Brampton Brick Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brampton Brick Bundle

Brampton Brick navigates a competitive landscape influenced by powerful buyers and the constant threat of substitute materials. Understanding these forces is crucial for any stakeholder looking to grasp the company's strategic position.

The full Porter's Five Forces Analysis dives deep into the bargaining power of suppliers and the intensity of rivalry within the brick manufacturing sector, revealing the true dynamics shaping Brampton Brick's market. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Brampton Brick's supplier power is significantly shaped by the concentration of its raw material sources. The availability and number of suppliers for essential inputs such as clay, shale, aggregates, and cement directly impact this dynamic. A limited number of large, consolidated suppliers for a crucial material can lead to increased pricing leverage and more stringent terms for Brampton Brick.

The company's dependence on specific geological deposits for its clay and shale can amplify supplier power in those particular regions. For instance, if a key clay deposit is controlled by a small group of entities, those suppliers gain considerable influence over Brampton Brick's procurement costs and supply chain stability.

The ease with which Brampton Brick can switch suppliers significantly influences the bargaining power of those suppliers. If Brampton Brick faces high costs when changing suppliers, perhaps due to specialized equipment needing recalibration for new material specifications or the complex establishment of new supply chains, this would naturally empower the existing suppliers. For instance, if a supplier provides a unique brick blend requiring specific kiln settings, switching to another supplier might necessitate costly adjustments to Brampton Brick's manufacturing processes.

Conversely, if Brampton Brick can readily switch between suppliers with minimal disruption or expense, the bargaining power of those suppliers is considerably weakened. This flexibility allows Brampton Brick to negotiate more favorable terms, as suppliers understand they could lose business without significant penalty. In 2024, the construction materials market saw continued pressure on input costs, making the ability to switch suppliers a critical factor for companies like Brampton Brick to manage their margins effectively.

The uniqueness of inputs significantly influences supplier bargaining power. If Brampton Brick relies on highly specialized or proprietary raw materials or additives that are not readily available from alternative sources, those suppliers can command higher prices and more favorable terms. For instance, if a particular pigment supplier offers a unique color palette for their bricks that is a key differentiator for Brampton Brick, that supplier holds considerable leverage.

While standard masonry inputs like clay and shale are generally commoditized, increasing supplier power in these areas is less likely. However, for specialized additives that enhance durability, fire resistance, or create unique aesthetic finishes, suppliers could wield more influence. In 2024, the construction industry has seen some volatility in raw material costs, with certain specialized additives experiencing price increases due to global supply chain adjustments, potentially amplifying supplier power for those specific components.

Threat of Forward Integration by Suppliers

Suppliers of raw materials like clay and shale could potentially integrate forward into Brampton Brick's core business of manufacturing masonry products. This threat is amplified if the capital expenditure required for brick production is manageable for these suppliers, or if they already control key distribution networks. For instance, a large quarry operator might find it feasible to invest in kilns and extrusion equipment, thereby becoming a direct competitor.

The feasibility of this forward integration hinges on several factors. If suppliers possess unique or proprietary technology that offers a significant cost or quality advantage in brick manufacturing, their ability to enter the market as competitors increases. Furthermore, if suppliers have established relationships and leverage over distribution channels, they can bypass traditional intermediaries and reach end customers directly, which would be a significant competitive move against Brampton Brick.

- Supplier Forward Integration Risk: Suppliers of raw materials could enter the masonry product manufacturing sector, directly competing with Brampton Brick.

- Key Drivers of Threat: Low entry costs into brick manufacturing and control over distribution channels by suppliers would heighten this risk.

- Industry Context: In 2024, the construction materials sector saw continued emphasis on supply chain resilience, potentially encouraging some upstream players to explore value-added manufacturing.

Importance of Brampton Brick as a Customer

The relative importance of Brampton Brick as a customer significantly impacts its bargaining power with suppliers. If Brampton Brick constitutes a substantial portion of a supplier's annual revenue, that supplier will likely be more accommodating to Brampton Brick's pricing and terms. This dependency reduces the supplier's leverage.

