Brampton Brick SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brampton Brick Bundle

Brampton Brick's strengths lie in its established brand and extensive distribution network, while its opportunities include expanding into new markets and leveraging sustainable building practices. Understanding these dynamics is crucial for navigating the competitive landscape.

Want the full story behind Brampton Brick's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Brampton Brick Limited boasts a significant market presence, with operations stretching back to the 1800s. This long history has cultivated a strong brand recognition and a deep understanding of its key markets.

The company's established footprint spans Ontario and Quebec in Canada, alongside the Northeastern and Midwestern United States. This extensive geographic coverage, supported by decades of experience, signifies a robust distribution network and established customer relationships in vital North American construction sectors.

Brampton Brick boasts a broad product range, encompassing traditional clay bricks, concrete blocks, and various veneer options. Their portfolio also includes pavers and retaining walls under the well-regarded Oaks brand. This extensive selection serves both residential and commercial construction markets, creating multiple avenues for revenue and mitigating risks tied to a single product or sector.

Brampton Brick's product line, particularly its clay bricks and concrete blocks, benefits significantly from inherent durability and aesthetic appeal. These qualities are highly sought after in the construction sector, leading to consistent demand from builders. For instance, in 2023, the company reported that its building products segment, which includes these core materials, generated approximately $413.7 million in revenue, underscoring their market relevance and customer preference.

Leveraging Technological Advancements

Brampton Brick has actively integrated technological advancements into its manufacturing, establishing a competitive edge in the brick and concrete stone sector. This commitment to innovation is evident in their exploration of areas like robotic assembly and smart masonry solutions, aiming to boost both production efficiency and product quality. For instance, in 2024, the construction industry's growing adoption of pre-fabricated and technologically enhanced building components underscores the strategic advantage of Brampton Brick's forward-thinking approach.

The company's embrace of technology allows for enhanced precision and potentially new product functionalities. This strategic direction aligns with broader industry trends, as seen in the increasing demand for sustainable and high-performance building materials, which often rely on advanced manufacturing techniques. Brampton Brick’s focus on these areas positions them well to capture market share in a rapidly evolving construction landscape.

- Enhanced Production Efficiency: Adoption of automation and robotics can significantly speed up manufacturing cycles.

- Improved Product Quality: Precision engineering through new technologies leads to more consistent and higher-grade products.

- Innovation in Materials: Exploring 3D printing and smart masonry opens avenues for novel product development.

- Market Competitiveness: Staying ahead of technological curves ensures Brampton Brick remains a leader in product offerings and operational excellence.

Beneficiary of Infrastructure and Housing Growth

Brampton Brick is well-positioned to benefit from the ongoing infrastructure and housing boom. Canada, in particular, is seeing substantial government investment in areas like transportation and sustainable infrastructure, which directly drives demand for building materials. This trend is expected to continue, with the Canadian construction sector projected for growth from 2025 onward.

The United States market also presents a strong opportunity, with sustained residential and commercial construction projects contributing to a robust demand for Brampton Brick's products. This dual-market strength provides a solid base for consistent sales and growth.

- Canadian Infrastructure Investment: Government initiatives focusing on housing, transportation, and green infrastructure are fueling construction activity.

- US Market Activity: Continued residential and commercial development in the US supports demand for building materials.

- Projected Sector Growth: The Canadian construction industry anticipates further expansion from 2025, indicating sustained demand.

Brampton Brick's extensive history, dating back to the 1800s, has cultivated a strong brand recognition and deep market understanding, particularly in Ontario and Quebec, as well as the Northeastern and Midwestern United States. This established presence is supported by a robust distribution network and long-standing customer relationships. The company offers a diverse product range, including traditional clay bricks, concrete blocks, pavers, and retaining walls under the Oaks brand, catering to both residential and commercial construction sectors. Their products' inherent durability and aesthetic appeal ensure consistent demand; the building products segment alone generated approximately $413.7 million in revenue in 2023.

The company's commitment to technological advancement, including exploration of robotic assembly and smart masonry, provides a competitive edge. This focus on innovation aligns with industry trends towards high-performance and sustainable building materials. Brampton Brick is also strategically positioned to capitalize on infrastructure and housing growth, with significant government investment in Canada and sustained construction activity in the US expected to drive demand for their products in the coming years.

