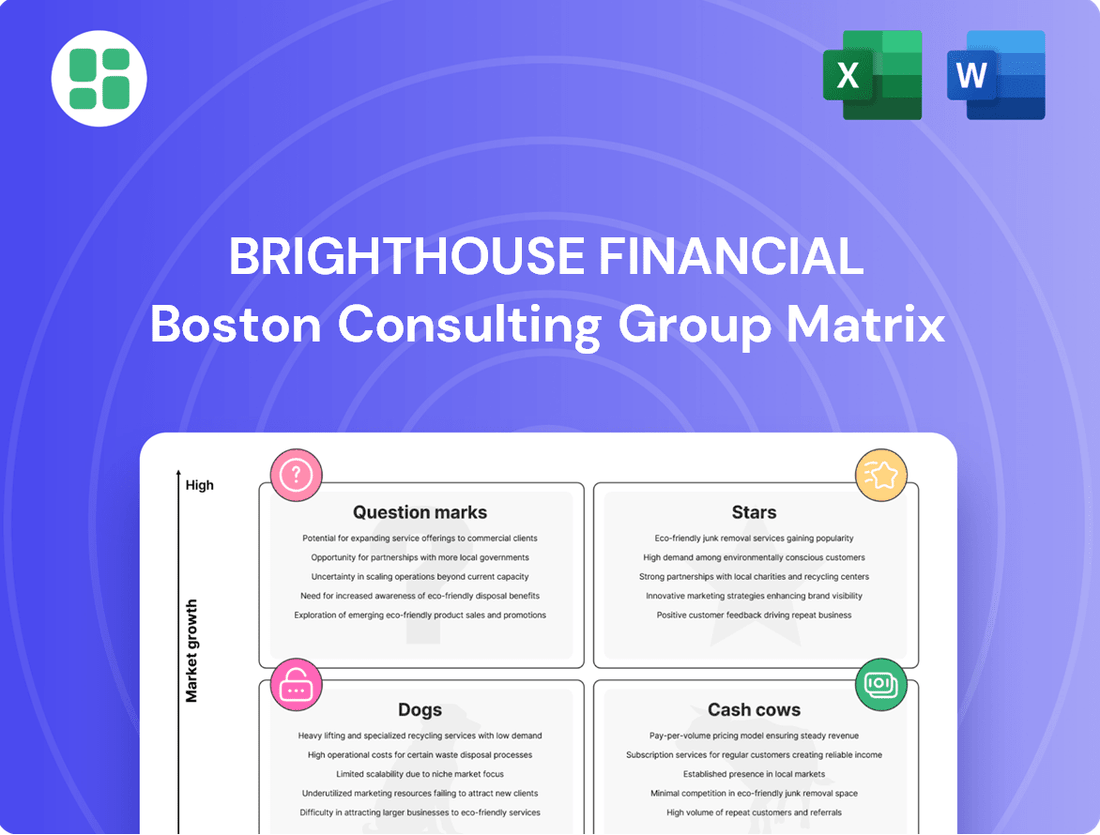

Brighthouse Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brighthouse Financial Bundle

Brighthouse Financial's BCG Matrix offers a crucial lens to understand its product portfolio's market share and growth potential. Are its annuity products Stars or Cash Cows, generating consistent revenue, or are newer offerings still Question Marks needing investment?

This preview hints at the strategic positioning, but for a complete picture and actionable insights, you need the full BCG Matrix. Uncover the detailed quadrant placements and understand where Brighthouse Financial should focus its resources for optimal growth and profitability.

Don't guess about your company's future; know it. Purchase the full Brighthouse Financial BCG Matrix to gain a data-driven roadmap for smart investment decisions and a clear competitive advantage.

Stars

Brighthouse Shield Level Annuities are a star in Brighthouse Financial's portfolio, showing robust sales and market leadership in registered index-linked annuities. In 2024, these annuities achieved a record $7.7 billion in sales, marking a significant 12% jump from the previous year.

This impressive momentum carried into 2025, with first-quarter sales reaching $2.0 billion and second-quarter sales hitting $1.9 billion. This sustained strong performance solidifies their status as a key growth driver for the company.

Brighthouse SecureKey Fixed Indexed Annuities, introduced in 2023, are a standout performer for Brighthouse Financial. These annuities experienced a remarkable 72% surge in sales during 2024, demonstrating their strong appeal in the market.

