Brighthouse Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brighthouse Financial Bundle

Navigate the complex external forces impacting Brighthouse Financial with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping the insurance landscape, and identify emerging social and environmental trends that could redefine the market. Gain a strategic advantage by downloading the full analysis to unlock actionable insights for your business decisions.

Political factors

The U.S. financial services industry, particularly insurance and annuities, operates within a stringent regulatory framework. For Brighthouse Financial, shifts in federal and state insurance laws, consumer protection measures, and solvency mandates directly influence product development, capital needs, and operational expenses. For instance, the National Association of Insurance Commissioners (NAIC) continuously updates model laws, impacting everything from annuity illustrations to capital adequacy, with solvency requirements often seeing adjustments to reflect market volatility.

Government fiscal policies, including decisions on taxation and budget spending, significantly shape the economic landscape in which Brighthouse Financial operates. For instance, changes in tax laws can impact consumer disposable income, affecting demand for financial products, while government debt levels can influence interest rate environments. In 2024, the U.S. national debt surpassed $34 trillion, a figure that underscores the ongoing fiscal considerations for policymakers and their potential ripple effects on the economy.

Monetary policies enacted by the Federal Reserve, particularly adjustments to the federal funds rate, directly influence Brighthouse Financial's profitability and investment returns. Higher interest rates, as seen with the Fed's aggressive hiking cycle through 2023 and into early 2024, can increase the cost of capital but also boost yields on fixed-income investments within Brighthouse's asset portfolio. Conversely, lower rates might compress investment income but could stimulate demand for certain financial products.

The United States experienced a period of relative political stability leading into 2024, which generally supports investor confidence and the long-term financial planning crucial for institutions like Brighthouse Financial. However, ongoing political discourse and potential shifts in policy direction can introduce uncertainty.

Geopolitical events, such as the ongoing conflicts in Eastern Europe and the Middle East, continue to shape global financial markets. These events, while not directly targeting Brighthouse Financial, create broader market volatility and can influence investment opportunities and risk assessments for a company operating within a globalized financial landscape.

Evolving international trade relations, including tariffs and trade agreements, also present indirect impacts. For instance, changes in trade policies between major economies could affect global economic growth, which in turn influences consumer spending and investment appetite, ultimately touching upon Brighthouse Financial's business segments.

Consumer Protection Initiatives

Governmental bodies, including the Department of Labor and state insurance departments, are intensifying their focus on consumer protection. This heightened scrutiny translates into new regulations impacting sales practices, disclosure mandates, and suitability assessments for financial products like those offered by Brighthouse Financial. For instance, in 2024, several states have proposed or enacted stricter disclosure requirements for annuity sales, aiming to provide consumers with clearer information on fees and surrender charges.

Compliance with these dynamic consumer protection standards is not merely a procedural necessity but a critical element for maintaining brand integrity and avoiding significant penalties. Failure to adapt can lead to fines and reputational damage, directly affecting consumer trust. The National Association of Insurance Commissioners (NAIC) has been actively reviewing and updating model laws related to annuity sales practices throughout 2024, signaling a nationwide trend toward more robust consumer safeguards.

- Increased Regulatory Scrutiny: Expect more stringent rules on how financial products are marketed and sold.

- Evolving Disclosure Standards: Companies must provide clearer, more comprehensive information to consumers.

- Suitability Requirements: Ensuring products align with individual client needs remains paramount.

- State-Level Initiatives: Consumer protection efforts are often driven by individual state insurance departments, creating a patchwork of regulations.

Government Healthcare Policies

While Brighthouse Financial's core business is annuities and life insurance, shifts in government healthcare policies can indirectly impact its market. For instance, reforms to the Affordable Care Act (ACA) or changes in Medicare benefits can alter how consumers prioritize their spending between healthcare expenses and long-term financial security, potentially influencing demand for Brighthouse's products.

These policy adjustments can steer individuals to re-evaluate their financial planning. A greater perceived burden of healthcare costs might lead some to delay or reduce contributions to retirement savings or life insurance, while expanded coverage could free up discretionary income for these products.

- Impact on Consumer Priorities: Government healthcare policy changes, such as potential adjustments to Medicare eligibility or prescription drug cost controls, can directly affect household budgets, influencing how much individuals can allocate to private savings and insurance products.