What is included in the product

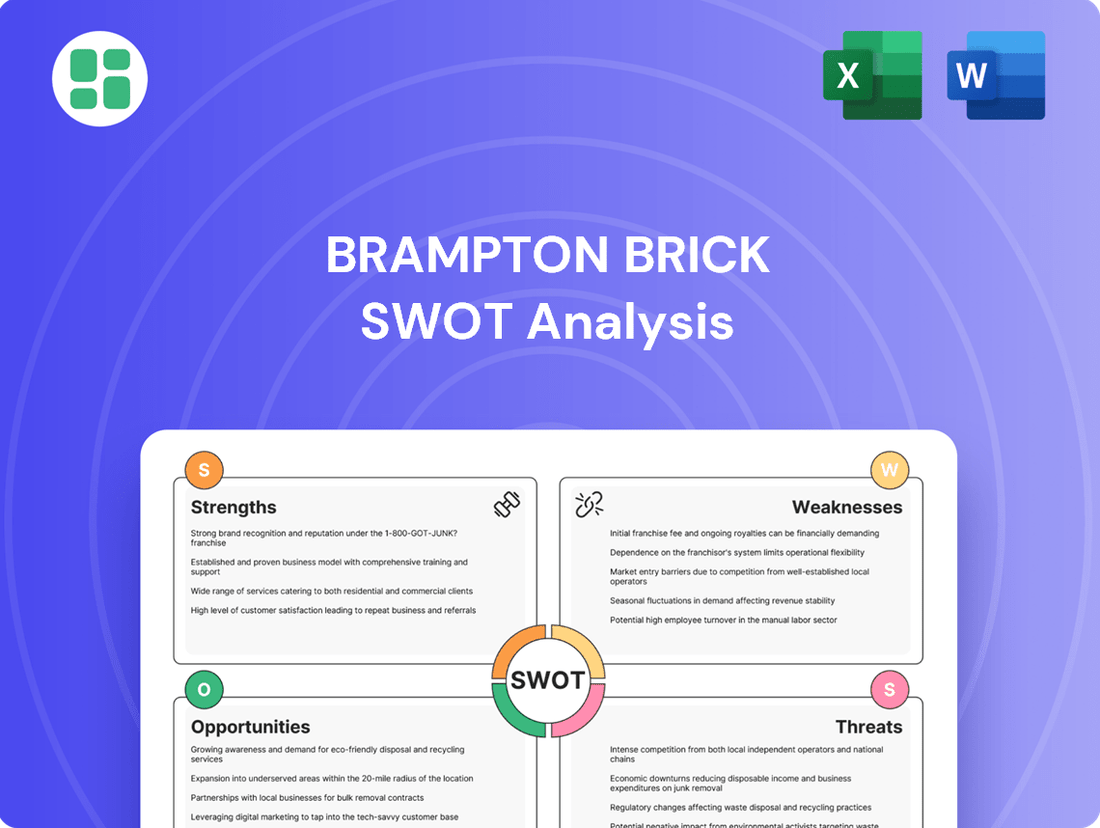

Analyzes Brampton Brick’s competitive position through key internal strengths and weaknesses, alongside external market opportunities and threats.

Offers a clear, actionable framework to identify and address Brampton Brick's strategic challenges and opportunities.

Weaknesses

Brampton Brick's performance is closely tied to the construction sector's ups and downs. This industry's cyclical nature means that changes in economic factors like interest rates and consumer confidence directly affect demand for their products. For instance, higher interest rates can slow down new housing starts, which in turn reduces the need for bricks and related masonry materials.

During economic downturns, both residential and non-residential construction projects often decrease. This directly impacts Brampton Brick's sales volume and profitability, leading to revenue fluctuations. In 2023, the Canadian housing market experienced a cooling effect due to rising interest rates, which likely presented challenges for companies like Brampton Brick reliant on new construction activity.

Brampton Brick's manufacturing processes, particularly for clay bricks and concrete blocks, are inherently energy-intensive. This reliance on significant energy consumption, such as natural gas and electricity, exposes the company to the volatility of energy markets. For instance, in early 2024, natural gas prices experienced fluctuations, impacting operational expenses for manufacturers in the sector.

Furthermore, the company's production relies heavily on key raw materials like clay, cement, and aggregates. Price swings in these essential inputs directly affect Brampton Brick's cost of goods sold. In 2024, the construction materials sector saw some upward pressure on aggregate prices due to increased demand and supply chain considerations, which can squeeze gross margins.

These combined cost volatilities in energy and raw materials create significant challenges for Brampton Brick. It makes accurate financial forecasting more difficult and necessitates robust cost management strategies to maintain profitability. Unexpected spikes in these input costs can directly erode the company's gross margins, impacting overall financial performance.

