new properties. This spans everything from the initial design concepts and securing planning permission to the actual construction and final handover of buildings. The company focuses on delivering high-quality, sustainable environments.

Significant projects like the Canada Water masterplan and office redevelopments at 2 Finsbury Avenue and Broadgate Tower exemplify this focus. These initiatives are designed to create top-tier, environmentally conscious spaces that meet evolving market demands.

As of early 2024, British Land maintained a substantial committed development pipeline, signaling ongoing investment and a forward-looking approach to property creation and value enhancement.

British Land's active asset management strategy focuses on optimizing its existing property portfolio to drive value and maintain high occupancy. This includes strategic refurbishments and re-leasing efforts to adapt spaces for evolving tenant needs and market trends.

In 2024, British Land reported a strong performance in its office portfolio, with 97% occupancy and a weighted average lease term of 7.4 years, demonstrating the success of their hands-on approach to asset management.

Leasing and Tenant Relationship Management

British Land actively manages its portfolio by securing and retaining top-tier tenants. This involves strategic leasing, favorable negotiations, and fostering strong occupier relationships to ensure consistent income and high occupancy rates across its campuses, retail, and urban logistics assets.

In fiscal year 2024, British Land demonstrated robust leasing performance, securing agreements for 3.3 million square feet. Notably, this activity was 15.1% above the estimated rental value (ERV), highlighting effective market positioning and negotiation.

- Tenant Acquisition: Proactive engagement with prospective tenants to fill vacancies across diverse property types.

- Lease Negotiation: Securing terms that are financially beneficial and align with market conditions.

- Tenant Retention: Building and maintaining positive relationships to encourage long-term occupancy.

- Portfolio Optimization: Continuously assessing and adapting leasing strategies to maximize asset value and income stability.

Sustainability and Community Engagement

British Land actively integrates sustainability into its core operations, focusing on low-carbon developments and boosting biodiversity. This commitment extends to fostering social value through community engagement, aiming to create 'Greener Spaces' and 'Thriving Places'. In 2024, the company continued its drive to reduce both embodied and operational carbon across its portfolio, a crucial step in its long-term environmental strategy.

- Low-Carbon Development: Implementing strategies to minimize carbon emissions in new construction and refurbishment projects.

- Biodiversity Enhancement: Initiatives focused on increasing green spaces and supporting wildlife within its developments.

- Community Engagement: Actively involving local communities in the planning and development process to ensure social value is created.

- Carbon Reduction: Setting and working towards ambitious targets for reducing embodied and operational carbon in its buildings.

British Land's key activities revolve around strategic property acquisition, particularly in London's growth sectors like campuses, retail parks, and urban logistics. They actively manage their existing portfolio through refurbishments and re-leasing to maintain high occupancy and adapt to tenant needs. Development management is also crucial, overseeing projects from design to completion, with a focus on sustainable, high-quality spaces.

| Key Activity | Description | 2024 Data/Examples |

|---|---|---|

| Property Acquisition | Acquiring prime real estate in growth sectors. | £738 million invested in retail parks since April 2024. |

| Asset Management | Optimizing existing portfolio through refurbishments and re-leasing. | 97% occupancy in office portfolio with 7.4-year weighted average lease term. |

| Development Management | Overseeing new property creation from design to completion. | Canada Water masterplan, office redevelopments at 2 Finsbury Avenue and Broadgate Tower. |

| Tenant Management | Securing and retaining top-tier tenants through strategic leasing. | 3.3 million sq ft of leasing secured, 15.1% above estimated rental value. |

| Sustainability Integration | Focus on low-carbon development and community engagement. | Continued drive to reduce embodied and operational carbon across portfolio. |

