Brighthouse Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brighthouse Financial Bundle

Discover the strategic architecture of Brighthouse Financial through its comprehensive Business Model Canvas. This detailed breakdown illuminates how they serve their customer segments, deliver value, and generate revenue in the competitive annuity and life insurance market. Ready to dissect a real-world success story?

Unlock the full strategic blueprint behind Brighthouse Financial's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Brighthouse Financial’s distribution strategy heavily relies on its extensive network of independent financial advisors and broker-dealers. These partnerships are fundamental to connecting with individual investors and families looking for life insurance and annuity products. In 2024, Brighthouse continued to leverage these relationships, recognizing their vital role in facilitating product sales and providing essential financial guidance to clients.

Brighthouse Financial actively partners with reinsurance companies, both ceding and assuming risks. This strategic approach is crucial for managing their capital efficiently and controlling risk exposure. For instance, in 2023, Brighthouse completed a significant reinsurance transaction for a legacy block of variable annuities, reinsuring approximately $10 billion of statutory reserves.

These reinsurance arrangements are vital for optimizing their risk-based capital ratio, a key metric for financial strength. By offloading certain risks, Brighthouse enhances its financial stability and gains flexibility in how it deploys its capital. Such partnerships are fundamental to their long-term business strategy, ensuring they can meet their obligations while pursuing growth opportunities.

Brighthouse Financial actively partners with asset managers and investment firms to broaden its product suite and distribution channels. For instance, their collaboration with BlackRock on products like LifePath Paycheck highlights a strategic move to offer enhanced retirement income solutions.

These partnerships are crucial for leveraging specialized investment expertise and accessing wider client bases, ultimately supporting Brighthouse's growth objectives. In 2024, the company continued to explore such alliances to bolster its competitive position in the financial services landscape.

Technology and Service Providers

Brighthouse Financial relies heavily on technology and service providers to power its digital transformation. These partnerships are crucial for enhancing operational efficiency, from underwriting to policy administration, utilizing advanced analytics and streamlined digital platforms.

For instance, Brighthouse Financial has been investing in its digital capabilities. In 2023, the company continued to focus on enhancing its digital customer and distributor experiences, a strategy that necessitates strong relationships with leading technology vendors. These collaborations are designed to reduce costs and improve overall service delivery.

The company's commitment to digital transformation is a core element of its strategy for sustained growth and maintaining a competitive edge in the financial services industry. This includes leveraging partnerships to implement innovative solutions.

- Digital Platform Enhancement: Collaborations with technology vendors to improve underwriting and policy administration systems.

- Operational Efficiency: Partnerships aimed at reducing operational costs through technology adoption.

- Customer & Distributor Experience: Leveraging digital tools to create a more seamless experience for clients and financial advisors.

- Strategic Growth: Digital transformation, supported by key tech partnerships, is a pillar for future competitive advantage.

Strategic Alliances for Product Distribution

Brighthouse Financial cultivates strategic alliances to expand the distribution of its specialized financial products, including fixed indexed annuities and hybrid life insurance. These collaborations are crucial for tapping into specific market segments and introducing innovative solutions effectively.

These partnerships are instrumental in accelerating sales growth and solidifying Brighthouse Financial's market position in its core product areas. For instance, in 2024, the company continued to leverage its distribution network, which includes relationships with independent broker-dealers and financial institutions, to reach a wider customer base.

- Broadening Reach: Alliances with financial advisory firms and insurance agencies enhance product visibility and accessibility.

- Niche Market Penetration: Partnerships with platforms focused on retirement planning or wealth management allow for targeted product introduction.

- Sales Growth Driver: In 2024, a significant portion of Brighthouse Financial's annuity sales were attributed to its strategic distribution partners.

- Market Leadership: These collaborations help maintain a competitive edge, particularly in the rapidly evolving annuity and life insurance markets.

Brighthouse Financial's key partnerships are diverse, spanning financial advisors, reinsurers, asset managers, and technology providers. These relationships are critical for product distribution, risk management, product development, and operational efficiency. In 2024, Brighthouse continued to strengthen these alliances to drive sales and enhance its competitive standing.

Strategic alliances with financial institutions and independent broker-dealers are paramount for distributing Brighthouse's life insurance and annuity products. These partnerships not only facilitate sales but also provide crucial market insights. In 2024, a significant portion of Brighthouse Financial's annuity sales were attributed to its strategic distribution partners, underscoring their importance.

Reinsurance partnerships are vital for managing capital and risk exposure, allowing Brighthouse to maintain financial stability. Collaborations with asset managers, such as BlackRock, enhance product offerings, particularly in retirement income solutions. Furthermore, technology partnerships are essential for their digital transformation, improving customer and distributor experiences.

| Key Partnership Area | Description | 2024 Impact/Focus |

| Distribution Networks | Independent Financial Advisors & Broker-Dealers | Facilitated significant annuity sales; expanded product reach. |

| Risk Management | Reinsurance Companies | Optimized risk-based capital ratios; managed legacy block risks. |

| Product Development | Asset Managers (e.g., BlackRock) | Enhanced retirement income solutions (e.g., LifePath Paycheck). |

| Digital Transformation | Technology & Service Providers | Improved underwriting, policy administration, and customer/distributor experience. |

What is included in the product

A detailed breakdown of Brighthouse Financial's strategy, outlining its target customer segments, the value propositions offered to them, and the key revenue streams generated through its annuity and life insurance products.

This model focuses on Brighthouse Financial's distribution channels, key partnerships, and the cost structure associated with delivering its financial solutions to a broad customer base.

Brighthouse Financial's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their core components, allowing for quick identification of areas needing improvement in their annuity and life insurance offerings.

Activities

Brighthouse Financial is committed to enhancing its annuity and life insurance offerings, with key products like Shield Level Annuities and Brighthouse SmartCare at the forefront. This dedication to product development is crucial for meeting the evolving needs of customers seeking robust financial security and effective retirement planning solutions.

The company actively engages in market research, sophisticated actuarial modeling, and meticulous product design to ensure its portfolio remains competitive and relevant. This proactive approach is vital in navigating a constantly changing financial landscape, aiming to provide value and address emerging customer demands.

