British Land Company Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

British Land Company Bundle

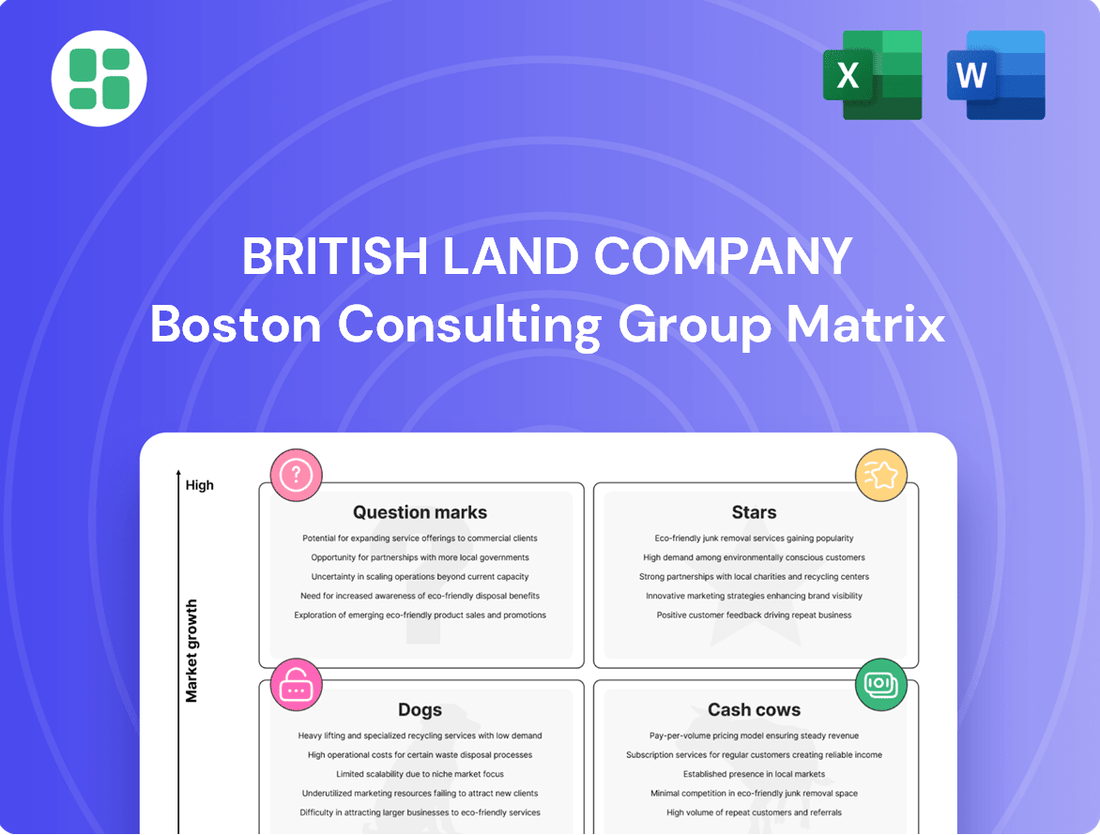

Curious about the British Land Company's strategic positioning? Our BCG Matrix preview offers a glimpse into how their portfolio might be categorized—Stars, Cash Cows, Dogs, or Question Marks.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of each segment, revealing actionable insights and data-driven recommendations to guide your investment and product development decisions for British Land.

Stars

British Land has strategically bolstered its retail park portfolio, acquiring assets worth £738 million in FY25. These investments are not only earnings accretive from the outset but also demonstrate robust valuation growth, currently standing at 7.1%.

This significant investment highlights British Land's focus on a sector experiencing strong performance and increasing market share. The company's aggressive acquisition strategy in retail parks positions them favorably within this outperforming segment of the market.

British Land is actively developing a substantial 2.4 million sq ft of London campus space. This pipeline focuses on creating top-tier, environmentally responsible buildings that are seeing strong tenant interest. For instance, their 2 Finsbury Avenue project is strategically positioned to gain a significant foothold in London's recovering premium office sector.

British Land's Prime UK Retail Warehousing Portfolio is a shining example of a Star in the BCG Matrix. In fiscal year 2025, this segment achieved an impressive 6% rental growth, showcasing its strong market position and demand. With an exceptionally high occupancy rate of 99%, it clearly leads the UK real estate subsector.

