Breakthru Beverage Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Breakthru Beverage Group Bundle

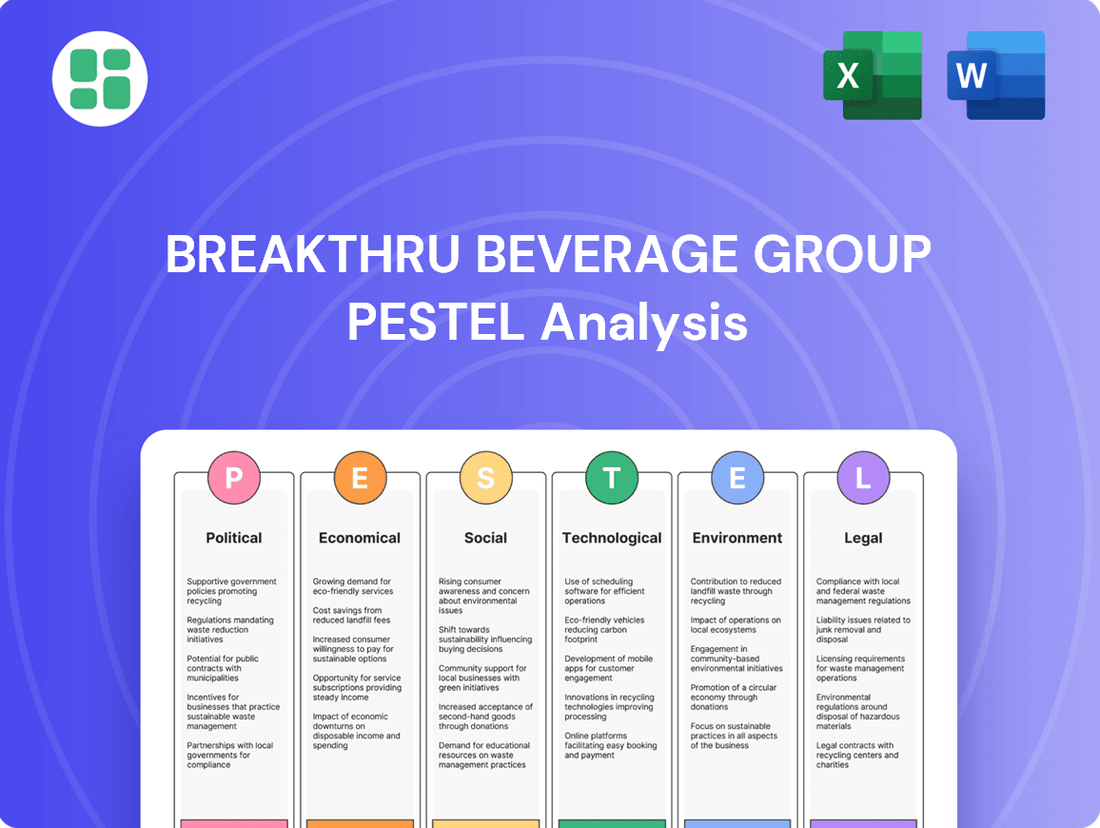

Navigate the complex external forces shaping Breakthru Beverage Group with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are critical to their success and future growth. This expertly crafted analysis provides the strategic intelligence you need to anticipate market shifts and identify opportunities.

Gain a competitive edge by delving into the detailed PESTLE factors affecting Breakthru Beverage Group. From evolving consumer preferences to new regulatory landscapes, this analysis offers actionable insights for investors, strategists, and industry professionals. Unlock the full potential of this research by downloading the complete report now.

Political factors

Breakthru Beverage Group navigates a complex web of state and provincial alcohol regulations across North America, impacting everything from licensing to distribution. For instance, the U.S. continues to grapple with its three-tier system, a framework that dictates the separation of producers, distributors, and retailers, influencing how Breakthru operates.

Trade policies, particularly between the U.S. and Canada, pose a significant risk. In 2024, ongoing discussions around potential trade adjustments could introduce tariffs, directly affecting Breakthru's supply chain costs and the availability of its extensive beverage portfolio.

North America's beverage alcohol sector operates under a complex web of state and provincial regulations governing distribution and sales. This fragmentation necessitates significant compliance efforts and tailored market strategies for companies like Breakthru Beverage Group.

In Canada, provinces such as Ontario and Quebec maintain stringent controls, often protecting their established distribution monopolies. However, a trend towards easing interprovincial trade barriers for alcohol is emerging in some Canadian provinces, potentially creating new opportunities and challenges.

Changes in excise taxes on alcoholic beverages, both federally and at the state or provincial level, directly impact product pricing and consumer purchasing habits. For example, Canada's federal excise tax on alcohol automatically increases annually, linked to the Consumer Price Index, which can influence Breakthru Beverage Group's profit margins and pricing strategies.