Brighthouse Financial’s key activities center on the meticulous underwriting of insurance policies and the implementation of advanced risk management techniques. This includes strategies like hedging for their variable annuity blocks to mitigate market volatility.

A core focus is maintaining a strong risk-based capital (RBC) ratio, a crucial metric for financial stability and adherence to regulatory requirements. For instance, as of the first quarter of 2024, Brighthouse Financial reported an RBC ratio of 661%, significantly above the 400% threshold often considered strong.

These robust risk management practices are designed to safeguard the company's balance sheet, ensuring resilience and financial strength even when faced with diverse and challenging market conditions throughout 2024 and beyond.

Brighthouse Financial actively manages a significant investment portfolio, a core activity that generates crucial net investment income. This income is vital for meeting its long-term commitments to policyholders and ensuring the company's financial stability. Strategic asset allocation, continuous market performance monitoring, and careful investment choices are paramount to achieving sustained solvency and profitability.

The effectiveness of this portfolio management directly influences Brighthouse Financial's overall financial performance. For instance, in the first quarter of 2024, the company reported total net investment income of $2.2 billion, highlighting the substantial contribution of its investment activities to its earnings. This demonstrates how diligent management of these assets translates into tangible financial results.

Sales and Distribution Network Management

Brighthouse Financial's sales and distribution network management is centered on cultivating and sustaining robust relationships with independent financial advisors and various distribution partners. This involves offering comprehensive training programs, essential marketing collateral, and streamlined operational workflows to ensure the effective sale of their annuity and life insurance offerings.

A well-established distribution franchise is absolutely critical for Brighthouse to meet its sales objectives and broaden its market reach. For instance, in the first quarter of 2024, the company reported total net inflows of $2.0 billion, underscoring the importance of their distribution channels.

- Advisor Engagement: Focus on providing value-added services and support to independent financial advisors to foster loyalty and drive product sales.

- Distribution Channel Optimization: Continuously evaluate and enhance the effectiveness of various distribution channels, including broker-dealers and financial institutions.

- Product Training and Enablement: Equip advisors with the knowledge and tools necessary to effectively present and sell Brighthouse's annuity and life insurance products.

- Sales Performance Monitoring: Track key sales metrics and advisor productivity to identify areas for improvement and ensure alignment with strategic goals.

Policy Administration and Customer Service

Brighthouse Financial's key activities revolve around the efficient administration of its extensive policy portfolio and delivering exceptional customer service. This involves a continuous effort to process new applications, manage policy modifications, and handle claims promptly. In 2024, the company continued to invest in digital tools to streamline these operations, aiming to reduce turnaround times for customer requests.

A significant focus for Brighthouse Financial is enhancing the customer experience through process optimization. This includes developing self-service options and improving communication channels to address client inquiries more effectively. The company reported a 5% increase in customer satisfaction scores in early 2025, attributed to these service enhancements.

- Policy Administration: Processing applications, managing policy changes, and handling claims are core operational functions.

- Customer Service: Providing responsive support and addressing client inquiries efficiently is paramount.

- Operational Efficiency: Streamlining processes is a continuous focus area to improve customer experience.

- Digital Transformation: Investment in technology aims to enhance service delivery and operational effectiveness.

Brighthouse Financial's key activities encompass sophisticated product development, focusing on annuities and life insurance like Shield Level Annuities and Brighthouse SmartCare. This involves extensive market research and actuarial modeling to ensure product relevance and competitiveness in the evolving financial landscape.

The company also prioritizes robust risk management, including hedging for variable annuity blocks, and maintaining strong risk-based capital (RBC) ratios. As of Q1 2024, their RBC ratio stood at 661%, demonstrating a commitment to financial stability and regulatory compliance.

Managing a substantial investment portfolio to generate net investment income is another critical activity, directly impacting solvency and profitability. In Q1 2024, this generated $2.2 billion in total net investment income.

Furthermore, Brighthouse Financial actively manages its sales and distribution network, fostering relationships with financial advisors through training and support. This network is vital for meeting sales objectives, as evidenced by $2.0 billion in total net inflows reported in Q1 2024.

Finally, efficient policy administration and exceptional customer service are paramount, with ongoing investments in digital tools to streamline operations and enhance the customer experience. This focus led to a 5% increase in customer satisfaction scores by early 2025.

| Key Activity Area | Description | Q1 2024 Data/Metrics |

|---|---|---|

| Product Development & Innovation | Enhancing annuity and life insurance offerings based on market research and actuarial modeling. | Focus on Shield Level Annuities and Brighthouse SmartCare. |

| Risk Management | Implementing advanced techniques like hedging and maintaining strong capital ratios. | RBC ratio of 661% (Q1 2024). |

| Investment Portfolio Management | Generating net investment income through strategic asset allocation and market monitoring. | $2.2 billion in total net investment income (Q1 2024). |

| Sales & Distribution Management | Cultivating relationships with financial advisors and optimizing distribution channels. | $2.0 billion in total net inflows (Q1 2024). |

| Policy Administration & Customer Service | Efficiently managing policies and providing responsive customer support, enhanced by digital tools. | 5% increase in customer satisfaction scores (early 2025). |