This product's success is a key driver in expanding Brighthouse Financial's reach within the fixed indexed annuity sector. The significant sales growth points to a substantial market share in a segment that is experiencing robust customer interest due to its combination of principal protection and growth potential.

The Enhanced Brighthouse SmartCare Life Insurance, a cornerstone of Brighthouse Financial's offerings, demonstrated remarkable momentum. In 2024, this flagship product achieved record sales totaling $120 million, representing an impressive 18% surge from the previous year.

These enhancements, rolled out in 2024, were strategically designed to ensure the product remained a leading choice for consumers, adapting to their changing requirements. The positive trajectory continued into the first half of 2025, with life sales climbing an additional 21% compared to the same period in 2024, underscoring its robust market standing and sustained growth.

Leadership in Registered Index-Linked Annuity (RILA) Market

Brighthouse Financial is focused on solidifying its leading position within the Registered Index-Linked Annuity (RILA) sector. This strategic emphasis is fueled by the ongoing strong performance of its Shield annuity products.

The broader U.S. annuity market, which encompasses RILAs, demonstrated impressive growth. In 2024, total U.S. annuity sales reached significant levels, underscoring the market's vitality.

- RILA Market Dominance: Brighthouse Financial's consistent high sales in the RILA segment highlight its leadership.

- Market Growth Trajectory: The overall U.S. annuity market, including RILAs, experienced robust expansion in 2024.

- Shield Product Success: The strong sales of Brighthouse's Shield annuities are a key driver of its RILA market leadership.

- Strategic Focus: Maintaining leadership in the high-growth RILA market is a core objective for Brighthouse Financial.

Strategic Product Innovation in Annuities

Brighthouse Financial’s strategic product innovation in annuities is a key driver of its market position. The company has focused on enhancing its existing Shield annuity products, which are designed to offer protection and growth potential. For instance, in 2024, Brighthouse continued to refine these offerings to better align with current economic conditions and investor needs.

The successful launch of SecureKey in 2024 further demonstrates this commitment. This new product aims to provide enhanced flexibility and security for annuity holders. By introducing innovative solutions like SecureKey, Brighthouse is actively responding to evolving customer demands for more adaptable and reliable retirement income solutions.

This proactive approach to product development is crucial for maintaining a competitive edge in the annuity market. Brighthouse’s investment in innovation ensures its product suite remains relevant and attractive to a broad range of investors seeking long-term financial security.

- Shield Annuity Enhancements: Ongoing updates to existing Shield products in 2024 to meet market demands.

- SecureKey Launch: Introduction of the SecureKey annuity in 2024, offering increased flexibility and security.

- Market Responsiveness: Strategic focus on adapting annuity offerings to evolving customer needs and economic landscapes.

- Competitive Positioning: Product innovation aimed at maintaining and strengthening Brighthouse's standing in the dynamic annuity sector.

Brighthouse Financial's Shield Level Annuities are clearly stars in their product lineup. These registered index-linked annuities (RILAs) have shown exceptional sales growth, reaching a record $7.7 billion in 2024, a 12% increase from the prior year. This strong performance continued into 2025, with first-half sales reaching $3.9 billion. The SecureKey Fixed Indexed Annuity, launched in 2023, also experienced a significant 72% sales surge in 2024, further solidifying Brighthouse's strength in the annuity market.

The Enhanced Brighthouse SmartCare Life Insurance also shines, with 2024 sales hitting $120 million, an 18% increase year-over-year. Life sales in the first half of 2025 were up 21% compared to the same period in 2024. These products represent key growth areas, demonstrating Brighthouse's ability to innovate and capture market share in competitive segments.

| Product | 2024 Sales (Billions) | YoY Growth (2024) | 2025 H1 Sales (Billions) |

|---|---|---|---|

| Brighthouse Shield Level Annuities | $7.7 | 12% | $3.9 |

| Brighthouse SecureKey Fixed Indexed Annuities | N/A (Launched 2023) | 72% | N/A |

| Enhanced Brighthouse SmartCare Life Insurance | $0.120 | 18% | N/A |

What is included in the product

This BCG Matrix analysis provides a tailored view of Brighthouse Financial's product portfolio, categorizing each unit to guide investment and divestment strategies.

A clear Brighthouse Financial BCG Matrix overview simplifies strategic decisions, relieving the pain of complex analysis.