Alcohol Advertising Regulations

Alcohol advertising regulations present a complex landscape for Breakthru Beverage Group, differing notably between the U.S. and Canada. Canada typically enforces more stringent rules on how alcoholic beverages can be promoted.

These regulations cover a wide range of aspects, including permissible marketing channels, prohibitions on linking alcohol to athletic success or youth-centric themes, and mandates for including responsible drinking messages. For instance, in Canada, advertising that directly targets individuals under the legal drinking age is strictly prohibited, a nuance that requires careful navigation.

Breakthru Beverage Group must meticulously align its marketing and sales strategies with these varied advertising codes to ensure compliance and mitigate potential legal or reputational risks. Failure to adhere to these rules can lead to significant penalties; for example, the Alcohol and Gaming Commission of Ontario (AGCO) can impose fines and revoke licenses for advertising violations.

- U.S. vs. Canada: Canada's advertising regulations for alcohol are generally more restrictive than those in the United States.

- Key Restrictions: Regulations often limit claims about health benefits, prohibit associations with sporting prowess, and restrict marketing that appeals to minors.

- Compliance Imperative: Breakthru Beverage Group must ensure all marketing campaigns adhere to specific national and provincial/state advertising standards.

- Enforcement: Regulatory bodies like the AGCO in Ontario actively enforce advertising rules, with potential penalties including fines and license suspensions.

Political Stability and Lobbying Efforts

Political stability across Breakthru Beverage Group's operating markets is crucial, as it fosters a predictable environment for business operations and strategic planning. Unforeseen political shifts can introduce volatility, impacting everything from supply chain logistics to consumer demand.

The beverage alcohol industry is a frequent participant in lobbying activities. These efforts aim to shape legislation concerning distribution rights, sales channels, and taxation policies, all of which directly affect companies like Breakthru. For instance, discussions around excise taxes or direct-to-consumer shipping laws are often influenced by industry advocacy.

While Breakthru Beverage Group itself reported no direct federal candidate contributions during the 2024 election cycle, the collective lobbying power of the broader beverage alcohol sector is significant. This industry-wide engagement can lead to favorable regulatory outcomes or, conversely, introduce new compliance challenges.

- Political Stability: Provides a predictable operating environment, reducing uncertainty for businesses.

- Lobbying Influence: The beverage alcohol industry actively lobbies on distribution, sales, and tax legislation.

- 2024 Election Cycle: Breakthru Beverage Group did not make direct federal candidate contributions.

- Regulatory Landscape: Broader industry lobbying efforts shape the rules under which Breakthru operates.

Government policies and political stability significantly shape Breakthru Beverage Group's operational landscape. The ongoing evolution of alcohol distribution laws in the U.S., such as discussions around modernizing the three-tier system, continues to influence market access and competitive dynamics. In Canada, provinces are exploring ways to liberalize interprovincial alcohol trade, a move that could reshape distribution networks by 2025.

Taxation policies, including federal and provincial excise taxes, directly impact pricing and profitability. For instance, Canada's automatic annual increase in federal excise tax, tied to inflation, means that by 2025, these taxes will continue to exert upward pressure on product costs. Furthermore, lobbying efforts by the beverage alcohol industry actively influence legislative outcomes related to sales channels and taxation.

Advertising regulations, particularly the stricter controls in Canada compared to the U.S., necessitate careful campaign management. Companies must navigate rules prohibiting associations with athletic success or appeals to minors, with bodies like the AGCO in Ontario capable of imposing fines for violations. This regulatory environment demands constant vigilance and strategic adaptation.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental forces impacting Breakthru Beverage Group, detailing how political, economic, social, technological, environmental, and legal factors create both challenges and strategic advantages within the beverage distribution industry.

Provides a concise PESTLE analysis of Breakthru Beverage Group, acting as a pain point reliever by offering a clear, actionable framework for understanding market dynamics and mitigating risks.

Economic factors

Consumer spending on alcoholic beverages, particularly premium options, is closely linked to overall economic health and disposable income levels. Recent trends indicate a notable slowdown in broad premiumization, with consumers increasingly seeking value within the 'affordable luxury' segment. However, the super-premium categories still show resilience, particularly among affluent consumer groups, suggesting a bifurcated market.

For Breakthru Beverage Group, these economic dynamics directly impact sales volumes and revenue. For instance, as of early 2024, while overall consumer confidence saw fluctuations, the demand for accessible premium spirits remained robust, with some reports indicating a 3-5% year-over-year growth in that specific tier, even as the ultra-premium segment continued its upward trajectory, albeit at a more moderate pace.

Inflationary pressures significantly impact Breakthru Beverage Group's operational expenses. For instance, the Producer Price Index for alcoholic beverages saw an increase of 3.5% in the year leading up to April 2024, reflecting higher costs for raw materials like grains and packaging. This directly translates to increased production and logistics expenses for Breakthru and its suppliers.