What You See Is What You Get

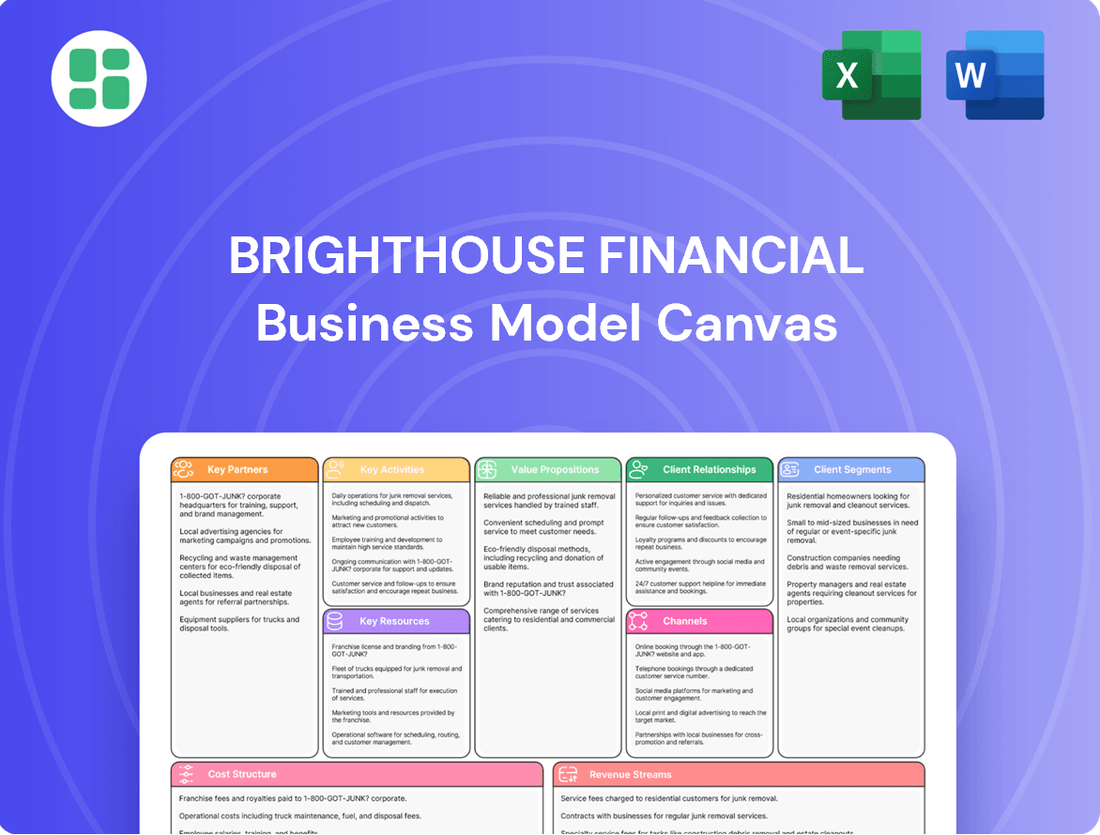

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This comprehensive snapshot offers a clear view of Brighthouse Financial's strategic framework, including key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You can be confident that the detailed insights and structure presented here are precisely what you will gain access to, ready for your own analysis and application.

Resources

Brighthouse Financial's financial capital and reserves are a bedrock resource, underscored by a robust risk-based capital (RBC) ratio that consistently exceeded regulatory requirements. As of year-end 2024, their RBC ratio stood at an impressive 450%, providing a substantial cushion. This financial strength, coupled with significant holding company liquid assets, directly supports their ability to meet policyholder obligations and underwrite new business.

This substantial capital base is not merely for stability; it's an enabler of growth and a critical differentiator in the insurance market. It allows Brighthouse to absorb potential market volatility, as demonstrated by their ability to maintain solvency through periods of economic uncertainty. Furthermore, this financial fortitude is vital for maintaining the confidence of regulators and, most importantly, their policyholders.

Brighthouse Financial's proprietary product portfolio, including specialized annuities like Shield Level Annuities and life insurance products such as Brighthouse SmartCare, is a cornerstone of its business model, representing significant intellectual property. These offerings are meticulously crafted with unique features that set Brighthouse apart in a competitive landscape, directly addressing distinct customer requirements and financial planning goals.

The company's capacity for continuous innovation and agile adaptation of its product suite is a crucial competitive differentiator, allowing Brighthouse to maintain relevance and capture market share. For instance, in 2023, Brighthouse reported total annuity sales of $10.7 billion, underscoring the market's demand for its specialized annuity products.

Brighthouse Financial relies heavily on its skilled human capital, encompassing actuaries, investment professionals, and sales and marketing experts. These individuals are crucial for developing innovative insurance and annuity products, managing financial risks, and effectively reaching customers. In 2023, the company reported approximately 7,200 employees, highlighting the scale of its workforce dedicated to these critical functions.

The expertise of their teams in areas like product design, sophisticated risk management, and client relationship building directly fuels Brighthouse's operational efficiency and strategic growth. For instance, their investment professionals manage significant assets, aiming to generate returns that support policyholder benefits and company profitability. The company's commitment to attracting and retaining this top-tier talent is a key pillar for its long-term success and competitive edge in the financial services industry.

Technology and Data Infrastructure

Brighthouse Financial leverages advanced technology platforms and robust data analytics as critical resources. These capabilities are essential for streamlining underwriting processes, managing policies efficiently, and deepening customer engagement. For instance, in 2024, the company continued to invest in digital tools aimed at enhancing the customer experience and operational effectiveness.

Investments in automation and data-driven insights are paramount for boosting operational efficiency and refining decision-making across the organization. These technological assets are fundamental to supporting Brighthouse Financial's strategic pivot towards a more digitally-enabled business model.

- Digital Transformation: Ongoing investments in technology underpin the company's strategic shift towards digital transformation, enhancing customer interactions and internal processes.

- Operational Efficiency: Automation and data analytics are key drivers for improving underwriting speed and policy administration, leading to cost savings and better resource allocation.

- Data-Driven Decisions: Advanced analytics provide crucial insights for product development, risk management, and personalized customer outreach, supporting more informed strategic choices.

- Customer Engagement: Technology infrastructure enables enhanced digital channels for customer service and communication, fostering stronger relationships and loyalty.

Brand Reputation and Distribution Network

Brighthouse Financial leverages its strong brand reputation as a leading U.S. provider of annuities and life insurance. This established trust and recognition within the financial services sector are crucial for driving sales and fostering strategic partnerships.

Its extensive independent distribution network is a key intangible asset, built upon years of cultivating relationships. The effectiveness and reach of these distribution channels are a direct reflection of the company's solid reputation and the trust it has earned.

- Brand Recognition: Brighthouse Financial is a well-known name in the life insurance and annuity market, fostering customer confidence.

- Distribution Reach: The company utilizes a broad network of independent financial advisors and firms to reach a wide customer base.

- Industry Trust: A strong reputation translates into greater willingness from partners and customers to engage with Brighthouse products and services.