- ACA Reforms and Market Access: Modifications to the Affordable Care Act could alter the landscape of health insurance availability and affordability, indirectly impacting consumer confidence and their capacity to invest in long-term financial planning tools offered by companies like Brighthouse.

- Long-Term Savings vs. Healthcare Costs: As of late 2024, projections indicate continued growth in healthcare spending, which may pressure consumers to allocate more resources to medical needs, potentially delaying or reducing commitments to life insurance or annuity products.

Political stability in the U.S. through early 2025 generally supports financial markets, benefiting Brighthouse Financial's long-term planning. However, ongoing policy debates and potential shifts in government direction can introduce market uncertainty, impacting investor confidence and product demand.

Increased regulatory focus on consumer protection in 2024, particularly from state insurance departments and the NAIC, means Brighthouse Financial faces evolving disclosure standards and stricter suitability requirements for its annuity and life insurance products. For example, several states proposed enhanced annuity sales disclosures in 2024.

Government fiscal and monetary policies remain critical. The U.S. national debt exceeding $34 trillion in 2024 highlights ongoing fiscal considerations, while Federal Reserve interest rate adjustments, like those seen through 2023-2024, directly influence Brighthouse's investment income and cost of capital.

Geopolitical events and international trade relations continue to create global market volatility, indirectly affecting Brighthouse Financial through broader economic impacts on consumer spending and investment appetite.

What is included in the product

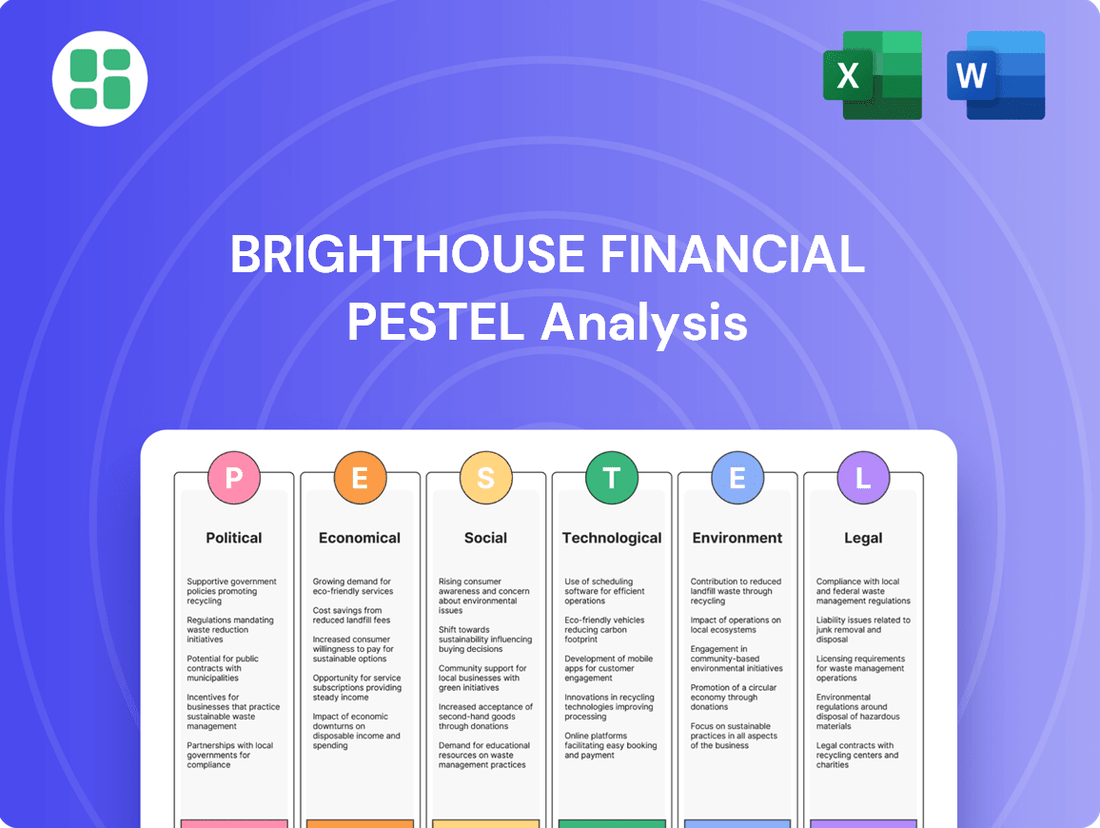

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Brighthouse Financial, providing a comprehensive overview of its external operating landscape.