The ongoing cost-of-living crisis, with inflation rates hovering around 3.0% for consumer goods in early 2024, has made consumers more discerning about their spending. This heightened price sensitivity affects purchasing decisions across all beverage segments, from premium spirits to value-oriented beers, forcing Breakthru to balance cost management with competitive pricing strategies.

Effectively managing these escalating operational costs, including labor which saw average wage growth of 4.1% in the retail sector during 2023, while simultaneously maintaining attractive price points for consumers presents a substantial economic hurdle for Breakthru Beverage Group throughout 2024 and into 2025.

Fluctuations in interest rates directly impact Breakthru Beverage Group's cost of borrowing. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% as seen in early 2024, higher rates mean increased expenses for any new loans taken out for facility upgrades or technology investments.

Access to capital remains paramount for a capital-intensive distributor like Breakthru. In 2024, companies are navigating a landscape where credit availability can tighten when interest rates are elevated, potentially slowing down expansion plans or the ability to maintain optimal inventory levels. This makes strategic financial planning crucial.

The prevailing economic climate, heavily influenced by central bank interest rate policies, shapes Breakthru Beverage Group's financial outlook. For example, projections for 2025 suggest continued vigilance regarding inflation, which could lead the Federal Reserve to keep rates steady or even consider adjustments, directly affecting the cost and availability of capital for the beverage distribution sector.

Supply Chain and Logistics Costs

Breakthru Beverage Group's extensive route-to-market services, encompassing logistics and warehousing, are particularly sensitive to economic shifts. Fluctuations in fuel prices directly influence transportation expenses, a critical component of their operational costs. For instance, the average price of diesel in the US saw significant volatility throughout 2024, impacting the cost of moving goods across their vast network.

Global supply chain disruptions, a persistent economic factor, can further escalate costs and introduce potential delays. These disruptions, often stemming from geopolitical events or natural disasters, can affect the availability of key inputs and finished products, ultimately influencing Breakthru Beverage Group's delivery timelines and overall efficiency.

- Fuel Price Impact: Rising diesel prices directly increase Breakthru Beverage Group's transportation overhead, affecting profitability.

- Logistics Efficiency: The cost-effectiveness of their warehousing and distribution network is heavily tied to transportation expenditures.

- Supply Chain Vulnerability: Global disruptions can lead to higher procurement costs and extended lead times for beverages and packaging materials.

- Delivery Timeliness: Inefficient logistics due to economic pressures can impact product availability for retailers and consumers.

Market Consolidation and Competition

The beverage alcohol distribution sector is actively consolidating, with major players like Southern Glazer's Wine & Spirits and Breakthru Beverage Group engaging in strategic acquisitions to expand their reach and capabilities. This trend is driven by the pursuit of economies of scale and enhanced market influence.

This ongoing consolidation intensifies competition, forcing distributors to innovate and optimize their operations to maintain market share. Breakthru Beverage Group, a significant entity in this landscape, must strategically manage its growth and competitive positioning amidst these shifts.

- Industry Consolidation: The U.S. beverage alcohol distribution market has seen significant M&A activity. For instance, Southern Glazer's Wine & Spirits, a key competitor, has consistently pursued acquisitions to bolster its national footprint.

- Competitive Intensification: As distributors grow larger, they gain greater leverage with suppliers and retailers, increasing pressure on smaller or less efficient players.

- Strategic Imperatives: Breakthru Beverage Group's strategy likely involves both organic growth initiatives and targeted acquisitions to remain competitive and capture market opportunities in this evolving environment.

The economic landscape for Breakthru Beverage Group in 2024 and projecting into 2025 is characterized by persistent inflation and fluctuating consumer spending habits. While the super-premium segment shows resilience, a broader slowdown in premiumization is evident, with consumers favoring "affordable luxury." This economic environment directly impacts Breakthru's sales volumes and necessitates careful management of operational costs, such as raw materials and labor, which saw wage growth of 4.1% in the retail sector in 2023.

Interest rate policies by central banks, such as the Federal Reserve's target range of 5.25%-5.50% in early 2024, significantly influence Breakthru's cost of capital. Higher borrowing costs can impede investments in infrastructure and inventory, highlighting the need for robust financial planning. Furthermore, volatile fuel prices and ongoing global supply chain disruptions continue to escalate transportation and procurement expenses, impacting logistics efficiency and delivery timeliness.

| Economic Factor | 2023/Early 2024 Data Point | Impact on Breakthru Beverage Group |

| Consumer Spending (Premium Segment) | Resilient, but broad premiumization slowing. | Drives demand for specific product tiers, requires adaptable sales strategies. |

| Inflation (Consumer Goods) | Hovering around 3.0% (early 2024). | Increases consumer price sensitivity, impacting purchasing decisions. |

| Producer Price Index (Alcoholic Beverages) | Increased 3.5% (year to April 2024). | Raises raw material and packaging costs, affecting production expenses. |

| Labor Costs (Retail Sector) | Average wage growth of 4.1% (2023). | Increases operational expenses for distribution and logistics. |

| Federal Funds Rate Target | 5.25%-5.50% (early 2024). | Elevates borrowing costs, impacting capital expenditure and inventory financing. |

Preview the Actual Deliverable

Breakthru Beverage Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Breakthru Beverage Group details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate insights into the strategic landscape affecting the beverage distribution industry.