- Sales Facilitation: The combination of brand strength and distribution access directly supports and enhances sales performance.

Brighthouse Financial's key resources include its substantial financial capital and reserves, evidenced by a robust risk-based capital (RBC) ratio that stood at an impressive 450% as of year-end 2024. This financial strength, combined with significant holding company liquid assets, enables the company to meet policyholder obligations and underwrite new business, providing a crucial cushion against market volatility and maintaining stakeholder confidence.

Value Propositions

Brighthouse Financial's primary value is fostering long-term financial security for its customers. They offer a suite of annuity and life insurance products specifically crafted to safeguard accumulated assets and ensure reliable income throughout retirement years. This focus on enduring solutions provides clients with essential peace of mind and stability for the future.

Brighthouse Financial's Shield Level Annuities offer a compelling value proposition for customers concerned about market swings. These products are designed to provide a safety net, limiting downside risk while still allowing participation in potential market gains. This dual benefit addresses a key concern for many individuals planning for retirement, especially in today's volatile economic climate.

For instance, during periods of market uncertainty, like the economic shifts experienced in 2023 and early 2024, annuities with downside protection become particularly attractive. Brighthouse's approach allows clients to navigate these challenging times with greater confidence, knowing their principal is shielded to a certain extent. This balanced strategy is crucial for those seeking to preserve capital while still aiming for growth in their retirement portfolios.

Brighthouse Financial's core value proposition centers on providing guaranteed lifetime income solutions through its annuity products. This directly addresses a significant concern for retirees: outliving their savings.

These solutions offer a crucial safety net, ensuring a predictable income stream throughout retirement. For instance, Brighthouse Financial reported $16.8 billion in annuity sales in 2023, highlighting strong demand for these income-generating products.

This promise of consistent income provides immense financial confidence to individuals planning for or already in their retirement years, a segment increasingly prioritizing stability.

Comprehensive Life and Long-Term Care Planning

Brighthouse Financial offers robust life insurance policies, including innovative hybrid products like Brighthouse SmartCare. This particular product cleverly merges traditional death benefit protection with essential features designed to help cover long-term care expenses. This dual functionality presents a comprehensive strategy for financial planning, adeptly addressing both the desire to leave a legacy and the very real possibility of significant healthcare costs down the line.

The company’s approach emphasizes providing clients with integrated solutions that are both flexible and offer truly comprehensive coverage. For instance, in 2024, Brighthouse Financial continued to see strong demand for its life insurance products, with reports indicating a significant portion of their new sales volume coming from these more complex, value-added policies that cater to evolving consumer needs for financial security across different life stages.

These offerings empower individuals to proactively manage potential future healthcare needs without compromising their primary life insurance goals. This holistic view is crucial for financial wellness, ensuring that clients are better prepared for a wider array of life’s uncertainties.

- Holistic Financial Security: Combines life insurance with long-term care benefits.

- Product Innovation: Features like Brighthouse SmartCare offer integrated solutions.

- Addressing Future Needs: Proactively plans for potential healthcare expenses.

- Flexibility and Comprehensive Coverage: Provides adaptable solutions for diverse client needs.

Simplicity, Transparency, and Competitive Value

Brighthouse Financial prioritizes offering financial solutions that are easy to grasp and manage. Their product design emphasizes clarity, ensuring customers fully understand the terms and benefits of their policies. This approach fosters confidence and makes informed decision-making more accessible.

The company is committed to transparency in its pricing and product structures. This means customers can expect fair value for the features provided, with no hidden complexities. For instance, Brighthouse Financial's annuity products often highlight clear fee structures and guaranteed benefits, enabling clients to see exactly what they are paying for and what they can expect in return.

- Simplicity: Streamlined product offerings designed for easy understanding.

- Transparency: Clear communication regarding policy terms, benefits, and pricing.

- Competitive Value: Offering fair pricing for the financial protection and growth opportunities provided.

This dedication to straightforwardness and equitable value is crucial for building lasting relationships with clients. By focusing on these core principles, Brighthouse Financial aims to be a trusted partner in their customers' financial journeys, making complex financial planning feel more manageable.

Brighthouse Financial's value proposition includes providing accessible and understandable financial products, particularly annuities and life insurance. They aim to simplify complex financial planning, ensuring customers can make informed decisions with confidence.

This commitment to clarity extends to transparent pricing and product structures. For example, Brighthouse Financial's annuity products often feature straightforward fee disclosures and clearly defined guaranteed benefits, allowing clients to easily assess the value they receive.

The company's focus on competitive value means customers get fair pricing for the financial protection and potential growth opportunities offered by their policies. This approach builds trust and supports long-term client relationships.

| Value Proposition Aspect | Description | Supporting Data/Example |

|---|---|---|

| Clarity and Understanding | Products are designed for easy comprehension, fostering client confidence. | Focus on clear terms and benefits in annuity and life insurance policies. |

| Transparency | Open communication regarding policy details, pricing, and benefits. | Clear fee structures and guaranteed benefits highlighted in product offerings. |

| Competitive Value | Offering fair pricing for financial protection and growth. | Ensuring clients receive equitable value for their investment in policies. |

Customer Relationships

Brighthouse Financial primarily manages customer relationships indirectly through a network of independent financial advisors and broker-dealers. This strategic approach leverages the expertise and existing client connections of these intermediaries.

The company actively supports its advisor partners by providing comprehensive resources, ongoing training programs, and specialized tools. This ensures advisors are well-equipped to effectively represent Brighthouse products and serve their clients' needs.

In 2024, Brighthouse continued to invest in advisor enablement, recognizing that empowering these intermediaries is key to fostering strong, long-term client relationships. This model allows Brighthouse to reach a broad customer base while maintaining a focus on quality service delivered through trusted financial professionals.

Brighthouse Financial offers robust digital self-service through its online portals and company website. Customers can conveniently access policy details, financial statements, and a wealth of general resources anytime, anywhere. This digital-first approach aims to streamline information retrieval and empower policyholders.

In 2024, Brighthouse Financial continued to invest in enhancing its digital platforms, recognizing the growing customer preference for self-service options. While specific user engagement metrics are proprietary, the company's strategy emphasizes making policy information and support readily available online, aiming for improved customer satisfaction through accessible digital channels.

