Brampton Brick PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brampton Brick Bundle

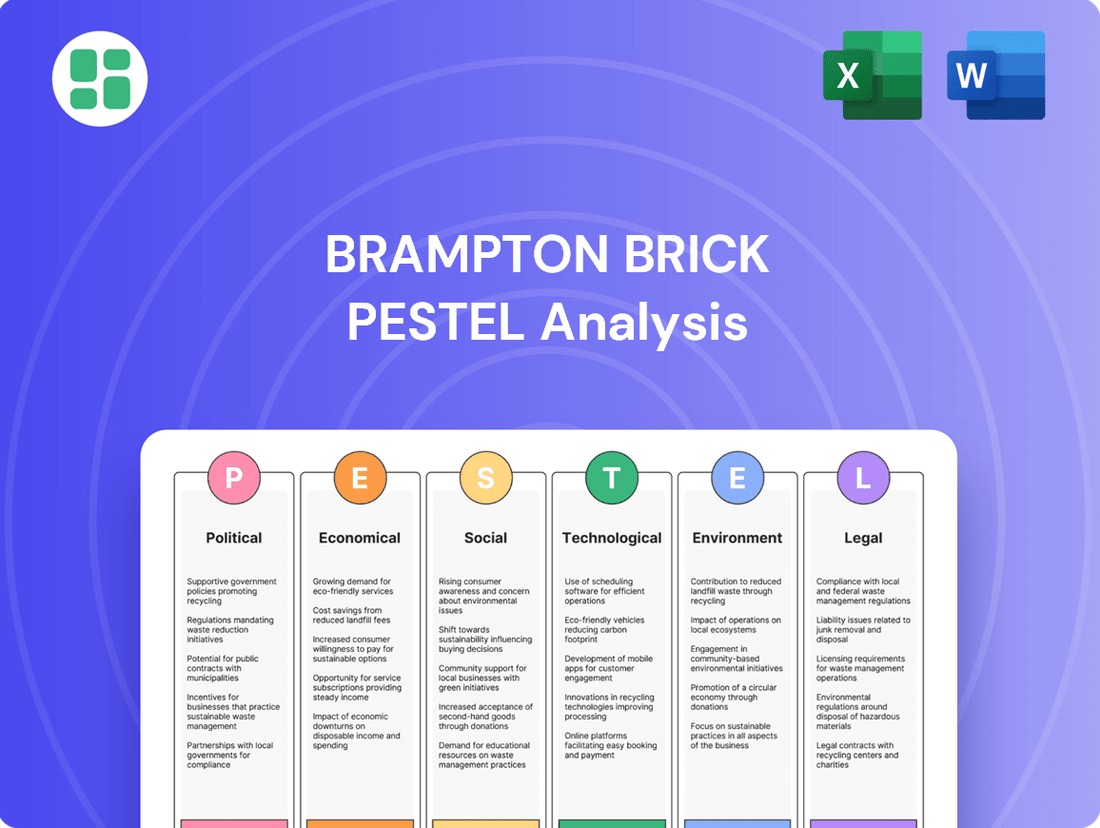

Unlock the critical external factors shaping Brampton Brick's destiny with our meticulously crafted PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both challenges and opportunities for the company. Equip yourself with the foresight needed to navigate this dynamic landscape. Download the full analysis now and gain a decisive competitive advantage.

Political factors

Government housing policies significantly shape the demand for masonry products like those from Brampton Brick. Initiatives such as affordable housing programs and subsidies for new home construction, prevalent in both Canada and the US, can directly stimulate residential construction activity. For instance, the Canadian government's National Housing Strategy, with its significant investment allocations, aims to increase housing supply and affordability, potentially boosting demand for building materials.

Changes in zoning laws and building codes also play a crucial role. Relaxed zoning regulations can encourage higher-density developments, while updated codes might favor specific materials or construction methods. In 2024, many municipalities are reviewing their zoning bylaws to address housing shortages, which could lead to increased construction projects and, consequently, higher demand for bricks and related products across Brampton Brick's operating regions.

Public and private sector investments in infrastructure, such as roads and utilities, directly fuel demand for construction materials like those Brampton Brick provides. In 2024, Canada's federal budget earmarked billions for infrastructure, with a significant portion allocated to public transit and green infrastructure projects, signaling continued demand for building materials.

Government spending priorities in both Canada and the United States heavily influence the scale of non-residential construction, a key market for Brampton Brick. For example, the US Infrastructure Investment and Jobs Act, passed in late 2021, continues to drive substantial investment in transportation and utility upgrades through 2025, benefiting companies supplying these sectors.

