Breakthru Beverage Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Breakthru Beverage Group Bundle

Breakthru Beverage Group navigates a complex landscape shaped by intense rivalry and significant buyer power. Understanding the threat of new entrants and the bargaining power of suppliers is crucial for their strategic positioning. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Breakthru Beverage Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Breakthru Beverage Group is heavily shaped by the concentration of major beverage brands and the clout of their product lineups. Dominant wine, spirits, and beer brands, often with unique offerings and robust consumer loyalty, wield considerable influence. For instance, in 2024, the top 10 global spirits brands accounted for a significant portion of the market share, underscoring their supplier strength.

The exclusivity of distribution agreements significantly impacts supplier power within the beverage alcohol industry. When Breakthru Beverage Group secures exclusive rights to distribute a highly desirable brand, it limits its own flexibility and strengthens the supplier's position. This is particularly true if the supplier's brand is in high demand and they have alternative distribution channels available, allowing them to negotiate more favorable terms.

The ability of suppliers to self-distribute can significantly influence their bargaining power with distributors like Breakthru Beverage Group. For instance, some craft breweries, which represent a growing segment of the beverage market, might possess the capacity to manage their own delivery networks. This capability, though requiring substantial logistical investment, allows them to exert leverage by threatening to bypass distributors if contract terms are not met.

Importance of Breakthru's Route-to-Market Services

Breakthru Beverage Group's extensive route-to-market services, encompassing sales, marketing, and logistics, significantly diminish supplier bargaining power. By offering a comprehensive solution that efficiently connects suppliers to a broad customer base, Breakthru demonstrates its indispensable value.

When suppliers depend on Breakthru's established distribution network and market expertise to reach diverse segments, their individual leverage naturally declines. This reliance is particularly pronounced in the competitive beverage alcohol industry, where efficient market access is paramount for brand growth.

- Breakthru's integrated approach streamlines operations for suppliers, often handling complex logistics and compliance requirements.

- Market reach capabilities are a key factor; for instance, Breakthru's presence in numerous states across the US provides suppliers with access to a fragmented and regulated market.

- Demonstrated sales performance, backed by data showing increased volume and market share for brands distributed by Breakthru, further solidifies its position and reduces supplier leverage. For example, in 2024, Breakthru reported continued growth in its key markets, indicating strong demand for its services.

- The cost and complexity for suppliers to replicate Breakthru's route-to-market infrastructure independently would be substantial, making them more amenable to Breakthru's terms.

Switching Costs for Suppliers

The financial implications of a supplier switching distributors are significant. For instance, if a supplier like a craft brewery needs to change distributors, they might face substantial costs related to new logistics, marketing collateral updates, and potentially lost sales during the transition. These costs directly influence their leverage.

High switching costs can make suppliers hesitant to move away from established distribution partners like Breakthru Beverage Group. The disruption to established supply chains, the need for rebranding efforts, and the potential loss of market penetration are all factors that can diminish a supplier's bargaining power. In 2024, the beverage distribution landscape continued to consolidate, meaning fewer large distributors like Breakthru are available, potentially increasing the switching costs for smaller suppliers.

- Switching Costs Impact: Suppliers face financial and operational hurdles when changing distributors, affecting their negotiation leverage.

- Examples of Costs: These can include new logistics arrangements, rebranding expenses, and the risk of reduced market access.

- Market Dynamics: In 2024, industry consolidation meant fewer distribution alternatives, potentially raising switching costs for suppliers.

The bargaining power of suppliers for Breakthru Beverage Group is moderated by the concentration of major brands and the availability of alternative distributors. While dominant brands hold sway, the ability of suppliers to find other distribution partners influences their leverage. In 2024, the beverage distribution sector saw continued consolidation, meaning fewer large-scale alternatives existed for many suppliers, thereby potentially increasing their reliance on established partners like Breakthru.