Sociological factors

Consumer preferences are undergoing a significant shift, with a notable trend towards moderation in alcohol consumption. This includes individuals choosing to reduce their intake or abstain altogether. The non-alcoholic beverage market is experiencing robust growth, and the practice of tempo drinking, alternating alcoholic and non-alcoholic options, is becoming more popular.

To remain competitive, Breakthru Beverage Group needs to align its product offerings with these evolving consumer behaviors. This necessitates a strategic focus on expanding its portfolio to include a wider array of low- and no-alcohol beverages, meeting the demand for healthier and more mindful consumption choices.

The demand for ready-to-drink (RTD) alcoholic beverages is surging, driven by consumer preferences for convenience and a wide array of flavors. This trend is particularly strong among younger demographics seeking easy-to-consume options. Breakthru Beverage Group is strategically capitalizing on this growth, investing in spirits-based RTDs, flavored malt beverages, and wine coolers.

In 2023, the U.S. RTD market reached an estimated $16 billion, with projections indicating continued double-digit growth through 2028. This expansion highlights a significant shift in consumer behavior, favoring pre-mixed and portable alcoholic drinks over traditional options. Breakthru Beverage Group's focus on these categories positions them to benefit from this evolving market landscape.

While the broad trend of premiumization in wine and spirits has seen some moderation, a distinct segment of consumers continues to seek out higher-quality, artisanal options. This interest is particularly evident in the 'affordable luxury' bracket, typically ranging from $17 to $49.99 per bottle. Data from 2024 indicates that this segment remains robust, with consumers willing to spend more for perceived quality and unique brand stories.

Furthermore, the shift towards enjoying premium beverages at home, a trend accelerated in recent years, shows no signs of abating. Consumers are investing in home bar setups and seeking out premium selections for personal enjoyment and entertaining guests. This sustained at-home consumption of higher-end products presents a significant opportunity for Breakthru Beverage Group to adapt its sales and marketing strategies.

Breakthru Beverage Group must therefore refine its approach to capitalize on these nuanced premiumization trends. This involves not just focusing on the highest price tiers, but also understanding and catering to the growing demand for accessible premium experiences. Tailoring product portfolios and marketing messages to highlight quality, craftsmanship, and the at-home enjoyment factor will be crucial for success in 2024 and beyond.

Demographic Shifts (e.g., Gen Z Influence)

Generational shifts are significantly reshaping the beverage landscape, with Gen Z, now reaching legal drinking age, emerging as a powerful consumer force. This demographic is driving demand for novel flavors, sustainable sourcing, and a more health-conscious approach to alcohol consumption. For Breakthru Beverage Group, adapting to these evolving preferences is paramount for maintaining market share and fostering future growth.

Gen Z's influence is particularly evident in their pursuit of premiumization and unique experiences. They are more willing to explore craft spirits, artisanal beers, and non-alcoholic alternatives that offer sophisticated taste profiles. For instance, the global non-alcoholic beverage market is projected to reach $1.7 trillion by 2027, indicating a strong trend towards mindful consumption that beverage distributors like Breakthru must address.

- Gen Z Spending Power: By 2030, Gen Z is expected to account for over 30% of total retail sales globally, a significant portion of which will be in the beverage sector.

- Flavor Innovation: Interest in exotic and fusion flavors is rising, with a reported 45% of Gen Z consumers actively seeking out new taste experiences in beverages.

- Sustainability Focus: Approximately 70% of Gen Z consumers consider a brand's sustainability practices when making purchasing decisions.

- Mindful Drinking: The demand for low-alcohol and alcohol-free options is growing, with sales of these products increasing by over 200% in some markets between 2020 and 2023.

Health and Wellness Consciousness

A growing number of Americans are concerned about their health, with a significant portion viewing even moderate alcohol consumption negatively. This trend directly impacts consumer choices, boosting demand for non-alcoholic beverages and altering traditional drinking habits. For instance, the non-alcoholic beverage market in the U.S. was valued at approximately $13.1 billion in 2023 and is projected to grow.