Preview Before You Purchase

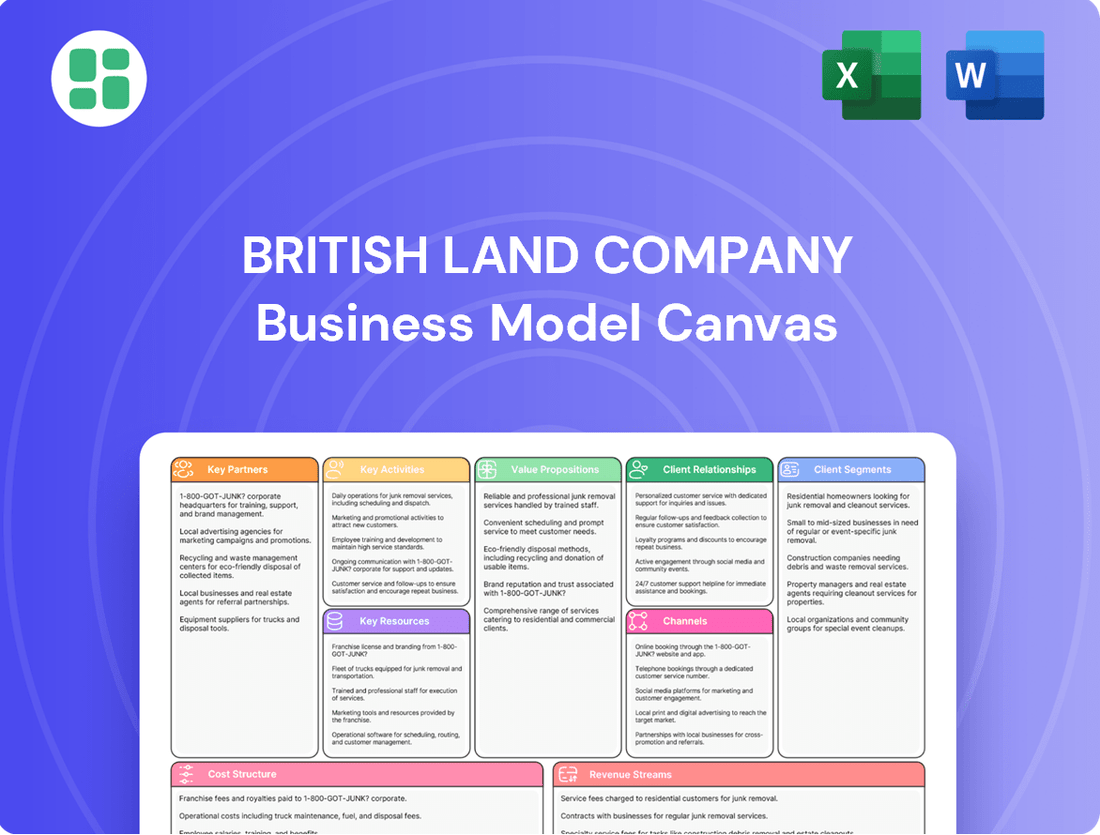

Business Model Canvas

The Business Model Canvas for The British Land Company that you are previewing is the exact, comprehensive document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the final deliverable, showcasing the detailed breakdown of their business strategy. Upon completing your order, you'll gain full access to this same professionally structured and ready-to-use Business Model Canvas, allowing you to explore and understand their operations with complete transparency.

Resources

British Land's most valuable asset is its extensive collection of high-quality properties. This portfolio is strategically positioned in key areas like London campuses, retail parks, and urban logistics hubs across London.

As of March 2025, the total value of this real estate portfolio stood at an impressive £14.6 billion. This substantial asset base forms the bedrock of the company's rental income stream and offers significant potential for future growth through development projects.

British Land's significant land bank and development pipeline are fundamental to its future growth. This strategic asset base ensures a steady supply of new, high-value properties. For instance, the company is actively developing a substantial pipeline of urban logistics projects, valued at approximately £1.3 billion, demonstrating a clear commitment to expanding its portfolio in key growth sectors.

The company's development strategy is exemplified by large-scale, multi-million square foot projects. A prime example is the Canada Water Masterplan, a transformative urban regeneration project that underscores British Land's capacity for ambitious, long-term value creation and its role in shaping urban landscapes.

British Land's access to substantial financial capital, encompassing equity, debt, and joint venture partnerships, is a cornerstone for its acquisition, development, and operational activities. This financial muscle is essential for executing its strategic vision in the property market.

The company boasts a robust balance sheet and significant undrawn credit facilities, offering considerable flexibility to pursue investment opportunities. As of the latest reporting, British Land had £2.2 billion in financing activity during fiscal year 2025, underscoring its active engagement in capital markets.

Expertise in Property Development and Management

British Land Company leverages its deep in-house expertise in property development and management as a cornerstone of its business model. This capability allows them to tackle complex projects from inception to completion, ensuring efficient execution and value maximization.

Their active asset management approach, driven by strategic market analysis, is crucial. This ensures their portfolio is consistently optimized for performance and future growth, adapting to evolving market demands.

- In-house Development Prowess: British Land's teams possess the skills to manage intricate development projects, from initial planning to construction, ensuring quality and timely delivery.

- Active Asset Management: The company actively manages its properties to enhance their value, focusing on tenant satisfaction, operational efficiency, and strategic repositioning.