| Factor | Impact on Supplier Bargaining Power | 2024 Relevance |

|---|---|---|

| Brand Concentration | High concentration of strong brands increases supplier power. | Top global spirits brands maintained significant market share. |

| Distribution Exclusivity | Exclusive agreements limit distributor flexibility, boosting supplier power. | Desirable brands with limited distribution channels held strong negotiation positions. |

| Supplier Self-Distribution Capability | Ability to self-distribute provides leverage. | Growing craft segment explored self-distribution, though capital intensive. |

| Breakthru's Value Proposition | Comprehensive services (sales, marketing, logistics) reduce supplier power. | Breakthru's extensive US route-to-market offered significant supplier advantages. |

| Switching Costs | High switching costs reduce supplier willingness to change distributors. | Industry consolidation in 2024 increased switching costs for many suppliers. |

What is included in the product

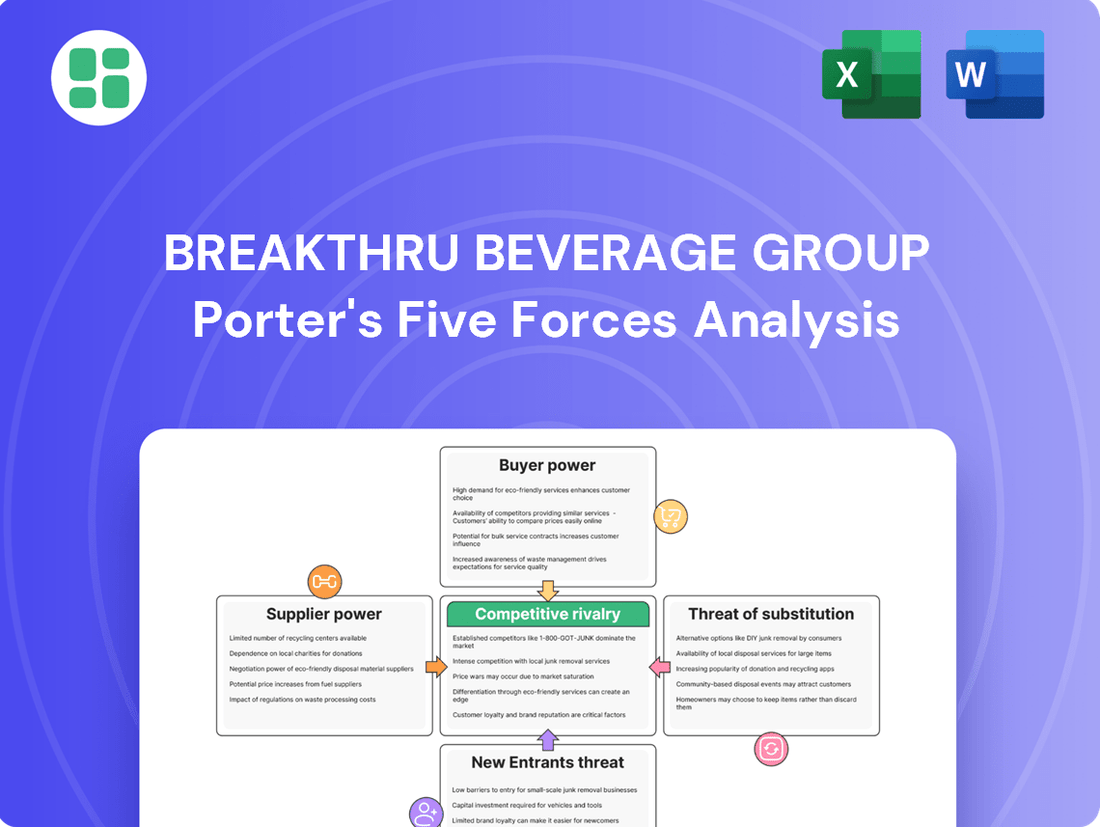

This Porter's Five Forces analysis for Breakthru Beverage Group examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes within the beverage distribution industry.

Breakthru Beverage Group's Porter's Five Forces analysis offers a clear, one-sheet summary of all five forces, perfect for quick decision-making and understanding competitive pressures.

Customers Bargaining Power

The bargaining power of customers for Breakthru Beverage Group is significantly influenced by their concentration and the volume of their purchases. Major retail chains and large restaurant franchises, due to their substantial order sizes, exert considerable influence. For instance, in 2024, large national grocery chains often account for a significant percentage of a beverage distributor's total sales, giving them leverage in price negotiations.

