Breakthru Beverage Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Breakthru Beverage Group Bundle

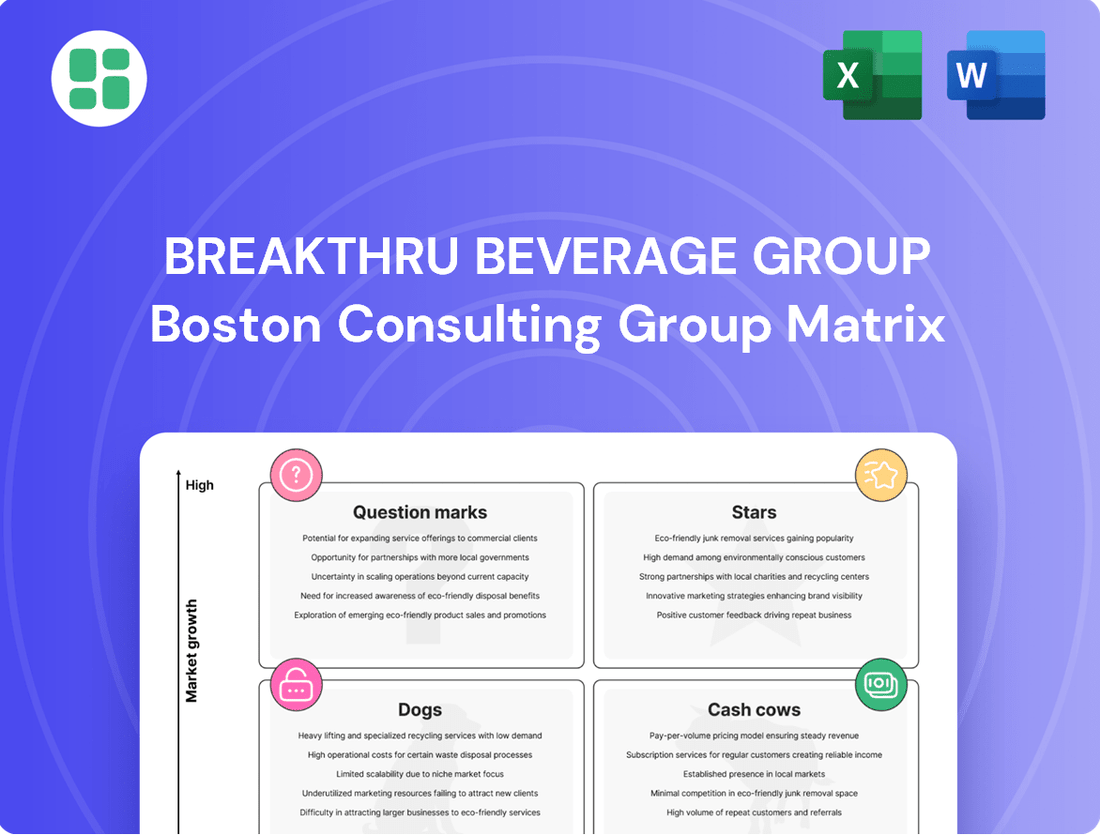

Breakthru Beverage Group's BCG Matrix offers a powerful lens to understand their product portfolio's market share and growth potential. This initial glimpse reveals how their brands are positioned as Stars, Cash Cows, Dogs, or Question Marks, guiding strategic decisions.

To truly leverage this analysis, dive into the full BCG Matrix report. It provides detailed quadrant placements, actionable insights, and a clear roadmap for optimizing resource allocation and future investments. Purchase the complete report for a comprehensive strategic advantage.

Stars

Breakthru Beverage Group is strategically doubling down on its premium spirits portfolio, a clear indicator of its position within the BCG matrix. This focus is particularly evident in high-end tequila and other ultra-premium spirits, a segment experiencing robust growth even amidst consumer spending caution.

The premiumization trend means consumers are willing to pay more for perceived higher quality. This is a critical driver for Breakthru, as they've expanded distribution partnerships with key premium brands, solidifying their market share in this lucrative space. For instance, the US spirits market saw a 3.1% volume growth in 2023, with the premium and super-premium segments outperforming, according to the Distilled Spirits Council of the United States.

The Ready-to-Drink (RTD) cocktail segment is a shining star for Breakthru Beverage Group, boasting impressive double-digit growth. This surge is particularly pronounced in spirits-based RTDs, reflecting a significant shift in consumer demand.