Conversely, if Brampton Brick is a small client for a supplier, the supplier has less incentive to negotiate favorable terms. In such scenarios, suppliers may be less flexible, knowing that losing Brampton Brick's business would not severely impact their overall financial performance. For instance, in 2023, the construction materials sector saw significant price volatility, making customer volume even more critical for supplier stability.

- Customer Dependency: Brampton Brick's substantial order volumes can make it a key client for certain suppliers, thereby diminishing the supplier's bargaining power.

- Supplier Revenue Share: A higher percentage of a supplier's revenue derived from Brampton Brick translates to greater leverage for Brampton Brick in negotiations.

- Market Conditions: During periods of high demand for construction materials, suppliers might have more power, but large, consistent buyers like Brampton Brick can still command better terms.

Brampton Brick's bargaining power with suppliers is influenced by the concentration of its customer base for its manufactured products. If Brampton Brick is a significant buyer of raw materials, suppliers are more inclined to offer favorable terms to retain its business.

Conversely, if Brampton Brick represents a minor portion of a supplier's sales, that supplier holds more leverage, potentially leading to less favorable pricing or contract conditions for Brampton Brick. In 2024, the construction industry's demand fluctuations meant that strong customer relationships were crucial for securing stable and cost-effective raw material supplies.

The threat of supplier forward integration is a key consideration. If raw material suppliers can easily enter Brampton Brick's manufacturing space, perhaps due to manageable capital requirements or existing distribution control, they gain leverage. This was a notable concern in 2024 as some material suppliers explored vertical expansion to capture more value in the construction supply chain.

| Factor | Impact on Brampton Brick's Supplier Bargaining Power | 2024 Industry Context |

|---|---|---|

| Supplier Concentration | Low concentration = Higher Brampton Brick power | Stable, with some regional consolidation in aggregate supply. |

| Switching Costs | High switching costs = Higher Supplier power | Moderate; significant for specialized additives, lower for bulk clay/shale. |

| Input Uniqueness | Unique inputs = Higher Supplier power | Increasing for specialized performance additives; stable for standard materials. |

| Customer Dependency | High Brampton Brick dependency = Higher Brampton Brick power | Crucial; large volume buyers like Brampton Brick maintained leverage amidst market shifts. |

| Forward Integration Threat | Low threat = Higher Brampton Brick power | Present; some upstream players considered value-added manufacturing. |