The availability of alternative distributors significantly impacts customers' bargaining power. If customers, such as retailers or restaurants, can easily switch between multiple beverage distributors in a market, they gain leverage to negotiate better terms. For instance, in 2024, markets with a higher density of distributors often saw distributors offering more competitive pricing and flexible delivery schedules to retain their client base.

Customer price sensitivity significantly influences their bargaining power. In 2024, the beverage alcohol industry, including distributors like Breakthru Beverage Group, faced ongoing pressure from retailers and consumers to maintain competitive pricing, especially with inflation impacting household budgets. This sensitivity means customers can easily switch to competitors if prices are perceived as too high, forcing distributors to absorb some cost increases or offer more promotions.

Importance of Breakthru's Product Portfolio

The extensive and diverse range of wine, spirits, and beer offered by Breakthru Beverage Group significantly dampens the bargaining power of its customers. By providing a wide selection, customers have fewer alternatives for sourcing specific products, making them more reliant on Breakthru. This dependency inherently limits their ability to negotiate for better terms or prices.

Breakthru's strategic focus on cultivating exclusive or highly sought-after brands further solidifies its position against customer bargaining power. For instance, in 2024, Breakthru continued to expand its portfolio of premium and craft beverages, a segment where brand loyalty and unique offerings are paramount. When customers cannot easily obtain these desirable products from competitors, their leverage to demand concessions diminishes.

- Extensive Portfolio: Breakthru's broad offering across wine, spirits, and beer reduces customer reliance on alternative suppliers.

- Exclusive Brands: Unique or highly desirable product selections make customers more dependent on Breakthru.

- Reduced Negotiation Leverage: Customer ability to negotiate prices or terms is weakened when alternatives are scarce.

Customer's Ability to Integrate Backward

The bargaining power of customers, particularly concerning their ability to integrate backward, presents a nuanced challenge for beverage distributors like Breakthru Beverage Group. While direct backward integration by individual customers is uncommon, the theoretical capability of large retail chains or major hospitality groups to establish their own distribution networks can significantly influence negotiations. This potential threat, even if not actively pursued, acts as leverage, prompting distributors to offer more favorable pricing and service agreements to retain business. For instance, a large national grocery chain could, in theory, bypass traditional distributors and manage its own logistics, thereby exerting considerable pressure on existing relationships.

This customer power is amplified when considering the concentration of buyers in the market. If a few dominant retailers or restaurant groups represent a substantial portion of a distributor's revenue, their ability to dictate terms increases. In 2024, the consolidation trend in the retail sector, with major players like Walmart and Kroger continuing to expand their market share, means that such large buyers hold more sway. Their potential to develop in-house distribution capabilities serves as a constant reminder to distributors like Breakthru to maintain competitive offerings and strong customer relationships to mitigate this risk.

The threat of backward integration can be observed through various industry trends:

- Increased Buyer Concentration: Large retail chains and hospitality groups often account for a significant percentage of a distributor's sales, giving them more leverage.

- Vertical Integration Examples: While rare in beverage distribution, some large retailers have explored or implemented their own logistics and warehousing solutions for other product categories.

- Negotiating Leverage: The mere possibility of a large customer developing its own distribution network can force distributors to offer better terms, such as lower margins or preferential delivery schedules.

- Market Dynamics: The competitive landscape of the beverage industry, with numerous distributors vying for the business of major retailers, further empowers these large customers.

The bargaining power of customers for Breakthru Beverage Group is moderated by the availability of substitutes and the cost of switching. While direct substitutes for specific brands are limited, customers can switch between different distributors or even different types of beverages, influencing price and service demands. In 2024, the increasing prevalence of private label brands in the retail sector offered consumers and retailers more options, indirectly impacting the bargaining power against established distributors.

The bargaining power of customers is also influenced by the importance of the product to the buyer. For many retailers and hospitality businesses, beverages are a significant revenue driver, making them sensitive to pricing and availability. This means customers have a vested interest in negotiating favorable terms with distributors like Breakthru. For instance, in 2024, restaurants often sought to secure competitive wholesale prices for popular spirits and wines to maintain their profit margins on menu items.