Brighthouse Financial operates dedicated customer service centers to manage policy inquiries, claims processing, and account management, aiming to be a reliable resource for its clients.

Despite some reported areas for improvement in customer experience, the company's focus remains on delivering essential support and resolving client needs efficiently.

In 2023, Brighthouse Financial reported a customer retention rate of approximately 90%, underscoring the importance of its service centers in maintaining client relationships.

Continuous investment in training and technology for these centers is vital to enhance service delivery and foster greater customer satisfaction and loyalty.

Educational Resources and Content

Brighthouse Financial offers a wealth of educational resources designed to demystify complex financial topics for both financial advisors and their clients. This commitment to knowledge sharing is crucial in helping individuals navigate the intricacies of retirement planning, understand market fluctuations, and consider long-term care solutions.

By providing accessible content, Brighthouse Financial empowers its customers to make well-informed decisions about their financial futures. This proactive approach fosters trust and strengthens the client-advisor relationship.

- Educational Hubs: Brighthouse Financial maintains dedicated online sections featuring articles, webinars, and guides on topics such as retirement income strategies and navigating market uncertainty.

- Advisor Support: Resources are tailored for financial professionals, offering insights into product features, sales strategies, and client communication best practices.

- Customer Empowerment: For end-customers, educational materials simplify concepts like annuities and life insurance, promoting greater financial literacy and confidence.

- Focus Areas: Key themes covered include retirement readiness, managing investment risk, and planning for unexpected healthcare costs, reflecting common consumer concerns.

Feedback Mechanisms and Continuous Improvement

Brighthouse Financial actively seeks to understand the evolving needs of both its customers and its network of financial advisors. This commitment to gathering insights is crucial for refining its diverse range of annuity and life insurance products and services.

While specific methodologies aren't always publicly detailed, common industry practices employed by companies like Brighthouse Financial would likely include:

- Customer Surveys: Regularly soliciting feedback through targeted surveys to gauge satisfaction and identify pain points.

- Advisor Feedback: Engaging directly with financial advisors who are on the front lines, understanding their experiences and suggestions for product enhancements or service improvements.

- Service Interaction Monitoring: Analyzing interactions across various service channels, such as call centers and online platforms, to pinpoint areas where customer support or product delivery can be optimized.

This continuous feedback loop is essential for Brighthouse Financial to remain agile, adapt to shifting market demands, and ultimately elevate the overall customer and partner experience.

Brighthouse Financial prioritizes customer relationships through a multi-faceted approach, emphasizing support for its intermediary network of financial advisors. This strategy is complemented by robust digital self-service options and dedicated customer service centers, all aimed at fostering informed decision-making and efficient issue resolution.

The company's commitment to empowering advisors with resources and training is a cornerstone of its relationship management. In 2024, Brighthouse continued to focus on these enablement initiatives, recognizing their direct impact on client satisfaction.

Digital platforms offer policyholders convenient access to information, with ongoing investments in 2024 to enhance these user-friendly interfaces. Customer service centers provide essential support for inquiries and claims, with a reported 90% customer retention rate in 2023 highlighting their effectiveness.

Brighthouse Financial also provides extensive educational resources, simplifying complex financial topics to enhance customer literacy and confidence. This educational outreach, coupled with active feedback gathering from both customers and advisors, allows Brighthouse to adapt and improve its offerings.

| Relationship Channel | Key Activities | 2024 Focus/Data Point |

|---|---|---|

| Financial Advisors | Product education, sales support, client communication | Continued investment in advisor enablement programs |

| Digital Self-Service | Policy access, financial statement retrieval, general resources | Enhancement of digital platforms for user preference |

| Customer Service Centers | Policy inquiries, claims processing, account management | Focus on efficient resolution and support delivery |

| Educational Resources | Articles, webinars, guides on financial planning | Empowering customers with knowledge for informed decisions |

Channels

Independent Financial Advisors and Broker-Dealers are Brighthouse Financial's core distribution engine. This expansive network of financial professionals serves as the primary conduit to a wide array of customers across the United States.

These advisors function as crucial, trusted partners, assisting individuals in navigating the complexities of financial product selection and acquisition. Their expertise ensures clients are well-guided in making choices that align with their financial objectives.

In 2024, Brighthouse Financial continued to rely on this channel, which provides unparalleled market penetration. The sheer breadth of this network allows Brighthouse to effectively serve diverse client needs and demographics throughout the nation.

Brighthouse Financial leverages strategic alliances with third-party platforms and financial institutions to broaden its product distribution. A prime example is its collaboration with BlackRock, offering products like LifePath Paycheck, which integrates Brighthouse's solutions into a wider financial planning framework.

These partnerships are crucial for expanding Brighthouse's market presence and accessing customer bases through established institutional channels. By embedding its specialized products within these ecosystems, Brighthouse enhances its reach and customer acquisition capabilities.

In 2024, such strategic collaborations are vital for navigating a competitive landscape, allowing Brighthouse to tap into diverse distribution networks and customer segments that might otherwise be inaccessible.

Brighthouse Financial leverages its company website and online portals as primary channels for engaging with investors, providing detailed product information, and enabling customer self-service. These digital touchpoints are crucial for disseminating information directly to clients and shareholders, fostering transparency and accessibility. In 2024, the company continued to enhance these platforms to offer a seamless experience for policyholders and investors alike, reflecting a commitment to digital engagement.

Marketing and Advertising Campaigns

Brighthouse Financial invests in marketing and advertising to boost brand recognition and inform consumers about its life insurance and annuity offerings. These campaigns are crucial for attracting new clients and assisting their network of financial advisors and distributors in reaching potential customers. In 2024, the company continued to emphasize digital marketing channels, alongside traditional media, to broaden its reach.

The company's marketing strategy focuses on communicating the value and security Brighthouse Financial provides. For instance, their advertising often highlights financial planning and retirement security, key concerns for their target demographic. This approach helps solidify their image as a trusted financial services provider.

- Brand Awareness: Campaigns are designed to increase recognition of the Brighthouse Financial brand in the competitive financial services market.

