Breakthru Beverage Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Breakthru Beverage Group Bundle

Breakthru Beverage Group leverages its extensive distribution network and strong supplier relationships as key strengths, but faces challenges in adapting to evolving consumer preferences and intense market competition. Understanding these dynamics is crucial for anyone looking to navigate the beverage alcohol industry.

Want the full story behind Breakthru Beverage Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Breakthru Beverage Group boasts an extensive North American distribution network, serving as a leading beverage wholesaler across 16 U.S. markets and holding the position of the largest broker in Canada. This expansive reach allows for efficient delivery of a comprehensive portfolio of wine, spirits, and beer to a broad customer base.

The company's strategic investments in new infrastructure, such as those in Delaware, Minnesota, and Florida, underscore its commitment to enhancing operational capabilities. These upgrades are designed to bolster efficiency and capacity, ensuring they can effectively manage their growing distribution footprint and product offerings.

Breakthru Beverage Group commands a robust market presence, ranking as the third-largest distributor of wine and spirits in the United States. This strong position is further solidified by projected revenues of $8.5 billion for 2025, reflecting its widespread operational reach.

Further underscoring its financial strength, Forbes recognized Breakthru Beverage Group with $8.4 billion in revenue for 2024, placing it at #61 on its list of America's Top Private Companies. This consistent financial performance highlights the company's substantial scale and stability within the competitive beverage distribution landscape.

Breakthru Beverage Group's commitment to digital innovation is a significant strength, evident in its proprietary B2B e-commerce platform, BREAKTHRU NOW. This platform is projected to generate $700 million in revenue by 2025, showcasing a substantial digital revenue stream.

Further bolstering its digital presence, Breakthru has renewed key partnerships with digital marketplaces like Provi, streamlining the ordering process for retailers and enhancing accessibility. This strategic move expands their digital reach and customer convenience.

The company is also actively integrating advanced technologies like AI and chatbots into its operations. These tools are designed to offer dynamic product recommendations and intelligent sales support, positioning Breakthru as a leader in technological advancement within the distribution sector.

Robust Supplier and Customer Relationships

Breakthru Beverage Group places a premium on cultivating strong connections with both its supplier partners and its wide-ranging customer base, aiming to be recognized as the most accommodating distributor in the industry. This focus on relationships is a core strength that underpins their market presence.

Their success in expanding distribution for brands like Chinola Liqueur into California and Stoli Group into Wisconsin, as reported in industry news from late 2024, underscores their effectiveness in building brands and driving supplier growth. These partnerships demonstrate a tangible ability to deliver results.

Breakthru's commitment to an omnichannel strategy further solidifies this strength by offering adaptable and superior service. This approach ensures they can effectively engage with customers across various channels, meeting evolving market demands.

- Supplier Partnerships: Proven success in expanding distribution for key brands in 2024.

- Customer Focus: Striving to be the easiest distributor to work with through flexible service.

- Brand Building: Demonstrated ability to drive growth for supplier partners.

- Omnichannel Strategy: Enhances accessibility and service for a diverse customer base.

Strong Corporate Culture and Social Responsibility

Breakthru Beverage Group's strong corporate culture is a significant asset, evidenced by its consecutive recognition as a U.S. Best Managed Company, achieving Gold Status in 2025. This award highlights their success in strategic planning, operational execution, and fostering a robust organizational environment.

Their commitment to social responsibility is equally noteworthy. The 2024 CSR Report, 'Executing with Excellence,' details substantial community engagement, including over $2.9 million invested in various nonprofit organizations and support for 500 charitable causes throughout the past year. This dedication not only enhances their brand reputation but also strengthens stakeholder relationships.

