Brighthouse Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brighthouse Financial Bundle

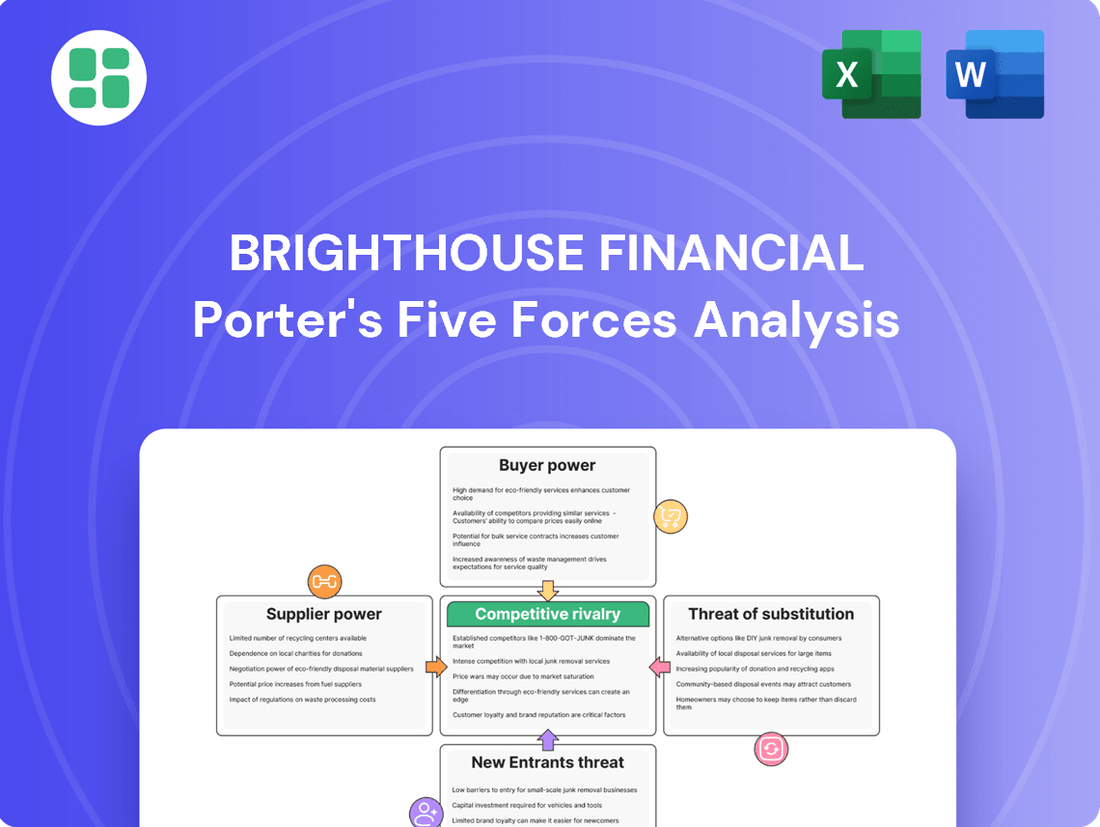

Brighthouse Financial navigates a landscape shaped by moderate buyer power and intense rivalry, with the threat of substitutes presenting a significant challenge. Understanding these forces is crucial for any investor or strategist looking to capitalize on the annuity and life insurance market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Brighthouse Financial’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Brighthouse Financial's reliance on specialized technology and data providers, particularly for InsurTech solutions, AI, and big data analytics, grants these suppliers a degree of bargaining power. The proprietary nature of these advanced platforms and the significant costs involved in integrating new systems create moderate to high leverage for these vendors. For instance, the InsurTech market saw substantial investment in 2024, with companies like Duck Creek Technologies, a major player in core insurance software, continuing to innovate, making switching providers a complex and expensive undertaking for insurers like Brighthouse.