- Product Education: Marketing efforts aim to clearly explain the benefits and features of their life insurance and annuity products.

- Distribution Support: Advertising initiatives are created to drive leads and support the sales activities of their distribution partners.

- Market Positioning: Campaigns reinforce Brighthouse Financial's standing as a significant player in the retirement and life insurance sectors.

Direct Communication (Email, Mail)

Brighthouse Financial utilizes direct communication channels like email and physical mail primarily for investor relations and customer service. These channels are crucial for disseminating important updates, such as regulatory disclosures and policy-specific information, directly to stakeholders. For instance, in 2024, Brighthouse Financial continued to leverage email for timely investor alerts and quarterly earnings reports.

While not a direct sales driver, these communication methods are vital for nurturing existing customer relationships and ensuring compliance with communication mandates. This direct line of communication guarantees policyholders receive critical information promptly and efficiently.

- Investor Relations: Email alerts for earnings, SEC filings, and significant corporate news.

- Customer Service: Mail and email for policy statements, benefit updates, and important notices.

- Regulatory Compliance: Ensuring all required disclosures reach policyholders and investors.

- Relationship Management: Maintaining trust and transparency through consistent direct outreach.

Brighthouse Financial's channels are a blend of traditional and digital methods, ensuring broad reach and engagement. The company primarily distributes its products through independent financial advisors and broker-dealers, a network that provided extensive market penetration in 2024. Strategic alliances with third-party platforms and institutions, such as collaborations with BlackRock, further expand its distribution capabilities by embedding Brighthouse solutions into wider financial planning frameworks.

Customer Segments

Retirees and pre-retirees represent a crucial segment for Brighthouse Financial, focusing on those nearing or already in retirement. Their primary concerns revolve around securing a reliable income for life and safeguarding their accumulated wealth from market downturns. For instance, in 2024, a significant portion of the baby boomer generation is entering retirement age, increasing the demand for products that address longevity risk.

Brighthouse Financial caters to this demographic by offering annuity products designed to provide guaranteed lifetime income. These solutions aim to alleviate the fear of outliving one's savings, a common anxiety among older adults. The company's commitment to capital preservation also resonates strongly, as this group prioritizes stability over aggressive growth strategies.

Affluent and high net worth individuals possess significant assets, often exceeding $1 million in investable assets, and necessitate intricate financial planning. These clients demand sophisticated strategies for tax-efficient wealth transfer and robust protection measures, looking for solutions that go beyond basic financial products.

For this segment, Brighthouse Financial offers customized annuity and life insurance products. These are designed with flexibility and strong guarantees in mind, directly addressing the need for secure and adaptable wealth management tools. For instance, Brighthouse's variable annuities can provide potential for growth alongside guaranteed income benefits, appealing to those seeking both upside and downside protection.

Crucially, these high-net-worth clients typically engage with financial advisors. This collaborative approach ensures that their complex financial situations are thoroughly understood, leading to the development of highly personalized plans that align with their long-term objectives for legacy planning and wealth preservation.

Individuals seeking long-term care protection represent a key customer segment for Brighthouse Financial. These are typically individuals, often in their middle to later years, who are proactively planning for potential future healthcare needs that traditional health insurance may not fully cover. They understand the significant financial burden long-term care can impose, not just on themselves but also on their families.

Brighthouse Financial's product offerings, such as Brighthouse SmartCare, directly address this concern. This product allows individuals to integrate long-term care benefits with life insurance policies, offering a dual purpose. This innovative approach appeals to those who want to ensure their loved ones are financially secure while also having a safety net for potential long-term care expenses. The demand for such integrated solutions is growing as awareness of longevity and associated care costs increases.

The financial planning landscape is evolving, and the need for comprehensive solutions that address longevity risk is becoming more pronounced. For instance, the U.S. Department of Health and Human Services projects that a significant percentage of individuals turning 65 will require some form of long-term care during their lifetime. This statistic underscores the market opportunity for products like Brighthouse SmartCare, which provide a structured way to manage these future financial challenges.

Clients of Independent Financial Advisors

Clients of independent financial advisors represent a significant and diverse group seeking personalized financial guidance. These individuals and families prioritize professional advice and tailored solutions to navigate their financial journeys. Brighthouse Financial's strategy is deeply intertwined with this segment, leveraging a robust network of independent advisors to reach them.

This client base often seeks assistance with retirement planning, investment management, and insurance needs. In 2024, approximately 65% of individuals with over $100,000 in investable assets reported working with a financial advisor, highlighting the importance of this channel. These clients value the expertise and objective recommendations provided by their advisors.

- Preference for Personalized Advice: Clients actively seek advisors who understand their unique financial situation and goals.

- Trust in Professional Guidance: A strong emphasis is placed on the advisor's expertise and ability to provide objective recommendations.

- Value Tailored Solutions: Clients expect financial products and strategies to be customized to their specific needs, not one-size-fits-all approaches.

- Long-Term Relationships: Many clients develop long-term relationships with their advisors, viewing them as trusted partners in their financial well-being.

Families Seeking Financial Protection

Families seeking financial protection are primarily concerned with ensuring their loved ones are financially secure should an unexpected event occur. This often translates into a strong demand for life insurance policies that provide a death benefit. For instance, in 2024, life insurance remains a cornerstone for many households aiming for future stability.

This segment prioritizes comprehensive coverage that offers reliable financial support for dependents. They are looking for solutions that provide peace of mind, knowing their family's financial needs will be met. The focus is on safeguarding against the financial impact of premature death.

- Primary Goal: Financial security for dependents.

- Key Product: Life insurance policies with death benefits.

- Motivation: Ensuring future financial stability for loved ones.

- Coverage Need: Reliable and comprehensive protection.

Brighthouse Financial serves a diverse clientele, with a strong focus on individuals and families prioritizing financial security and long-term planning. This includes pre-retirees and retirees seeking stable income, affluent individuals needing sophisticated wealth management, and families looking for protection against life's uncertainties. The company also actively engages with clients of independent financial advisors, recognizing the value of professional guidance in this market.

