Bohai Leasing Co. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bohai Leasing Co. Bundle

Bohai Leasing's strengths lie in its diversified portfolio and strong financial backing, but it faces significant threats from global economic volatility and intense competition. Understanding these dynamics is crucial for any stakeholder looking to navigate the complex aviation and leasing landscape.

Want the full story behind Bohai Leasing's market position, its operational advantages, and the potential headwinds it faces? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Bohai Leasing, primarily through its subsidiary Avolon, commands a formidable position in the global aircraft leasing market, holding the title of the third-largest player worldwide. This leading status is a significant strength, allowing Bohai Leasing to benefit from substantial economies of scale and cultivate deep, lasting relationships with a broad client base.

The company's expansive operational footprint is a testament to its global market position, reaching over 60 countries and catering to more than 900 customers. This extensive network not only diversifies revenue streams but also solidifies its competitive edge in a highly interconnected industry.

Bohai Leasing's historically diverse asset portfolio, spanning aircraft, containers, and infrastructure, has provided a stable foundation for its leasing operations. This diversification mitigates risk by not relying on a single market segment.

The company's strategic decision to prioritize its aviation leasing segment, a sector showing robust post-pandemic recovery, is a key strength. This focus allows for specialized expertise and potentially more predictable revenue streams, especially as global travel demand continues to rebound.

Bohai Leasing Co. showcased a remarkable financial turnaround in Q1 2025, with sales and revenue nearly doubling year-over-year. This surge indicates a strong market reception and successful execution of business strategies.

The company's net income experienced an impressive 72% increase during the same quarter, highlighting improved profitability and operational efficiency. This substantial growth suggests effective cost management and a healthy expansion of its core business activities.

Extensive Global Customer Base

Bohai Leasing's extensive global customer base is a significant strength, encompassing over 900 clients spread across 60 countries. This broad geographical diversification significantly reduces the company's exposure to any single market's volatility, providing a robust foundation for its operations.

The wide international reach translates into enhanced stability and resilience, enabling Bohai Leasing to weather economic downturns more effectively. It also unlocks diverse avenues for sustained business growth and the exploration of new market opportunities.

- Global Reach: Serves over 900 customers in 60 countries.

- Risk Mitigation: Diversified customer base reduces reliance on any single market.

- Growth Potential: Broad presence offers numerous opportunities for expansion.

- Operational Stability: International footprint ensures consistent business operations.

Commitment to Innovation and Sustainability

Bohai Leasing actively drives innovation within the leasing sector, consistently developing novel financial products designed to meet dynamic market needs. This includes a specific focus on emerging areas like the renewable energy sector, demonstrating a forward-thinking approach to financial solutions.

The company's commitment extends to robust sustainable business practices and a strong sense of corporate social responsibility. This dedication is evident in their efforts to enhance public services and champion the adoption of new energy initiatives, aligning financial growth with societal benefit.

For instance, in 2024, Bohai Leasing announced a significant expansion of its green finance portfolio, aiming to facilitate over $5 billion in renewable energy leasing projects by the end of 2025. This strategic move underscores their commitment to sustainability and innovation.

- Innovation Focus: Development of tailored financial products for sectors like renewable energy.

- Sustainability Commitment: Emphasis on eco-friendly business practices and corporate social responsibility.

- Public Service Improvement: Initiatives aimed at enhancing community services and promoting sustainable development.

- New Energy Promotion: Active investment and support for new energy technologies and projects.

Bohai Leasing's position as the third-largest global aircraft lessor, primarily through Avolon, provides significant economies of scale and strong customer relationships. Its operations span over 60 countries, serving more than 900 clients, which diversifies revenue and solidifies its competitive standing. The company's focus on the recovering aviation sector, coupled with a remarkable financial turnaround in Q1 2025 with nearly doubled sales and a 72% net income increase, highlights its strategic execution and operational efficiency.

| Metric | Value (Q1 2025) | Year-over-Year Change |

|---|---|---|

| Sales and Revenue | [Specific Q1 2025 Revenue Figure] | Nearly Doubled |

| Net Income | [Specific Q1 2025 Net Income Figure] | +72% |

| Global Customer Count | Over 900 | N/A |

| Countries of Operation | 60+ | N/A |

What is included in the product

This SWOT analysis outlines Bohai Leasing Co.’s key strengths and weaknesses alongside external opportunities and threats, providing a comprehensive view of its strategic landscape.