Cash Cows

Brighthouse Financial's established fixed annuity portfolio, despite ongoing reinsurer transitions, continues to be a reliable source of stable cash flow. These offerings appeal to investors prioritizing principal protection and guaranteed returns over market volatility.

In the second quarter of 2025, fixed annuities played a significant role in Brighthouse's overall annuity sales, underscoring their enduring appeal and the company's strong, albeit mature, position in this segment.

Brighthouse Financial's in-force traditional life insurance policies are a significant Cash Cow. These policies, accumulated over time, provide a steady stream of premium income and predictable cash flows, bolstering the company's financial stability. For instance, as of the first quarter of 2024, Brighthouse reported approximately $1.4 billion in total net investment income, with a substantial portion attributable to its life insurance segments.

While the company strategically emphasizes growth in newer products like SmartCare, the established block of traditional life policies continues to be a reliable revenue generator. This enduring income stream ensures a consistent financial foundation, even as the company innovates its product offerings. The predictable nature of these liabilities further solidifies their role as a stable contributor to Brighthouse's overall financial health.

Brighthouse Financial's older variable annuity blocks, when well-hedged, function as reliable cash cows. These in-force segments consistently deliver fee income derived from their assets under management, and their value is protected by sophisticated risk management techniques that buffer against market downturns.

The company's commitment to refining its hedging strategies is crucial for maintaining the stability and profitability of these established annuity portfolios. This focus ensures a dependable revenue stream, even amidst fluctuating economic conditions, supporting overall financial health.

General Account Products Generating Stable Investment Income

Brighthouse Financial's general account products, such as fixed annuities and life insurance policies, are designed to generate stable investment income. These products are supported by a broadly diversified portfolio of high-quality fixed-income securities and other assets, aiming to smooth out returns. For instance, in the first quarter of 2024, Brighthouse reported net investment income of $1.9 billion, a significant portion of which is attributable to these general account assets.

These offerings are generally less volatile than market-sensitive products, providing a predictable revenue stream that bolsters the company's financial resilience. This consistent income is crucial for covering operational expenses and maintaining a strong capital position. The company's focus on these stable earners helps ensure reliable profitability, even during periods of market uncertainty.

- Stable Income Generation: Brighthouse's general account products are engineered for consistent investment income.

- Diversified Portfolio Support: These products are backed by a wide array of investments, reducing risk.

- Market Resilience: They exhibit lower sensitivity to market downturns, ensuring reliability.

- Profitability Contribution: In Q1 2024, net investment income reached $1.9 billion, highlighting the importance of these assets.

Consistent Premium-Generating Universal Life Policies

Brighthouse Financial's consistent premium-generating universal life policies, especially those past their surrender periods, act as significant cash cows. These policies represent a stable, predictable revenue stream, drawing on a loyal, long-term customer base. Their established nature means they require minimal new capital infusion for ongoing support, unlike more volatile or growth-oriented products.

These mature universal life policies are vital for Brighthouse's financial stability. They provide a reliable source of funds that can be reinvested or used to support other business segments. For instance, in 2024, the life insurance sector continued to demonstrate resilience, with companies like Brighthouse leveraging their in-force blocks of business. While specific figures for these mature policies aren't publicly itemized separately from the broader universal life segment, the overall life insurance industry's performance in 2024 indicated sustained demand for such products.

- Stable Revenue: Mature universal life policies offer predictable premium income.

- Low Investment Needs: Require less capital for maintenance compared to growth products.

- Customer Loyalty: Benefit from a long-term, established customer base.

- Cash Flow Generation: Contribute significantly to the company's overall cash flow.

Brighthouse Financial's established fixed annuity and traditional life insurance portfolios are key cash cows. These mature products, characterized by steady premium income and predictable cash flows, require minimal new capital investment. Their stability is further enhanced by a diversified portfolio of high-quality fixed-income securities within the general account, which generated $1.9 billion in net investment income in Q1 2024.

| Product Segment | Key Characteristic | Financial Contribution |

| Fixed Annuities | Stable, guaranteed returns | Reliable cash flow, stable sales |

| Traditional Life Insurance | Steady premium income | Predictable cash flows, financial stability |

| General Account Products | Consistent investment income | $1.9B Net Investment Income (Q1 2024) |

Full Transparency, Always

Brighthouse Financial BCG Matrix

The Brighthouse Financial BCG Matrix preview you're currently viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, crafted by industry experts, is ready for immediate integration into your strategic planning, offering actionable insights into Brighthouse's product portfolio performance.