Urban Logistics Development Pipeline

British Land's urban logistics development pipeline is a prime example of a star in the BCG matrix. The UK logistics market is expected to expand significantly, with a projected compound annual growth rate (CAGR) of 5.8% between 2025 and 2033. This robust growth, coupled with British Land's substantial investment of 1.9 million square feet in urban logistics developments, positions the company to capture a considerable portion of this expanding market.

The strategic focus on urban logistics is particularly noteworthy given the escalating demand for efficient last-mile distribution centers. These hubs are critical for meeting consumer expectations for faster delivery times, a trend that is only set to intensify. British Land's proactive development in this area directly addresses this market need, reinforcing its star status.

Key aspects supporting its star classification include:

- Significant Market Growth: The UK logistics sector's projected CAGR of 5.8% (2025-2033) indicates a high-growth environment.

- Strategic Investment: British Land's 1.9 million sq ft urban logistics pipeline demonstrates a commitment to capitalizing on this growth.

- Demand for Last-Mile: The increasing need for last-mile distribution hubs directly aligns with the company's development focus.

- Market Share Potential: This strategic positioning allows British Land to aim for substantial market share gains in a thriving sector.

ESG-aligned Premium Office Spaces

British Land's ESG-aligned premium office spaces are positioned as a Stars in the BCG Matrix. This segment benefits from a pronounced market trend of 'flight to quality,' where demand is robust for offices that are not only sustainable but also equipped with cutting-edge amenities. In 2024, the company's strategic emphasis on developing and managing these superior assets within its campuses is yielding increasing valuations, underscoring its high-growth potential and ambition for market leadership in this category.

- High Demand for Sustainable Spaces: The market shows a clear preference for environmentally conscious and modern office environments.

- Value Appreciation: British Land's premium, ESG-compliant office assets are experiencing significant value growth.

- Market Leadership Aspiration: The company is actively pursuing a leading position in this high-growth segment.

- Campus Focus: Development and management within British Land's campuses are key to this strategy.

British Land's Prime UK Retail Warehousing Portfolio stands out as a Star in the BCG Matrix, demonstrating exceptional performance. In FY25, this segment achieved a 6% rental growth, reflecting its strong market position and high demand. With an impressive 99% occupancy rate, it clearly leads the UK real estate subsector.

The urban logistics development pipeline is another clear Star. The UK logistics market is projected to grow at a 5.8% CAGR between 2025 and 2033. British Land's 1.9 million sq ft investment in urban logistics developments positions it to capture significant market share in this expanding sector, driven by the increasing demand for last-mile delivery centers.

British Land's ESG-aligned premium office spaces are also classified as Stars. The market exhibits a strong 'flight to quality,' favoring sustainable and amenity-rich offices. In 2024, these superior assets within British Land's campuses are showing increasing valuations, highlighting their high-growth potential and the company's aim for market leadership in this category.

| BCG Category | British Land Segment | Key Metrics (FY25/2024 Data) | Growth Indicators |

|---|---|---|---|

| Stars | Prime UK Retail Warehousing | 6% Rental Growth, 99% Occupancy | Strong market leadership in UK real estate |

| Stars | Urban Logistics Development | 1.9 million sq ft pipeline | 5.8% CAGR projected for UK logistics (2025-2033) |

| Stars | ESG-aligned Premium Office Spaces | Increasing Valuations | 'Flight to Quality' trend, high tenant interest |

What is included in the product

This BCG Matrix overview for British Land Company highlights which business units to invest in, hold, or divest based on market growth and share.

A clear BCG Matrix visualizes British Land's portfolio, reducing strategic uncertainty.

Cash Cows

British Land's established London campuses, like Broadgate and Regent's Place, are its undisputed cash cows. These prime locations consistently deliver robust rental income, boasting an impressive 96.5% occupancy rate across its campuses as of recent reports.

These mature assets require minimal new capital infusion to sustain their strong cash-generating capabilities, making them reliable pillars of British Land's financial performance. Their established nature and premium positioning ensure continued demand and stable returns for the company.

British Land's core, high-occupancy retail parks are true cash cows. These established assets, boasting a 99% occupancy rate, consistently generate substantial and reliable cash flow. Their strength lies in robust tenant covenants and minimal capital expenditure needs, making them highly efficient profit generators for the company.

British Land's prime London urban logistics assets, boasting an impressive 99% occupancy rate, represent a significant cash cow. These strategically located properties, often co-located with retail spaces, are in a sector experiencing robust demand, ensuring a steady stream of rental income.