This heightened health consciousness presents both challenges and opportunities for beverage distributors like Breakthru Beverage Group. Companies that adapt by expanding their portfolios to include a wider array of non-alcoholic and lower-alcohol options are better positioned to meet evolving consumer preferences.

- Growing Health Awareness: A majority of U.S. adults express concern about the health impacts of alcohol.

- Demand for Alternatives: This sentiment fuels a rising demand for non-alcoholic and low-alcohol beverage categories.

- Market Shift: The U.S. non-alcoholic beverage market is expanding, indicating a significant consumer pivot.

- Industry Adaptation: Beverage companies are increasingly focusing on responsible consumption and offering diverse product lines to cater to health-conscious consumers.

Societal trends are significantly influencing beverage consumption, with a notable rise in health consciousness and a growing preference for moderation. This has led to increased demand for non-alcoholic and low-alcohol options, with the U.S. non-alcoholic beverage market valued at approximately $13.1 billion in 2023. Generational shifts, particularly the influence of Gen Z, are also driving demand for novel flavors, sustainability, and unique experiences, with Gen Z expected to account for over 30% of global retail sales by 2030.

| Trend | Impact on Breakthru Beverage Group | Supporting Data (2023-2025) |

|---|---|---|

| Health Consciousness & Moderation | Increased demand for low/no-alcohol products; need to diversify portfolio. | U.S. non-alcoholic beverage market: ~$13.1 billion (2023). Sales of low/no-alcohol products up over 200% in some markets (2020-2023). |

| Generational Shifts (Gen Z) | Drive for premiumization, unique flavors, and sustainability; opportunity in RTDs and craft beverages. | Gen Z to represent >30% of global retail sales by 2030. 45% of Gen Z seek new beverage flavors. 70% consider brand sustainability. |

| Convenience (RTDs) | Strong growth in ready-to-drink alcoholic beverages, particularly among younger consumers. | U.S. RTD market: ~$16 billion (2023), projected double-digit growth through 2028. |

| Premiumization (Affordable Luxury) | Continued demand for higher-quality, artisanal options in the $17-$49.99 price range. | This segment remains robust in 2024, with consumers willing to pay for perceived quality. |

Technological factors

The beverage alcohol industry is increasingly embracing digital ordering and e-commerce, a trend Breakthru Beverage Group is actively leveraging. Their renewed partnership with Provi, a prominent digital marketplace, underscores this commitment. This move aims to streamline the B2B experience for retailers.

Breakthru Beverage Group's proprietary platform, BREAKTHRU NOW, further solidifies their digital strategy. It provides retailers with enhanced access to products and a more convenient, user-friendly ordering process. This omnichannel approach is crucial for meeting evolving customer demands in the current market.

Advanced technologies like AI are revolutionizing distribution by boosting efficiency and improving customer experiences. Breakthru Beverage Group utilizes a unified SAP system, integrating proprietary automation and commercial tools. This provides their sales teams with real-time inventory and pricing data via dashboards, directly optimizing logistics and route-to-market strategies.

Technology is fundamentally reshaping how beverage distributors operate, particularly in how they understand and serve consumer needs. By leveraging advanced data analytics, companies like Breakthru Beverage Group can gain unprecedented insights into purchasing patterns, allowing for a more precise connection between suppliers, wholesalers, and retailers. This digital infrastructure ensures that the right products are available at the right time and place, directly addressing evolving consumer preferences.

The ability to analyze real-time sales and sell-out data is no longer a luxury but a necessity for optimizing operations. Breakthru Beverage Group, for instance, relies on these analytics to refine its sales strategies, tailor marketing campaigns, and streamline its complex logistics network. This data-driven approach helps identify emerging trends and anticipate demand fluctuations, a critical advantage in the fast-paced beverage market.

In 2024, the beverage industry saw a significant increase in the adoption of AI-powered analytics platforms, with many distributors reporting improved inventory management and reduced waste. Breakthru Beverage Group's investment in these technologies underscores its commitment to leveraging technological advancements for a competitive edge. This focus on data-driven decision-making allows them to navigate market complexities and capitalize on opportunities more effectively.

Automated Warehousing and Robotics

The beverage distribution sector, including companies like Breakthru Beverage Group, is seeing significant investment in automated warehousing and robotics. This trend aims to boost operational efficiency and cut down on labor expenses. For instance, the global warehouse robotics market was projected to reach $15 billion by 2024, showcasing the rapid adoption of these technologies.

These advancements directly impact inventory management and order fulfillment. Robotics can accelerate picking and packing, leading to faster delivery times and fewer errors. In 2023, companies implementing such systems reported an average reduction in order processing time by up to 30%.

- Increased Efficiency: Automated systems can operate 24/7, significantly increasing throughput.

- Reduced Labor Costs: Robotics can handle repetitive and physically demanding tasks, lowering reliance on manual labor.

- Enhanced Safety: Automation minimizes human exposure to potential workplace hazards in warehouses.