Dogs

The legacy variable annuity run-off block at Brighthouse Financial represents older business lines that are capital-intensive and less profitable. The company is actively pursuing strategies to reduce its exposure to this segment, aiming to improve overall financial performance. In 2023, Brighthouse continued its efforts to manage this block, which has historically presented challenges to profitability.

Certain fixed deferred annuity products at Brighthouse Financial saw a dip in sales during 2024, largely attributed to a necessary shift to a new reinsurer. This operational change temporarily impacted sales figures, creating a period of underperformance for these specific offerings.

Despite a sales recovery observed in the third quarter of 2024, the initial disruption highlights a potential challenge for older or less competitive versions of these annuities. They may find it difficult to recapture substantial market share or achieve robust profitability when contrasted with Brighthouse's more contemporary and market-aligned products.

This segment warrants a thorough strategic review to prevent it from evolving into a drain on resources. The focus should be on assessing whether these underperforming fixed deferred annuities can be revitalized or if they represent a strategic divestment opportunity to redirect capital towards more promising areas of the business.

Outdated traditional life insurance policies, especially those not aligned with Brighthouse Financial's evolving SmartCare offerings, can be categorized as dogs in the BCG matrix. These legacy products often struggle to compete on features, pricing, and updated benefit structures, leading to declining new sales. For instance, in 2024, policies lacking features like flexible riders or competitive long-term care benefits saw a significant drop in market appeal compared to newer, more comprehensive solutions.

These policies typically exhibit low new business premiums and may face increased customer churn through surrenders, demanding administrative resources without generating proportional revenue. The administrative burden associated with maintaining these older blocks of business can outweigh the financial contribution they make, hindering overall profitability and growth initiatives.

Products Requiring Excessive Capital for Minimal Returns

Products within Brighthouse Financial that require substantial capital for limited returns are considered 'dogs' in the BCG matrix. These are typically legacy products or those with declining market share and low growth potential, making them capital drains. For instance, older annuity products with guaranteed benefits that are no longer competitive or attract new business can fall into this category. Such products may have high surrender charges, limiting customer mobility, but also represent a drag on the company's financial resources.

The company's strategic imperative to improve capital efficiency means these 'dog' products are prime candidates for divestiture or a deliberate reduction in their presence. This aligns with a broader industry trend of insurers shedding less profitable or capital-intensive business lines. Brighthouse Financial's stated goal of optimizing its capital structure, particularly in light of its debt obligations, makes addressing these low-return assets a critical focus. For example, in Q1 2024, Brighthouse reported total debt of approximately $11.5 billion, underscoring the need for efficient capital deployment.

- Legacy Annuity Products: Older, guaranteed-benefit annuities that are capital-intensive to maintain and offer minimal new sales.

- Underperforming Life Insurance Lines: Certain whole life or universal life policies with high administrative costs and low profit margins.

- Products with High Solvency Requirements: Offerings that necessitate significant capital reserves due to their guaranteed features or market sensitivities.

- Non-Core or Divested Business Remnants: Portfolios or product features retained from past acquisitions that no longer fit the current strategic direction.

Discontinued or Non-Core Product Lines

Brighthouse Financial's discontinued or non-core product lines, fitting the 'dog' category in the BCG matrix, represent offerings that no longer align with the company's strategic direction. These are typically products with declining market share and low growth potential, often managed for their existing customer base rather than for new business generation. For instance, if Brighthouse were to exit a specific type of legacy variable annuity product with high surrender charges and minimal new sales, it would likely be categorized as a dog.

These segments often require ongoing administrative support and capital allocation but contribute little to the company's overall growth or profitability. Managing these "dogs" involves a strategy of run-off, focusing on servicing existing policyholders until the contracts naturally expire. This approach aims to free up resources that can be reinvested in more promising areas of the business, such as their core annuity and life insurance products.

- Discontinued Products: Examples include specific legacy life insurance policies or annuity riders that are no longer actively sold.

- Non-Core Offerings: These might be specialized insurance products with limited market appeal or those that don't fit the primary annuity and life insurance strategy.

- Resource Drain: Such lines consume operational and capital resources without generating significant new revenue or strategic advantage.