A PESTLE analysis for Brighthouse Financial that highlights key external factors, offering a clear understanding of market dynamics to proactively address potential challenges and inform strategic decisions.

Economic factors

The prevailing interest rate environment significantly influences Brighthouse Financial's annuity business. As of mid-2024, the Federal Reserve's monetary policy has kept benchmark interest rates elevated compared to the preceding decade, making fixed annuity products more appealing to consumers seeking stable returns. This trend is supported by the Fed's continued focus on inflation control, which has maintained higher rates than seen in the early 2020s.

Higher interest rates generally benefit Brighthouse Financial by improving the investment returns on its substantial asset base, which supports its annuity guarantees. For instance, if the company holds a large portfolio of bonds, rising rates mean new investments yield more. This can help offset the cost of guaranteed benefits offered in their products, potentially widening profit margins on new business compared to periods of very low rates.

Conversely, a sharp or sustained decline in interest rates, should that occur, would present challenges. Such a scenario would compress the company's ability to offer competitive guaranteed rates on its fixed annuities without impacting profitability. This pressure could force Brighthouse to adjust product features or pricing to maintain margins, potentially making their offerings less attractive in a competitive market.

Inflation significantly impacts Brighthouse Financial by eroding the purchasing power of future payouts from life insurance and annuities. For instance, if inflation averages 3% annually, the real value of a fixed benefit paid out in 20 years is substantially less than its nominal value today. This necessitates careful management of investment portfolios to ensure that returns outpace inflation, preserving the real value of customer benefits.

While deflation is less frequent, it presents its own set of challenges. A sustained period of falling prices, as seen in some historical economic downturns, can depress investment returns and create economic uncertainty, potentially affecting consumer demand for financial products. Brighthouse must maintain flexible investment strategies to navigate these opposing price trends and safeguard its financial stability.

In 2024, inflation rates remained a key concern globally, with the US experiencing inflation around 3.4% in early 2024, a decrease from its 2022 peaks but still above the Federal Reserve's target. This persistent inflation underscores the need for Brighthouse to actively manage its asset allocation, seeking investments that offer protection against rising prices and ensure long-term policyholder value.

Robust economic growth and high employment levels are crucial for Brighthouse Financial. In 2024, the US economy showed resilience, with GDP growth projected around 2.5% and unemployment rates hovering near multi-decade lows, often below 4%. This environment typically boosts consumer confidence and disposable income, making individuals more inclined to purchase long-term financial products such as annuities and life insurance, which Brighthouse offers.

Conversely, an economic slowdown or a significant rise in unemployment could dampen demand. For instance, if unemployment were to climb to 6% or higher, as seen during past recessions, consumers would likely shift their focus to essential expenses, potentially reducing discretionary spending on financial planning and insurance products.

Market Volatility and Investment Performance

Market volatility directly influences Brighthouse Financial's investment performance, impacting the value of assets that support its insurance and annuity products. For instance, during periods of heightened market swings, the value of variable annuity subaccounts, where policyholders bear investment risk, can fluctuate significantly. This necessitates robust risk management strategies to protect both the company and its customers.

The S&P 500 experienced a notable surge in 2024, with many analysts projecting continued, albeit potentially more moderate, growth into early 2025. However, geopolitical tensions and inflation concerns continue to pose risks, leading to unpredictable market movements. Brighthouse, like other financial institutions, must navigate these uncertainties to maintain stable investment returns.

- Market Volatility Impact: Fluctuations in equity and fixed-income markets directly affect the value of Brighthouse's investment portfolio.

- Variable Annuity Risk: Policyholders in variable annuities share in market risk, making product performance sensitive to asset class performance.

- 2024/2025 Outlook: While markets showed resilience in 2024, potential headwinds from inflation and global events could introduce volatility into 2025.

- Risk Management Focus: Brighthouse's ability to manage investment risk is crucial for maintaining profitability and policyholder confidence amid market uncertainty.

Household Debt and Savings Rates

High levels of household debt can significantly constrain consumers' capacity to save and invest in financial products, directly impacting Brighthouse Financial's potential customer base. For instance, in Q1 2024, total household debt in the U.S. reached approximately $17.7 trillion, a figure that requires careful management by consumers.