Reinsurance providers are crucial for Brighthouse Financial, offering a safety net for significant risks in products like annuities and life insurance. Their influence is particularly strong when specialized or highly sought-after reinsurance is needed. For instance, Brighthouse Financial shifted its fixed deferred annuity reinsurance to a new provider in 2024, highlighting the dynamic nature of these supplier relationships and the potential leverage reinsurers hold.

Brighthouse Financial relies heavily on actuaries for pricing and reserve calculations and investment managers to oversee its vast portfolio. The specialized knowledge of these professionals, especially those with proven success, gives them significant leverage because they directly influence the company's profitability and risk management. For instance, in 2023, the U.S. life insurance industry paid out over $100 billion in benefits, underscoring the critical role of accurate actuarial work.

Talent Pool (Skilled Professionals)

The availability of skilled professionals like financial advisors, actuaries, data scientists, and IT specialists represents a crucial supplier group for Brighthouse Financial. A scarcity of these highly qualified individuals, particularly in insurance and fintech, can drive up recruitment and retention expenses, thus amplifying the bargaining power of this human capital. For instance, in 2024, the demand for data scientists with insurance experience remained exceptionally high, leading to competitive salary offers and signing bonuses.

The industry's continuous digital transformation further intensifies the need for tech-savvy talent, making it harder for companies to secure and keep these essential employees. This trend means that skilled professionals have more leverage when negotiating terms, directly impacting Brighthouse Financial's operational costs.

- Talent Shortages: In 2024, the U.S. faced a notable shortage of experienced actuaries, with many companies reporting extended hiring timelines.

- Digital Skills Premium: The average salary for cybersecurity analysts in the financial services sector saw a double-digit percentage increase in 2024 compared to the previous year.

- Industry Demand: The insurance sector's need for AI and machine learning specialists outpaced supply in early 2025, giving these professionals significant negotiating power.

Financial Market Data Providers

Financial market data providers wield significant bargaining power over Brighthouse Financial. Access to real-time and historical data is fundamental for Brighthouse's investment strategies, product creation, and risk oversight. Providers like Bloomberg and Refinitiv often have proprietary data sets and sophisticated analytical platforms, making them indispensable. In 2024, the market for financial data and analytics was valued at over $30 billion, highlighting the industry's substantial economic footprint and the leverage held by key players.

The critical nature and often exclusive access to essential financial data give these suppliers considerable sway. This power directly impacts Brighthouse's capacity to price its products competitively and manage its investment portfolios effectively. The accuracy and promptness of this data are non-negotiable for making sound decisions. For instance, a delay or error in market data could lead to mispricing of securities or incorrect risk assessments, costing millions.

- High Switching Costs: Migrating data systems and retraining personnel can be costly and time-consuming for Brighthouse.

- Data Exclusivity: Certain specialized data sets are only available from a limited number of providers.

- Reputation and Reliability: Brighthouse relies on the trusted and proven accuracy of data providers for its core operations.

- Concentration of Providers: A few dominant players control a significant share of the financial data market.

Brighthouse Financial's dependence on specialized technology and data providers, particularly for InsurTech, AI, and big data analytics, grants these suppliers significant bargaining power. The proprietary nature of these platforms and high integration costs make switching vendors a complex and costly endeavor. For example, investments in the InsurTech market in 2024 continued to bolster the position of core software providers, making them difficult to replace.

What is included in the product

This analysis delves into the competitive forces impacting Brighthouse Financial, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the annuity and life insurance markets.

A comprehensive overview of Brighthouse Financial's competitive landscape, helping to identify and mitigate potential threats from rivals and new market entrants.

Customers Bargaining Power

Customers for standard annuity and life insurance products often show significant price sensitivity, especially when products are similar and lack unique features. This sensitivity is amplified by the ease of online comparison shopping, where aggregators and financial advisors allow consumers to quickly assess and switch to providers offering more favorable terms.

The bargaining power of these customers is further strengthened in markets like fixed annuities, where the primary competitive factor is often the interest rate offered. For instance, a 0.25% difference in annual yield on a substantial annuity investment can translate to thousands of dollars over the life of the contract, making price a critical decision-making element for many individuals.