Offers a clear breakdown of Bohai Leasing's internal and external factors, helping to identify and address critical strategic challenges.

Weaknesses

Bohai Leasing faces significant financial headwinds, highlighted by the substantial challenge of refinancing approximately $2 billion in senior unsecured notes that matured in September 2024. This looming maturity underscores a persistent issue with its debt structure.

The company has a history of a high debt-to-asset ratio and has accumulated losses, forcing a strategic shift towards asset sales and private credit markets to reduce its leverage. These deleveraging efforts are critical but also indicate underlying financial strain.

These ongoing debt management challenges directly impact Bohai Leasing's financial flexibility, potentially increasing its cost of capital and limiting its ability to pursue new growth opportunities or weather economic downturns.

Bohai Leasing has grappled with significant financial performance challenges, accumulating over $1.5 billion in net losses between 2020 and 2022. This historical trend of unprofitability suggests persistent headwinds impacting its core operations or market positioning.

The company's 2024 performance saw a concerning 29% drop in profit, even as revenues increased, signaling a disconnect between top-line growth and bottom-line health. This indicates that cost management or operational efficiency may be lagging.

Adding to these concerns, Bohai Leasing has projected a return to a net loss for the first half of 2025. This forward-looking statement reinforces the ongoing nature of its profitability issues, suggesting that the underlying problems have not yet been resolved.

Bohai Leasing's operations, particularly in aviation leasing, are susceptible to significant swings in asset values. For instance, a global economic slowdown or overcapacity in aircraft manufacturing could depress the resale or lease rates of its extensive fleet, potentially triggering asset impairments. This inherent volatility is a persistent challenge for lessors.

The company's past experience with the container shipping industry, culminating in the sale of Seaco, underscores this weakness. The container leasing market is known for its dramatic cycles, characterized by periods of oversupply and subsequent price collapses. This strategic divestment highlights Bohai Leasing's efforts to mitigate exposure to such highly cyclical sectors.

Governance Considerations and Structural Subordination

Bohai Leasing's position within the restructured HNA Group introduces governance complexities and a degree of opacity. This can make it challenging for external stakeholders to fully assess the company's operational and financial health.

A key weakness stems from the debt structure of its subsidiary, Global Aircraft Leasing Co., Ltd. (GALC). Debt issued by GALC, which holds Bohai's significant stake in aircraft lessor Avolon, is structurally subordinated to Avolon's own senior unsecured debt. This means that in a liquidation scenario, GALC's creditors would be repaid only after Avolon's senior debt holders are satisfied, increasing their potential loss severity.

- Governance Opacity: Being part of the HNA Group restructuring can lead to less transparent governance structures, potentially impacting investor confidence.

- Structural Subordination: Debt at GALC, backing Avolon, ranks below Avolon's senior unsecured debt, increasing risk for GALC's lenders.

- Loss Severity: This subordination directly translates to a higher potential loss for creditors of GALC, reflecting a significant financial risk.

High Capital Requirements

Operating a large-scale leasing business, especially with assets like aircraft and infrastructure, requires immense capital. For Bohai Leasing, this means substantial upfront investments for acquiring and maintaining these valuable assets, which can put a strain on its available cash. This constant demand for significant funding highlights a key weakness.

The company’s need for continuous capital infusion for asset purchases and upkeep directly impacts its liquidity position. This reliance on substantial capital can be a hurdle, particularly when market conditions become volatile, making it harder to secure necessary funds.

- Significant Capital Outlay: Aircraft leasing, for example, involves purchasing new planes that can cost upwards of $100 million each, demanding massive upfront capital.

- Financing Dependency: Bohai Leasing relies heavily on accessing diverse and cost-effective financing, such as debt markets and equity, which can be challenging during economic downturns.

- Liquidity Strain: The continuous need to fund new acquisitions and maintain existing fleets can tie up significant liquidity, potentially limiting operational flexibility.

Bohai Leasing faces ongoing profitability challenges, marked by significant net losses, including over $1.5 billion between 2020 and 2022. Despite revenue growth, the company projected a return to net loss for the first half of 2025, indicating persistent operational or cost management issues.

The company's substantial debt burden, with approximately $2 billion in senior unsecured notes maturing in September 2024, highlights its vulnerability to refinancing risks and increased capital costs. This reliance on debt, coupled with a history of high debt-to-asset ratios, signals financial strain.