What is included in the product

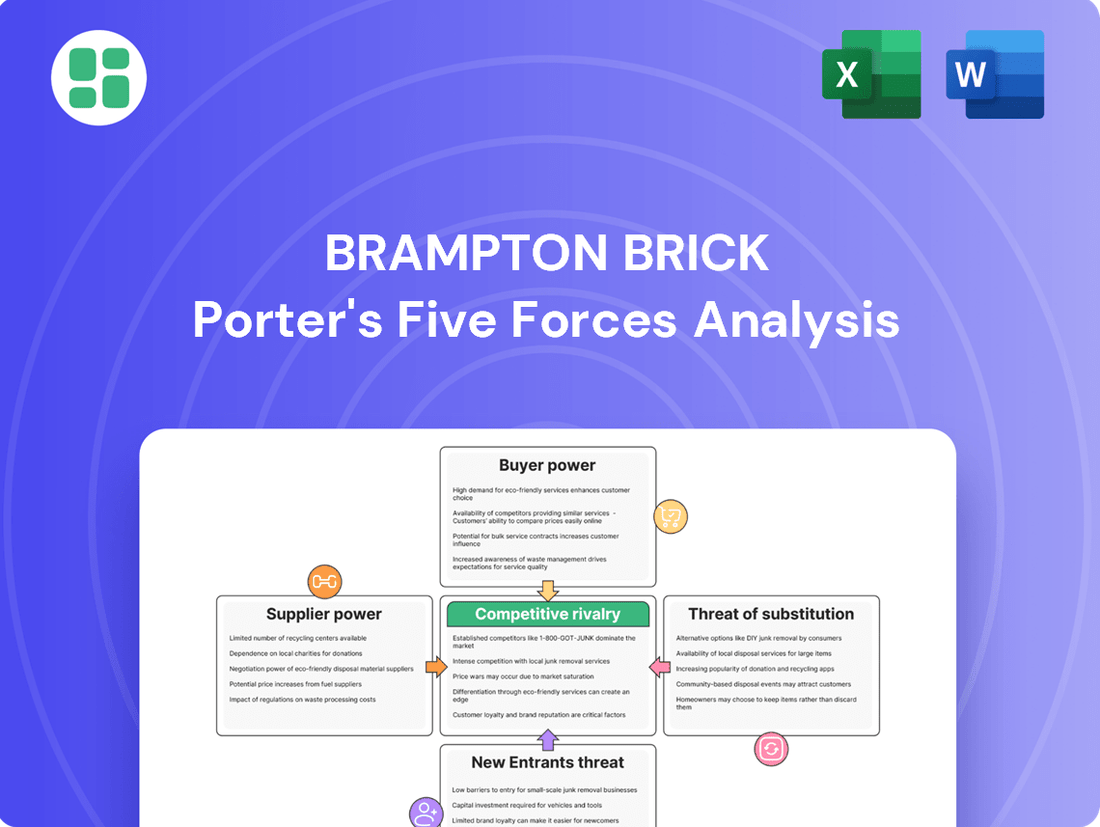

This analysis of Brampton Brick's competitive environment examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Brampton Brick's Porter's Five Forces Analysis provides a clear, one-sheet summary of all five forces—perfect for quick decision-making on competitive pressures.

Customers Bargaining Power

Brampton Brick's customers, including builders and distributors in the construction sector, often view masonry products as commodities. This perception naturally leads to a strong focus on price, meaning they have considerable power to negotiate lower costs, especially when economic conditions like rising interest rates impact the construction industry. For instance, in 2023, the Bank of Canada's aggressive interest rate hikes likely amplified customer price sensitivity, as builders faced increased financing costs and a potential slowdown in new projects.

The availability of numerous alternative suppliers for clay bricks and concrete blocks significantly amplifies customer bargaining power. In 2024, the North American construction materials market, particularly in regions like Ontario, Quebec, and the Northeastern and Midwestern United States, is characterized by a robust presence of both large-scale manufacturers and smaller regional producers. This competitive landscape allows buyers, from large developers to individual contractors, to readily compare pricing and terms across multiple vendors, making it easier to switch for more favorable deals.

Large-volume customers, such as major construction companies or large distributors, wield significant bargaining power due to the sheer scale of their orders. For instance, in 2023, Brampton Brick's revenue was approximately CAD 745 million. These substantial clients can negotiate for discounts, more favorable payment terms, or even customized product specifications, directly impacting Brampton Brick's profitability and operational flexibility.

Switching Costs for Customers

Brampton Brick faces a significant challenge with low switching costs for its customers. This means that buyers can readily shift their business to a competitor without facing substantial financial penalties or operational disruptions. For instance, in the market for standard masonry products, the ease with which customers can source materials from alternative suppliers directly enhances their leverage in price negotiations and other terms.

The ability for customers to easily compare prices and product offerings from various manufacturers, including smaller regional players, puts pressure on Brampton Brick to remain competitive. This low barrier to switching suppliers is a key factor contributing to the overall bargaining power of customers in the construction materials sector.

- Low Switching Costs: Customers can easily switch to competitors without significant financial or operational impact.

- Price Sensitivity: For standard products, customers are likely to prioritize price, leading them to shop around.

- Competitive Landscape: The presence of numerous suppliers allows customers to readily find alternatives.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large construction firms and developers, can significantly enhance their bargaining power against Brampton Brick. If these entities possess the capability or a strong incentive to manufacture their own masonry products, they can exert greater pressure on pricing and terms. This is a more plausible scenario for basic concrete block production, especially for massive construction projects where the scale might justify in-house manufacturing. For instance, a major developer undertaking a multi-billion dollar housing project could explore setting up their own block-making facilities to control costs and supply, thereby reducing their reliance on external suppliers like Brampton Brick.

While Brampton Brick's core business is specialized brick manufacturing, which is less susceptible to customer backward integration due to its complexity and capital requirements, the broader market for masonry products includes less specialized items. In 2024, the construction industry saw continued demand for materials, but also a focus on cost optimization. Large-scale projects might consider vertical integration for components like concrete blocks if cost savings and supply chain reliability are paramount. Data from industry reports in late 2023 and early 2024 indicated that some larger construction conglomerates were evaluating options to bring certain material productions in-house to mitigate supply chain disruptions and volatile raw material costs.