- Run-Off Strategy: The focus shifts to managing existing in-force business, minimizing new sales and administrative costs until contracts naturally terminate.

Dogs in Brighthouse Financial's portfolio, often legacy products like certain older annuities or life insurance policies, are characterized by low market share and minimal growth prospects. These offerings typically demand significant administrative resources and capital for what amounts to little return, acting as a drag on overall financial performance. For instance, by the end of 2023, Brighthouse continued to manage its legacy variable annuity block, which, while representing older business, was capital-intensive and less profitable, fitting the 'dog' profile.

The strategic approach for these 'dog' products usually involves a run-off strategy, focusing on servicing existing policyholders rather than pursuing new sales. This allows the company to free up capital and resources that can be redirected to more profitable and growth-oriented business lines. In 2024, Brighthouse's efforts to manage underperforming fixed deferred annuities, partly due to a reinsurer transition, highlighted the challenges of revitalizing older products or the need for divestment.

These underperforming segments require careful assessment to determine if they can be revitalized or if they represent an opportunity for strategic divestment. The company's overall goal of improving capital efficiency makes addressing these low-return assets a critical focus, especially considering its debt obligations. As of Q1 2024, Brighthouse Financial reported total debt of approximately $11.5 billion, underscoring the importance of efficient capital deployment away from 'dog' products.

Identifying and managing these 'dog' products is crucial for Brighthouse Financial's strategic objectives. By shedding or running off these low-growth, high-cost segments, the company can better allocate resources to its core, more competitive offerings, thereby enhancing overall profitability and shareholder value. This aligns with a broader industry trend of insurers streamlining their portfolios.

| Product Category | BCG Matrix Classification | Key Characteristics | Brighthouse Financial Example (2023-2024) | Strategic Implication |

| Legacy Variable Annuities | Dog | Capital-intensive, low profitability, declining new sales | Run-off block managed for capital efficiency | Run-off or divestment to free capital |

| Certain Fixed Deferred Annuities | Dog | Sales impacted by operational changes, potential difficulty in recapturing market share | Sales dip in 2024 due to reinsurer shift | Strategic review for revitalization or divestment |

| Outdated Traditional Life Insurance | Dog | Low market appeal, declining new sales, high administrative costs | Policies lacking flexible riders or competitive long-term care benefits | Focus on core SmartCare offerings |

Question Marks

Brighthouse Financial's 2024 expansion into the institutional market with BlackRock's LifePath Paycheck™ solution marks a strategic move. This new channel saw initial deposits, indicating early adoption and potential for future growth in the defined contribution plan space.

While the LifePath Paycheck™ offering presents a significant growth opportunity by tapping into the worksite channel and reaching new customer segments, its current market share remains modest. The gradual implementation by defined contribution plans suggests that inflows are anticipated to be uneven, reflecting the developmental stage of this initiative.

Brighthouse Financial is actively pursuing new digital transformation initiatives, focusing on leveraging advanced analytics and digital platforms. These efforts are designed to streamline core operations like underwriting and policy administration, while simultaneously elevating the customer experience. This strategic pivot aims to capture high-growth potential within an increasingly tech-driven industry.

The company's investment in these areas is substantial, reflecting a commitment to operational efficiency and enhanced customer engagement. For instance, in 2024, Brighthouse Financial reported dedicating a significant portion of its technology budget to these digital advancements, aiming to improve underwriting accuracy and speed, which could lead to a more competitive market position.

While these initiatives hold considerable promise for future growth, their ultimate market impact and return on investment remain subjects of ongoing evaluation. The significant upfront capital required for these digital transformations necessitates careful monitoring of key performance indicators to ensure alignment with strategic objectives and financial targets.

Brighthouse Financial's emerging niche annuity offerings represent their 'Question Marks' in the BCG matrix. These innovative products, designed for specific market segments or evolving retirement needs, are positioned in high-growth areas but currently have a low market share. For instance, the company has been exploring solutions for the growing gig economy workforce, a segment often underserved by traditional retirement plans.

The company's commitment to product development, including potential offerings like annuities with enhanced longevity risk pooling or those designed for tax-efficient wealth transfer, indicates a strategy to tap into these expanding markets. While these niche products are in their nascent stages, their potential to capture significant market share in the future is substantial, provided they can gain traction.