Breakthru's ability to differentiate its offerings, including value-added services like merchandising support and data analytics, can also reduce customer bargaining power. When customers perceive unique value beyond just the product itself, their willingness to switch or demand lower prices diminishes. In 2024, distributors that provided robust marketing support and consumer insights to their retail partners often found themselves in a stronger negotiating position.

| Factor | Impact on Breakthru's Customer Bargaining Power | 2024 Context |

| Buyer Concentration | High concentration of large buyers increases their power. | Retail consolidation continues; major chains hold significant sway. |

| Price Sensitivity | High sensitivity allows customers to demand lower prices. | Inflationary pressures in 2024 heightened price awareness among retailers and consumers. |

| Availability of Substitutes | More substitutes increase customer options and leverage. | Growth of private label brands and alternative beverage categories provides more choices. |

| Switching Costs | Low switching costs empower customers to change suppliers. | Relatively low switching costs between distributors in many markets. |

| Threat of Backward Integration | Potential for customers to distribute themselves adds leverage. | Theoretical possibility for large retailers to manage their own logistics, influencing negotiations. |

Preview Before You Purchase

Breakthru Beverage Group Porter's Five Forces Analysis

This preview showcases the complete Breakthru Beverage Group Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for the beverage distribution industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for immediate use.

Rivalry Among Competitors

The beverage distribution landscape, especially in North America, features a concentrated market with a few dominant players. Breakthru Beverage Group operates within this oligopolistic structure, facing formidable competition from giants like Southern Glazer's Wine & Spirits. This limited number of large entities intensifies rivalry as they vie for market dominance.

The beverage distribution industry, including segments where Breakthru Beverage Group operates, is generally considered mature with growth rates that are not explosive. This maturity often leads to more intense competition as companies fight for existing market share rather than benefiting from a rapidly expanding overall market. For instance, in 2023, the U.S. beverage market saw modest growth, with alcoholic beverages experiencing a slight uptick while non-alcoholic segments remained relatively stable, forcing distributors to be more aggressive in their sales and service strategies.

Consolidation within the beverage distribution sector is a significant trend that directly impacts competitive rivalry. Larger players, through mergers and acquisitions, are becoming even larger, creating fewer, but more powerful, entities. This has been evident in recent years with several notable deals, such as the ongoing integration of acquired regional distributors into national networks, which increases the scale and bargaining power of the remaining major distributors, thereby intensifying the pressure on those that have not consolidated.

Breakthru Beverage Group differentiates itself by offering more than just product delivery. They focus on the quality of their sales and marketing support, aiming to be a true partner for their suppliers and customers. This comprehensive approach includes advanced logistics for efficiency and robust data analytics to provide market insights.

The company's brand-building capabilities are also a significant differentiator. By investing in strong relationships and tailored marketing strategies, Breakthru aims to elevate the brands they represent. This focus on value-added services helps reduce the pressure of direct price competition in the beverage distribution market.

Exit Barriers for Competitors

Breakthru Beverage Group faces intense competition partly due to high exit barriers for its rivals. Significant investments in physical infrastructure, like extensive warehouse networks and specialized delivery fleets, make it costly for competitors to simply walk away from the market. For instance, the beverage distribution industry often requires substantial capital outlays for temperature-controlled storage and logistics, locking companies into operations.

Furthermore, these companies are often bound by long-term contracts with both suppliers and a diverse customer base, including retailers and hospitality businesses. These agreements create a sticky environment where exiting is not a simple matter of ceasing operations; it involves navigating contractual obligations and potential penalties. This commitment ensures that even when market conditions are unfavorable, competitors tend to stay put, perpetuating a highly competitive landscape.

- High Capital Investment: Beverage distributors require significant investment in warehousing, transportation fleets, and technology.

- Long-Term Contracts: Existing agreements with suppliers and customers create inertia, making it difficult to exit quickly.

- Specialized Workforce: The industry relies on a skilled workforce with expertise in logistics, sales, and regulatory compliance, which is not easily redeployed.

- Brand and Relationship Equity: Competitors have invested years in building relationships and brand recognition, assets that are lost upon exit but are difficult to divest.