Brampton Brick's operations are heavily concentrated in Canada, specifically Ontario and Quebec, and in the Northeastern and Midwestern United States. This geographic focus, while allowing for operational efficiencies, creates a significant vulnerability. A downturn in these specific regional economies, for instance, could disproportionately impact sales and profitability.

For example, a severe economic slowdown in Ontario, which represented a substantial portion of Brampton Brick's sales in recent years, could lead to a significant drop in demand for its products. Similarly, adverse weather events impacting construction activity in the Northeastern US could directly hinder revenue generation.

Competition from Alternative Building Materials

Brampton Brick contends with a growing array of alternative building materials. These include steel, engineered wood products, and emerging sustainable options like bamboo and hempcrete, each presenting unique advantages in cost, aesthetics, or environmental impact. This diversification in the construction materials market poses a significant challenge, potentially siphoning demand away from traditional brick and paver products.

The market actively seeks materials that offer enhanced performance or lower lifecycle costs. For instance, advancements in steel framing can provide faster construction times and greater design flexibility. Likewise, the increasing focus on sustainability is driving interest in materials like cross-laminated timber (CLT) and innovative composite materials, which can offer a competitive edge over conventional masonry.

- Steel Framing: Offers lighter weight and faster installation compared to traditional brick.

- Engineered Wood: Provides strength and sustainability benefits, appealing to eco-conscious builders.

- Sustainable Composites: Emerging materials like hempcrete offer low embodied carbon and unique insulation properties.

- Market Share Shift: Analysts project a continued, albeit gradual, shift in construction material preferences, impacting traditional product demand.

Workplace Safety and Regulatory Compliance Challenges

Brampton Brick has faced scrutiny regarding workplace safety. For instance, in 2023, the company received a significant fine of $125,000 following a conviction related to a serious workplace incident, underscoring potential gaps in safety procedures and regulatory adherence. These occurrences can lead to substantial financial repercussions and damage the company's reputation, affecting employee confidence and public trust.

The company's commitment to robust safety protocols and strict compliance with evolving labor laws is crucial. Failures in these areas can result in:

- Financial Penalties: Fines and legal costs associated with safety violations.

- Reputational Damage: Negative publicity impacting brand image and customer loyalty.

- Operational Disruptions: Potential shutdowns or slowdowns due to safety investigations.

- Employee Morale: Concerns over safety can lower productivity and increase turnover.

Brampton Brick's reliance on the cyclical construction industry exposes it to significant demand fluctuations tied to economic conditions. Higher interest rates, as seen impacting the Canadian housing market in 2023, directly curb new construction, reducing sales volume and profitability. The company's energy-intensive manufacturing processes also make it vulnerable to volatile energy prices, with natural gas costs fluctuating in early 2024 affecting operational expenses.

Preview Before You Purchase

Brampton Brick SWOT Analysis

This is the actual Brampton Brick SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It offers a comprehensive look at the company's internal strengths and weaknesses, alongside external opportunities and threats. You'll gain valuable insights to inform strategic decisions.

Opportunities

The market for green building materials is experiencing robust growth, fueled by stricter environmental regulations and increasing consumer demand for sustainable options. This trend is particularly evident in North America, where projects seeking certifications like LEED (Leadership in Energy and Environmental Design) are on the rise, creating a significant opportunity for manufacturers of eco-friendly construction products.

Brampton Brick is well-positioned to leverage this expanding market by focusing on its sustainable masonry product lines. For instance, products with improved thermal insulation properties can contribute to energy efficiency in buildings, a key factor in green building assessments. The company's existing infrastructure for brick production can be adapted to incorporate lower-carbon manufacturing processes or utilize recycled content, further aligning with sustainability goals.

Significant government investments in Canadian and US infrastructure, including transportation and urban development, are expected to fuel construction sector growth through 2025. For instance, Canada's 2024 budget allocated billions to infrastructure projects, while the US continues to implement its Infrastructure Investment and Jobs Act.

This robust infrastructure spending, coupled with ongoing urbanization, directly translates into increased demand for construction materials. Brampton Brick is well-positioned to capitalize on this trend, as the need for durable and efficient building materials for both large-scale projects and high-density housing continues to rise.

Technological advancements offer significant opportunities for Brampton Brick. Innovations like robotics for bricklaying and 3D printing of masonry components can dramatically improve manufacturing efficiency and precision. For instance, the global construction robotics market was valued at approximately $1.5 billion in 2023 and is projected to grow substantially, indicating a strong trend towards automation that Brampton Brick can leverage.