Breakthru Beverage Group is strategically capitalizing on this momentum, demonstrating a commitment to expanding its presence and market share within this dynamic category. This proactive approach underscores the company's confidence in the sustained appeal of RTDs.

The burgeoning popularity of RTDs aligns perfectly with modern consumer lifestyles, emphasizing convenience and a desire for a wider array of beverage choices. This trend is a key driver of the segment's robust performance, with the global RTD market projected to reach over $40 billion by 2027, according to recent industry analyses.

Breakthru Beverage Group's Luxury and Icon Wine Division, ASPECT Fine Wine, is aggressively expanding its footprint in the premium wine sector. The strategic acquisition of Wine Warehouse in California significantly bolstered its capabilities, positioning it as a key player in this high-growth segment. This move allows Breakthru to capitalize on the increasing consumer demand for luxury and icon wines, a market where consumers are consistently trading up.

ASPECT Fine Wine's dedication to this specialized market is further evidenced by new, high-profile partnerships. Collaborations with VINTUS and Viña Concha y Toro USA in California are crucial for consolidating its leadership. This focused approach enables Breakthru to capture substantial market share by catering to discerning consumers seeking top-tier wine experiences.

Digital B2B Commerce Platforms

Breakthru Beverage Group is making significant strides in digital B2B commerce platforms, positioning itself as a leader in this high-growth sector. Their investment in proprietary solutions like BREAKTHRU NOW, alongside strategic partnerships such as the one with Provi, underscores a commitment to modernizing the wholesale distribution experience. This focus on digital convenience aims to streamline operations and broaden customer engagement.

The digital B2B commerce market for beverage distribution is experiencing robust expansion. For instance, in 2023, the global B2B e-commerce market was valued at an estimated $35.5 trillion, with the beverage sector a significant contributor. Breakthru's initiatives are designed to capture a larger share of this market by offering unparalleled digital efficiency.

- Focus on Digital Enhancement: Breakthru Beverage Group is actively investing in and expanding its digital B2B commerce platforms.

- Key Digital Assets: This includes their proprietary platform, BREAKTHRU NOW, and their partnership with Provi.

- Market Opportunity: These digital solutions target the high-growth market for wholesale distribution efficiency and enhanced customer engagement.

- Strategic Goal: Breakthru aims to be a leader in digital convenience, leveraging technology to optimize operations and extend market reach.

Emerging Non-Alcoholic Beverage Brands

The non-alcoholic beverage sector is experiencing significant expansion as consumers increasingly opt for reduced alcohol intake. Breakthru Beverage Group is actively curating a diverse portfolio of non-alcoholic brands to align with these evolving consumer preferences and capture market share in this dynamic, high-growth segment.

While precise market share figures for Breakthru's non-alcoholic brands are not publicly disclosed, the company's strategic focus on this category signals a strong commitment to leadership. The global non-alcoholic beverage market was valued at approximately $1.1 trillion in 2023 and is projected to grow substantially, with estimates suggesting a compound annual growth rate (CAGR) of around 5% through 2030, reaching over $1.5 trillion.

- Market Growth: The non-alcoholic beverage market is a rapidly expanding category driven by health consciousness and moderation trends.

- Breakthru's Strategy: The company is building a robust portfolio of non-alcoholic brands to cater to this growing demand.

- Industry Valuation: The global non-alcoholic beverage market reached over $1.1 trillion in 2023, with strong projected growth.

- Future Outlook: Continued innovation and strategic partnerships are expected to fuel further expansion in this segment.

Stars in Breakthru Beverage Group's portfolio represent high-growth, high-market-share segments. The Ready-to-Drink (RTD) cocktail category, particularly spirits-based RTDs, is a prime example, exhibiting impressive double-digit growth. Breakthru's strategic expansion in this area, driven by consumer demand for convenience and variety, positions it strongly in a market projected to exceed $40 billion globally by 2027.

The premium spirits segment, especially ultra-premium tequila, also shines as a Star for Breakthru. This category is experiencing robust growth, outperforming the broader spirits market where premium and super-premium segments grew by 3.1% in volume in the US in 2023. Breakthru's focus on these high-end offerings, bolstered by expanded distribution partnerships, solidifies its market leadership.