- Strategic Market Insight: A core strength lies in their ability to conduct thorough market analysis, identifying emerging trends and opportunities to inform investment and development strategies.

- Value Creation Engine: This combined expertise allows British Land to create significant value by spotting and capitalizing on opportunities, executing projects efficiently, and optimizing the performance of their entire property portfolio.

Strong Brand and Reputation

British Land's strong brand and reputation are cornerstones of its business model, acting as a significant draw for high-quality tenants and investment partners.

This established trust, built over years of successful development and management of prime UK property, translates into favourable financing terms and a competitive edge in the market.

For instance, their focus on creating sustainable and engaging urban spaces, like the revitalized Regent's Place or Canada Water, reinforces this positive perception.

- Established Trust: British Land's long-standing presence and delivery of successful projects build confidence among stakeholders.

- Tenant Attraction: A reputable brand attracts premium tenants seeking quality, well-managed spaces.

- Investment Appeal: Strong reputation enhances attractiveness to investors and partners, potentially leading to better deal terms.

- Financing Advantage: A track record of success and a solid brand can secure more favourable financing options.

British Land's key resources are its substantial property portfolio, valued at £14.6 billion as of March 2025, and a significant development pipeline, including £1.3 billion in urban logistics projects. Access to robust financial capital, with £2.2 billion in financing activity in fiscal year 2025, and deep in-house expertise in development and asset management are also critical. Their strong brand reputation further solidifies their market position.

| Resource | Description | As of March 2025 (or FY25) |

|---|---|---|

| Property Portfolio | High-quality real estate across London campuses, retail parks, and urban logistics hubs. | £14.6 billion |

| Development Pipeline | Future growth through new property development, particularly in urban logistics. | £1.3 billion (urban logistics) |

| Financial Capital | Equity, debt, and joint venture partnerships for acquisitions and development. | £2.2 billion (financing activity FY25) |

| In-house Expertise | Property development, management, and strategic market analysis capabilities. | Core operational strength |

| Brand & Reputation | Established trust and positive perception among tenants and investors. | Attracts premium tenants and favourable financing |

Value Propositions

British Land provides access to prime urban and retail locations, with a growing emphasis on sustainability. These sites are chosen for their strategic advantage and are increasingly developed to meet occupier needs for efficiency and wellbeing.

The company targets high sustainability credentials for its properties, aiming for certifications like BREEAM Outstanding and EPC A ratings. This focus reflects a commitment to environmental responsibility and modern occupier demands.

British Land Company is committed to building enduring shareholder value by strategically acquiring, developing, and managing its property portfolio. This long-term perspective is designed to achieve steady rental income growth and enhance the overall worth of its assets.

The company's strategy is rooted in capitalizing on robust demand for space and addressing market shortages. This allows them to generate appealing returns for investors.

In its 2024 fiscal year, British Land reported a portfolio valuation of £10.9 billion. The company's focus on sectors with strong occupational fundamentals, such as urban logistics and residential, underpins its long-term value creation objective.

British Land cultivates 'Places People Prefer,' crafting vibrant, mixed-use campuses and retail hubs that are designed to spark community, foster collaboration, and drive innovation. These thoughtfully integrated environments are replete with amenities, services, and inviting public spaces, all aimed at enriching the experience for both those who work and visit.

For instance, their Canada Water development is envisioned as a comprehensive new town centre, aiming to create a dynamic and engaging urban destination. This approach underscores British Land's commitment to building more than just buildings; they are creating living, breathing ecosystems that support diverse activities and connections.

Flexible and Tailored Space Solutions

British Land excels at offering flexible property solutions designed to meet a wide array of customer needs. This adaptability spans from accommodating large corporate headquarters to providing adaptable retail units and efficient urban logistics hubs.

The company's commitment to flexibility is evident in its provision of specialized spaces, such as adaptable laboratory environments. British Land also offers a variety of leasing options, ensuring that spaces can be tailored to accommodate the constantly evolving requirements of businesses.

- Tailored Spaces: From large corporate offices to smaller retail units and logistics centers, British Land customizes properties.

- Specialized Offerings: Includes flexible laboratory spaces catering to specific industry needs.

- Leasing Variety: A range of leasing terms and structures are available to match business lifecycle changes.

- Customer Focus: Solutions are developed to support the dynamic and changing operational demands of tenants.