Adopting these cutting-edge technologies, including advanced mortar formulations, can lead to reduced labor costs and increased productivity. This not only enhances operational performance but also opens doors to new product capabilities and a stronger competitive position within the evolving construction materials sector.

Expansion into New or Underserved Markets

Brampton Brick has an opportunity to grow by entering new geographic markets or increasing its presence in existing ones where demand for its products is on the rise. This could involve acquiring smaller regional players, forging new alliances with distributors, or implementing focused marketing campaigns to reach untapped customer bases.

The company can explore expansion opportunities in underserved regions within North America, potentially targeting areas experiencing significant construction or renovation activity. For instance, while Brampton Brick has a strong presence in Ontario, exploring markets in the Atlantic provinces or certain U.S. states with robust housing starts could yield significant growth.

- Market Penetration: Deepening market share in existing regions by offering specialized products or enhanced service models.

- Geographic Expansion: Identifying and entering new North American markets with favorable construction trends and lower competitive intensity.

- Acquisition Strategy: Pursuing strategic acquisitions of smaller masonry product suppliers in target expansion areas to gain immediate market access and operational synergies.

- Distribution Network Enhancement: Establishing new distribution partnerships or strengthening existing ones to improve product availability and reach in both current and new markets.

Product Innovation and Customization

Brampton Brick has a significant opportunity in product innovation, particularly by developing masonry products with advanced features. Imagine bricks that offer superior insulation, reducing energy costs for buildings, or those with unique textures and dimensional cuts that appeal to architects seeking distinctive designs. These advancements can carve out new market niches and justify premium pricing, enhancing profitability.

The company can also leverage customization as a key differentiator. Offering tailored solutions for architects and designers, allowing them to specify unique colors, finishes, or even integrated smart functionalities, would set Brampton Brick apart from rivals. This bespoke approach caters to the growing demand for personalized and high-performance building materials, potentially boosting sales and brand loyalty.

For instance, the construction industry in 2024 and 2025 is seeing a surge in demand for sustainable and energy-efficient materials. Brampton Brick could tap into this by developing products that meet stringent environmental standards and offer tangible energy savings. The global green building materials market is projected to reach substantial figures, indicating a ripe environment for such innovations.

- Enhanced Insulation: Developing bricks with integrated insulation properties to reduce building energy consumption.

- Aesthetic Innovation: Introducing new textures, finishes, and dimensional cuts to appeal to modern architectural trends.

- Smart Functionalities: Exploring the integration of smart technologies, such as sensors or embedded lighting, into masonry products.

- Customization Services: Offering bespoke design options for architects and developers to meet specific project requirements.

Brampton Brick can capitalize on the growing demand for sustainable building materials, driven by environmental regulations and consumer preferences for eco-friendly options. The company's existing infrastructure can be adapted to produce lower-carbon masonry or incorporate recycled content, aligning with green building trends prevalent in North America through 2025.

Significant government investment in infrastructure projects across Canada and the US, projected through 2025, will boost construction activity. This trend, combined with ongoing urbanization, directly increases the need for durable building materials like those Brampton Brick provides, supporting growth in both large-scale developments and housing.

Technological advancements, such as robotics in manufacturing and 3D printing for masonry, offer substantial opportunities for Brampton Brick to enhance efficiency and precision. The global construction robotics market, valued around $1.5 billion in 2023, highlights a strong shift towards automation that the company can leverage for improved productivity and cost reduction.

Expanding into new geographic markets or deepening penetration in existing ones presents a clear growth avenue for Brampton Brick. Strategic acquisitions or enhanced distribution networks in regions with strong construction demand, particularly in underserved areas of North America, can unlock new revenue streams and market share.

Product innovation, focusing on enhanced insulation, unique aesthetics, and smart functionalities, can create new market niches for Brampton Brick. Offering customization services to architects and developers further differentiates the company, catering to the increasing demand for personalized, high-performance building materials and potentially commanding premium pricing.

Threats

Persistent high interest rates, like those seen through 2024 and into early 2025, can significantly dampen new construction. This is because borrowing costs for developers and homebuyers increase, making projects less feasible and reducing affordability for new homes. For Brampton Brick, this translates to potentially lower sales volumes as demand for their products softens.

Brampton Brick faces the significant threat of new trade tariffs, particularly on imported building materials from the United States. Such tariffs, if implemented, could directly increase the cost of essential inputs, impacting the company's profitability and potentially forcing price adjustments for its customers. For instance, a hypothetical 10% tariff on imported clay or concrete components could add millions to Brampton Brick's annual material expenses.