Conversely, rising personal savings rates often indicate a greater willingness among individuals to pursue long-term financial planning and investment opportunities. The U.S. personal savings rate hovered around 3.7% in early 2024, showing a steady, albeit not exceptionally high, propensity for savings.

Brighthouse Financial's growth trajectory is intrinsically linked to the financial health and saving behaviors of its target demographic.

- U.S. Household Debt: Reached roughly $17.7 trillion in Q1 2024, potentially limiting consumer investment capacity.

- U.S. Personal Savings Rate: Was around 3.7% in early 2024, suggesting a moderate inclination towards saving.

- Impact on Brighthouse: The company's success depends on the financial flexibility and saving habits of its target market, influencing demand for its products.

The economic landscape in 2024 and the outlook for 2025 present a mixed but generally stable environment for Brighthouse Financial. Elevated interest rates, while beneficial for investment returns on its reserves, also influence product pricing and consumer demand for annuities. Inflation, though moderating from its 2022 highs, remains a key consideration, impacting the real value of future payouts and necessitating careful investment management to outpace price increases.

Consumer financial health, as indicated by savings rates and debt levels, directly shapes Brighthouse's market. With household debt substantial, consumers must balance obligations with savings, influencing their capacity to invest in long-term products. The resilience of the US economy, marked by low unemployment and steady GDP growth in 2024, supports consumer confidence and demand for financial services, though potential slowdowns remain a risk.

Market volatility, a constant factor, influences Brighthouse's investment performance and the attractiveness of its variable annuity offerings. While markets showed strength in 2024, geopolitical and economic uncertainties could introduce fluctuations into 2025, highlighting the importance of robust risk management for the company.

| Economic Factor | 2024 Data/Outlook | Impact on Brighthouse Financial |

|---|---|---|

| Interest Rates | Elevated, Fed focus on inflation control (mid-2024) | Benefits investment returns on reserves, influences annuity pricing. |

| Inflation | Around 3.4% (early 2024), above Fed target | Erodes purchasing power of future payouts; requires inflation-hedging investments. |

| Economic Growth (US GDP) | Projected ~2.5% (2024) | Supports consumer confidence and demand for financial products. |

| Unemployment Rate (US) | Near multi-decade lows, below 4% (2024) | Indicates strong consumer financial capacity for savings and investment. |

| Household Debt (US) | ~$17.7 trillion (Q1 2024) | Potentially constrains consumer savings and investment in financial products. |

| Personal Savings Rate (US) | ~3.7% (early 2024) | Suggests moderate consumer willingness to save and invest long-term. |

| Market Volatility | Resilient markets in 2024, but potential headwinds for 2025 | Affects investment performance and variable annuity product values. |

Preview Before You Purchase

Brighthouse Financial PESTLE Analysis

The preview shown here is the exact Brighthouse Financial PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting Brighthouse Financial, delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, providing a detailed strategic overview.

Sociological factors

The United States is experiencing a significant demographic shift with an aging population and increasing longevity, directly fueling demand for retirement income solutions. This trend is a key driver for companies like Brighthouse Financial, as more people need to secure their finances for extended retirement periods.

In 2023, the U.S. Census Bureau reported that individuals aged 65 and over represented 17.3% of the total population, a figure projected to grow substantially in the coming decades. This demographic reality creates a robust market for annuities and other products designed to provide stable income throughout longer lifespans.

Brighthouse Financial is well-positioned to capitalize on this trend by developing products tailored to the specific financial needs and preferences of older consumers, ensuring they have the resources for a comfortable and extended retirement.

The traditional idea of retirement is changing. Many people are choosing to work longer, perhaps part-time, or they're looking for more flexible ways to ease into retirement. This means fewer people are solely relying on traditional pensions. For instance, a 2024 report indicated that nearly 60% of workers aged 50 and over are considering delaying their retirement or working past age 65.

This evolving landscape demands that companies like Brighthouse Financial adjust their products. Instead of offering generic annuity options, there's a growing need for personalized retirement plans that fit individual circumstances. This could include annuities with features that allow for phased withdrawals or options that adjust based on market performance and individual needs.

The level of financial literacy significantly impacts how consumers engage with financial products. For Brighthouse Financial, a higher general understanding of financial concepts means a greater potential for individuals to grasp the benefits of annuities and life insurance. A 2024 survey indicated that only 57% of U.S. adults feel confident managing their finances, highlighting a clear opportunity.