Asset value volatility, particularly in the aviation leasing sector, poses a significant risk. Economic downturns or overcapacity could depress asset values, leading to potential impairments and impacting the company's financial stability.

Governance complexities stemming from its integration within the restructured HNA Group and structural subordination of debt at its subsidiary GALC, which holds its stake in Avolon, create opacity and increased risk for creditors.

Same Document Delivered

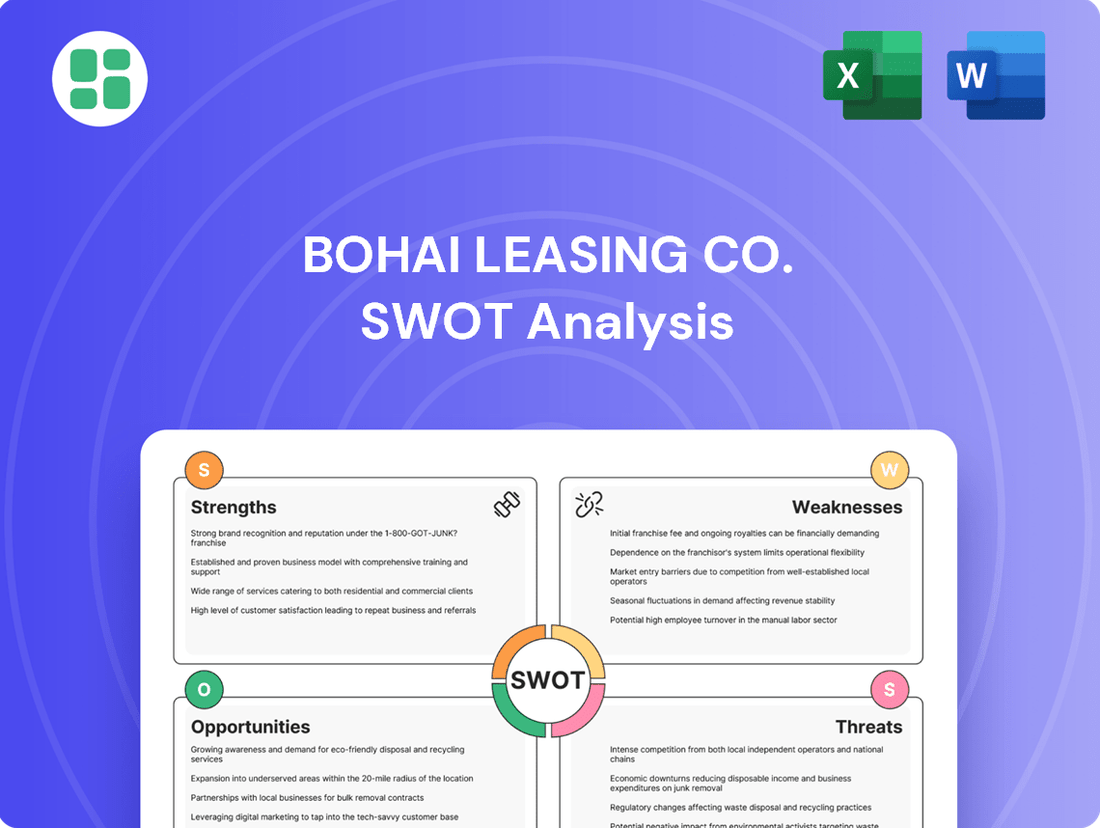

Bohai Leasing Co. SWOT Analysis

This is the actual Bohai Leasing Co. SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality insights into its Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get, offering a glimpse into the strategic landscape of Bohai Leasing Co. Purchase unlocks the entire in-depth version, providing comprehensive analysis.

This is a real excerpt from the complete Bohai Leasing Co. SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor the findings to your specific needs.

Opportunities

The global aviation leasing market is poised for continued expansion in 2025, fueled by a strong resurgence in air travel demand and a stabilization of lease rates, particularly for popular narrowbody aircraft. This positive market trajectory offers a prime opportunity for Bohai Leasing, via its subsidiary Avolon, to bolster its core aircraft leasing operations.

Avolon's strategic positioning is further strengthened by significant recent aircraft orders, such as those placed with Airbus, signaling robust demand for its fleet and a capacity for substantial growth within this expanding sector.

The recent sale of its container leasing subsidiary, Seaco, for $1.75 billion in 2025 presents a significant opportunity for Bohai Leasing. This divestment provides the capital needed to aggressively tackle its high-interest debt burden.