- Awarded U.S. Best Managed Company Gold Status in 2025

- Recognized for excellence in strategy, execution, culture, and governance

- Invested over $2.9 million in nonprofits in 2024

- Supported 500 charitable causes in the past year

Breakthru Beverage Group's extensive distribution network across 16 U.S. markets and its position as Canada's largest broker are key strengths. This reach is further amplified by its status as the third-largest wine and spirits distributor in the U.S., with projected 2025 revenues of $8.5 billion. Forbes recognized the company's substantial scale, reporting $8.4 billion in revenue for 2024 and ranking it #61 among America's Top Private Companies.

| Metric | 2024 Data | 2025 Projection |

|---|---|---|

| Total Revenue | $8.4 Billion (Forbes) | $8.5 Billion |

| U.S. Distribution Markets | 16 | 16 |

| Canada Brokerage Position | Largest | Largest |

| U.S. Distributor Rank (Wine & Spirits) | 3rd Largest | 3rd Largest |

What is included in the product

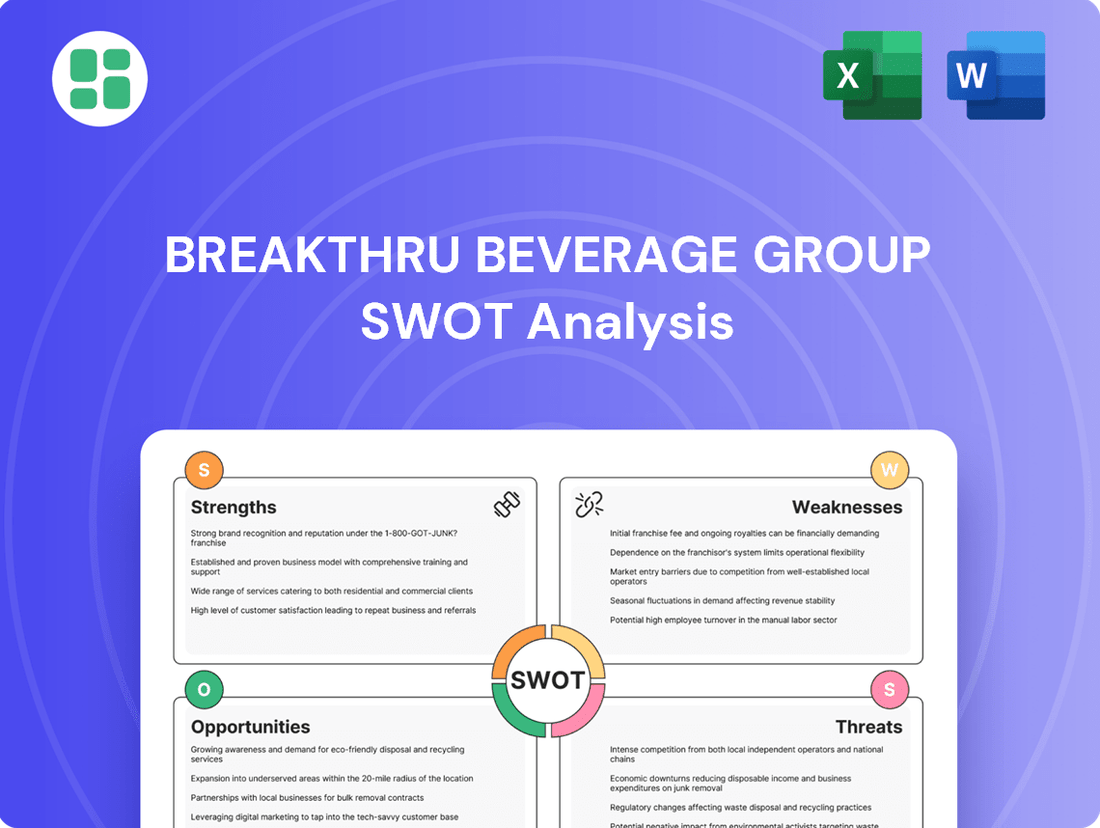

Breakthru Beverage Group’s SWOT analysis identifies its strong distribution network and brand portfolio as key strengths, while also highlighting potential weaknesses in digital integration and market consolidation. The company is poised to capitalize on growing consumer demand for premium and craft beverages, but faces threats from increased competition and evolving regulatory landscapes.

Offers a clear, actionable framework to address Breakthru Beverage Group's market challenges and capitalize on growth opportunities.