Brighthouse Financial can strategically leverage its position by investing in financial education programs. By empowering consumers with knowledge, the company can foster a market more receptive to its specialized offerings. For instance, increasing the percentage of adults who understand retirement planning could directly translate to more annuity sales.

Consumer Preferences for Digital Engagement

Consumers increasingly favor digital channels for managing their finances, with a significant portion preferring online self-service options. This shift directly influences how Brighthouse Financial must architect its customer journeys, emphasizing intuitive digital platforms. For instance, a recent survey indicated that over 70% of millennials prefer digital communication for financial matters.

Brighthouse Financial's strategy must incorporate robust digital tools to meet this demand. Offering personalized financial advice through these platforms is key to engaging a growing segment of tech-savvy clients. By 2025, it's projected that digital channels will account for the majority of customer interactions across the financial services industry.

- Digital Dominance: A substantial majority of consumers now expect seamless digital interactions for financial services.

- Self-Service Expectations: Customers are actively seeking online tools that allow them to manage accounts and access information independently.

- Personalization Imperative: Tailored digital experiences, including personalized advice, are becoming a critical differentiator for attracting and retaining clients.

- Industry Trend: The financial sector is rapidly evolving, with digital engagement becoming the primary mode of customer interaction.

Shifting Wealth Distribution and Income Inequality

Shifting wealth distribution and rising income inequality significantly impact Brighthouse Financial's customer base. As the gap widens, identifying segments with the disposable income and need for long-term financial security products like annuities and life insurance becomes crucial for targeted marketing and product development.

Data from 2023 and projections for 2024/2025 highlight this trend. For instance, the top 1% of earners continue to accumulate a disproportionate share of wealth, while middle and lower-income households face persistent challenges. This divergence necessitates a nuanced approach to product design and distribution.

- Wealth Concentration: In the US, the top 10% of households held approximately 70% of the nation's wealth as of early 2024, a figure expected to remain high.

- Income Gap: The median household income for the top quintile saw continued growth, while the bottom quintile experienced more modest gains, creating a widening disparity.

- Target Market Impact: Brighthouse must focus on affluent and upper-middle-income segments who possess the financial capacity for retirement planning and life insurance solutions.

- Product Adaptation: Tailoring product features and communication strategies to address the specific financial concerns and aspirations of these growing wealth segments is essential.

Societal attitudes towards financial planning and retirement are evolving, with a growing emphasis on personalized solutions and digital engagement. As of 2024, a significant portion of Americans, particularly those nearing retirement age, are seeking more flexible and digitally accessible financial products. This shift necessitates that companies like Brighthouse Financial adapt their offerings to meet these changing consumer expectations, focusing on intuitive online platforms and tailored advice to cater to a more informed and tech-savvy clientele.

Technological factors

Brighthouse Financial is increasingly leveraging digital transformation and automation to streamline its operations. This strategic shift aims to boost efficiency and cut costs across various functions. For instance, automating underwriting and claims processing can significantly speed up turnaround times, directly improving the customer experience.

The company's investment in these technologies is crucial for staying competitive. By automating policy administration and customer service interactions, Brighthouse can offer faster, more responsive support. This digital push is expected to lead to a more agile and cost-effective business model, enhancing its market position.

Brighthouse Financial is increasingly leveraging big data analytics and AI to understand customer patterns, tailor product offerings, and refine risk evaluation for underwriting. For instance, in 2024, the company continued to invest in AI-driven platforms to analyze vast datasets, aiming to improve customer retention and identify new market opportunities. This technological push is crucial for enhancing operational efficiency and competitive positioning in the financial services sector.

As a financial institution, Brighthouse Financial is a prime target for cyber threats, given its handling of sensitive customer information. The company's commitment to robust cybersecurity measures is therefore critical to safeguarding data, maintaining client confidence, and adhering to stringent privacy laws like GDPR and CCPA.

In 2024, the financial services sector saw a notable increase in sophisticated cyberattacks. Brighthouse Financial's continuous investment in advanced security technologies, such as AI-powered threat detection and multi-factor authentication, is essential to stay ahead of these evolving risks and prevent costly data breaches.

Insurtech Innovation and Partnerships

The insurance landscape is being reshaped by Insurtech innovation, with new technologies and business models emerging rapidly. Brighthouse Financial faces a critical decision: treat these advancements as competitive threats or explore strategic partnerships to leverage their potential. For instance, Insurtech startups are attracting significant venture capital; in 2023, global Insurtech funding reached approximately $5.5 billion, demonstrating the industry's dynamism.