The internet has truly leveled the playing field when it comes to financial product information. Customers today have access to a wealth of data, from detailed product comparisons to reviews of financial institutions. For instance, in 2024, platforms like NerdWallet and Bankrate continue to provide consumers with easy-to-digest comparisons of insurance policies, investment accounts, and loan rates, significantly reducing the information gap.

This easy access to information directly translates into increased customer bargaining power. With readily available data, consumers can efficiently identify the most competitive offerings and providers, forcing companies to offer better terms and pricing to remain attractive. The ability to quickly compare features and costs empowers customers to negotiate more effectively or simply switch to a more favorable provider.

While some annuity and life insurance products come with surrender charges, the actual costs for customers to switch providers can be surprisingly low, especially when purchasing new policies or considering rollovers. This ease of moving funds or choosing a different company for future investments significantly boosts customer leverage because they aren't deeply tied to one insurer.

This dynamic is particularly noteworthy considering the robust sales figures in the annuity market, which saw total annuity sales reach a record $385 billion in 2023, according to LIMRA. Such high transaction volumes indicate a market where customers are actively exploring options, underscoring the impact of lower switching costs on their bargaining power.

Demographic Trends and Demand for Specific Solutions

The aging demographic, especially baby boomers approaching retirement, significantly influences the bargaining power of customers in the financial services sector. This group has a heightened need for guaranteed lifetime income, directly boosting demand for products like annuities. For instance, in 2024, the U.S. annuity market saw continued robust sales, with fixed indexed annuities, a popular choice for guaranteed income, experiencing substantial growth.

This concentrated demand for specific, secure financial outcomes empowers customers. They are not just looking for any product but for solutions that offer financial certainty in retirement. This collective focus allows them to exert pressure on insurers for competitive pricing and product innovation, as seen in the ongoing development of more flexible and transparent annuity features to meet evolving customer expectations.

- Aging Population Driving Demand: Baby boomers, a significant demographic cohort, are increasingly seeking retirement solutions.

- Annuity Market Growth: Demand for guaranteed lifetime income products, like annuities, is robust, with sales showing strong performance in 2024.

- Customer Power Through Specific Needs: The clear demand for financial security and predictable income gives customers leverage.

- Influence on Product Development: Insurers are compelled to innovate and offer competitive pricing to attract and retain this powerful customer segment.

Impact of Financial Advisor Influence

Customers often depend heavily on financial advisors when navigating intricate financial products such as annuities and life insurance. This reliance means advisors’ recommendations can steer customer decisions, thereby centralizing some customer bargaining power through this intermediary.

Brighthouse Financial’s strategy must therefore prioritize strong relationships and support for its network of financial advisors. For instance, in 2023, Brighthouse reported that a significant portion of its annuity sales were influenced by its distribution partners, highlighting the critical role advisors play in customer acquisition and retention.

- Advisor Dependence: Many individuals lack the expertise to evaluate complex financial products independently, making them reliant on advisor counsel.

- Influence Channel: Financial advisors act as a conduit, consolidating customer preferences and bargaining power through their aggregated influence.

- Distribution Network: Brighthouse Financial’s success is closely tied to its ability to effectively engage and support its financial advisor partners.

- 2023 Data Insight: A substantial percentage of Brighthouse’s annuity business in 2023 was attributed to advisor-driven sales, underscoring their impact.

Customers for standard annuity and life insurance products often show significant price sensitivity, especially when products are similar and lack unique features. This sensitivity is amplified by the ease of online comparison shopping, where aggregators and financial advisors allow consumers to quickly assess and switch to providers offering more favorable terms.

The bargaining power of these customers is further strengthened in markets like fixed annuities, where the primary competitive factor is often the interest rate offered. For instance, a 0.25% difference in annual yield on a substantial annuity investment can translate to thousands of dollars over the life of the contract, making price a critical decision-making element for many individuals.