Any shifts in these government infrastructure spending plans can create volatility in Brampton Brick's non-residential segment. A slowdown in planned projects or a redirection of funds could directly impact the company's sales volumes in this crucial area.

Trade policies between Canada and the U.S., including potential tariffs, directly influence Brampton Brick's operational costs. For instance, changes in lumber tariffs could affect the cost of wood used in packaging and shipping. In 2023, Canada's exports to the U.S. reached $476.5 billion, highlighting the significance of these trade flows.

Political Stability and Elections

Political stability in Canada and the United States significantly influences the construction sector, directly impacting demand for building materials. Upcoming election cycles, such as the anticipated 2025 Canadian federal election and the 2024 US presidential election, can introduce a degree of uncertainty. This uncertainty might cause investors and developers to pause or delay new construction projects, waiting for clearer policy directions from potential new administrations. For Brampton Brick, this translates to potential fluctuations in order volumes.

Stable political environments are crucial for fostering long-term investment in infrastructure and housing, which are key drivers for Brampton Brick's sales. For instance, government infrastructure spending initiatives, often announced or adjusted following elections, can create substantial demand. Conversely, political instability or significant policy shifts can lead to project deferrals and a general slowdown in construction activity, directly affecting the company's revenue streams.

- Canadian Federal Election: While the exact date is unconfirmed, the next federal election is constitutionally due by October 2025, potentially impacting policy decisions relevant to housing starts and infrastructure investment.

- US Presidential Election: The 2024 US presidential election could lead to changes in trade policies and economic stimulus measures that affect cross-border construction material demand and supply chains.

- Infrastructure Spending: Government commitments to infrastructure projects, such as those seen in the 2023 Canadian federal budget allocating billions to infrastructure, directly benefit companies like Brampton Brick by creating sustained demand.

Regulatory Environment for Manufacturing

Government regulations significantly shape Brampton Brick's manufacturing landscape. For instance, evolving environmental standards, such as those related to industrial emissions and waste management, can directly impact operational costs. In 2024, the Canadian federal government continued to emphasize sustainability goals, potentially leading to increased compliance burdens for manufacturers.

Worker safety legislation also plays a crucial role. Adherence to stringent occupational health and safety regulations, like those overseen by provincial ministries of labour, requires ongoing investment in training and equipment. Failure to comply can result in fines and operational disruptions, as seen in various industrial sectors.

Conversely, supportive government policies can offer a competitive edge. Tax incentives for capital investments in modern, efficient manufacturing technologies, or grants aimed at reducing carbon footprints, could provide Brampton Brick with financial advantages. For example, provincial programs designed to boost domestic manufacturing capacity might offer beneficial terms for expansion projects.

Key regulatory considerations for Brampton Brick include:

- Environmental Protection: Compliance with air and water quality standards, and waste disposal regulations.

- Workplace Safety: Adherence to occupational health and safety acts and standards.

- Building Codes: Meeting standards for the quality and performance of manufactured brick products.

- Trade Policies: Navigating import/export regulations for raw materials and finished goods.

Political stability and upcoming elections in Canada and the US introduce uncertainty for Brampton Brick. The 2024 US presidential election and the potential 2025 Canadian federal election could lead to shifts in housing and infrastructure policies, impacting demand for building materials. Government spending on infrastructure, such as the billions allocated in Canada's 2023 budget, directly supports companies like Brampton Brick by ensuring sustained project pipelines.

What is included in the product

This Brampton Brick PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

A clean, summarized Brampton Brick PESTLE analysis provides a clear overview of external factors, alleviating the pain of information overload and enabling focused strategic discussions.

Economic factors

Interest rate fluctuations significantly affect mortgage affordability for homebuyers and financing costs for developers, directly impacting residential construction. For instance, the Bank of Canada's key policy rate, which influences mortgage rates, saw increases throughout 2022 and 2023, reaching 5.00% by July 2023. Higher borrowing costs can cool housing demand and slow down new housing starts, consequently reducing the demand for materials like bricks and concrete blocks supplied by companies like Brampton Brick.

The economic health of Brampton Brick's key markets, including Ontario, Quebec, and the Northeastern and Midwestern United States, directly impacts construction activity. For instance, the U.S. real GDP grew by an annualized rate of 1.3% in the first quarter of 2024, showing a slowdown but still indicating expansion. Similarly, Canada's GDP saw a modest 0.2% increase in the first quarter of 2024.

