Brampton Brick Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brampton Brick Bundle

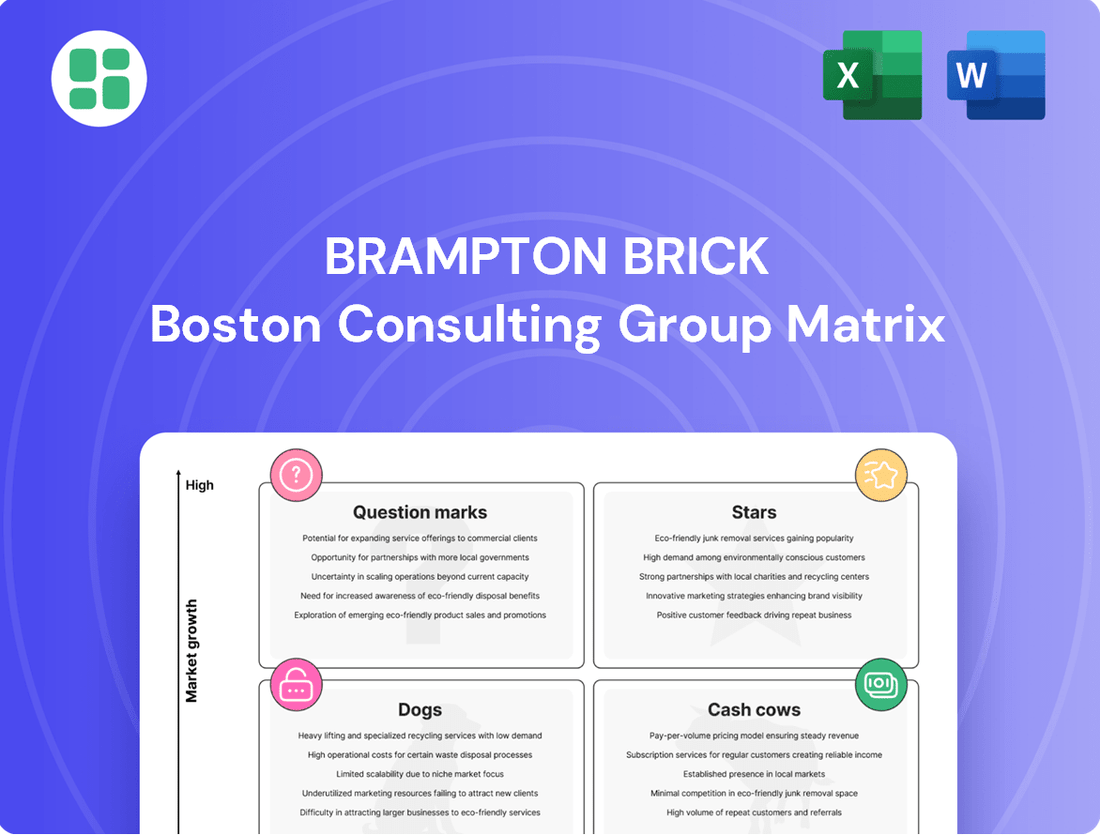

Curious about Brampton Brick's strategic product portfolio? Our BCG Matrix analysis offers a glimpse into their market position, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Uncover the full picture and gain actionable insights to drive your own investment decisions.

Don't settle for a partial view. Purchase the complete Brampton Brick BCG Matrix report to receive a detailed breakdown of each product's quadrant placement, along with expert recommendations for optimized resource allocation and future growth strategies.

This is your opportunity to understand the dynamics shaping Brampton Brick's success. Invest in the full BCG Matrix for a comprehensive strategic roadmap, enabling you to make informed decisions and stay ahead of the competition.

Stars

Premium Architectural Masonry, Brampton Brick's high-end clay brick and stone veneer offerings, are a star in their portfolio. These products, celebrated for their aesthetic appeal and superior quality, cater to a growing market segment. This growth is fueled by a demand for distinctive building materials, particularly in areas with significant custom home construction and large-scale commercial developments.

'Oaks' Landscape Products, encompassing interlocking paving stones, retaining walls, and garden walls, taps into a robust landscape and outdoor living market. This segment is experiencing significant growth, fueled by a strong trend in residential renovations and enhanced outdoor living spaces. Brampton Brick's established reputation and market penetration provide a solid foundation for these offerings.