The internet has truly leveled the playing field when it comes to financial product information. Customers today have access to a wealth of data, from detailed product comparisons to reviews of financial institutions. For instance, in 2024, platforms like NerdWallet and Bankrate continue to provide consumers with easy-to-digest comparisons of insurance policies, investment accounts, and loan rates, significantly reducing the information gap.

This easy access to information directly translates into increased customer bargaining power. With readily available data, consumers can efficiently identify the most competitive offerings and providers, forcing companies to offer better terms and pricing to remain attractive. The ability to quickly compare features and costs empowers customers to negotiate more effectively or simply switch to a more favorable provider.

While some annuity and life insurance products come with surrender charges, the actual costs for customers to switch providers can be surprisingly low, especially when purchasing new policies or considering rollovers. This ease of moving funds or choosing a different company for future investments significantly boosts customer leverage because they aren't deeply tied to one insurer.

This dynamic is particularly noteworthy considering the robust sales figures in the annuity market, which saw total annuity sales reach a record $385 billion in 2023, according to LIMRA. Such high transaction volumes indicate a market where customers are actively exploring options, underscoring the impact of lower switching costs on their bargaining power.

The aging demographic, especially baby boomers approaching retirement, significantly influences the bargaining power of customers in the financial services sector. This group has a heightened need for guaranteed lifetime income, directly boosting demand for products like annuities. For instance, in 2024, the U.S. annuity market saw continued robust sales, with fixed indexed annuities, a popular choice for guaranteed income, experiencing substantial growth.

This concentrated demand for specific, secure financial outcomes empowers customers. They are not just looking for any product but for solutions that offer financial certainty in retirement. This collective focus allows them to exert pressure on insurers for competitive pricing and product innovation, as seen in the ongoing development of more flexible and transparent annuity features to meet evolving customer expectations.

Customers often depend heavily on financial advisors when navigating intricate financial products such as annuities and life insurance. This reliance means advisors’ recommendations can steer customer decisions, thereby centralizing some customer bargaining power through this intermediary.

Brighthouse Financial’s strategy must therefore prioritize strong relationships and support for its network of financial advisors. For instance, in 2023, Brighthouse reported that a significant portion of its annuity sales were influenced by its distribution partners, highlighting the critical role advisors play in customer acquisition and retention.

| Factor | Impact on Customer Bargaining Power | 2023/2024 Data/Trend |

|---|---|---|

| Price Sensitivity & Online Comparison | High | Continued growth of comparison platforms in 2024. |

| Switching Costs | Low | Record annuity sales in 2023 ($385 billion) suggest active shopping. |

| Demographic Needs (Retirement) | High | Robust demand for guaranteed income products in 2024. |

| Advisor Dependence | Moderate to High | Significant portion of Brighthouse annuity sales in 2023 driven by advisors. |

Full Version Awaits

Brighthouse Financial Porter's Five Forces Analysis

This comprehensive Porter's Five Forces analysis of Brighthouse Financial, as previewed, details the competitive landscape impacting the company's profitability. You'll receive this exact, fully formatted document immediately after purchase, offering an in-depth examination of industry rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. This preview is not a sample; it is the actual deliverable, ready for your immediate use and strategic planning.

Rivalry Among Competitors

The U.S. annuity and life insurance sector is a crowded arena, with many seasoned companies actively competing. This maturity means that firms like Brighthouse Financial face a significant number of established rivals, including giants such as New York Life, MassMutual, Prudential, and Corebridge Financial.

This intense competition forces companies to constantly battle for customers and market share. For Brighthouse Financial, this dynamic makes it difficult to secure a leading position, as market gains are hard-won against a backdrop of numerous well-entrenched players.

Brighthouse Financial offers a variety of annuities and life insurance, but many of these products, like variable, fixed, and indexed annuities, can appear quite similar to consumers. This similarity makes it tough to truly stand out based on product features alone.