The consistent performance of these mature assets, which are already generating reliable cash flows, underpins their classification as cash cows. While the urban logistics sector holds future growth potential, these established holdings provide stable returns.

Long-Term Leased Portfolio Assets

British Land's long-term leased portfolio assets, featuring blue-chip tenants like major retailers and financial institutions, are classic Cash Cows. These properties generate highly predictable and stable income, significantly contributing to underlying profits with minimal volatility. For instance, as of their fiscal year ending March 31, 2024, British Land reported a substantial portion of their rental income derived from these secure, long-term leases, underscoring their role as reliable income generators.

These assets are characterized by their low risk and consistent cash flow, making them foundational to British Land's financial stability. The predictable nature of these income streams allows for strategic reinvestment or distribution to shareholders without the uncertainty often associated with more dynamic market segments. The company's focus on high-quality, long-lease properties ensures a resilient revenue base, even in fluctuating economic conditions.

- Stable Income Generation: Properties with long-term leases to creditworthy tenants provide a consistent and reliable revenue stream.

- Reduced Volatility: These assets contribute significantly to profit with lower risk compared to other portfolio segments.

- Tenant Quality: Leases are typically secured by major retailers and financial firms, indicating strong tenant covenant.

- Financial Contribution: In FY24, a significant portion of British Land's total rental income was attributed to its diversified portfolio of long-lease assets.

Completed Phases of Major Regeneration Projects

British Land's major regeneration projects, such as Canada Water, represent significant investments. Once these large-scale developments are completed and fully leased, they are expected to transition into mature assets. These mature assets are designed to generate consistent, long-term cash flows, moving past the initial high-investment and uncertain growth phases.

The completion of key phases in these regeneration projects signifies a shift. For instance, the progress at Canada Water, a significant undertaking for British Land, means that substantial portions of the development are nearing operational status. This transition from development to operational asset is crucial for their classification as cash cows.

- Canada Water Project: This flagship regeneration scheme is a prime example of British Land's strategy. Upon completion and full occupancy, it is poised to become a significant contributor to the company's cash flow generation.

- Mature Asset Status: Projects like Canada Water, once stabilized, will represent mature assets in British Land's portfolio. This means they have moved beyond the speculative development stage and are expected to provide predictable income streams.

- Long-Term Cash Flows: The objective of these regeneration projects is to create assets that deliver steady, long-term cash flows. This stability is characteristic of assets that fall into the cash cow category of the BCG matrix.

- Reduced Investment Risk: As phases are completed and leasing progresses, the investment risk associated with these projects diminishes. This de-risking process reinforces their potential to become reliable cash generators.

British Land's prime London office campuses, such as Broadgate and Regent's Place, are its most reliable cash cows. These established locations consistently generate strong rental income, with occupancy rates across its campuses reaching 96.5% in recent reports. These mature assets require minimal new capital to maintain their robust cash-generating abilities, serving as stable financial anchors for the company.

The company’s high-occupancy retail parks, boasting a 99% occupancy rate, are also key cash cows. These established properties consistently produce substantial and predictable cash flow. Their strength is derived from strong tenant covenants and low capital expenditure requirements, making them highly efficient profit generators.

British Land's strategically located urban logistics assets, also achieving a 99% occupancy rate, are significant cash cows. These properties, often situated alongside retail spaces, benefit from high demand in the sector, ensuring a steady rental income stream. The consistent performance of these mature assets underpins their cash cow classification.

| Asset Type | Occupancy Rate (Recent Reports) | Key Characteristics |

|---|---|---|

| London Office Campuses (e.g., Broadgate) | 96.5% | Mature, established, minimal capex, strong rental income |

| Retail Parks | 99% | Strong tenant covenants, low capex, reliable cash flow |

| Urban Logistics | 99% | High demand sector, steady rental income, strategically located |

Preview = Final Product

British Land Company BCG Matrix

The British Land Company BCG Matrix preview you're currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present in the final file, ensuring you get a professionally designed and analysis-ready report for immediate strategic application.

Dogs

Non-core shopping centres, like British Land's former stake in Meadowhall, often fall into the Dogs category of the BCG Matrix. These assets typically exhibit limited growth potential and require substantial ongoing investment. British Land's sale of its 50% interest in Meadowhall for £360 million in July 2024 exemplifies a strategic move away from such assets.

Secondary or older office stock, particularly those struggling to meet contemporary environmental, social, and governance (ESG) criteria or tenant expectations for modern amenities, are experiencing a noticeable uptick in vacancies. In 2024, these older buildings saw vacancy rates around 15%, a stark contrast to the 6% observed in newer constructions.