In 2024, the demand for outdoor living solutions continued to rise, with homeowners investing more in their backyards. The 'Oaks' brand is well-positioned to capitalize on this, benefiting from Brampton Brick's extensive distribution channels. Ongoing innovation in product design and material quality further solidifies 'Oaks' as a leader in this expanding market segment.

Brampton Brick's concrete blocks and related products for multi-unit residential construction in Canada are a clear star in its portfolio. This segment is booming due to robust population increases and a significant demand for housing, especially rental apartments and larger residential complexes.

The company's status as Ontario's leading producer of concrete masonry products translates into a commanding market share within this rapidly growing sector. For instance, in 2023, new housing starts for multi-unit buildings in Canada saw a substantial increase, reflecting the ongoing demand for such properties.

Eco-Friendly Masonry Solutions

Eco-friendly masonry solutions, such as pollution-absorbing bricks and sustainable concrete, are carving out a significant niche in the construction industry. This segment is experiencing robust growth, fueled by heightened environmental awareness and stricter building codes. For instance, the global green building materials market was valued at approximately $230 billion in 2023 and is projected to reach over $400 billion by 2028, indicating a strong upward trend.

Brampton Brick's early engagement in developing and offering these innovative products positions them favorably within this expanding market. While precise market share figures for Brampton Brick in this specialized area are still emerging, their commitment to sustainability suggests substantial future growth potential. The company's strategic focus on R&D for these advanced materials is key to solidifying their leadership in this burgeoning sector.

- Growth Potential: The market for sustainable building materials is expanding rapidly, driven by environmental regulations and consumer demand.

- Innovation Focus: Brampton Brick's investment in pollution-absorbing bricks and other eco-friendly concrete materials aligns with market trends.

- Market Positioning: Early involvement in this nascent segment provides an opportunity for Brampton Brick to capture significant market share.

- Strategic Advantage: Continued research and development in green masonry can establish Brampton Brick as a leader in sustainable construction.

High-Demand US Residential Markets

Clay brick products are performing exceptionally well in supply-constrained US residential markets, especially in the Northeast. This segment shows strong potential, aligning with the characteristics of a star in the BCG matrix. The demand for new homes remains robust, even with some variability in overall US housing starts, particularly in areas with limited inventory.

Brampton Brick's established footprint in these high-demand regions positions them to seize opportunities in this expanding market. They already hold a significant share, allowing for efficient capture of growth. For instance, in 2024, the US Northeast region continued to see strong demand for building materials, with housing starts in some key metropolitan areas exceeding national averages, driven by demographic shifts and limited resale inventory.

- Market Focus: Northeast US residential markets with tight housing supply.

- Product Strength: Clay brick products are in high demand.

- Growth Driver: Persistent demand for new homes in inventory-constrained areas.

- Company Advantage: Brampton Brick's existing market share in these regions.

Brampton Brick's Premium Architectural Masonry, 'Oaks' Landscape Products, and concrete blocks for multi-unit residential construction in Canada are all identified as stars within their BCG matrix. These product lines exhibit high market growth and strong competitive positions, indicating significant potential for continued expansion and market leadership.

| Product Category | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| Premium Architectural Masonry | High | Strong | Star |

| 'Oaks' Landscape Products | High | Strong | Star |

| Concrete Blocks (Multi-Unit Residential, Canada) | High | Strong | Star |

What is included in the product

This BCG Matrix analysis highlights Brampton Brick's product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide strategic investment decisions.

The Brampton Brick BCG Matrix simplifies strategic decisions by clearly visualizing each business unit's market share and growth, relieving the pain of complex analysis.

Cash Cows

Brampton Brick's traditional clay bricks have been a cornerstone of Canadian residential construction for over a century, solidifying their status as a mature cash cow. This long-standing presence translates into a significant and stable market share across Canada, ensuring consistent revenue streams for the company.

The mature nature of this core market means that the need for extensive promotional spending is minimal, allowing Brampton Brick to enjoy strong, reliable cash flow generation from this segment. For instance, in 2024, the Canadian housing market, while experiencing some fluctuations, continued to demand durable and aesthetically pleasing building materials like clay bricks, supporting Brampton Brick's consistent sales performance.

Standard concrete blocks, a cornerstone product for Brampton Brick as Ontario's largest producer of concrete masonry, are a classic cash cow. These blocks are fundamental for both residential and non-residential construction across Canada, serving as the backbone for foundations and structures.

The market for these essential building materials is mature and stable, characterized by consistent, high demand. Brampton Brick's significant market share in this segment allows for predictable revenue streams and strong profitability without requiring substantial investment in market expansion.