Robust economic growth fuels consumer confidence and business investment, which in turn drives demand for both residential and non-residential construction. This increased activity translates into higher sales volumes for building materials like those produced by Brampton Brick. A strong economy generally means more projects get the green light, from new homes to commercial buildings.

Rising inflation in 2024 and projected into 2025 is significantly increasing the cost of essential raw materials for Brampton Brick, including clay, cement, and aggregates. Energy prices, a major component of manufacturing, are also experiencing upward pressure, alongside labor costs, directly impacting the company's operational expenses.

The ability of Brampton Brick to effectively pass these escalating production costs onto its customers through price adjustments will be crucial for safeguarding its profit margins throughout this period. Successfully navigating these inflationary headwinds is a primary economic challenge for the company.

Housing Starts and Construction Spending

The health of the housing market is a critical economic factor for Brampton Brick. In 2024, Canada saw a notable increase in housing starts, with CMHC reporting a 10% year-over-year rise in new housing construction activity by the end of the third quarter, reaching an annualized rate of approximately 230,000 units. This upward trend directly translates to increased demand for building materials like those supplied by Brampton Brick.

Construction spending also plays a vital role. In the first nine months of 2024, total construction investment in Canada experienced a 7% increase compared to the same period in 2023, driven by both residential and non-residential projects. This broad-based growth indicates a robust environment for construction materials suppliers.

Looking ahead to 2025, forecasts suggest continued strength in residential construction, particularly in major urban centers. For instance, projections for the Greater Toronto Area anticipate a 5% to 8% increase in housing starts for 2025, a key market for Brampton Brick. Monitoring these regional trends and project pipelines is essential for the company's strategic inventory and production planning.

- Housing Starts: Canada's annualized housing starts reached approximately 230,000 units by Q3 2024, a 10% increase year-over-year.

- Construction Spending: Total construction investment in Canada grew by 7% in the first nine months of 2024 compared to the prior year.

- Regional Forecasts: The Greater Toronto Area is expected to see a 5-8% rise in housing starts for 2025, impacting demand for building materials.

Exchange Rates

Fluctuations in currency exchange rates, especially between the Canadian Dollar (CAD) and the US Dollar (USD), directly impact Brampton Brick's financial performance due to its significant cross-border activities. A stronger Canadian dollar, for instance, can reduce the profitability of sales made in the United States when those earnings are converted back into Canadian currency. Conversely, a weaker Canadian dollar can enhance the competitiveness of Brampton Brick's products in the US market.

The volatility inherent in exchange rates presents both financial risks and potential opportunities for the company. For example, in early 2024, the CAD experienced some weakening against the USD, which could have provided a tailwind for Brampton Brick's US-based revenues. However, the exact impact depends on the timing of transactions and hedging strategies employed.

- Exchange Rate Impact: Brampton Brick's revenue and cost structures are sensitive to the CAD/USD exchange rate.

- Stronger CAD: Reduces profitability of US sales upon conversion.

- Weaker CAD: Enhances competitiveness of Canadian sales in the US.

- 2024 Trend: Early 2024 saw some CAD depreciation against the USD, potentially benefiting US sales conversion.

The economic landscape for Brampton Brick in 2024 and 2025 is shaped by both growth and cost pressures. While increased housing starts and construction spending, like the 7% rise in Canadian construction investment through Q3 2024, signal robust demand, rising inflation is a significant concern. This inflation impacts raw material and energy costs, directly affecting operational expenses for the company.

Interest rates remain a key factor, with the Bank of Canada's key policy rate at 5.00% as of July 2023, influencing mortgage affordability and developer financing. Economic growth, though moderating with a 1.3% annualized GDP growth in the US for Q1 2024, generally supports construction activity. The company's ability to manage costs and pass them on will be crucial.