This segment of British Land's portfolio is likely to face challenges with rental growth, necessitating strategic decisions. The company would likely consider divesting these assets or investing heavily in significant, often costly, refurbishments to bring them up to current market standards and attract tenants.

Peripheral or underperforming retail assets within British Land's portfolio represent smaller, less strategically vital properties, or those situated in weaker regional markets. These locations often don't complement the company's primary focus on high-performing retail parks.

These assets may demand significant management resources while yielding minimal returns, presenting a challenge to overall portfolio efficiency. For instance, while British Land's overall retail portfolio saw a valuation of £4.7 billion as of March 2024, a portion of this is comprised of these less impactful units.

Assets Identified for Capital Recycling

British Land Company actively pursues a capital recycling strategy, divesting mature, non-core assets with limited growth prospects to fund investments in higher-yielding opportunities. This approach is central to their portfolio management, aiming to optimize returns and enhance future performance.

In 2024, British Land continued to execute this strategy. For instance, the company has been actively managing its retail portfolio, identifying assets that no longer align with its long-term vision for growth and rental income. This often involves selling off older or less strategically located retail spaces.

The proceeds from these disposals are then strategically reinvested. British Land focuses on sectors offering stronger rental growth and capital appreciation potential, such as urban logistics and modern, sustainable office spaces. This dynamic reallocation of capital is key to their business model.

- Retail Disposals: British Land has been strategically reducing its exposure to certain retail assets, focusing on those with weaker performance metrics.

- Reinvestment in Growth Sectors: Capital generated is being channeled into areas like logistics and prime office spaces, which exhibit greater growth potential.

- Portfolio Optimization: The ongoing process of identifying and selling lower-yielding assets is integral to optimizing the overall return profile of the company's property portfolio.

Properties with High Vacancy and Low Rental Tension

Properties experiencing high vacancy rates and low rental tension are considered Dogs within British Land Company's portfolio. These assets, characterized by persistent underoccupancy and a lack of tenant demand, represent a drain on resources without generating substantial earnings. For instance, in 2024, certain retail units within older shopping centers might fall into this category, requiring ongoing maintenance and marketing efforts with minimal return.

These underperforming assets can negatively impact overall portfolio yield and require strategic decisions for improvement or divestment. The challenge lies in their inability to attract and retain tenants, leading to prolonged periods of unutilized space. This situation is exacerbated in markets with shifting consumer preferences or oversupply of similar properties.

- High Vacancy: Assets with occupancy rates consistently below 80% in the current market.

- Low Rental Tension: Minimal competition among prospective tenants for available space, indicating weak demand.

- Resource Drain: Ongoing costs for maintenance, security, and marketing without commensurate rental income.

- Limited Earnings Contribution: These properties fail to contribute significantly to the company's overall revenue growth or profitability.

Dogs in British Land's portfolio are assets with low market share and low growth prospects, often requiring significant capital without substantial returns. These might include older retail centers with declining footfall or secondary office buildings struggling to attract tenants. For example, British Land's sale of its stake in Meadowhall for £360 million in July 2024 signals a move away from such mature retail assets.

These underperforming properties face challenges such as high vacancy rates, with older office stock seeing around 15% vacancies in 2024 compared to 6% for modern buildings. The company's strategy involves divesting these non-core assets or investing heavily in refurbishments to improve their marketability and rental income potential.

British Land's capital recycling strategy actively addresses these Dogs by selling them to fund investments in higher-growth sectors like logistics and prime office spaces. This proactive management aims to optimize the portfolio's overall performance and financial returns.

| Asset Type | BCG Category | 2024 Market Observation | Strategic Action Example |

|---|---|---|---|

| Older Shopping Centres | Dogs | Declining footfall, high vacancy rates | Sale of Meadowhall stake (July 2024) |

| Secondary Office Stock | Dogs | 15% vacancy rates, ESG compliance issues | Divestment or significant refurbishment |

| Peripheral Retail Units | Dogs | Low rental growth, minimal strategic fit | Capital recycling into growth sectors |

Question Marks

British Land's early-stage London campus developments, like the unleased portions of 2 Finsbury Avenue, represent significant investments in prime locations. These projects are categorized as Stars due to their high potential and the substantial upfront capital required, aiming to capture a growing market share in the premium office sector.