Weaknesses

Breakthru Beverage Group's extensive operations across numerous U.S. states and Canadian provinces mean they must navigate a complex and ever-changing web of alcohol regulations. This includes diverse licensing, labeling, and distribution laws, requiring significant resources and careful management to ensure compliance. For instance, in 2023, the Alcohol and Tobacco Tax and Trade Bureau (TTB) continued to update its guidance on labeling and advertising, a process Breakthru must meticulously track across all its markets.

As a major beverage distributor, Breakthru Beverage Group contends with significant operational costs. These include substantial expenses for transportation and labor, persistent issues in the food and beverage sector. For instance, the trucking industry in the US faced a driver shortage in 2024, pushing up freight costs.

Supply chain vulnerabilities pose another considerable weakness. Geopolitical tensions, extreme weather events, and economic downturns can all disrupt the flow of goods. In 2024, ongoing global shipping challenges, including port congestion and container shortages, continued to impact delivery times and increase procurement expenses for many distributors.

The beverage distribution market, especially for wine and spirits, is quite mature, meaning there aren't many new customers entering the market. This maturity fuels intense competition, with established giants like Southern Glazer's and Republic National Distributing Company holding significant sway. Breakthru Beverage Group, as a major player, constantly navigates this crowded space.

Maintaining and growing its market share demands a proactive approach. This includes developing innovative strategies, aggressively pursuing new business opportunities, and crucially, securing and keeping strong relationships with suppliers. In 2024, the industry saw continued consolidation and strategic partnerships as companies sought to gain an edge in this highly competitive environment.

Vulnerability to Shifting Consumer Preferences

Consumer tastes in beverages are constantly changing, with a growing interest in non-alcoholic drinks, ready-to-drink (RTD) options, and healthier choices. Breakthru Beverage Group, while adapting, could see its traditional wine and spirits business affected by swift or substantial shifts in these preferences. This necessitates ongoing efforts in portfolio diversification and marketing strategies to keep pace.

For example, the U.S. non-alcoholic beverage market was projected to reach $190 billion by 2024, with RTDs showing particularly strong growth. Breakthru's ability to pivot its offerings to meet these evolving demands is crucial for mitigating risks associated with its established product lines.

- Dynamic Consumer Tastes: The beverage market sees rapid shifts towards non-alcoholic, RTD, and health-focused products.

- Impact on Core Business: Significant changes away from traditional wine and spirits could affect Breakthru's primary revenue streams.

- Adaptation Strategy: Continuous portfolio expansion and agile marketing are key to addressing these evolving consumer preferences.

- Market Trends: The non-alcoholic beverage sector is a significant and growing market, with RTDs showing particularly strong momentum.

Potential Impact of Economic Downturns on Discretionary Spending

Economic pressures, such as ongoing inflation and elevated interest rates, significantly impact consumer spending. This often leads to a decrease in discretionary purchases, including premium beverages, which directly affects companies like Breakthru Beverage Group.

A prolonged economic downturn could prompt consumers to opt for more budget-friendly alternatives or cut back on their overall alcohol consumption. For instance, in 2023, consumer spending on non-essential goods saw a noticeable slowdown as inflation persisted.

This sensitivity to economic shifts presents a risk to Breakthru's sales volumes and profitability. Despite efforts to maintain top-line revenue growth, the company remains vulnerable to changes in consumer purchasing power and preferences during economic uncertainty.

- Inflationary Impact: Persistent inflation in 2024 continues to erode consumer purchasing power, potentially shifting demand away from higher-priced beverage categories.

- Interest Rate Sensitivity: Higher interest rates can reduce disposable income, making consumers more cautious about spending on premium or luxury goods.

- Downtrading Trend: In periods of economic stress, consumers often trade down to less expensive brands or private label options, impacting premium sales.

- Recessionary Fears: Concerns about a potential economic slowdown in late 2024 and early 2025 could lead to preemptive spending cuts by consumers.

Breakthru Beverage Group's reliance on a vast and complex distribution network, while a strength, also presents a significant weakness. Managing this intricate web across multiple jurisdictions with varying regulations requires substantial investment in compliance and logistics. This complexity can lead to inefficiencies and increased operational costs, especially when navigating differing state-specific alcohol laws, which saw continued updates and enforcement actions in 2023 and 2024.