Currency exchange rates also present a dynamic. A weaker Canadian dollar in early 2024 could benefit Brampton Brick's US sales conversion, while a stronger dollar would have the opposite effect. These economic variables require careful monitoring for strategic planning.

| Economic Factor | 2024 Data/Trend | 2025 Outlook | Impact on Brampton Brick |

|---|---|---|---|

| Housing Starts (Canada) | Approx. 230,000 units (annualized) by Q3 2024 (+10% YoY) | Projected continued strength, especially in GTA (+5-8% starts) | Increased demand for building materials |

| Construction Spending (Canada) | +7% in first nine months of 2024 vs. 2023 | Expected to remain strong | Sustained demand across project types |

| Interest Rates (Bank of Canada Key Policy Rate) | 5.00% (as of July 2023) | Subject to ongoing review, potential for stabilization or further adjustments | Affects affordability for buyers and financing costs for developers |

| Inflation | Rising costs for raw materials, energy, and labor | Projected to remain a significant factor | Increased operational expenses, pressure on profit margins |

| CAD/USD Exchange Rate | Some depreciation against USD in early 2024 | Volatile, subject to global economic conditions | Impacts profitability of US sales and competitiveness in US market |

Same Document Delivered

Brampton Brick PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Brampton Brick's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises regarding the PESTLE factors impacting Brampton Brick.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive PESTLE analysis for Brampton Brick.

Sociological factors

Canada's population is projected to reach 40 million by 2030, with Ontario and Quebec leading the growth, driven by both natural increase and immigration. This demographic expansion, particularly in the Greater Toronto Area where Brampton Brick is a key supplier, directly translates to increased demand for new housing and infrastructure projects. For instance, Ontario's population grew by 1.4% in 2023, adding over 200,000 people, signaling a robust need for construction materials.

Changes in household formation, such as smaller average family sizes and an increase in single-person households, are also influencing housing demand. This often leads to a greater need for multi-unit dwellings and townhouses, sectors where Brampton Brick's diverse product line is well-suited. The continued influx of immigrants, with a significant portion settling in Ontario, further bolsters the need for new residential construction, directly impacting the demand for building materials.

Consumer tastes in housing are changing, with a noticeable lean towards designs that blend modern aesthetics with classic durability. In 2024, for instance, surveys indicated that over 60% of new homebuyers expressed a preference for natural materials, with brick consistently ranking high for its perceived longevity and traditional appeal.

This trend directly influences the demand for masonry products like those offered by Brampton Brick. A continued appreciation for the aesthetic of traditional brick, coupled with specific color and texture preferences, presents a significant opportunity for the company to capitalize on this market segment.

However, the rise of alternative building materials, such as advanced composites and engineered wood, presents a competitive challenge. Brampton Brick needs to remain attuned to these shifts, potentially by diversifying its product lines or emphasizing the unique benefits of brick in its marketing to maintain market share.

Urbanization and suburbanization significantly shape construction demands. As cities grow denser, there's an increasing need for multi-story residential and commercial buildings, impacting the types of bricks and masonry products required. For instance, in 2024, many major Canadian urban centers continued to see a rise in apartment construction, a trend Brampton Brick must consider for product development.

Conversely, suburban expansion often favors single-family homes, which typically utilize different brick styles and quantities. In 2023, suburban areas around Toronto, a key market for Brampton Brick, experienced sustained growth in new housing starts, primarily detached and semi-detached dwellings, highlighting the need for varied product offerings.

Brampton Brick must actively track these demographic shifts and development patterns to align its product portfolio and sales strategies. Understanding whether a region is experiencing urban infill or suburban sprawl allows the company to optimize its inventory and marketing, ensuring it meets the specific needs of builders and developers in each area.

Sustainability and Green Building Demand

Societal awareness regarding environmental impact is significantly shaping the construction industry. Consumers and developers are actively seeking sustainable building materials, driving demand for products with a lower carbon footprint and increased use of recycled content. This trend is evident in the growing market for green building certifications, which often prioritize materials that contribute to energy efficiency and reduced waste. For instance, the global green building market was valued at over USD 300 billion in 2023 and is projected to reach over USD 1 trillion by 2030, indicating a substantial shift in consumer preference.

Brampton Brick must acknowledge this evolving landscape. Highlighting the sustainable attributes of its clay brick products, such as durability and potential for reuse, is crucial. Furthermore, exploring investments in greener manufacturing processes, like reducing energy consumption or incorporating recycled materials into their production, will be key to aligning with market expectations. The company's 2024 sustainability report indicated a 5% reduction in energy intensity per ton of product, a step towards meeting this demand.

- Growing Green Building Market: The global green building market is expanding rapidly, projected to exceed USD 1 trillion by 2030.

- Consumer Preference for Sustainability: Buyers are increasingly prioritizing materials with lower environmental impact and energy efficiency.

- Material Innovation: Demand for recycled content and products with a reduced carbon footprint is on the rise.

- Brampton Brick's Response: The company is focusing on highlighting product sustainability and improving manufacturing efficiency, with a reported 5% energy intensity reduction in 2024.