When products are seen as alike, competition often shifts to factors like price, the interest rates offered, or the payout rates on annuities. This can put pressure on Brighthouse to lower its prices or offer higher payouts, which in turn can squeeze their profit margins. For instance, in 2023, the annuity market saw intense competition, with companies actively adjusting crediting rates to attract business.

To combat this, Brighthouse is focusing on innovation, such as their Shield Level Benefit annuities, which offer unique features designed to provide greater security and flexibility for contract holders. This strategic product development is crucial for differentiating themselves in a crowded marketplace and attracting customers seeking more than just basic coverage.

The annuity market has experienced robust growth, with 2024 marking a record year for sales. However, this growth is closely tied to interest rate environments. A projected decrease in interest rates for 2025 could impact demand for traditional fixed-rate annuities, potentially intensifying rivalry as companies vie for customers in other growing segments.

This sensitivity to interest rates means that as rates fall, competition might heat up for products like fixed indexed annuities and registered index-linked annuities, which offer potential for growth tied to market performance. Companies will likely focus more on product innovation and marketing to capture market share in these more dynamic annuity categories.

High Exit Barriers

The life insurance and annuity sector faces substantial exit barriers, largely due to the immense capital needed to operate and the long-term commitments tied to existing policies. These factors, coupled with intricate regulatory landscapes, make it exceptionally challenging for companies to simply walk away from the market. As of 2024, the industry's solvency requirements, for instance, necessitate robust capital reserves, making divestiture or closure a costly and complex undertaking.

These high exit barriers mean that even when profitability dips, companies are often compelled to stay and compete for market share. This persistence ensures a consistently competitive environment, as firms are incentivized to manage their existing business rather than incur significant losses by exiting. For example, companies like Brighthouse Financial, with its substantial block of annuity business, must continue to manage these long-term liabilities, influencing their strategic decisions and competitive posture.

- Capital Intensity: The life insurance industry requires significant capital reserves to meet policyholder obligations, often measured in billions of dollars, making it difficult to exit without substantial financial loss.

- Long-Term Obligations: Policyholders have contracts that can last for decades, creating ongoing liabilities that companies must service, even in adverse market conditions.

- Regulatory Hurdles: Insurance companies are heavily regulated, and exiting the market typically involves complex approvals and wind-down procedures that are both time-consuming and expensive.

- Brand and Reputation: A company's reputation is crucial in the insurance industry; a disorderly exit could severely damage its brand and impact any remaining operations or future ventures.

Intense Focus on Digital Transformation and Customer Experience

Competitive rivalry within the life insurance sector is escalating, driven by an intense focus on digital transformation and customer experience. Companies are pouring resources into advanced technologies like artificial intelligence and data analytics. For instance, in 2024, many insurers reported significant increases in their IT spending, with a substantial portion allocated to digital initiatives aimed at improving customer interactions and operational efficiency.

This technological arms race compels Brighthouse Financial to continuously innovate. Competitors are leveraging these advancements to offer more streamlined services, sophisticated risk assessment tools, and highly personalized product offerings. The goal is to create seamless digital journeys for customers, from initial inquiry to policy management.

- Digital Investment: Competitors are heavily investing in digital transformation, AI, and data analytics.

- Customer Experience Enhancement: These investments aim to improve customer experience and streamline operations.

- Personalized Products: The focus is also on developing personalized insurance products.

- Innovation Pressure: This technological race intensifies rivalry, pushing Brighthouse Financial to continuously innovate its digital offerings.

The competitive landscape for Brighthouse Financial is intensely crowded, featuring numerous well-established players like New York Life and Prudential. This fierce rivalry is further amplified by product similarities, forcing companies to compete aggressively on price and payout rates, which can compress profit margins. For example, 2023 saw aggressive adjustments in crediting rates across the annuity market.