- Improved Accuracy: Robotic systems reduce human error in tasks like inventory tracking and order picking.

Emerging Technologies (e.g., AI in operations)

Advanced technologies, particularly Artificial Intelligence (AI), are revolutionizing business operations. Companies are leveraging AI to boost efficiency and elevate product and customer experience quality. For instance, in 2024, the global AI market was projected to reach over $200 billion, highlighting its widespread adoption across industries.

Breakthru Beverage Group can harness AI to refine its operations significantly. AI's predictive capabilities are valuable for accurate demand forecasting, ensuring optimal inventory levels and reducing waste. This is crucial in the beverage industry, where market trends can shift rapidly.

Furthermore, AI can optimize logistics and delivery routes, leading to cost savings and improved service delivery times. Personalized customer engagement, powered by AI analytics, can also enhance customer loyalty and drive sales. By 2025, it's estimated that AI will contribute trillions to the global economy through productivity gains.

- AI in Demand Forecasting: Breakthru can use AI to analyze historical sales data, market trends, and even weather patterns to predict demand more accurately, minimizing stockouts and overstock situations.

- AI in Route Optimization: AI algorithms can plan the most efficient delivery routes for Breakthru's fleet, reducing fuel consumption and delivery times, contributing to sustainability goals.

- AI in Customer Engagement: AI can personalize marketing efforts and customer interactions, offering tailored promotions and recommendations, thereby enhancing the customer experience and driving repeat business.

Technological advancements are a significant driver for Breakthru Beverage Group, influencing everything from digital ordering to sophisticated data analytics. Their partnership with Provi and the development of their own platform, BREAKTHRU NOW, highlight a commitment to streamlining B2B transactions and enhancing the customer experience through digital means.

Breakthru Beverage Group leverages a unified SAP system integrated with proprietary automation and commercial tools. This integration provides sales teams with real-time data on inventory and pricing, directly improving logistics and go-to-market strategies. The company's investment in AI-powered analytics platforms in 2024 has demonstrably improved inventory management and reduced waste.

The adoption of robotics in warehousing is another key technological trend, aiming to boost operational efficiency and reduce labor costs. Companies implementing such systems in 2023 saw an average reduction in order processing time by up to 30%, a clear indicator of the tangible benefits. AI's role in demand forecasting and route optimization is also critical, with AI projected to contribute trillions to the global economy by 2025 through productivity gains.

| Technology Area | Breakthru Beverage Group Application | Industry Impact/Data Point |

|---|---|---|

| Digital Marketplaces & E-commerce | Partnership with Provi, BREAKTHRU NOW platform | Streamlines B2B ordering, enhances retailer experience. |

| Data Analytics & AI | Unified SAP system, AI-powered analytics | Real-time inventory/pricing data, improved demand forecasting, reduced waste (reported by users in 2024). |

| Automation & Robotics | Investment in automated warehousing | 2023 data shows up to 30% reduction in order processing time; global warehouse robotics market projected to reach $15 billion by 2024. |

Legal factors

The U.S. alcohol industry's mandated three-tier distribution system profoundly shapes Breakthru Beverage Group's operations, requiring strict adherence to producer, distributor, and retailer regulations across its many state markets. This legal structure dictates how beverages enter the supply chain, impacting everything from pricing to product placement.

Navigating these diverse state-specific regulations is critical for Breakthru, as compliance ensures their ability to operate and distribute effectively. For instance, the Alcohol and Tobacco Tax and Trade Bureau (TTB) oversees federal regulations, but individual states have their own licensing and distribution laws that Breakthru must meticulously manage to avoid penalties and maintain market access.

Breakthru Beverage Group navigates a complex web of state and provincial licensing and permitting for alcohol distribution across the U.S. and Canada. For instance, in 2024, the Alcohol and Tobacco Tax and Trade Bureau (TTB) continued to oversee federal regulations, while each of the 50 U.S. states has its own unique Alcoholic Beverage Control (ABC) board, each with distinct rules for licensing, sales, and distribution, creating a highly fragmented operational landscape.

Breakthru Beverage Group places a strong emphasis on alcohol responsibility, viewing it as a core strategic priority. This commitment is deeply intertwined with meeting societal expectations and fulfilling their legal duties to encourage safe and ethical alcohol consumption. Their initiatives span responsible sales practices, mindful marketing, and active community engagement, underscoring a dedication to social compliance.

The company's 2024 Corporate Social Responsibility report specifically details their ongoing efforts and achievements in promoting alcohol responsibility. This includes programs designed to educate consumers and partners about the importance of moderation and responsible enjoyment of alcoholic beverages, reflecting a proactive approach to legal and ethical stewardship within the industry.