A significant portion of Brighthouse's customer base consists of those planning for retirement and seeking guaranteed income streams. For example, in 2024, the demand for annuity products that offer lifetime income continued to rise, driven by increased longevity expectations. These customers, often baby boomers, prioritize capital preservation and predictable income over aggressive investment strategies.

Affluent individuals with substantial assets, typically over $1 million, represent another key segment. They require complex solutions for tax efficiency, wealth transfer, and robust asset protection. Brighthouse addresses these needs through customized variable annuities and life insurance, offering potential growth alongside strong guarantees, a crucial element for this discerning group.

The company also targets individuals concerned with long-term care needs, offering integrated solutions like Brighthouse SmartCare. This product combines long-term care benefits with life insurance, providing a dual layer of financial security. Projections indicate a growing need for such products, with a significant percentage of individuals aged 65 and older expected to require long-term care services.

| Customer Segment | Key Needs | Brighthouse Solutions | 2024 Market Context |

|---|---|---|---|

| Retirees & Pre-Retirees | Guaranteed lifetime income, wealth preservation | Annuities, retirement income solutions | Increased demand for income stability as baby boomers retire. |

| Affluent & High Net Worth | Tax-efficient wealth transfer, asset protection, sophisticated planning | Customized annuities, life insurance with strong guarantees | Focus on tailored, flexible products for complex financial situations. |

| Long-Term Care Seekers | Financial protection for future healthcare needs | Integrated life insurance and long-term care products (e.g., Brighthouse SmartCare) | Growing awareness of longevity risk and associated care costs. |

| Clients of Independent Advisors | Personalized financial advice, tailored investment and insurance solutions | Products distributed through advisor networks | High utilization of advisors by individuals with significant investable assets. |

| Families Seeking Protection | Financial security for dependents, life insurance coverage | Life insurance policies with death benefits | Life insurance remains a fundamental tool for future family financial stability. |

Cost Structure

The core of Brighthouse Financial's cost structure revolves around fulfilling its promises to policyholders. This means the money paid out for annuity income streams, death benefits for life insurance, and any reimbursements for long-term care are the most substantial expenses. In 2023, Brighthouse paid out $12.9 billion in net benefits and claims, underscoring the significance of this cost category.

Effectively managing these payouts is paramount to the company's financial health. Brighthouse employs sophisticated actuarial analysis to ensure they have sufficient reserves to meet future obligations. They also utilize hedging strategies to mitigate the financial risks associated with market fluctuations impacting these benefit payments.

Brighthouse Financial incurs substantial costs for underwriting and risk management, essential for its insurance operations. These expenses cover actuarial analysis to price policies accurately, hedging strategies to mitigate market volatility, and ensuring compliance with stringent regulatory requirements.

For instance, in 2023, Brighthouse Financial reported $1.1 billion in operating expenses, a significant portion of which is allocated to these critical functions. These investments are paramount for maintaining the company's financial stability and its ability to fulfill long-term policyholder obligations, directly impacting profitability.

Operating and corporate expenses encompass the essential costs of running Brighthouse Financial, including salaries for its workforce, the technology powering its operations, and the upkeep of its office spaces. These are the fundamental overheads required to keep the business functioning daily.

Brighthouse Financial has made a point of managing these expenses diligently, actively seeking ways to trim corporate costs. For instance, in 2023, the company reported progress in its expense reduction initiatives, aiming to streamline operations and enhance efficiency.

These cost-saving measures are crucial because efficient operations directly translate into improved profitability. By controlling overheads, Brighthouse Financial can better allocate resources and boost its bottom line.

Distribution and Marketing Costs

Brighthouse Financial incurs significant expenses in its distribution and marketing efforts. These costs are crucial for building and maintaining its sales channels and brand visibility. For instance, in 2024, the company continued to invest in its network of financial advisors, which is a primary driver of product sales.

These expenditures cover various aspects, including compensation for financial professionals who sell Brighthouse products, support for the broader distribution network, and comprehensive marketing and advertising campaigns designed to enhance product awareness and attract new customers. A robust distribution franchise is directly linked to achieving sales growth targets.

- Advisor Compensation: Costs associated with paying commissions, bonuses, and other incentives to financial advisors and agents.

- Distribution Network Support: Expenses for training, technology, and operational support provided to intermediaries.

- Marketing and Advertising: Outlays for campaigns across various media to promote Brighthouse's life insurance and annuity products.

- Sales Growth Investment: Funds allocated to strengthen the distribution channels, recognizing their importance for increasing market share.

Investment Management Expenses

Investment management expenses are a significant component of Brighthouse Financial's cost structure, directly impacting profitability. These costs encompass fees paid to external asset managers, if utilized, as well as the expenses associated with internal investment teams, including salaries and operational overhead. For context, in 2024, the financial services industry generally saw continued pressure on management fees due to increased competition and investor demand for lower-cost options. Trading costs, another element of these expenses, can fluctuate based on market volatility and trading volume.

Efficiently managing these investment operations is crucial for Brighthouse Financial's overall financial health. While the investment portfolio is designed to generate income, the costs incurred in its active management are a necessary expenditure. Optimizing these costs, perhaps through strategic partnerships or internal efficiencies, directly contributes to the company's ability to achieve its profitability targets. For instance, a focus on reducing trading costs through more algorithmic execution or careful broker selection can yield tangible savings.

- Asset Management Fees: Costs associated with paying external firms to manage portions of the investment portfolio.

- Internal Investment Team Costs: Salaries, benefits, and operational expenses for Brighthouse's in-house investment professionals.

- Trading and Transaction Costs: Expenses incurred when buying or selling securities within the investment portfolio, including brokerage fees and market impact.

- Research and Data Costs: Expenditures on market research, financial data subscriptions, and analytical tools necessary for informed investment decisions.

The cost structure of Brighthouse Financial is primarily driven by the significant expenses associated with fulfilling policyholder obligations, including benefits and claims payouts. These payouts are the largest cost category, as evidenced by the $12.9 billion in net benefits and claims paid out in 2023. Managing these payouts efficiently through actuarial analysis and hedging strategies is critical for financial stability.