In 2024, the Canadian construction sector continues to see demand for concrete products, with housing starts and infrastructure projects driving sales. Brampton Brick's established position in this segment ensures it capitalizes on this ongoing need.

Brampton Brick's Core Landscape Pavers, primarily under the well-regarded Oaks brand, are firmly positioned as cash cows within its product portfolio. These established lines of interlocking paving stones and retaining walls have secured a significant market share in mature Canadian landscape markets.

The consistent demand for outdoor renovations and new construction projects fuels the steady sales of these mature products. This reliable demand, coupled with their strong brand recognition and extensive distribution network, ensures a consistent and substantial cash flow for Brampton Brick.

In 2024, the Canadian construction industry, including residential landscaping, continued to show resilience. While specific figures for Brampton Brick's Oaks brand are proprietary, the broader market for hardscaping materials, including pavers and retaining walls, experienced steady growth, reflecting ongoing consumer investment in outdoor living spaces.

Masonry Products for Canadian Institutional Projects

Brampton Brick's masonry products catering to Canada's institutional construction sector, such as healthcare and education facilities, represent a robust cash cow within its BCG Matrix. This segment benefits from the stability of consistent public funding and the nature of long-term infrastructure projects, which translates into a predictable and reliable revenue stream for the company.

The company's established reputation and strong, long-standing relationships within this market are key drivers of its high market share. Operating in a mature, low-growth environment, these factors solidify its position as a dominant player.

- Stable Revenue: Institutional projects provide a consistent demand for masonry products.

- Market Dominance: Brampton Brick holds a significant market share in this mature sector.

- Predictable Funding: Public funding for healthcare and education ensures project continuity.

- Low Growth, High Share: Characteristics of a classic cash cow, generating substantial cash flow.

Clay Bricks (US Northeast Residential)

The sale of clay bricks to the residential construction market in the Northeastern United States is a significant cash cow for Brampton Brick. This region benefits from stable demand due to its mature market, often experiencing supply constraints that favor established players like Brampton Brick. Their deep roots and market share in the Northeast ensure a consistent and reliable source of cash flow.

In 2024, the US housing market continued to show resilience, with new residential construction starts projected to reach around 1.4 million units. While the Northeast might not see the explosive growth of other regions, its established demand base and Brampton Brick's strong position make it a dependable revenue generator. For instance, in 2023, Brampton Brick reported that its US operations, heavily weighted towards the Northeast, continued to be a strong contributor to overall profitability.

- Stable Demand: The Northeastern US residential market offers consistent demand for clay bricks.

- Market Maturity: While not the fastest-growing, the Northeast's mature market provides predictable sales.

- Supply Constraints: Regional supply limitations can benefit Brampton Brick's established production and distribution.

- Consistent Cash Flow: The combination of market position and demand generates reliable cash for the company.

Brampton Brick's traditional clay bricks, a cornerstone of Canadian residential construction, represent a mature cash cow with a significant and stable market share. This segment generates consistent revenue with minimal promotional spending, ensuring strong cash flow. In 2024, the Canadian housing market’s continued demand for durable materials like clay bricks supported Brampton Brick's sales performance.

Standard concrete blocks, produced by Brampton Brick as Ontario's largest producer, are also a classic cash cow. These essential blocks for residential and non-residential construction benefit from a mature and stable market with consistent demand, allowing for predictable revenue streams and strong profitability without requiring substantial investment.

Brampton Brick's Core Landscape Pavers, under the Oaks brand, are firmly positioned as cash cows in mature Canadian landscape markets. Consistent demand from outdoor renovations and new construction, coupled with strong brand recognition, ensures a substantial and steady cash flow for the company.

The sale of clay bricks to the Northeastern United States residential construction market is a significant cash cow. This region's stable demand and supply constraints favor established players like Brampton Brick, ensuring a consistent and reliable source of cash flow. In 2023, Brampton Brick reported strong profitability from its US operations, heavily weighted towards the Northeast.

Preview = Final Product

Brampton Brick BCG Matrix

The Brampton Brick BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after your purchase. This means no watermarks, no incomplete data, and no hidden surprises – just a comprehensive strategic analysis ready for immediate implementation. You can be confident that the professional design and insightful content you see will be yours to utilize for business planning and decision-making without any further modifications. This is the complete, actionable report, delivered directly to you upon completion of your purchase.