Labor Availability and Skilled Trades

The availability of skilled labor, particularly masons and general construction workers, is a critical factor for Brampton Brick. A robust construction workforce directly translates to a higher volume of building projects, thereby increasing the demand for brick and related materials. For instance, in 2023, the Canadian construction industry faced ongoing labor challenges, with Statistics Canada reporting a significant number of job vacancies.

Labor shortages can significantly impede construction timelines and escalate project costs. This, in turn, can dampen the demand for building materials like those supplied by Brampton Brick. The overall health and capacity of the construction labor market therefore has a direct and indirect influence on Brampton Brick's market performance and sales volume.

- Skilled Labor Shortages: Persistent shortages in trades like masonry can slow down residential and commercial construction.

- Impact on Project Timelines: Delays in project completion due to labor scarcity can lead to reduced material orders.

- Cost Escalation: Increased wages and recruitment costs for skilled workers can raise overall construction expenses, potentially affecting material demand.

- Workforce Capacity: The general capacity of the construction workforce directly correlates with the potential market size for Brampton Brick's products.

Societal attitudes towards homeownership and community design are evolving, impacting the demand for specific housing types. There's a growing appreciation for aesthetically pleasing, durable building materials, with brick consistently favored for its timeless appeal and low maintenance. This preference is reinforced by a desire for sustainable living, where materials that offer longevity and reduce the need for frequent replacement are highly valued.

Consumer preferences are shifting towards more compact, energy-efficient homes, often in mixed-use developments that foster community. This trend means Brampton Brick needs to consider product lines that cater to multi-unit residential buildings and urban infill projects. For example, in 2024, new housing starts in urban centers saw a higher proportion of apartment and townhouse construction compared to single-family homes, a pattern that influences the types and quantities of bricks required.

The emphasis on community well-being also extends to public spaces and infrastructure, creating opportunities for brick in commercial and civic projects. As urban planning prioritizes pedestrian-friendly environments and durable public amenities, the demand for high-quality masonry products for facades, pathways, and decorative elements is likely to increase. This aligns with Brampton Brick's established reputation for quality and a wide range of aesthetic options.

Brampton Brick must remain agile in responding to these evolving societal expectations. By understanding the nuances of consumer preferences and urban development trends, the company can better position its products and marketing efforts to meet the demands of a changing market. This includes potentially developing new brick styles or colors that align with modern architectural trends while still leveraging the inherent benefits of traditional brick construction.

Technological factors

Advancements in automation and robotics are significantly reshaping brick and concrete block manufacturing. For Brampton Brick, this means potential gains in production efficiency and a reduction in labor costs, as automated systems can operate with greater speed and precision than manual processes. Improved product consistency is another key benefit, leading to fewer defects and higher quality output.

Investing in cutting-edge manufacturing technology is crucial for maintaining competitiveness and scaling operations effectively. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow significantly, indicating a strong industry trend towards automation. This investment can bolster Brampton Brick's capacity and operational agility.

The adoption of smart factory solutions, which integrate automation, data analytics, and connectivity, can further optimize resource utilization. This includes better management of energy consumption, raw material flow, and waste reduction, contributing to both cost savings and environmental sustainability for Brampton Brick.

Innovations in building materials present a dynamic technological landscape for Brampton Brick. The emergence of advanced composites and alternative materials, offering enhanced durability, reduced weight, or cost efficiencies, could directly challenge the market share of traditional masonry. For instance, the growing interest in engineered wood products and high-performance concrete alternatives means Brampton Brick needs to stay vigilant.

To maintain its competitive edge, Brampton Brick is compelled to actively track material science advancements. This includes a potential focus on research and development to either improve its existing brick offerings or diversify into new material categories. The company's long-term viability hinges on its ability to adapt to and potentially integrate these emerging technologies, ensuring its product portfolio remains relevant and attractive in a rapidly evolving construction industry.

The construction industry is seeing a significant shift towards prefabrication and modular building. This trend, particularly the rise of non-masonry modular units, could directly impact the demand for traditional brick products. For instance, a 2024 report indicated that the global modular construction market is projected to reach $257.4 billion by 2027, showcasing its rapid expansion.

Widespread adoption of these off-site construction methods might reduce the need for on-site masonry labor and materials, potentially affecting companies like Brampton Brick. Understanding how these evolving techniques influence material specifications is crucial for adapting product offerings and maintaining market share in the coming years.