Embracing Insurtech solutions could offer Brighthouse Financial substantial benefits. These include enhancing customer engagement through personalized digital experiences, accelerating product development cycles with agile methodologies, and optimizing distribution channels for broader reach and efficiency. The potential for improved operational efficiency and customer satisfaction is a key driver.

- Customer Engagement: Insurtech platforms often excel at providing seamless, digital-first customer journeys, which can increase policyholder satisfaction and retention.

- Product Development: Technologies like AI and big data analytics enable faster, more data-driven product creation and customization.

- Distribution Channels: Insurtechs are pioneering new distribution models, including embedded insurance and direct-to-consumer online sales, expanding market access.

- Operational Efficiency: Automation and AI can streamline underwriting, claims processing, and customer service, leading to cost reductions.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are emerging as transformative forces in the financial services industry, including insurance. While adoption within the insurance sector is still in its early stages, these technologies offer significant potential to overhaul core processes. They can enhance transparency, bolster security, and streamline operations through applications like smart contracts for automated claims processing and secure digital record-keeping. Brighthouse Financial is likely evaluating these advancements for future operational improvements and to simplify administrative burdens. For instance, in 2024, the global blockchain in insurance market was valued at approximately USD 450 million, with projections indicating substantial growth, potentially reaching over USD 2.5 billion by 2030, driven by increased demand for efficiency and fraud reduction.

The integration of blockchain could lead to more efficient and secure data management within Brighthouse Financial. This technology can create immutable records, reducing the risk of errors and fraud in policy administration and claims handling. Furthermore, smart contracts, powered by blockchain, can automate policy payouts and other contractual obligations, leading to faster settlements and reduced operational costs. By 2025, it's estimated that smart contracts could automate a significant portion of insurance claims processing, freeing up resources and improving customer experience.

- Enhanced Transparency: Blockchain provides a shared, immutable ledger, allowing all parties involved in a transaction to view and verify information, fostering trust and reducing disputes.

- Improved Security: Cryptographic principles inherent in blockchain technology make data highly secure and resistant to tampering, crucial for sensitive financial and personal information.

- Streamlined Claims Processing: Smart contracts can automatically trigger claim payouts upon verification of predefined conditions, significantly speeding up the process and reducing administrative overhead.

- Reduced Operational Costs: By automating processes and minimizing manual intervention, blockchain and DLT can lead to substantial cost savings in areas like record-keeping, compliance, and claims management.

Brighthouse Financial's technological strategy centers on digital transformation and automation to enhance efficiency and customer experience. Investments in AI and big data analytics are key for understanding customer behavior and refining risk assessment, with AI platforms actively used in 2024 for improved retention and market identification.

The company prioritizes robust cybersecurity, investing in advanced defenses like AI-powered threat detection due to the increasing sophistication of cyberattacks observed in 2024. This focus is vital for protecting sensitive data and maintaining client trust amidst evolving digital threats.

Embracing Insurtech is a strategic imperative, with global Insurtech funding reaching approximately $5.5 billion in 2023. Brighthouse Financial can leverage Insurtech for better customer engagement, accelerated product development, and optimized distribution, as seen in the growth of new models like embedded insurance.

Blockchain and DLT offer transformative potential for operational efficiency and security in insurance. The global blockchain in insurance market, valued around $450 million in 2024, is projected for significant growth, driven by demand for automation in claims processing and fraud reduction, with smart contracts expected to automate a substantial portion of claims by 2025.

Legal factors

Brighthouse Financial navigates a dense regulatory landscape, with state and federal laws dictating everything from financial solvency to product approvals and how they interact with customers. For instance, in 2024, state insurance departments continue to focus on ensuring companies like Brighthouse maintain robust capital reserves to meet policyholder obligations, a key aspect of solvency requirements.

Adherence to these rules, enforced by entities such as state insurance departments and the National Association of Insurance Commissioners (NAIC), is paramount. Failure to comply can result in significant fines and, more critically, the suspension or revocation of operating licenses, directly impacting business continuity.

Evolving data privacy laws, like the California Consumer Privacy Act (CCPA) and emerging state-level regulations, significantly impact Brighthouse Financial's operations. These laws dictate stringent protocols for data collection, storage, usage, and sharing, directly affecting how the company manages sensitive customer information.