- Customer Capacity: Large construction firms may have the financial resources and technical expertise to establish their own masonry production facilities.

- Cost Savings Incentive: Significant project volumes can create a compelling economic case for customers to produce materials internally rather than purchasing them.

- Supply Chain Control: Backward integration offers customers greater control over material availability, quality, and delivery schedules, reducing dependency on suppliers.

- Market Diversification: For customers involved in a wide range of construction types, producing basic masonry units could be a strategic move to diversify their operational capabilities.

Customers, particularly builders and distributors, often treat masonry products as commodities, heavily influencing price negotiations. The construction industry's sensitivity to economic factors, such as the Bank of Canada's interest rate hikes in 2023, further empowers buyers to seek lower costs. This dynamic is exacerbated by the ease with which customers can switch suppliers due to low switching costs and the availability of numerous competitors in the market.

| Factor | Impact on Brampton Brick | Customer Bargaining Power |

| Commoditization of Products | Reduced pricing flexibility, pressure on margins | High |

| Low Switching Costs | Increased customer retention challenges | High |

| Availability of Alternatives | Intensified competition, need for competitive pricing | High |

| Customer Concentration (Large Volume Buyers) | Significant leverage for major clients, potential for volume discounts | Very High |

| Potential for Backward Integration | Risk of lost sales if customers produce in-house | Moderate to High |

What You See Is What You Get

Brampton Brick Porter's Five Forces Analysis

This preview showcases the exact Brampton Brick Porter's Five Forces Analysis you will receive immediately after purchase, offering a comprehensive examination of the competitive landscape. You'll gain immediate access to this professionally formatted document, detailing the industry's rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. Rest assured, what you see is precisely what you get, ready for your strategic planning needs.

Rivalry Among Competitors

The Canadian and U.S. masonry markets are quite active, featuring numerous companies that produce both brick and concrete blocks. Brampton Brick, for instance, holds the position of Canada's second-largest clay brick manufacturer, highlighting the presence of other substantial players in this competitive arena.

The construction industry's growth rate significantly influences competitive rivalry. In 2024, the sector experienced a slowdown, with housing starts projected to be around 1.4 million units in the US, a decrease from 2023. This slower pace means fewer opportunities, intensifying competition among companies like Brampton Brick as they fight for available projects.

However, the outlook for 2025 suggests a rebound, with forecasts indicating an increase in housing starts to approximately 1.6 million units. This anticipated growth could ease some competitive pressures, but the underlying demand for materials like bricks will still be a key factor in how intensely companies compete for market share.

While clay bricks and concrete blocks might seem like standard building materials, Brampton Brick actively differentiates itself. They focus on superior quality, offering a wide array of colors, textures, and sizes to meet diverse architectural needs. This strategy extends to specialized products like attractive stone veneers and functional permeable pavers, setting them apart from basic offerings.

Exit Barriers

Brampton Brick faces significant exit barriers in the masonry manufacturing sector. The industry demands substantial capital for specialized plants and kilns, making it difficult for companies to divest or repurpose assets. For instance, brick manufacturing facilities represent a considerable, often illiquid, investment.

These high exit barriers mean that even struggling companies may remain operational, contributing to market overcapacity. This situation can lead to prolonged periods of intense price competition, as firms fight for market share to cover their fixed costs, even when profitability is low. This dynamic was evident in the broader construction materials sector during periods of economic slowdown.

- High Capital Investment: Specialized kilns and manufacturing equipment represent millions in sunk costs, hindering easy exit.

- Specialized Assets: Machinery is often designed for specific product lines, limiting resale value or alternative uses.

- Long-Term Contracts: Supply agreements and customer commitments can obligate firms to continue operations.

- Market Saturation: The presence of many firms, unable to exit due to barriers, fuels competitive pricing.

Fixed Costs and Capacity Utilization

The masonry manufacturing sector, including companies like Brampton Brick, is heavily reliant on significant capital investment. These high fixed costs stem from the need for extensive plant infrastructure and specialized machinery. For instance, in 2023, Brampton Brick reported capital expenditures of $32.4 million, underscoring the ongoing investment in its operational assets.