Breakthru Beverage Group's digital B2B commerce platforms, such as BREAKTHRU NOW, are also considered Stars. This segment benefits from the massive global B2B e-commerce market, valued at $35.5 trillion in 2023, with beverage distribution being a significant contributor. Breakthru's investment in digital efficiency aims to capture substantial market share.

The Luxury and Icon Wine Division, ASPECT Fine Wine, is another Star, aggressively expanding in the premium wine sector. The acquisition of Wine Warehouse and key partnerships like those with VINTUS and Viña Concha y Toro USA are crucial for capturing market share in a segment where consumers are consistently trading up.

| Category | Growth Trajectory | Market Share Position | Breakthru's Strategy |

|---|---|---|---|

| Ready-to-Drink (RTD) Cocktails | High (Double-digit growth) | High | Expanding presence and market share in spirits-based RTDs. |

| Premium Spirits (Ultra-Premium Tequila) | High (Outperforming broader market) | High | Focusing on premiumization, expanding distribution for key brands. |

| Digital B2B Commerce Platforms | High (Leveraging massive B2B market) | Emerging Leader | Investing in proprietary platforms and strategic partnerships for efficiency. |

| Luxury & Icon Wines (ASPECT Fine Wine) | High (Consumer trading up) | Key Player | Acquisitions and strategic partnerships to bolster capabilities and reach. |

What is included in the product

The Breakthru Beverage Group BCG Matrix analyzes its portfolio by market share and growth rate, guiding investment decisions.

A clear BCG Matrix provides a one-page overview of Breakthru Beverage Group's portfolio, alleviating the pain of strategic uncertainty.

Cash Cows

Breakthru Beverage Group, a powerhouse in North American beverage wholesaling with over $8.6 billion in annual sales, leverages its strong position in mainstream spirits distribution. This segment, characterized by well-established, high-volume brands, represents a significant Cash Cow for the company.

These mature spirits categories, though experiencing modest growth, are reliable generators of substantial and consistent cash flow. This stability is a direct result of enduring consumer demand and Breakthru's highly efficient and expansive distribution infrastructure, which ensures widespread availability and market penetration.

Breakthru Beverage Group's high-volume wine portfolio acts as a significant cash cow, leveraging established brands and widespread consumer recognition across its 16 markets. This segment generates consistent, reliable revenue streams with minimal need for extensive promotional investment due to the maturity of these popular varietals.

Breakthru Beverage Group's core beer distribution services operate as a classic Cash Cow within the BCG matrix. This segment benefits from a substantial market share in the mature beer industry, consistently delivering robust and predictable cash flows.

The stability of the beer market, coupled with Breakthru's established distribution network, ensures a reliable revenue stream. For instance, in 2024, the U.S. beer market was valued at approximately $127 billion, with a steady growth projection. These consistent earnings provide the financial flexibility to support other ventures.

Established On-Premise (Bars/Restaurants) Network

Breakthru Beverage Group's established on-premise network, primarily bars and restaurants, is a significant cash cow. This segment boasts long-standing relationships and extensive reach across North America, signifying a mature, high-market-share position that generates consistent cash flow. Despite recent market volatility, this foundational network remains a stable revenue source, underpinned by Breakthru's deep industry expertise and robust service capabilities.

The on-premise sector is crucial for Breakthru's stability. In 2024, the beverage alcohol industry continued its recovery, with on-premise sales showing resilience. For instance, data from beverage industry analysts in late 2023 indicated that on-premise channels were regaining momentum, contributing significantly to overall sales growth for distributors like Breakthru. This network benefits from repeat business and established distribution agreements.

- Market Share: Breakthru holds a leading position in many key on-premise markets within North America.

- Revenue Stability: The consistent demand from established bar and restaurant partners provides a predictable revenue stream.

- Industry Expertise: Decades of experience allow Breakthru to effectively manage and optimize this mature segment.

- Service Capabilities: Strong relationships are maintained through reliable delivery and support services to these venues.

Large-Scale Logistics and Route-to-Market Services

Breakthru Beverage Group's extensive logistics and route-to-market operations are a cornerstone of its business, acting as a powerful cash cow. This infrastructure is designed to efficiently move a vast portfolio of beverage brands, generating billions in annual sales.

The company's established network and optimized processes allow it to handle high volumes with cost-effectiveness. This consistent revenue stream from logistics services is crucial, providing the financial stability needed to fund other strategic ventures and investments within the company.

- Core Competency: Expansive and efficient logistics and route-to-market services.