Energy Efficiency in Production

Technological advancements are revolutionizing energy efficiency in brick and concrete block production. Innovations in kiln and curing processes, such as advanced insulation and optimized firing cycles, can lead to substantial reductions in energy consumption. For Brampton Brick, this translates directly into lower operational costs, a critical factor given the energy-intensive nature of its manufacturing. For instance, a shift to more efficient kiln designs could potentially cut energy use by 10-15% per unit, a significant saving for a large-scale producer.

Implementing these new energy-saving technologies is crucial for Brampton Brick to manage its energy expenses effectively. Energy costs represent a considerable portion of manufacturing overhead in this sector. By adopting cutting-edge solutions, the company can not only mitigate rising energy prices but also make significant strides toward its sustainability objectives. This proactive approach aligns with broader industry trends toward greener manufacturing practices.

The continuous improvement in energy efficiency offers dual benefits: economic and environmental. Reduced energy consumption directly lowers production costs, enhancing profitability. Simultaneously, it decreases the company's carbon footprint, addressing environmental concerns and potentially improving its public image and compliance with future regulations. This strategic focus on technological adoption positions Brampton Brick for long-term resilience and competitive advantage.

- Kiln Efficiency: Modern kilns can achieve up to 20% greater thermal efficiency compared to older models, significantly reducing fuel consumption.

- Curing Process: Advanced curing methods, like steam curing or accelerated drying, can shorten production cycles and lower energy demands.

- Waste Heat Recovery: Technologies that capture and reuse waste heat from the production process can further boost overall energy efficiency by an estimated 5-10%.

- Smart Monitoring: Digital monitoring systems allow for real-time tracking of energy usage, enabling prompt identification and correction of inefficiencies.

Digital Design and Building Information Modeling (BIM)

The construction industry is increasingly adopting digital design tools and Building Information Modeling (BIM), which enable more accurate planning and material selection. For instance, by 2024, the global BIM market was projected to reach over $11.8 billion, highlighting its growing importance.

Brampton Brick can capitalize on this trend by offering digital product libraries for architects and engineers. This makes it simpler for them to incorporate Brampton Brick's products into contemporary building designs, potentially increasing specification rates.

- Digital Integration: Providing BIM-ready product data enhances Brampton Brick's accessibility to design professionals.

- Market Reach: A strong digital presence can expand Brampton Brick's influence in project specifications.

- Efficiency Gains: BIM adoption in construction projects is estimated to improve efficiency by up to 20% in some cases, making product integration smoother.

Technological advancements in automation and digital design are reshaping the construction materials sector. Brampton Brick can leverage these by integrating smart factory solutions for efficiency and providing BIM-ready product data to designers, as the global BIM market was projected to exceed $11.8 billion by 2024. Innovations in kiln technology also offer significant energy savings, with modern kilns achieving up to 20% greater thermal efficiency, directly impacting operational costs and sustainability efforts.

| Technology Area | Impact on Brampton Brick | Relevant Data/Trend |

| Automation & Robotics | Increased production efficiency, reduced labor costs, improved product consistency. | Global industrial robotics market valued at ~$50 billion in 2023, with significant projected growth. |

| Energy Efficiency Innovations | Lower operational costs, reduced carbon footprint. | Modern kilns offer up to 20% greater thermal efficiency; waste heat recovery can boost efficiency by 5-10%. |

| Digital Design (BIM) | Easier product integration into designs, potential increase in specification rates. | Global BIM market projected to reach over $11.8 billion by 2024; BIM adoption can improve project efficiency by up to 20%. |

Legal factors

Changes in national, provincial, and municipal building codes, such as those impacting energy efficiency or seismic resilience, directly affect the required specifications for masonry products used in construction. For instance, evolving energy codes might necessitate improved insulation properties in brick assemblies, influencing product development for Brampton Brick. Compliance with these mandatory standards is crucial for market access and product acceptance across different jurisdictions.

Environmental protection laws, covering air emissions, water discharge, waste management, and quarrying, directly impact Brampton Brick's production and sourcing. For instance, in 2024, Canada’s federal government continued to focus on reducing greenhouse gas emissions, potentially affecting energy-intensive brick manufacturing processes.

Securing and maintaining environmental permits is vital for Brampton Brick's operations. In Ontario, where Brampton Brick primarily operates, the Ministry of the Environment, Conservation and Parks oversees stringent permitting for industrial activities, with potential for increased compliance costs or limitations on expansion if regulations tighten.

Continuous adherence to these environmental statutes is a non-negotiable legal requirement for Brampton Brick. Failure to comply can result in significant fines and operational disruptions, underscoring the importance of robust environmental management systems.