The annuity market's growth, with 2024 setting sales records, is closely linked to interest rate environments. As rates are projected to decline in 2025, competition is expected to intensify, particularly for products like fixed indexed annuities and registered index-linked annuities, as firms vie for market share in more dynamic segments. This necessitates continuous innovation and strategic product development, such as Brighthouse's Shield Level Benefit annuities, to differentiate offerings.

Furthermore, the sector's high capital intensity, long-term policyholder obligations, and stringent regulatory requirements create significant exit barriers, ensuring that even underperforming companies remain active competitors. This persistence maintains a highly competitive environment, compelling firms like Brighthouse to actively manage their extensive business portfolios.

The ongoing digital transformation, with significant IT spending by insurers in 2024 on AI and data analytics, is also a major driver of rivalry. Competitors are enhancing customer experiences and streamlining operations through these advancements, pushing Brighthouse to continuously innovate its digital services and product personalization to remain competitive.

SSubstitutes Threaten

Individuals have a wide array of direct investment options available, such as stocks, bonds, mutual funds, and ETFs, which can be used for retirement savings or financial security. These alternatives allow people to bypass traditional insurance products offered by companies like Brighthouse Financial. For instance, in 2024, the U.S. stock market saw significant growth, with the S&P 500 index returning over 25% for the year, making direct equity investments an attractive proposition for many.

The ease of access and the potential for greater returns, though accompanied by increased risk, present a substantial substitute threat to annuities and life insurance policies. Many investors are drawn to the direct control and potential upside offered by these avenues, especially in favorable market conditions. The global ETF market alone managed over $11 trillion in assets as of early 2025, underscoring the significant capital flowing into these directly managed investment vehicles.

Traditional savings and retirement accounts like 401(k)s and IRAs pose a significant threat to annuities, particularly during the accumulation phase. These alternatives offer familiar avenues for wealth building, often with lower associated fees compared to some annuity products. For instance, in 2024, the average expense ratio for index funds, commonly held within 401(k)s, hovered around 0.5%, whereas annuity fees can range from 1% to over 3% annually.

While these substitutes may not replicate the guaranteed lifetime income features of annuities, their accessibility, liquidity, and straightforward investment options appeal to a broad customer base. Many individuals prioritize capital growth and the flexibility to access funds without penalty, making these traditional vehicles a compelling choice. The sheer volume of assets held in U.S. retirement accounts, exceeding $12 trillion by the end of 2023, underscores their market dominance as alternatives.

Real estate and tangible assets like gold present a significant threat of substitution for Brighthouse Financial. Investors seeking wealth accumulation and inflation protection might opt for property or precious metals instead of life insurance or annuities, as these offer a direct, physical store of value. For instance, the S&P 500, a broad market index, saw a 26.3% return in 2023, while gold prices also experienced a notable surge, reaching all-time highs in early 2024, demonstrating their appeal as alternative investment avenues.

Self-Insurance or Risk Retention

Self-insurance, or risk retention, presents a significant threat to traditional life insurance providers like Brighthouse Financial. For affluent individuals and families, especially those with substantial liquid assets, the ability to absorb potential losses directly can negate the need for insurance premiums. This approach effectively acts as a substitute by allowing them to self-fund future financial obligations, such as income replacement or estate planning, rather than transferring that risk to an insurance company.

The appeal of self-insurance grows when individuals perceive the cost of insurance as outweighing the perceived benefit, or when they have a high degree of confidence in their ability to manage and mitigate risks themselves. For instance, a family with a net worth exceeding $10 million might find it more economical to allocate a portion of their investment portfolio to cover potential future needs, rather than paying for life insurance coverage. This strategy is particularly attractive in low-interest-rate environments where the opportunity cost of premiums is higher.

The increasing availability of sophisticated financial planning tools and wealth management services further empowers individuals to effectively self-insure. These resources allow for more accurate risk assessment and the construction of diversified portfolios designed to meet long-term financial goals. As of 2024, the total investable assets held by high-net-worth individuals globally continue to climb, indicating a growing pool of potential self-insurers.