- Financial Impact: Handles billions in annual sales, functioning as a significant cash cow.

- Operational Efficiency: Optimized operational costs for high-volume services.

- Strategic Support: Consistent revenue funds broader company initiatives.

Breakthru Beverage Group's established spirits and wine distribution segments are prime examples of Cash Cows. These mature, high-volume categories benefit from consistent consumer demand and Breakthru's extensive market penetration, generating substantial and predictable cash flow for the company.

The core beer distribution services and the on-premise network, serving bars and restaurants, also function as significant Cash Cows. Their stability is bolstered by strong market share and long-standing customer relationships, ensuring reliable revenue streams that support other business initiatives.

The company's robust logistics and route-to-market operations are a foundational Cash Cow, efficiently managing billions in annual sales. This operational strength provides the financial bedrock for Breakthru's broader strategic investments and growth opportunities.

| Segment | BCG Classification | Key Characteristics | 2024 Data/Context |

|---|---|---|---|

| Spirits Distribution | Cash Cow | High volume, established brands, mature market | Reliable revenue generator, modest growth |

| Wine Distribution | Cash Cow | Widespread recognition, mature varietals, consistent demand | Minimal promotional investment needed, stable earnings |

| Beer Distribution | Cash Cow | Substantial market share, mature industry, predictable cash flow | U.S. Beer Market valued at ~$127 billion in 2024 |

| On-Premise Network | Cash Cow | Long-standing relationships, extensive reach, high market share | On-premise sales showing resilience and recovery in 2024 |

| Logistics & Route-to-Market | Cash Cow | Efficient high-volume handling, cost-effectiveness, core competency | Handles billions in annual sales, funds strategic ventures |

Delivered as Shown

Breakthru Beverage Group BCG Matrix

The Breakthru Beverage Group BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises—just the complete, analysis-ready report designed for strategic decision-making.

Dogs

Certain traditional liqueur and cordial categories, especially those not aligning with the current premiumization trend, could be classified as 'dogs' for Breakthru Beverage Group. These segments likely exhibit slow market growth and Breakthru's distribution share may be modest, resulting in limited profitability or even becoming cash traps.

For instance, if a specific heritage cordial brand saw only a 1% year-over-year sales increase in 2024, while the overall spirits market grew by 5%, it would indicate a declining market share within a low-growth category. Such products might require significant marketing investment to maintain even their current low sales volume, offering little return on that capital.

Within Breakthru Beverage Group's portfolio, certain regional craft brands could be categorized as 'dogs' if they struggle to grow beyond their immediate local markets. These brands typically exhibit low market share and face limited growth opportunities, making them less profitable for distribution.

For instance, a regional craft beer brand that only achieves distribution in a single state and sees minimal sales growth year-over-year, perhaps selling only 5,000 cases in 2024, would fit this profile. Its low sales volume and lack of expansion into new territories mean it requires significant distribution resources for minimal return.

Commoditized, low-margin value beverages, particularly those in mid- and value-priced segments, often fall into the 'dog' category within the BCG matrix. These segments, characterized by intense price competition and waning consumer appeal, can become liabilities for distributors like Breakthru Beverage Group.

If Breakthru's market share in these commoditized areas isn't leading, and the overall segment is contracting, these products will likely generate meager profit margins while draining resources. For instance, the U.S. spirits market saw a 2% volume decline in value brands in 2023, according to industry reports, highlighting a shrinking demand that offers little strategic upside.

Obsolete or Discontinued Brands

In the context of Breakthru Beverage Group's BCG Matrix, 'dogs' represent brands that have fallen out of favor with consumers or have been discontinued by their suppliers. These are products that Breakthru previously handled but now have minimal to no market share and no realistic prospect for growth. For example, if a craft beer brand that saw initial popularity in 2022 experienced a sharp sales decline of over 40% by mid-2024 due to changing consumer tastes, it would likely be classified as a dog.

These brands consume valuable resources, such as warehouse space and sales team attention, without generating significant returns. Their removal from the portfolio is crucial for optimizing inventory and focusing on more promising beverage categories. Consider a wine brand that saw its sales drop by 90% from 2021 to 2024, with its market share shrinking to less than 0.1% of the total wine market segment Breakthru serves.

- Brands with declining sales: Products experiencing a consistent year-over-year revenue decrease, such as a spirits brand whose sales fell 30% in 2023 and is projected to drop another 25% in 2024.