Beyond direct tariffs, broader geopolitical tensions and the risk of labor disputes in key supply regions pose a considerable threat. These factors can create unpredictable disruptions in the flow of raw materials and finished products, leading to heightened operational costs and the potential for project delays. The ongoing global economic climate, marked by supply chain vulnerabilities exposed in recent years, means that such disruptions remain a persistent concern for manufacturers like Brampton Brick.

The masonry sector faces significant competition from both established brick manufacturers and suppliers of alternative building materials like concrete, metal, and wood. This crowded market dynamic frequently translates into intense pricing pressures, forcing companies like Brampton Brick to carefully manage costs and explore avenues for product innovation to stand out.

For instance, in 2023, the U.S. construction market saw continued demand for various materials, but the cost of inputs, including energy and raw materials, remained a concern, impacting pricing strategies across the board. Brampton Brick’s ability to navigate these pressures will hinge on its operational efficiency and its success in differentiating its product lines through quality or unique offerings.

Strict Environmental Regulations and Sustainability Pressures

Brampton Brick faces increasing pressure from stricter environmental regulations, particularly concerning manufacturing emissions and material sourcing. These evolving standards can lead to higher compliance costs and necessitate substantial investments in upgrading to cleaner production technologies. For instance, in 2024, many North American manufacturers anticipated increased capital expenditure related to environmental compliance, with some projections indicating a 5-10% rise in operational costs for facilities needing significant upgrades.

Failure to proactively adapt to these sustainability demands could jeopardize Brampton Brick's market standing and sales performance. Consumers and business partners are increasingly prioritizing environmentally responsible suppliers, and a perceived lag in sustainability efforts could lead to a loss of competitive advantage. By 2025, it's expected that supply chain sustainability assessments will become even more critical for securing major contracts.

Key considerations for Brampton Brick include:

- Adapting to evolving emissions standards: This may require investment in advanced filtration systems or alternative, lower-emission manufacturing processes.

- Sourcing sustainable raw materials: Ensuring that quarried materials meet environmental certifications and responsible extraction practices is crucial.

- Investing in energy efficiency: Reducing the carbon footprint of operations through energy-saving measures can mitigate regulatory risks and reduce costs.

Labor Shortages and Rising Labor Costs

The construction sector, including masonry, continues to grapple with a persistent scarcity of skilled workers, coupled with increasing wage expectations. This situation directly impacts companies like Brampton Brick by inflating production expenses and potentially causing project timelines to stretch. For instance, in 2024, the U.S. construction industry reported a significant shortage, with estimates suggesting millions of unfilled positions were needed to meet demand.

These labor dynamics can hinder Brampton Brick's capacity to expand its operations or fulfill market needs, particularly if its manufacturing processes are labor-intensive. The rising cost of labor not only affects direct production but also influences the overall cost structure, potentially impacting profitability and competitiveness in the market.

- Skilled Labor Gap: The construction industry, a key market for Brampton Brick, faces ongoing shortages of skilled masons and other tradespeople.

- Wage Inflation: To attract and retain workers, companies are experiencing upward pressure on wages, increasing operational costs.

- Production Capacity Limits: Labor constraints can restrict Brampton Brick's ability to ramp up production to meet peak demand, leading to missed opportunities.

- Project Delays: A shortage of skilled labor can result in longer project completion times for customers, potentially impacting future business.

Persistent high interest rates through 2024 and into early 2025 continue to challenge the construction sector, directly impacting demand for building materials like those supplied by Brampton Brick. Increased borrowing costs for developers and homebuyers can make new projects less feasible and reduce affordability, potentially leading to lower sales volumes for the company.

Brampton Brick also faces threats from evolving environmental regulations, which may necessitate costly upgrades to cleaner production technologies. For example, projections for 2024 indicated a potential 5-10% rise in operational costs for North American manufacturers needing significant environmental compliance investments. Failure to adapt could impact market standing as customers increasingly prioritize sustainable suppliers, with supply chain sustainability assessments expected to be critical for contracts by 2025.

The company must also contend with a persistent scarcity of skilled labor in the construction industry, a situation that inflated production expenses and potentially stretched project timelines in 2024, with millions of unfilled positions estimated across the U.S. construction sector. This labor dynamic can limit Brampton Brick's capacity to expand operations or meet market needs, impacting overall profitability and competitiveness.

SWOT Analysis Data Sources

This Brampton Brick SWOT analysis is built upon a foundation of credible data, including their official financial statements, comprehensive market research reports, and expert industry commentary to ensure a robust and insightful assessment.