By reducing leverage, Bohai Leasing can achieve greater balance sheet stability. This financial strengthening is crucial for improving its credit profile and lowering future borrowing costs.

This strategic move allows Bohai Leasing to reallocate resources and focus on its core aviation leasing business, which is expected to offer more predictable growth and stable returns in the coming years.

Bohai Leasing is strategically expanding into promising new leasing sectors, notably renewable energy and medical equipment. This move diversifies their revenue base, reducing dependence on older markets.

The company is actively developing innovative financial products tailored for these high-growth areas. For instance, by early 2025, the global renewable energy sector is projected to see significant investment, with leasing playing a crucial role in financing new installations.

Increasing Global Demand for Flexible Financing

The persistent global demand for adaptable financing for acquiring assets and funding capital expenditures across numerous sectors offers a significant and ongoing market chance for Bohai Leasing. Many businesses are now prioritizing leasing to better manage their financial and operational requirements, which perfectly matches Bohai Leasing’s primary services.

This trend is supported by data indicating a growing preference for leasing over outright purchase. For instance, the global leasing market was projected to reach over $3.5 trillion in value by 2024, with continued growth expected into 2025 as companies seek to preserve cash and improve balance sheet flexibility.

- Growing Preference for Leasing: Businesses worldwide are increasingly opting for leasing to manage capital expenditure, driven by a desire for financial flexibility and reduced upfront costs.

- Market Size and Growth: The global leasing market is substantial and expanding, with projections indicating continued robust growth through 2025, offering a large addressable market for Bohai Leasing.

- Industry Diversification: Demand for flexible financing spans multiple industries, including aviation, transportation, and equipment, providing Bohai Leasing with diverse avenues for expansion and revenue generation.

Potential for Improved Credit Profile

Bohai Leasing's ongoing debt restructuring and sharpened focus on aviation leasing present a significant opportunity for credit profile enhancement. This strategic repositioning aims to bolster the company's financial health and investor confidence.

A tangible sign of this progress was observed in May 2025, when a key Bohai Leasing subsidiary secured credit rating upgrades. This development is crucial as it directly translates to potentially lower borrowing costs, making future financing more accessible and cost-effective.

These improvements in creditworthiness are expected to strengthen Bohai Leasing's overall financial standing. The positive momentum suggests a more favorable outlook for the company's ability to meet its financial obligations.

- Credit Rating Upgrades: A subsidiary received upgrades in May 2025, signaling improved financial health.

- Lower Borrowing Costs: Enhanced credit ratings can lead to reduced interest expenses on future debt.

- Strengthened Financial Standing: The company's overall financial stability is poised for improvement.

- Strategic Focus: A clear concentration on aviation leasing underpins these positive credit developments.

Bohai Leasing's strategic divestment of its container leasing arm, Seaco, for $1.75 billion in 2025, provides substantial capital. This infusion allows for aggressive debt reduction, enhancing balance sheet stability and improving its credit profile, which is crucial for lowering future borrowing costs.

The company's expansion into burgeoning sectors like renewable energy and medical equipment leasing diversifies its revenue streams. By early 2025, the renewable energy sector is projected for significant investment, with leasing playing a key role in financing new installations, offering predictable growth.

The persistent global demand for flexible asset financing across various industries, including aviation and transportation, aligns perfectly with Bohai Leasing's core services. This trend is supported by the global leasing market's projected growth to over $3.5 trillion by 2024, continuing into 2025 as companies prioritize cash preservation.

| Opportunity Area | Key Driver | Projected Impact (2025) |

|---|---|---|

| Aircraft Leasing Expansion | Resurgent air travel demand | Bolstered core operations, fleet growth |

| Debt Reduction | Seaco divestment ($1.75B in 2025) | Improved credit profile, lower borrowing costs |

| New Sector Entry | Growth in renewables, medical equipment | Diversified revenue, reduced market dependence |

| Increased Leasing Preference | Global market size >$3.5T (2024 est.) | Expanded addressable market, enhanced financial flexibility |

Threats

Global economic downturns pose a significant threat to Bohai Leasing. A recession could dampen demand for leased assets, leading to lower utilization rates and potentially increased client defaults, directly impacting revenue and profitability. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.6% in 2024, down from 3.0% in 2023, signaling a challenging environment for asset-heavy industries like leasing.