The company operates in a highly competitive landscape dominated by established players like Southern Glazer's and Republic National Distributing Company. This intense competition puts pressure on pricing, margins, and market share, necessitating continuous innovation and strategic partnerships to maintain a competitive edge. For instance, industry consolidation continued through 2024 as companies sought scale and broader market reach.

Breakthru's business model is inherently tied to the economic health of its consumer base. Inflationary pressures and rising interest rates, prevalent throughout 2023 and into 2024, directly impact discretionary spending on beverages. This economic sensitivity can lead to reduced sales volumes, particularly for premium products, as consumers opt for more budget-friendly alternatives.

| Weakness Area | Description | Impact Example (2023-2025 Focus) |

|---|---|---|

| Regulatory Complexity | Navigating diverse and evolving state-specific alcohol laws requires significant resources for compliance. | Increased legal and administrative costs associated with differing labeling requirements across markets in 2024. |

| Intense Market Competition | Dominance by major competitors like Southern Glazer's and Republic National Distributing Company limits pricing power and market share growth. | Ongoing need for aggressive sales strategies and potential margin compression to secure supplier and retail partnerships in 2024. |

| Economic Sensitivity | Vulnerability to consumer spending shifts due to inflation and interest rate hikes impacts sales of premium beverages. | Potential for downtrading by consumers to less expensive brands during economic uncertainty projected for late 2024 and early 2025. |

Full Version Awaits

Breakthru Beverage Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Breakthru Beverage Group's Strengths, Weaknesses, Opportunities, and Threats. This detailed report is ready for your strategic planning needs.

Opportunities

The beverage industry is seeing robust expansion in areas like ready-to-drink (RTD) cocktails, reduced-alcohol drinks, and non-alcoholic selections. Breakthru Beverage Group's strategic focus on these growing segments offers a significant chance to expand its market presence and diversify its offerings beyond traditional wine and spirits.

This strategic alignment with shifting consumer tastes for healthier and more convenient options is crucial. For instance, the global RTD beverage market was valued at approximately $1.1 trillion in 2023 and is projected to grow substantially in the coming years, indicating a strong tailwind for companies like Breakthru that are investing in these categories.

Breakthru Beverage Group has a significant opportunity to further its digital transformation by deeply integrating AI and machine learning. This continued investment can unlock greater efficiencies across its operations. For instance, AI can refine inventory management and predict demand more accurately, potentially reducing waste and improving stock availability, a critical factor in the beverage distribution industry.

Leveraging platforms like 'Breakthru Now' with enhanced AI capabilities presents a chance to deepen customer and supplier relationships. By analyzing purchasing patterns and preferences, Breakthru can offer more personalized experiences and tailored solutions, fostering loyalty. This data-driven approach can also streamline the ordering and delivery process, making it more intuitive and responsive to market needs.

The company's commitment to AI literacy among its workforce is a strategic advantage. By empowering employees with the skills to understand and utilize AI, Breakthru can foster a culture of innovation. This will enable them to make more informed, data-backed decisions, from optimizing delivery routes to identifying emerging market trends, ultimately enhancing their competitive positioning in the dynamic beverage market.

The beverage distribution landscape is ripe for consolidation, with ongoing merger and acquisition (M&A) activity. Breakthru Beverage Group has a history of successfully integrating acquired businesses, like their substantial acquisition of Wine Warehouse in California, which solidified their standing as a leading wine distributor. This strategic approach allows for market expansion and the absorption of new brands and capabilities.

Growth in E-commerce and Digital Sales Channels

The beverage industry's ongoing digital transformation offers significant avenues for Breakthru Beverage Group. Expanding their e-commerce presence allows for more direct engagement with customers and a more streamlined sales process. This shift is crucial as consumer purchasing habits increasingly favor online channels.

Breakthru Beverage Group can capitalize on this trend by further developing and promoting their proprietary digital platform, 'Breakthru Now.' This internal tool, coupled with strategic alliances with B2B digital marketplaces like Provi, allows them to meet retailers where they are shopping. In 2024, digital marketplaces for B2B sales are projected to see substantial growth, with the global B2B e-commerce market expected to reach trillions of dollars.