Compliance is not just a legal necessity but a critical factor for maintaining customer trust and avoiding substantial penalties. For instance, the CCPA grants consumers rights regarding their personal data, requiring businesses to be transparent and provide opt-out mechanisms, which Brighthouse must actively implement.

The financial services industry, including life insurance providers like Brighthouse, faces increasing scrutiny regarding data handling practices. As of early 2024, over a dozen US states have enacted comprehensive data privacy laws, creating a complex compliance landscape that demands continuous adaptation and investment in robust data governance frameworks.

Regulations like the SEC's Regulation Best Interest (Reg BI) and state-specific annuity suitability rules mandate that financial professionals prioritize client interests. Brighthouse Financial must ensure its sales practices and advisor training adhere to these elevated standards to avoid legal repercussions and protect its reputation.

Anti-Money Laundering (AML) and Sanctions Compliance

Brighthouse Financial, as a financial services entity, operates under strict Anti-Money Laundering (AML) regulations and sanctions programs. These legal frameworks are designed to prevent financial crimes and ensure adherence to national and international mandates. The company's commitment to compliance is paramount.

To meet these obligations, Brighthouse Financial must maintain robust internal controls. This includes rigorous customer due diligence processes to understand client activities and identify potential risks. Reporting suspicious transactions to relevant authorities is also a critical component of their compliance strategy.

Recent enforcement actions highlight the seriousness of these regulations. For instance, in 2023, the U.S. Treasury's Financial Crimes Enforcement Network (FinCEN) continued to emphasize the importance of effective AML programs across the financial sector, with penalties for non-compliance potentially reaching millions of dollars.

- Regulatory Scrutiny: Financial institutions like Brighthouse are under constant scrutiny from regulators like FinCEN and OFAC.

- Due Diligence: Implementing comprehensive Know Your Customer (KYC) procedures is essential to identify and verify clients.

- Suspicious Activity Reporting: Timely and accurate filing of Suspicious Activity Reports (SARs) is a key legal requirement.

- Sanctions Compliance: Adhering to OFAC's sanctions lists ensures the company does not facilitate transactions with prohibited entities or individuals.

Contract Law and Product Liability

Brighthouse Financial's operations are deeply rooted in contract law, as its annuity and life insurance products are essentially legal agreements. Navigating these contracts, ensuring clarity in terms, and managing disclosures are critical. In 2024, the company, like others in the industry, faces ongoing scrutiny regarding policyholder rights and the interpretation of contract language, particularly concerning variable products and fees.

Product liability, in the context of insurance, often centers on allegations of misrepresentation, inadequate disclosure, or failure to meet policy performance expectations. Brighthouse Financial must actively manage these risks. For instance, regulatory bodies continue to emphasize consumer protection, which can lead to increased oversight and potential litigation if policy terms are perceived as misleading or if product performance doesn't align with advertised benefits.

- Contractual Foundation: Brighthouse Financial's core business is built upon the enforceability of its insurance and annuity contracts.

- Disclosure Obligations: Adherence to stringent disclosure requirements for policy terms, fees, and potential risks is paramount to avoid legal challenges.

- Product Liability Management: The company must proactively address potential claims arising from policy performance and customer satisfaction.

- Regulatory Environment: Evolving consumer protection laws and regulatory guidance directly impact how Brighthouse Financial structures and communicates its product offerings.

Brighthouse Financial operates within a complex web of federal and state regulations. For example, in 2024, the Securities and Exchange Commission (SEC) continues to enforce rules like Regulation Best Interest (Reg BI), which mandates that financial professionals act in their clients' best interests, impacting sales practices and advisor conduct.

Data privacy laws, such as the CCPA and similar state-level legislation enacted by over a dozen states by early 2024, significantly shape how Brighthouse handles sensitive customer information, requiring transparent data collection and usage policies.

The company's core business relies on contract law, with insurance and annuity products being legal agreements. In 2024, regulatory bodies are increasing scrutiny on policyholder rights and contract clarity, particularly concerning fees and variable product performance, leading to a focus on robust disclosure obligations.

Anti-money laundering (AML) regulations and sanctions compliance, enforced by bodies like FinCEN, remain critical. Brighthouse must maintain strong internal controls, including Know Your Customer (KYC) procedures and suspicious activity reporting, to prevent financial crimes and avoid penalties, which can be substantial as demonstrated by FinCEN's continued emphasis in 2023.