Brampton Brick must navigate a complex web of labor laws and workplace safety regulations across Canada and the United States. These regulations, covering minimum wage, worker benefits, and occupational health and safety, directly influence operational costs and human resource strategies. For instance, in Ontario, the minimum wage increased to $17.30 per hour as of October 1, 2024, impacting labor expenses.

Failure to comply with these legal frameworks, such as OSHA standards in the US or provincial workplace safety acts in Canada, can result in significant fines and reputational damage. Adherence is crucial for maintaining a safe working environment, which in turn affects employee morale and productivity. Changes in legislation, like potential updates to overtime rules or new safety protocols, can necessitate adjustments in staffing levels and training programs, adding another layer of complexity to Brampton Brick's management.

Product Liability and Consumer Protection Laws

Laws governing product quality, warranties, and consumer protection are crucial for manufacturers like Brampton Brick. These regulations ensure that products are safe and perform as expected, holding companies accountable for any shortcomings. For Brampton Brick, adhering to these standards is essential to avoid costly product liability claims and maintain consumer trust. In 2024, the Canadian consumer protection landscape continues to emphasize transparency and product safety, with potential fines for non-compliance reaching significant amounts, impacting profitability.

Brampton Brick must actively ensure its masonry products consistently meet stringent quality benchmarks and fully comply with all applicable consumer protection legislation. This proactive approach is vital for mitigating legal risks associated with product liability. For instance, a failure to meet stated durability standards could lead to claims for repair or replacement, directly impacting the company's bottom line. Maintaining high product quality is therefore not just a matter of good practice, but a fundamental strategy for avoiding legal disputes and safeguarding its reputation.

- Product Quality Standards: Ensuring all bricks and masonry products meet or exceed industry-specific quality certifications, such as CSA standards, is paramount.

- Warranty Compliance: Clearly defined and honorably upheld warranties on product durability and performance are critical to consumer confidence and legal protection.

- Consumer Protection Legislation: Strict adherence to federal and provincial consumer protection acts, including those related to advertising and product safety, is necessary.

- Risk Mitigation: Proactive quality control and robust warranty management significantly reduce the likelihood and financial impact of product liability lawsuits.

Land Use and Zoning Regulations

Land use and zoning regulations are critical for Brampton Brick, directly dictating where construction can take place and the size of projects. These rules influence the availability of land for new developments, impacting the overall construction pipeline and, consequently, the demand for building materials. For instance, in 2024, the Greater Toronto Area, Brampton's primary market, continued to grapple with housing supply shortages exacerbated by restrictive zoning in some municipalities, potentially limiting the pace of new residential construction.

Understanding local zoning ordinances is therefore essential for accurate market forecasting. Changes in zoning laws, such as increased density allowances or the creation of new development zones, can unlock significant opportunities for material suppliers like Brampton Brick. Conversely, stricter regulations can curtail development, affecting sales volumes. For example, the Ontario government's Bill 23, More Homes Built Faster Act, introduced in late 2022 and continuing to influence 2024 development, aims to streamline approvals and increase housing supply, which could positively impact demand for brick products in the coming years.

- Zoning Impact on Development: Regulations determine permissible land uses and building densities, directly affecting the scale and location of construction projects.

- Land Availability and Construction Pipeline: Zoning laws influence the supply of developable land, which in turn shapes the demand for building materials.

- Market Forecasting: Local zoning is a key variable for predicting construction activity and material needs.

- Regulatory Changes: Shifts in land use policies, like those aimed at increasing housing supply, can significantly alter market dynamics for construction material suppliers.

Brampton Brick must navigate a complex web of labor laws and workplace safety regulations across Canada and the United States. These regulations, covering minimum wage, worker benefits, and occupational health and safety, directly influence operational costs and human resource strategies. For instance, in Ontario, the minimum wage increased to $17.30 per hour as of October 1, 2024, impacting labor expenses.

Environmental factors

The escalating frequency and intensity of extreme weather events, like intense rainfall and heatwaves, pose direct challenges to Brampton Brick's manufacturing processes and the on-site installation of their masonry products. For instance, prolonged periods of heavy rain can disrupt construction schedules, delaying projects and potentially impacting material integrity.

Furthermore, growing awareness of climate change is fueling a market shift towards building materials that offer enhanced resilience and improved energy efficiency. This trend is significant, as the construction sector's contribution to global carbon emissions remains a key concern.