While the London office market, particularly for high-quality space, shows resilience, these developments are still in their growth phase. For instance, as of early 2024, British Land reported a strong leasing pipeline, but the full economic impact and market share of these specific, large-scale projects are still being established, reflecting their Star status.

British Land is actively developing a pipeline of urban logistics sites within London, a segment poised for considerable growth with an estimated compound annual growth rate of 5.8%. This strategic move aligns with the company's diversification efforts into high-potential real estate sectors.

These new, speculative logistics developments, particularly those in their nascent stages, represent a significant capital investment for British Land. The ultimate market share and profitability of these ventures are still in the process of being determined as the market evolves.

British Land could consider smaller-scale ventures into emerging niche sectors such as life sciences and data centers, areas where their current market presence is limited. These specialized property sub-sectors represent high-risk, high-reward opportunities, demanding significant upfront investment and specialized expertise.

For instance, the UK life sciences real estate market saw significant investment in 2023, with £2.7 billion transacted, indicating strong demand for lab and R&D space. Data centers are also a booming sector, with global investment expected to reach $900 billion by 2026, driven by AI and cloud computing growth.

Mixed-Use Regeneration Masterplans in Initial Phases

British Land's mixed-use regeneration masterplans in their initial phases, such as the ongoing development at Canada Water, represent significant long-term investments. These projects are characterized by substantial upfront capital expenditure for planning, infrastructure, and site preparation, positioning them as cash consumers with delayed return generation. For instance, the initial stages of such large-scale urban regeneration often involve years of planning and significant investment before any rental income or sales can be realized, placing them firmly in the 'Question Marks' category of the BCG matrix.

The financial commitment to these early-stage regeneration efforts is considerable, with the potential for high future growth but also a high degree of uncertainty regarding market absorption and timing. British Land's strategy involves de-risking these projects over time through phased development and strategic partnerships, aiming to eventually transition them into 'Stars' or 'Cash Cows' as they mature and become established hubs.

- High upfront investment: Early-stage regeneration masterplans require substantial capital for infrastructure, design, and initial site works.

- Long gestation periods: Returns are typically deferred over many years as projects progress through planning, construction, and leasing/sales phases.

- Market uncertainty: Future rental income, capital values, and demand are subject to evolving economic conditions and occupier preferences.

- Strategic importance: Despite cash consumption, these projects are crucial for future growth and portfolio diversification.

New Flexible Workspace Partnerships or Offerings

British Land's new flexible workspace partnerships or offerings, such as their recent ventures into flexible office solutions, would likely be positioned as Question Marks in the BCG Matrix. While the demand for flexible and co-working spaces is certainly on the rise, the company's specific market share and profitability within these newer, evolving models remain uncertain. For instance, in 2023, the flexible workspace sector saw continued growth, with major players reporting increased occupancy rates, but the long-term viability and British Land's specific competitive advantage in this space are still being established.

These initiatives require significant upfront investment to build out the necessary infrastructure, technology, and marketing efforts to attract and retain tenants. The success of these Question Mark ventures depends heavily on their ability to capture market share and achieve profitability in a competitive landscape. British Land's strategy here involves testing and learning, with potential for these offerings to become Stars if they gain traction and demonstrate strong returns.

- Market Uncertainty: The exact market share and profitability of British Land's new flexible workspace offerings are not yet fully determined.

- Investment Required: Significant capital is needed to establish and scale these flexible workspace solutions.

- Growth Potential: These ventures have the potential to become Stars if they successfully capture market demand and achieve profitability.

- Competitive Landscape: The flexible workspace market is dynamic, requiring continuous adaptation and innovation.

British Land's large-scale urban regeneration projects, such as Canada Water, represent significant capital outlays with long development timelines. These are considered Question Marks because their future market share and profitability are uncertain, despite their strategic importance for future growth.

These ventures require substantial upfront investment for infrastructure and site preparation, with returns not expected for many years. The success hinges on evolving economic conditions and occupier preferences, making their eventual market position unclear.

New flexible workspace initiatives also fall into the Question Mark category, requiring investment in infrastructure and technology. Their long-term viability and British Land's competitive edge are still being established in a dynamic market.

The company's entry into niche sectors like life sciences and data centers, while holding high growth potential, also presents Question Mark characteristics due to limited current market presence and the need for specialized expertise and significant upfront capital.

BCG Matrix Data Sources

Our British Land Company BCG Matrix is built on verified market intelligence, combining financial data from company reports, industry research, and expert commentary to ensure reliable, high-impact insights.