Commitment to Social and Environmental Impact

British Land actively offers stakeholders the advantage of aligning with a business dedicated to fostering positive social and environmental changes. This commitment resonates with tenants and investors who prioritize strong Environmental, Social, and Governance (ESG) principles.

The company has set ambitious targets, including achieving net-zero carbon emissions and delivering biodiversity net gain across its portfolio. For instance, by March 2024, British Land reported progress towards its net-zero targets, aiming for a 50% reduction in Scope 1 and 2 emissions by 2030 compared to a 2019 baseline.

Furthermore, British Land focuses on creating tangible social value within the communities where it operates. This includes initiatives aimed at improving local employment, skills development, and community well-being, demonstrating a holistic approach to sustainable development.

- Net-Zero Carbon Targets: Aiming for significant emissions reductions by 2030.

- Biodiversity Net Gain: Committed to improving ecological value on its sites.

- Social Value Creation: Investing in community development and local impact.

- ESG Appeal: Attracting tenants and investors with a strong sustainability focus.

British Land offers strategically located urban and retail properties, increasingly focused on sustainability and occupier well-being. They prioritize high sustainability credentials, aiming for certifications like BREEAM Outstanding and EPC A ratings, reflecting a commitment to environmental responsibility and modern demands.

The company's value proposition centers on creating 'Places People Prefer,' developing vibrant, mixed-use environments that foster community and collaboration. This includes flexible property solutions tailored to diverse business needs, from corporate offices to specialized laboratory spaces and adaptable retail units, supported by a variety of leasing options.

British Land actively aligns stakeholders with its dedication to positive social and environmental change, setting ambitious ESG targets. By March 2024, the company reported progress towards its net-zero goals, aiming for a 50% reduction in Scope 1 and 2 emissions by 2030 against a 2019 baseline, while also investing in local community development and skills.

| Value Proposition | Description | Key Metrics/Examples |

| Prime Urban & Retail Locations | Access to strategically advantageous sites with a focus on sustainability and occupier needs. | Portfolio valuation of £10.9 billion (FY24). Focus on urban logistics and residential sectors. |

| 'Places People Prefer' | Development of vibrant, mixed-use environments fostering community, collaboration, and innovation. | Canada Water development as a new town centre example. |

| Flexible Property Solutions | Tailored spaces and diverse leasing options to meet evolving business demands. | Provision of specialized laboratory environments; range of leasing terms available. |

| Strong ESG Commitment | Alignment with stakeholders prioritizing positive social and environmental impact. | Targeting net-zero carbon emissions; 50% Scope 1 & 2 reduction by 2030 (vs 2019). Biodiversity net gain initiatives. |

Customer Relationships

British Land cultivates strong tenant bonds via specialized account and asset management groups. These teams offer continuous assistance, tackle unique tenant requirements, and ensure efficient property oversight, nurturing enduring collaborations and robust tenant loyalty. This proactive strategy contributes to maintaining elevated occupancy levels, a key driver of consistent revenue.

British Land actively fosters strong connections with local communities around its projects. They achieve this through dedicated engagement programs and thoughtful placemaking efforts. For instance, in 2024, they continued to invest in creating vibrant public spaces and organizing events that bring people together, directly supporting their sustainability goal of creating thriving places.

British Land leverages digital platforms extensively to manage customer relationships, focusing on efficient communication and enhanced tenant services. These platforms facilitate everything from property management updates to quick service requests, significantly improving the overall tenant experience.

In 2024, British Land continued to invest in its digital infrastructure, enabling seamless interaction for its diverse customer base. This digital-first approach allows for rapid information dissemination and feedback collection, crucial for adapting to evolving tenant needs.

Beyond tenant services, British Land utilizes its digital channels for robust investor engagement. This includes providing timely updates on performance and strategic initiatives, fostering transparency and trust with its stakeholders.

Tailored Solutions and Advisory Services

British Land provides tailored solutions and advisory services to its major tenants, helping them with their unique real estate strategies, growth ambitions, and environmental objectives. This consultative approach fosters stronger connections, positioning British Land as a valued strategic ally rather than merely a property owner.

This focus on partnership is evident in their engagement with key occupiers. For instance, in their 2024 financial reporting, British Land highlighted increased tenant engagement on sustainability initiatives, a direct result of these advisory services.

- Bespoke Solutions: Offering customized real estate strategies to meet specific occupier needs.

- Strategic Partnerships: Moving beyond landlord-tenant dynamics to become a collaborative partner.

- Sustainability Focus: Assisting occupiers in achieving their environmental, social, and governance (ESG) targets through real estate.