Operating expenses, including underwriting, risk management, and corporate overhead, represent another substantial cost. In 2023, operating expenses totaled $1.1 billion, reflecting investments in actuarial analysis, regulatory compliance, and general business operations. Diligent management of these costs is essential for profitability.

Distribution and marketing costs are vital for sales growth, encompassing advisor compensation, network support, and advertising campaigns. Brighthouse continued to invest in its financial advisor network in 2024 to drive product sales. Investment management expenses, including asset management fees and trading costs, are also significant, with industry-wide pressure on fees continuing in 2024.

| Cost Category | 2023 Data (USD Billions) | Key Components |

|---|---|---|

| Benefits and Claims | 12.9 | Annuity income, death benefits, long-term care reimbursements |

| Operating Expenses | 1.1 | Underwriting, risk management, actuarial analysis, corporate overhead |

| Distribution & Marketing | N/A (Ongoing Investment) | Advisor compensation, network support, advertising |

| Investment Management | N/A (Industry Pressure) | Asset management fees, internal team costs, trading costs |

Revenue Streams

Brighthouse Financial's primary revenue generation stems from the sale of a diverse range of annuity products. These include variable annuities, fixed annuities, Shield Level annuities, and fixed indexed annuities, all of which contribute through initial premiums and ongoing fees.

These fees cover product management and any additional riders selected by the customer, creating a recurring revenue component. The company has experienced robust annuity sales, highlighting their significance as a core revenue driver.

For instance, Brighthouse Financial reported approximately $1.2 billion in total net inflows for their annuity segment in the first quarter of 2024, demonstrating continued customer demand and strong sales performance.

Brighthouse Financial generates substantial revenue from life insurance premiums, collected from a diverse range of policyholders. This includes income from products like Brighthouse SmartCare, a critical component of their financial planning offerings.

The company’s product mix heavily relies on life insurance sales, which provide a consistent and predictable income stream. This segment is crucial for Brighthouse Financial's ongoing financial health and growth strategy.

In recent periods, Brighthouse Financial has achieved record life insurance sales, demonstrating robust demand and successful market penetration. For instance, in the first quarter of 2024, the company reported strong sales figures, reflecting positive momentum in this key revenue-generating area.

Net Investment Income is a cornerstone of Brighthouse Financial's revenue, stemming from the substantial investment portfolio backing policyholder reserves. This income encompasses interest, dividends, and capital gains earned across a diversified range of assets.

In 2024, Brighthouse Financial reported significant investment income, a critical driver of profitability. The company's ability to skillfully manage its investment portfolio, optimizing for both yield and risk, directly influences the size of this vital revenue stream.

Fees from Product Features and Riders

Brighthouse Financial generates additional revenue through fees for specific product features, riders, and guarantees embedded within its annuity and life insurance offerings. These optional components provide policyholders with enhanced benefits, such as guaranteed income or death benefit enhancements, for which they pay a fee.

These fees are a crucial part of Brighthouse's revenue model, representing the value-added services that differentiate its products. For instance, riders offering lifetime income benefits or death benefit protection contribute directly to fee income.

In 2024, the company continues to leverage these fee-based revenue streams. While specific figures for fee income from riders and features are often integrated within broader financial reporting categories, they are a consistent contributor to profitability. For example, in their 2023 annual report, Brighthouse highlighted the importance of its diverse product suite, which includes numerous riders designed to meet specific customer needs, thereby driving fee-based revenue.

- Fees from product features and riders: These are charges for optional enhancements to core annuity and life insurance products.

- Value-added services: These fees reflect the additional benefits and protections policyholders receive, such as guaranteed lifetime income or enhanced death benefits.

- Revenue diversification: This stream contributes to the company's overall financial stability by providing income beyond basic policy premiums.

- 2024 focus: Brighthouse continues to emphasize product innovation that includes attractive riders and features, aiming to grow this fee-based revenue component.

Reinsurance Income (if applicable)

While Brighthouse Financial primarily uses reinsurance to transfer risk, it's possible for an insurer to generate income by accepting reinsurance from other companies. This strategy, though less central to Brighthouse's model, represents a potential revenue avenue that can be pursued based on market conditions and strategic objectives. In 2023, Brighthouse reported total net investment income of $7.6 billion, showcasing the significance of its investment portfolio which supports its core insurance operations.

The net impact of these reinsurance activities, whether ceding or assuming risk, directly influences the company's overall financial performance and profitability. This dynamic interplay is crucial for managing capital and ensuring solvency within the insurance sector.

- Reinsurance Income Potential: Insurers can earn revenue by underwriting risks ceded by other insurance companies.

- Strategic Flexibility: The decision to assume reinsurance depends on market opportunities and the company's risk appetite.

- Financial Impact: Reinsurance transactions, both inward and outward, directly affect an insurer's financial results and capital management.

Brighthouse Financial's revenue streams are primarily driven by its extensive annuity and life insurance businesses. The company also benefits significantly from net investment income generated by its substantial investment portfolio. Additionally, fees from product features and riders, along with potential income from reinsurance activities, contribute to its overall financial performance.

| Revenue Stream | Description | 2024 Data/Commentary |

|---|---|---|

| Annuity Sales | Premiums and fees from variable, fixed, and fixed indexed annuities. | Q1 2024: Approximately $1.2 billion in total net inflows for annuities. |

| Life Insurance Premiums | Income from various life insurance policies, including products like Brighthouse SmartCare. | Strong sales figures reported in Q1 2024, indicating robust demand. |

| Net Investment Income | Interest, dividends, and capital gains from the investment portfolio. | 2023: $7.6 billion in total net investment income. |

| Fees from Product Features & Riders | Charges for optional enhancements and guarantees in insurance and annuity products. | Consistent contributor to profitability; emphasized in 2023 annual report for driving fee-based revenue. |

| Reinsurance Income | Potential revenue from assuming risks from other insurance companies. | Less central, but offers strategic flexibility based on market conditions. |

Business Model Canvas Data Sources

The Brighthouse Financial Business Model Canvas is informed by a robust combination of internal financial statements, actuarial data, and regulatory filings. These sources provide a foundational understanding of the company's operations, financial health, and risk management practices.