Dogs

Standard, undifferentiated concrete blocks sold into the US Midwest non-residential construction market are likely a dog in Brampton Brick's BCG Matrix. This segment faces a challenging outlook, with projections indicating significant declines in commercial and industrial construction throughout 2025, resulting in very low market growth.

Given this contracting market, if Brampton Brick possesses a low market share within this specific niche, these products would generate minimal returns and, more critically, tie up valuable capital that could be better allocated to more promising business areas.

Certain older or less visually appealing clay brick lines within Brampton Brick's portfolio might be categorized as dogs. These products, often not aligning with contemporary masonry design trends, face declining demand as the market increasingly favors mixed materials, modern installation techniques, and sustainable building solutions.

The shift in consumer preferences away from traditional, undifferentiated brick offerings in a mature, low-growth segment directly impacts the market share and profitability of these older lines. For instance, if a particular brick line saw its market share drop from 5% to 2% between 2022 and 2024 in a segment that grew only 1% annually, it would indicate a classic 'dog' profile.

Niche concrete products with very limited application or low sales volume are classified as Dogs within Brampton Brick's BCG Matrix. These items typically hold a small market share in specialized segments that aren't seeing much growth, resulting in very little revenue for the company. For instance, custom-molded concrete components for highly specific industrial machinery might fall into this category, with sales potentially in the tens of thousands annually rather than millions.

The challenge with these Dog products is that the expenses associated with keeping them in production and distribution often exceed the income they generate. Consider a specialized concrete aggregate used in a single, discontinued type of construction project; maintaining the tooling and inventory for such a product in 2024 would likely be a net loss. Brampton Brick would need to carefully assess if the minimal contribution justifies the ongoing operational costs.

Products in Highly Competitive, Price-Sensitive Segments

Products from Brampton Brick that operate in highly competitive, price-sensitive segments, such as basic concrete pavers or standard-sized bricks, could be classified as Dogs in the BCG Matrix. These markets are often saturated with numerous suppliers, leading to intense price wars and thin profit margins. For instance, the North American concrete manufacturing industry, which includes paver production, faced average profit margins hovering around 5-10% in recent years, making it challenging to achieve significant returns in these commoditized areas.

In these Dog categories, Brampton Brick might struggle to gain substantial market share due to low barriers to entry and the sheer volume of competitors. This lack of differentiation means that pricing becomes the primary competitive lever. For example, in 2023, the overall construction materials sector saw input cost inflation, but for highly commoditized products, passing these costs on was difficult without losing volume, further squeezing profitability.

- Low Market Share: Difficulty in capturing a significant portion of the market due to intense competition and lack of product differentiation.

- Low Market Growth: These segments often experience slow or stagnant growth, offering limited opportunities for expansion.

- Low Profitability: Price sensitivity and high competition typically result in minimal profit margins, potentially leading to cash drain.

- High Competition: Numerous players vie for market share, often leading to price wars that erode profitability.

Specific Commercial Construction Materials in Declining Markets

Masonry materials specifically designed for commercial construction projects in contracting sectors, such as particular office building types in areas like the US Midwest, fall into the dog category within Brampton Brick's BCG Matrix. These specialized products face limited market growth and potentially declining market share as these non-residential sub-sectors are projected to shrink. For instance, the U.S. office vacancy rate reached 19.6% in the fourth quarter of 2023, a significant increase from previous years, directly impacting demand for associated construction materials.

The outlook for these specific construction materials is challenging. With projected declines in demand from these niche commercial segments, their market growth rate is low. Brampton Brick's market share within these shrinking areas also needs careful scrutiny, as it may not be sustainable. Companies must consider strategic options, including divestment, for products tied predominantly to these underperforming markets.

- Low Market Growth: Projections indicate a contraction in specific commercial construction sub-sectors, leading to minimal growth opportunities for associated materials.

- Potential Low Market Share: Products exclusively catering to these declining segments may struggle to maintain or grow their market share.

- Strategic Evaluation Required: Careful assessment of these segments is crucial, with divestment being a potential consideration for Brampton Brick.

- Example Data: U.S. office vacancy rates hitting 19.6% in Q4 2023 highlight the contraction in a key commercial sector.

Products like standard, undifferentiated concrete blocks sold into contracting US Midwest non-residential construction markets are likely dogs for Brampton Brick. These segments face very low market growth, with commercial and industrial construction projected to decline significantly through 2025.