- Wealthy individuals can use their own assets to cover potential financial shortfalls, bypassing the need for life insurance.

- This strategy is more viable for those with significant liquid assets and a strong capacity to absorb risk.

- The perceived cost-benefit analysis of insurance versus self-retention influences this substitution.

- Advancements in financial planning and wealth management enhance the feasibility of self-insurance.

Government Social Security and Pension Plans

Government Social Security benefits and employer-sponsored defined benefit pension plans act as substitutes for annuities by offering a baseline of guaranteed retirement income. While often not enough to fully replace private savings, these programs can lessen the perceived urgency for individuals to purchase annuities for income security. For instance, in 2023, the average monthly Social Security retirement benefit was approximately $1,827, providing a foundational income stream for millions of Americans.

These government and employer-backed programs reduce the demand for private retirement income solutions like annuities, especially for those who view them as sufficient for their basic needs. The continued existence and payouts from these plans represent a significant, albeit often incomplete, alternative to the income guarantees offered by annuity products. As of 2024, over 67 million Americans are projected to receive Social Security benefits.

The threat of substitutes for Brighthouse Financial is significant, as individuals have numerous alternative avenues for wealth accumulation and risk management. Direct investments in stocks and bonds, as well as readily available retirement accounts like 401(k)s and IRAs, offer competitive returns and liquidity, often with lower fees than traditional insurance products. For example, the S&P 500 index yielded over 25% in 2024, making direct equity investments highly attractive. Furthermore, tangible assets like real estate and gold also serve as substitutes, appealing to investors seeking inflation protection and a direct store of value, with gold prices reaching all-time highs in early 2024.

Self-insurance, particularly for affluent individuals, poses another substantial threat. Those with significant liquid assets can absorb potential financial losses directly, bypassing insurance premiums and associated costs. This strategy becomes more appealing when the perceived cost of insurance outweighs its benefits, a calculation influenced by factors like opportunity cost in low-interest-rate environments. The global high-net-worth individual population continues to grow, increasing the pool of potential self-insurers.

Government programs like Social Security and employer-sponsored pensions also act as substitutes by providing a baseline of guaranteed retirement income. These can reduce the perceived need for private annuity products, especially for individuals who view these existing income streams as sufficient for their basic needs. In 2023, the average monthly Social Security retirement benefit was approximately $1,827, illustrating the foundational income these programs provide.

| Substitute Type | Key Characteristics | 2024/2025 Data Points | Impact on Brighthouse Financial |

| Direct Investments (Stocks, Bonds, ETFs) | Potential for higher returns, liquidity, direct control | S&P 500 returned >25% in 2024; Global ETF market >$11 trillion assets (early 2025) | Reduces demand for annuities and life insurance by offering attractive alternatives |

| Retirement Accounts (401k, IRA) | Familiarity, lower fees, tax advantages | Average index fund expense ratio ~0.5% in 2024 vs. annuity fees 1-3%+ | Competes directly with annuities for retirement savings |

| Tangible Assets (Real Estate, Gold) | Inflation hedge, physical store of value | Gold prices hit all-time highs in early 2024 | Attracts capital that might otherwise be allocated to financial products |

| Self-Insurance | Risk retention by individuals with high net worth | Growing global high-net-worth population | Decreases need for life insurance among affluent clients |

| Government/Employer Pensions | Guaranteed income stream | Average Social Security benefit ~$1,827/month (2023); 67M+ Americans projected to receive SS (2024) | Reduces reliance on annuities for basic retirement income |

Entrants Threaten

The insurance sector, especially for annuities and life insurance, necessitates significant capital. This is to cover regulatory reserves, solvency mandates, and long-term financial obligations. For instance, in 2024, the U.S. life insurance industry maintained over $5 trillion in reserves, a testament to the capital intensity.

These substantial capital requirements act as a formidable barrier, effectively discouraging new companies from entering the market. It becomes exceptionally challenging for startups or smaller entities to challenge the competitive standing of established firms like Brighthouse Financial, which possess the necessary financial muscle.