Investor Relations and Shareholder Engagement

British Land prioritizes open communication with its investors and shareholders. They achieve this through consistent financial reporting, investor calls, and dedicated Q&A sessions, ensuring stakeholders are kept fully abreast of the company's financial health and strategic direction.

This commitment to transparency builds a strong foundation of trust and confidence among its investor base. For instance, in their 2024 fiscal year, British Land reported a 10.5% increase in underlying profit, demonstrating their dedication to shareholder value.

- Regular Financial Reporting: Dissemination of interim and full-year financial results.

- Investor Presentations: Detailed updates on strategy, performance, and market outlook.

- Shareholder Engagement: Active participation in Annual General Meetings and direct communication channels.

- Proactive Communication: Timely updates on significant company developments and strategic initiatives.

British Land fosters deep tenant relationships through dedicated teams offering tailored property management and advisory services, aiming for long-term partnerships. In 2024, their focus on sustainability saw increased collaboration with key occupiers on ESG goals, reinforcing their role as a strategic ally. This approach is supported by robust digital platforms for efficient communication and service delivery, enhancing the overall occupier experience.

| Relationship Type | Key Activities | 2024 Focus/Data Point |

|---|---|---|

| Tenant Relationships | Specialized account & asset management, bespoke solutions, advisory services | Increased tenant engagement on sustainability initiatives |

| Community Engagement | Placemaking, local events | Continued investment in vibrant public spaces |

| Investor Relations | Regular financial reporting, investor calls, proactive communication | 10.5% increase in underlying profit (FY24) |

Channels

British Land's direct sales and leasing teams are crucial for engaging with tenants across their campus, retail, and urban logistics portfolios. These in-house specialists foster strong relationships, enabling a deep understanding of tenant requirements and the development of customized leasing solutions.

This direct approach is a key driver of leasing success. For instance, in the fiscal year ending March 2024, British Land reported a strong leasing performance, securing 2.7 million sq ft of space across its portfolio, demonstrating the effectiveness of their dedicated sales and leasing efforts.

British Land collaborates with external property agents and commercial real estate brokers to broaden its market presence. These partnerships are vital for marketing their diverse portfolio, which includes significant holdings in London’s office and retail sectors. For instance, as of early 2024, British Land's London portfolio comprises 20 office buildings and 17 retail assets, all of which benefit from the extensive networks of these external specialists.

These brokers and agents play a key role in identifying potential tenants and buyers, thereby expediting leasing and sales processes. Their expertise in market trends and tenant demand helps British Land optimize its property offerings. In 2023, the company reported a strong leasing performance, securing new agreements and renewals across its portfolio, a testament to the effectiveness of these collaborations.

British Land Company leverages its corporate website and various property listing platforms to showcase its extensive portfolio and highlight new developments. This digital presence is crucial for broad market visibility and attracting a diverse range of customer segments, from individual investors to commercial tenants.

Digital marketing campaigns are integral to communicating British Land's value propositions, effectively reaching potential clients and partners. In 2024, the company continued to invest in its online channels, recognizing their importance in a competitive real estate market.

Industry Events and Conferences

British Land actively participates in major real estate industry events and conferences. This engagement is crucial for networking, fostering business development, and establishing thought leadership within the sector. These platforms allow the company to connect with potential partners, secure new tenants, and attract investors, while also showcasing its strategic direction and market insights.

These industry gatherings are vital for British Land's outreach and relationship building. For instance, in 2024, the company likely presented its portfolio and future plans at events such as MIPIM or UKREiiF, key fixtures in the real estate calendar. Such participation directly supports business development objectives by creating visibility and facilitating direct engagement with stakeholders.

- Networking Opportunities: Connect with peers, potential tenants, and investors.

- Business Development: Identify and pursue new partnerships and leasing opportunities.

- Thought Leadership: Share insights on market trends and company strategy.

- Brand Visibility: Enhance the company's profile within the real estate industry.

Public Relations and Media Coverage

British Land strategically leverages public relations and media engagement to cultivate a robust public image. This involves proactive communication with key financial and real estate media, ensuring their narrative on achievements and strategic pivots resonates widely.

Positive media attention directly bolsters British Land's brand reputation, reaching a diverse stakeholder base, from investors to potential tenants. For instance, in the first half of fiscal year 2024, the company's proactive stakeholder engagement contributed to a steady flow of positive reporting on their development pipeline and sustainability initiatives.

- Media Engagement: Consistent outreach to financial journalists and real estate publications.