To offset these substantial fixed costs and achieve economies of scale, manufacturers strive for high capacity utilization. This means running their facilities as close to maximum output as possible. Brampton Brick, for example, aims to optimize its production lines to spread fixed costs over a larger volume of output.

During economic downturns or periods of reduced demand, this pressure to maintain capacity utilization can lead to aggressive price competition. Companies may lower prices to keep production lines running and avoid the full impact of underutilized assets, thereby intensifying rivalry within the industry.

- High Fixed Costs: Masonry manufacturing requires substantial investment in plants and machinery, creating a significant cost barrier.

- Capacity Utilization Drive: Companies aim for high capacity utilization to spread fixed costs and improve profitability.

- Price Pressure: Low demand periods can trigger price wars as firms try to maintain production levels.

The competitive rivalry in the masonry market is intense, driven by the presence of numerous players and the cyclical nature of the construction industry. Brampton Brick, as Canada's second-largest clay brick manufacturer, operates within a landscape where companies actively differentiate themselves through product quality and variety, rather than solely on price. The sector's high capital requirements and specialized assets create significant exit barriers, meaning even less profitable firms tend to remain operational, contributing to sustained competitive pressure.

The drive for high capacity utilization, essential for covering substantial fixed costs in masonry manufacturing, often leads to aggressive pricing strategies during periods of lower demand. For example, Brampton Brick's 2023 capital expenditures of $32.4 million highlight the ongoing investment required, reinforcing the need to maximize output. This pressure intensifies rivalry as companies strive to maintain production levels and spread overheads, especially when facing market slowdowns like the projected dip in US housing starts to 1.4 million units in 2024.

| Factor | Description | Impact on Rivalry |

| Number of Competitors | Active market with multiple clay brick and concrete block producers. | High rivalry, as many firms vie for market share. |

| Industry Growth Rate | Construction sector growth, with US housing starts projected at 1.4M in 2024, rising to 1.6M in 2025. | Slower growth (2024) intensifies competition; anticipated growth (2025) may ease pressure slightly. |

| Product Differentiation | Focus on quality, variety (colors, textures), and specialized products (stone veneers, pavers). | Reduces direct price competition, but firms still compete for customer preference. |

| Exit Barriers | High capital investment in specialized plants and machinery, specialized assets, long-term contracts. | Firms remain in market even if unprofitable, leading to overcapacity and sustained price competition. |

| Fixed Costs & Capacity Utilization | High fixed costs necessitate high capacity utilization to cover expenses. | Pressure to maintain production can lead to price wars during demand downturns. |

SSubstitutes Threaten

The threat of substitutes for traditional clay bricks and concrete blocks is substantial. Builders have a broad array of alternative materials to choose from for construction projects, impacting demand for Brampton Brick's core products.

These alternatives include wood framing, steel structures, glass facades, pre-fabricated panels, stucco finishes, and various siding options. The market also sees increasing adoption of newer, sustainable materials like engineered wood and recycled composites, offering competitive performance and aesthetic qualities.

In 2024, the global construction market continued to see a diversification in material usage, with wood products, particularly engineered lumber, gaining traction in residential construction due to perceived sustainability and faster build times. This trend directly challenges the market share of brick and block manufacturers.

The appeal of substitute building materials hinges on their price-performance ratio compared to traditional brick. For instance, while early adoption of hempcrete might involve higher initial costs, its long-term benefits in insulation and reduced environmental impact could sway builders.

Emerging materials like mass timber, which saw significant growth in construction projects in 2024, offer a lighter, faster construction alternative to brick, potentially reducing labor and project timelines. Recycled plastic bricks are also gaining traction, presenting a more sustainable and potentially lower-cost option, though durability and aesthetic considerations remain key factors.

Switching from traditional masonry to alternative building materials can incur costs for Brampton Brick customers. These costs might include redesigning plans, adapting construction methods, and retraining labor, potentially adding to project timelines and budgets. For instance, a shift to prefabricated panels could necessitate specialized equipment and installation crews, impacting overall project expenses.