Regulatory Landscape and State-by-State Variations

The alcoholic beverage industry is heavily regulated, with a patchwork of state-by-state laws governing distribution, licensing, and sales. This complexity intensifies competitive rivalry, as companies with deep expertise in navigating these varied legal frameworks gain a significant advantage.

For instance, in 2024, the differing approaches to direct-to-consumer shipping laws across states like California, which generally permits it, versus states with more restrictive policies, creates distinct operational challenges and opportunities for beverage distributors. Breakthru Beverage Group, with its extensive network and experience, is positioned to leverage these regulatory differences.

- Navigating State-Specific Alcohol Laws: Compliance with over 20,000 state and local regulations is a significant barrier to entry and a differentiator for established players.

- Licensing and Distribution Rights: Obtaining and maintaining licenses for alcohol sales and distribution varies greatly by state, impacting market access and operational costs.

- Impact on Competitive Advantage: Firms with robust legal and compliance teams can more effectively manage market entry and expansion, turning regulatory hurdles into competitive strengths.

Competitive rivalry within beverage distribution, particularly for a player like Breakthru Beverage Group, is fierce due to the industry's consolidated nature and mature growth. Companies like Southern Glazer's Wine & Spirits represent significant competition, intensifying the fight for market share in a landscape where aggressive sales and service are paramount.

The trend of consolidation further heightens rivalry, as larger entities grow stronger through mergers, leaving less room for smaller players and increasing pressure on those that haven't consolidated. This dynamic is evident as national networks absorb regional distributors, amplifying scale and bargaining power.

Breakthru Beverage Group differentiates itself through value-added services like advanced logistics and data analytics, aiming to be a strategic partner rather than just a distributor. This focus on brand building and supportive services helps mitigate direct price competition.

High exit barriers, including substantial capital investments in infrastructure and long-term contracts, ensure that competitors remain in the market, perpetuating intense rivalry. Navigating complex, state-specific alcohol regulations, a significant challenge in 2024, also creates a competitive advantage for firms with deep compliance expertise.

| Competitor | Estimated 2023 Revenue (USD Billions) | Key Market Focus | Competitive Strategy Highlight |

|---|---|---|---|

| Southern Glazer's Wine & Spirits | ~20+ | North America (extensive) | Scale, broad portfolio, integrated technology |

| Breakthru Beverage Group | ~7-8 | North America (key states) | Value-added services, brand building, data analytics |

| Republic National Distributing Company (RNDC) | ~12-13 | North America (growing) | Strategic partnerships, operational efficiency |

SSubstitutes Threaten

The rise of direct-to-consumer (DTC) sales by producers presents a substantial threat of substitutes for distributors like Breakthru Beverage Group. Wineries, craft breweries, and distilleries are increasingly leveraging e-commerce platforms and their own tasting rooms to reach consumers directly, effectively sidestepping the traditional three-tier distribution system.

This trend is particularly impactful for smaller, niche brands that can build loyal customer bases online without relying on broader distribution networks. For instance, the U.S. wine DTC market alone generated over $4 billion in sales in 2023, highlighting the significant volume that can be diverted from traditional channels.

The burgeoning online retail sector presents a significant threat of substitutes for traditional beverage distribution. Platforms like Drizly, Instacart, and even direct-to-consumer (DTC) options from wineries and breweries are increasingly offering consumers convenient alternatives to purchasing through brick-and-mortar stores serviced by distributors.

In 2024, the online alcohol sales market continued its upward trajectory, with projections indicating further growth. For instance, the US online alcohol market was estimated to be worth billions, with a substantial portion of sales occurring through these alternative channels, directly bypassing traditional distribution models.

While many online retailers currently rely on existing distribution networks for their inventory, the long-term threat lies in their potential to develop proprietary sourcing and logistics. This could allow them to circumvent distributors entirely, offering a direct substitute for the services Breakthru Beverage Group provides.

The increasing popularity of non-alcoholic beverages presents a significant threat of substitutes for Breakthru Beverage Group. A notable trend is the growing consumer preference for health and wellness, which has fueled the expansion of non-alcoholic beers, spirits, and functional drinks. For instance, the global non-alcoholic beverage market was valued at approximately $1.1 trillion in 2023 and is projected to grow substantially.