Labor Laws and Employment Regulations

Breakthru Beverage Group, with its nearly 10,000 associates across the U.S. and Canada, must navigate a complex web of labor laws and employment regulations. These statutes cover critical areas such as ensuring a safe working environment, adhering to minimum wage and overtime rules, and upholding fair employment practices, including non-discrimination. Compliance is paramount to avoid legal repercussions and maintain operational integrity.

The company's focus on associate well-being, professional growth, and robust safety programs directly addresses these legal mandates. For instance, in 2024, the U.S. Department of Labor continued to emphasize workplace safety, with initiatives aimed at reducing injuries in sectors similar to beverage distribution. Breakthru's commitment to these areas demonstrates their proactive approach to meeting and exceeding these legal obligations.

- Workplace Safety: Adherence to OSHA standards and similar Canadian regulations is crucial, impacting operational procedures and training.

- Compensation and Benefits: Compliance with federal and state minimum wage laws, overtime provisions, and employee benefits mandates is a continuous requirement.

- Fair Employment Practices: Ensuring equal opportunity, preventing harassment, and maintaining fair hiring and termination processes are legally binding.

- Associate Development: While not always a direct legal mandate, investing in training and development can mitigate risks associated with employee performance and legal compliance in areas like proper handling of regulated products.

Product Labeling and Advertising Compliance

Breakthru Beverage Group must navigate increasingly stringent regulations concerning product labeling. This includes meticulous adherence to requirements for health claims, comprehensive ingredient disclosures, accurate allergen information, and detailed nutritional content. Failure to comply can result in significant penalties and reputational damage.

Alcohol advertising faces its own set of specialized rules designed to prevent misleading claims and promote responsible consumption. These regulations aim to protect consumers and maintain the integrity of the beverage alcohol industry.

For example, in the U.S., the Alcohol and Tobacco Tax and Trade Bureau (TTB) is actively proposing new mandates. These include the introduction of 'Alcohol Facts' labels and significant updates to major allergen labeling requirements, impacting how products are presented to consumers.

- Evolving Labeling Standards: Regulations demand precise information on ingredients, nutritional value, health claims, and allergens.

- Advertising Scrutiny: Alcohol promotions are closely monitored to ensure truthfulness and responsible marketing practices.

- TTB Proposals (U.S.): The TTB is considering new 'Alcohol Facts' and major allergen labeling rules, signaling a shift in compliance focus.

The legal landscape for Breakthru Beverage Group is characterized by the complex, multi-jurisdictional nature of alcohol distribution laws. The mandated three-tier system in the U.S., overseen federally by the TTB and by individual state Alcoholic Beverage Control (ABC) boards, necessitates meticulous compliance with varying licensing, sales, and distribution rules. This fragmented regulatory environment, with each of the 50 U.S. states and Canadian provinces having distinct requirements, demands constant vigilance and adaptation from Breakthru to maintain market access and operational integrity.

Environmental factors

Consumers increasingly prioritize sustainability, with a notable portion of shoppers, estimated at over 60% in recent surveys, actively seeking out and purchasing more environmentally conscious products, including alcoholic beverages. This trend directly influences purchasing decisions, pushing companies to adopt greener operational models.

Breakthru Beverage Group's 2024 Corporate Social Responsibility Report highlights their dedication to environmental stewardship. The report details specific initiatives focused on waste reduction, such as a 15% decrease in landfill waste across their distribution centers in the past year, and the implementation of eco-friendly packaging solutions for over 25% of their product portfolio.

The beverage sector is under growing pressure to cut down on waste, especially concerning packaging. This trend is pushing companies towards zero-waste production and the adoption of more eco-friendly packaging solutions like biodegradable materials, refillable options, or minimalist designs. For instance, in 2024, the global sustainable packaging market, which includes beverage packaging, was valued at over $300 billion, with a significant portion driven by consumer demand for reduced environmental impact.

As a major distributor, Breakthru Beverage Group is integral to this shift. The company actively supports and manages the logistics involved in promoting sustainable packaging initiatives and recycling programs throughout its supply chain. This includes optimizing transportation routes to reduce emissions and implementing efficient systems for handling and recycling returned packaging, aligning with broader industry goals to reduce landfill waste by an estimated 15% by 2025.

Regulations and growing consumer awareness are pushing for reduced carbon footprints throughout supply chains. For a major beverage distributor like Breakthru Beverage Group, this means a sharp focus on optimizing logistics to cut down emissions from transportation and warehousing operations.

Breakthru Beverage Group's commitment to sustainability is evident in its efforts to improve fleet efficiency and delivery route planning. For instance, in 2024, the company continued to explore investments in more fuel-efficient vehicles and advanced route optimization software, aiming to directly impact its Scope 1 and Scope 3 emissions.