Environmental factors

While Brighthouse Financial isn't directly exposed to physical property damage like a P&C insurer, its substantial investment portfolio is vulnerable to climate change's indirect impacts. Extreme weather events, such as the record-breaking heatwaves and intensified hurricane seasons observed in 2023 and projected for 2024, can destabilize economies and disrupt supply chains. This disruption can negatively affect the value of assets Brighthouse holds across various sectors, from real estate to corporate bonds.

Investor and public demand for Environmental, Social, and Governance (ESG) factors continues to reshape investment strategies. By the end of 2024, global ESG assets were projected to reach over $30 trillion, highlighting a significant shift in capital allocation.

Brighthouse Financial, like its peers, faces increasing pressure to integrate ESG principles into its investment portfolios and demonstrate tangible sustainability commitments. Failure to do so could impact its brand image and ability to attract the growing segment of socially conscious investors, a trend clearly visible in market performance data from early 2025.

Concerns about resource scarcity and the environmental impact of business operations, like energy consumption and waste, are pushing companies toward sustainability. For Brighthouse Financial, while not directly tied to physical resources, optimizing its operational footprint, such as reducing energy use in its offices, can enhance its corporate responsibility image.

In 2023, the financial services sector, including firms like Brighthouse, continued to focus on reducing their carbon footprint. For example, many companies are investing in energy-efficient technologies for their data centers and office spaces. While specific data for Brighthouse's operational footprint reduction for 2024 is not yet widely published, industry trends indicate a commitment to lowering energy consumption and digital waste.

Regulatory Focus on Climate Risk Disclosure

Regulators are intensifying their focus on how financial firms like Brighthouse Financial evaluate and report climate-related financial risks. This trend is pushing for greater transparency and accountability in how companies manage their exposure to climate impacts within their operations and investments.

Brighthouse Financial can anticipate evolving regulatory landscapes that may mandate more detailed disclosures concerning its investment portfolio's susceptibility to climate change. This includes outlining strategies for mitigating these identified risks, mirroring a broader push across the financial sector for climate-resilient business models.

- Increased Scrutiny: Regulators globally are enhancing oversight of climate risk management by financial institutions.

- Disclosure Requirements: Brighthouse Financial may face new obligations to report on its climate-related financial exposures and mitigation plans.

- Industry Alignment: These potential requirements align with a growing industry-wide commitment to integrating sustainability and climate considerations into financial strategies.

Brand Reputation and Sustainability Initiatives

Brighthouse Financial's brand reputation is increasingly tied to its environmental, social, and governance (ESG) performance. Consumers, particularly younger demographics like Millennials and Gen Z, are actively seeking out companies that demonstrate a commitment to sustainability. For instance, a 2024 survey indicated that over 60% of investors consider ESG factors when making investment decisions, a trend that directly impacts how financial services firms are perceived and patronized.

Engaging in robust sustainability initiatives can serve as a significant differentiator for Brighthouse Financial in the crowded insurance and annuity market. Beyond customer appeal, a strong ESG profile also aids in talent acquisition. A 2025 report highlighted that companies with strong sustainability commitments are 20% more likely to attract top-tier talent, suggesting that Brighthouse's efforts in this area could bolster its workforce quality.

- Enhanced Brand Image: Demonstrating a commitment to environmental sustainability can positively influence public perception and customer loyalty.

- Customer Attraction: Younger consumers, who prioritize socially responsible businesses, are more likely to engage with companies showing strong ESG credentials.

- Competitive Advantage: Sustainability initiatives can set Brighthouse Financial apart from competitors, offering a unique selling proposition.

- Talent Acquisition: A strong ESG record makes the company more attractive to potential employees, particularly those seeking purpose-driven careers.

Environmental factors significantly influence Brighthouse Financial, primarily through its investment portfolio's exposure to climate change impacts and the growing demand for ESG integration. Extreme weather events, a growing concern for 2024, can indirectly affect asset values, while investor preference for sustainable practices, with ESG assets projected to exceed $30 trillion by the end of 2024, pressures financial firms to adapt.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Brighthouse Financial is built on a robust foundation of data from reputable sources including government regulatory filings, industry-specific market research reports, and economic forecasting agencies. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.