While these alternatives do not directly replace alcoholic beverages, they can siphon consumer spending away from traditional options. This diversion of funds impacts the overall market volume for distributors like Breakthru. In 2024, the non-alcoholic beer segment alone saw a significant uptick in sales, with some reports indicating double-digit growth in certain markets, indicating a tangible shift in consumer habits.

Legalization and Growth of Cannabis Market

The increasing legalization and growth of the cannabis market present a potential substitute for alcoholic beverages. In 2024, the U.S. legal cannabis market was valued at approximately $38 billion, with projections indicating continued expansion.

As cannabis becomes more accessible and socially accepted, some consumers may opt for it as a recreational alternative to alcohol. This shift could gradually erode demand for traditional spirits, wine, and beer.

- Cannabis Market Growth: The U.S. legal cannabis market is expected to reach over $70 billion by 2030, indicating a significant and growing alternative for consumer spending.

- Consumer Preferences: Studies suggest a correlation between cannabis legalization and a decline in alcohol consumption among certain demographics, highlighting the substitution effect.

- Distribution Expansion: As cannabis producers develop more sophisticated distribution channels, their products will become more readily available, intensifying the competitive threat to alcoholic beverage sales.

Supplier-Managed Logistics and Self-Distribution

The threat of substitutes for Breakthru Beverage Group's distribution services, specifically concerning supplier-managed logistics and self-distribution, is generally low but not entirely absent. While the infrastructure and expertise required for a national beverage distribution network are substantial, large beverage manufacturers could theoretically invest in building their own capabilities.

For instance, a major brewery or spirits producer with exceptionally high sales volumes might find it economically viable to bypass third-party distributors for certain product lines. This would involve significant capital expenditure in warehousing, transportation fleets, and sales force management. However, the complexity and cost associated with replicating Breakthru's established network make this a difficult undertaking for most. In 2024, the average cost for a distributor to manage a warehouse space of 100,000 square feet could range from $1.2 million to $2 million annually, a substantial barrier to entry for self-distribution.

- High Capital Investment: Establishing a proprietary national logistics and distribution network requires hundreds of millions of dollars in infrastructure and fleet acquisition.

- Operational Complexity: Managing a diverse portfolio of alcoholic beverages, including varying storage requirements and regulatory compliance across states, is highly complex.

- Economies of Scale: Breakthru Beverage Group benefits from significant economies of scale in purchasing, warehousing, and transportation, which are difficult for individual suppliers to match.

- Market Reach: Breakthru provides access to a broad customer base across numerous states, a reach that would be challenging and time-consuming for a single supplier to replicate independently.

The threat of substitutes for Breakthru Beverage Group is multifaceted, encompassing direct-to-consumer (DTC) sales, the rise of non-alcoholic alternatives, and the expanding cannabis market. While large manufacturers could theoretically develop their own distribution, the substantial capital and operational complexity make this a low probability for most.

The increasing popularity of non-alcoholic beverages, a market valued at approximately $1.1 trillion in 2023, siphons consumer spending, impacting overall market volume for distributors. Similarly, the U.S. legal cannabis market, valued at around $38 billion in 2024, presents a growing recreational alternative to alcohol, potentially eroding demand for traditional beverages.

| Substitute Category | Market Size/Value (Approx.) | Key Trend/Impact |

|---|---|---|

| Direct-to-Consumer (DTC) Sales | U.S. Wine DTC: Over $4 billion (2023) | Bypasses traditional distribution, especially for niche brands. |

| Non-Alcoholic Beverages | Global Market: ~$1.1 trillion (2023) | Siphons consumer spending and shifts habits, impacting alcoholic beverage volume. |

| Cannabis Market | U.S. Legal Market: ~$38 billion (2024) | Offers a recreational alternative to alcohol, potentially reducing alcohol consumption. |

Entrants Threaten

The beverage distribution sector demands considerable capital for essential assets like expansive warehouses, a substantial fleet of specialized trucks, sophisticated inventory tracking, and robust technology. For instance, establishing a distribution network comparable to Breakthru Beverage Group’s scale would likely necessitate hundreds of millions of dollars in initial investment, making it difficult for smaller players to compete.