Brampton Brick must therefore evaluate how its product portfolio aligns with the growing demand for climate-resilient solutions. Adapting operational strategies to mitigate the impacts of unpredictable weather patterns, such as investing in more robust supply chain logistics or developing products with superior thermal performance, will be crucial for sustained success in the 2024-2025 period and beyond.

Brampton Brick's reliance on clay, shale, sand, and aggregates means that the availability and sustainable sourcing of these materials are paramount. Environmental scrutiny around quarrying practices and the long-term impact of resource depletion is intensifying, potentially leading to more stringent regulations or higher procurement costs for essential inputs.

For instance, in 2023, the global demand for construction aggregates was projected to grow, but concerns about the environmental impact of extraction, including habitat disruption and water usage, led to increased regulatory oversight in many regions. This trend is expected to continue, impacting companies like Brampton Brick.

Ensuring a secure and ethically managed supply chain for these raw materials is therefore crucial for Brampton Brick to sustain its production levels and mitigate operational risks associated with environmental pressures.

Brampton Brick's manufacturing processes, particularly for bricks and concrete blocks, are inherently energy-intensive, contributing to substantial carbon emissions. In 2023, the construction sector globally accounted for approximately 37% of energy-related CO2 emissions, highlighting the industry-wide challenge.

Increasing global and governmental pressure to curb greenhouse gas emissions means Brampton Brick faces a growing need to invest in more sustainable practices. This includes exploring cleaner energy sources, optimizing manufacturing processes for efficiency, and potentially adopting carbon capture technologies, which are becoming more viable for industrial operations.

Regulatory frameworks, such as carbon pricing mechanisms or stricter emission limits, can directly influence Brampton Brick's operational expenses and its standing relative to competitors. For instance, Canada's federal carbon pricing system, which saw a price of $65 per tonne of CO2 in 2023 and is set to rise, directly affects energy costs for industrial emitters.

Waste Management and Recycling

Environmental regulations and growing societal expectations are compelling industries to adopt more sustainable waste management practices, emphasizing recycling and waste reduction. Brampton Brick must efficiently manage its manufacturing by-products and investigate avenues for incorporating recycled materials into its product lines, or recycling its own production waste. For instance, in 2023, the construction and demolition waste sector in Ontario, where Brampton Brick operates, generated approximately 12 million tonnes, with recycling rates varying across municipalities. Effective waste management can lead to significant cost savings and bolster the company's environmental credentials.

Brampton Brick's commitment to sustainability is crucial, especially considering the increasing focus on circular economy principles within the building materials sector. The company can explore partnerships to either recycle its production waste or source recycled content for its products.

- Waste Reduction Initiatives: Implementing strategies to minimize waste generated during the brick manufacturing process.

- Recycled Content Integration: Researching and developing methods to incorporate recycled materials, such as crushed concrete or glass, into new brick products.

- Cost Savings and Environmental Performance: Achieving operational efficiencies and enhancing Brampton Brick's reputation by effectively managing waste and reducing its environmental footprint.

Water Usage and Conservation

Water is absolutely essential for Brampton Brick's manufacturing processes, especially for concrete block production. As concerns about water scarcity grow, particularly in areas that experience droughts, stricter regulations on water usage could definitely affect their operations. For instance, in 2024, many regions experienced below-average rainfall, leading to increased scrutiny on industrial water consumption.

To ensure they can keep operating smoothly in the long run, Brampton Brick needs to focus on conserving water and looking into different ways to source it. This might involve investing in more efficient machinery or exploring recycled water systems. By proactively addressing water challenges, the company can build a more sustainable future.

Key considerations for Brampton Brick regarding water include:

- Manufacturing Dependency: Concrete block production requires significant water input, making it a critical resource.

- Regulatory Impact: Increased water scarcity concerns can lead to tighter usage regulations, potentially increasing operational costs or limiting production capacity.

- Sustainability Initiatives: Implementing water conservation technologies and exploring alternative water sources are vital for long-term resilience.

The increasing focus on climate change necessitates Brampton Brick's adaptation to growing demand for energy-efficient and resilient building materials. Extreme weather events, such as those experienced in 2024, directly impact construction timelines and material integrity, requiring operational adjustments and a review of product offerings to align with sustainability trends.

PESTLE Analysis Data Sources

Our Brampton Brick PESTLE Analysis is built on a robust foundation of data from government agencies, industry associations, and reputable market research firms. We incorporate economic indicators, construction sector reports, and regulatory updates to provide a comprehensive view.