- Reputation Management: Highlighting successful projects and ESG (Environmental, Social, and Governance) commitments.

- Stakeholder Communication: Ensuring clear messaging on strategic goals and financial performance.

- Brand Visibility: Maintaining a strong presence in industry news and broader business media.

British Land employs a multi-channel strategy, blending direct engagement with broad market outreach. Their in-house teams excel at building tenant relationships, complemented by external agents who expand market reach. Digital platforms and industry events are key for visibility and business development, while public relations efforts shape their corporate image.

| Channel | Description | Key Activities | Data/Evidence (FY24/Early 2024) |

|---|---|---|---|

| Direct Sales & Leasing | In-house teams engaging directly with tenants. | Relationship building, customized solutions. | Secured 2.7 million sq ft of space. |

| External Property Agents | Partnerships with real estate brokers. | Marketing, tenant identification, sales acceleration. | Covering 20 office and 17 retail assets in London. |

| Digital Presence | Corporate website and listing platforms. | Showcasing portfolio, digital marketing campaigns. | Continued investment in online channels. |

| Industry Events | Participation in conferences and trade shows. | Networking, business development, thought leadership. | Likely presence at MIPIM or UKREiiF. |

| Public Relations | Media engagement and corporate communications. | Brand reputation building, stakeholder communication. | Positive reporting on development pipeline and ESG. |

Customer Segments

Large corporate occupiers are a cornerstone for British Land, representing major companies in need of premium office spaces, especially in their London campus developments. These businesses are looking for state-of-the-art facilities, excellent transport links, and environmentally conscious buildings to house their headquarters or key operational hubs.

These clients typically require extensive, adaptable floor areas to accommodate their workforce and evolving business needs. For instance, British Land's focus on creating integrated campuses, like those in the City of London, caters directly to this segment's demand for amenity-rich environments that foster collaboration and employee well-being. In 2024, the company continued to emphasize its strategy of developing high-quality, sustainable office space to attract and retain these significant tenants.

National and multi-channel retailers, including major chains and prominent brands, represent a key customer segment for British Land. These businesses seek out-of-town retail park locations that are both cost-effective and easily accessible, serving a dual purpose for their physical store networks and online order fulfillment operations. In 2024, British Land's strategic focus on retail parks saw its exposure increase significantly, with these locations demonstrating resilience and continued demand from such retailers.

This segment includes businesses that need prime urban locations for their last-mile delivery operations and efficient distribution networks across major UK cities, particularly London. The booming e-commerce sector is a significant driver of demand for these well-connected and functional logistics spaces.

British Land is actively developing a robust pipeline of urban logistics assets, aiming to meet this growing need. For instance, in 2024, the company continued to advance its development projects, underscoring its commitment to this crucial market segment.

Institutional Investors and Funds

Institutional investors, including sovereign wealth funds and pension funds, represent a crucial customer segment for British Land. These entities seek dependable, long-term returns derived from premium real estate holdings, often engaging through joint ventures or direct acquisitions. British Land's established track record and varied property portfolio are key attractors for this group.

For the fiscal year ending March 31, 2024, British Land reported a portfolio valued at £7.5 billion. This segment is vital for securing significant capital for development projects and maintaining portfolio stability.

- Sovereign Wealth Funds: Seeking diversification and stable income streams.

- Pension Funds: Prioritizing long-term, secure investments to meet future liabilities.

- Insurance Companies: Looking for yield enhancement and asset-liability matching.

- Real Estate Funds: Partnering for access to specific market segments and development opportunities.

Science and Technology Companies

Science and technology companies represent a burgeoning customer segment for British Land, especially within its campus development strategy. These businesses require highly specialized laboratory and office spaces designed for cutting-edge research, development, and innovation. They are actively seeking environments that foster collaboration and provide proximity to skilled talent. For instance, British Land's focus on life sciences demonstrates a commitment to catering to this dynamic sector, recognizing its significant growth potential.

This segment places a premium on integrated ecosystems that support their intensive operational needs. They look for locations offering not just physical space but also access to research infrastructure and a network of like-minded organizations. British Land's approach to developing these campuses aims to create hubs where scientific advancement can thrive, attracting companies at the forefront of technological progress.

- Specialized Space Needs: Demand for flexible, high-specification lab and R&D facilities.

- Collaboration and Talent: Emphasis on locations with strong talent pools and opportunities for inter-company synergy.

- Life Sciences Focus: British Land is actively targeting and developing properties for the growing life sciences sector, a key driver of innovation.