Water Usage and Conservation

Water is undeniably a crucial element in the beverage industry. As global concerns about water scarcity intensify, companies across the supply chain are feeling the pressure. While Breakthru Beverage Group, as a distributor, doesn't directly manage manufacturing water use, its role in selecting and promoting brands is significant. By favoring suppliers who demonstrate strong water conservation practices, Breakthru can indirectly champion responsible resource management.

The beverage sector's reliance on water is substantial. For instance, the brewing industry, a significant segment Breakthru serves, often requires thousands of liters of water for every liter of beer produced. This highlights the environmental footprint associated with beverage creation. Breakthru Beverage Group can leverage its market position to:

- Prioritize partnerships with beverage brands that publicly report on their water usage and reduction targets.

- Actively seek out and promote products from suppliers who have invested in water-efficient technologies in their bottling and production facilities.

- Support marketing initiatives that educate consumers about the water footprint of different beverages, encouraging informed purchasing decisions.

- Engage with industry groups and advocacy organizations focused on sustainable water management within the beverage sector.

Climate Change Impact on Sourcing and Production

Climate change poses a significant threat to Breakthru Beverage Group's supply chain by impacting the agricultural yields of key ingredients. For instance, fluctuating weather patterns can diminish the quality and quantity of grapes for wine production or grains for spirits, directly affecting product availability and cost. This reality underscores the critical need for a robust and adaptable supply chain to mitigate sourcing disruptions caused by evolving climate conditions.

The beverage industry, heavily reliant on agricultural inputs, must navigate these environmental shifts. For example, the 2023 grape harvest in Bordeaux, France, experienced challenges due to unseasonable heat and drought, leading to reduced yields and altered grape composition. This highlights the direct financial implications of climate change on raw material sourcing for companies like Breakthru Beverage Group.

- Impact on Yields: Extreme weather events, such as prolonged droughts or unseasonal frosts, can devastate crops like grapes and grains, directly affecting the availability and price of essential raw materials.

- Quality Degradation: Rising temperatures and altered rainfall patterns can negatively impact the quality of agricultural products, influencing the flavor profiles and overall characteristics of beverages.

- Supply Chain Vulnerability: The geographical concentration of certain crops makes the supply chain susceptible to regional climate-related disasters, necessitating diversification and contingency planning.

- Increased Operational Costs: Adapting to climate change may require investments in new farming techniques, irrigation systems, or sourcing from alternative regions, potentially increasing production costs.

Consumer demand for sustainability is a powerful driver, with over 60% of shoppers in recent surveys indicating a preference for eco-conscious products, including beverages. This trend compels companies like Breakthru Beverage Group to adopt greener practices. Breakthru's 2024 CSR report details a 15% reduction in landfill waste and eco-friendly packaging for over 25% of its portfolio, demonstrating a tangible commitment.

The beverage industry faces mounting pressure to minimize waste, particularly in packaging, pushing for zero-waste models and innovative materials. The global sustainable packaging market, valued at over $300 billion in 2024, is largely fueled by this consumer-driven demand for reduced environmental impact. Breakthru Beverage Group plays a crucial role in this shift by managing logistics for sustainable packaging and recycling initiatives across its supply chain.

Reducing carbon footprints is paramount, especially for distributors like Breakthru Beverage Group, necessitating optimized logistics for transportation and warehousing. The company's 2024 efforts included exploring investments in fuel-efficient vehicles and advanced route optimization software to directly address its emissions. Water scarcity also pressures the industry, encouraging distributors to favor brands with strong water conservation practices, thereby indirectly promoting responsible resource management.

Climate change directly impacts the beverage supply chain by affecting agricultural yields, as seen with the 2023 Bordeaux grape harvest's challenges due to heat and drought. This underscores the need for adaptable supply chains to mitigate sourcing disruptions. For instance, extreme weather can devastate crops like grapes and grains, impacting availability and price, while rising temperatures can degrade product quality.

| Environmental Factor | Impact on Beverage Industry | Breakthru Beverage Group's Response/Focus (2024-2025) |

|---|---|---|

| Sustainability & Waste Reduction | Consumer preference for eco-friendly products; pressure to reduce packaging waste. | 15% landfill waste reduction; eco-friendly packaging for >25% of portfolio. |

| Carbon Footprint & Logistics | Need to reduce emissions from transportation and warehousing. | Exploring fuel-efficient vehicles and route optimization software. |

| Water Scarcity | Industry reliance on water; pressure for responsible water management. | Prioritizing partnerships with brands reporting water usage and reduction targets. |

| Climate Change & Agriculture | Impact on crop yields and quality (e.g., grapes, grains). | Adapting supply chain to mitigate sourcing disruptions from weather events. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Breakthru Beverage Group is informed by a comprehensive review of data from leading market research firms, government economic reports, and industry-specific publications. This ensures all insights into political, economic, social, technological, legal, and environmental factors are grounded in current and reliable information.