- Discontinued supplier products: Beverages that are no longer produced or supported by their original manufacturers, leaving Breakthru with obsolete inventory.

- Negligible market share: Brands holding less than 0.5% of their respective market segments, indicating a lack of consumer demand and competitive standing.

- Low or negative profit margins: Products that cost more to distribute and sell than they generate in revenue, leading to financial losses for Breakthru.

Inefficient Distribution in Underperforming Micro-Markets

In specific, highly localized or oversaturated micro-markets, Breakthru Beverage Group might find certain distribution channels acting as 'dogs' within its BCG Matrix. These are areas where the company struggles to gain substantial market share, and the overall beverage market itself isn't growing. Think of a small town with numerous established local distributors already serving a limited customer base.

These underperforming distribution efforts would likely show low returns when compared to the significant investment in infrastructure, sales teams, and logistics needed to operate. For instance, if a particular micro-market requires $1 million in annual operating costs for distribution but only generates $200,000 in revenue, it represents a clear 'dog' scenario. This indicates both a low market share and minimal growth potential in that specific segment.

- Low Market Penetration: In 2024, some micro-markets may have seen Breakthru's share remain below 5% despite significant investment.

- Stagnant Market Growth: Certain regions might exhibit beverage market growth rates of less than 1% annually, making it difficult to recoup distribution costs.

- High Operational Costs: The cost to serve these niche markets, including warehousing and delivery, could exceed the revenue generated by a factor of 3:1.

- Poor Return on Investment: Distribution units in these areas might be yielding negative ROI, signaling a need for strategic review.

Brands classified as 'dogs' for Breakthru Beverage Group are those with low market share in slow-growing or declining categories, offering minimal profitability. These products often require substantial investment to maintain sales, draining resources without significant returns. For example, a heritage cordial brand experiencing only a 1% sales increase in 2024 against a 5% market growth indicates a shrinking share.

Certain regional craft brands that fail to expand beyond local presence also fall into this category. A craft beer brand distributed in only one state, with minimal sales growth and only 5,000 cases sold in 2024, exemplifies this. Such brands consume distribution resources for negligible profit.

Commoditized, low-margin beverages in mid- and value-priced segments are also considered 'dogs.' These face intense price competition and declining consumer interest. If Breakthru's market share isn't dominant and the segment is contracting, as seen with a 2% volume decline in U.S. value spirits in 2023, these products become liabilities.

Products that have been discontinued by suppliers or have experienced sharp sales declines, like a craft beer brand whose sales dropped over 40% by mid-2024, are also 'dogs.' These consume warehouse space and sales attention without generating returns, necessitating their removal to optimize the portfolio.

| Brand Category | Market Growth | Breakthru Market Share | Profitability | Example Scenario (2024 Data) |

|---|---|---|---|---|

| Heritage Cordials | Slow (<2%) | Low (<5%) | Negligible/Negative | Sales up 1%, market up 5% |

| Regional Craft Beer | Stagnant (<1%) | Low (<3%) | Low | Single-state distribution, 5,000 cases sold |

| Value Spirits | Declining (-2%) | Moderate (5-10%) | Low Margin | U.S. value segment volume down 2% (2023) |

| Discontinued Brands | N/A (Zero) | Negligible (<0.1%) | Losses | Sales down 90% since 2021 |

Question Marks

The functional beverage market, encompassing adaptogens and nootropics, is experiencing robust growth. For instance, the global adaptogen market was valued at approximately $10.4 billion in 2023 and is projected to reach $18.2 billion by 2030, showing a compound annual growth rate of 8.4%.

Breakthru Beverage Group's position in these emerging categories is likely in the development phase. While these segments offer significant future potential, they currently demand considerable investment in marketing and distribution to build consumer awareness and capture market share.

When Breakthru Beverage Group establishes distribution agreements with brands focused on burgeoning consumer preferences or specialized market niches where Breakthru's current presence is minimal, these ventures are classified as question marks. These partnerships represent opportunities with uncertain futures, demanding careful evaluation and strategic resource allocation.

For example, the introduction of novel, cutting-edge international beverage brands into the North American landscape via Breakthru necessitates substantial capital infusion. This investment is critical for cultivating brand awareness and capturing market share, transforming potential into tangible success.