- Campus Development Strategy: These companies are ideal tenants for British Land's large-scale, integrated campus projects designed to attract and retain innovation-driven businesses.

British Land serves a diverse clientele, from large corporations seeking premium London office spaces to national retailers prioritizing accessible retail parks. The company also targets institutional investors for capital and joint ventures, and a growing segment of science and technology firms needing specialized facilities.

In 2024, British Land's strategic focus on retail parks saw its exposure increase, demonstrating resilience and continued demand from national retailers. Their portfolio, valued at £7.5 billion as of March 31, 2024, is attractive to institutional investors like sovereign wealth and pension funds seeking stable, long-term returns.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Large Corporate Occupiers | Premium, sustainable office space, excellent transport links | Core to London campus strategy, attracting major businesses. |

| National/Multi-channel Retailers | Cost-effective, accessible retail park locations for physical and online operations | Increased exposure in 2024, showing resilience and demand. |

| Institutional Investors | Dependable, long-term returns from premium real estate | Crucial for capital and portfolio stability; portfolio valued at £7.5bn (FY24). |

| Science & Technology Companies | Specialized lab/office space, collaborative environments, talent access | Growing focus on life sciences and innovation hubs. |

Cost Structure

British Land Company dedicates substantial capital to acquiring prime land and existing properties. These acquisition costs encompass not only the purchase price but also associated legal fees and stamp duty, reflecting the significant investment required to secure assets for their development and investment portfolio. For instance, in the fiscal year ending March 31, 2024, the company's capital expenditure on property acquisitions and development was a key driver of their financial activity.

Development and construction expenses represent a significant outlay for British Land, encompassing the design, planning, and physical building of new properties and substantial renovations. These costs are multifaceted, including everything from raw materials and skilled labor to the fees for architects, engineers, and project managers. For instance, in the fiscal year ending March 31, 2024, British Land reported capital expenditure of £330 million, a substantial portion of which would be allocated to these development activities.

A key focus within these costs is the integration of sustainable construction practices. This means investing in materials and methods that reduce embodied carbon and enhance energy efficiency over the building's lifecycle. This commitment to sustainability, while potentially increasing upfront costs, aligns with long-term operational efficiency and regulatory expectations.

Property operating and maintenance costs represent the ongoing expenses British Land incurs to keep its existing portfolio in good condition and functional. These include essential services like utilities, routine repairs, security, cleaning, and fees paid to property management firms.

For the year ended March 31, 2024, British Land reported £134 million in property operating expenses, a slight increase from £131 million in the previous year, reflecting continued investment in maintaining asset quality and operational efficiency.

Effective asset management is crucial for controlling these costs. By implementing proactive maintenance schedules and optimizing utility consumption, British Land aims to manage these expenditures, which are vital for preserving the value and attractiveness of its properties.

Financing Costs

Financing costs, primarily interest payments on debt, are a significant expense for British Land due to the capital-intensive nature of real estate investment and development. In fiscal year 2024, the company reported interest expenses that reflect its ongoing leverage to fund its portfolio and growth initiatives. British Land actively manages its debt levels and financing strategies to optimize these costs and support its strategic objectives.

- Interest Expense: For the year ended March 31, 2024, British Land's net finance costs were £307 million.

- Debt Management: The company maintains a diversified debt maturity profile and access to various funding sources to manage its financing needs efficiently.

- Leverage Strategy: British Land utilizes leverage to enhance returns on its property investments and development projects, balancing risk and reward.

Administrative and Overhead Expenses

British Land's administrative and overhead expenses encompass the costs of running its corporate functions. This includes salaries for its administrative teams, marketing initiatives, essential legal and compliance services, and general operational overheads necessary to support its real estate portfolio and development activities.

The company actively pursues good cost control across all its operations to maintain efficiency. For the year ended March 31, 2024, British Land reported administrative expenses of £151 million, reflecting their commitment to managing these costs effectively.

- Salaries: Compensation for corporate staff, including executive, finance, HR, and legal departments.

- Marketing & Branding: Costs associated with promoting British Land's properties and brand identity.

- Legal & Compliance: Expenses related to legal counsel, regulatory adherence, and risk management.

- General Overheads: Includes IT, office supplies, utilities for corporate offices, and other general administrative costs.