- Enhanced Retailer Experience: Digital platforms facilitate easier product discovery, ordering, and account management for retailers.

- Operational Efficiency: Streamlining online sales can reduce manual order processing and improve inventory management.

- Market Reach Expansion: Digital channels provide access to a broader customer base, including those in geographically diverse areas.

- Data-Driven Insights: Online interactions generate valuable data on customer preferences and purchasing patterns, informing future strategies.

Leveraging Sustainability and Ethical Sourcing Initiatives

Breakthru Beverage Group can capitalize on the growing consumer preference for sustainable and ethically sourced products. Their established Corporate Social Responsibility (CSR) programs provide a solid foundation to build upon, allowing them to stand out in a competitive market. By enhancing eco-friendly operations, such as optimizing logistics and adopting greener packaging, Breakthru can resonate with environmentally aware consumers, boosting brand loyalty and market position.

Further investment in sustainability initiatives presents a clear path to enhanced brand perception and market differentiation. For instance, a focus on reducing carbon emissions in transportation, a key aspect of beverage distribution, could yield significant reputational benefits. Companies in the beverage sector are increasingly reporting on their environmental impact, with many aiming for specific emissions reduction targets by 2030, a trend Breakthru can leverage.

- Enhanced Brand Reputation: Aligning with consumer values for transparency and ethical sourcing strengthens brand image.

- Market Differentiation: Proactive sustainability efforts can set Breakthru apart from competitors.

- Consumer Loyalty: Demonstrating commitment to CSR and environmental stewardship fosters deeper customer relationships.

- Operational Efficiency: Investing in eco-friendly practices, like optimized logistics, can also lead to cost savings.

Breakthru Beverage Group is well-positioned to capitalize on the expanding market for ready-to-drink (RTD) cocktails, reduced-alcohol, and non-alcoholic beverages, aligning with evolving consumer preferences for convenience and health. The global RTD beverage market was valued at approximately $1.1 trillion in 2023, with strong projected growth, offering a significant opportunity for Breakthru to increase its market share and product diversity.

The company can further leverage its digital transformation by integrating AI and machine learning into operations, enhancing efficiency in areas like inventory management and demand forecasting. This strategic digital advancement, exemplified by platforms like 'Breakthru Now,' can also foster deeper customer and supplier relationships through personalized experiences and streamlined processes.

The ongoing consolidation within the beverage distribution sector presents a prime opportunity for Breakthru Beverage Group, given its proven track record in successful acquisitions, such as the significant integration of Wine Warehouse. This strategic M&A approach facilitates market expansion and the absorption of new brands and capabilities, strengthening its competitive standing.

Breakthru's commitment to sustainability offers a notable advantage, tapping into the growing consumer demand for ethically sourced products. By enhancing eco-friendly operations, such as optimizing logistics and adopting greener packaging, the company can bolster brand loyalty and differentiate itself in a competitive market, aligning with industry trends that saw many beverage companies setting emissions reduction targets by 2030.

Threats

While the three-tier system still governs alcohol distribution, the rise of e-commerce and direct-to-consumer (DTC) sales in the wider beverage sector presents a growing challenge. This shift means brands might increasingly bypass traditional distributors.

In 2024, the U.S. e-commerce alcohol market saw continued expansion, with some projections indicating it could reach over $30 billion by 2025, highlighting the increasing consumer comfort with online purchasing. This trend directly impacts the traditional distribution model.

As more beverage brands, not just alcohol, adopt DTC strategies, they gain more control over customer relationships and data, potentially diminishing the perceived necessity of wholesalers for certain product segments or geographic areas.

Breakthru Beverage Group, like other distributors, must continually prove its value proposition by offering enhanced services, data insights, and efficient logistics to retain brand partnerships in this evolving landscape.

The beverage alcohol sector faces significant risks from evolving regulations. For instance, potential increases in federal excise taxes on spirits, which have been a consistent point of discussion in recent years, could directly affect Breakthru Beverage Group's pricing strategies and consumer demand.