If Brampton Brick holds a small market share in these contracting niches, these products will yield minimal returns and tie up capital. Older, less popular clay brick lines, not aligning with current design trends, also fall into this category due to declining demand and market shifts favoring mixed materials and sustainable solutions.

Niche concrete products with very limited applications or low sales volumes, such as custom-molded components for specific industrial machinery, are also considered dogs. The expenses of production and distribution for these items often outweigh the income they generate, as seen with specialized aggregates for discontinued projects.

Commoditized products like basic concrete pavers or standard bricks in highly competitive, price-sensitive markets are dogs. Intense price wars and thin profit margins, with industry averages around 5-10% in recent years, make significant returns difficult.

| Product Category | Market Growth | Market Share | Profitability | Key Challenge |

|---|---|---|---|---|

| Standard Concrete Blocks (US Midwest Non-Res) | Low (Projected Decline) | Potentially Low | Low | Contracting Market Demand |

| Older Clay Brick Lines | Low (Declining Demand) | Potentially Declining | Low | Shifting Design Trends |

| Niche Concrete Products (Low Volume) | Very Low | Low | Negative | High Production/Distribution Costs vs. Revenue |

| Basic Concrete Pavers/Standard Bricks | Low (Mature Market) | Low (High Competition) | Low (Thin Margins) | Price Wars, Commoditization |

Question Marks

Brampton Brick's newer 'enviro products' and sustainable masonry innovations are currently positioned as question marks in the BCG matrix. The market for eco-friendly building materials is experiencing robust growth, projected to reach over $200 billion globally by 2028, driven by heightened environmental consciousness and stricter regulations. However, Brampton Brick's penetration in these emerging segments may still be limited.

These innovative, sustainable offerings necessitate substantial investment to secure a significant market share and capitalize on their high growth potential. Without this strategic investment, there's a risk these products could transition into the 'dogs' category, failing to generate sufficient returns.

Brampton Brick's exploration into advanced masonry technologies, like prefabricated brick panels or materials designed for robotic laying, places these components squarely in the question mark category of a BCG Matrix. The construction industry is increasingly embracing automation and prefabrication, indicating a high-growth potential market for these innovations.

While the overall market for advanced construction components is expanding, Brampton Brick's current market share in these specific, cutting-edge areas is likely nascent. This means they have a low share in a high-growth market, a classic question mark scenario.

Significant investment is crucial for Brampton Brick to develop and refine these technologies, build production capacity, and secure a competitive position. This strategic investment aims to transform these question marks into stars as the demand for automated and efficient construction methods continues to rise, potentially by 2024 and beyond.

Brampton Brick's strategic push into less penetrated US geographic sub-markets represents a classic BCG Matrix question mark. These areas, such as the burgeoning Sun Belt or specific Midwestern metropolitan areas experiencing renewed construction activity, present substantial untapped potential. For instance, while Brampton Brick has a presence in established markets, its penetration in rapidly growing secondary cities in states like Texas or Florida is still developing.

The success of these ventures hinges on targeted investments. By late 2024, Brampton Brick's capital expenditure plans are expected to allocate a significant portion to bolstering its sales teams and distribution infrastructure in these emerging regions. This proactive approach is vital to capture market share before competitors solidify their positions, transforming these question marks into potential stars in the company's portfolio.

Premium Concrete Products for Emerging Architectural Trends

Brampton Brick's development of premium concrete products for emerging architectural trends, like structured simplicity and earth-inspired colors, positions them as question marks in the BCG matrix. These innovative offerings cater to a rising demand for modern aesthetics, but their current market share is likely low. For instance, the global precast concrete market, which includes these specialized products, was valued at approximately USD 150 billion in 2023 and is projected to grow, indicating a fertile ground for new entrants.

- Focus on Structured Simplicity: Products featuring clean lines and geometric patterns align with the trend towards minimalist design, a key driver in contemporary architecture.

- Earth-Inspired Color Palettes: The introduction of concrete hues mirroring natural elements taps into a growing consumer preference for sustainable and organic aesthetics.

- Market Entry Strategy: Significant investment in marketing, R&D, and design is crucial to establish brand recognition and capture market share in this evolving segment.

- Potential for Growth: While currently question marks, successful adoption could propel these products into stars, given the projected growth in the construction sector and demand for unique materials.

Specialized Masonry for High-Growth US Non-Residential Niches

Brampton Brick's exploration into specialized masonry for burgeoning US non-residential sectors, such as data centers and healthcare facilities, represents a strategic move into areas where its current market presence may be nascent. These markets, while offering substantial growth opportunities, require dedicated effort to gain traction.