British Land's cost structure is heavily influenced by property acquisition and development, with significant outlays for land, construction materials, and skilled labor. For the year ended March 31, 2024, capital expenditure on property acquisitions and development was a primary financial activity. Property operating expenses, including utilities and maintenance, were £134 million for the same period, reflecting ongoing investment in asset quality. Financing costs, such as interest payments on debt, are also substantial due to the capital-intensive nature of the business, with net finance costs reported at £307 million for FY24.

| Cost Category | FY24 (Millions £) | Key Components |

|---|---|---|

| Property Acquisitions & Development | (Not specified as a single line item, but a significant driver of capital expenditure) | Land purchase, construction materials, labor, design fees |

| Property Operating Expenses | 134 | Utilities, repairs, security, cleaning, property management fees |

| Financing Costs (Net Finance Costs) | 307 | Interest payments on debt |

| Administrative & Overhead Expenses | 151 | Salaries, marketing, legal, IT, general office costs |

Revenue Streams

British Land's main income comes from renting out its properties. This includes office buildings on their campuses, shops in their retail parks, and urban logistics sites. This rental income is a steady and predictable source of money for the company.

In the fiscal year ending March 31, 2024, British Land reported a robust rental income performance. The company's focus on prime locations and high-quality assets contributed to strong leasing activity and rental growth across its key sectors.

British Land generates revenue through the strategic sale of properties. This includes offloading mature, underperforming, or non-core assets from its extensive portfolio. For instance, the company has actively pursued disposals, such as the sale of its stake in Meadowhall, to reallocate capital more effectively.

Development profits are generated when British Land successfully completes and then leases or sells its new building projects. This is a major way the company plans to grow its income in the future, as it continuously invests in new developments.

These new developments are anticipated to boost the company's underlying earnings per share. For example, in fiscal year 2024, British Land reported a significant portion of its portfolio was in development, aiming to capture value from these projects upon completion and leasing.

Service Charge Income

British Land Company generates revenue through service charge income, which are fees collected from tenants for shared services and maintenance in their multi-tenant properties. This income stream is crucial for covering the operational costs of communal areas, security, and other shared amenities, ensuring the smooth functioning and upkeep of their portfolio. For the year ended March 31, 2024, British Land reported total revenue of £655 million, with service charges forming a consistent part of this operational income.

- Service Charge Income: Fees from tenants for shared services and maintenance.

- Operational Revenue Contribution: Covers upkeep of communal areas, security, and amenities.

- Portfolio Management: Essential for maintaining property value and tenant satisfaction.

- 2024 Financial Context: Contributes to British Land's overall revenue generation, supporting portfolio operations.

Joint Venture Income and Fees

British Land Company generates revenue through its involvement in joint ventures, receiving a portion of the profits from these collaborative projects. For instance, in the fiscal year ending March 31, 2024, British Land's share of profit from its joint ventures contributed significantly to its overall income, reflecting the success of these strategic alliances.

Beyond profit sharing, British Land may also earn fees for its expertise in managing joint venture properties or overseeing development initiatives. These fees represent a direct return for the company's operational capabilities and project management skills, further diversifying its revenue streams.

- Income from Joint Venture Profits: British Land shares in the profits generated by its joint venture partnerships, providing a direct financial benefit from successful collaborations.

- Management and Development Fees: The company can earn fees for its services in managing joint venture assets or leading development projects, leveraging its expertise.

- Increased Scale and Diversification: Joint ventures enable British Land to undertake larger-scale projects and diversify its income sources, reducing reliance on single assets or markets.

British Land's revenue streams are diverse, primarily driven by rental income from its extensive property portfolio, which includes office spaces, retail parks, and urban logistics sites. The company also generates income through property sales, capturing value from mature or non-core assets. Furthermore, development profits are a key growth area, as British Land capitalizes on new projects upon completion and leasing.

| Revenue Stream | Description | FY24 Relevance |

|---|---|---|

| Rental Income | Income from leasing properties to tenants. | Core and stable income source. |

| Property Disposals | Proceeds from selling properties. | Capital recycling and portfolio optimisation. |

| Development Profits | Profits from completing and leasing/selling new projects. | Future growth driver; significant portfolio in development. |

| Service Charge Income | Fees from tenants for shared services and maintenance. | Supports operational costs and tenant satisfaction. |

| Joint Venture Income | Share of profits and fees from collaborative projects. | Diversifies income and enables larger-scale projects. |

Business Model Canvas Data Sources

The British Land Company Business Model Canvas is informed by a blend of internal financial disclosures, extensive market research on the UK real estate sector, and strategic analysis of competitor activities. These sources provide a robust foundation for understanding customer segments, value propositions, and revenue streams.