However, if these switching costs are perceived as minimal, or if the advantages of alternatives like speedier construction or reduced labor requirements are significant, the threat of substitution intensifies. For example, in 2024, the demand for faster construction cycles in residential development has driven interest in materials that can be erected more quickly than traditional bricklaying, potentially eroding Brampton Brick's market share if the cost-benefit analysis favors alternatives.

Technological Advancements in Substitutes

Ongoing innovation in construction materials presents a significant threat of substitutes for traditional masonry products like those offered by Brampton Brick. For instance, advancements in engineered wood, composite materials, and advanced polymers are creating alternatives that can match or exceed the performance of brick in certain applications, often with lighter weight or faster installation times.

Emerging technologies such as graphene-reinforced concrete and mycelium-based building blocks are also gaining traction. These materials can offer enhanced durability, insulation properties, or sustainability benefits that might sway builders and consumers away from conventional brick. By 2024, the global market for sustainable building materials was projected to reach over $300 billion, indicating a growing demand for innovative alternatives.

- Graphene-reinforced concrete offers superior strength and durability compared to traditional concrete.

- Mycelium-based blocks provide excellent insulation and are a biodegradable alternative.

- Engineered wood products are increasingly used in structural applications, challenging masonry's dominance.

- Composite materials offer a blend of properties like strength, weather resistance, and aesthetic appeal.

Changing Building Codes and Sustainability Trends

Evolving building codes and a heightened focus on sustainability are increasingly pushing the construction industry towards alternative materials. This trend directly impacts traditional products like brick, as demand grows for materials offering enhanced energy efficiency and lower carbon footprints. For instance, by 2024, many jurisdictions have updated regulations requiring higher insulation values in new builds, making materials with inherent thermal resistance more attractive.

The growing consumer and regulatory push for sustainable and low-carbon construction materials presents a significant threat of substitution for brick manufacturers. As environmental consciousness rises, builders and developers are actively seeking out materials that align with green building certifications and reduce the overall embodied energy of structures. This shift is not just about environmental impact; it's also about long-term operational cost savings for building owners through improved energy performance.

Brampton Brick itself acknowledges these shifts. Their investment in technologies like CarboClave for concrete blocks, which aims to sequester carbon, demonstrates a proactive response to the threat of substitutes. This initiative highlights a strategic move to offer products that meet the evolving demands for more environmentally responsible construction solutions, potentially mitigating the impact of alternative materials.

The threat of substitutes is amplified by the increasing availability and performance of alternative building materials. These include engineered wood products, advanced insulation systems, and prefabricated modular components, all of which can offer comparable or superior performance in areas like structural integrity, fire resistance, and thermal efficiency. For example, cross-laminated timber (CLT) has seen significant growth in 2023-2024 as a sustainable alternative for mid-rise construction.

The threat of substitutes for traditional brick and block products remains significant, driven by innovation and evolving market demands. Builders have a wide array of alternatives, from wood and steel to advanced composites and engineered materials, each offering different advantages in terms of cost, speed of construction, and sustainability. The increasing focus on green building and faster project completion directly challenges the market position of conventional masonry.

In 2024, the global market for sustainable building materials continued its upward trajectory, with engineered wood products like cross-laminated timber (CLT) seeing substantial adoption in mid-rise construction projects. This trend directly competes with brick and block usage, especially where speed and lighter structural components are prioritized. The demand for materials with lower embodied carbon is also a key driver, pushing innovation in alternatives.

| Alternative Material | Key Advantages | 2024 Market Trend/Note |

|---|---|---|

| Engineered Wood (e.g., CLT) | Lighter weight, faster installation, sustainable sourcing | Growing adoption in mid-rise construction, perceived lower carbon footprint |

| Steel Framing | High strength-to-weight ratio, recyclable, precise fabrication | Established alternative, particularly in commercial and high-rise projects |

| Pre-fabricated Panels | Rapid assembly, controlled factory production, potential cost savings | Increasing use in residential and modular construction for speed |

| Advanced Composites | Durability, weather resistance, customizable aesthetics | Emerging applications in facades and structural elements |

Entrants Threaten

The masonry manufacturing industry, especially for clay bricks, demands significant upfront capital. Think about the cost of land, specialized machinery, kilns, and the necessary facilities. These substantial financial hurdles make it tough for new companies to even get started.