For instance, the US data center construction market alone was projected to reach over $100 billion by 2024, indicating a significant demand for specialized building materials. Similarly, healthcare construction continues to expand, with projections suggesting continued robust growth through 2025.

- Market Potential: High-growth sectors like data centers and healthcare present substantial revenue potential.

- Current Foothold: Brampton Brick's market share in these specialized niches may be limited, classifying them as question marks.

- Strategic Imperative: Success hinges on focused investment in tailored product development and aggressive, targeted sales initiatives.

- Conversion Goal: The objective is to transform this potential into tangible market share and profitable revenue streams.

Brampton Brick's newer 'enviro products' and sustainable masonry innovations are currently positioned as question marks in the BCG matrix. The market for eco-friendly building materials is experiencing robust growth, projected to reach over $200 billion globally by 2028, driven by heightened environmental consciousness and stricter regulations. However, Brampton Brick's penetration in these emerging segments may still be limited, requiring significant investment to secure a substantial market share and capitalize on their high growth potential.

These innovative, sustainable offerings necessitate substantial investment to secure a significant market share and capitalize on their high growth potential. Without this strategic investment, there's a risk these products could transition into the 'dogs' category, failing to generate sufficient returns.

Brampton Brick's exploration into advanced masonry technologies, like prefabricated brick panels or materials designed for robotic laying, places these components squarely in the question mark category of a BCG Matrix. The construction industry is increasingly embracing automation and prefabrication, indicating a high-growth potential market for these innovations.

While the overall market for advanced construction components is expanding, Brampton Brick's current market share in these specific, cutting-edge areas is likely nascent. This means they have a low share in a high-growth market, a classic question mark scenario.

Significant investment is crucial for Brampton Brick to develop and refine these technologies, build production capacity, and secure a competitive position. This strategic investment aims to transform these question marks into stars as the demand for automated and efficient construction methods continues to rise, potentially by 2024 and beyond.

Brampton Brick's strategic push into less penetrated US geographic sub-markets represents a classic BCG Matrix question mark. These areas, such as the burgeoning Sun Belt or specific Midwestern metropolitan areas experiencing renewed construction activity, present substantial untapped potential. For instance, while Brampton Brick has a presence in established markets, its penetration in rapidly growing secondary cities in states like Texas or Florida is still developing. The success of these ventures hinges on targeted investments. By late 2024, Brampton Brick's capital expenditure plans are expected to allocate a significant portion to bolstering its sales teams and distribution infrastructure in these emerging regions. This proactive approach is vital to capture market share before competitors solidify their positions, transforming these question marks into potential stars in the company's portfolio.

Brampton Brick's development of premium concrete products for emerging architectural trends, like structured simplicity and earth-inspired colors, positions them as question marks in the BCG matrix. These innovative offerings cater to a rising demand for modern aesthetics, but their current market share is likely low. For instance, the global precast concrete market, which includes these specialized products, was valued at approximately USD 150 billion in 2023 and is projected to grow, indicating a fertile ground for new entrants.

Brampton Brick's exploration into specialized masonry for burgeoning US non-residential sectors, such as data centers and healthcare facilities, represents a strategic move into areas where its current market presence may be nascent. These markets, while offering substantial growth opportunities, require dedicated effort to gain traction. For instance, the US data center construction market alone was projected to reach over $100 billion by 2024, indicating a significant demand for specialized building materials. Similarly, healthcare construction continues to expand, with projections suggesting continued robust growth through 2025.

| Brampton Brick Question Marks | Market Growth | Brampton Brick Market Share | Strategic Need |

| Enviro Products & Sustainable Masonry | High (Projected >$200B globally by 2028) | Low/Nascent | Significant Investment for Market Penetration |

| Advanced Masonry Technologies (e.g., Prefab Panels) | High (Driven by Automation & Prefab) | Low/Nascent | Investment in R&D, Production, and Market Positioning |

| Premium Concrete for New Architectural Trends | Moderate to High (e.g., Global Precast Concrete Market ~$150B in 2023) | Low | Targeted Marketing, R&D, and Design Investment |

| Specialized Masonry for Data Centers & Healthcare | High (e.g., US Data Center Construction >$100B by 2024) | Low/Nascent | Focused Investment in Tailored Products and Sales Initiatives |

BCG Matrix Data Sources

Our Brampton Brick BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.