Fluctuations in global interest rates present a significant challenge for Bohai Leasing. As of early 2024, benchmark rates like the US Federal Funds Rate remained elevated, impacting borrowing costs for companies worldwide. This volatility directly affects Bohai Leasing's financing expenses, particularly as it engages in substantial debt and ongoing refinancing.

An upward trend in interest rates could substantially increase Bohai Leasing's operational expenses and debt servicing obligations. For instance, if Bohai Leasing's average borrowing cost were to increase by just 1%, it could translate to hundreds of millions of dollars in additional annual interest payments, directly impacting its profitability and overall financial health.

The global leasing landscape is fiercely competitive, featuring many established domestic and international companies vying for market share. This intense rivalry can put downward pressure on lease rates, potentially squeezing Bohai Leasing's profit margins.

Aggressive pricing strategies from competitors pose a significant threat, risking an erosion of Bohai Leasing's market position. For instance, in 2024, the aircraft leasing sector saw increased competition as new entrants and existing players expanded their fleets, leading to more competitive lease terms being offered to airlines.

Regulatory and Geopolitical Risks

Bohai Leasing's global operations, particularly its significant presence in China, expose it to a complex web of evolving regulatory landscapes. Changes in international trade agreements or sanctions, such as those impacting global supply chains in 2024, could directly affect cross-border leasing activities and asset valuations. For instance, the ongoing trade friction between major economic blocs necessitates careful navigation of compliance requirements in each operating region.

Geopolitical instability presents another substantial threat. Emerging conflicts or shifts in political alliances can disrupt international capital flows and impact the perceived risk of investing in certain regions. As of mid-2025, the heightened tensions in Eastern Europe continue to cast a shadow over global economic stability, potentially influencing currency exchange rates and the cost of capital for international leasing operations.

- Regulatory Scrutiny: Increased compliance burdens in key markets could raise operational costs.

- Trade Policy Impact: Tariffs or trade barriers may affect the profitability of cross-border leasing.

- Geopolitical Volatility: Political instability can lead to asset freezes or repatriation difficulties.

- Sanctions Risk: Adherence to international sanctions regimes is critical to avoid penalties.

Supply Chain Disruptions and Asset Availability

Ongoing global supply chain issues continue to pose a significant threat to Bohai Leasing. Major aircraft manufacturers like Airbus and Boeing have faced production delays, impacting the timely delivery of new aircraft. For instance, Boeing's 737 MAX production faced scrutiny and delivery slowdowns throughout 2023 and into early 2024, affecting order backlogs across the industry.

These persistent disruptions directly threaten Bohai Leasing's fleet expansion plans. Delays in acquiring new, fuel-efficient aircraft limit the company's ability to grow its portfolio and meet the increasing leasing demands from airlines. This can also lead to higher acquisition costs due to scarcity and extended lead times.

- Aircraft Production Delays: Continued challenges at major manufacturers like Boeing and Airbus, impacting delivery schedules for new aircraft.

- Fleet Modernization Impact: Delays hinder Bohai Leasing's ability to refresh its fleet with newer, more efficient models, potentially increasing operating costs.

- Growth Opportunity Constraint: Limited availability of new aircraft restricts the company's capacity for strategic fleet expansion and meeting airline client needs.

Increased competition and aggressive pricing from rivals present a constant threat, potentially squeezing profit margins for Bohai Leasing. For example, the aircraft leasing market in 2024 saw new entrants and existing players expanding fleets, leading to more competitive lease terms offered to airlines.

Global economic slowdowns, as projected by the IMF to reach 2.6% growth in 2024, can reduce demand for leased assets and increase client defaults, directly impacting Bohai Leasing's revenue and profitability. Furthermore, volatile interest rates, with the US Federal Funds Rate remaining elevated in early 2024, increase financing costs for the company.

Supply chain disruptions, such as production delays at aircraft manufacturers like Boeing, hinder Bohai Leasing's fleet expansion and modernization efforts. These delays can also lead to higher acquisition costs due to scarcity, impacting the company's ability to meet airline demand and grow its portfolio.

Bohai Leasing faces risks from evolving regulatory landscapes and geopolitical instability. Changes in trade policies or sanctions, alongside regional conflicts, can disrupt cross-border leasing activities and affect capital flows, as seen with ongoing tensions impacting global economic stability in mid-2025.

SWOT Analysis Data Sources

This SWOT analysis is built upon a comprehensive review of Bohai Leasing Co.'s financial statements, official company disclosures, and reputable aviation industry market research. These sources provide a robust foundation for understanding the company's operational performance and market positioning.