Stricter enforcement of trade practices or new environmental regulations concerning packaging and distribution could also introduce substantial compliance costs. For example, a hypothetical 5% increase in compliance-related operational expenses, stemming from new labeling mandates, could reduce profit margins by impacting the cost of goods sold.

Ongoing supply chain vulnerabilities remain a significant threat for Breakthru Beverage Group, with elevated transportation, labor, and raw material costs impacting profitability. For instance, the average cost of shipping a 40-foot container globally saw significant increases throughout 2023 and into early 2024, directly affecting Breakthru's landed costs.

Global events, such as geopolitical tensions and labor shortages, can further disrupt the seamless flow of products, leading to inventory imbalances and increased operational expenses. These disruptions can create challenges in meeting customer demand efficiently, potentially impacting sales and market share.

Shifting Consumer Lifestyle and Drinking Habits

A significant societal shift is underway, with consumers increasingly re-evaluating their relationship with alcohol. This trend, particularly noticeable in key markets, is leading to a reduction in overall alcohol consumption. For instance, the global non-alcoholic beverage market is projected to reach $1.9 trillion by 2027, indicating a strong consumer preference for alternatives.

This growing health consciousness and economic prudence are fueling a demand for lower-alcohol or no-alcohol options. Such a pivot directly threatens traditional alcohol volume sales, as consumers seek healthier or more budget-friendly choices. Data from 2023 showed a 5% year-over-year increase in sales for the low- and no-alcohol (LNA) category in the US.

- Declining Volume Sales: Reduced overall alcohol consumption directly impacts the volume of products Breakthru Beverage Group can sell.

- Rise of Health and Wellness: Consumers are prioritizing health, leading them to cut back on alcohol or opt for reduced-alcohol alternatives.

- Economic Factors: In uncertain economic times, consumers may reduce discretionary spending on alcohol.

- Portfolio Adaptation Needed: Breakthru must actively adapt its product offerings and marketing to cater to the growing demand for LNA beverages.

Economic Instability and Inflationary Pressures

Persistent inflation and rising interest rates in 2024 and projected into 2025 continue to erode consumer purchasing power. This economic instability directly impacts discretionary spending on beverages, potentially pushing consumers towards value-oriented or lower-priced alternatives. For instance, the U.S. Consumer Price Index (CPI) showed a 3.4% increase year-over-year as of April 2024, highlighting ongoing inflationary pressures.

These economic headwinds create significant challenges for Breakthru Beverage Group. Reduced consumer spending on premium or mid-tier products can directly affect sales volume and revenue. Furthermore, the difficulty in accurately forecasting demand amidst such volatile economic conditions complicates inventory management and strategic planning, potentially squeezing profit margins.

- Inflationary Impact: Continued inflation, with CPI figures remaining elevated, directly reduces the real disposable income available for beverage purchases.

- Consumer Behavior Shift: Consumers are increasingly likely to seek discounts, private label brands, or simply buy less, impacting premium segments.

- Interest Rate Sensitivity: Higher interest rates increase the cost of capital, potentially affecting Breakthru's investment in growth and operational efficiency.

- Forecasting Uncertainty: Economic volatility makes it harder to predict sales volumes, leading to potential overstocking or stockouts.

The rise of e-commerce and direct-to-consumer (DTC) sales poses a significant threat as brands may bypass traditional distributors like Breakthru Beverage Group. This shift, evidenced by the U.S. e-commerce alcohol market potentially exceeding $30 billion by 2025, allows brands to control customer relationships and data more directly.

Evolving regulations, including potential federal excise tax hikes on spirits and stricter trade practice enforcement, could increase compliance costs and impact pricing. For instance, a hypothetical 5% rise in compliance expenses could directly reduce profit margins.

Supply chain disruptions, driven by geopolitical events and labor shortages, continue to elevate transportation and operational costs. Global shipping costs, which saw substantial increases through 2023 and into early 2024, directly impact Breakthru's landed costs.

Societal shifts towards health and wellness are driving reduced alcohol consumption, with the low- and no-alcohol (LNA) category sales in the U.S. increasing by 5% year-over-year in 2023, directly threatening traditional volume sales.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, incorporating Breakthru Beverage Group's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.