To shift these 'Question Marks' into 'Stars,' Brighthouse Financial would need to make considerable investments in targeted marketing and distribution strategies. This could involve partnerships with specialized financial advisors or direct-to-consumer digital platforms to reach these specific customer bases. The success of these investments will be crucial in determining whether these niche annuities become future growth drivers.

New Life Insurance Products Targeting Specific Underserved Markets

Brighthouse Financial is actively developing life insurance products designed to serve previously overlooked segments of the market. Beyond their established SmartCare offering, the company is exploring solutions for younger demographics, individuals in specific income brackets, and those with specialized financial planning requirements.

These new initiatives represent a strategic move to tap into high-growth potential areas, though current market penetration is naturally low. Success in these nascent markets could pave the way for substantial future expansion. For instance, in 2024, the millennial generation, comprising over 72 million individuals in the U.S., represents a significant opportunity for life insurance adoption, with many seeking financial products that align with their evolving needs and digital preferences.

- Targeting Gen Z and Millennials: Products with flexible premiums and digital onboarding are being considered to attract younger, tech-savvy consumers.

- Addressing the Gig Economy: Life insurance solutions tailored for independent contractors and freelancers, offering portable coverage, are under development.

- Financial Wellness Integration: Bundling life insurance with financial planning tools and education aims to appeal to individuals seeking holistic financial security.

- Affordable Protection for Lower-Income Households: Simplified issue policies with lower death benefits are being explored to make coverage accessible to a broader economic spectrum.

Strategic Partnerships for New Distribution Channels

Brighthouse Financial could forge strategic alliances to tap into untapped customer bases, moving beyond its established distribution channels. These partnerships offer a pathway to high-growth markets where Brighthouse currently has limited reach.

For instance, in 2024, the financial services industry saw a significant trend of fintech collaborations aimed at expanding customer access. Many firms reported that partnerships with digital platforms increased their customer acquisition by an average of 15% in the first year. This suggests that Brighthouse could leverage similar strategies to access younger demographics or underserved markets.

The initial phase of these new ventures carries inherent uncertainty, necessitating considerable investment and a willingness to adapt to evolving market conditions. Success hinges on identifying partners whose customer base aligns with Brighthouse’s target segments and whose operational models complement Brighthouse’s offerings.

- Accessing New Customer Segments: Partnerships with digital aggregators or employee benefit platforms could reach millions of individuals who may not interact with traditional financial advisors.

- High-Growth Channel Penetration: Collaborations with direct-to-consumer platforms or affinity groups can unlock channels with historically low penetration for Brighthouse, potentially accelerating growth.

- Investment and Adaptation Needs: Initial investments in technology integration, marketing campaigns, and partner training are crucial, with early ROI uncertain but potentially high if market adaptation is successful.

- Industry Trend: In 2024, over 60% of financial institutions surveyed by Deloitte indicated plans to increase investment in strategic partnerships to drive digital transformation and market expansion.

Brighthouse Financial's niche annuity offerings and new life insurance products for underserved segments are their current Question Marks. These products target high-growth markets but have low market share, requiring significant investment to become Stars.

The company's focus on digital transformation and strategic partnerships aims to boost these emerging products. Success depends on effectively reaching new customer bases, such as millennials and the gig economy, and adapting to evolving consumer needs.

Targeting Gen Z and millennials with digital-first products, alongside solutions for the gig economy, are key strategies. These initiatives aim to capture growth in markets where Brighthouse currently has limited penetration, with industry trends showing increased investment in partnerships for market expansion.

| BCG Category | Brighthouse Financial Product/Initiative | Market Attractiveness | Brighthouse Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | Niche Annuities (e.g., for gig economy) | High (growing retirement needs, specific segments) | Low (nascent stage, targeted development) | Invest heavily in marketing, distribution, and product refinement to gain share. |

| Question Mark | New Life Insurance for Underserved Segments (e.g., Gen Z, lower-income) | High (large demographic potential, evolving needs) | Low (early-stage products, new market entry) | Develop targeted digital strategies and partnerships to increase adoption. |

| Question Mark | Institutional Market Expansion (BlackRock LifePath Paycheck™) | High (defined contribution plan space growth) | Low (initial deposits, early adoption phase) | Focus on scaling distribution and demonstrating value to plan sponsors. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data from Brighthouse Financial's reports, industry growth rates, and competitor analysis to ensure reliable insights.