Established players like Brampton Brick leverage substantial economies of scale in manufacturing, raw material sourcing, and logistics. For instance, in 2024, Brampton Brick's operational efficiency, driven by its large-scale production facilities, allowed it to maintain competitive pricing against smaller competitors.

Newcomers face a significant hurdle in matching these cost advantages. Without a comparable initial production volume, new entrants would find it challenging to achieve the same per-unit cost efficiencies, thereby struggling to compete effectively on price in the market.

Brampton Brick has cultivated extensive distribution networks throughout Ontario, Quebec, and key regions of the United States, catering to both direct construction clients and a robust dealer base. New companies entering the market would struggle to replicate these established relationships and secure equally effective channels to reach customers.

Brand Loyalty and Reputation

Brampton Brick benefits from a deeply entrenched brand loyalty and a stellar reputation built over decades. This established trust, particularly for quality and durability in the Canadian and US construction sectors, is a formidable barrier. For instance, in 2024, the company continued to leverage its long-standing relationships with builders and distributors, a network that new entrants would struggle to replicate quickly.

Developing a comparable level of brand recognition and customer confidence in the construction materials industry requires substantial, sustained investment and time. New companies entering the market face the significant challenge of overcoming Brampton Brick's established market presence and the inherent skepticism towards unproven brands in a sector where reliability is paramount.

- Established Reputation: Brampton Brick has cultivated a strong reputation for quality and durability over its extensive history.

- High Switching Costs: For builders and contractors, switching from a trusted supplier like Brampton Brick involves significant risk and potential disruption.

- Brand Recognition: Decades of operation have cemented Brampton Brick's brand in the minds of industry professionals.

Regulatory and Permitting Hurdles

The manufacturing of construction materials, such as those produced by Brampton Brick, is heavily influenced by stringent regulatory and permitting hurdles. New companies entering this sector must contend with complex environmental regulations, zoning laws, and a labyrinth of permitting processes. These requirements can impose significant time and financial burdens, particularly for facilities involved in large-scale industrial operations like brick firing, which often require extensive environmental impact assessments and approvals.

For instance, securing the necessary permits for a new brick manufacturing plant can take years and cost hundreds of thousands, if not millions, of dollars in studies, legal fees, and compliance measures. These upfront costs act as a substantial barrier, discouraging potential new entrants who may lack the capital or expertise to navigate such an intricate system. This regulatory landscape effectively limits the number of new competitors that can realistically enter the market.

- Environmental Compliance: Adherence to air and water quality standards, waste disposal regulations, and emissions controls.

- Zoning and Land Use: Obtaining approvals for industrial land use, which can be challenging in urban or environmentally sensitive areas.

- Permitting Processes: Navigating federal, provincial, and municipal requirements for building, operating, and safety certifications.

- Capital Investment: The significant upfront costs associated with meeting these regulatory requirements can deter new market participants.

The threat of new entrants for Brampton Brick is relatively low due to substantial capital requirements for establishing brick manufacturing facilities, including land, machinery, and kilns. Furthermore, navigating complex environmental regulations and obtaining necessary permits can take years and incur significant costs, acting as a major deterrent for potential new players in the market.

New competitors would also struggle to match Brampton Brick's established economies of scale, which in 2024 contributed to competitive pricing. Replicating the company's extensive distribution networks and deeply entrenched brand loyalty, built over decades, presents another formidable challenge for any aspiring entrant seeking to gain market traction.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for land, machinery, and facilities. | Significant financial hurdle to entry. |

| Regulatory Hurdles | Complex environmental and zoning permits. | Time-consuming and expensive compliance. |

| Economies of Scale | Cost advantages from large-scale production. | Difficulty competing on price. |

| Distribution Networks | Established channels to reach customers. | Challenging to replicate existing reach. |

| Brand Loyalty | Reputation for quality and trust. | Hard to overcome established customer relationships. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Brampton Brick leverages data from company annual reports, investor presentations, and industry-specific trade publications. We also incorporate market research reports and government economic data to assess competitive dynamics.