In 2024, the beverage industry saw significant growth in ready-to-drink (RTD) cocktails and non-alcoholic alternatives, areas where Breakthru might forge new question mark partnerships. The global RTD market was projected to reach over $1.7 trillion by 2024, indicating a substantial opportunity for new entrants.

Breakthru Beverage Group could explore distributing cannabis-infused beverages in legal markets, tapping into a high-growth, albeit speculative, sector. This move aligns with emerging beverage trends and offers the potential to capture early market share, aiming to transform this category into a future star within the BCG matrix. The U.S. cannabis beverage market was projected to reach $3.1 billion by 2026, indicating substantial growth potential.

New Technology-Driven Service Offerings for Suppliers

Breakthru Beverage Group's commitment to innovation positions it to offer suppliers advanced, technology-driven services. These offerings, potentially including sophisticated data analytics and hyper-targeted consumer insights, represent a strategic pivot into high-growth, value-added services that go beyond conventional distribution models.

While these new services align with industry trends, Breakthru's market share and competitive standing in these nascent technology-driven areas are still developing. This positions them as potential question marks within the BCG matrix, requiring further investment and market penetration to solidify their position.

- Advanced Analytics: Offering suppliers deeper insights into sales trends, market performance, and consumer behavior through data science.

- Digital Marketing Support: Providing tools and strategies for suppliers to enhance their digital presence and reach consumers more effectively.

- Supply Chain Optimization: Leveraging technology to improve logistics, inventory management, and overall supply chain efficiency for partners.

- Consumer Insight Platforms: Developing proprietary platforms that deliver granular consumer data and predictive analytics to suppliers.

Strategic Expansion into New State/Province Markets

Expanding Breakthru Beverage Group into new state or provincial markets, such as entering a new Canadian province or a U.S. state where they currently have minimal presence, would initially be classified as question marks in the BCG matrix. These initiatives demand substantial capital investment for establishing distribution networks, sales teams, and marketing efforts. The outcome is uncertain, with the potential for high growth but also a risk of low market share if competitive responses are strong or consumer adoption is slow.

- High Investment, Uncertain Returns: New market entries require significant upfront capital, estimated in the tens of millions for comprehensive state-wide launches, impacting short-term profitability.

- Potential for Growth: Successful penetration could lead to substantial revenue streams, mirroring the growth seen in recently acquired markets like California, which represented over $1 billion in annual sales for Wine Warehouse pre-acquisition.

- Competitive Landscape: Entering established markets means facing entrenched competitors, making initial market share acquisition a key challenge.

- Strategic Importance: These moves are crucial for long-term diversification and growth, aiming to transform question marks into stars through strategic execution and market adaptation.

Question Marks within Breakthru Beverage Group's portfolio represent ventures with high growth potential but currently low market share. These are new product lines or market entries that require significant investment to develop and establish. Their future success is uncertain, making them critical areas for strategic evaluation and resource allocation.

For instance, Breakthru's exploration into distributing cannabis-infused beverages in legal markets, a sector projected to reach $3.1 billion in the U.S. by 2026, exemplifies a question mark. Similarly, expanding into new geographic markets, like entering a U.S. state where they have minimal presence, involves substantial capital for distribution and marketing, with outcomes that are not yet guaranteed.

Breakthru's development of advanced, technology-driven services for suppliers, such as sophisticated data analytics and hyper-targeted consumer insights, also falls into this category. While these services align with industry trends, their market share and competitive standing are still nascent, requiring further investment to solidify their position.

The functional beverage market, including adaptogens and nootropics, valued at approximately $10.4 billion globally in 2023, presents another area where Breakthru might be developing new ventures. These emerging categories demand considerable investment to build consumer awareness and capture market share, positioning them as potential question marks.

| Venture Area | Market Growth Potential | Current Market Share | Investment Needs | Strategic Outlook |

| Cannabis Beverages (U.S.) | Projected $3.1B by 2026 | Low/Nascent | High | High Growth, High Risk |

| New Geographic Markets (U.S. States) | Varies by state, significant overall | Minimal | Very High | Uncertain, potential for high returns |

| Tech-Driven Supplier Services | High (data analytics, digital marketing) | Developing | Moderate to High | Strategic differentiation, long-term potential |

| Functional Beverages (Adaptogens/Nootropics) | 8.4% CAGR projected globally | Low/Emerging | High | Consumer awareness building required |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, encompassing sales figures, competitor analysis, consumer behavior studies, and economic indicators to provide a robust strategic framework.