The alcohol distribution industry, including players like Breakthru Beverage Group, faces significant threats from new entrants due to complex regulatory and licensing hurdles. Navigating the intricate and varied state and provincial regulations, which often require obtaining numerous licenses and permits for alcohol distribution, presents a substantial barrier. For instance, in 2024, the Alcohol and Tobacco Tax and Trade Bureau (TTB) continues to enforce a rigorous federal licensing process, adding another layer of complexity.

These legal and compliance complexities create a steep learning curve and high costs for any new company attempting to enter the market. The sheer volume of paperwork, legal fees, and the time investment required to secure all necessary approvals can easily run into hundreds of thousands of dollars, making it difficult for smaller, less capitalized entities to compete.

Established distributors like Breakthru Beverage Group benefit from deeply ingrained, often exclusive, relationships with major beverage manufacturers. This makes it incredibly challenging for new entrants to secure comparable product portfolios, as suppliers are unlikely to jeopardize their existing, high-volume arrangements.

Furthermore, Breakthru's extensive network of customer accounts, built over years of reliable service, presents a significant barrier. Newcomers would struggle to replicate this reach and displace incumbent distributors in established retail and on-premise channels, where loyalty and consistent delivery are paramount.

Economies of Scale and Experience Curve Effects

Breakthru Beverage Group, like other major players in the beverage distribution industry, benefits from substantial economies of scale. This means their sheer size allows them to negotiate better prices from suppliers and operate their logistics networks more efficiently than smaller competitors. For instance, in 2024, the top beverage distributors often handle millions of cases annually, spreading fixed costs over a vast volume and achieving lower per-unit operational expenses.

New entrants face a significant hurdle in matching these existing cost advantages. To compete, they would need to invest heavily to achieve comparable scale, likely incurring substantial initial losses. This makes it difficult for newcomers to offer competitive pricing or achieve profitability without a considerable upfront investment, acting as a strong deterrent.

- Economies of Scale: Breakthru's large distribution network allows for bulk purchasing and optimized logistics, leading to lower per-unit costs.

- Experience Curve: Years of operational experience have refined Breakthru's processes, further reducing costs and improving efficiency.

- Barriers to Entry: New distributors would struggle to match Breakthru's scale and efficiency, making it difficult to compete on price.

- Competitive Disadvantage: Without achieving similar scale, new entrants would face higher operating costs, impacting their ability to gain market share.

Brand Recognition and Reputation

The threat of new entrants in the beverage distribution sector, particularly for a company like Breakthru Beverage Group, is significantly influenced by brand recognition and reputation. Even though distributors operate business-to-business, their perceived reliability, the quality of their service, and their established market reach are paramount for suppliers. New entrants face a considerable challenge in building this trust and a strong brand presence, requiring substantial time and financial investment, which acts as a potent non-financial barrier.

For instance, in 2024, the beverage distribution market continued to consolidate, with larger players leveraging their established networks and supplier relationships. A new distributor would need to demonstrate a compelling value proposition to overcome the inertia associated with existing, trusted partnerships. The reputational capital built by established firms like Breakthru Beverage Group, often spanning decades, is a formidable hurdle for any newcomer seeking to gain traction and secure supplier agreements.

- Established Trust: Suppliers often prioritize distributors with a proven track record of consistent delivery and sales performance.

- Resource Investment: Building a reputable distribution network requires significant capital for logistics, sales teams, and marketing.

- Supplier Relationships: Long-standing relationships between established distributors and beverage producers are difficult to disrupt.

- Market Access: A strong reputation translates to better access to desirable brands and markets, which new entrants lack.

The threat of new entrants for Breakthru Beverage Group is moderate to low. Significant capital investment is required for infrastructure, and navigating complex alcohol distribution regulations presents substantial barriers. Established relationships with suppliers and customers, coupled with economies of scale and brand reputation, further deter new competition.

Porter's Five Forces Analysis Data Sources

Our Breakthru Beverage Group Porter's Five Forces analysis is built upon a robust foundation of data, including financial reports from publicly traded competitors, industry-specific market research from firms like IWSR, and regulatory filings from relevant government bodies.