The life and annuity sector operates under a dense web of state and federal regulations. These rules cover everything from licensing and ongoing compliance to detailed reporting, creating substantial hurdles for any newcomers.

For instance, navigating the intricacies of annuity illustrations and reinsurance requires significant investment in legal and compliance expertise. In 2024, the cost of regulatory compliance for financial services firms continued to rise, with many reporting it as a top operational challenge.

These complex requirements act as a formidable barrier, deterring potential new entrants who may lack the capital, expertise, or willingness to undertake such extensive compliance efforts.

Established insurers like Brighthouse Financial leverage decades of built-up customer trust and strong brand recognition, crucial for long-term financial security products. For instance, as of the first quarter of 2024, Brighthouse reported total assets under management of $235 billion, a testament to its established market presence and the trust it has cultivated.

New entrants struggle to replicate this deep-seated trust and brand loyalty, facing a significant hurdle against companies with proven track records and robust financial strength ratings, which are paramount in the insurance sector.

Distribution Channel Access

Gaining access to effective distribution channels, like independent financial advisors, broker-dealers, and captive agent networks, is absolutely critical for companies selling annuities and life insurance. Without these pathways, it's incredibly difficult to get products in front of potential customers. In 2024, the insurance industry continues to rely heavily on these established relationships.

Established players in the insurance market have cultivated deep, long-standing relationships and possess extensive networks of intermediaries. This makes it a significant challenge for any new company trying to break in and reach a broad customer base. For instance, many large, well-established insurance firms have dedicated teams that nurture these advisor relationships, a resource that is hard for newcomers to replicate quickly.

- Distribution Channel Access: New entrants face substantial barriers in securing access to crucial distribution channels, including independent financial advisors, broker-dealers, and captive agent networks, essential for selling annuities and life insurance.

- Entrenched Relationships: Established insurance companies benefit from deeply entrenched relationships and vast networks, creating a significant hurdle for new companies seeking to reach a wide customer audience.

- Market Penetration: The difficulty in accessing these established channels directly impacts a new entrant's ability to achieve significant market penetration and build a comparable sales infrastructure to incumbents.

Complexity of Product Development and Actuarial Expertise

Developing competitive and actuarially sound annuity and life insurance products demands extensive specialized knowledge, advanced modeling, and substantial R&D investment. This inherent complexity, along with the critical need for seasoned actuarial talent, presents a significant hurdle for new companies looking to enter the market.

The intricate nature of product design and the reliance on precise actuarial calculations are substantial barriers. For instance, in 2023, the life insurance industry saw significant investment in technology and data analytics to enhance product development and risk assessment, a trend expected to continue. Companies lacking these capabilities would struggle to compete effectively.

- High R&D Costs: Significant capital is required for actuarial modeling, product design, and regulatory compliance.

- Specialized Talent Scarcity: Access to experienced actuaries and product development specialists is limited and costly.

- Regulatory Hurdles: New products must navigate complex and evolving regulatory frameworks, adding to development time and expense.

- Market Acceptance Risk: Innovative products require substantial marketing and education to gain consumer trust and adoption.

The threat of new entrants in the annuity and life insurance market, where Brighthouse Financial operates, is generally low. This is primarily due to the substantial capital requirements for regulatory reserves and solvency, which in 2024, saw the U.S. life insurance industry holding over $5 trillion in reserves. Furthermore, the complex regulatory landscape, demanding significant investment in legal and compliance expertise, acts as a major deterrent. For instance, the rising cost of regulatory compliance in 2024 presented a top operational challenge for many financial services firms.

Porter's Five Forces Analysis Data Sources

Our Brighthouse Financial Porter's Five Forces analysis is built upon a foundation of credible data, including Brighthouse's own SEC filings, annual reports, and investor presentations. We supplement this with industry-specific research from leading financial data providers like S&P Capital IQ and IBISWorld, alongside macroeconomic data from sources such as Bloomberg.